Yves here. Lady Fortune has smiled on Europe, at least as far as gas prices are concerned. As Wolf Richter lists below, many factors have broken their way, presently taking the pressure off what was close to universally predicted to be price hell or at least price pain.

However, Wolf’s tally omits some key items:

Europe having loaded up on Russian gas in 2022

The suspensions of activity and even closure of facilities in energy-intensive industries, such as BASF’s decision to permanently cut operations at its main plant in Ludwigshafen

China’s stop and go growth under Zero Covid, which looks set to remain dampered under “Let ‘er rip” (unless China proves more adept at managing a chronically tight labor market than the US)

Borderline recessionary global outlook for 2023. The World Bank forecast this year to show the weakest growth since the financial crisis and Covid

In other words, Europe may continue to have favorable gas prices. But at what cost?

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

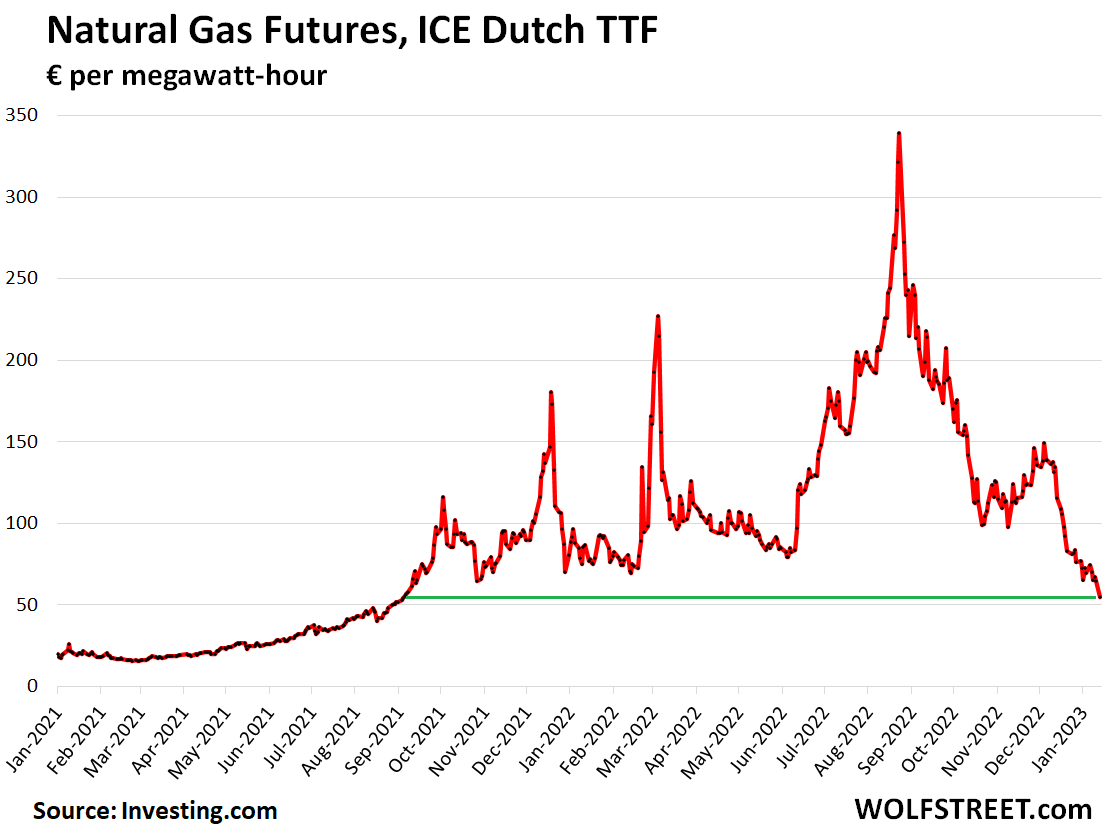

The price of Dutch front-month TTF Natural Gas Futures – a benchmark for northwest Europe – plunged 15% today to €54.85 per megawatt-hour (MWh), and has now collapsed by 84% from the crazy spike in the summer of 2022. The price is now back where it had first been in early September 2021 (data via Investing.com):

What spooked the European natural gas market today into the 15% sell-off were reports that Chinese importers of LNG were trying to divert February and March LNG shipments from China to Europe, as they were sitting on large stockpiles of LNG amid dropping prices in China.

There had been fears that the reopening of China’s economy would put further strain on the global LNG markets. Or was that just hype all over again?

In 2022 and into 2023, several factors came together to avert what had been seen as a potentially dreadful energy crisis:

- Surging supply of LNG from the US and other locations around the world.

- Rapid deployment of floating storage and regasification units (FSRU) in Europe to offload this LNG supply, including in Germany.

- Pipeline natural gas from Norway to the rest of Europe grew by 4% year-over-year in 2022 113 billion cubic meters (Bcm), according to S&P Global. Norway is now Europe’s largest supplier. Norwegian gas deliveries to Germany reached historic highs.

- A large-scale effort by households and businesses particularly in Germany to reduce natural gas consumption (heating, hot water), motivated also by the big price increases of natural gas.

- A shift in power production from natural gas to other energy sources, including coal, also motivated by big price increases of natural gas through the summer of 2022.

- A warm winter.

All of this worked together to reduce demand for natural gas and increase supply to replace pipeline natural gas from Russia.

Natural gas storage facilities in Europe are in exceptionally good shape for this time of the year. In the European Union overall, storage facilities were 81.7% full on January 14, according to GIE (Gas Infrastructure Europe). This is how the 916 terawatt-hours (TWh) of natural gas in storage on January 14, compares to the levels at the same time of the year in prior years:

- 76% above 2022

- 32% above 2021

- 1% above 2020

- 30% above 2019

- 44% above 2018

Storage levels differed by countries, but all of them were in great shape, particularly in Germany, which has managed to actually increase its storage levels over the past few weeks during a period (winter) that would normally be the withdrawal period. As of January 14, per GIE:

- Germany: 90.5% full

- France: 79.7% full

- Italy: 79.3% full

- Spain: 93.6% full

- Netherlands: 75.8% full

- Poland: 95.6% full

- Sweden: 88.4% full

- Belgium: 88.6% full

- Austria: 87.3% full

- Denmark: 91.5%% full

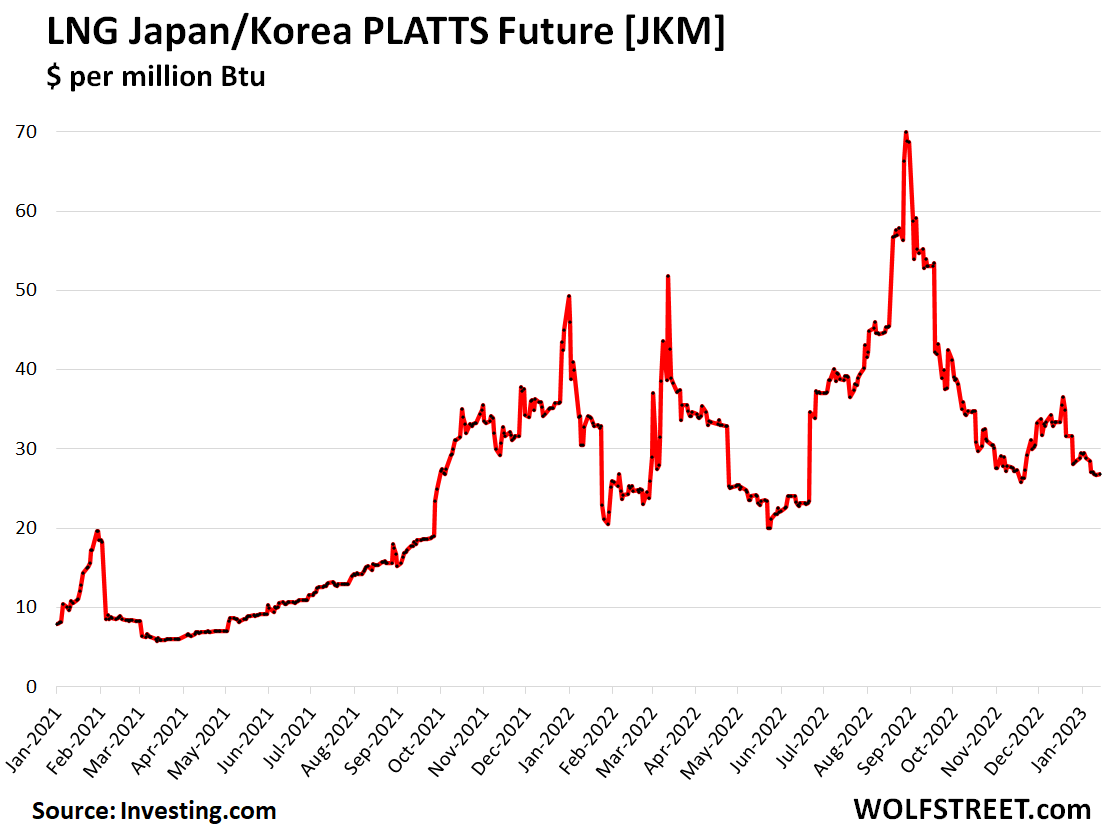

In terms of LNG pricing, the pressure has come off too. The price of the Japan Korea Marker (JKM) futures contract, at $26.80 per million Btu has plunged 62% from the crazy peak on August 31, 2022 (data via Investing.com):

This is much in line with what I’ve been hearing. The German/EU leadership may be idiots, but at the level below there are still very capable managers and there has been frantic activity since summer to protect supplies and boost alternatives. I’m not closely connected with energy supply people, but the conversations I’ve had for the past month have all been fairly confident that barring a super cold and windless winter things wouldn’t be so bad, even if more mothballed coal plants couldn’t be brought back into play (as has been the case). A key point that is often not appreciated by energy doomsayers is that major industrial gas and electricity users have far more flexibility than is often assumed. Indeed, this need for flexibility is invariably in their supply contracts. Its not comfortable for them, but its possible to slow down or temporarily shut down many processes without a full damaging closure. Grids are also far more resilient than a decade or two ago thanks to reinforcing needed for taking on more renewables.

However, the economic impacts will still be very severe. A lot of gas has been bought forward, so dropping prices won’t push down electricity prices. In the past two weeks I’ve had three separate conversations with people in shock over their winter electric bill. I’m an extremely light power user so its been mild for me, but people with families and small businesses (especially restaurants) are in pain, and this will impact in spending very seriously over the next 6 months.

True that many factors influence NG consumption and it is possible that a mild winter is not the main factor in some places. Foe instance, In Spain, NG for home heating (NG boilers) is small part of NG consumption that goes primarily to power generation (and I believe only a tiny part of heating in Spain is from power energy, though I have no real data). Power energy consumption in the EU has almost certainly declined. At least, in Spain, current demand is nearly 6% below these days in year-to year comparison. Whether this has affected energy intensive industries much more that other sectors I cannot tell and a good analysis would require a very detailed study. Peak demand has dropped similarly, energy losses drop and some other energy sources might be gaining market share. In another instance these days in Spain Combined Cycle and Co-generation (the two main NG-based power production facilities) are only small part of the total mix (about 10%), much smaller compared with their share during late summer so I can confidently say that NG consumption in Spain drops in winter compared to summer due to several factors: eolic energy is much higher in winter, as well as hydraulic, and then nuclear is more stable. In summer only solar “competes” with NG. So, even if total power consumption is somehow lower in summer (about 10-15%) the share of NG is much higher and total NG consumption is quite higher in summer in Spain (part of it because AC, it is too hot!). Contrary to conventional wisdom, winter is not precisely the most favourable season for NG, at least in Spain.

6% year-over-year decline is normally associated with severe economic contraction.

Not a good omen for unemployment levels.

As you say “normally associated”. We are in times other than normal and I cannot tell what is exactly going on. In the energy markets, as PK says above, there is some flexibility and that might be playing a role on final consumption. Might be, I do say, with all caution so the observed decline might be indicator of severe contraction or might not. I would need several hours of data search to have the slightest idea. Particularly given that I not longer trust any single source.

Yes, there will be huge regional variations according to usage and supply.

Here in Ireland the biggest user of gas is electricity generation – most industry (including, notoriously, server farms) use electricity, and their use is low during winter. Gas is also used a lot for domestic heating.

There was a record electricity peak – first time over 7GW – during the cold snap at the beginning of December, but since then its been mild and windy so wind has taken a lot of the strain – usually averaging around 60% of electricity supply. Thanks to the timely addition of a giant centrifuge at one of the biggest thermal plants in October they can now run wind supply closer to demand (i.e. they don’t have to run the thermal plants all the time). I don’t follow UK supply so closely, but the massive investment in off-shore wind seems to have really paid off this winter.

I’ve not seen much evidence from the figures so far that (despite government exhortations) people are doing much to save energy. Demand is very high, but its hard to know what component of that is the rapid rise in population and server farms over the past year (i.e. natural demand rise). The government here is giving 200 euro a month to householders to discount price rises (good news for me as I use much less than 200 euro a month of electricity, even at peak prices) but i think this gave people a false sense of security, hence the belated shock at recent bills. These may well encourage people to do what they should have been doing months ago and turn down their thermostats and shower less, etc., not to mention the Irish addiction to having lights on all winter long, but I think its a little late for this year.

Incidentally, the Irish government has formally withdrawn targets on EV car sales, and instead have declared a policy of reducing all car ownership and usage (but typically haven’t said how they’ll do it). There is massive interest in off-shore wind now – it seems highly profitable given the companies piling into the sector – but it will be 2-3 years at least before they are in place. There is, however, a massive amount of ongoing investment in existing permitted wind and solar farms in addition to storage. What is interesting is that at present the Irish grid doesn’t actually know how much storage is available as lots of private wind generators have put in their own battery storage in order to sell power at times of higher rates. As so often, industry is well ahead of the curve. Current plans are to place spinning capacity (centrifuges) in all thermal and CCGT plants, with battery supply for 2-3 hour+ demand, and additional pump storage for longer term.

Indeed off-shore wind is, I believe, one of the most important investments in energy production these days. Special ships have been built to move the giant blades and structures to their positions, large cranes to put all in place fixed in or anchored to the seabed. Engineers have been working hard!

Centrifuge? Surely flywheel?

Yup, sorry, technical term is big spinning thingy.

Just to add to the above, I posted without checking recently the excellent CREA energy and CO2 tracker. There has been quite a significant drop in energy use in the EU, although it seems to be mostly in non-electricity use (presumably both industrial and domestic users).

Only time will tell if this is a loss of critical industrial capacity, or just high price signals meaning everyone is being more careful and efficient.

At least for Germany, it seems very probable that the reduction in gas consumption is largely due to cuts in industrial activity. Here is the latest report of the Bundesnetzagentur regarding gas in Germany.

Look at chart 3.1 “Gasverbrauch Industriekunden (wöchentlicher Mittelwert)”, i.e. Gas consumed by industrial customers (weekly average): Ever since calendar week 23 and with only a two-week exception at the very end of 2022, industrial gas usage has been significantly lower than the lowest level since 2018. Because the reduction started in June, the argument based on a “mild winter” does not hold. In January 2023, industrial gas consumption is down by a third from a year ago — which was already slightly below the medium-term average.

Chart 3.2 “Gasverbrauch der Haushalts- und Gewerbekunden”, i.e. gas consumed by households and commerce, shows that gas usage has been very low, but not abnormally so, except for some weeks in autumn and in winter.

The issue is not a temporary slowdown.

Industrial products in Europe will be at a long term competitive disadvantage in the world market. For nations like Germany that are reliant on their exports to the world of manufactured goods, that’s a huge problem.

Having worked in manufacturing myself, its a far bigger issue because of the competition. Manufacturing is competing on a global level. The competitor has a say in whether or not European Costs are competitive.

In industries like automotive manufacturing, multiple shifts of production is required for the car manufacturer to remain competitive. Shutdowns are a disaster and suppliers are fined tens of thousands of dollars (or Euros) per minute for shutdowns.

Shutdowns for employees means loss of income and ultimately, plant closures as plants in Europe become structurally uncompetitive.

Indeed, it’s difficult to tease out these sorts of structural economic problems with short term data. How well can the EU economies deal with structurally more expensive energy? There isn’t any one thing we can point to that tells us this too easily, and our examples from the past we can look to are mostly all from the oil shock era of the 70s, which give difficult to interpret examples that don’t necessarily fit well in our neoliberal era.

Whatever happens, I think we’re still very firmly in “It ain’t over till the fat lady sings” territory.

The high prices for energy for private consumers are locked in in Germany for 2022/2023 as many people (including me) renewed their energy supply contracts at the end of 2022 at high prices in order to avoid the threat of even higher prices. Whether the Govt. will step in to limit excess profits is unclear.

As the gas storage levels fall towards the end of winter and Europe tries to fill up again for 2023 without Russian gas then I am guessing that the prices will rise again. We also have not seen the effect of the still-to-come oil sanctions that could really cause a major problem with diesel production.

We shall see.

These are the storages that matter most (from the GIE link):

Germany: 90.5% full

Italy: 79.3% full

France: 79.7% full

Netherlands: 75.8% full

These countries has more then half of the storage capacity of the EU. The relationship between consumtion and storage varies a lot. The big ones above can store about 1/4 of their own consumtion. Latvia can store almost a years consumtion. Spain with gas from North Africa has a storage capacity of about a tenth, but isn’t dependent on Russian gas.

UK uses 75 times more then Latvia, and has a smaller storage capacity then Latvia. Guess that is the consequences of being the most neoliberal country in Europe. As the North Sea gas fields has peaked, and UK is out of EU, and UK imports about half of their consumtion, I would think UK is most exposed to risk here. But that is speculation on my part.

Just a question: What is Europe going to do with all its underground stored nat gas which it bought for I guess 120 euros per MWh? A bit expensive toy to play with. TTF gas price fall also probably reflects panic among nat gas distributors. Imagine that your company has commited to buy few TWh at 120 euros. So you try to sell as fast as you can because commodity exchange asks you to deposit the difference in cash. More energy distributors going to get saved by EU governments?

Use it, I guess.

I don’t know the details of the gas storage business, but checking Germany the largest gas storage company – SETE – is now owned by the German federal government. It was previously known as Gazprom Germany. Checking France the largest gas storage company is owned by a company which is owned to 25% by the French government.

If there are gas storage companies that is neither owned by a government nor is integrated in a larger gas company or energy company (which has been making large bucks from gas and electricity prices), they might have a problem. If they go under they can probably be integrated into the dominant structures, wheter these are private or government controlled. Most non-UK EU conutries has these dominating giants. Energy is in the end to important to let the markets fail.

The storage facilities (in DE at least) are service providers only. The gas belongs to their individual customers.

The cost of the purchased gas will result in corresponding tariffs. I just received notice from my provider that electricity will go from €0.3558/kWh to €0.4938/kWh on 1st of March.

Makes sense.

Thanks.