By Conor Gallagher

On Dec. 19 the Biden administration rolled out its initiative to tackle homelessness in the US. It’s basically a big plan to make a lot of plans, but one thing it doesn’t aim to do anything about? The ongoing private equity and hedge fund takeover of real estate across the country, which is driving up rents, evictions, and homelessness.

First, a reminder of the tragedy that is US homelessness:

A study last year from The Guardian and the University of Washington found that across 73 US cities and counties there were at least 18,000 deaths of people experiencing homelessness over the 2016 to 2020 time period with the number increasing 77 percent over that five-year period. (The federal government makes no effort to count the number of homeless deaths, and many believe the number to be much higher.)

The US Department of Housing and Urban Development 2022 Homeless Report released last month found that 582,462 people were experiencing homelessness on a single night in January 2022 – an 0.3 increase compared to 2020 (the count was postponed in 2021 due to the pandemic). The data also showed a 3.4 percent increase in unsheltered homelessness and a nearly 15 percent increase in chronic homelessness.

Not surprisingly, the US doesn’t have a great way to collect data on the crisis; the number is tallied by volunteers, and it is believed to be a vast undercount. Still, the official numbers show the homeless population increasing steadily since 2016.

The jump in both the number of homeless and number of deaths comes amid the ongoing private equity and hedge fund takeover of real estate across the country. As these firms buy up an increasing amount of shelter, they squeeze them for every last drop of profit – a process that involves more evictions, higher rents, and increased vacancy rates.

Algorithms, Higher Prices, and Increased Vacancy

Wall Street’s takeover of the American rental market really took off during Obama’s foreclosure regime as the firms snapped up properties (including from many small landlords) at bargain prices. The pace has continued to accelerate. According to ProPublica:

Private equity is now the dominant form of financial backing among the 35 largest owners of multifamily buildings, the analysis showed. In 2011, about a third of the apartment units held by the top owners were backed by private equity. A decade later, half of them were.

Private equity-backed firms in the top 35 cumulatively held roughly a million apartments last year, the analysis showed. That is likely an undercount, because private equity giants like Blackstone, Lone Star Funds and others don’t participate in the National Multifamily Housing Council’s annual survey.

More “innovative” tools are being used by the investment goliaths. Private equity and hedge fund firms use computer algorithms to find houses that would be profitable to turn into rental properties, often snapping them up with cash bids within minutes of a property coming onto the market. And when areas no longer have affordable houses to buy, they can raise rents.

It’s now coming to light that these investment behemoths might also be using algorithms to essentially act as one national landlord cartel that coordinates pricing. Recent lawsuits allege that Texas-based RealPage’s YieldStar software helps landlords set prices for apartments across the US. From one of the lawsuits:

Beginning in approximately 2016, and potentially earlier, Lessors replaced their independent pricing and supply decisions with collusion. Lessors agreed to use a common third party that collected real-time pricing and supply levels, and then used that data to make unit-specific pricing and supply recommendations. Lessors also agreed to follow these recommendations, on the expectation that competing Lessors would do the same.

The lawsuit contends that RealPage’s software covers at least 16 million units across the US, and private equity and hedge funds are the main driver behind RealPage’s growth. From ProPublica:

RealPage’s influence was burgeoning. [In 2017], the firm’s target market—multifamily buildings with five or more units—made up about 19 million of the nation’s 45 million rental units. A growing share of those buildings were owned by firms backed by Wall Street investors, who were among the most eager adopters of pricing software.

…Somewhere around 2016, according to one trade group, the industry’s use of the pricing software began to achieve “critical mass.”

Enough properties were now using RealPage’s services, that its pricing algorithm began to take full effect. The time frame coincides with astronomical rental price growth and a resurgence in homelessness numbers and uptick in deaths.

There’s constant media talk of a housing shortage to explain the US homelessness crisis, but according to the lawsuit against RealPage, one of its tactics is also keeping units off the market in order to drive up prices. From the lawsuit:

RealPage allows participating Lessors to coordinate supply levels to avoid price competition. In a competitive market, there are periods where supply exceeds demand, and that in turn puts downward pressure on market prices as firms compete to attract lessees. To avoid the consequences of lawful competition, RealPage provides Lessors with information sufficient to “stagger” lease renewals to avoid oversupply. Lessors thus held vacant rental units unoccupied for periods of time (rejecting the historical adage to keep the “heads in the beds”) to ensure that, collectively, there is not one period in which the market faces an oversupply of residential real estate properties for lease, keeping prices higher.

The property companies began to listen to the algorithm, and the results were predictably higher prices and profits and fewer units available. At least, that’s according to former RealPage CEO Steve Winn:

During an earnings call in 2017, Winn said one large property company, which managed more than 40,000 units, learned it could make more profit by operating at a lower occupancy level that “would have made management uncomfortable before,” he said.

The company had been seeking occupancy levels of 97% or 98% in markets where it was a leader, Winn said. But when it began using YieldStar, managers saw that raising rents and leaving some apartments vacant made more money.

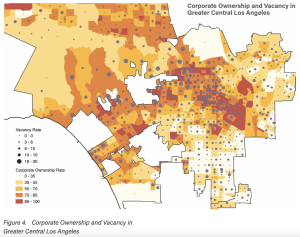

Take the situation in Los Angeles, which has some of the highest rents in the country and biggest homeless populations. According to a recent study from the LA-based housing rights group Strategic Actions for a Just Economy (SAJE), more than 34,000 housing units are simply held off the market (this figure does not include vacation homes or units that have been sold or leased and not yet occupied). The units (typically higher end apartments) are left vacant for speculative reasons and represent enough housing to shelter the majority of the area’s homeless.

One of RealPage’s pricing software’s main architects is Jeffery Roper who was Alaska Airlines’ Director of Revenue Management when it and other airlines began using common software to share nonpublic planned routes and prices with each other in a price fixing scandal that resulted in overcharging consumers by up to $2 billion. But Roper and other airline executives faced no punishment. In 1994, Clinton’s Justice Department negotiated a settlement with the companies that involved no jail time, fines, or consumer refunds (however, some affected consumers received 10 percent discount coupons for future travel as part of a private lawsuit).

RealPage has denied all the allegations in the lawsuits despite bragging about its software’s effectiveness in accomplishing higher returns for landlords. Again from the lawsuit:

RealPage is proud of its role in the exploding increase in the prices of residential leases. In a marketing video used to attract additional Lessors to the conspiracy, a RealPage Vice President discussed the recent and never-before seen price increases for residential real estate leases, as high as 14.5% in some markets. When another RealPage executive asks: “What role has the [RealPage] software played” in those increases, the RealPage Vice President responded: “I think it’s driving it, quite honestly.”

Surveillance and Evictions

By tightening its grip on the American rental market, Wall Street has helped cement the idea of a home as a commodity, spurred the assetization of housing, and embedded these assets in the international financial system. And an growing number of smaller landlords have learned to function like the big dogs on Wall Street. According to SAJE:

An increasing share of landlords – even smaller family run operations – now resemble a miniature REIT, managing their investments through professionalized, platformized property management companies, remotely contracting for labor and maintenance, and imposing automated fee and eviction schedules on tenants who fall behind on rents.

Speculative landlords are incentivized to evict tenants by the promise of higher rents, higher sale prices for vacated buildings, or the possibility of just leaving them vacant as the lawsuits against RealPage shows.

And the tech being deployed isn’t just algorithmic software like RealPage offers. In addition to unreasonable and possibly illegal rent increases, buyouts, long-term harassment, intimidation, and spurious notices, surveillance tech is also part of the eviction tool kit.

A report from the Anti-Eviction Mapping Project focuses on how these technologies are being rolled out and tested in the center of the global landlord tech industry: New York City. The surveillance systems are frequently used to harass and intimidate rent-regulated tenants, speed up evictions, and attract new tenants who see tools like facial recognition as a perk rather than a threat. From the report:

In such poor and working-class housing contexts, tenants rightly interpret the deployment of such systems as intended to “catch” them for minor lease violations, and to squeeze them out, making way for higher-paying tenants and gentrification. As we have found, many of the buildings where landlord tech is being installed for such purposes are situated upon gentrification’s frontlines.

For those who face eviction, the effects can be devastating and long-lasting. An eviction record can trap people in poverty and homelessness as it can force people to miss time from work, lead to drastically increased temporary living costs, and make it harder to find new permanent housing due to background checks. It can lead to or worsen physical and mental health. Pregnant women are more likely to experience birth complications if evicted.

Surrveillance companies market their products specifically for eviction purposes. Take the example of Reliant Safety:

Reliant Safety also displays a number of “case study” videos on their website, showing tenants breaking their leases or the law. Viewers can watch the videos and then learn about how the surveillance was used to either prosecute tenants, charge them for lease violations, or evict them. These are categorized as either: lease violations, criminal activity, insurance claims and liability claims, or narcotics.

Corporate entities that invest in rental housing are the driving force behind the surveillance tech, according to the Anti-Eviction Mapping project report. In one example, tenants tried to organize against the implementation of facial recognition cameras at a property owned by Nelson Management Group, which owns more than 7,500 properties across the five boroughs. According to the report:

The tenants who had been organizing received full color surveillance camera print-outs of them standing in the lobby. Their apartment numbers and timestamps were written on the photos, which were slipped under their apartment doors. They also received accompanying letters asserting their behavior was not allowed and they could be fined for loitering. The tenants were fully within their rights to organize, and this invasive image capture was simply an intimidation technique. Yet this was not the first time that the existing CCTV cameras were used to target tenants. Nelson Management had already used camera footage to financially penalize minor infractions such as “not separating recycling.”

Landlord tech systems are often integrated with current and/or ex-law enforcement, creating data flows and surveillance networks:

For instance, when landlords license Reliant Safety’s facial recognition systems, they also get access to a Mobile Response Team consisting of former law enforcement officers and military personnel. The team liaises with property management and law enforcement, and provides intelligence from informants via the anonymous Tenant Tips Hotline, along with video footage.

With so much money at stake, one can only imagine imagine how such arrangements could be abused to lead to arrests, evictions, or worse. Recall that the home invasion and killing of Breona Taylor by Louisville police in 2020 was linked to plans to clear the neighborhood and speed up a major redevelopment plan.

Speaking of a lot of money at stake, according to OpenSecrets, members of Congress invest more cash in real estate than any other industry, which has been true every year since 2008 when the research group first began tracking Congressmembers’ investments.

No doubt they’re pleased by the returns.

This is just one reason I have repeatedly called for the Fed to sell off it’s balance sheet – all 8 trillion of it.

The only reason to the Fed should be allowed to increase it’s balance sheet, is to buy US Treasuries to fund Federal Government deficits so that federal spending is always fully funded, so that fiscal (not monetary) stimulus can be used.

That sucking sound you would here would be the swamp draining from hedge funds and private equity, and along with it a diminished ability of their take over of the housing market and other parts of the economy.

And let’s stop bashing higher interest rates, because rate suppression and it’s accompanied QE (Fed’s inflated balance sheet) is the primary funding source of hedge funds and private equity that are now taking over the housing market thanks to decades of low rates and QE. Higher interest takes that money away from hedge funds and private equity and puts it into the hands of The Little People some of whom are still able to save.

Let’s realize that interest rates are near-ish to a sane normal level, and should generally stay that way.

Yes, there are other factors encouraging the centralization of the economy like tax and spending subsidies to the rich, over taxing working folk, regulatory favoring of the rich and corporations etc. It’s not all about interest rate suppression and QE – those are policies that also favor wealth concentration.

But when will the little people get higher interest bearing opportunities? Seems like for most you get a savings account that pays almost zero interest while you’re charged interest rates on everything else that are much higher than zero. I know that there are options outside of simple banking to get higher returns but I really would like to hear from other people in this esteemed commentariat when this supposed effect from rising interest rates will ever occur.

IMO, I think what we’ve got now is what will continue into the future. We’ll see much higher borrowing costs, high rates for mortgages, usurous credit card fees, and near zero interest paid on CDs and savings accounts until some kind of revolution occurs. Even then, I’m not convinced a Danton or Robespierre lead government would ever get down to the level of worrying about interest paid to common citizens. Those kinds of awful revolts tend to destroy more than they help. Short of some regulatory regime coming in to say “the minimum interest rate allowed in a FDIC backed savings account is X%” I don’t think what we have now is ever going to change :/

I leave as little money as possible in my checking and savings accounts and keep the rest under the perverbial mattress.

I’ll be damned if I let them use my money for free.

What are you talking about with respect to interest rates? The natural rate of interest for a fiat currency is zero — central banks have to “defend” any rate higher than zero either by activity in open market operations (the old fashioned way) or by paying interest on reserves.

The overnight rate is a policy lever — there is nothing “natural” about it.

Like all Central Banks, the Federal Reserve, counterfeits today’s and tomorrow’s money on yesterday’s Public assets.

The “Too Big To Fail” crowd gets those Fed dollars to front-run assets, stocks, bonds, real estate while the guarantor of Fed Debt (the Nation) is unaware of the in-your-face 3 card Monty.

From a high producer nation to a Rentier Nation in less than a generation. Amazing, the depth of the Con job.

Sorry, too many assumptions here are misguided. First “selling off the balance sheet”…what does that even mean? Taper tantrums for all? And why? Does the Fed need dollars? And do those dollars grow on billionaires?

What’s obviously been needed for a long time now is for the federal government to stop relying on the Fed to handle problems. It needs to authorize the fiscal resources resume building rental housing. It can afford anything for sale in the entire economy, and for the billions sent Ukraine could have solved homelessness many times over. Richard Nixon put a moratorium on building federal rental housing and Reagan–as he was cutting taxes for the rich roughly in half, and, with his successor, raising payroll taxes eightfold–cut HUD’s affordable housing budget (section 8?) by 75%.

…but the beatings must continue until morale improves.

Great post. Thanks.

Agreed. Great post. I can foresee a time down the track where all these practices will start applying to the multi-million dollar homes and apartments in places like New York city. And it will be at that point that you will hear those wealthy people start making accusations of violations of the RICO Act.

Yes the homeless need homes but do the homeless vote or can they? Also, do the really struggling middle and lower classes who pay inflated rents to keep the roof over their heads care more about the homeless getting houses or the Government getting its act together to ban the use of the Yieldstar software to lower their rents? Politically will this issue get traction as long as it is framed as a ‘homes for the homeless’? For too many, the adjective ‘homeless’ conjures a vision of either drug addicts or people with mental health issues and they switch off instantly.

As long as the majority of Americans believe that home ownership should be the goal for everyone, the homelessness crisis will continue, because putting every American into a house is unrealistic. Most low income people simply cannot afford the expense of owning a house and many lack the skills to maintain a house and lack the income to hire professionals to do the work, elderly and disabled people living on Social Security are especially unlikely to be able to do this. As numerous studies have shown, home ownership is not the best investment and can easily ruin a low income person because for the first 20 years at least, most mortgages are much higher than rents in the same area, often so much higher that the home owner goes into debt to hold onto the property, the appreciation of which will never repay the amount invested in the down payment, the interest on the loan, and the maintenance of the house. But rather than face reality and accept that for many people renting an apartment is a better choice than owning a house, we continue to ignore the problems with predatory landlords and practices like the ones detailed in this article.

Important post.

My rent just went up $200 a month. I am a low income person who is barely making it financially so this is a catastrophe for me. My landlord owns a large number of properties, most of which are luxury apartments. Mine is not. I don’t know how I am going to be able to stay here or find an affordable place in the current rental market so I am facing homelessness in the New Year. I suspect this is happening to many people across the country. Just another “go die” message from our betters.

Pre-2020, I worked in an office located in Hollywood for about 7 years.

Lots of new apartment buildings went up in the area. I and other co-workers would notice the high rent prices and lack of occupancy – years of high vacancy rates (staggering rates we guessed at over 30%…on the low end) and increasing homelessness.

And, yes, they started using units for Airbnb.

A discussion about the US housing market without discussing zoning is never complete. Zoning is a huge issue that keeps the availability of housing down, and props up housing values in suburban markets. There needs to be reforms to local control of zoning so that more inventory can be built.

Ah zoning! The con of cons. In California, we do use-based zoning. “Put the residences here, the offices there, and the commerce and industry yonder.” These decisions are typically made by concerned citizens sitting around a map, armed with stickers and highlighters. The zoning is often decided as much as a decade or two before any building occurs. So…after a decade or so, what does the market want? Should a particular parcel be residences or commerce or apartments or offices? The answer: Not even psychic Ms. Cleo could guess this. So all the time and energy spent “deciding” the zoning is completely wasted (although the governing officials will use zoning as an excuse to deny proposals, or accept them whenever it suits them and the donor class).

That is why use-based zoning is a con. Oh yes, “zoning changes,” “variances” and “use permits” and a massive industry of lawyers and consultants can change whatever zoning is decided at the drop of a hat.

Why is zoning important? In large part because land speculators can buy ag land for a few thousand dollars an acre, and when they get the entitlements to develop it, they can sell it to builders (unimproved!) often for 50 – 100 times what they paid for it. And if they 1031 exchange out of the sale to income-producing real estate like apartments or shopping centers, they defer even income tax indefinitely on that 5,000% – 10,000% gross profit.

It’s quite a racket, and is why speculator Alex Spanos owns the San Diego Chargers, and why we don’t have a Sacramento Galleria, we have one named for speculator Angelo Tsakopoulos. Sacramento can’t afford it…they gave all the money to Angelo.

Interesting side note: Angelo is active in D politics, while his brother George is active with Rs. They don’t care who they support as long as they get that extraordinary profit (“the unearned increment”). In keeping with the idea of suppressing public participation in governance, the Tsakopoulos Galleria charges for meetings even though every other library in the County does not (the Galleria is attached to the central library, which does not have free meeting rooms.) One former County Supervisor said the Sacramento region is widely acknowledged throughout the state as the area the most in the hip pocket of developers. I say that’s a contest virtually no one wants to win.

Meanwhile, an alternative exists: Form-based zoning. That’s “build the big buildings here, the medium-sized ones there, and the little ones over yonder.” It lets the market decide the use when builders are ready to develop what’s zoned. Yes, that can be abused, but it’s not a transparent fraud like use-based zoning.

The recent moves by the state legislature range from good (“complete streets” are now required) to nibbling-around-the-edges (permit higher density even when single-family zoning is the rule).

What a load of crap!

In California, we do use-based zoning. “Put the residences here, the offices there, and the commerce and industry yonder.” These decisions are typically made by concerned citizens sitting around a map, armed with stickers and highlighters. The zoning is often decided as much as a decade or two before any building occurs.

vs.

Meanwhile, an alternative exists: Form-based zoning. That’s “build the big buildings here, the medium-sized ones there, and the little ones over yonder.” It lets the market decide the use when builders are ready to develop what’s zoned. Yes, that can be abused, but it’s not a transparent fraud like use-based zoning.

Good grief, chill, please. Look who sponsored this, The Guardian, a left leaning paper in the UK. So to expect any but a critical look at the hot money makes it hard to take seriously.

Like has hot money moved into rentals? Yes, sir it has. But is the hot money always right? Maybe watch how quickly they drop the idea of rentals once they realize poor people aren’t necessarily the best sheep to try and shear.

My point? Everything is cyclical and just as the price of gasoline went up and came down, high rents will crash back down to reality as homes and apartments sit vacant longer. Remember, leases come due on about a yearly cycle so it takes time for all this to develop.

Sucks to be a renter right now, no question because landlords have ears and nobody wants to accept any less than what something is worth, so they’ll hike rent because everybody is doing it. Makes the news.

What doesn’t make the news? Homes and apartments sitting vacant longer. So those rewarded with a tenant accepting a higher price will be happy and try it again. Nature of the rental beast, however, if the place sits empty a little while, then landlords readjust their expectations lower to fill the unit. And renters being human grouse about the rent and word someone pays less spreads like wildfire leading to readjustments. Especially if another place nearby is available for less. A type of contagion. Human nature.

Source? Grandmother owned apartments and accompanying her or my uncle to collect rent each month as soon as I was old enough to walk and climb stairs without help are some of my earliest memories.

John-boy, I see you didn’t read the article very carefully or you would not have bothered with your fifth paragraph. Bye the bye, do you happen to be a landlord?

It’s not grandma’s world anymore, unless grandma colluded with other landlords to keep rentals off the market.

UTGDFA

U = understand, the rest is up to your imagination.

Pleas, let’s not get hasty in our angry condemnations.

Like with my family, the life he has lived inform his beliefs; this world, with the vampiric vampire squids sucking the life out of everything, everywhere with their existence and existence camouflaged via the news media, is still somewhat new, why shouldn’t a person doubt these conclusions? I know that I would if I was any older. And I would be a Boomer if I was.

Hell, I have lived this lifelong slow collapse, reading about it as it has happened, and I still get dizzy comparing my childhood dreams with today’s financialized abattoir.

John, do you have any stats, data or links to information supporting your position? We have one rental property so I’m curious if you can let us know some other options or trends.

IRS tax rules for Corporations under Schedule C vastly more favorable than Schedule E for Ma & Pa Kettle landlord. Big change occurred around 1986 with Reagan-Rostenkowski.

My landlord is selling my three unit ex-single family dwelling. He asked me if I wanted to buy it after he told me he spent $22K on repairs last year. This is how a happy little rentier becomes euthanized when his cozy little enterprise turns into a money pit. He wants $750K for the place. So, the perspective owner is facing around $35K in opportunity costs if he buys the place instead of say passively investing in Treasury bills.

This will work if the guy lives in one of the units and has no repair bills…heh, heh. The house was built in 1886 and is badly in need of all new windows…25 or 30 of them, and the roof still leaks. Anyway, it looks good. It has vinyl siding. Who knows what charms lurk beneath the plastic.

So, if the place is sold, I figure I’m looking at $2,500/month rent for my 2 bedroom apartment. It has been a painful decade for the voluntary renter. My wife’s 2-br. unit went from $1K/month in 2010 to $2K/month today. Single family home-owners are clueless. All they can think about is their property taxes. When I tell the local pols. we need a rent control ordinance they look at me like I’m the brother from outer space. What?! Renters don’t vote.

1886? !!!

What’s the non-visible plumbing (inside walls and floors) like? Wiring? Unless it had a legit professional gut-rehab in past 40 years I would run the other way, no matter the market circumstances.

On vacant properties copper miners usually come in with a SAWZALL, not shovel.

Has anyone done a truly comprehensive scientific study of all the factors affecting rent increases over the last twenty years? So often you hear, “no, it’s not NIMBY zoning, it’s privacy equity” or the reverse. Or the fact that new construction is catering to the high end of the market. Or the only solution is more public housing or rent control.

But it’s probably all these factors.

>>>Or the fact that new construction is catering to the high end of the market.

Hello, San Francisco. Land of the 1.8% population homeless.

Rethinking the Economics of Land and Housing by Josh Ryan-Collins, Toby Lloyd and Laurie Macfarlane is my personal recommendation. They say 80% of the rise in house prices (and one might assume rents) stems from land appreciation (“Paging Henry George!”)… They also debunk the idea that rent controls adversely affect the supply of rental housing. Refreshingly, they also seem informed about MMT.

When private equity purchases a firm, that usually results in the wholesale looting of the firm’s assets followed by dismantling and selling off the remnants of the firm four ways to the wind. Now private equity, and Big Money investors — I am not sure what the difference is — are taking over housing. I wonder whether some analog of their destruction of firms might attend their tenure as landlords. I forgot to mention Corporate investors. I also forgot the wondrous inflation of rents and home prices, and consolidation and collusion in the provision of housing for the u.s. Populace. I am coming to believe our Power Elite is totally dedicated to engineering a horrific Collapse for the u.s.

Another, important factor is hundreds of thousands of recently arrived legal and illegal immigrants occupying the least expensive housing wherever they choose to alight. Landlords love them because they can pay more rent for large numbers of people occupying say, a suburban house, versus a plain old vanilla American family of four people.

“Nearly 10% of the nation’s 11.1 million immigrants who are in the country illegally reside in Los Angeles and Orange counties”

https://www.latimes.com/local/lanow/la-me-illegal-immigration-los-angeles-20170208-story.html

The U.S. is responsible for 41 changes of government south of its borders between 1798 and 1994, and it hasn’t stopped. That created a constant stream of military and political refugees. The economic attacks, like NAFTA, are as bad. In the wake of NAFTA, Mexican real, median income declined 34%. Those little Mexican corn farmers couldn’t compete with subsidized Iowa corn…so now they’re mowing lawns and painting homes in Gringolandia so they can feed their families.

The immigrants are a real “problem” (except for employers) and a handy target of resentment, but I’d settle for the U.S. stopping its aggressive policies that creates them in the first place before we put them in cages here. If that occurred, we might actually have to pay labor more…(although, oddly, a few years ago, Krugman estimated the impact of immigrant labor on very low incomes at less than 7%…but hey, that’s free-trade-lover Krugman)

Tell that to homeless veterans living in cardboard boxes. It’s all their fault?

The issue is high rents, not our foreign polic–. To and including French, Portuguese and Belgian colonies residents that are coming across by the tens of thousands?

Maybe our soldiers should have stayed home in WWII to avoid foreign wars? Or, perhaps the U.S. should have seized all of Latin America to the southern tip of South America? I guess that would satisfy apologists for foreign invasion.

Of course rising rents have nothing to do with rising property taxes, which generally are targeted at properties that are not owner-occupied.

California has prop 13 which limits property tax increases, and is among the states with the highest property values and rents. Michael Hudson (and Henry George) say higher taxes limit land speculation, which makes sense. The speculators can’t keep the land off the market for so long if doing so is costly. Studies say that 80% of price rises stem from land (see previous comment).

As for whether non-owner-occupied property is targeted, Prop 13 has a gigantic $12 billion loophole for commercial and investor-owned property. Residential properties are reassessed with every sale, but commercial properties are not reassessed if less than half the property changes hands at once. Assessments are the basis of the property tax bill. Stagnant assessments mean stagnant tax collection.

So Michael Dell (of Dell computers) bought a Santa Monica hotel and split title between his wife, himself and a corporation he controls. It’s still assessed at 1978 values (plus the ~1% a year assessment appreciation Prop 13 permits) No new assessment in a state that’s experienced 30% a year appreciation several times since 1978, when the proposition passed. The proposition to close this loophole hit the ballot just as COVID hit businesses (who paid millions to defeat the loophole closer). So the state is out $12 billion even low real estate taxes could collect without the loophole.

Likely from just one city, San Jose, in the vicinity proclaimed, for over two decades, as the most Meritocratic (Silicon Valley/Santa Clara County) in the world, let alone the US, on December 27th, 2022: By LaMonica Peters 4 homeless men die in Santa Clara County in a single day https://www.ktvu.com/news/four-homeless-men-die-in-santa-clara-county-in-a-single-day . Bolding mine:

A most sickening thing is that neither of the 2 major NonProfit News Sites reporting on Silicon Valley, even bothered to report these four, 12/27/23 deaths.

P.S. to those so glib about homelessness: what in the world is wrong with you?

To many, the homeless are the same as the disposable; people of no worth and usually are solely the cause of their condition. While it is true that those fruits of despair, alcoholism and other evils, are quite common among the class of disposables, that a minimum wage job could get you and your family an apartment sixty years ago in

Santa ClaraSilicon Valley, and for a little more a house albeit not of the best standard, is simply ignored; now, a six figure income is needed for the same standard of living; a similar story can be said about almost all of the United States, but acknowledging this would be acknowledging the true state of our nation with the attendant fears, and it might even force our society to fix itself with the attendant threats to the wealth and privileges of the influential and powerful.People who have benefited from the economic and social devastation do not want these facts to be accepted; those threats means nothing substantially to the benefit of the majority of Americans is going to happen until things get much worse with spying, arrests, and bullets being used before that happens.

It’s not that we’re glib or uncaring, it’s just that we get up to the alarm at 5AM, roll out of bed for morning prayer and ablutions, and are out the door to work. Work, remember that? Why work? Expressly to not be homeless!

I watched my Dad hold down a second job when he wanted to buy a fishing boat. I remember he and my mother discussing not being able to afford it and his saying he’d take a second job and save for it (both were phobic about debt, as am I).

So I’m curious . . . how many homeless have you taken into your abode? If you say you have someone homeless in your spare bedrooms right now I’ll shut up and thank you for doing God’s work – but – somehow I suspect that’s not the case and instead you want people who pay taxes to take care of people who don’t work.

Someone mentioned illegal immigrants crowding into a home. Do a bit of reading, home ownership is a recent human development. Turn of the century Europe as well as New York was characterized people living in a room in a tenement or a long term hotel. Not saying it’s not an aspiration but people have been working to live in one room since forever and only now are we getting to the point many are buying homes for them and theirs.

Does it make me glib and uncaring? No, it makes me a realist. Those Mexicans who arrive to any job they can find. often not speaking much English end up with sons and daughters who are integrated into American society.

And nobody gave them diddly. Why? because they don’t have time to become drug addled or alcoholics because they work for a living. Easy life? Oh Hell no. But they work, send money back to their parents and somehow make it. We’re getting a few into Congress and I imagine the day is not long off where one will become President. It’s called the American dream for a reason.

John, respectfully, claiming realism is an excuse. Many of the homeless have jobs. Sixty years ago most anyone could have a middle class life. Even a working class job was often good enough for a decent life for most. That was a forty hours a week job for more than just housing, food, and clothing.

Where are the factory jobs, the free college education, the affordable housing? Just where are these opportunities to get ahead? Aside from a lucky few in the lower classes or for the connected in the top ten percent? I do not think it happenstance that the lack of homeless during my childhood to the abundance of street denizens occurred. We can blame laziness or addiction, I suppose, but really, is that true? Somehow, over a million Americans are too lazy or drug addicted to get enough work every night, unlike those hardworking days of yore?

Today, in California, a studio apartment is usually two thousand, or more, dollars a month. That does not cover food, clothing, utilities, transportation, or medical, plus incidentals like shampoo. Lets say three thousand dollars. That is thirty-six thousand dollars a year. A entry wage job is less than twenty dollars an hour. Usually with little or no healthcare, vacation, or retirement of any kind. Lets bump it up to twenty dollars an hour. To cover taxes, that is about forty thousand dollars a year or a hundred and sixty-seven hours a month just to survive. Forever. Don’t get sick, old, disabled, laid off, married, have children, or any bad luck. Ever. Or Covid.

Right after the Great Depression and the Second World War, all sides of my family didn’t much, but right after the Second World War, there were plenty of opportunities that could be had with hard work. My own classmates forty years ago still had some of those opportunities. Those opportunities to go from field work to owning houses are gone, now, especially in places like California. And it is only getting worse, with more hours needed every year just to stay housed, forget about getting ahead and since businesses don’t want to give full time work, that means stitching multiple jobs together just to get enough hours. Multiple jobs one has to commute to and from. That often have every changing hours.

So, just what is truly happening here?

Interesting discussion. The root of the problem is the overwhelming power Big Capital now has over working Americans. We are speeding toward a new Gilded Age with huge sprawling homeless camps across the country. FDR only became a “liberal” when he saw a real possibility of a communist revolution occurring. Until schools are fully funded and unions are allowed to organize freely this spiral will continue. When people can once again afford to buy their own houses the private equity crowd will be forced out.

I take Matt Desmond to be an, if not the, authority on eviction, private market rent and poverty in the US. He estimates the total cost of housing all homeless in the US at $20B.

That’s half a Ukraine war bailout bill! Or a rounding error in the Defense budget!

Point is, as many have pointed out, homelessness makes for a great business. On both sides. Advocates fighting for the unhoused get great, often cushy, and righteous jobs. On the other side the meh crowd are too busy squeezing more cash out of the desperate and poor and disrupting any policy that might infringe in their god given American right to exploit the impoverished.

Oh my, John Beech ( at https://www.nakedcapitalism.com/2023/01/how-wall-street-takeover-of-rental-market-is-fueling-the-homelessness-crisis.html#comment-3834658 , above), I made a very generic comment, about some being way too glib about homelessness, then you go into attack mode regarding my comment about homelessness deaths; even though I had quite a few commenters in mind, and never focused on you at all.

Further, you couldn’t be further from reality in your implications regarding me. The only decent thing about your comment is your backhanded way of admitting your glibness, and refusal to acknowledge the ghastly realities of the ever increasing homelessness deaths in the U.S.

This article made me physically ill.

Is there any kind of potential policy solution (monetary, fiscal, regulatory)?

If I begin my career in rentier finance, is my soul lost? Would working at the Fed really be any better?

– a tired and terrified undergrad shouting into the void