By Henk Jan Reinders, PhD researcher at Rotterdam School Of Management, Erasmus University, Economist at The World Bank, Dirk Schoenmaker, Professor of Banking and Finance, Rotterdam School of Management at Erasmus University Rotterdam, and Mathijs Van Dijk, Professor of Finance, Rotterdam School of Management at Erasmus University Rotterdam. Originally published at VoxEU.

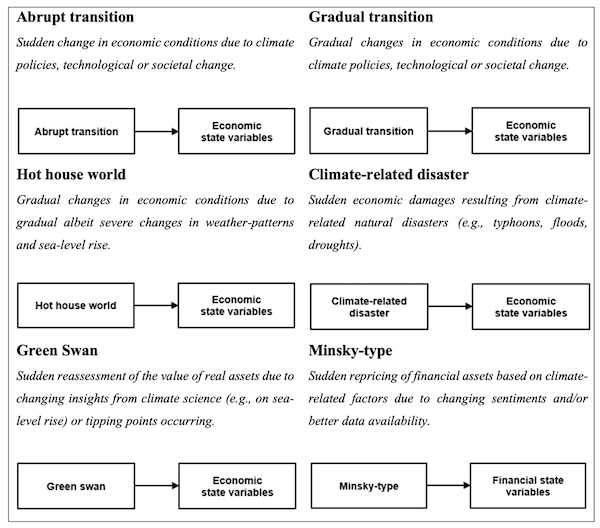

Climate change can potentially cause highly adverse shocks to the financial sector. Central banks and other policy institutions increasingly rely on a host of newly developed climate risk stress-testing (CRST) methods to assess these potential effects. While traditional financial risk assessment methods typically assume that the future will be similar to the past, climate change is likely to lead to unprecedented and often detrimental changes in a broad set of regions and economic sectors over a long period of time. This implies a need for forward-looking risk assessments, based on those future outcomes that are potentially most detrimental. We identify six types of climate-related shocks that are relevant for climate risk assessments: abrupt transition, gradual transition, hot house world, climate-related disaster, ‘green swan’ events, and Minsky-type shocks. Figure 1 provides an overview.

Figure 1 Classification of climate shocks

Several of these shocks have been investigated in some detail in current CRST applications. These include orderly transitions, disorderly transitions, and gradual changes in economic conditions due to changes in weather patterns and sea-level rise. The latter is also referred to as a ‘hot house world’ scenario (NGFS 2022). Disorderly transitions have primarily been investigated by looking at the sudden introduction of climate policies (e.g. Battiston et al. 2017) or policy uncertainty (Berg et al. 2023). Furthermore, an emerging strand of literature investigates the occurrence of one or more climate-related natural disasters on financial institutions (Hallegatte et al. 2022). This type of shock is highly relevant from a financial stability perspective, as disasters may cause high losses for banks and manifest themselves in very short time horizons (Klomp 2014).

Other shocks have received much less attention. This is specifically the case for scenarios in which financial sector agents suddenly change their perception of current and future risks, which would be rapidly reflected in today’s market prices of financial instruments. In the climate context, this could chiefly be for two reasons. First, a shock could emanate directly from our changing perception of the state of the global climate system. This could include the unexpected occurrence of climate tipping points or changing insights from climate science – for example, when research would find that sea-level rise occurs more quickly than previously thought. Bolton et al. (2020) label these tipping points and changing insights as a ‘green swan’ event. Second, a shock could emanate from the financial sector if it fails to continuously incorporate the latest climate science and financial sector agents suddenly do so at some point in time – for example, due to increased awareness, a large natural disaster event, or strongly improved climate risk data. We label the latter as a Minsky-type shock.

CRST Modelling Approaches

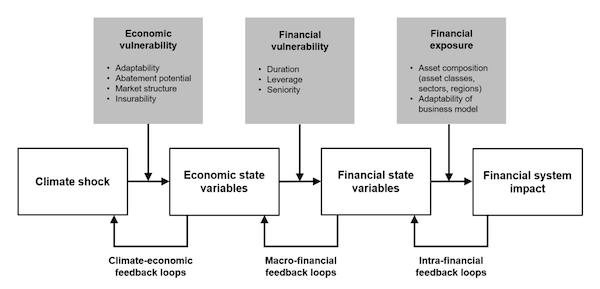

To assess the impact of climate shocks on the financial system, different modelling approaches are emerging. CRST must convert initial parameters (climate shocks) into key financial sector variables such as solvency and liquidity ratios. The typical way that CRST methods do this is by employing macroeconomic models and translating shocks to key variables, such as GDP, into expected losses for the financial system. Additional modelling steps are often required to model the effect of severe climate shocks on the economy and financial system, as they do not have precedents in the past. Furthermore, climate-related shocks often have specific sectoral and regional impacts, increasing the need for disaggregated (micro-based) modelling approaches. Our review of CRST methods (Reinders et al. 2023) finds that, besides traditional macro-financial modelling, three new approaches are emerging:

- The micro-financial approach focuses on firm or asset-level variables and uses valuation models and regression or structural models to estimate financial risk measures and losses.

- The non-structural approach treats the economic effects of a shock as a black box and directly models the relationship between climate shock and financial outcomes, often using empirical methods.

- The disaster risk approach links disaster risk models to financial sector outcomes, estimating the impact on variables such as economic damage and total factor productivity, which can be further linked to insurance liabilities or non-insurance financial variables.

Next to several relevant moderating effects, there are important feedback loops within the financial system (intra-financial), from the financial system to the economy (macro-financial) and from the economy to climate risk (climate-economic). These feedback loops are endogenous and may amplify the initial shock, as happened during the Global Financial Crisis of 2008-2009 (see Figure 2).

Figure 2 Moderating variables and feedback loops in the climate-financial relation

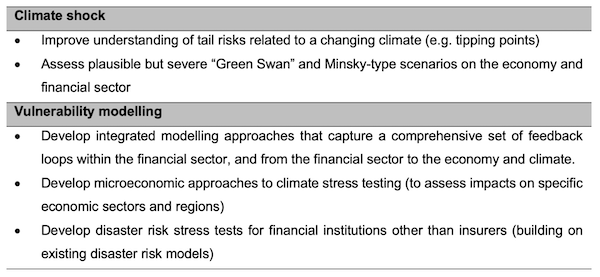

Policy Recommendations

Given the complexity of the link between climate shocks and financial sector outcomes, we conclude that all CRST exercises to date have substantial drawbacks. CRST is a developing field with, so far, a wide variety of approaches to model the relation between climate shocks and financial sector outcomes. Common limitations include limited scopes (such as including only subsets of channels and asset classes) and incomplete modelling (such as excluding feedback effects). Furthermore, our review points to an overreliance on macro models with low sectoral and spatial granularity and neglect of certain climate shock types. We conclude that these limitations may well lead to a significant underestimation of potential system-wide financial losses. We offer suggestions for improving CRST approaches, summarized in Table 1. In particular, we believe it is important that the next generation of CRST exercises assess the potentially most damaging scenarios (such as ‘green swan’ events or rapid repricing of financial assets) and include feedback loops that can amplify shocks between climate, economic, and financial systems.

Table 1 Avenues for future research

Good ideas, but VIPs will have to admit we’re headed for disaster for this to proceed.

Related and upbeat video: Nate Haugens interviews Kate Raworth. There’s quite a bit of discussion of financial impacts with a promised second session including Steve Keen.

Why do I think all the VIPs will demand more power and control before they’ll say they are able to “do something”? / ;) ( too cynical? )

Some random Sunday morning thoughts here.

It seems that climate risk stress tests consistently underestimate whatever it is that’s being measured.

The “financial sector” is as doomed as the rest of us.

The “troubles” in France are coming to a theater near you.

The Gilded Age 2.0 has come to a close.

I fear you are too optimistic.

That fear is why the PMC Democrat Liberals are so desperate to achieve Gun Control against the American People.

Because what if all those guns were to get aimed ” up the ladder” and “towards the top of the pyramid”?

Gun control is a “flag” issue. It’s primarily a fund raising tool. Their “desperation”, like the “passionate defense of our constitutional right to bear arms” from the other side is nothing more than a marketing strategy. And your comment proves it still works.

I can understand the desire to point out the need for more research as elaborated in Table 1 at the tail of this post. It is hard to be a PhD researcher without funding lines.

I doubt new risk models are needed or would prove useful. The old risk models work fine. Let someone else suffer the impacts of the risks. Get your fees and commissions up front. Have an exit plan for leaving the bag on some one else’s front porch. Dust off the risk models from the 2008 crash and bundle up risks to make the AAA before you sell them to speculators and retirement funds. Worst case make sure to buy enough government to assure that you receive plenty of government money to recover any loses you do suffer and a nice chunk of gains.

Nice try! But the author of this post needs to take a sabbatical and study at some u.s. School Of Management. Why waste time writing research papers when you can get in on the ground floor of an opportunity like Climate Chaos?

It will be hard for us mere citizens to air-gap ourselves from the Financial Sector, even by a little bit. But the effort deserves to be made, at the personal, neighborhood, local and semi-local levels, etc.

If the Financial Sector could lose so much money that it lost its power or even its existence before it facilitated the destruction of all life on earth in its Prime Directive Drive to keep itself in power until the Very Last Day, then unpredicted losses to the Financial Sector would be a good outcome of Climate Shocks. Hopefully millions of people could somehow air-gap themselves from the Financial Sector to the point where they could afford to agree with that sentiment.

In the realization of Marxistianity’s ” Arrival of Heaven on Earth” wherein the Proletariat ” expropriates the expropriators” . . . . what happens when the Proletariat realizes that there is nothing left to expropriate . . . that every last bit of it has all burned down to the ground? Did Father Marx have anything to say about that?