Yves here. This is deceptively important post. We’ve regularly mentioned that mainstream economists and the monetary economists at the Fed and presumably many other central banks adhere to the “loanable funds” theory of investment and lending. That model posits that loans come from a pre-existing pool of savings. The credit view, which the Bank of England, and even Greenspan and Bernanke have effectively admitted is how things really work, is that banks create loans out of thin air, and simultaneously, the related deposit. The check on this process is the cost of money (the central bank’s policy rate). This model, unlike the loanable funds story, explains how central bank policy influences credit and money supply growth.

Note that author Peter Bofinger is a very influential German economists and among other things has been a member of the German Council of Economic Experts.

By Peter Bofinger, Professor for Monetary Policy and International Economics University of Wuerzburg; Lisa Geißendörfer, Research Associate, Chair for Monetary Policy and International Economics University of Wuerzburg; Thomas Haas, Research Associate, Chair for Monetary Policy and International Economics University of Wuerzburg; and Fabian Mayer, Research Assistant and PhD candidate, Chair for Monetary Policy and International Economics University of Wuerzburg. Originally published at VoxEU

Recent research has shown that the stance of monetary policy can influence financial stability. This column provides an explanation for the effects of monetary policy on credit growth based on a ‘credit creation theory of banking’. In this framework, ‘funds’ are liquid bank deposits created by the banking system independently of private saving(s). The central bank policy rate has a direct effect on credit supply by influencing the refinancing costs of banks. This provides a clear mechanism through which central banks can influence bank lending and financial stability.

A recent study by Grimm et al. (2023: 34) “provides the first evidence that the stance of monetary policy has implications for the stability of the financial system. A loose stance over an extended period of time leads to increased financial fragility several years down the line“. However, the paper says relatively little about the theoretical transmission mechanisms from low policy rates to financial instability: “Why, though, do money and credit expand in the first place? By analyzing this question, we contribute to the strand of the literature that focuses on potential causes of credit booms. To the best of our knowledge, this strand is relatively thin.”

An interesting new explanation of the link between the central bank’s policy and credit growth is provided in recent paper by Kashyap and Stein (2023). The authors argue: “(…) it now appears clear that both conventional and unconventional monetary policy actions gain much of their traction over the real economy by influencing a range of risk premiums in financial markets, where the risk premium on an asset is the expected return that an investor can expect to earn above and beyond the safe rate on a government bond of comparable maturity” (p.55). However, this transmission channel focuses mainly on non-banks and on money market funds. As far as banks are concerned, it neglects the effects of the central bank policy rate on the liability side of bank balance sheets which can compensate the negative effects of lower interest rates on the accounting income of banks.

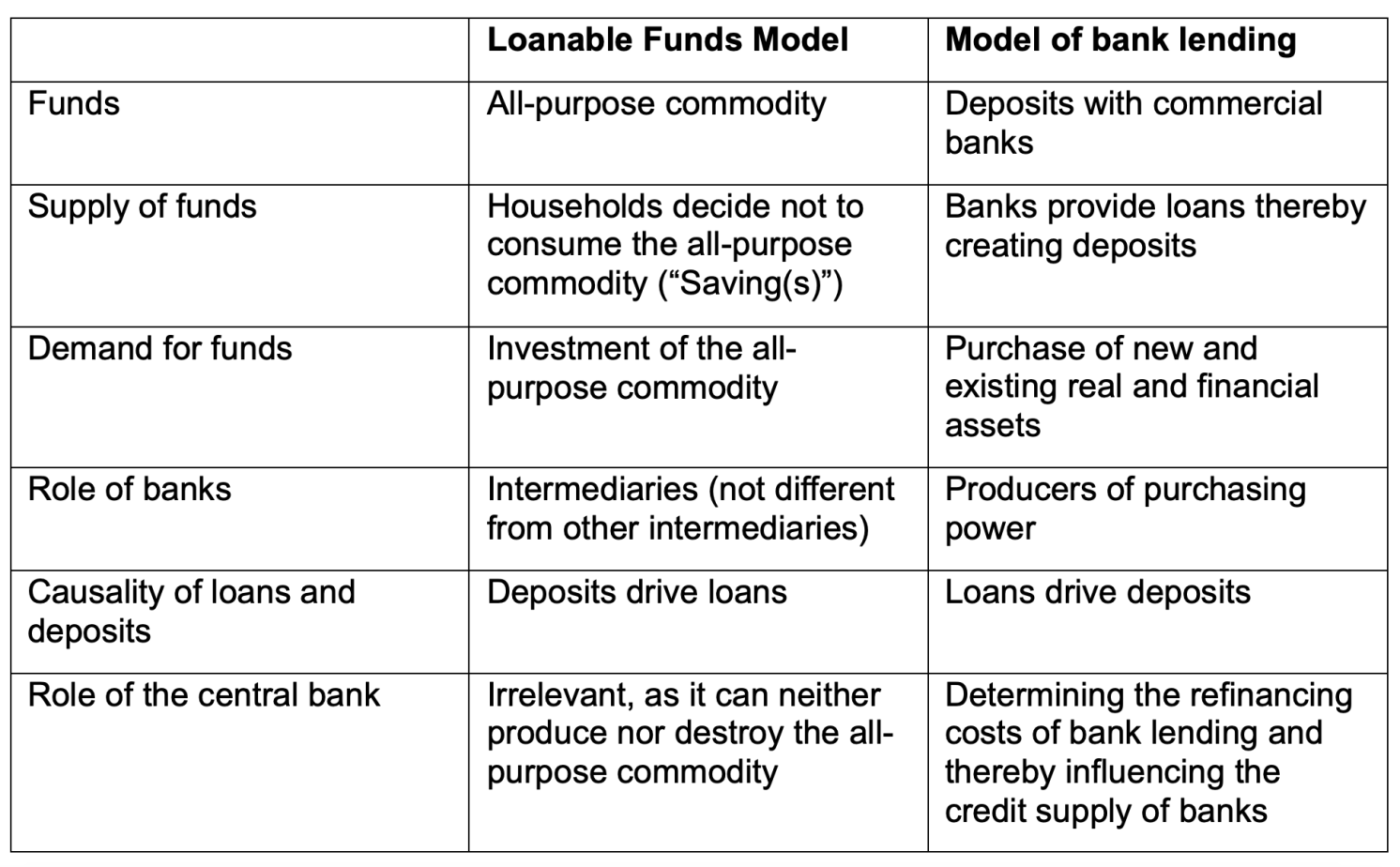

In a recent paper (Bofinger et al. 2023), we provide an alternative and more direct theoretical explanation for the effect of central bank policy rates on credit growth. Our model differs from standard models in that it is not based on the ‘financial intermediation theory of banking’, but on the ‘credit creation theory of banking’ (Werner 2014). 1 The main differences between the two approaches can be illustrated by comparing the standard loanable funds model with a model of the market for bank loans.

In the loanable funds model, ‘funds’ are an all-purpose commodity that can be used interchangeably as a consumption good, as an investment good, and as ‘capital’ or ‘saving(s)’ that banks intermediate from savers to investors. 2 Households supply the good on the ‘capital market’, where there is demand from investors who use it to increase the capital stock. Thus, deposits drive loans. In this setup, the role of banks is limited to the intermediation funds, as they cannot produce or consume the all-purpose commodity. The same applies to the central bank, which therefore has no role to play in this model.

With the loanable funds model still the dominant paradigm in monetary macroeconomics, it is not surprising that Mian and Sufi (2018: 50), for example, are puzzled by the dynamics of private credit growth:

“Much of the work on the credit-driven household demand channel takes the expansion of credit supply as a given. But what kind of shock leads to credit supply expansion? We should admit that we have now entered a more speculative part of this essay”.

Indeed, with household saving as the sole source of funds, the strong credit growth preceding financial crises is difficult to explain. This reflects the fundamental flaw in the model, namely that the monetary sphere is identical to the real sphere. In fact, only two decisions can be made: (1) the saving decision, which is identical with the consumption decision; and (2) the investment decision. How can one expect to explain the mechanics of the financial system with consumption and investment?

This is different in our model of bank lending: the monetary sphere is not constrained by the real sphere, since ‘funds’ are liquid bank deposits. They are created by the banking system ex nihilo, i.e. completely independently of private saving(s). The mechanics of this approach have been explained in detail by the Bank of England (McLeay et al. 2014) and the Deutsche Bundesbank (2017). The logic is quite simple: by lending to a customer, the bank credits his/her deposit account. Thus, the very act of lending creates deposits (i.e. money).

In this model, the central bank can directly influence the supply of credit by banks. This is because of the secondary effects of bank credit creation. In most cases, borrowers use their new deposits to make payments to another bank. For the bank that made the loan, this means a reduction in its reserves at the central bank. Assuming that it had an optimal level of reserves before the loan, the bank needs to replenish its deposits with the central bank. This can be done by borrowing from other banks on the money market or directly from the central bank. In the case of an interbank loan the interest rate on this borrowing is close to the central bank’s policy rate. In the case of central bank refinancing it is equal to the policy rate.

In addition to the central bank’s policy rate, in our model the supply of bank loans depends on the banks’ assessment of risk and the overall economic situation, represented by the output gap. Thus, in the model of the market for bank loans, the central bank’s policy rate is a key determinant of the cost of bank loans.

On the demand side, our monetary model is not restricted to demand for investment loans that increase the capital stock. It can also be related to the purchase of existing assets, particularly real estate. We assume that the demand for loans depends negatively on the interest rate on bank loans and positively on the level of economic activity.

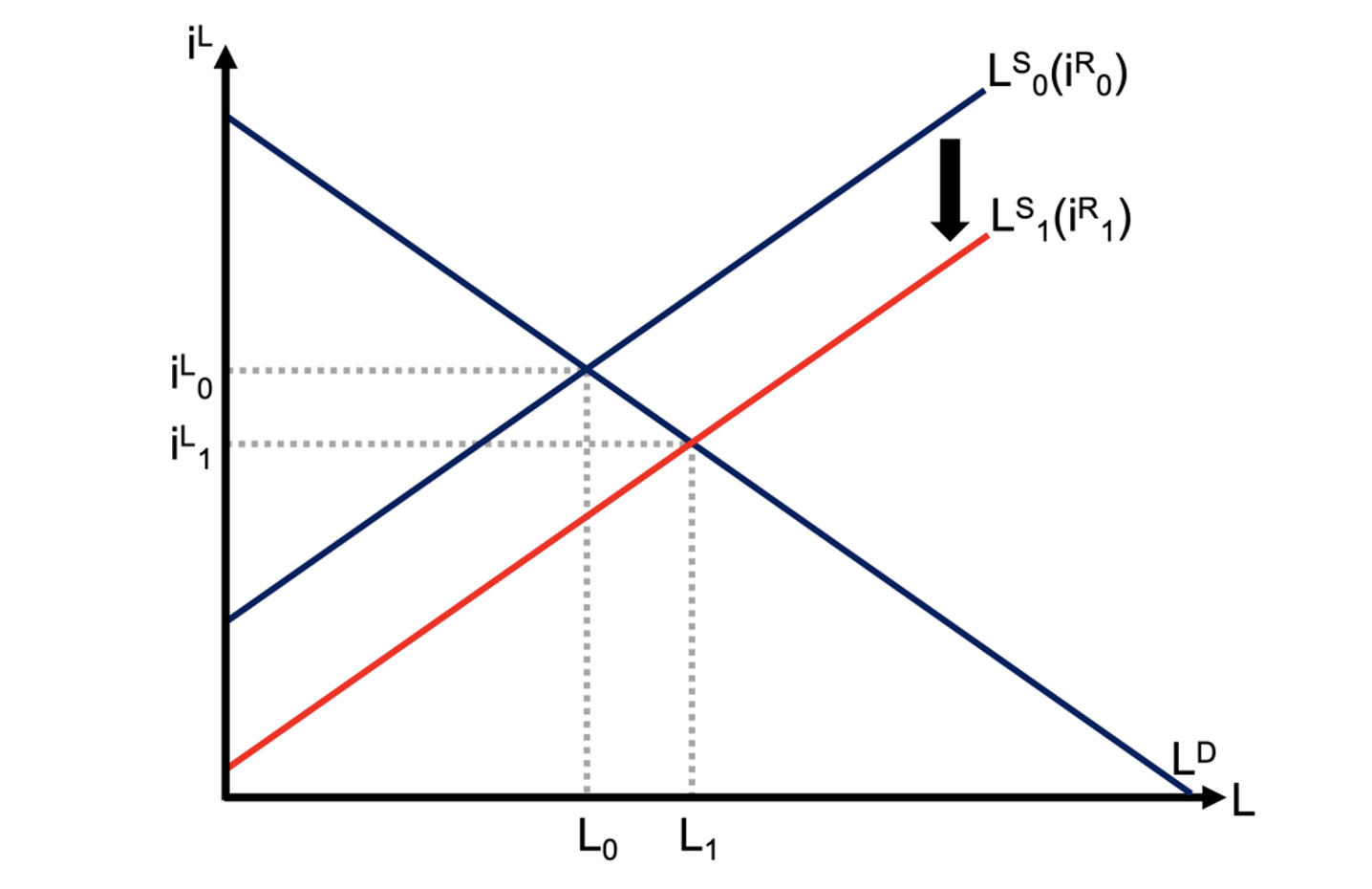

The impact of the central bank policy rate on the amount of credit in the economy can be easily described in the model. If the central bank lowers the policy rate (iR) from, for example in order to stimulate the economy, the supply of bank loans (LS) shifts downwards along the demand curve (LD) due to the reduced refinancing costs of banks. This lowers the loan interest rates (iL) and increases the equilibrium amount of loans (L) in the economy (Figure 1):

Figure 1 Change in policy rate in bank loan market

The model differs from the textbook multiplier 3 which underlies the bank lending channel in that it assumes reverse causality. The textbook multiplier is rightly criticised for assuming that an increase in monetary base causes a higher amount of bank loans and money (Carpenter and Demiralp 2012). In our model, the amount of bank loans is determined in the market for bank loans for a given central bank policy rate. The multiplier translates the amount of bank loans into the required monetary base. For a given multiplier, this implies that the central bank must passively supply the required amount of monetary base.

To sum up, it is not surprising that models that are essentially based on the loanable funds model, in which the role of banks is limited to the intermediation of funds created by savers, have difficulty in explaining the effects of the central bank’s policy rate on bank lending and financial stability. This is different in a monetary model with banks as ‘producer of purchasing power’ (Schumpeter 1934), 4 where the central bank’s policy rate plays an important role in the supply of bank credit. Table 1 summarises the fundamental differences between the two alternative approaches.

Table 1 Loanable funds model versus a monetary model of bank lending

References

Bofinger, P, L Geißendörfer, T Haas and F Mayer (2023), “Schumpeter’s insights for monetary macroeconomics and the theory of financial crises”, Industrial and Corporate Change, published 7 February.

Carpenter, S and S Demiralp (2012), “Money, reserves, and the transmission of monetary policy: Does the money multiplier exist?”, Journal of Macroeconomics 34(1): 59-75.

Deutsche Bundesbank (2017), “The role of banks, non-banks and the central bank in the money creation process”, Monthly Report 69(4): 13–34.

Goodhart, C and F Decker (2018), “Credit mechanics: A precursor to the current money supply debate”, VoxEU.org, 14 December.

Grimm, M, Ò Jordà, M Schularick and A M Taylor (2023), “Loose Monetary Policy and Financial Instability”, NBER Working Paper Series No. 30958.

Kashyap, A K and J C Stein (2023), “Monetary Policy When the Central Bank Shapes Financial-Market Sentiment”, Journal of Economic Perspectives37(1): 53-76.

Mayer, F, L Geißendörfer, T Haas and P Bofinger (2022), “Discovering the ‘true’ Schumpeter: New insights on the finance and growth nexus”, VoxEU.org, 3 February.

McLeay, M, A Radia and T Ryland (2014), “Money creation in the modern economy”, Bank of England Quarterly Bulletin, Q1.

Mian, A and A Sufi (2018), “Finance and Business Cycles: The Credit-Driven Household Demand Channel”, Journal of Economic Perspectives32(3): 31-58.

Schumpeter, J A (1934), The theory of economic development, Harvard University Press.

Stella, P and S Manmohan Singh (2012), “The (other) deleveraging: What economists need to know about the modern money creation process”, VoxEU.org, 2 July.

Werner, R A (2014), “Can banks individually create money out of nothing? — the theories and the empirical evidence”, International Review of Financial Analysis 36: 1-19.

Footnotes

- For a critical discussion of both views, see Goodhart and Decker (2018).

- The term ‘savings’ which is often used as a synonym for ‘saving’ is confusing. While ‘saving’ is a flow variable, ‘savings’ can be also interpreted as a stock variable as it has a strong association with ‘savings deposits’.

- An interesting discussion of the textbook multiplier is provided by Stella and Singh (2012).

- For Schumpeter’s theory of banking, see Bofinger et al. (2023).

And yet the paper still has to brandish the supply and demand totem.

But as the saying goes, Rome was not built in a day.

Yes, the up-sloping supply curve suggests bank lending is a positive function of the interest rate. In practice, like firms, banks mark-up their rate based on the cost of funds which is set by the Fed’s target rate. The supply of funds is horizontal at that interest rate. Banks will meet whatever demand happens to be at that rate. As one of my favorite Wall Street economists from the 1980s (Al Wojnilower) wrote, “there is a narcotic demand for credit, and banks are always able to meet that demand”.

So this implies that illicit money from risky and criminal activity is… money too. And the CB must decide the level of risk posed by an increase of credit which creates imbalances within the banking reserves between banks and their settlements? Or stg. Like that. So for instance when a bunker of gold bars kept safe by the treasury of some country suddenly turns up missing or some other huge thing of collateral disappears by being rehypothecated exponentially it is simply another form of credit supply, maybe negative credit, which can actually be booked and balanced by prudential risk assessment and the stimulation or depression of the underlying economies? Which ultimately causes massive inequality, sort of like Picketty describes? But not to worry because the banks are all in balance. Can somebody please go through this one more time top to bottom?

I find it supremely ironic that thanks to Naked Capitalism, this Humanities major has a better handle on how money and banking actually work than many (most?) economists. Thank you, Yves Smith!

Some of the best economics work has come from non-economists…

If I recall correctly, Keynes took his first degree in Mathematics at Cambridge, for example. He only studied Economics informally before taking up a lectureship and then fellowship at Kings College, Cambridge.

It’s possible, that “humanities” in Western Europe requires the college grad to understand both philosophy, history, literature, the sciences and economics. Professor Veghi of Cardiff College in the UK is a “philosopher” but being a very well educated Italian, he’s been writing about the US/Western Banking World and how seriously maladjusted it is. Philosophical Salon.com

Of course you going to use the loanable funds model to convince the smurfs how good things are while the more accurate model of bank lending is being used to goose asset prices and drive the ownership of property, resources and profits into the FIRE sector…where further enslavement, lowering of living standards and dispossession of the wealth to favor the top 1% will continue.

Just look at the news of real estate suffering it’s first loss of sales price for the first time (the beginning? fire sale by the distressed smurfs) and the record purchases of homes by investors (buyers of said smurf property) who then maximize rent to further squeeze said smurfs…..self licking ice cream cone comes to mind.

While on the hill – it’s been perverted to show that these increased wages that drive inflation need to increase the rate of interest and quell inflation.

Of course this policy will put more home owners in distress and put investors in position to buy, buy buy and continue the entire circle over again.

Since the Congress is where the financial minions go to roost at the behest of the financial geniuses you’ll get the old ‘doing gods work’ and ‘who could of knowd’

Thomas Jefferson would be displeased and Hamilton happy but maybe with some regret

This is useful. I must admit that I had not previously understood fully how central banks can regulate the supply of credit via interest rate adjustments.

When I studied economics in the 80s I did believe it was axiomatic that banks create money, although the linkage of monetary economics with classic Keynesian style macro economics was (as far I could tell) never very elegant.

If I recall history though, the earliest banks in the western world were the goldsmiths. They realised that they could create “money” as “loans” in excess of the gold deposits that they actually holding on behalf of customers. So they created money in the way that the paper describes, although this was really an IOU to provide gold. So unless I am missing something their ability to do so was dependent on the overall quantity of gold deposited, despite their use of fractional reserve banking. Ultimately, the amount of credit had a relationship to the total amount of gold.

I think the authors are arguing though that modern bank credit is not linked to the total amount of monetary base because real monetary deposits are created by each new loan and these loans then become full monetary deposits elsewhere that can be used to create more loans. So I guess that the loanable funds was correct at some point in the past up until gold reserves stopped being the anchor for the system.

Would be interested if anyone else has a fuller or better understanding.

Yep, that is the basic problem of economics. It is stuck thinking in terms of commodity money (or veil over barter as i have seen it formulated sometimes), where as the actual economy has long since moved beyond that except when under extreme duress.

This similar to if you ask actual bosses about how they run companies, the dynamic is nothing like the whole diminishing marginal utility economists like to talk about.

Frankly if you poke around economics enough, it all starts to read like religious moralizing stripped of its divine sky parent.

This is why they have a death grip on Barter theory and Says law because without out it the whole narrative goes poof …. and then they have some explaining too do …

The “loanable funds” model may suit “hard currency” regimes (eg. gold standard) but is an anachronism in a fiat or “soft currency” regime.

It’s taking a terribly long time for orthodox economics to catch up to the reality of floating currencies inaugurated with the abandonment of Bretton Woods, and nowhere do the ghosts of gold standards past haunt more dreadfully than among the credulous policymakers still in thrall to the zombie economics that is Monetarism.

In my opinion this is one of the most important finance articles every discussed on Naked Capitalism.

This article will hopefully become a source for a much needed in-depth discussion on the appropriate role of Central banks as well as small and medium sized private banks and their role in any productive economy ( I believe the CCP early on grasped the importance of small and medium sized banks for stimulating productive growth in their economy).

Also please see the March 20, 2023 article in Fortune magazine by Richard A. Werner (the man who apparently supplied Bofinger with a significant part of his bank-lending theory discussed above.

The Werner article is entitled “The expert who pioneered “quantitative easing,” has seen enough: Central banks are too powerful and they’re to blame for inflation.” Note in particular how Werner hypothesizes, the key role BlackRock played in pushing the Fed to go direct (i.e. to get central banks to consider bypassing small retail banks and to get bank money directly into the hands of the public thereby paving the way for a serious consideration of CBDC).

As an addendum, I found this related article by R. A. Werner to be enlightening:

Shifting from Central Planning to a Decentralised Economy: Do we Need Central Banks?

Oddly enough, I was just reading something from the late 30’s discussing this very conundrum. https://web.archive.org/web/20121103110209/http://home.comcast.net/~zthustra/pdf/a_program_for_monetary_reform.pdf

A secret proposal referred to as the Chicago plan. The quality of writing has declined over the last 90 years.

This was transcribed from a single surviving copy, which can also be seen on the wayback machine.

https://en.wikipedia.org/wiki/Chicago_plan

As a non-economist, I’ve always assumed bank lending to Real-world investors would be dominated primarily by their customers’ ability to find investable opportunities and, only in a distant second place, by the interest cost of those loans. While a 0.5% overnight change in interest rates would be huge in financial markets, I suspect it would be seen as a rounding error to most real-world investors.

However, in the real economy good investment opportunities are relatively limited, especially if the economy is plagued by monopolies, hamstrung by low skill levels, and so on creating a constraint on business growth and therefore also on loan growth.

The easy solution for ambitious banks is to make loans into a Ponzi-world where, by definition, real-world constraints don’t apply. That’s most easily done with property since the supply is fixed so readily available loans will reliably bid up prices making them good for both bank and borrower. Even better, you can do this sort of lending very cheaply based on contracted out ‘independent’ valuations and formalised credit scoring without having to retain highly skilled and experienced (and correspondingly expensive) bankers to exercise their judgement. I suspect a corresponding dynamic happens with derivatives, but I don’t have the background to be sure of that.

This works until it doesn’t as it meets the Minsky Moment when, as all Ponzis eventually must, it fails catastrophically leaving little behind.

Why do elite lack wisdom (the constant openness to the possibility you might be wrong and a different course of thought or action may be required)?

Regardless of why, they are morons. Only a moron could think something as simplistic as the loanable funds theory actually represents anything close to reality. And if they were as omnipotent as they think they are they would be able to make the world conform to their theories to make it work “perfectly” but they can’t.

I mean have they never used a credit card? Where’s the collateral (“all purpose commodity”) for that debt? Student Debt? Where is the collateral? Just two examples that immediately spring to mind. Absolute morons.

I am glad to see this article posted here … but what exactly is new about it? The loanable funds theory has been criticized at least since Keynes published the General Theory in 1936. I’ve been teaching Modern Monetary Theory for several years now, and we’ve always used short-hand phrases like “loans drive deposits” as heuristics. Does this article say anything that post-Keynesians have not been saying for a long time … or is it merely the fact that these are orthodox economists making the point?

It must be the latter — don’t worry, they’ll soon be claiming that they knew it all along!

What is new James E Keenan is TomW’s post of a 1934 article that posits bank fractional reserves should be bank 100% reserves.

Wash your mouth out. Fractional reserves is a loanable funds concept and has nothing to do with how banks actually lend. It’s a myth.

See here for a debunking:

https://www.forexlive.com/centralbank/!/fractional-reserve-banking-is-a-myth-20180606

I came for the politics, and got schooled on political economics. That is my experience with NC in a nutshell.

And as others have suggested, this is one of my favorite articles so far on that topic. I can say that I got a bit lost during the discussion of the graph variables (maybe because I never took stats in college?), but the table at the end was, very digestable.

I can now use the phrase loanable funds theory and explain it to others.

The impact of the central bank policy rate on the amount of credit in the economy can be easily described in the model. If the central bank lowers the policy rate (iR) from, for example in order to stimulate the economy, the supply of bank loans (LS) shifts downwards along the demand curve (LD) due to the reduced refinancing costs of banks. This lowers the loan interest rates (iL) and increases the equilibrium amount of loans (L) in the economy (Figure 1):

===========================================

So I understand that loans create money. But I don’t understand this particular sentence:

….the supply of bank loans (LS) shifts downwards along the demand curve (LD) due to the reduced refinancing costs of banks.

I would assume that as the cost of loans (interest rates) goes down, the demand for loans goes up? Perhaps “bank loans” does not mean a loan to borrowers, but to other banks?