Yves here. It is striking, as Steve Keen describes long-form below, how much the economics profession manages to unlearn, mainly for the purpose of defending capitalist interests. It’s remarkable how John Galbraith’s The New Industrial State, a widely praised best-seller in its day, is seldom mentioned today, even though, as Keen describes, many of its observations have held true. One reason is that Galbraith was an institutionalist. Institutionalist is out of fashion, because among other things, it considers power dynamics.

By Steve Keen, an Australian economist, and author of The New Economics: A Manifesto, Debunking Economics, and other books. Originally published at his website

I was asked to contribute to an Italian online publication’s tribute to John Kenneth Galbraith, by answering some questions about the relevance of his major work The New Industrial State (Galbraith and Galbraith 1967) six decades later. These were my responses.

About sixty years later, how relevant and actual is the vision of the American economy and economic system proposed by John K. Galbraith in his “The new industrial state”?

Reading The New Industrial State (Galbraith and Galbraith 1967) again, six decades after it was first published, highlighted for me just how far economic theory has retreated from reality since the 1960s.

The New Industrial State (hereinafter called TNIS) described the actual structure of a modern industrial economy. It has nothing to do with Alfred Marshall’s vision of a market economy, in which a multitude of small entrepreneurial firms sold homogenous goods directly to consumers in anonymous markets, and in which prices were set by the intersection of supply and demand. Instead, the economy is dominated by large corporations, which themselves are run by a bureaucratic “technostructure”—the term Galbraith invented—that attempts to manage everything, from input costs to final consumer demand which they manipulate via marketing. Prices are tamed by long term contracts, and the only source of instability in prices comes from wage demands on the one hand, and the vagaries of agricultural and energy production on the other.

This was the reality of the mid-1960s on which Galbraith commented. At the time he wrote, Galbraith was confident that this reality would supplant the Marshallian fantasy of supply and demand curves, which dominated economic theory.

Fat chance! Galbraith’s optimism about his profession of economics was misplaced: faced with a conflict between reality and theory, mainstream economic elevated theory over the inconvenient facts of the real world. The main real-world changes since Galbraith’s time have been the crushing of trade unions, which has largely eliminated the capacity of workers to bargain for wage rises, the development of globalization, which has created long and extremely fragile supply chains, with much production occurring offshore rather than in American factories, and the financialization of near everything. But a “technostructure” is still in charge, and the realities of production, management and marketing are the same as he observed in the mid-1960s.

None of this realism has seeped into economic theory.

Galbraith gained his knowledge of the actual nature of the management of industrial capitalism from simple observation and, crucially, being involved in the procurement and price control efforts of World War II. In the 1990s, the mainstream economist Alan Blinder gained similar knowledge via a very careful random survey of American companies with sales exceeding $10 million per year.

The answers these companies gave Blinder about their operations turned everything in mainstream economics upside-down—just as Galbraith’s book had done 30 years earlier. Firms face falling marginal costs, not the rising marginal costs assumed by economic theory. Over 70% of their output is sold to other companies, not to end consumers. Prices of industrial goods are subject to long-term contracts, and change rarely. Word for word, the survey reproduced the vision of the corporate sector that Galbraith had laid out. Blinder himself observed that “The overwhelmingly bad news here (for economic theory) is that, apparently, only 11 percent of GDP is produced under conditions of rising marginal cost”, and that “their answers paint an image of the cost structure of the typical firm that is very different from the one immortalized in textbooks” (Blinder 1998, pp. 102, 105).

The real world is “overwhelmingly bad news” for economic theory because, with falling marginal cost, the textbook supply curve does not exist: the output of firms is not constrained by rising costs, but instead, any firm that secures a larger market share also secures a higher profit. The neat equilibrium of the textbook is replaced by an evolutionary struggle for survival and dominance.

Not a word of that reality made it into economic textbooks. Even Blinder’s own undergraduate textbook (Baumol and Blinder 2015) pretends that Marshall’s model is accurate, despite his own knowledge that the results of his survey were “overwhelmingly bad news here (for economic theory)”.

Galbraith’s book therefore remains relevant as a description of economic reality, but the optimism he had that his realistic vision would replace textbook fantasies was misplaced.

Do you think that today we have passed from an industrial technostructure to a digital and high tech technostructure? Has the role, once of the industrial circuit, been taken today by big tech and corporate related to social networks?

Much of the US industrial circuit has been relocated to China and other developing economies, but if anything this has strengthened the importance of the technostructure: the coordination that Galbraith saw playing out across the continental USA is now an order of magnitude more complex.

The growth of software has also made Galbraith’s analysis even more apposite. Though the marginal costs of industrial firms are low and falling—the opposite of the textbook model—the marginal costs of software firms are closer to zero. The profit margins from market dominance are therefore even bigger. There is no second place in the word processor market (Microsoft Word) or the browser market (Google Chrome), and second place in the operating system market (Apple MacOs) is long distant from first place (Windows).

The need to control prices and manage demand are even bigger in the digital/high-tech world than they were in Galbraith’s industrial day, while the capacity for market dominance by the market leader is stronger still where products have a substantial network effect. This applies to everything from the obvious—such as social media products like Twitter and Facebook—to the mundane. Word’s dominance of the word processor market is largely due to the fact that it was the program most users used. Minority product users—which I once was, using Lotus Word Pro in preference to Word because of its superior desktop publishing features—were forced to adopt Word for compatibility with the people with whom we had to communicate. Rivals like Word Pro withered and died in the marketplace, simply because they were not the number one product.

Textbooks treat this as an interesting—and easily ignored—exception to the assumed rule of rising marginal cost. But in fact, it is an amplification of the processes Galbraith identified in the industrial state, which make the textbook model even more irrelevant to the real world.

Is the role of the proletariat and the workforce in this new digital state today played by capital and technical means that replace the social weight of the workforce?

The decline in the political power of the working class since the publication of TNIS has been dramatic. Galbraith foresaw this possibility, as he noted the extent to which the technostructure attempted to have workers identify with the firm rather than their social class. Here Galbraith deserves praise for a great deal of prescience:

The planning system, it seems clear, is unfavorable to the union. Power passes to the technostructure, and this lessens the conflict of interest between employer and employee which gave the union much of its reason for existence. Capital and technology allow the firm to substitute white-collar workers and machines that cannot be organized for blue-collar workers who can. The regulation of aggregate demand, the resulting high level of employment together with the general increase in well-being, all, on balance, make the union less necessary or less powerful or both. The conclusion seems inevitable.

The union belongs to a particular stage in the development of the planning system. When that stage passes, so does the union in anything like its original position of power. And, as an added touch of paradox, things for which the unions fought vigorously—the regulation of aggregate demand to ensure full employment and higher real income for members—have contributed to their decline. (Galbraith and Galbraith 1967, p. 337)

Starting from the text “The economy of innocent fraud” how has the role of finance changed the link between technostructure and markets?

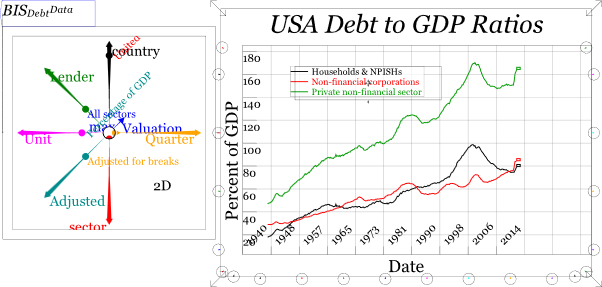

One factor that Galbraith did not anticipate in 1967 was the rise in the significance of the financial sector, not only in the USA, but worldwide. When TNIS was published, private debt was under 90 percent of GDP, and the industrial sector was the dominant sector of the US economy. Today, private debt is over twice as high relative to GDP, and the financial tail now wags the industrial dog—see Figure 1.

Figure 1: Private debt is dramatically higher today than it was when TNIS was first published in 1967

As a result, America is no longer dominated by the military-industrial complex—to use the phrase invented not by Galbraith, but his contemporary President Dwight D. Eisenhower—but by what I call the politico-financial complex. We have to look, not to Galbraith in 1967, but to Marx a century earlier, for an accurate characterisation of what this has meant for the viability of the capitalist system:

Talk about centralisation! The credit system, which has its focus in the so-called national banks and the big money-lenders and usurers surrounding them, constitutes enormous centralisation, and gives to this class of parasites the fabulous power, not only to periodically despoil industrial capitalists, but also to interfere in actual production in a most dangerous manner—and this gang knows nothing about production and has nothing to do with it. (Marx 1894, Chapter 33)

What is the major legacy of Galbraith?

Re-reading TNIS made me nostalgic for the 1960s, not because the music was better—though, of course, it was—but because the vision of the future which Galbraith had was better than the future itself has turned out to be. Galbraith’s erudite prose was underwritten by a presumption that the knowledge he had acquired—of how the American industrial sector actually functioned—would supplant the reassuring fictions of Marshallian markets that academic economists continued to peddle in their first year textbooks.

It didn’t. Economic textbooks today are even more arcane than the academic products of the 1960s, which Galbraith felt he could comfortably disparage as he outlined what he called the “revised sequence” of how goods are manufactured and marketed in an advanced capitalist economy:

In the form just presented, the revised sequence will not, I think, be challenged by many economists. There is a certain difficulty in escaping from the inescapable. There is more danger that the point will be conceded, and its significance then ignored…

The revised sequence sends to the museum of obsolete ideas the notion of an equilibrium in consumer outlays which reflects the maximum of consumer satisfaction. (Galbraith and Galbraith 1967, p. 265)

Unfortunately, his “revised sequence” was not even conceded by the discipline, let alone ignored. The museum of obsolete ideas is alive and well in the 2020s, instructing economics students today in a vision of a market economy even more arcane that the 1960s economics textbooks that Galbraith clearly—and wrongly—thought were going the way of the Dodo.

Instead, Galbraith’s own contributions largely went the way of the Dodo. Modern students of economics are unaware of his contributions, from the practical work he undertook to enable the USA to dramatically expand wartime production without causing inflation in either military or consumer goods prices, to his eloquent erudition of an alternative economics in works such as TNIS, The Affluent Society (Galbraith 2010) and The Great Crash 1929 (Galbraith 1955).

Galbraith partly contributed to his own subsequent irrelevance, by not providing a means by which his eloquence could be turned into equations. His contemporary Hyman Minsky (Minsky 1975, 1982), who was far less well-known than Galbraith at the time—even in non-orthodox economic circles—is the one whose non-orthodox vision lives on after him, largely because his vision could be put into a range of analytic forms (Keen 1995; Delli Gatti and Gallegati 1996; Dymski 1997; Wray 2010; Keen 2020). Even Neoclassicals, who remain as ignorant of Minsky’s real insights as they are of Galbraith’s, must acknowledge the existence of “Minsky Moments” (Bressler 2021). There is no Galbraithian equivalent.

6) What would be the characteristics of a “New Digital state”?

The main difference between the Industrial State that Galbraith described, and the Digital (and Financial) State in which we reside today is the importance of network effects for the Digital economy.

The goods produced by the companies Galbraith’s that treatise considered were not dependent on widespread consumer conformity. The New Industrial State led to the dominance of mega-corporations (like Ford, General Electric, and IBM), but their dominance did not mean that rival companies (like General Motors, Westinghouse and Burroughs) were unable to achieve market share. However, in today’s Digital State, it is near impossible for a rival to Facebook to achieve critical mass, because Facebook already has that critical mass. This makes the Digital State a much more all-or-nothing contest than the New Industrial State of the mid-1960s.

The effect is profound. If the market had reason to complain about the product of an industrial giant—say, for example, the Ford Edsel—it was easy to switch to a rival product from a rival manufacturer. But complain as consumers do today about Google, Facebook and Twitter, the capacity to turn those complaints into a rival product is virtually non-existent.

In this way, the dominance of the technostructure over the market that Galbraith identified in the 1960s is even greater today. But the Silicon Valley hipsters who might well use the word as they debate the Internet-Of-Things over a soy latte would never know that the word that describes them so well was invented by John Kenneth Galbraith.

_____________

Baumol, William J, and Alan S Blinder. 2015. Microeconomics: Principles and policy (Nelson Education).

Blinder, Alan S. 1998. Asking about prices: a new approach to understanding price stickiness (Russell Sage Foundation: New York).

Bressler, Paige D. 2021. ‘In a Minsky Moment, can financial statement data predict stock market crashes and recessions?’, The Journal of corporate accounting &finance, 32: 155–63.

Delli Gatti, Domenico, and Mauro Gallegati. 1996. ‘Financial Instability Hypothesis and Stabilization Policy: Hyman P. Minsky’s Contribution to Political Economy’, Economic Notes, 25: 411–24.

Dymski, Gary. 1997. ‘Deciphering Minsky’s Wall Street Paradigm’, Journal of Economic Issues, 31: 501.

Galbraith, James K. 2010. The affluent society and other writings, 1952–1967 (Penguin: New York).

Galbraith, John Kenneth, and James K. Galbraith. 1967. The new industrial state (The James Madison library in American politics) (Princeton University Press: Princeton).

Galbraith, John Kenneth. 1955. The Great Crash 1929 (Houghton Mifflin Company: Boston.).

Keen, Steve. 1995. ‘Finance and Economic Breakdown: Modeling Minsky’s ‘Financial Instability Hypothesis.”, Journal of Post Keynesian Economics, 17: 607–35.

———. 2020. ‘Emergent Macroeconomics: Deriving Minsky’s Financial Instability Hypothesis Directly from Macroeconomic Definitions’, Review of Political Economy, 32.

Marx, Karl. 1894. Capital Volume III (International Publishers: Moscow).

Minsky, Hyman P. 1975. John Maynard Keynes (Columbia University Press: New York).

———. 1982. Can “it” happen again? : essays on instability and finance (M.E. Sharpe: Armonk, N.Y.).

Wray, L. Randall. 2010. ‘Minsky, the Global Money-Manager Crisis, and the Return of Big Government.’ in Steven Kates (ed.), Macroeconomic Theory and Its Failings: Alternative Perspectives on the Global Financial Crisis (Cheltenham, U.K. and Northampton, Mass.: Elgar).

Glad to see Keen on here. And i love how he is not afraid to drop a Marx quote when needed.

BTW, the quite is from volume 3. It was assembled from Marx’s notes by Engels after Marx died. It demonstrates that Marx had a far deeper insight into economics back then than many big name economists have today! Likely though said economists know on what side the bread is buttered.

Also, the math thing is what i think Keen once referred to as physics envy. Economists wants to model human interaction like physicists can model the interaction of planets and particles. Problem is that in a complete inversion of physics, economists had a nasty habit of ignoring observational data when it does not fit their neatly laid out models. Instead economists will try to force humanity to behave in accordance with said models. That is a behavior more befitting priests than scientists.

Well said digi. All due to your night vision capabilities I guess. ;)

Different time zones rather (though i do maintain a nocturnal lifestyle ever so often).

Oh, but I was referring to your ‘nick-surname’ owl, not the time of posting. ;)

The thing is, Keen is very mathematically sophisticated. His model of the macro-economy–called “Minsky”–extends the work of the very math-intensive economist Minsky: that a capitalist economy is inherently unstable. Keen’s model incorporates nonlinearity, which basically makes the economic system fairly chaotic (depending on the parameters).

Self-regulating equilibrium is something the profession needs to abandon. And, following Minsky and Keen, it needs to incorporate risk and bad (ponzi) actors into their models. Doing so will provide a stronger rationale for government regulation of markets, and for more social safety nets, than the profession has been comfortable with hitherto. Can the profession venture outside the safe, tidy but tiny box they’ve lounged in since Wealth of Nations? Can they incorporate the more important Theory of Moral Sentiments? They’ll have to if the profession wants to stay relevant.

True, Keen is doing what other economists just claim to be doing.

Thanks for this post Yves. This made me wonder on the free-market imperative in the EU that in one hand disallows for state level subsidies for industries (with a small “minimis” exemption of 200.000€) and, to tell the truth, for real state-level industrial policies while in the other hands tries, somehow hypocritically, to stand against market concentration and collusion which according to Galbraith’s and Keen’s observations is something unavoidable given lowering marginal costs and market manipulations. In the end there are no real constraints to industrial concentration as the experience shows. Try to argue against the free-market imperative with EU politicians at your own risk. These guys live in fantasy land at all levels and want us to join. We are in debt of “gratitude” with the economics profession aren’t we?

Let me repeat, thanks a lot for this post.

EU, just like USA, will go after large companies external to its market, while ignoring internal companies.

The whole free market claptrap is just a veil over modern imperialism. They will use free market arguments to get a claim on resources in a smaller nation, but refute the same when another large nation makes a better offer.

It indicates a need for some natural level of change in a dynamic modern market. Some non-disruptive equilibrium. Competition is cutthroat. Instead of organizations cooperating in some realistic paradigm, they all gear up like little militaries to “kill” the competition. I might be that competition for good innovation produces the best company and probably good spinoff companies that support its products. But a profit imperative corrupts it all, making excessive competition counterproductive. Maybe the two don’t mix. Maybe seeking profit beyond a certain level of market share should automatically go into self trust-busting mode because managers just can’t bear to fall behind. Hey – there’s probably an app for that. A certain portion of the market being guaranteed to the company would eliminate harmful competition and and it’s bff – profiteering. In non-economic-speak. And the market could still be relatively”free”. The reason they call us grown-ups is because we stop growing.

More Steve Keen, please.

When I was in college studying economics, I took several classes from a professor who was prominent in the Institutionist School. He recommended when faced with neo-classical economics utilizing calculus, always step away from the math and closely examine the underlying assumptions of the argument.

The assumptions go unexamined in neoclassical economics, and that is no accident — it’s how they smuggle their normative judgements in via the back door.

We can only hope that the studious navel gazing of the neo-classical school will be faced with a little punctuated equilibrium sooner rather than later.

Science!

That was always my problem – in physics you are very clear on your assumptions, in economics not so much.

Minor quibble— yes, the financial political complex has asserted itself in a huge way, but I would argue it has NOT replaced the M I complex… they are both apparently on equal footing, dominant, and synchronistically hand-in-glove.

Or at least in reach around…

Apologies. Damned coffee… coffeefeve

I am not qualified to cavil at JKG’s economics*, despite having read everything he wrote. I can only say that he is worth reading for his prose alone. Given his dry subject, he still manages to be clear to the layman, genial and witty, never strident or shrill. The aspiring writer could do well to read some of it and examine its style. “The Great Crash 1929” is a good starting point. It is less a book on economics than the story of a disaster. Fine reading for anyone who enjoys history.

*Okay, just one cavil, to address his economics and to try to stay on topic. I think JKG over-emphasizes consumption. He often says in his writings that those with lower incomes are reliable spenders, that they spend everything they have. As if this were a good thing. It slights the necessary savings/investment sector of an economy. Savings and investments are important—very important—for future contingencies, such as the day one’s roof starts leaking.

But private savings are the opposite of government debt by sectoral balances. Private savings in aggregate are not morally superior to government borrowing, especially as (putatively) they will depress demand whereas deficit spending will increase it.

They are kinda close. One is prevention – government spends into the economy to keep it going. Individuals put aside money, knowing they will need it for something. They are both a form of insurance.

Awesome post. Now I am wondering if this also torpedoes the idea of sustainability/circular economy? If the marginal profit increases faster than marginal environmental cost (which may be zero), then there is no incentive to reduce harmful practices?

As a dissident economist, allow me to respond:

It does torpedo the idea of sustainability.

The working model of the capitalist economy treats nature as a “free gift” in two ways: a source of natural resources and as an essentially costless waste dump. This is not circular in the way sustainability should be. This does not typically consider the costs of resource extraction and use, nor typically the generation of wastes of whatever type that are generated by consumption and use.

There is still an element of circularity that exists when you look at market exchange; money flows between firms and households, and goods and services flow between businesses and households (though in a modern capitalist economy there are a lot of business to business flows that the typical economy circular flow model (like the one I just described) misses. In other words, resources are used, transformed, reused/recycled for a while (maybe) then dumped back out into ‘nature.’

Economists are increasingly aware of this, but the dominant neoclassical ideas are inadequate to deal with it. William Nordhaus had for a while become the de-facto economic spokesperson on climate change for the neoclassical school. Keen has some very good take-downs of Nordhaus. Maybe the best known is this one:

The appallingly bad neoclassical economics of climate change

If you do an internet search on Keen vs Nordhaus you will find the linked article, as well as some shorter blog posts.

Profits are virtually automated. Why isn’t sustainability? They should be part of the same equation.

They should be but aren’t.

Profits are measured in monetary terms, and businesses get fixed on that. You pointed that out in an earlier post in this thread.

Those monetary terms do not necessarily reflect the physical realities. So the incentive is for business to capture as much monetary profits as possible, while foisting the other costs, the physical costs like train derailments off on others so that they don’t have to be responsible for them.

So the idea is to privatize the profits as much as possible, and socialize the costs. Or people assume that all the costs, monetary and physical, have been paid for because that’s what they were taught in their introductory economics courses. I do not teach that in my economics courses.

I took his course on this book as a Harvard undergraduate, probably in 1967. It was in a good lecture hall and the audience was not large. About all I remember today is that commercial advertising had to be “invented” by large industrial companies to manage consumer demand. Probably one of my most useful and interesting courses..

The Capture of Cool. Back then.

Modern marketing in our early future, good book.

Yep. Edward Bernays basically created marketing using the theories of his uncle, Freud, in order to goose demand for products after WW1. This because factories has scaled up massively to meet demand from the US military, and now needed to recoup that investment.

His peak came perhaps when using the feminist movement to market cigarettes for women, by having them referred to as “torches of freedom”.

a century later, and big business is still exploiting feminism to push conspicuous consumption…

Yes, I think so. I remember my mother (b. 1916) always claimed to be a feminist “because I smoked”. In defiance. Of what I was never sure.

I enjoyed JKG’s sparring with Wm. F. Buckley on the latter’s program Firing Line. Their good natured duels, sprinkled with considerable wit, were something to behold.

His son James continues in his Dad’s footsteps as economist-gadfly for the profession admirably well.

I suspect the Institutionalists are less influential in Economics because they moved to the Sociology Department. If you want to study power dynamics in society and institutions you go there.

Great post! JKG described the first experiment he ever saw in his autobiography, published in the late-1970s IIRC (A Life in Our Time, 1981). This was more than 40 years ago, so bear with me; I would look it up if my malamute had not eaten the book in retaliation when I left her unattended for a full day. JKG grew up in Ontario, where maple syrup is a thing. One season, a local farm covered its collection cans with tin or the equivalent to keep debris and litter out of the sap. The resulting syrup did not taste right. So he observed an old timer taking a barrel of the “clean” stuff and adding some leaf litter, bark, dirt, animal hair, several insects, and a couple of rat turds before boiling it down to syrup. Yes, the taste returned to normal.

I also read most of his popular works starting with the Crash of 1929. All good and all understandable to an interested citizen. We could use some countervailing power about now. He was also a member of the Strategic Bombing Survey after WWII, which came to the conclusion that strategic bombing did not do much to slow down the Nazi war effort and may have had the opposite effect when residents of Hamburg were bombed out of their houses and had no alternative but to work in war production. I imagine the US Army Air Corps was unimpressed with that result.

Clearly. Macnamara was either unimpressed or oblivious.

John, in his later years, said that the Republican agenda was to identify a higher moral purpose for selfishness.

By now that applies equally to the rest as well.

JKG’s TNIS was one of the first books I read after graduating in the mid-60s from theological seminary during my first stint in a church. It’s clarity superceded anything I had read in theology during my studies. Economics is to civil society as theology is to the church.

TNIS shaped my vision of the world as only a handful of books have. I have had recourse to its ideas throughout the years since. Heartening to read Keen’s appreciation of it.