Yves here. Wolf Richter gets credit for having said for some time that Tesla valuations were ridiculous given that all it did was make cars (oh, and some speciality batteries). The problem is when you are early to point out the obvious, the touts and true believers can still look like winners for a very long time

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

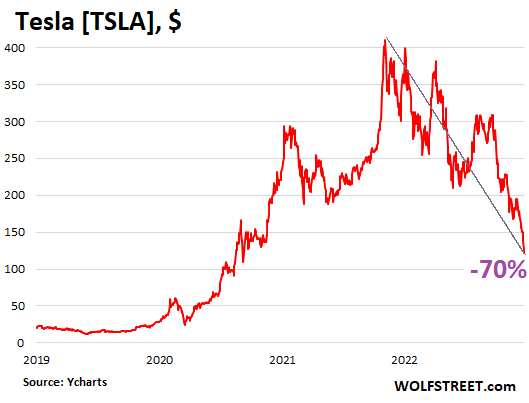

Tesla’s shares fell another 1.8% to $123.15 at the close on December 23, back to where they had first been in August 2020. They’re now down by 70.3% from the high on November 4, 2021, and thereby qualify for my ballooning pantheon of Imploded Stocks. For this honor, our heroes must have fallen by at least 70% from their crazy high in the era of money printing and consensual hallucination (data via YCharts):

The stock still has a PE ratio of 38, which is ridiculously high for a profitable automaker, but ridiculously low for an object of religious veneration, which Tesla used to be. It used to be run by Elon Musk, who used to walk on water. But walking on water turned out to be boring, and Elon is having too much fun goofing off over at Twitter for all to see, and he’s too busy tweeting goofy stuff and annoying people, including Tesla’s current or potential customers and shareholders.

So now, as people are coming out of consensual hallucination, they realize that Tesla is just an automaker, with lots of competition in the EV space, and that Musk no longer walks on water. They see that Tesla now has to do stuff that other automakers had to do for decades, like plastering big incentives on its vehicles to get them moving before year-end, talking about hiring freezes and lay-offs, and even, in a desperate move, touting possible share buybacks to try to boost its stock price. But the stock kept sinking.

And what’s the next shoe to drop? Is Tesla going to have to spend a few billion dollars a year on advertising, just like other automakers had to do for decades, in order to move the iron that is parked on vast lots across the country?

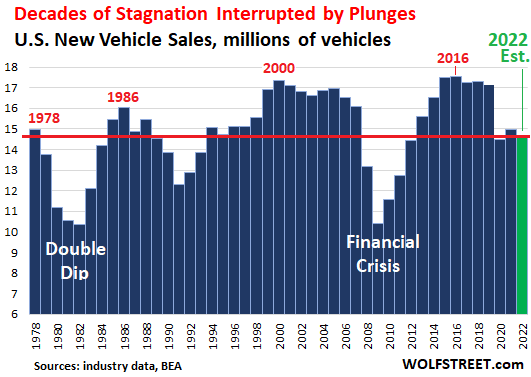

And people suddenly realized that Tesla, instead of being an object of religious veneration, is in the same overall industry – the auto industry – as other automakers, and that in terms of unit sales, this auto industry has stagnated for decades, interrupted only by deep plunges in between.

Turns out, EVs are merely replacing ICE vehicles, not adding to them, this industry being a tough zero-sum game, and every new competitor is taking a bite out of everyone else’s lunch, and the only way to increase revenues for the industry is by selling pricier vehicles year after year, which is what they have been doing, which is maybe why vehicle sales look the way they do (2022 new vehicle sales data through November; my estimate for December):

That’s the Real World for Automakers. And Tesla Is Joining It.

Tesla rattled these legacy automakers and got them off their lazy butts about EVs, and single-handedly revolutionized the auto industry. Musk was able to pull this off because investors saw him walking on water.

But now the legacy automakers have woken up from their stupor, and a bunch of new ones have piled into the market, and some of them actually have EVs out on the street, and investors have poured hundreds of billions of dollars into these EV makers, and into legacy automakers that are now chasing after Tesla with their own EVs.

Now, Tesla is having to do what other automakers had to do for decades: Pile incentives on its Model 3 and Model Y to move the iron. $7,500 plus “10,000 miles of free Supercharging,” if you take delivery of the vehicle by December 31, as it says on its website.

So there is a bunch of inventory, gone are the waiting lists, and you can just go and pick one out, and get a $7,500 credit plus 10,000 miles of free Supercharging?

This offer is an improvement over its prior offer of a credit of $3,750 for the Model 3 and Model Y.

So Tesla faces a situation: Congress passed legislation that gives $7,500 in incentives to buyers of certain EVs, and Teslas qualify, but those incentives don’t kick in until January 1, and some other automakers still benefit from the old $7,500 incentives that expired for Tesla years ago.

Business might have taken a serious hit as folks decided to wait till January 1 to get that federal $7,500, and so Tesla had to choose: Match it, or report a nasty surprise in Q4 deliveries that could tank its stock further?

And who knows what else might be going on. Maybe potential customers got turned off by Musk’s goofy tweets that you cannot escape even if you never ever look at Twitter because they get picked up everywhere in the media. And while these turned-off customers were moping about that, they found out that there are some other EVs out there now, even real 4×4 580-hp pickup trucks, while Tesla is still promising to eventually build one.

To sort of lower the intense selling pressure on Tesla shares, Musk, who’d said a gazillion times before that he’s done selling shares only to sell a whole bunch more, including $3.6 billion last week, which brought his total sales to nearly $40 billion, at ever lower prices, well, after Tesla shares had kathoomphed 8.9% during regular trading hours Thursday evening, he said at a Twitter Spaces audio chat, reported by Reuters: “I won’t sell stock until, I don’t know, probably two years from now. Definitely not next year under any circumstances and probably not the year thereafter.”

“I needed to sell some stock to make sure, like, there’s powder dry…to account for a worst-case scenario,” he said, according to Reuters. Twitter seems to come to mind in terms of that worst-case scenario.

No regulator is ever going to crack down on what Musk says or tweets. So he says and tweets whatever, no matter how goofy, which is fine for most people but not great for CEOs, and not great for shareholders if this goofy stuff goes in the wrong direction, as it has been doing recently.

Back in the day when he was still walking on water, and when consensual hallucination still ruled the trading day, his goofy tweets would cause the shares to spike. But now Tesla is becoming like other automakers, with the same problems, and what matters is the harsh reality of the auto market that has now woken up to EVs.

Purportedly from a used car dealer on Twitter (GuyDealership), car loans underwritten by the big lenders for non-prime borrowers is drying up. While there are a lot more failed wholesale car auctions—meaning buyers are not interested at the minimum price wanted by sellers.

Any decline in used car prices is meaningless if most buyers can’t access credit.

When the plankton die off, the fish and whales are not fall behind.

A stock that falls 70% still can fall other 50%. assuming earnings stay constant (big if), that would put Tesla’s P/E at 19 (38*.5)……stil high for a carmaker.

Compare Tesla to another High Flyer. Amazon.

Peak shares at $185, now $85. For a loss of $1 TRILLION.

Income $11 billion over 1,544,000 employees over 2.000 working hours per year is $3.56/hour. What could go wrong.

PE of 79.

Amazon (today’s Sears Roebuck) is still at least 5 times a healthy PE.

So Tesla is just like many other Fed inflated Wonders.

And another $1.7 Trillion in spending, passed by the UniParty while sticking their thumbs in the eyes of recent voters.

The USA hath become the USSR. Even Rome took a few centuries to unravel, Where will the U.S. be in 20 years?

The NEV (New Energy Vehicle) market is going gangbusters in Asia, with China leading the charge, and will eventually catch on in USA– while we have some EV, no one can say that the market here for these vehicles is anything more than in it’s infancy.

Personally, I think China will soon be what Japan was in the 1970s-80s in terms of vehicles exported to the USA: a lot of Americans want a basic, reliable vehicle that doesn’t set them back an additional mortgage or rent payment a month, and US automakers aren’t meeting consumers where they’re at– but somebody will.

While Tesla has some really cool tech (aside from its cars), their share price was scary and I didn’t add any to my IRA. However, I am now looking at Chinese companies listed on the NYSE now that the delisting threat has receded: I believe that after the great decline over the past year that there is value (as an investor) to be found there.

Gigantism is usually a sign of pathology, and the constant increase in size of vehicles most USAians drive is a case in point.

Go Green: buy an electric F-150!

This video comparing the most popular U.K. car with the most popular U.S. car (sorry, truck) might be interesting. Spoiler: the U.K. vehicle is not quite as large….

https://youtu.be/Q-MPxnsRRZs

I do believe that life cycle cost and life cycle environmental impact are key things to think about.

My car is a nearly seven year old Jag that I had from new. Happens to be diesel because for years we were pushed to buy them in Europe. Is replacing it with a new EV that has to be built really an environmentally friendly thing to do? It would definitely be more expensive. The current car costs very little to run because depreciation is now super low and unusually for a Jag it never goes wrong. No mega battery to recycle either.

Stephen

Do you remember when pickup trucks were all 2 door? Something maybe to do with maximizing cargo space. I think they were, but maybe it was a hallucination – it was so long ago… But maybe they were just Hollywood fabrications, like the Enterprize or Millenium Falcon spaceships. I haven’t seen a 2 door pickup since I don’t know when – I can only conclude it was just my imagination…

If the truck bed won’t take a 4’x8′ (the 8′ being the problem) or there isn’t a frame extending over the cab for such storage, and the owner doesn’t have livestock to pick up stuff for… the vehicle is a fashion accessory, just like my Fiat Spider.

True! Though I remember when I was a kid, around 1960, I was about seven years old, and my dad bought a little calf for me to raise with a suckle bucket. Of course Dave, my calf WAS small then, but Daddy put him in the back of our station wagon and let me sit right next to him as we drove him back to our farm. Wouldn’t be allowed today!

I had what was then a full size standard bed GMC pickup, two door. Was cheaper than a sedan, similar gas mileage with bed empty. Utilitarian interior. But that was 25 years ago. Seen many threads on Wolf Street over time with other old fogeys comparing notes on best years and models of used pickups to look for if you want a truck for use beyond Costco runs.

UK tax distortion here. Dual-cab pickups do not count as a domestic vehicle and receive much more generous capital allowances against tax and benefit in kind treatment so sole traders (builders, plumbers, farmers but also small businesses with no real need for a flatbed, e.g. beauticians) are all tooling around in dualcab pickups, like a four door car with a biiiig boot….

After a year, I finally was contacted my my local ford dealer to finalized my Ford lightning. When I looked again, they were all 4-door, but had a 5½’ bed WTF! They advertise this model as being a contractor’s truck. I guess they hire sloppy contractors that don’t have a push broom, or shovels. Needless to say, I’m still waiting for an 8′ bed model.

I ended up buying a 2020 F-150 XL configured as a “fleet” vehicle. These are no frills, rubber mat flooring, no power anything, two door, 8 foot bed with a very basic (reliable) drive train. It replaced the 1991 F-150 “fleet” truck I had been driving for thirty years.

The new one has a radio, the old one didn’t. Progress!

@LawnDart Your comment abut Chinese NEVs is interesting, because perhaps EV imports from China won’t have the massive surveillance built in that Teslas do. Not suggesting that they won’t want to, but that the anti-China xenophobia may prevent it. No way I’d buy a Tesla partly because of that surveillance, partly because I don’t like the lack of control over car firmware (OTA upgrades etc).

India is coming on strong too, and they probably already have your medical data, so you don’t have much left in the way of privacy to worry about.

The neighborhood electric vehicle’s speed and range class got rebranded with a propaganda term? Or is this actually something else?

Actually something else.

In China, the term “New Energy Vehicle” covers fuel cell powered and hybrid vehicles as well, so not only pure electric.

China’s current 15-year plan seeks to take these vehicles from a 13-14% market penetration rate to 40% by 2035. This goal is accompanied by a massive, multi-billion dollar build-out and modernization of the national electric grids, with non-fossil power generation a key focus.

(*Hydrogen fuel cells)

One of the things that struck me about Teslas (and maybe other EVs now?) is that you’re locked in to their ecosystem for service and maintenance. I have two older Toyotas and used to take them to the dealership for maintenance until I found a small independent mechanic who does the work for about 2/3 the price of the dealer and never tries to up-sell me.

Tesla’s valuation was always unjustified, but the narrative that anointed it the bluest of blue chip automakers at a time when it had just over 1% market share in the global automotive industry, while simultaneously writing premature eulogies about its competitors, achieved such spectacular liftoff that every investor and their dog were stampeding to buy the stock. Add the assumption of inevitable monopoly in the EV market (much like Uber was priced with the belief that becoming a global rideshare monopoly was all but guaranteed), the brash personality of a maverick CEO with a throng of fanboys and gals (even, or perhaps especially in the analyst community) hanging by his every word and one can see how the wild ride from peak of 2021 to the trough of 2022 was only a matter of time.

I see a judge has negated Alex Jones bankruptcy moves which might be cause for him spontaneously combusting, all for something that didn’t really matter…

Elon Musk has thrown it all away for something that also didn’t matter, what possessed him to buy Twitter?

Did no one else notice how easily he could manipulate the price of crypto currency via a single Twitter post? Elon noticed. Elon likey easy money.

https://www.outlookindia.com/business/10-elon-musk-tweets-that-created-waves-in-crypto-world-news-233190

I assume he has mental health issues like most people, but what possessed all his coinvestors?

Kudos to Wolf Richter and his excellent work here. There has been so many trillions of dollars washing through the world that any goofball idea could find backers, especially if they had a showman like Musk there to sell his ideas. It is all this stupid money that keeps entities like Uber still going too. Musk might be wise to appoint a general manager to run Twitter for a while and go back to Tesla and try to salvage what he can. But at the end of the day a Tesla is just a car with a few gimmicks in it to get people to ‘take part in the adventure’ of buying one. Now its just another car.

I’m waiting for AirBnb to crater next.

Me too, but the hangover in Tiny Town with 300+ out of 1,100 homes being short term vacation rentals all of the sudden being put on the market (they’re all ready to be put up for sale, every last one of them ‘staged’ with no personal belongings in the domiciles) will really put a whammy to real estate values, already plummeting across the country.

Most of the rentals were rode hard and put away wet, and i’d guess a good many of them will be foreclosed on.

Good riddance though, I look forward to the end of this saga.

Wait the percentage in your town is almost 30%?? Why hasn’t the town thrown down the hammer on it, property taxes??

We’re unincorporated and Tulare County’s cash cow, the 10% transient occupancy tax goes to them, not us.

Not sure this post is properly valuating Tesla. What I see unique about it is

1. Battery tech. If Tesla is a leading edge battery tech, that would seem to open additional market such as Tesal walls but for other applications

2. I understand Tesla collects an incredible amount of data on driver behavior from the cars. That data may have value outside of designing/selling cars. And considering the business model of Twitter seems to be to act as a front end for US gov’t, it could be that USG will also be a big customer for Tesla data.

So what should Tesla be valued as? A battery tech company? A car maker? A software company? The marginal cost of battery or car production isn’t zero and there are no known network effects that Tesla can currently claim to have, so while at the peak of the bubble its valuation multiple was trending above pureplay software companies, what’s the justification for valuing it as something other than what it is, an automotive company? Additionally, hardware companies find it incredibly difficult to transition to services businesses (where the software revenue leapfrogs the hardware revenue), even the big daddy of them all Apple, despite a respectable services business built from its walled garden ecosystem, still has iphone sales ringing more cash registers than any other part of the business. Tesla might make cool cars and may have interesting battery tech, but the reality as suggested by the post is that the load bearing column for its outlandish valuation was Musk’s salesmanship.

Tesla buys its batteries from 3rd parties, so far it’s been unable to ramp the “dry” process of the Maxwell acquisition. As to data, there are many sources, and so far car companies are struggling trying to monetize the data. So in fact those aspects aren’t unique. Furthermore, unlike other car companies it has stinted on new product development, the Model 3 is stale and fading in China (I don’t follow Europe). China sales are dominated by the Model Y. Meanwhile everyone else is developing, or (BYD and several others) already has a product portfolio. We’ll see when they actually get the CyberTruck into production, and what the specs and cost are. It’s clearly not designed as a work truck, but the suburban pickup market is pretty big. However, pickups are a non-starter in China and Europe, so it won’t move the needle in 2023.

Google Tesla battery patents. There are many.

Panasonic is a partner in the Nevada Gigafactory, and was the original supplier of all Tesla battery cells. They got cold feet for a while about four years ago as they saw Tesla basically looking over their shoulders at what they were up to, demanding to be taught. Musk and his vertical integration trying to make everything from scratch. Somehow Panasonic were pacified, probably by Tesla’s push to China. Some business is better than none they finally decided, but Panasonic’s image of itself as a technology leader turned into a mere commodity supplier has not sat well with the company, particularly when their IP has been co-opted. I believe they suspect Tesla of giving away secrets to Chinese battery suppliers, but are “polite” enough to not make a big issue of it.

When Tesla went to China and built a factory in Shanghai, there were two Chinese companies who vied to take over Panasonic’s place as battery supplier. That allowed cheaper batteries, not as good as Panasonics, to take over the Tesla business there simply because they were OK and cheap. Europe and China itself got the second tier stuff via exports from Shanghai. Any US-bound Teslas from Shanghai used to still have Panasonic cells, but I do not know about today.

As a car enthusiast who habituates automotive forums, I find many of these words about Tesla on a non-automotive site to be rehashes of arguments from years past. The stock price dive is of course recent, but the Elon BS story has been well over a decade in the making. The PMC class who idolized Tesla is now calming down as he turns out to be a regular rich dunce with “opinions” after his Twitter buy, but the hero-worship he got 6 to 8 years ago was always a complete hoot to vehicle enthusiasts. People who thought a electric car was a new idea, as if bought his line of BS. Still, we must remember he started a new productive company and avoided the trap of selling financial thin air of zero value to like-minded dingbats in the deindustrializing USA. So there are real positives to the Tesla story.

It would take a book to go back over the full Tesla story, and it’s Xmas Eve, so let’s leave/forget the weaves and dodges of the story and how carbon credits propped up Tesla for years from going bust. The end story won’t change just because the engineering details get mixed up by uninformed pontificators and the stock market “analysts”, soothsayers of the modern world, legal gamblers kitted out in nice clothes and about as informed as anyone else who holds a wet finger up to the wind and makes sonorous pronouncements.

Tesla itself? Not very good quality cars from someone who thought he knew better than legacy automakers how to build one, and found out, nope, that wasn’t the case. Pure cocksuredness from someone without the first clue, and learning from scratch. But the PMC non-technical class bought the carnival barkery, and the company valuation became so silly high that only cretins could believe it was real and based on results and actual company value. Tesla worth as much as GM, VW, Ford and Toyota combined? Yes, and thus fatuous beyond belief. The hold-up on Cybertruck is for the sixteenth of an inch thick stainless steel cladding and the Italian company providing the bending/stamping machinery. Been the story for over two years now. The ugliness of the beast has been forgotten because there are none to have to gaze at so far.

We’ll see how it all plays out, but production constraints on EVs from legacy automakers are hampering their efforts to dethrone Tesla. A lot of the delay has been due to Korean battery maker LG, who never saw a contract they didn’t want to win, and then delivered diddly squat on time, quality or quantity, screwing up VW and Mercedes and Volvo production plans among many others. Like the original “GM” Ultium batteries that are being replaced on original Bolts. Say what you will, Tesla has battery supply locked up nice and tight including raw material supply, and that’s their current advantage — vehicles that are actually available for sale while the rest play catch up and can only produce limited numbers of E-vehicles in batches.

Except for the Chinese, of course, but I suspect that the US will not allow mass imports of their EVs given the current posturing of the neocons.and the IRA. Korea, Japan and Germany are complaining about that, so EV adoption in the US is delayed by politics. Unless you produce E-vehicles and batteries in Nafta zone, you’re effectively shut out of the US market. Just another part of the beggaring of US allies and blackmailing them to send their factories to the US we see from the sanctions fallout and lack of Russian energy supplies to Europe since the start of the SMO.

Thanks for the overview. For all his faults, Musk knows something about his business, and he was faster than legacy car markers to realise the importance of securing the entire EV battery chain (and one thing Tesla do know, is batteries). They are struggling to catch up, especially the Japanese and US companies. There was an interesting presentation about 6 months ago by the head of EV production for VW (its on YT somewhere, I can’t find it right now) going into the details of VW’s plans. Its clear that they know the hazards of depending on a small number of third party suppliers and are determined to cover all their bases if possible no matter what the cost. Reading between the lines, the main problem is that raw material supply chains are focused on China. So while they are building gigafactories in Europe and north America, they are not yet sure of the raw material supplies. But that may not be an issue if politics restricts Chinese production.

My personal prediction for many years, for what its worth, is that Tesla’s future would be as a takeover or partnership with a major legacy manufacturer. This has been the history of car manufacturing – small, innovative high end companies getting taken over and absorbed by the bigger companies. VW of course has been very good at maximising the value of this type of take-over – the incredible success of Audi (imo the most overpriced and over engineered cars on the market) really comes down to mixing a high end brand with low end mass production knowhow.

The Chinese, almost by accident, have become leaders in EV, but as you suggest, I think politics will stop them dominating the market. Other countries, and not just in the West, just can’t afford to let them take over their domestic markets. So they’ll have to compromise somehow, probably with all sorts of mergers and deals.

All the car manufacturers are collecting large amounts of data from the tech inside cars now. IDK if Tesla has more granular or personalized data though.

I suspect that VW have more data than anyone else. I don’t own a car, but I rent regularly so I get to compare a lot of different low to medium range cars. VW’s always seem most efficient and keenest to plug into my phone. They are certainly well aware of my habit of crossing the central white line in Irish country driving, they never stop giving me warnings (one day I’ll work out how to shut off the warning indicator).

Not all Twitter users own a Tesla, but all Tesla owners are Twitter users.

While I appreciate what Musk has done with the Twitter files, Teslas were bought by predominantly Twitter users virtue/status signalling. I don’t think angry liberals will be lining up for Tesla.

Respectfully disagree. On my street, I’m one of maybe three households without a Tesla, many own two. Not about Elon or Twitter, it’s just a status symbol around here.

…and that status symbol is now being shared with the Quatro E-tron electric vehicle in my part of SoCal.

As Wolf points out, there is real competition in the market now.

The demographic that I see in and around San Jose makes me agree with polar donkey. Also, at lot of the cars I see being operated *oddly* are Teslas. Wrong lane, wrong speed, cutting in, no signal etc. Just like Priuses tend to be slow to accelerate, Volvos (and immaculate 25 year old Cadillacs) just slow, and any car with a farty exhaust driven to show that.

Elon doesn’t walk on water any more. He walks on mud. Sticky mud.

Twitter was bought cheaply really. USD $44 billion of fiat currency from selling ridiculously overpriced stawk, however the result of upending a whole lot of apple carts is priceless, so in my book, money well wasted and a public service by holding up a magnifying glass to the total corruption the monetary system.

As for Tesla the car. They are long in the tooth and the money required to develop new ones that the public will buy,. without the absurd subsidies, could leave a smoking hole that Tesla will never climb out of..

Musk is certainly an interesting (in the Chinese proverb sense) person, but the fact that he let Taibbi air the dirty laundry must be pissing off a lot of Big Gov people. I give both gentlement a lot of kudos for that. Musk’ll be marked down as not One of Us, just like Trump was, and Tesla did have USG investment in the starting days.

Appy Crimble to y’all, BTW.

There has never been a case for buying a Tesla other than a) Virtue/Status-Signalling or b) A Pass to the Car Pool Lane.

The cars are ridiculously expensive, poorly assembled, dangerously full of driver distractions, and require frequent charging that over-taxes our century-old electrical grid.

But don’t count ol’ Elon out. He’s already pivoted to China.

There has never, ever, been a reason to buy a car bigger than a VW Golf. Everything above that size is marketing and hormones.

Doesnt Tesla make most of its money from carbon offsets?

Yes- before they’d ever actually made one car they had millions (maybe even billions) of carbon offset tax credits from the state of CA based solely off of the pre-orders of cars. It was their most significant asset for many years.

What a sweet deal for them. Without that, I don’t think we would have ever even heard of Tesla.

You don’t think the members of Congress actually write / read these laws, especially those with some 40,000 odd pages?

I had that discussion this weekend with PMC relative about the 4000 pages recently passed overnight. “But each section is carefully reviewed in committees. ”

I segued to the weather…..

How trustworthy is the data reported in Corporate reports? After the Enron and the transformation of Anderson into Accenture, I have felt very untrusting of Corporate financials. I hope I am wrong, but I have the distinct impression that little or nothing was done to repair accounting standards. I remember when capital investment, steady growth, and reliable dividends were what to look for in a stock. But that was replaced with the relentless quest of purported exponential growth and rapid increases in share price became the new determinants to look for. The increasingly rampant practice of share buybacks and monetizations of Corporate cash flows to fund dividends and share buybacks combined with what I perceived as the elaborately costumed mendacity of Corporate reports worked to lend a mystical aura to the assets markets. This aura of occult mysteries only thickened as asset valuations climbed to wondrously impossible heights. What surprises me is how long the asset markets have managed and continue to manage to cling to their tulip bulb prices.

In the first season of the new Star Trek series, Star Trek Discovery, a character actually mentions Elon Musk in a list of names of the greatest scientists and engineers in history. Even more insane than that Simpsons episode.

The man had the media in his pocket. I want to know how he did it.