Polar Socialist pointed to an article published in the Russian Journal of Economics in December 2022: New approaches to international reserves: The lack of credibility in reserve currencies by three economists from Eurasian Development Bank. We have embedded it at the end of the post.

Like Polar Socialist, I am not sure how “good” a paper this is, but it sets forth 13 alternatives that central banks could use to address the the problem of international reserves. So it is useful in providing an extensive list of options. However, we’ll note right at the top that the authors deem none of the ideas alone to a stand-alone remedy (the one they argue could be requires universal buy-in so as not to be gamed, and they see that at not attainable).

Even though we have some considerable quibbles with this piece, it does ask the right question, and that is too often lost in the discussions over what countries are opposed to US abuse of its power as issuer of the reserve currency can do.

The real problem facing central banks is that they need international reserves. However, they do not need to achieve the easily generation-plus project of having a new reserve currency to better their lot, even if the article does not find a magic bullet near-term alternative.1

Remember, the SDR is not a reserve currency but a reserve asset that in is designed to serve as a backup for central bank international reserves. And although yours truly is not a fan of the IMF, Russia is still a member, as in the IMF did not see US and European sanctions on Russia (or Iran earlier, for that matter) as binding.

The big problem is countries, particularly smaller ones with large export sectors, find it desirable and frankly necessary to have international reserves. And perhaps even more important, most countries like pursuing the sort of mercantilist trade policies that result in them accumulating reserves.

Let’s first look at the “need to have” part of the equation. The US is, or should be, in an advantaged position because we are a large country with many natural resources and (despite the squeezing of the middle class) have a lot of internal demand and thus in theory do not need to trade much. Most countries are not in that position. Their import and export sectors are larger relative to GDP out of necessity. The result of being more trade exposed, particularly for emerging economies, means they can be whipsawed by changes in global interest rates, global demand, and changes in the value of your currency.

So they are subject to two types of crises. One is an external debt crisis if the country or its businesses and citizens borrow in a foreign currency and then that currency rises in price, raising the cost of debt service. This sadly happens a lot since foreign currency interests are regularly lower than domestic rates. The second is a currency crisis, where the government wants to intervene to prevent its currency from falling further (recall businesses often have foreign currency needs beyond debt payments like supplies, so there are exposures well beyond borrowings). Of course, the former often produces the latter.

Recall the 1997-1998 Asian crisis. The high-flying Asian Tigers were hit and wound up seeking IMF support (although South Korea wound up participating in an IMF “program” that was arguably unnecessary and most of its citizens feel made matters worse). Afterwards, they all built up bigger dollar FX reserves (no one much minded that it took some currency manipulation to do so) in order never to be subject to the tender ministrations of the IMF again.

However, another reason countries accumulate foreign currency reserves (which they hopefully can use as international reserves) is they really like running trade surpluses. That means they are exporting jobs. High employment and rising wages are popular and in China, recognized as critical to the legitimacy of the government. Trade surpluses are also seen as proof of economic competitiveness and in particular, success in manufacturing and technology. Recall in particular how Germany (before being cut to size by the loss of cheap energy) would run large trade surpluses within Europe, and then complain about the inevitable side of the equation, that they had to lend to those layabouts in southern Europe.

A conundrum with foreign exchange reserves is that if they are going to be useful in a crisis, as in when you have to defend your currency, is that central banks will need to sell currencies in size. So liquidity also matters.

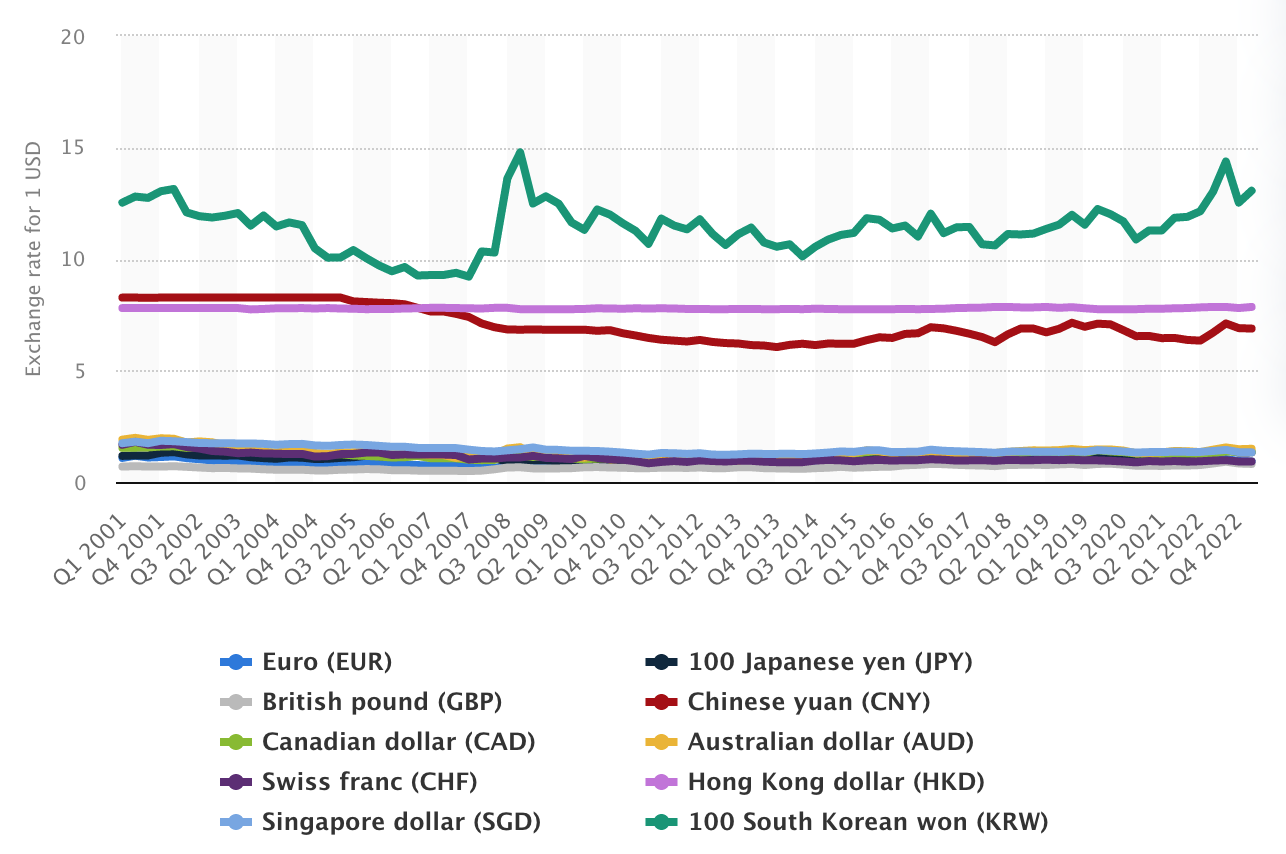

And that brings us to a big blind spot in the paper. It starts with the premise of loss of in trust in the dollar. Yet despite the shock and awe sanctions, and increasing levels of trade being moved to direct bi-lateral foreign exchange, the level of the dollar has not been dented. See this chart of the dollar versus ten other currencies through the first quarter of 2023::

How can this be?

The issue, as we have repeatedly pointed out, is that the use of currencies in investment transactions dwarfs the use in trade. In one analysis, the Bank of International Settlements found that investment-related transactions were over sixty times that of trade related ones.2

That leads to foreign exchange transaction volumes that some will find counterintuitive. The Australian dollar is the fifth most traded currency, at about 4% of total volume, while the renminbi is number eight, at only 2% of trading volume. This is because China attempts to allow the renminbi to be used freely for trade but has strict capital controls.3.

To put it another way, the authors misconstrue what trust means in a currency context. Most varieties of trust it mentions don’t embrace what really matters, which is what wealthy folks and countries want to hold wealth in, plus what will allow them to do short run deals with “certain” assets. That certainly is affected by how reliably they can trade monies for other monies.

Yes, there are limits to the dollar. But the problem is that all the alternatives, arguably except for gold, are a lot less reliable on average. The authors themselves point out that central banks can’t use gold as a major reserve asset, since there’s not enough. And in the 2007-2008 crisis, gold did not rise in price as a supposed “safe haven”, it fell as investors dumped it to cover margin calls.

I don’t think any cryptocurrency belongs on the list, but one can surmise they are pet ideas among some policy makers and promoters and so needed to be discussed. A digital central bank currency is merely an implementation. And as for private crypto currencies, see the Heisenberger Report’s masterful takedown. Key section (emphasis original):

Beyond that, though, the notion of private money at scale, and, more to the point, the notion of private money at scale as an investable proposition, is stupid. Not “misguided,” not “misplaced” and not any other more generous adjective either. Just plain old stupid.

Aside from the “wild West banking” problems revealed by FTX, no private cryptocurrency will have the depth of liquidity to serve a central bank’s needs.

There are also linchpin assumptions in the paper that seem questionable:

We assume that the fundamental principle would be ensuring the safety of reserve assets through diversification of instruments, management of reserves by multiple operators, and fragmentation of reserve functions between different instruments.

The last two assumptions are not sound ideas operationally. When the paper talks about multiple operators, that includes sovereign wealth funds. You can see that countries are already starting to move more of their international reserves into their sovereign wealth funds….which also means that looking at central bank holdings of various currencies no longer tell you the whole story, you also need to look at their sovereign wealth funds:4

The big surplus countries are either selling state assets (China, possibly, through the SCBs) or adding to their SWFs (the Saudis/GCC when oil prices allow) rather than their formal fx reserves. pic.twitter.com/xEAvK47DaQ

— Brad Setser (@Brad_Setser) August 19, 2023

The authors appear to see that as desirable, but I am not sure why.5 In a crisis, a central bank will need to move quickly and decisively.5 The FX trading desks at the central bank will be the ones with experience in daily market action. The ones at the sovereign wealth fund will be far less market savvy. And that is even before getting to the issue of coordination, and whether it would be controversial if the sovereign wealth fund took losses to stem a debt or currency crisis.

Again, remember that liquidity will be a key need for any central bank for international reserves to have any insurance value. You need to be able to break glass and sell in size. And we see how even the renminbi is only number eight due to its capital controls. Even the Canadian dollar is more actively traded. So it is not clear that the idea of “fragmentation of reserve functions between different instruments” can go all that far in practice.

Mind you, the authors do consider what they call “a global synthetic currency,” aka new reserve currency. They don’t consider it viable. The reason is the one we’ve repeatedly cited, that it would require ceding considerable elements of sovereigntiy, and therefore runs afoul of one of the prime attractions of the multipolarity initiative, that of nations getting more control over their economic affairs. Recall that one of the big aims of Keynes’ bancor ideas was to use it to impose punishments on countries that built up big foreign exchange reserves, which Keynes saw as destabilizing. But as we described above, the policies that produce those reserves are popular. Who wants to be punished for doing what, outside the reserves context, seems like a good thing?

From the paper:

It may be challenging to handle all macroeconomic adjustments in the global economy as they stem from unilateral moves to restructure the IR [international reserves]. Countries could consider renegotiating and reaching a new multilateral agreement on reforming the IMF to potentially establish a global synthetic currency (GSC)…..

Such a unit [the international clearing unit of the bancor] would make sense only if all countries joined the system, as in the IMF pattern, because a new regional currency created by a group of countries would simply force the imbalances into this system.

The GSC is the most effective solution for reforming the global financial system. The countries, however, must be willing to accept the restrictions associated with the introduction of the GSC, and this is a major issue.

The authors also discuss the idea of an “energy standard” which seems unworkable due to the various sources of energy and how to establish relative pricing among them.

While the authors are correct to say that more progress will be made on this front, since the dollar was destined to fall in importance even before the US embarked on its self-destructive sanctions against Russia, the paper makes clear that there is no neat, simple path to a new order. Expect a lot more improvisation and experimentation.

______

1 Remember, the SDR is not a reserve currency but a reserve asset that in is designed to serve as a backup for central bank international reserves. And although yours truly is not a fan of the IMF, Russia is still a member, as in the IMF did not see US and European sanctions on Russia (or Iran earlier, for that matter) as binding.

2 Mind you, the BIS did not consider that to be a good thing. It clearly saw, as did Ken Rogoff and Carmen Reinhardt in a paper on 800 years of financial crises, that a high level of international capital flows was destabilizing.

3 Some companies play transfer pricing games to move money out of China.

4 Setser made an additional point today:

China doesn't need dollars from the US or anyone else to manage domestic financial distress.

The far more relevant question is how willing the US and the rest of the world are willing to supply China with demand so its export machine can help offset investment weakness.

2/2

— Brad Setser (@Brad_Setser) August 20, 2023

5 In fairness, the authors likely also meant “organizations” like multinational development banks. The IMF allows 20 organizations in addition to member states to hold SDRs.

00 RUJEC_article_98242_en_1

the sources are very biased, as it’s biased the argument construction: it’s not necessary a single alternative, it’s just necessary that a number of alternatives will reach a critical mass to be used togheter. so the first thing is to expand the brics group, then once it will be expanded, more realistic consideration about exchanges and invesments can be done. there are 2 things that economist don’t care. first one are the rising prices that are haunting the western economies making them not sustainable. second one is the chinese response: once the west will manage to 3dworldize their population and they will got no money to buy things with chinese components, like medecines, what will stop the chinese to flood the navy of united states? once there wont be further consequences on their economy cause the commerce will stop the only answer could be the usa navy might. so good luck with the type 055 and the technology to spot us nuclear submarines

Thanks for this post! I will have to set aside some time to go deeper on the source material here, but as always, appreciate gems like this:

So again yes, the whole idea of capital controls (pointed out later w.r.t. China) and “Trilemma” begin to rear their heads. This will help me further – and better – flesh out my ideas on a multi-national community currency platform.

Cheers.

One question I have is what proportion of investment transactions are useful or productive for anyone except the investors. Ie, how much of this dwarfing trade is financial chicanery that economies could live without…

Agreed, I wish someone could explain why that is. Perhaps “investments” is a euphemism for foreign exchange trading. Just to give a notion of what is problematic: imagine that one builds 60 factories in a year, but that together they only produce enough trade in a year to cover the “cost” of one factory. Something doesn’t make sense.

Dollar will remain no.1 currency but its share will be slowly shrinking as national currency settlement will expand. That will limit total USD funding pool and central banks will hold less USd denominated reserves and less US Treasury papers. The trend is already here and fact that some CBs hold US equities is the confirmation. On the other side of equation are growing funding needs of Washington, nowadays $2 trillions a year. The money are not plainly available and even US Treasury has to pay over 5%p.a. for short-term and 4% for long-term funding. How long will the US economy survive this? And when recession comes how eager will foreign CBs be to hold their reserves in US Treasuries? Another problem is criminalization of Trump and his supporters which can lead to some sort of rebellion. We are talking about 50 million people mostly armed with fire arms. And many other problems which make dollar less and less atractive with passing time. The result of all this will be high dollar interest rates or multiple QEs. Both of these “solutions” to federal funding problem undermine trust in dollar.

Hi,

This isn’t a contribution, but I’d really appreciate it if someone could direct me to the referenced BIS paper separating investment and trade flows in forex transactions. I’m not experienced in searching academic repositories, and I haven’t been able to find it from cursory searches. Thanks in advance!

This post links to it and summarizes it: https://www.nakedcapitalism.com/2011/09/the-very-important-and-of-course-blacklisted-bis-paper-about-the-crisis.html

This is an extremely interesting discussion. However as a gold and crypto investor it has always been the question, is it a currency or is it an asset?

Dollars in reserve are both a currency and an asset at the same time, just the same as Gold and Bitcoin.

Gold and Bitcoin are indeed too small of markets today, but that just means everybody does not feel compelled to get away from the dollar as a reserve asset today.

If people were compelled to get away from the dollar, then Gold and Bitcoin could increase in unit price one investor at a time converting their dollar reserves into these other asset until their total world wide values made them large enough for the central banks to replace dollars as their liquid reserve asset, could they not?

And they are the only asset options that carry no government counterparty risk, which does make them a uniquely attractive asset over other governmental currencies subject to the governments whims of valuation.

The probability for Gold and Bitcoin replacing the dollar as the worlds reserve asset is very, very low, but the slower this transition away from dollars reserves happens, the more likelihood the alternative is determined by organic private consensus rather than governmental agreement and decree, in which case it would be Gold and/or Bitcoin rather than another governmental currency that becomes the worlds defacto reserve asset.

The odds are certainly much higher than zero.

The way to make an international reserve currency work is to build in enough inflation to discourage hoarding. Gold and bitcoin are horrible as alternatives to fiat precisely because there is no inflation.

Presumably, at some point, USA will go full Argentina completely monetize its debt, thus punishing USD hoarders and forcing creation of international currency.

Wouldn’t an international currency also be subject to debasement? No, for 2 reasons. First, it would be fully monetized from day 1. No international interest paying debt, just the raw currency with a mandate for governors to keep inflation at a minimum and long-term average of 2% with no maximum on short-term inflation. This disincentivizes hoarding of the currency. Second, assuming governors of the currency are elected by vote of participating countries, probably on GDP basis, and no country has more than 50% votes, then presumably enough countries world resist debasement to counter countries fallen into financial trouble and wanting a quick infusion of more currency. (New currency distribution, like votes for governors, would be on GDP basis.) These are the fatal flaws in current fiat systems: government money and government interest paying debt are tightly integrated, so possible for hoards to accumulate, and same government that controls creation of currency benefits from excessive creation.

(Need some agreement as to how to measure inflation on an international basis, but not important exactly how this is done, as long as there is clearly some inflation. Change 2% to 5% minimum if necessary to drive the point home to everyone that hoarding excessive currency is not a good idea.)