Yves here. I have not checked the state of the rental market, since Birmingham routinely has high rent relative to purchase prices. That may be a big reason the housing market here is very strong. Not bidding wars, but brokers seem to have a finely-tuned sense of where to price a house and they usually sell very quickly, without an open house, at or a tiny bit above the asking price. 15 viewings will regularly yield 4-5 offers.

What are conditions like in your area, for rentals and buys?

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

High demand by renters of choice trying to outwait the housing turmoil pushes up actual rents in a range of 6% to 8%.

Landlords and tenants are throwing a bucket of cold water on hopes that rent inflation will back off – it just doesn’t seem to be happening.

These reports have been coming in from the largest landlords of single-family houses and from multifamily landlords. The largest landlords of single-family houses are publicly traded, and so they report operational details, such as actual rent increases for lease renewals for newly executed leases on a same-house basis. The apartment data is based on millions of actual transactions, renewals and new leases.

They’re actual rents that tenants pay. Changes in actual rents for specific rental units are also the base for the rent inflation measures in the Consumer Price Index and the PCE price index.

None of them include “asking rents,” which are the advertised rents that landlords want to get for their vacant apartments, whether or not they’re actually able to lease at those asking rents. Zillow, Zumper, Apartment List, and others report “asking rents.” The double-digit spikes last year occurred in asking rents, not in actual rents.

Rent Increases Reported by the Largest Single-Family Rental Landlords

Invitation Homes [INVH], in its earnings call for Q1 on May 2, said that rent growth in April showed “further acceleration” in newly executed leases:

- April new lease rent increase: +7.5%

- April renewal rent increase: +7.2%

- April blended rent increase: +7.3%.

In terms of Q1, it said, “We have also seen stronger demand return following the winter leasing season, with new lease rent growth accelerating sequentially each month during the first quarter”:

- Q1, new lease rent increase: +5.7%

- Q1, renewal rent increase: +8.0%

- Q1, blended rent increase: +7.3%.

American Homes 4 Rent [AMH], in its Q1 earnings call on May 5, said that “strong demand continues to fuel solid occupancy and rental rate growth,” in Q1 and continued in April.

- April new lease rent increase: +9.4%

- April renewal rent increase: +6.2%

- April blended rent increase: +7.1%

Which were “well above our seasonal pre-pandemic norms,” it said.

- Q1 new lease rent increase: +7.8%

- Q1 renewal rent increase: +6.8%

- Q1 blended rent increase: +7.1%

Which “drove same-home core revenue growth of 7.7% for the quarter,” it said.

John Burns Research & Consulting reported some “takeaways” from the National Rental Home Council Industry Leaders Conference, including this:

“Rent Increases Driven by a Substantial Shift to Renters by Choice.”

“The tenant profile in professionally managed build-to-rent and single-family rental communities is significantly shifting. There is a growing trend of even more tenants choosing to rent single-family homes rather than buy one. More prospective homeowners believe that prices and rates will come down and more resale buying opportunities will emerge, so they are delaying their home buying.

“This shift has led to a rise in the number of renters who are less rent-sensitive, creating demand for higher-quality rental properties.

“These renters, by choice, value superior interior finishes, better amenities, and overall design, which were not commonly available 15 years ago. As a result, property owners and managers can command a premium for such properties.”

Multifamily Apartment Rents Continue to Surge.

The National Multifamily Housing Council last week released its industry benchmark report for January (the delay is to comply with federal antitrust guidelines, it says). This data is based on executed transactions tracked by RealPage from over 13 million rental apartments in over 400 markets. “Asking rents” for vacant units are not included:

- New leases (per square foot): +8.9%

- Rent at renewal (effective rent on the same unit): +8.4%.

You Get the Idea

Lots of demand for rentals, given the high cost of ownership. A lot of people are now asking the question why buy the house, when you can lease a similar house for a lot less and outwait the situation – falling home prices and high mortgage rates.

And this relatively high demand by people who are renters of choice, who got the biggest wage increases in 40 years, is pushing up rents. That dynamic has been in place for a couple of years. And it hasn’t vanished at all, but appears to accelerate, based on these reports from the industry.

Rents Are a Big Factor in CPI and PCE Price Index

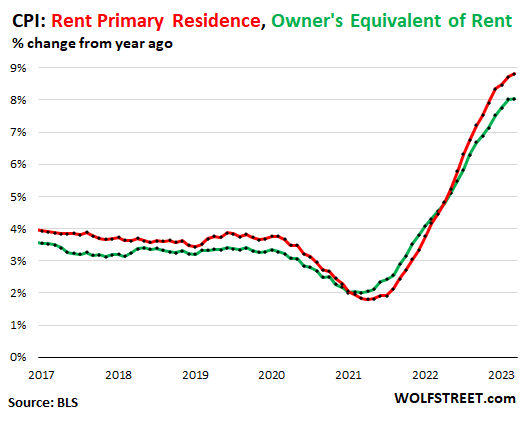

The Consumer Price Index for April will be released this week. About one-third of the CPI is “shelter,” based on two rent factors: Owner’s Equivalent of Rent and Rent of Primary Residence.

Both factors have shot up last year and this year. In March, OER was 8% and Rent hit 8.8%. The incremental increases slowed in March, and will likely slow further, and the year-over-year increases likely peaked, with annual rent inflation eventually dipping below that 8% level.

And those indices continue to be in line with what landlords are reporting.

We can see in the data reported by landlords that 6% to 8% increases in actual rents – renewals and newly executed leases, which is also how CPI measures rents – are currently playing out. So this is a little slower than the CPI rent increases in the range of 8% to 9%.

But the 6% to 8% range is a far cry from the hoped-for massive decline in rents – hopes that were espoused by big drops in “asking rents” off of the double-digit spike last year. But neither the spike nor the drop-off from that spike made it into actual increases that tenants are actually paying at renewal and when signing new leases.

So it seems unlikely that Fed chair Jerome Powell’s assumption will play out that rent inflation will be slowing sharply in a few months, and that actual rents are already going down, and that rent inflation will reach the point where it will no longer be an issue, and that the CPIs for rent are heading back to the 2% to 3% range, and that this decline is already baked in because the rent indices are lagging indicators, etc. etc.

It seems much more likely, based on these actual rent increases, that rent inflation will remain well in the hot range, above 6%, and that it will not help push down the services inflation measures and “core” inflation measures that the Fed is now so focused on.

It’s possible I am a tad bit early, but the article seems to be missing? Here’s the link to the actual article: https://wolfstreet.com/2023/05/08/why-im-skeptical-of-powells-claim-red-hot-rent-cpi-will-just-vanish-landlords-report-the-opposite-even-for-april/

To demonstrate how (in my opinion) insane housing prices are….20 min away there is a trailer park in the middle of the warehouse-industrial zone, the lot rental price is $870! (that’s before you bring put down a trailer home).

And at the other end of the spectrum, anything >$1,000,000 in move-in condition is flying like hotcakes too.

Anything reasonably priced, in move-in condition, is lasting less than 3 weeks on the market.

People have no choice, most people want to live relatively near work (even those with work-from-home) and (in my opinion) the appetite for hyper-long commuting is not like it was 20 years ago for those who have a choice.

And I think at the high-end buyers have the mentality that housing is less likely to go down than a 401k.

Anecdotal to myself in South Carolina (Greenville and Spartanburg MSA), it does seem housing supply is expanding as new tracts are being cleared almost everywhere a person looks. Even one off locations, where a few homes or even the rare duplex are seemingly shoe-horned into place. I’m not sure if this supply is all just single family residential, but it sure appears this way. Some developers will send out mailers about their local development and offers to the renters here, although the terms are not too favorable to an informed consumer.

I’m anticipating an increase of 5.0% to 6.0% at a minimum, when this current abode and apartment rental comes for renewal in August to September.

I wonder how much of this is the result of former “owners” who have had to walk away from overpriced homes bought in the last few years? There is also the question of those evicted from homes and apartments now that the various Coronavirus Pandemic rent and mortgage “moratoriums” have expired. I have read of a spike in evictions, especially in California.

One thing I have seen is that the national rental management companies have focused on “high end” properties and that this has spilled over into the mid-range property market. Not everyone can afford marble countertops or ‘designer’ appliances, but many ‘rental agencies’ force them upon the tranche of renters who can barely afford such. Look at the open houses at many of the suburban apartment complexes. These companies aren’t allowing for the constraints experienced by Fred and Wilma Deplorado.

Don’t even get me started on “Public Housing.” The low rent Public Housing apartment complex here in our half-horse North American Deep State town is a centre of the drugs trade. The local police now have a round the clock manned “outreach centre” at the place.

On a similar social collapse note, there was an attempted carjacking in an older suburb in New Orleans Sunday. Four teenagers were using a stolen car to ride around robbing people and doing random break-ins. Two of the boys tried to ‘jack’ a man unloading his SUV in his driveway. A shootout ensued. Two “robbers,” ages 11 and 13 were shot in their legs. The driver, the oldest, was 16. Reminds me of the 1972 film, “Bad Company.”

As usual, stay safe. Practice situational awareness.

I think the increased focus on getting better quality tenants is due to increased tenant protections, specifically difficulty with evictions. When it takes a year instead of a couple months to evict a non paying tenant that drastically changes the equation for a landlord.

While granite countertops forced upon tenants is one way to look at the dynamic, another is that landlords are using them to filter out those who are more likely to have issues paying rent down the line. Any increase in the rent is a bonus, but it doesn’t necessarily need to fully offset the cost of the upgrade to make sense

Just anecdotal, but I just handled a closing where my clients purchased a new home but did not sell their old home. Right after signing the contract they advertised the old home for rent and were flooded with phone calls wanting to see the place ASAP. They ultimately received multiple offers and settled on a 2 year lease with solid tenants for a rental payment almost twice the amount to cover their note.

I practice in the Chicagoland area. My general observations are that there is no supply because everyone who owns is in a good mortgage and does not want to sell. The majority of sellers that are out there are boomers who don’t need a loan to downsize to their next home. And they get multiple offers. So it does not surprise me that rental market is cut throat as supply of homes for sale is really low.

This probably will not change until Powell lowers rates or the coming recession causes unemployment to rise to the level where rental prices come down. I’m betting on the later.

I’m betting on those newly unemployed to end up on the street. Greed is firmly in control of the “market” today. I see residential rental management adopting many of the attitudes of Commercial rental management.

I agree on the lower edge of the market homelessness will increase. On the middle to higher end of the rental market, there will also be a significant amount of young people who will move back in with their parents, delay life decisions like marriage and children, and have their careers set back a decade (or forever?) just like the millennials after 2008.

>Greed is firmly in control of the “market” today

Why would it be greedy for someone to defer from providing a good for free? We can discuss society being greedy for not supporting those that are down and out, but just like I wouldn’t expect an individual to invite the homeless into their house and give them a place to stay I wouldn’t expect any individual landlord to do this either. It is the government/society’s job – not any one person.

I cannot disagree with your point as it stands. The confounding factor is the rise of Thatcherism in the “society” over the last few decades. So, if the “society” will not assist the destitute, then what is their main recourse? Crime. Given the lawlessness of the Elites today, adopting the ethos of Crime is positively patriotic now.

The good that you are speaking of is 100% in control of local boards who control how and when the supply expands. Why should they allow it to expand when they are making a killing.

If I was in my 20s in this market I would expatriate.

I expatriated for a large part of my 20s-30s (Boston was way ahead of the curve on cost of living) and now am doing the same in my 40s, another digital nomad.

And the US is losing Yves, too.

I am a small town landlord in South Carolina. I have five units. We have seen an explosion in rents over the past two or three years. I have raised mine very little if at all, but have a gradual plan to get closer to market rents over the next few years. It seems that now we’re at 40% to 50%.

Twenty years ago, there was an abundance of houses available to rent in the large town adjacent to us. Today that’s not the case, and since the pandemic, I think rents have doubled.

An insurance agent told me yesterday that he has observed a new tactic in the real estate sales market. A seller will list at a reasonable price, say $199,900. This will attract perhaps ten bids, and the actual sale will be at $249,900. I wonder if something similar is coming to the rental market.

—I wonder if something similar is coming to the rental market.—

Honestly (in my opinion) for a small-time landlord, it’s better to go the other way around. Start high with the expectation of giving a solid tenant a discount.

For a small-time landlord, you have very asymmetric risk–one bad tenant will be more hassle than a whole building of good tenants. (take with salt) Heard a story via family an uncle of a landlord friend who had all the appliances stolen from the unit by a tenant who walked away from the lease.

Rents above market will only attract those who cannot find housing at market price – precisely the types of people who are likely to have trouble paying rent

And if you are offering discounts to specific tenants you are opening yourself up to tenant protection/discrimination laws

Well, the “good news” is that imputed homeowners’ rent will push up GDP!

True, but what if we removed rents from the M-2 Index? (I know. I know. Stupid question.)

As a near colony, Ontario is much the same. A host of issues suppress the supply while government policy drives up demand. Also, Powell’s rate increases exasperated supply side impact on inflation by suppressing investment, and this is going to be true for nearly all the stuff that flows in and out of homes or whether unhoused, rented or purchased.

A very simple solution that the rentiers will fight to the point of death.

Banks should be mandated take into account consistency rental payments in EVERY mortgage application.

Preparing my snowballs just in case.

They do.. or at least they assume rent payments will not be consistent. Landlords are only allowed to count 75 percent of rent towards income precisely because of things like capital expenses and missed payments. That’s for conventional mortgages. Private mortgages require even more stringent underwriting. The problem isn’t loose underwriting, it’s too much money flowing to the top 0.1 percent in the first place

I imagine the institutional buyer rate is up and, combined with the use and abuse of analytic rent setting software, you have another block against lower rental costs and general acquisition costs to a level that the general economy can handle. Housing is become another chip and the wall street casino which is favored by laws, taxes and political capture of our legislators.

I just speculating about this but, I imagine if facts were checked, my statements above would prove out – would love to be wrong as it would rid me of some of my cynicism.

National news appears only if sensationalized or of a political narrative of a combative good v evil. It is a shame that the financial predators hubris kills the real worlds advances like a boa constrictor

On why rents may seem high in relation to purchase prices in Birmingham:

it’s always useful to look at property taxes, because they vary from state to state. SC’s are three or four times NC’s for rental property, and rents generally reflect that if you look closely enough. SC owner occupied property taxes, on the other hand, are very low, particularly if you’re a retiree of a certain age.

The Jefferson County Tax Assessor does not differentiate on rentals v. owner-occupied for single family homes and property taxes here are pretty low. But they may be much higher on multifamily developments as a non-zoning NIMBY.

Both American Homes 4 Rent and Invitation Homes were net sellers of SF homes last Q. My anecdata is that I would get 2-3 cold calls a day offering to buy a Fla SF property; that isn’t the case any more. We are small-fry SF landlords. We price a bit below market in CA and MD (both areas with much higher than nat’l average home prices) and our tenants never leave. IIRC I think our last rent increases were in the 4% range. Our local Honolulu SF/condo market inventory is down some and prices fairly flat, though median SF remains around $1 mil. The constant complaint is that prices are driven by out of state / international buyers/investors but no one provides any data to prove that. The latest scheme was to impose a Vancouver, BC style empty house tax but so far that hasn’t got traction.

Don’t know about Birmingham, but I know if we sold here in Honolulu and bought at same price in Montgomery we would be in a mansion.

“Henry George to the courtesy phone please …”

Can someone please explain to me the mechanism by which the Fed expects rents to fall in a rising rate environment with a tight labor market?

(Not an assignment — just my way of saying how that doesn’t make any sense to me)

Increased rates bring down the money supply. (People stop borrowing money to spend.) Less money sloshing about means less purchases.

Where the theory somewhat falls apart though is that purchases are the result of quantity multiplied by price. The ultra wealthy have gotten so concentrated in some cases they can adjust the quantity while simultaneously increasing price, regardless of fed monetary policy.

I think it is a worthwhile question if that’s going on in the housing market – I’m not fully convinced yet. (At least not nationwide.) The current increases could just be making up from when rents were flat during the covid stimulus, a time when the monetary reserve doubled or even tripled.

In my community of older homes, houses are being snapped up by LLC’s paying close to the asking in cash the day they hit the market or soon after. They put a few grand into cosmetic upgrades and then expect high rents in not especially desirable neighborhoods. Ordinary people looking to be homeowners don’t have a chance in the Greater Cleveland market. It’s terrible.

It’s similar here in western WA – typical rents for a 3 bedroom house start at around $2500, and this is outside of Seattle.

Western Massachusetts here. Moribund economy (it’s been this way for decades) but housing and rents have gone way up in the last 10-15 years, especially the last 5.

Lots of immigrants have moved into the area in the last 15 years. CT and MA are the main destinations for Puerto Ricans who have fled because of the economy in PR.

They don’t build new houses here. They refurbish (gentrify) old ones. Population growth and no new houses means prices only go up.

What is missing from these discussions is how the suppliers in this market have always colluded to raise prices while the buyers are particularly atomized, no renters’ unions like in Germany, and renters seem to have relatively little sway with municipal governments compared with landlords, despite obviously constituting vastly more voters.

As a landlord, I’m not sure who I should be colluding with? I do know that I have been getting increases in local rental taxes / licenses that I have to pay for the privilege of providing my tenants a home.

I live in a college town, middling population growth and a bit overbuilt, vacancies can be found (I am not sure about prices). It seems that rentals are dominated by few landlords/managers (I rent from a managing company, little idea who owns…). In this case, collusion is rather simple, landlords would not decrease rents (increase more slowly) unless vacancy rate is too high etc. For small landlords, several units, “collusion” would indeed be harder.

One investigation of major landlords using software to collude on rents.

There are landlords’ lobbying groups at the local, state, and national levels.

For small landlords, there are Facebook groups.

“Providing my tenants a home…” like the troll under the bridge is providing the goats a means of crossing the river. Pure rent-seeking activity. In simpler terms, landlords generally create nothing but instead hoard a limited supply of urban real estate, do the minimal maintenance possible, in the process driving up the cost of buying a home, pushing the American dream out of reach for others.

Even those who are waiting to sell because of their “low” mortgage rate, are being beseiged by huge increases in insurance, in maintenance and in higher taxes. They are all barely hanging on and are maxing out their credit cards….and the truth is that the real value of all these “properties” is nowhere near near the stated value as the infrastructure surrounding the homes keeps degrading….how bizarre the price of necessities has become in this country…bring back the “cost of living councils” we used to have….

As interest rates rise, so do the repayments on new or rollover mortgages so the cost of housing goes up.

Landlords with mortgages will want to pass on the cost. Landlords without mortgages can raise rents since the cost of housing, i.e. the prices in the market they compete in, has gone up.

So why should we expect rental housing inflation to disappear?

Worth remembering: Nixon put a moratorium on federally-built affordable housing, and, as he was cutting taxes for the wealthy in half (and with his successor, raising payroll taxes eight-fold) Reagan cut HUD’s affordable housing budget by 75%. Gosh, I wonder why affordable housing is so hard to find?

I don’t know how to anticipate real estate. Being among the first of the boomers we were able to surf that housing wave all the way to a comfy retirement. But population booms do not last forever. This whole economy still feels like a controlled crash to me. And more complicated than it was in say 2008. Real estate was part of the voracious growth paradigm – it was kinda like the toilet, flushing all that money down the drain and off to more investments. With no moral imperative to provide housing for the steady percentage of the population that fell through almost nonexistent safety nets. It has all been unconscionable imo. So now we are left to read the tea leaves because there has been no adequate legislation on the problem. Probably because it would interfere with private equity gobbling up distressed housing for a profit. So we are left to our own sense of things, listening to “thunder over distant mountains” – (Chief Joseph’s spirit name, aptly).

If you want to see where this is all headed, look to Ireland – it is the archetype of whatever the next/current stage of economic/societal exploitation is – and these housing figures truly are ‘rookie numbers’ compared to what’s happening in Ireland.

The country is expecting a surplus a sizeable proportion of its GDP over the next few years – and there is nothing less than a complete ideological refusal to build houses – which has gone on for about a decade now.

That’s the future – and all of the narratives for that future are already written and have been on display for much of a decade, in Ireland.

In western WA (Snohomish and Skagit counties) if you have $500-600k and up, all is good — but if you’re trying to find a house under that amount (as we are) it is extremely difficult. Under $500k either the house is too small, in a flood zone, or there is something wrong with it. We’ve been looking for months but the market here is extremely tight with very little inventory in our price range. As recently as 2020 you could find places for well under that amount but no more. If there is nothing wrong with the house they typically sell in a week or less. The prevalence of people flipping houses is high as well, and while I can’t blame people for trying to make some money, it has made the market even tighter. Nobody wants to sell their place and move — why trade a 3.5% interest rate for 7%?

The predatory nature of so many transactions necessary for life is simply stunning. I wonder how big an impact cartels have in setting rental prices: https://www.propublica.org/article/yieldstar-realpage-rent-doj-investigation-antitrust.

Thank you for the comments. I have been searching for a retirement home base. Thought I found the perfect humble home in a nice affordable town, but discovered anything affordable sells instantly with multiple bids, often from the AirBnB would-be millionaires.

I have a secure income right around the median, should be able to afford something safe and decent, if modest. Instead, all over the country I see dilapidated neighborhoods full of homes residents could not afford to maintain properly, or landlords would not maintain properly, stable neighborhoods where nothing is for sale, and new housing tracts full of shiny new homes priced at double what I could afford.

I wish there was a map of ‘hot’ markets so I could at least not waste my time investigating them, any data sources would be welcome. Meanwhile, it is scary to even consider becoming a renter, why bother going that route if Engulf & Devour is going to buy up my house and double rent at will?

I used to live in Lexington, KY where “affordable housing” has been an oxymoron for decades. I kept having apartment buildings bought out from under me and the rent jacked up and I’d move to the next one where it was just rinse and repeat. In 2007, during the housing bubble, I decided I need to quit renting and finally buy a house as at least a form of rent control. Priced out of my neighbourhood in two weeks because the prices of houses kept going up, if some dump of a place didn’t sell, the price went up and weirdly, the house would sell in days. Houses in other part of the city that were “affordable” meant you were looking at ridiculous amounts of repairs just to make them livable.

Rent in Lexington in 2007 was in the upper 900 range. When I bought a house the next town over (Paris) my mortgage is 750. Rent in 2023 is now 1600 dollars with the very poorest part of town about a 1000 dollars a month. I know people who are terrified they are going to be living in their cars at the rate rent is increasing for them. These are people with jobs who previously didn’t worry about making their rent.

Local government in Lexington has been hand wringing over “affordable housing” forever but nothing changes in any meaningful way. I feel lucky to have escaped but the small town I live in now (Paris) hasn’t built any affordable housing in nearly twenty years. All the construction is for “luxury” housing and nothing for workers. Any beautiful old downtown building that gets redone also becomes “luxury” housing. Everyone thinks they’ll get people from Lexington but what about the people who already live here?