By Conor Gallagher

Between 1993 and 2011 the Department of Justice Antitrust Division issued a trio of policy statements (two during the Clinton administration and one under Obama) regarding the sharing of information in the healthcare industry. These rules provided wiggle room around the Sherman Antitrust Act, which “sets forth the basic antitrust prohibition against contracts, combinations, and conspiracies in restraint of trade or commerce.”

And it wasn’t just in healthcare. The rules were interpreted to apply to all industries. To say it has been a disaster would be an understatement. Companies increasingly turned to data firms offering software that “exchanges information” at lightning speed with competitors in order to keep wages low and prices high – effectively creating national cartels.

Here are just two recent examples:

- Real estate investment behemoths are allegedly using third-party software algorithms to essentially act as one national landlord cartel that coordinates pricing (i.e., keeping your rent sky high). The real estate rental giants and the information-sharing company that connects them all are facing a series of lawsuits, and the DOJ is also investigating the companies accused of colluding to keep apartments vacant and rents elevated. The increased use of such information sharing has coincided with astronomical rent growth and increases in the number of homeless Americans and deaths of the homeless.

- Last year the DOJ fined a group of major poultry producers $84.8 million over a long-running conspiracy to exchange information about wages and benefits for poultry processing plant workers and collaborate with their competitors on compensation decisions in violation of the Sherman Act. The DOJ also ordered an end to the exchange of compensation information, banned the data firm (and its president) from information-sharing in any industry, and prohibited deceptive conduct towards chicken growers that lowers their compensation. Neither the poultry groups nor the data consulting firm admitted liability.

The good news is that the DOJ is finally admitting that these loopholes were a mistake and has closed them. Here is the Feb. 3 statement from the DOJ:

After careful review and consideration, the division has determined that the withdrawal of the three statements is the best course of action for promoting competition and transparency. Over the past three decades since this guidance was first released, the healthcare landscape has changed significantly. As a result, the statements are overly permissive on certain subjects, such as information sharing, and no longer serve their intended purposes of providing encompassing guidance to the public on relevant healthcare competition issues in today’s environment. Withdrawal therefore best serves the interest of transparency with respect to the Antitrust Division’s enforcement policy in healthcare markets. Recent enforcement actions and competition advocacy in healthcare provide guidance to the public, and a case-by-case enforcement approach will allow the Division to better evaluate mergers and conduct in healthcare markets that may harm competition.

The effect could be swift as businesses try to avoid antitrust suits. From ArentFox Schiff LLP, a national law and lobbying firm:

The withdrawal of the safety zone and increased scrutiny of information exchanges signal that broader enforcement against information sharing is coming. Companies should consult with their antitrust counsel to re-evaluate their current information-sharing practices.

The rules were based on junk economics and were big gifts to big business from the Clintons. In 1993, first lady Hillary Rodham Clinton and other officials announced steps to make healthcare more “available” and “affordable” to all Americans.

The policy statements provided for antitrust “safety zones” which created circumstances under which the DOJ and the FTC would not challenge the following:

- Hospital mergers;

- Hospital joint ventures involving high-technology or other expensive medical equipment;

- Physicians’ provision of information to purchasers of health care services;

- Hospital participation in exchanges of price and cost information;

- Joint purchasing arrangements among health care providers;

- Physician network joint ventures.

The rules were further liberated in 1996 and then again in 2011 under Obama’s Affordable Care Act and its Accountable Care Organizations provision.

While all of these rules allowed for more concentration, which is well known, the “exchange of price and cost” provision also made it so even in non concentrated industries, businesses could still wield monopoly pricing power by exchanging information with “competitors” through middlemen. Here was the loophole, according to the DOJ’s now-withdrawn enforcement policy:

Accordingly, in order to qualify for this safety zone, the collection of information to be provided to purchasers must satisfy the following conditions:

(1) the collection is managed by a third party (e.g., a purchaser, government agency, health care consultant, academic institution, or trade association);

(2) although current fee-related information may be provide to purchasers, any information that is shared among or is available to the competing providers furnishing the data must be more than three months old; and

(3) for any information that is available to the providers furnishing data, there are at least five providers reporting data upon which each disseminated statistic is based, no individual provider’s data may represent more than 25 percent on a weighted basis of that statistic, and any information disseminated must be sufficiently aggregated such that it would not allow recipients to identify the prices charged by any individual provider.

For the consumer this means that whether you’re going to the grocery store or the doctor or paying rent, it’s always like a trip around a consolidated monopoly board. One need look no further than the series of lawsuits and DOJ investigation against real estate rental giants and the middleman company RealPage, which (allegedly) supplied software allowing landlords across the country to collude on rental prices.

How it’s supposed to work, or used to anyways, is that when occupancy dropped, rents would also drop so that properties would be full. Companies would compete for more “heads in beds” through lower rental prices and typically aim for occupancy rates around 97-98 percent. But the RealPage software allows property owners to keep prices high even during periods of high vacancy. The software required users (landlords) to maintain pricing at levels its algorithm set, which often meant higher vacancy, but landlords found that they were still making more money.

Just look at some of the real estate goliaths named in the lawsuits who were using RealPage software to keep rents artificially high:

- Greystar: The nation’s largest property management firm with nearly 794,000 multifamily units and student beds under management. In December, it was nominated for six(!) 2022 Private Equity Real Estate Awards.

- Trammell Crow Company, headquartered in Dallas, is a subsidiary of CBRE Group, the world’s largest commercial real estate services and investment firm.

- Lincoln Property Co. Manages or leases over 403 million square feet across the US.

- FPI Management. Currently manages just over 155,000 units in 18 states.

- Avenue5 manages $22 billion in multifamily and single-family assets nationwide.

- Equity Residential, the 5th largest owner of apartments in the United States, primarily in Southern California, San Francisco, Washington, D.C., New York City, Boston, Seattle, Denver, Atlanta, Dallas/Ft. Worth, and Austin.

- Mid-America Apartment Communities, which as of June 30, 2022, owns or has ownership interest in 101,229 homes in 16 states throughout the Southeast, Southwest, and Mid-Atlantic regions.

- Essex Property Trust (62,000 units). This fully integrated real estate investment trust (REIT) acquires, develops, redevelops, and manages multifamily apartment communities located in supply-constrained markets on the west coast.

- Thrive Community Management (18,700 units in Washington and Oregon). Adorably refers to employees as “thrivers.”

- AvalonBay Communities, Inc. As of September 30, 2022, the Company owned or held a direct or indirect ownership interest in 293 apartment communities containing 88,405 apartment homes in 12 states and DC.

- Cushman & Wakefield, with a portfolio of 172,000 units.

- Security Properties portfolio reflects interests in 113 assets encompassing nearly 22,354 multifamily housing units.

No wonder Moody’s declares that the “US is now rent-burdened nationwide for the first time.” More:

The national average rent-to-income (RTI) reached 30% for the first time in our 20+ years of tracking history, up 1.5% from year-ago or 0.2% from Q3, keeping the growth rate constant throughout the second half of last year.

Rising mortgage rates caused many households to be priced out from home buying and would-be buyers to remain renters. Apartment demand surged as a result and drove rates sky high. As the disparity between rent growth and income growth widens, American’s wallets feel financial distress as wage growth trails rent growth.

Rents continue to help drive inflation with Tuesday’s Labor Department report showing that Americans continued to be burdened by higher costs for rental housing. From Reuters:

The consumer price index increased 0.5% last month after gaining 0.1% in December, the Labor Department said on Tuesday. A 0.7% rise in the cost of shelter, which mostly reflected rents, accounted for nearly half of the monthly increase in the CPI.

In a Feb. 2 speech announcing the withdrawal, Principal Deputy Attorney General Doha Mekki explained that the development of technological tools such as data aggregation, machine learning, and pricing algorithms have increased the competitive value of historic information. In other words, it’s now (and has been for a number of years) way too easy for companies to use these safety zones to fix wages and prices.

It’s an open question as to how much this algorithmic price-fixing software could be contributing to inflation, but as the Kansas City Fed noted in January, “markups could account for more than half of 2021 inflation.”

Mekki admitted as much on Feb. 2 at an antitrust conference in Miami:

An overly formalistic approach to information exchange risks permitting – or even endorsing – frameworks that may lead to higher prices, suppressed wages, or stifled innovation. A softening of competition through tacit coordination, facilitated by information sharing, distorts free market competition in the process.

Notwithstanding the serious risks that are associated with unlawful information exchanges, some of the Division’s older guidance documents set out so-called “safety zones” for information exchanges – i.e. circumstances under which the Division would exercise its prosecutorial discretion not to challenge companies that exchanged competitively-sensitive information. The safety zones were written at a time when information was shared in manila envelopes and through fax machines. Today, data is shared, analyzed, and used in ways that would be unrecognizable decades ago. We must account for these changes as we consider how best to enforce the antitrust laws.

The DOJ withdrawal of these rules is a major change from the lax attitude for the past 30 years. There are still unanswered questions, but the shift is clear. From ArentFox Schiff LLP, a national law and lobbying firm:

The withdrawal of the policy statements forecasts greater DOJ scrutiny of information sharing; however, it is still clear that not all information sharing is illegal. Both the Supreme Court and the DOJ have recognized that, in many instances, competitors need to share information to achieve legitimate pro-competitive goals. However, exchanges of information could violate the Sherman Act, which prohibits a “contract, combination…or conspiracy” that unreasonably restrains trade, if they allow competing sellers to collude or tacitly coordinate in an anti-competitive manner, such as by coordinating prices. Generally, courts will balance these two competing concerns. The Supreme Court has protected information exchanges where the data was publicly available, was historic rather than current or forward-looking, and/or was aggregated to make the information anonymous. It has also emphasized that certain exchanges of current price information and information exchanges in concentrated markets may receive greater scrutiny.

The DOJ has not stated whether it plans to replace the policy guidance. In addition, when assessing information exchanges, it is important to remember that there has been a clear trend toward increased review of information sharing. For example, the DOJ recently fined three poultry producers $84.8 million over allegations that they improperly shared employee wage and benefit information. Companies should expect increased scrutiny in the future.

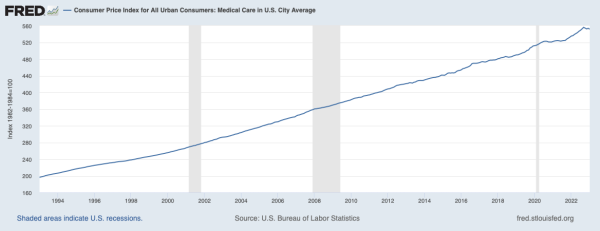

So much for the romantic notion that the sharing of information would lead to better care and reduced costs. According to the DOJ, this was the stated reason for the Clintons unveiling the “safety zones”:

The policy statements will help alleviate uncertainty within the health care industry making it easier for mergers and joint ventures to take place, resulting in lower health care costs.

How’d that work out?

Well, it took thirty years, but the DOJ has finally admitted this specific scheme started under the Clintons was a massive mistake, and it marks another sign that business as usual might be changing at the FTC and DOJ.

5. Changing a broad policy regime doesn’t happen in one moment. There are thousands of switches to flip, and it requires a relentlessness and willingness to address each one. That’s what we’re seeing in how Biden is addressing corporate power. An almost unnoticed shift.

— Matt Stoller (@matthewstoller) February 7, 2023

Somewhat baffled by this. Cui bono?

Are we to believe that the Biden administration is actually trying to fix something for altruistic reasons? What’s next? Prison reform?

People are strange, sometimes. Biden shits on railroad workers and won’t raise min wage, but genuinely seems to be backing his DOJ and FTC changes.

His SOTU speech was a pretty strong rhetorical endorsement of the changes they’ve made.

Skin in the game maybe?

To rally the people around the flag in the upcoming war against China and Russia, the American society needs some rejigging, because the proles have absolutely no skin in the game and in fact might take advantage of the situation to launch a civil war… This is how the Russian Revolution got started…

Perhaps Biden blames big business for his dad’s reversals.

I don’t trust any of this nonsense. Let’s be honest Biden isn’t mentally capable to be president. Call me cynical there are always ways around these rules.

You are confusing a president with an administration. Maybe no one person is capable of being president. This is not some conspiracy. This is a reversal of the Clinton policy. The Clinton administration saw monopoly as the path to defeat foreign industrial producers from taking domestic share. Now the Biden administration sees anti-trust enforcement as a path to reducing inflation. Neither Clinton or Biden are economists. They follow advice. That advice is often ideologically driven but hopefully based on real data. A president is only as good as the people he hires to steer him. We don’t choose presidents who are capable, We choose presidents who are good bullshitters. A good president would be someone who admits to themselves that they don’t know enough about anything but can hire a good staff.

[1] Well done, Conor. This draws together the important threads well; if journalists still doing their job reporting on this stuff, this would be how to do it.

[2] Matt Stoller covers some angles here in his latest (apologies if Stoller’s piece will also crop up in Links) —

https://mattstoller.substack.com/p/on-lina-khan-derangement-syndrome

On Lina Khan Derangement Syndrome: Republican FTC Commissioner Christine Wilson quits in a huff, accusing Lina Khan of lawlessness, dishonesty, and corruption. Wilson’s allegations are false. So why is she making them?

[3] I was working as a journalist in the latter 1990s, covering global and national security issues, and I remember being struck by the extent to which then-Defense Secretary William Perry made creating consolidation and mergers in the “defense industry” (military-industrial complex) his primary task. I recall wondering, “suppose this doesn’t turn out well.’

i remember bill clinton saying get big, or get out. with everything he did, i knew it would not turn out well.

this was a towering exposure of the clintons and their junk economics. if we do not expose and confront those who did this to us, we will get a obama, a biden, a harris, a buettigieg and on and on and on.

well done Conor!

Though I don’t doubt the Clintons misguided deregulation efforts (among other disastrous initiatives) , I think “Get big or get out” was said by Earl Butz, Nixon’s sec. of Agriculture, talking to small and medium-sized farmers.

The cynic in me worries that this is too little too late. As I remarked a couple weeks ago, any high school kid with a computer and internet can track vacancy nationwide, but the small landlord in East Podunk can’t manage his cashflow using national trends.

A new NAIRV (Non-Accelerating Inflation Rate of Vacancy) has been set, and none of the five behemoths that control the National Home Rental Council (much less Blackstone) appear above in Biden’s crosshairs.

Who will gobble up these companies after Lina Kahn prosecutes them?

It’s unclear to me what this does legally. While it does seem like an excellent idea, according to the Feb 3 statement from the DOJ linked to above –

‘Guidance’ seems to be referring back to the three statements being withdrawn. If you read further, the DOJ statement says –

So while the loophole statements were in place, the industries could essentially collude to fix prices, but weren’t required to. But obviously they were going to if it made them more money. Now that the guidance has been withdrawn, if they weren’t legally obligated to follow the guidance in the first place, are they actually legally obligated to stop following it now?

Maybe I’m just confused by the legalese of haven’t fully woken up yet, but it sounds like there might be some loopholes in getting rid of the loopholes, and I’ve learned that you really can’t be too cynical when it comes to US govt actions.

I worked for a third party aggregator of provider health care data that followed those rules and I explained the “Safe Harbor Provisions” endlessly. Sharing price information is illegal period under Sherman and other acts. The guidance stated practices for which the DOJ would not ordinarily seek prosecution as DOJ believed these limits would substantially mitigate anti-competitive collusion. But DOJ would not guarantee that they would never prosecute despite staying within these rules and no one can use the guidance as excuse for illegal behavior.

Thank you. So the guidance was similar to advising a teenager how much faster than the posted speed limit they can drive before the cops are likely to take notice. If the limit is 40 you aren’t likely to be pulled over for going 45, but you could be.

Maybe it’s a sign the DOJ is looking to toughen up on antitrust, but it doesn’t sound like it changes the legality of any behaviors.

also all of the companies listed, lift off their hoods and peak at all of the foreign money in those companies.

to get back what we lost, we have to be ready to expose the creatures that did this to us, and reverse what they did.

The Clintons really were and are the worst of the worst. Everything they did was disastrous. The US will continue to suffer from the damage they caused for many decades to come. My guess is that the Biden administration is desperate to get inflation under control before the next election, and they also knew that raising interest rates would not do it as long as these rules were in place.

Yes, Hillary, as you may have screamed, you all should hang from nooses.

Triangulate that*, you scheming [family-blogging e-mailing family-blogger] has-been. Wow, did the world ever dodge a bullet in 2016.

*The clever Clinton calculus so often praised in the Post and beyond didn’t seem to factor in any human downsides, just political ones. The approach repurposed self-interest to get those butchers, bakers, PMCs and such to become really greedy and amoral. Some needed less nudging than others.

The Clinton’s were also possibly pioneers in corruption of tax-exempt organizations.

“In December 2018, Moynihan and Doyle both testified to a House committee that the Foundation wrongly operated as a foreign lobbyist by accepting overseas donations and then trying to influence U.S. policy.”

See also: https://justthenews.com/accountability/whistleblowers/w-judge-orders-irs-reveal-if-it-criminally-investigated-clinton?utm_source=justthenews.com&utm_medium=feed&utm_campaign=external-news-aggregators

But further digging shows IRS whistle-blower ofc to be moribund…

I still find it hard to believe that the Podesta emails revealed that Bill Clinton’s longtime crony, Ira Magaziner, embezzed $23 million from the Clinton Foundation without any of the official directors knowing about it until they realized their bank accounts were light, although to be fair its clear the Clintons themselves knew, as he kept his job.

Even worse, the fact that their “charity” was taking in over $1 billion annually yet tracked their finances on an excel spreadsheet that only Magaziner and his cronies had access to was not deemed a real story either by the media.

One day years from now those emails are going to be a treasure trove for somebody interested in writing about our American Borgias, the Clinton family.

On top of all the other corrupt and disastrous things the Clintons did, I keep wondering how much influence they have had in the Ukraine mess. The people in charge now are all Clintonites, and it would not surprise me if Hillary Clinton turned out to be egging them on all along. It would really round out the Clinton’s portfolio of death and destruction.

Wow. I’ve not heard about Magaziner’s heist but I’m not surprised. THe CLintons still are being protected by the MSM. When one of the most prominent, salacious scandals of recent decades ends with not one but *two* principals being suicided (Epstein and his French pimp Jean-Luc Brunel) while in jail and the ‘cui bono’ clearly points to the Clintons more than anyone else, and the media lets it all slide, that tells you of the Clinton power.

BTW, I have loathed Ira Magaziner ever since the CLinton Health Care fiasco, when Magaziner was the architect of that plan (if you’re old enough and into the issue you’ll remember the blown-up “org chart” that Arlen SPector dragged onto the Senate floor during debate and how he was able to ridicule the baroque ridiculousness of the monstrosity Magaziner designed for his boss, Hillary Clinton). The Clintons could have pushed a Canadian single payer system that could have been outlined on one piece of paper, but that wasn’t enough for these Ivy-educated Mandarins. Matt Stoller wrote a great book on anti-trust, and one of its heroes was a Depression-era congressman named Wright Patman, who never attended college and yet was the author of many of the New Deal and even Great Society programs we still rely on today.

It tells you about the size of the Clinton corruption that they could decide $23 million is too small to worry about. The comparison to the Borgias is apt, but at least the Borgias were benefactors to some of the great Italian artists of the Renaissance. The best Bill can point to is midnight basketball.

BTW2, kudos to Conor on a great piece. Worthy of Yves and Lambert at their best.

P

“How it’s supposed to work, or used to anyways, is that when occupancy dropped, rents would also drop so that properties would be full. Companies would compete for more “heads in beds” through lower rental prices and typically aim for occupancy rates around 97-98 percent. But the RealPage software allows property owners to keep prices high even during periods of high vacancy. The software required users (landlords) to maintain pricing at levels its algorithm set, which often meant higher vacancy, but landlords found that they were still making more money…”

At some places and points in time, this has to mean there is a lot of straight up lying about apartment and housing supply. Saying the algorithm set the price is a way for people to remove themselves from responsibility and accountability. The algorithm was programmed based on biased priorities (profit first and zero sense of community and decency), lies, and/or inaccuarate information. GIGO or GIGESO (Garbage in, garbage economic system out).

Look at cities like the LA area: Constant apartment building and homelessness increases.

And in all parts of the country, banks don’t have to list foreclosures for sale and can take as long as they want to foreclose in the first place.

Again and again we see a mix of cobra effects and Campbell’s Law in action.

Do look at the Moody’s report that Conor links to. My favorite chart: New York’s rent-to-income ratio is 70%. That means that 70% of one’s INCOME goes to pay rent.

it’s obviously trust funds and capital gains that pays.

It’s a world of cartels, we’re just living in it.

IIRC, the old federal guidelines from the 1960s, one was supposed to pay no more then 25% or 30% of their income for rent. Since it was apparently possible to do so, it is no wonder there was little homelessness back then.

This is a really good post.

I also greatly appreciate this post. I ran across the writings of Barry Lynn, but watched his fire burn to ash. Then Matt Stoller came along and I was hopeful. I remain hopeful … but Stoller’s fire much less brightly burns than when he began. This post goes into the heart of means and methods used to assemble shadowy conglomerations driving up economic rents. Data sharing seems far the most insidious means for colluding yet invented.

There’s a time element that is very interesting. If there is real time information showing what the market will bear then the cost of rent can jump higher and faster than if it gradually became obvious that rents could be raised because people had more money to spend. And it obviously warps the economy. It’s just a bit of evidence that one of the most important qualities – and most ignored – about a healthy economy is its flexibility. and when everybody is “maximizing productivity” at the same time there’s really nothing tacit about it. It’s just another feeding frenzy.

It’s most sickening when you look at who benefits from the productivity gains…

charles hugh smith is always pretty good on this point, with charts…

https://www.oftwominds.com/blogfeb23/middle-class2-23.html

“”But the RealPage software allows property owners to keep prices high even during periods of high vacancy. The software required users (landlords) to maintain pricing at levels its algorithm set, which often meant higher vacancy, but landlords found that they were still making more money.””

Did anyone else catch this point? Is this not the very definition of collusion?

It’s way past your point Mikel.

And then there is the small and mid-sized commercial rental market, which is even more dysfunctional than the home rental market.

An anecdote in support of my observation. There is a stand alone restaurant site on the Main Drag adjacent to the State University campus. The building is perhaps twelve years old and in decent condition. It has an outdoor seating “porch” as well as the usual amenities inside the building. It was originally built as a restaurant.

Over the years this site has hosted three minor chain eateries, (the dreaded Illegal Burrito being one of the more egregious examples.) It has been empty now for two years. Over those two years, I have seen two signs on the property facing the Main Drag promising new businesses at the site. One was an all you can eat buffet and the other was for an Urgent Care clinic. Neither promise was fulfilled. This is a prime business site, on the Main Drag and in close proximity to the University and one of the ‘upscale suburbs’ of the town. Why it is still empty, I know not. I can speculate, but that would be just that, speculation.

The above mentioned phenomenon is replicated at several sites around this region. Signs go up promising new businesses in empty spaces, and nothing further. There is a purpose built mid-sized eatery close to the Interstate 55 interchange that has a similar history to the Main Drag one. I do know from a conversation with a nearby store manager that the first rebranding of the site collapsed because the franchisee played financial games with the funds flow of the business. Evidently the bank holding the loans noticed irregularities in those funds flows and called in the loans. Now, evidently, the Bank owns the building. The place was stripped internally for a rehab last year, but the process stopped there. This place has also had a history of multiple promised business occupants that resulted in no actual new businesses. The aforementioned business forced to close was the lone exception to the “Promises Promises” rule.

All I can say is that there is a steady stream of promised business openings that do not materialize. It looks like the only people who are making money off of this trend are the sign painters.

Stay safe all.

What’s worse is all the health organizations who don’t even stay within the “Safe Harbor Provisions” but shared directly raw price data with each other. I once caused a panic at my employer when I told a major client during a meeting it would be illegal to match our data to a database of raw price and cost data then being submitted in real time from many unrelated hospitals. An hour later I had to explain to our senior management and our own chief legal officer that we stayed within this safe harbor and the description of the safe harbor was embedded as boilerplate within all our contracts, proposals, data documentation, and data handling procedures just as seriously as HIPAA.

Of course they wanted to know what everyone else was charging and getting paid and what the others were paying for things. Tough.

The very rich control history. That is why it repeats endlessly. It repeats to keep them rich. Once there was no Sherman Anti-trust. Now it is no more again. This retraction of guidance is akin to a Salome dance. “Now you see me, now you don’t”. When that great Servant of the 0.1% Fraud Fukuyama wrote of “the end of History” maybe what he was telling us was that now history is forever in the hands of his masters but we understood it not

I have always wondered why when such reprehensible corporate activities are ongoing, within the educated and aware sectors of our economic and political systems; they still act as though they will ‘get away’ with all (unlike the main street criminal-who are usually ‘punished’).

Maybe we taxpayers should also question why corporations are entitled to welfare/subsidies but woe-be-tide every individual who needs real help.

Imagine if we could test whether the maxim is true. That corporations can do just as well profit-wise without any crony —taxpayer subsidies (in the billions per annum). Time to find out, is not on our side. take care.

I am convinced that vacancies and rents in apartment buildings are kept high for a number of reasons. The most oblivious one is that (private or mutual owner) owners can claim a loss for tax reasons. Example, if a building has fifty apartments, and ten are always kept empty. The owners raise the rent on the forty other tenants, to pay for the ten unrented apartments. Making the same amount of money. On top of that they can then take a loss for tax reasons on the ten unrented apartments and save on the amount of taxes they pay. This also ties into a change in the 1 percent to a 2 percent rate of return on investment properties that has taken place in the last decade, that banks and mutual funds who invest in property management use as a cash cow. This is the benefit of using algorithms such as RealPage software. But the RealPage software which requires users (landlords) to maintain pricing at levels its algorithm. So that landlords in Richmond VA, require there renters pay the same price for rent as those who live in NY city or Los Angeles where wages are higher. This is the reason so many work from home employees from large cities (with higher wages) are moving to cities such as Richmond keeping rents incredibly high. While the vacancies still remain. There is a fine line of course between the money saved in taxes losses, vs keeping the empty apartments rented. .If is the reason so many banks and mutual funds now see property management as a hedge fund, they build 5 over 1 apartments as an income and tax loss scheme thanks to algorithms and the sharing of financial information that was once illegal. Instead of investing in the free market economy on Wall Street as there is a greater rate or return.

A windfall tax on outrageous profits is the only sane answer to this problem, especially in the health care industry.