Yves here. The anodyne title does a disservice to an intriguing piece, which discusses how political scientist Tom Ferguson came to be the first who broke in a major way with prevailing theories of voting behavior and political power. Those cheerful fairy tales reflected the naive view that democracies worked as advertises. that politicians responded to the weight of voter interests. Ferguson’s wake up call was a visit to Roosevelt administration archival material, which quickly revealed that settled views that Roosevelt international economic policy was clueless. In fact, Roosevelt’s team was acutely aware of key issues but didn’t have great options.

This discovery helped Ferguson crystalize his instinct that corporate interests were far more influential than widely belied because the cost of political action was and is high and they are well-positioned to bear it. That also meant that intra-big-business difference in interest were also consequential. That led to the money theory of politics, where the weight of spending mattered more than voter desires.

Ferguson also discusses how advanced economies are moving toward what he calls affluent authoritarianism.

By Thomas Ferguson, Research Director, Institute of New Economic Thinking; Professor Emeritus, University of Massachusetts, Boston. Originally published at the Institute for New Economic Thinking website

Preface to the Japanese Edition of Golden Rule

I am lucky enough to have some real, if distant, ties to Japan and its singular culture. Some years ago I gave a series of lectures as a visiting professor at Keio University. Later I taught for some weeks at Chuo University. I learned a great deal from Japanese scholars in both places. Over the years my engagement with Japan deepened thanks to my family: One of my daughters studied for a semester at a girl’s high school on the Tokyo-Yokohama border and then majored in Japanese at Princeton University, where she took time out to spend another semester at Waseda University. Books have to stand on their own, but when I learned that Golden Rule was being translated, I jumped at the chance to offer a few remarks to help readers understand what Golden Rule was trying to do and, more importantly, alert them to subsequent work that strongly buttresses its contentions.

The heart of Golden Rule is its presentation of the investment theory of party competition. This developed out of a crucial formative experience of mine as a graduate student at Princeton University in the mid-seventies. At that time in economics and political science, mathematical models of party competition were all the rage. As Golden Rule discusses at length, these models purport to show how citizens control the direction of government policy by voting in contested elections. I did not believe this claim: the surging power of money, now obvious in the United States (and many other countries) – was already plain to me, but I was struggling to put my finger on the flaws in the standard models.

An adviser remarked to me that Ivy Lee’s papers were over at Seeley Mudd Library, Princeton’s principal archive for collections of private papers. I knew Lee’s history, as a co-founder (with Edward L. Bernays, the nephew of Sigmund Freud) of public relations in America. I also knew he had been a principal adviser to John D. Rockefeller, Sr., and many enterprises related to the billionaire. I had never consulted an archive – that was simply not done in either political science or economics at that time, but with an eye to finding some inspiration for my Ph.D. thesis, I decided to go take a look.

Within minutes I had dredged up a memorandum by Lee on his conversation with President Franklin D. Roosevelt in the turbulent late fall of 1933. At the time, the dollar was still floating (really: sinking) in the wake of the President’s decision to abandon the gold standard and ramp up the First New Deal’s National Recovery Administration. What shocked me was the directness and clarity with which Roosevelt discussed his international economic policy aims. Nothing I had read or heard on the New Deal prepared me for this. The customary view, as expressed in such works as Stephen V. O. Clarke’s study of the Tripartite Money Agreement for the Princeton University Studies in International Finance, was that top Roosevelt administration policymakers had very little idea about what they were doing.[1] Their experts may have, but not the policymakers. As Charles Kindleberger later put it to me after I joined the faculty at MIT, “Roosevelt was just a quarterback calling plays in a tough situation hoping to find something that would work.”[2]

Lee’s memorandum exposed the hollowness of that claim. Roosevelt was no international trade theorist, but there he was calmly discussing his aims vis-a-vis Great Britain, assessing the recovery of American domestic prices, and monitoring the pace of domestic economic revival.

Two other features of the memo also stood out. Roosevelt’s matter-of-fact allusions to conversations with many other top business leaders and the use Ivy Lee made of his own memo. The President was obviously engaged in a constant dialog with prominent business leaders about the progress of his programs. By granting Lee an exclusive, private interview, Roosevelt was confirming his status as a participant in the broader deliberations – even then, visitors to the White House were watched carefully by many different interests. Lee wasted no time capitalizing on the incident. Emphasizing the transcription’s confidential character, he dispatched a copy to a top investment banker he knew well.

I was intrigued and decided to go through Lee’s papers more thoroughly. They were thin and quickly exhausted, but Princeton also had Bernard Baruch’s papers. One of the best-known financiers of his age, Baruch had headed Woodrow Wilson’s War Industries Board during World War I and advised the President at Versailles. He remained a major player in both business and politics down at least to the late nineteen forties, with a famously elusive relation to Roosevelt and the New Deal. The papers were enormous and richly detailed. For months I tunneled through them, trying to absorb as much as possible. The collection also contained many newspaper clippings, including many from sources that were difficult to access in that pre-internet age.

The gap between what I was seeing in the archives and learning in my classes made a deep impression on me. I began jokingly referring to America as the “Dark Continent.” When I took a position at MIT, I realized that I was just across the river from the Baker Business Library at Harvard Business School, which had vast collections of papers that have never been properly exploited, including those of several of the most important bankers of the age, notably Thomas W. Lamont of J.P. Morgan & Co. Thus I kept working in archives for years, first in the United States and eventually in Great Britain, France, and Germany. More than once I dug out important new collections from heirs or was allowed to see material that was and sometimes still is closed.

These experiences showed me that the consensus historiography of the New Deal of Schlesinger, Leuchtenburg, Frank Freidel, and other scholars only scratched the surface of what actually happened. Many more business leaders and their agents were active participants; reports of meetings and bill draftings routinely left out key players, etc. Some of the omissions are astonishing, such as the real background to Herbert Hoover’s famous 1931 call for a moratorium on war debt payments.[3] While some of these discoveries postdate Golden Rule, its accounts of policymaking, especially in the American New Deal, draw heavily on this material. So, of course, do other papers I have written since the book appeared, including my co-authored studies of the 1931 German financial crisis and the coming of the Nazis with Peter Temin and Joachim Voth, respectively. The latter paper also provides an example of how recent developments in econometrics permit quantitative tests of the investment approach that previously seemed impossible.[4]

While I continued my archival research, I kept working on a more formal and explicit account of how money transforms the dynamics of politics. Golden Rule presents that. Along the way, an answer emerged to one of the questions that had long bothered me: What was historically distinctive about the post-New Deal Democratic Party? It was obviously different from the Republican Party. In the New Deal and after, it enjoyed real support from labor unions and certainly pushed programs that constrained businesses and sometimes advanced broader interests in the whole society. To this extent, it shared some similarities with post-World War II European Socialist parties – which to this day its Republican opponents love to dwell on. But on closer inspection, the idea that the Democrats represent a socialist party is obviously ridiculous. Most Democratic cabinets and advisers come from capital-intensive, free-trading business groups, not organized labor, and since the nineteen seventies labor has wasted away under Democratic presidents.

Golden Rule’s analysis of this problem highlights the crucial interaction between social class and industrial structures. It flatly rejects notions that party systems are “normally” defined by conflicts between business and labor parties. That happens only if labor is fairly organized and strong. Short of that, divisions within the business community, especially over international trade and sometimes public investment, emerge and drive the party system.

I developed this approach by studying the broader literature on industrial structure, fitfully advanced over several generations by such scholars as Alexander Gerschenkron, Eckart Kehr, Arthur Rosenberg, and James Kurth.[5] At the heart of the investment approach is the acknowledgment that in most modern countries, political action is far more costly in terms of both time and money than classical democratic theories imagined. Thus the central question for analyzing political party competition becomes the extent to which ordinary citizens can bear those costs. Nothing metaphysical is implied here: to control the state citizens need to be able to share costs and pool resources easily. In practical terms, this requires functioning organizations – unions, neighborhood organizations, cooperatives, etc. – in civil society that represent them without enormous expenditures of time and money. There is one and only one guarantee of this: those organizations have to be controlled by (and, in the end, financially dependent on) their real constituents. If existing parties are not controlled by voters, then they have to undertake the comparatively expensive process of running candidates of their own or lose control of the system. To the extent that “secondary” organizations flourish, or the population directly invests its own resources in candidates, popular control of the state and effective mass political movements can flourish.

Where investment and organization by average citizens are weak, however, power passes by default to major investor groups, which can far more easily bear the costs of contending for control of the state. This is where industrial structure really matters. These investor groups normally align in distinctive blocs arising out of historically specific patterns of industry structures (where “industry” embraces finance, mining, agriculture, and services alike). In most modern market-dominated societies – those celebrated recently as the “end of History” – levels of effective popular organization are generally low, while the costs of political action, in terms of both information and transactional obstacles, are high. The result is that conflicts within the business community normally dominate contests within and between political parties – the exact opposite of what many earlier social theorists expected, who imagined “business” and “labor” confronting each other in separate parties. Few indeed are the labor movements today that can realistically expect to control parties of their own. In the United States, for example, organized labor’s share of political money amounted to about 7% of the approximately $8 billion dollars spent during the 2016 election.[6] So much for what used to be known as “countervailing power.”

Given that only political appeals that can be financed can be brought before the public, there is thus little reason to expect that many important issues of great concern to ordinary voters are likely to find expression in the political system. In money-driven elections and policymaking, you will have candidates, elections, real competition that is not collusion, and all kinds of noise, but when the smoke clears – and there will be lots of handsomely subsidized smoke – average (“median”) voters will not determine where policy settles.[7] This doesn’t mean that elections do not present real choices: divisions among oligarchs can really matter. Witness the case of Donald Trump. But if you want to tax the rich or pass broad social welfare programs, you will need a real mass movement not dependent on the goodwill of the super rich.

Alas, today, as one contemplates the vast increases in economic inequality in most formally democratic countries, it is necessary to ask whether the United States and similar countries are not sliding into a new form of “affluent authoritarianism.” In recent years, scholars have tried to assess statistically how responsive governmental policies are to clear shifts of public opinion in several different countries.[8] Many such efforts have led to discouraging results. As one well-known study of the United States concluded: “Not only do ordinary citizens not have uniquely substantial power over policy decisions; they have little or no independent influence on policy at all.”[9]

So far, social scientists play with these devastating findings like cats with balls of yarn. They seem unable to metabolize them or build upon them. Instead, they keep repeating variations on old themes and stay fixated on opinion. If average voters are unimportant, they want to identify some precise stratum of opinion that is – perhaps the most affluent 10% of all voters, the top 2%, or even the famous 1%.

But as I have emphasized in work published since Golden Rule, the idea that any stratum of “opinion” holds the key to policy is delusory. Surveys of policy views held by the 1% or 2%, or even the top 10% of voters, especially if they are trying to explain changes in policy, do not typically reflect anything as innocently vaporous as “opinion” at all. Their data are instead noisy by-products of the mobilization of big money with its comet-like trail of social networks, subsidized op-eds, subservient think tanks, and journalists seeking applause and better positions. That is how the reality of money-driven political systems shows up in surveys.[10]

This is the crucial point that contemporary economics and political science need to absorb and why Golden Rule remains relevant. Refining models of voter behavior to take more account of voter ignorance is pointless if you systematically bypass what’s driving the system, especially when money speeds across state lines at the speed of light.

Thanks to the rise of “big data” in the social sciences, it is now possible to be much more precise about the relationship between money and elections. Golden Rule focused on national-level political coalitions in which presidential elections received the most attention. Those are one-off events by constitutional design. In the years after the great financial crisis of 2008, though, I spent increasing amounts of time applying the investment approach to the U.S. Congress with quantitative data.

The great thing about analyzing congressional elections is that they are not unique events: hundreds of candidates run for seats. Thus genuine statistical approaches are possible. Neither the United States nor anywhere else in the world provides reliable statistics on the many forms political money assumes and makes the figures available to the public. The “Spectrum of Political Money” is much wider than formal campaign funds.[11] But the United States does collect and publish far more substantial data on campaign funds than most other countries. Working with two gifted scholars, Jie Chen and Paul Jorgensen, I have taken advantage of the relatively abundant U.S. data to explore the relationship between campaign money and election outcomes in more detail.

Our basic finding is startling and provides a perfect place to end this preface and launch readers into the book. When I wrote Golden Rule, I had no precise idea of what a reasonably accurate graph of the relation between political money and election outcomes would look like. I assumed the relationship would be strong, but I also took it for granted that it would be irregular, full of exceptions, and admit many qualifications.

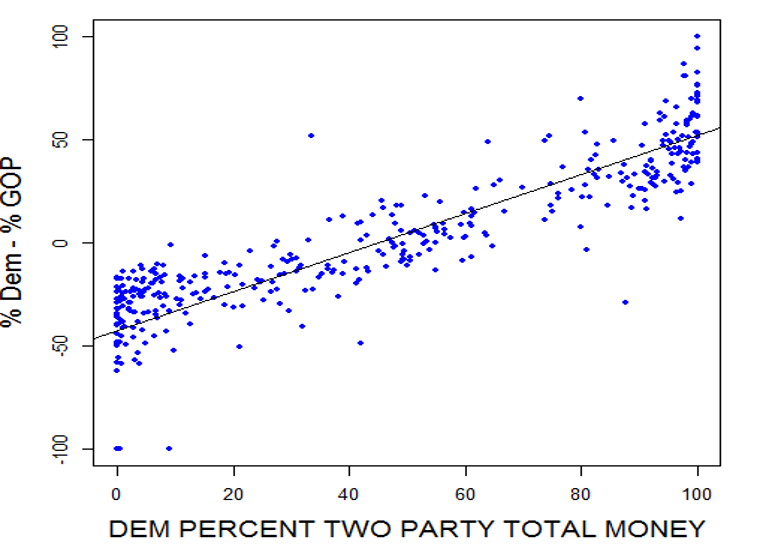

After the 2012 election, however, my colleagues and I decided it was time to actually look at real data for congressional elections. Because we had built up special files integrating many forms of campaign money, we decided to directly examine whether knowing the percentage of campaign funds a Democrat or a Republican spent in the campaign compared to his or her opponent could be used to predict how many votes they got. To our astonishment, the finding was a near-perfect straight line. See Figure 1.[12]

Figure 1 – Campaign Expenditures and Vote Shares are Strongly Associated (Data for 2012) [13]

Do not be put off by the figure. It is a simple scatter diagram and easy to read. Along the bottom from left to right runs the Democratic percentage of the total dollar amounts spent on any given race – not the cost of votes per ballot or other measures that vary with district size and other characteristics. The vertical axis going up the left side benchmarks the percentage of the two-party vote that the Democrats garner. That axis is scaled as the difference between the Democratic and Republican shares of the vote, meaning that as the difference goes positive for the Democrats (roughly in the middle of the figure), they start winning seats. At the bottom left corner, in other words, the Democrats get no or hardly any money and win no or hardly any seats. At the upper right, they slurp in all the money and get all the votes.[14]

The spread of the dots around the line – outcomes of actual congressional races – shows how far reality diverged from the pure linear model. The discordance in 2012, as in so many elections before, was not much. Some races did deviate – they always do, and in 2020 the Democrats lost some close ones they might normally have won.

But the big story is the persisting dominance of the linear model. My colleagues and I have demonstrated that it holds for every election for which we have data – that is, from 1980 to 2022. We have also shown that the only possible rejoinder to the diagram – that seeing should not lead to believing because the money must be following polls, so that the apparent correlation is just an artifact – is mistaken. Though some money follows polls, most does not.[15]

Noam Chomsky has recently remarked that there are few real regularities discovered in the social sciences, but that the linear model is one. With forty years of evidence, I, of course, think it is time to agree. But I hope that the Japanese translation of Golden Rule gives readers real food for thought and perhaps leads them to reconsider some basic notions about how politics works, along with an appreciation for the dangers that now shadow contemporary democratic systems.

Notes

This is the English version of the author’s preface to the Japanese translation of Golden Rule: The Investment Theory of Party Competition and the Logic of Money-Driven Political Systems (Chicago: University of Chicago Press, 1995). The Japanese version is published in two volumes by Keiei Kagaku Publishing and this preface appears here with its permission.

[1] Stephen V. O. Clarke, Exchange-Rate Stabilization in the Mid-1930s: Negotiating the Tripartite Agreement, Princeton Studies in International Finance No. 41 (Princeton, N.J.: International Finance Section, Department of Economics, 1977), pp. 8–21.

[2] The exact sense of Kindleberger’s comment still sticks vividly in my mind, but I have no notes. It is possible that one or another word was in a different order.

[3] Compare the account in “Normalcy to New Deal,” in Golden Rule with many later treatments, including Adam Tooze’s The Deluge: The Great War, America and the Remaking of the Global Order, 1916-1931 (New York: Penguin, 2015). Cf. Thomas Ferguson, “Affluent Authoritarianism: McGuire and Delahunt’s New Evidence on Public Opinion and Policy,”Institute for New Economic Thinking, November 2, 2020.

[4] Thomas Ferguson and Peter Temin, “Made in Germany: The German Currency Crisis of 1931.” Research in Economic History 21 (2003): 1–53: Ferguson and Temin, “Comment on “The German Twin Crisis of 1931,” Journal of Economic History, Vol. 64, No. 3 (Sept. 2004), pp. 872-876; Thomas Ferguson and Joachim Voth, “Betting on Hitler – the Value of Political Connections in Nazi Germany,” Quarterly Journal of Economics, Volume 123, Issue 1, February 2008, Pages 101–137.

[5] Kehr and Rosenberg wrote their classic works mostly in the interwar period. See, e.g., Eckart Kehr’s, Schlachtflottenbau und Parteipolitik 1894-1901, (Paderborn: Salzwasser-Verlag GmbH & Company, 2012 reprint); and his Economic Interest, Militarism, and Foreign Policy, Gordon Craig, ed., (Berkeley, University of California Press, 1977). Arthur Rosenberg, Geschichte der Weimarer Republik, (Hamburg, Europaeische Verlagsanstalt,1974); and his much-underappreciated Democracy and Socialism, (New York, Knopf, 1939). A generation later, the approach returned to life, mostly at the hands of authors from the right, rather than the left. See in particular, Alexander Gerschenkron, Bread and Democracy in Germany (New York, Howard Fertig, 1966); and his Economic Backwardness in Historical Perspective (Cambridge, Harvard University Press, 1966). Among Kurth’s works, see especially James Kurth, The Political Consequences of the Product Cycle: Industrial History and Political Outcomes. International Organization, 33, 1984, 1-34.

[6] Thomas Ferguson, Paul Jorgensen, and Jie Chen, “How Money Drives US Congressional Elections: Linear Models of Money and Outcomes,” Structural Change and Economic Dynamics 61 (2022), pp. 527-45.

[7] Informally, the “median voter” is the voter in the middle of the opinion distribution. If two parties are competing, then they should both head there to gain the most votes. The qualifications are many, as Golden Rule discusses.

[8] See the discussion in Ferguson, “Affluent Authoritarianism.”

[9] Gilens, Martin, and Benjamin I. Page. 2014. “Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens.” Perspectives on Politics 12, no. 3: 564-81. See the discussion, though, in Ferguson, “Affluent Authoritarianism.”

[10] Ferguson, “Affluent Authoritarianism.”

[11] See the discussion in Thomas Ferguson, “Big Money, Mass Media, and the Polarization of Congress,” in William Crotty ed., Polarized Politics: The Impact of Divisiveness in the US Political System. Boulder: Lynne Rienner Books; and Thomas Ferguson, Paul Jorgensen, and Jie Chen, “How Much Can the U.S. Congress Resist Political Money? A Quantitative Assessment,” Institute for New Economic Thinking Working Paper Series No. 109; August 2020. This last paper was written to show up common claims that it was impossible to show that political money actually changed votes in Congress.

[12] The major two-party split is the crucial number; minor parties are not considered. See details in the paper cited below. On data, see Thomas Ferguson, Paul Jorgensen & Jie Chen, “Party Competition and Industrial Structure in the 2012 Elections,” International Journal of Political Economy, (2013) 42:2, 3-41,

[13] For the figure, cf. Ferguson, Jorgensen, and Chen, 2020: “How Much Can the U.S. Congress Resist Political Money? A Quantitative Assessment”; and the discussion in Ferguson, Jorgensen, and Chen, “How Money Drives US Congressional Elections: Linear Models of Money and Outcomes,” Structural Change and Economic Dynamics 61 (2022), pp. 527-45.

[14] For the technical details of the figure, see Ferguson, Jorgensen, and Chen, “How Much Can the U.S. Congress Resist Political Money?”

[15] For 1980 to 2018, see See Ferguson, Jorgensen, and Chen, “How Money Drives US Congressional Elections: Linear Models of Money and Outcomes.” For 2020, cf. Ferguson, Jorgensen, and Chen, “Big Money Drove the Congressional Elections—Again,” Institute for New Economic Thinking, February 21, 2021. The Structural Change and Economic Dynamics essay uses both advanced statistics and gambling odds in the spirit of recent work in event analysis to show that probabilities of reelection do not drive most money flows. As the paper also mentions, researchers in other countries have begun to look for and find similar linear relations between money and election outcomes. The Japanese version of the Preface was written before the data for the 2022 elections became available. The text here has been amended to reflect the analysis in Ferguson, Jorgensen, and Chen, “No Bargain: Big Money and the Debt Ceiling Deal,” Institute for New Economic Thinking, May 30, 2023.

Thank you for this. I would assume the golden rule applies to Japan as well, though it could be interesting to hear a little about how the LDP is getting support and money not only from corporations, but also from organizations like the Unification Church, and the extent to which that is decisive for maintaining their hegemony.

Yes, thanks for this post. Ferguson’s analysis is insightful and disturbing. If I understand it, he describes how the average person (which means the vast majority of workers) is now “priced out” of the system. To wit:

An extract particularly worth contemplating: “In most modern market-dominated societies – those celebrated recently as the “end of History” – levels of effective popular organization are generally low, while the costs of political action, in terms of both information and transactional obstacles, are high. The result is that conflicts within the business community normally dominate contests within and between political parties – the exact opposite of what many earlier social theorists expected, who imagined “business” and “labor” confronting each other in separate parties. Few indeed are the labor movements today that can realistically expect to control parties of their own.”

Labor is no longer a factor, whether as organized labor or simply as those who do the work: Which means that the vast majority of citizens has no representation. It also explains why politicians can bloviate about laws to ease unionization–but never deliver (Obama and check-offs, Biden and “ProAct,” or whatever it was called).

It also explains why, here in Italy, the bill in parliament for a minimum wage of 9 euro / hour by the leftish parties and the one or two leftist parties will be defeated next week by the majority with an amendment to force its withdrawal.

I recall the wisdom of Giuseppe Tomasi di Lampedusa in The Leopard–a book that is meant as a portrait of one of the last nobles but is also a portrait / foreshadowing of those who would come after.

What is to be done?

Roger Ebert reviews the movie.

https://www.rogerebert.com/reviews/great-movie-the-leopard-1963

Staring Burt Lancaster.

The New York Times reviews the book.

https://www.nytimes.com/2008/07/13/books/review/Donadio-t.html

Sicily is the key to Italy, as Goethe once wrote, and one novel is the key to Sicily: “The Leopard,” Giuseppe Tomasi di Lampedusa’s masterpiece. This tale of the decline and fall of the house of Salina,…

Thanks Thomas Ferguson. Elites v Aspiring Elites = Old Cheats v New Cheats.

What is to be done? Escalate labor to join with “lower class salaried workers” and form a party of new labor = anyone below the C-Suite. If you work in American Industrial Corporations, you saw the rise of CEO (CFO, COO etc.) compensation, perks and options to 400 x average salary. A single generation ago executive comp was 40 x the average salary.

New lines are drawn. New leadership can reorganize into new sides.

Attractive new names need to be given to these modern coalitions. Even the gig economy can have similar issues. Salary is often an excuse for employers to adopt “casual overtime” (at no pay), chiseled benefits (defined benefit to defined contribution), nothingburger retirements (your own money in a 401k) and so forth.

These are all MAKERS. The C-suite largely looks out for stockholders these days and partake as RAKERS (kinda like rentiers, but with company money not family wealth).

America’s self-appointed aristocracy mingles in board rooms. They also lobby the DOL to dilute ERISA by advising “reduce the regulatory burden” while forgetting that the law was to support the Employee Retirement Income Security (Act).

Thanks for this.

I am impressed that the linear “fit” appears to pass very nearly precisely through the point x=50% of the expenditure, y=50% of the vote, which suggests that in aggregate, there is no D/R bias; the outcome is determined by the cash input.

But there is surely tendency toward D or R at the level of individual congressional districts.

The thought occurs that one could do this analysis diachronically for individual districts and in that way accurately quantify the D/R tendency of individual districts. Perhaps this has already been done and is used by the national parties to decide “how much to ‘invest’ ” in influencing congressional races. I’ve been struck for years by how often the outcomes of consequential congressional and Senate races are surprisingly close to 50/50; it suggests that the parties are employing their own analysts to determine how much they have to spend to win marginal races. If they can do this accurately, it would tend to drive outcomes toward 50/50.

—

Perhaps this could be turned to public purposes. “We are many; they are few”; OTOH, it may be that widespread precarity will offset the many-ness of the many.

I think the analysis would be even more disturbing if the data included money spent by advertisers favoring one issue against another. I say “issue” because propaganda spending like 501(c)4 money cannot be so simply assigned to one party or another.

Money is power. Equality demands a Maximum wage.

This makes me wonder about Germany. How come corporate interests there seem unable to influence Ukraine and China related policy? See also the reaction to the “China Strategy” by the German BEA:

https://twitter.com/RnaudBertrand/status/1679798503370035200?t=triH9u5vrtqNgTcf7d29wA&s=19

https://www.bwa-deutschland.com/bwa-china-strategie-der-bundesregierung-nicht-im-interesse-des-deutschen-mittelstands?s=09

Is that going to temper that policy at all? Or does that drive votes to the AfD?

To some extent the same goes for the USA.

We know from Helmuth Kohl’s guy who handled contacts with the US (German television, clip has been circulating online) that whenever Germany didn’t want to go along with the US will, the US used threats. Threats that, iirc, where not limited to direct German interests, but also against the image of Germany. If memory serves, Kohl’s guy used the term blackmail.

Now, we know from Snowden that the US has surveillance on German politicians.

We also know from the scandal in Denmark a year or so ago that Danish intelligence has files on politicians in surrounding countries.

We know from the FRA debate in Sweden 2007-2008 (forced into the light by the Swedish Pirate Party), that NSA has bulk access to FRA’s surveillance.

If we assume, that there is nothing peculiar with Sweden or Denmark here, then EU intelligence agencies as a rule can be assumed to surveil politicians in surrounding countries and act as sub contractors for the NSA. Assuming further that NSA does their job in providing US negotiators with anything useful and that US negotiators use the same strategies as in the 90ies, but with more tools.

Then the conclusion would be that German politicians working in the US interest might be doing so because of blackmail. Unlikely to be any concrete proof of it though, until NSA files are opened up. And that kind of secrets are usually only available in the aftermath of the fall of an empire.

A spook speaks:

Why We Spy on Our Allies

Wall Street Journal, March 17, 2000 11:56 a.m. ET

By R. James Woolsey, former Director of Central Intelligence

https://archive.li/hqfyE

See also:

Melissa Eddy, “Germany Is Accused of Helping N.S.A. Spy on European Allies”, N.Y. TIMES (Apr. 30, 2015), https://www.nytimes.com/2015/05/01/world/europe/germany-is-accused-of-helping-nsa-spy-on-european-allies.html

Hah hah. Woolsey says it’s all Jean Baptiste Colbert’s fault. You can’t make this stuff up.

Hm. I gather the answer to Mr. Woolsey’s op-ed is, loosely interpreted, to enforce ‘our’ rules based order. But what my eye was drawn to was his braggadocio re. “attracting capital to fast moving young businesses.” Considering this was written in 2000 that would surely signify esp. the “dot com boom.” The post mortem of Wall St’s bonanza on that score whose effects are still ‘booming’ today must surely be some kind of line drive between inequality (Piketty ?) and mal-investment. Shoot I’m so far above my pay scale here I’d best give up. Words fail.

They pretty much are. When the latest generation Marjata set sail in Norway, its first stopover was Virginia.

And back when the Russian submarine Kursk sank supposedly NSA and DC knew of it before Oslo, thanks to the previous gen Marjata (these days sailing as Eger) sailing as close to events as national borders allowed.

I have sometimes wondered who the officers of the Norwegian military would side with, should there come a serious political rift between USA and Norway.

Within those Roosevelt administration archives, did they have anything to say about the Smedley Butler testimony and revelations?

Within those Roosevelt administration archives, did they have anything to say about the Smedley Butler testimony and revelations?

Knowing about old Smedley removes the blinders that are written into so many history textbooks.

The American system of governance (setting policy) is way more complex that just winning a Congressional district. Congres-scritters are constantly angling for re-election, so constantly angling for dollars. Senators have six year hiatus between elections, so the scramble is more lie-sure-ly and they are not selected proportionately but geographically. (See: California-Wyoming.)

And then this group of Senate Grandees is the arbiter/appointment of Supremes and lower federal judges. Policymakers all! (Your chances for individual success in any federal court is subject to your ability to fund your attorney(s).)

So, elections are just a part of the Kabuki.

If TweedleD opposes TweedleR, is it so surprising that campaign expenditures and vote shares are strongly associated, downright linearly related? How many Congressional elections can be most aptly characterized as TweedleD versus TweedleR? I believe mechanisms of the golden rule select for a TweedleD and TweedleR, but the mechanism for golden rule in this case is less plainly evident than campaign expenditures. Elections are the finale of the sausage making process. Considerable investment goes into the party machinery and Media devoted to picking and promoting primary candidates. Considerable investment goes into other components of the political process: “Their data are instead noisy by-products of the mobilization of big money with its comet-like trail of social networks, subsidized op-eds, subservient think tanks, and journalists seeking applause and better positions.” I think this mobilization of Big Money also goes into fashioning the issues battleground where Big Money factions battle through their selected TweedleD or TweedleR proxies. Unless there is some glitch certain issues are never raised, never discussed, and never litter the political battleground. When glitches occur there is also considerable investment in forces of damage control and issue removal.

Considering the inroads of the CIA into politics and media I believe more players than just Big Money invest into the party machinery and elections machinery. Big Money is motivated by the desire for more Money and Control over the making of money. The Government Agencies are motivated by the desire for more Power and money as a tool for exercising Power.

But election is just a ticket to ride. Big Money and Government Agencies reward their politicians who deliver the goods reward their minions more directly after their tenure. For a lucky few this might mean offer of a chance at higher offices or plum appointments. For many it means a well-paid sinecure after leaving office. These are the fruits of Big Money and Government Agency investments in parties, Corporations, think tanks, and universities. I believe these investments represent the greater part of Big Money and Government Agency investments in owning the democratic process.

Bernie Sanders could obtain money to pay for campaign expenditures from large numbers of small contributions. But I suspect campaign expenditures represent a very small portion of the money invested in the machinery of the so-called democratic process. Bernie was sandbagged by the democratic party machinery, and the Media.

“This doesn’t mean that elections do not present real choices: divisions among oligarchs can really matter.” … “But if you want to tax the rich or pass broad social welfare programs, you will need a real mass movement not dependent on the goodwill of the super rich.” I think this real mass movement would need to be much larger and aggressive than the present Government would tolerate without massive bloodshed.

So, elections are just a part of the Kabuki — perhaps a very minor part.

Yet one can change the coalitions of voters. Trump did it. He harnessed the quasi-military when he said “Stand down” and added, “Stand by.” He sent his bandwagon to the rural areas where patriotic motorcyclists held parades for “Back the Blue” when police were underdogs, and he gave out those red MAGA hats and giant Trump flags that whipped in the wind like Winged Hussars. Excitement in the backwater, he knew. His bandwagon was at the end of the parades and suddenly, a campaign parade was Disneyed out of a permitted “Back the Blue.” And the disenfranchised thought they had a friend.

So, in modern times, “labor” is not all manual. There are downtrodden office workers. There are men in “gray flannel suits” working overtime without pay. There are underpaid females who may not want to be out in front while slowly climbing career ladders, but who would privately vote in such a coalition. There are salaried workers everywhere who wish they were in unions. Get them around one table of shared economic strata and unfinished dreams.

I think that Ferguson’s greatest contribution here is his new focus on congressional elections rather than the national presidential races. Congress is where the action happens placing a governmental finger on the scales favoring accumulation over the greater good. The presidential races are mere theater designed to delude the masses on cultural issues having no bearing on accumulation.

I prefer Sheldon Wolin’s framing in America, Inc of Inverted Totalitarianism. Ferguson’s Affluent Authoritarianism, sounds almost benign. Lambert’s “Second Rule of Neoliberalism” Go Die is hardly benign — and it is real. Our Billionaire Overlords have long-ago passed mere “affluence.” Their goal is the total domination of all people and accumulation of all things of any value.

We are beginning to see Inverted Totalitarianism everywhere: our inverted concentration camps put the prisoners on the streets and everyone else behind walls. In public pension systems such as CalPERS we have stood the theory that finance “saves” and labor “spends” on its head. Labor saves for the future and their savings are skimmed-off by Our Billionaire Overlords, with crumbs kicked-back to fund party politics — at the level of congressional races as my fellow public pensioners are recently discovering, proving Ferguson correct.

Why isn’t this causing a revolution? Our Billionaire Overlords numb the masses with “entertainment” and “sports” while killing them around the margins with pandemics and a flood of drugs both legal and illegal — 80 percent of the ads on my television insist that I can medicate myself to happiness with drugs and booze.

In spite of the clear rise in conflicts over natural resources driven by anthropogenic climate change Our Billionaire Overlords continue to accumulate so that they can party like it’s the End of Days. Which it probably is…

Interested readers can find Ferguson’s book here: https://archive.org/details/thomas_ferguson_golden_rule_the_investment_theory_of_party_competition

These analyses have problems with establishing if the relationship is causal.

Are donations to a party high because they’re popular or are they popular because donations are high? Because parties usually spend all the money you don’t really know, but I’d like to see a study that uses some clever instrumentation to separate the causality