There was much drama around the last-minute congressional deal to raise the debt limit in June. The heavy focus on this public debt, which had climbed above $31 trillion for the first time, is misplaced, however; it’s private debt that should be the center of attention. That’s according to Richard Vague in his new book, The Paradox of Debt.

The news on that front is less than ideal:

- With inflation biting, credit card debt in the US has been rising at one of the fastest rates in history and is at record highs.

- The Supreme Court just struck down the Biden administration’s modest student loan relief plan. 100 million Americans are struggling with healthcare debt, and 20 million of them don’t expect to ever pay it off.

- Increasing precariousness has homelessness rising across the country, including up 40 percent in Los Angeles County over the past five years. It’s jumped18 percent this year in New York City.

What gives? The US economy has grown at 3.2 percent, 2.6 percent, and 2 percent in recent quarters.

Vague’s Paradox of Debt explains that for the economy to grow, debt must rise. It is, according to Vague, “an inherent feature of the modern economic system.” The problem is this eventually leads to too much private debt, bad lending and a crash before the debt continues to grow ever higher. While economists obsess over public debt, financial crises are overwhelmingly caused by out of control lending in the private sector:

Total debt has always grown as fast or faster than GDP, except in periods of calamity. Debt outgrows income, and this growth is not a cycle, but instead a jagged yet nevertheless unending upwards march.

It isn’t just high private debt alone that causes a crash, rather it is the rapid acceleration of debt growth that signals rough times ahead. Vague’s research with his colleagues shows the following:

When the ratio of private debt to GDP in a major, developed country increases by at least 15 percent to 20 percent in five years or less, then a financial crisis or some other calamity is likely, especially if the overall private debt ratio is at 150 percent or higher.

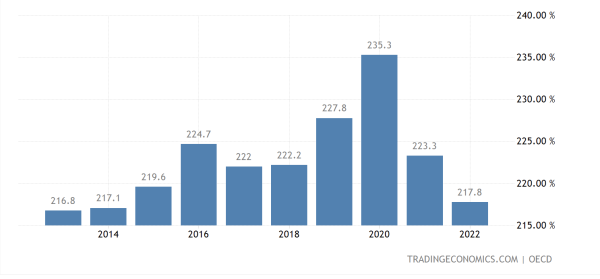

Here’s what total private debt to GDP looks like in recent years:

Private sector debt (the sum of household and non-financial business debt) percent of GDP is overwhelmingly in the household mortgage and commercial real estate debt.

Is Economic Growth Possible Without Overreliance on Debt?

In his book Vague goes into fascinating detail on all aspects of US private debt and debunks widespread myths on government spending and inflation with thorough research. Vague describes how private debt deleveraging requires public debt growth (and vice versa) in order to maintain GDP growth and household income (which helps explain the decline in private debt in the graph above following pandemic government stimulus).

While public debt ratio to GDP used to decline when the private debt ratio increased and vice versa, since the 1980s in the US both private and public debt ratios have continued to grow.

Increasing net exports is one option, although it’s difficult (the US hasn’t had a surplus since 1975). The other option is to moderate debt growth, although again, that’s easier said than done as debt is outgrowing GDP in the 300 – 600 percent range in the world’s large economies.

Vague also offers compelling examinations of the different debt profiles of the world’s seven largest economies. It’s not great news anywhere despite the different debt growth strategies. China, for example, follows a path that relies heavily on business sector losses and debt and has been struggling to change course without slowing the growth of household income.

Germany, which for decades had followed a trade surplus model, is searching for a new route of growth following Berlin’s decision to sever itself from Russian energy and amid worsening ties with its largest export market in China. The shift is likely to be painful for most Germans.

He also examines the UK, France, India, and Japan. One common theme in all countries is that this debt paradox also drives up inequality.

“One Entity’s Liability Is Another’s Asset.”

While Vague says the debt growth we should be worried about is private debt, there’s also this fact: rising levels of government debt lead to rising inequality.

So without changes to government policy, it seems we should also be worried about government debt. While it may not portend some sort of crash, it causes its own calamity in other ways.

On the private debt front, the bottom two-thirds of Americans are the ones falling further and further behind, which only enriches the wealthy even more.

And the great debt explosions in recent decades has fallen hardest on lower income households:

The reality is that the debt service ratio, which is a household’s monthly debt payments in ratio to their income, is today 30 percent higher than it was in the 1950s and 1960s…the trend in the debt service ratio is worse for households in the lowest income segment.

Increased debt has led to an increase in land and stock purchases, which has sent their values soaring, but those “gains” have not been evenly distributed:

We’ve seen that most of the gain in household wealth comes through the increased value of stocks and real estate, which increase in value as debt increases. Because the top 10 percent of US households own most of the stocks and real estate, these rewards fall on them disproportionately while the burdens of increasing debt fall disproportionately on the bottom 60 percent. And because growth in debt is essentially perpetual, with only episodic, calamitous reversals, the pressure towards growth in inequality, however fast or slow, is likely also essentially perpetual, absent some major countervailing change, such as a change in tax policy.

More debt among the bottom 60-plus percent helps push up the value of real estate and stocks owned overwhelmingly by the wealthy, which Vague says “adds to our growing inequality dilemma.” But is it really a dilemma for the country’s elite or is it working exactly as the American elite want it to?

The promise of trickle down wealth has never materialized. Debt, however, that’s another story:

In the period 1945 to 2020, when household net worth nearly doubled, US household debt grew a monumental sixfold, from 13 percent to 79 percent of GDP. However, in relative terms, this increase has fallen harder on middle- and lower-income Americans, with significant economic and political consequence.

Vague doesn’t get into what those consequences are, but typically inequality unaddressed can lead to some dark places. Because inequality is already so entrenched it’s difficult to reverse or even slow down.

Pandemic relief, basic income, welfare, or any government policy that sends money to help people survive ultimately ends up enriching the wealthiest since the money is inevitably spent on goods and services overwhelmingly controlled by them. In other words, our society is already so unequal, it’s challenging not to make it more so:

Tens of millions of both middle- and lower-income households – those in the sixtieth to ninetieth percentiles as well as the bottom 60 percent – have essentially no net worth and high levels of debt. And much of that debt is for purchases of goods and services from companies owned largely by the top 10 percent.

So millions of Americans are stuck slaving away with no hope of ever climbing onto sturdier ground; they slog on just to survive and further enrich the rich. And the results are predictable:

We see that the total net worth of the top 10 percent of US households has increased from 161 percent to 288 percent of GDP, an extraordinary increase of 78 percent. At the same time, the debt to income ratio of the top 10 percent has increased by less than 20 percent, from 52 percent to 61 percent of GDP – a small amount in the context of their overall balance sheets.

In this same period [1989 – 2019], the total net worth of the bottom 60 percent of households has actually declined, from 63 percent to 59 percent of GDP. … Further the debt to income ratio for the bottom 60 percent has nearly doubled, from 38 percent to 72 percent of GDP.

Reforming to the Current System is a Sisyphean Task

As I read the above-mentioned statistics on how debt intertwines with inequality, I was ready for drastic solutions to meet the scale of despair and destruction wrought by this economic system. Alas, I was underwhelmed by the relatively orthodox prescriptions to avoid crashes and make debt more tolerable.

Vague believes these crises can be averted by watching for such overlending and increasing regulation when the alarm bells begin to sound. His solutions to the debt paradox basically boil down to detect and stop.

While Vague acknowledges this wouldn’t be easy, it’s worth emphasizing just how difficult it would be. As Vague mentions, inequality is already so far out of the barn, it’s nearly impossible to enact a government program that helps the poor without simultaneously increasing inequality. But that’s not the only way inequality has spun out of control.

There’s also the problem of how much power rests in the hands of the rich due to that inequality. How is proposed detection and regulation going to overcome such regulatory capture and bipartisan opposition? Vague mentions the case of Federal Loan Bank Board Chair Edwin J. Gray who tried to put a stop to irresponsible lending in the runup to the savings and loan crisis in the 1980s. How did that go? The industry threw money around and got him removed from the board. That type of control over government has only increased over the 40 years since.

Is there any other incentive for lenders to guard against overheating? Vague mentions the moral hazard point that people who get bailed out could be more imprudent with future borrowing. But what about lenders who are the ones actually receiving bailouts. Why would they relinquish control of government and submit themselves to regulation when they can simply profit, crash, and get bailed out?

Vague has a lot of plans for eliminating the taxes on dividends for the bottom 60 percent and means-tested relief for mortgage, healthcare, and student loan debt. He also proposes debt jubilees:

Debt forgiveness is actually an ancient idea. Kings of Ancient Egypt and Babylon routinely proclaimed an amnesty from debt when debt levels began to crush the population, which provides surprising attestation to the universality of the problems of debt overaccumulation. We need modern-day private debt jubilees to be a component of our economic system if we are to reduce accumulated debt sufficiently to meaningfully improve lives and economic growth, and to do so without damaging the economy.

Maybe I’m too cynical, but it’s hard to see how these proposals would do more than make the situation a little less horrible. Any assistance would certainly be welcome, but would it be enough or does it end up like current solutions to the US’ ever-increasing homeless problem: get one person off the streets and into stable housing, and five more take their place because it’s simply impossible to keep up, and all it takes is one bad break.

Debt jubilees, for example, sound great, but unless you fix the underlying rapaciousness, how often do you need to beg the king(s) for a jubilee? Once a year? Every six months? The jubilee might come in time for some, but not for others.

For such situations, Vague turns to Massachusetts Senator Elizabeth Warren’s proposals for reforming bankruptcy law. These all sound logical, but the simpleton in me wonders if it wouldn’t be better to have an economic system that didn’t cause so many people to go bankrupt from healthcare, education, housing, and other costs.

Vague also advocates for a strengthening of the social safety net to prevent people from falling further behind, but his main goal is to offer plans that would help individuals “advance financially.”

And how are individuals starting from behind supposed to do that in order to take advantage of IRA tax breaks? Vague wants to “boost the marketable skills of the millions of people who are currently underemployed in the economy.” How to do that? Vague writes:

Lifelong education is not a temporary challenge, nor is this solution meant to be a stopgap for a few years while we wait for well-trained young people to fill the ranks. We have to learn how to train, re-train, and properly utilize the full complement of an aging workforce.

Maybe it’s just me, but that sounds like a horrible existence. I have different hopes for my 40s, 50s, and 60s other than frequent re-training so as to stay afloat. And while I’m no economist, I’d argue that if people cannot have shelter, healthcare and an education without going into crushing debt (and without such debt, the economic system as a whole begins to falter), maybe that entire system needs a rethink.

Richard Vague is the author of The Case for a Debt Jubilee, An Illustrated Business History of the United States, A Brief History of Doom, andThe Next Economic Disaster. He is a former banking executive and the former Secretary of Banking and Securities for Pennsylvania. His latest book, The Paradox of Debt, is available July 11.

“These all sound logical, but the simpleton in me wonders if it wouldn’t be better to have an economic system that didn’t cause so many people to go bankrupt from healthcare, education, housing, and other costs.’

Billionaires don’t earn their billions, they steal it; or, it’s transferred within a dynastic estate and essentially no tax is paid on the income. The U.S. economic system oppresses the majority of the American people.

Relief from bankruptcy is an illusion. For instance, the system, post bankruptcy, intentionally debases your credit rating for a specified time (approximately 7 years), rendering you economically disadvantaged. In this way, the parasitic-billionaire ruling-class can extort additional wealth from victims through usury, higher cost housing and insurance, or other insidious schemes and practices. The U.S. economic system is dysfunctional, arbitrary, and malicious.

Consider that Joe Biden helped to author legislation that essentially precludes students (student loans) from discharging their enormous debts through bankruptcy. This exemplifies the chicanery perpetrated by the billionaire ruling-class to extort wealth from the working-class – this expropriation fosters the establishment and maintenance of the rentier-class.

You may have asked yourself why you are in debt, have limited wealth, or don’t have much in the form of chattel. Here’s one of the reasons why: Betsy DeVos’s McMansion Hell.

In Buying Time Streeck underlined the transformation of taxing-capable states in the second half of the 20th c into debt states: instead of taking from elites in the form of taxes they gave interest to them. Does Vague completely lose track of that shift? It does suggest a simple remedy.

It’s not that the remedy is complicated; it’s that the ruling class don’t wanna remedy nothin’. All is going according to plan. Their plan.

Why is economic growth necessary? As noted, greater than half the US population receives no income growth/benefit.

Most of the U.S. homeless travel to California, therefore the homelessness is rising 40% in Los Angeles is a meaningless statistic.

How many of those unhoused are actually FROM L.A.?

Incorrect. A recent study has shown that the majority of the unhoused in LA had actually lived there beforehand: https://www.theguardian.com/us-news/2023/jun/20/california-affordable-housing-crisis-homelessness-study-myths-older-black-residents

Maybe not all debt is the same. You do have debt which is used to build or make something to generate an income which then liquidates the original debt and accrued interest. This is both normal and healthy. But then you have debts which can never be paid back. Again, this is normal as some debts will end up like this.

What is not normal or healthy is when banks and other financial corporations continue to carry these debts and not write them down as it would make them look bad or would put executive bonuses at risk. So they stay on the books and end up accumulating like an overhanging cliff. I would hate to guess how much debt there is like this out there right now.

One other factor. The economy has been expanding for a few centuries now and was to a large part fueled by debt. So what happens when the world economy starts to falter and then starts to contract due to factors like resource depletion? What happens to all those debts then?

The unhealthy debt you describe in your second paragraph is the economic equivalent of the metabolic dysregulation associated with obesity in the body.

I very much enjoyed Vague’s A Brief History of Doom so I’m looking forward to this new book.

I’m not sure why we’re surprised that an increase in the size of the economy is accompanied by an increase in debt, since our entire fiat money system creates debt simultaneously with money creation (either in the commercial bank credit system or by Federal spending, which itself creates money) — it’s simply an artefact of the balance sheet.

The problem as far as I can see isn’t debt itself, but its distribution (along with the distribution of assets). Unfortunately our elites see the current distribution as a feature, not a bug …

The link to credit card weeping story is terrifying. A mom with three children, 2, 4 and 6 old, has a decent job with ca. 3k/month net, but she lost her husband. The article says “divorce”, but nothing about support, so there is something dark there.

To work she needs daycare, 1500/month. From what I remember 40 years ago, this is a good price, and alternative, a baby sitter, would cost more. But how can you feed, dress etc. 4 persons in USA on 1500/month? Do you need a car with gasoline and insurance? But somehow the mom “almost” made it. As an aside, that shows that “near Nashville, TN” the rents got to be low. But to “balance that”, Tennessee is quite stingy with support for childcare etc., so our mom did not qualify.

So she became a heroic person that keeps solvency of our banking system, namely a revolver. This suggest playing Russian roulette, a bit misleading, it is more like Russian roulette with a bullet in every single chamber. Revolver is a person who does not pay full balance on the credit card, often just the minimum payment, so she was REVOLVING the balance. And the interest rate starts at 26% if you need it (i.e. you have not so good credit rating). There were times when I was young, and there existed usury laws. Note that this interest rate is whopping

20% above inflation.

Stand to reason that you should rather eat the grass than revolve your balance. For starters, DO NOT PAY MEDICAL BILLS. They actually have more decent interest rate, and they do not pester too much. But eating grass is easier said than done. I check historical accounts how it was done in Polish Wikipedia on “przednowek”, English version on “hunger gap” is much less informative. In Poland and further east, every early spring majority of peasants had to survive with hardly any food. One reason was that potatoes, beets etc. stored since Autumns were rotting in spring, and an obvious solution was to eat them anyway. A more reliable way was to eat weeds, especially the seeds of a weed with related to quinoa. Good food! But you have to find it, and getting food out of it requires A LOT OF WORK (collecting weeds and converting into seeds that are not poisonous), something that poor peasants had time and knowhow. BTW, Native Americans abandoned that plant once they were able to grow much less nutritious corn, surely because of inferior food/work ratio. Perhaps our mom, helped by 6 year old daughter, could spend weekends foraging like that …

Financially, our mom would do better by leaving younger children under the care of 6 year old daughter, another approach of poor peasants, but risky and perhaps even illegal.

Basically, the old mantra about consumer spending being 2/3 of the economy (or in that general vicinity), without qualifying for increased spending servicing debt, belongs to a different age of industrial capitalism.

This is the golden age of rentierism.

Conor Gallagher, what a stellar contribution to Naked Capitalism ! Many thanks.

I would change just one thing in the whole piece, in your concluding sentence: “And while I’m no economist, I’d argue that if people cannot have shelter, healthcare and an education without going into crushing debt (and without such debt, the economic system as a whole begins to falter), maybe that entire system needs a rethink.”

I would delete the “maybe.”

If you are not familiar with Jason Hickel’s “Less Is More,” it’s a concise read that gave me some hope. If only more Americans were aware of it.

I agree that debt is an artifact of an accounting system. An accounting system of information which is purely social but is magically transformed into debits and credits. That little nexus where this cognitive alchemy is performed, as if it were as logical as breathing because, in fact, money does make the system function, is such a tight little tangle of non-accountability it’s almost a punchline. We all come from a village way back when money was pure cooperation. What we need is the modern equivalent of that village. It could serve to balance the books by eradicating profit in proportion to poverty and inequality so that no gains emerge if inequality exists. This is really the ultimate account, not just morally, but sustainably.

Inequality twists our thinking too…

“In … Domination and the Arts of Resistance (1990), James Scott makes the point that whenever one group has overwhelming power over another, as when a community is divided between lords and serfs, masters and slaves, high-caste and untouchable, both sides tend to end up acting as if they were conspiring to falsify the historical record. That is: there will always be an ‘official version’ of reality–say, that plantation owners are benevolent paternal figures who only have the best interest of their slaves at heart–which no one, neither masters nor slaves, actually believes, and which they are likely to treat as self-evidently ridiculous when ‘offstage’ and speaking only to each other, but which the dominant group insists subordinates play along with, particularly at anything that might be considered a public event. In a way, this is the purest expression of power: the ability to force the dominated to pretend, effectively, that two plus two is five. Or that the pharaoh is a god. As a result, the version of reality that tends to be preserved for history and posterity is precisely that ‘official transcript.’ ”

– From (footnotes) The Dawn of Everything: A New History of Humanity by Graeber and Wengrow

Actually, this does not agree fully with my limited historical knowledge. For example, Old Testament may have one writer or many, but the perspective is of the priestly caste which could make some allowance for the “interests of the common people” who should not be so destitute as not being able to make offering to the Lord, i.e. the priests. The treatment of women was basically like the cattle, as in the ire of God commanding to not only kill all the Amelek, but also their women and the cattle. Or when the only just man on Sodom sacrificed his daughter to lecherous Sodomites, a good deed, but alas, no second just Sodomite was found. So (a) the daughter did not count (b) letting the daughter be raped was a good deed. No different from letting his cow be slaughter to appease the abusers.

The longer text written in my mother tongue was also the first text not written by a clergyman. It was a satire on lazy peasants, and since every one has to learn it in school, the first verse, “Cunningly peasants live with their lords” is proverbial for pretending to work/make effort (it also sounds funny, in part for being archaic). It took hundreds of years for the first text expressing care for peasants to be written. In short, the fate of lower classes in old times has to be deduced from the elite writings and archaeology.

To some degree, this persists even today. From idle curiosity, I used Google to search about the unhappiness of Chinese workers few years ago. Notably, there were quite a few articles about unhappy overworked office workers. By the way of contrast, production line workers were happy not to be in their poor villages, and suicides, while making news, were actually rare. Both groups were equally subjected to overtime, but at least in the case of workers making I-phones for Apple, office staff was not living in military-style barracks with limited contact with the outside, so they could tell their sorrows to the reporters. But lower classes are literate these days, so there are more accounts from their perspective.

Does this book say that American money are private, while Chinese money are public?

Making money public will go a long way to solving the debt problem. When the banks and money are public, then interest accrues to the public…

while my dominant opinion, agrees with Carla above; roughly that the powers that be are getting their cake and eating it too, so the people with the levers of power surely think everything is just fine enough, why bother “fixing” anything. Their only move would be to FURTHER entrench themselves.

But as far as the issue. There are many aspects of debt, sure. To the rich bondholders. the poor people’s debt is their asset. There will never be a , “we’ve got to see eye to eye on this” kind of moment. which is natural.

I do think that as far as the national debt of the US, there is a comparison to be made with the climate changes underway that, like debt; is an insurmountable problem. I think looking at every change to be made as to having to “fix” the problem is wrong headed, and guaranteed to always fall short.

But , just like there is no way to reverse course on the climate with any actions that can be taken and completed , there is no way to fix the predatory economic/ monetary system we have that is the basis for our current neoliberal ,finance capital driven; nightmare . I think that breaking down the components of the problems, do offer things to go after.

Just like global warming can’t be stopped now. We can try to focus on clean water. clean air. clean soil. clean food. clean energy. etc. each of these sections broken down, has “something” that can be done. And IF we were ever able to do them…. it seems that we would also be “down the road” on the way to doing something about the climate. And if we were not, we would be in a better place to face the inevitable. We would have clean air, water, food, energy, These are parallel goals.

And like debt, and the problem of inequality. it is insurmountable. but one thing that is a parallel goal to producing equality, and eliminating the public national debt of the US, would be to end the private monetary system we have.

The federal reserve act that enshrined our private monetary system, created the framework of what the US dollar is now. That framework , which is where the banks, create the US dollars and the government borrows them, creates markets to monetize them, backstops the institutions who control the flows, And also pretends to regulate them; Is the hive mind that controls the US economy and by extension the world.

But, if something like the old chicago plan or the new NEED act (HR 2990 112th congress 2011-2012) could be adopted, we could radically change the dynamic of everything from wall streets power to decide what direction the country takes. to congressional budgetary power to give the people what they need…. and then PAY for it . DEBT FREE. The NEED act, was proposed to congress. It has already gone through the process of being vetted by congressional legal scrutiny. It is a viable plan. With no one left holding any debt, going unpaid for past contracts, and no new debt being created.

It would be akin to doing something concrete, that WILL change the dynamic. In particular ways.

Also, this seems to be the distinction made numerous times by Michael Hudson, who regularly points out the difference between china’s ability to choose industrial capitalism, because they haven’t privatized their monetary system. Whereas, we have to do what all the “experts” tell us , and accept that there is no alternative.

The ability to create money, is also where the powers that be get the never ending streams of money that is used to pervert our political system.

The solution to problems has to be broken down to solvable pieces. Otherwise no progress is happening, or will happen.

Sorry, but as an oldie I need my pension. So if you have a mortgage to buy a house during your working life, then you are contributing to the present retirement generation, for which I am grateful. The demographics of pensions implies increasing debt!

By the way, no-one ever got wealthy by compound interest after tax. Wealth comes from an advantageous trade off between assets vs liabilities, and – ever since Pacioli – no-one can escape having to manage both sides of their balance sheet…

Maybe we should seek a fix by starting from the now well-supported assumption that the private sector is no longer competent to provide adequate compensation for any type of work. The government would then institute graded basic incomes, with the highest incomes for the nastiest jobs.

Retrieval of all unearned wages from our oversupply of elite and elite aspirants will help. Unfortunately when the elites and the elite aspirants compete for other people’s wages, they cheat. And they cheat big, you might say.

I found this article depressing! After following Michael Hudson et al arguements for twenty years and more, and given the efforts he puts at his age into spreading his ideas on debt, this book, and – with apologies to Conor who usually does good pieces on various topics, this review – leaves so much to be desired in analysing the what, why and how of debt (and its flip side credit and money), that one might consider them designed to obfuscate any real understanding…(I am reminded of a BBC Radio documentary on ‘money’ in its “Analysis” series, which might have been better labelled ‘paralysis’ so inneffective was it at explaining that topic!)

As Irish president Michael D Higgins said recently, speaking to an economics audience: “there is nothing in economics that cannot be understood if explained properly”. A ‘Comments’ section is not the place for this explanation. All I can recommend is that readers consult Michael Hudson, Steve Keen, David Graeber, Richard Werner etc….