Yves here. This is a very important piece by Bill Lazonick, in which he continues his extensive documentation of the damage done by corporate stock buybacks, which he calls corporate financialization. This is looting by top executives and board members. Lazonick shows its many high costs, such as regularly paying workers less than living wages, which forces governments to make up some of the shortfall (see the number of WalMart staffers who are on food stamps) and underinvestment.

By William Lazonick, Professor of Economics, University of Massachusetts Lowell and President, The Academic-Industry Research Network. Originally published at the Institute for New Economic Thinking website

fter decades of worsening inequality, the United States has an extreme concentration of income and wealth among its super-rich, while most American workers live paycheck to paycheck. A Brookings study, using 2012-2016 data, found that 44% of all US workers ages 18-64 earned low hourly wages. In the last half of the 2010s, the US labor movement focused on the “fight for $15”—which, at $31,200 annually, still represents low-paid work. Oxfam reports that, in 2022, with inflation eroding real wages, 32% of the US labor force had hourly wages of $15 or less.

Even in the tech sector, which provides large numbers of high-paid jobs, employment has become very unstable. There were almost 225,000 tech layoffs in the first seven months of 2023, adding to and far surpassing the 165,000 tech layoffs in all of 2022. Meanwhile, as documented in studies by the Academic-Industry Research Network for the Institute of New Economic Thinking, leading US companies are finding themselves vulnerable to more innovative global competitors in sectors such as aviation, communications, semiconductors, and alternative energy that are critical to US productivity growth and national security.

My just-published book, Investing in Innovation: Confronting Predatory Value Extraction in the U.S. Corporation(currently available for free pdf download), exposes corporate financialization as a prime source of the nation’s extreme income inequity and diminished innovative capability. Central to corporate financialization is “predatory value extraction”: the power of senior corporate executives, Wall Street bankers, and hedge-fund managers to extract far more value from industrial corporations in which they have acquired shares than they have contributed to the creation of value by these corporations.

The main instrument of predatory value extraction is the open-market repurchase of the corporation’s own outstanding shares—aka stock buybacks—the overwhelming purpose of which is to manipulate the corporation’s stock price. In 2012-2021, the 474 corporations included in the S&P 500 Index in January 2022 that were listed throughout the decade funneled $5.7 trillion into the stock market as buybacks, equal to 55% of their combined net income, and paid $4.2 trillion to shareholders as dividends, another 41% of net income. When Joe Biden was vice president, he condemned buybacks. Yet, under the Biden administration, the $874 billion in buybacks by S&P 500 companies in 2021 easily outstripped the previous annual high of $806 billion in 2018, fueled by the Republican 2017 corporate tax cuts. In 2022, S&P 500 buybacks reached a new record of $923 billion, before declining in the first half of 2023.

Unlike dividends, which provide a yield to all shareholders, stock buybacks increase the realized gains of sharesellers, including senior corporate executives, with their copious stock-based pay, and hedge-fund managers, who are in the business of timing the buying and selling of shares on the stock market. Since buybacks became widespread in the mid-1980s, they have contributed to inequitable income distribution, unstable employment opportunities, and fragile productivity growth in the US economy. Within the business corporation, buybacks come at the expense of rewards to employees for prior contributions to successful value creation as well as the company’s investment in the productive capabilities to generate the innovative products on which a new round of value creation depends.

A company can grow through innovation by retaining a substantial proportion of corporate profits and reinvesting in the productive capabilities of its labor force. Indeed, an outsized proportion of stock buybacks are done by corporations that have become highly profitable through prior “retain-and-reinvest” allocation regimes. In 2021, 68% of all S&P 500 buybacks were done by the 50 largest repurchasers, which also had 34% of the S&P 500 revenues and 45% of the profits while paying out 28% of the dividends.

The 20 Largest Industrial Corporate Repurchasers

Investing in Innovation delves into the resource-allocation transitions of many of the foremost US-based industrial corporations from retain-and-reinvest to “dominate-and-distribute,” as the company continues to grow but prioritizes distributions to shareholders/sharesellers in corporate resource allocation; and possibly to “downsize and distribute,” as the company downsizes its labor force even as it distributes massive amounts of cash to the stock market. Once a business corporation engages in downsize-and-distribute, it is very difficult for it to return to a regime of retain-and-reinvest.

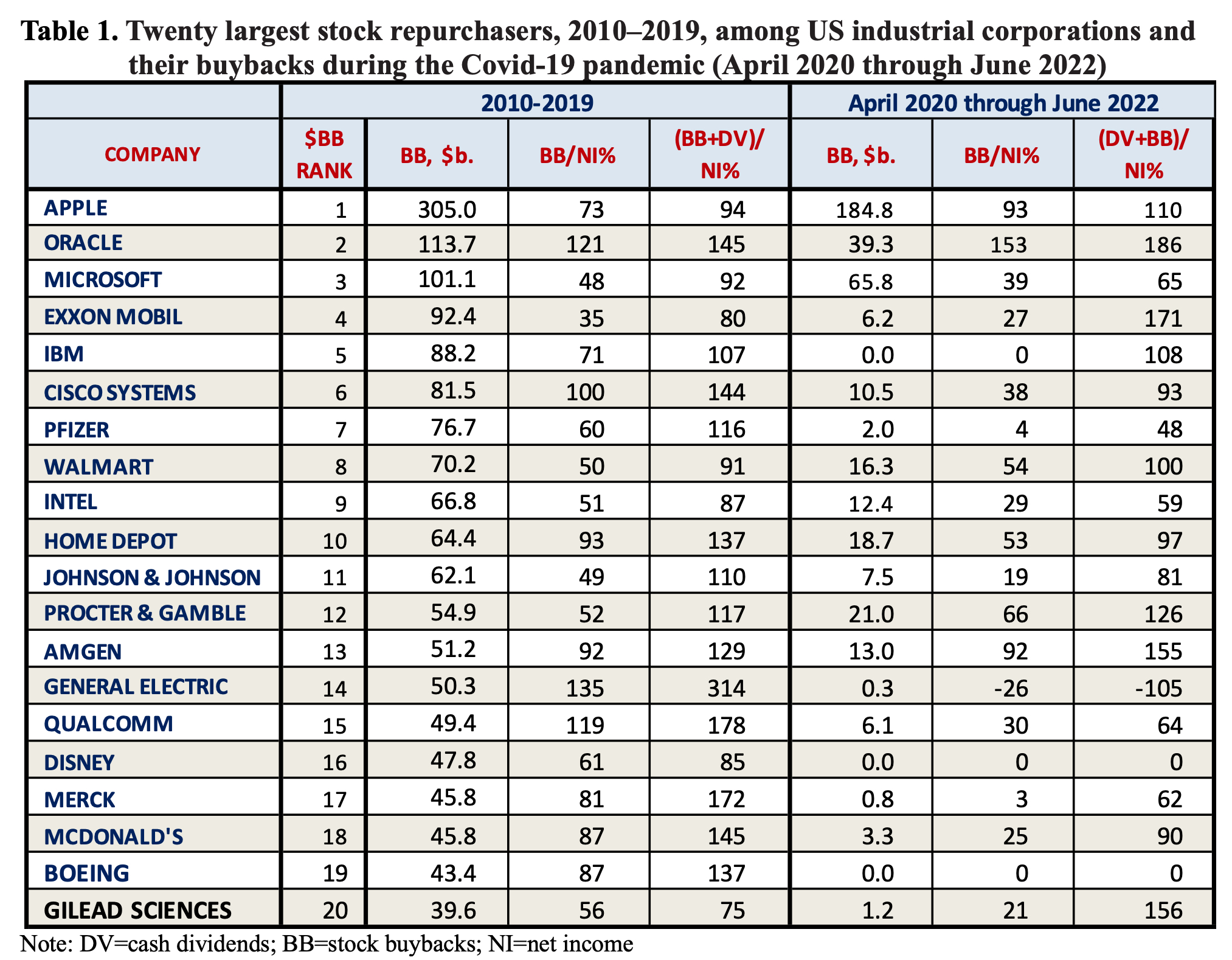

Table 1 shows the 20 largest share repurchasers among industrial corporations for the decade 2010-2019 and their distributions to shareholders/sharesellers during the Covid-19 pandemic (April 2020-June 2022). Coming into the pandemic, 11 companies on the list—Apple, Oracle, Microsoft, Cisco, Walmart, Intel, Home Depot, Johnson & Johnson, Amgen, Qualcomm, and Gilead—were in dominate-and-distribute mode, using the profits from their still-dominant market positions primarily to support their stock prices; while seven—ExxonMobil, IBM, Procter & Gamble, General Electric, Merck, McDonald’s, and Boeing—were in downsize-and-distribute mode, distributing corporate cash to shareholders/sharesellers as they downsized their labor forces. The other two companies, Pfizer and Disney, ceased doing buybacks in 2019 in attempts to return to retain-and-reinvest.

Consumer-oriented companies such as Disney, Home Depot, McDonald’s, Procter & Gamble, and Walmart employ large numbers of low-paid workers who, in the absence of buybacks, could have had substantial raises. Gains in the wages and benefits of low-paid workers at the most profitable companies help to lift the incomes of low-paid workersthroughout the US economy. In 2015, for the first time, the labor movement focused on the adverse impacts of stock buybacks when a campaign was launched to support wage increases for McDonald’s employees. Recently, unions representing flight attendants, mine workers, and freight-rail workers have called for a cessation of buybacks. Labor organizations such as United for Respect make the case for a company such as Walmart to prioritize wage increases for employees over buybacks for sharesellers.

Five of the largest industrial repurchasers—Amgen, Gilead Sciences, Johnson & Johnson, Merck, and Pfizer—are pharmaceutical companies. We depend on these companies to develop safe and effective medicines that are often a matter of life or death. Through their trade association, Pharmaceutical Research and Manufacturers of America (PhRMA), these companies contend that they need high (unregulated) prices on existing drug products so that their high profits can be reinvested in the innovative medicines of the future. In fact, major US-based pharmaceutical companies tend to use their profits to boost the yields on their corporate stock.

In line with the data for the five drug companies in Table 1, for the decade 2012-2021, distributions to shareholders/sharesellers by the 14 pharmaceutical companies among the 474 S&P 500 companies in the database represented 110% of net income, a larger proportion than the highly financialized 96% for all 474 companies. At 55%, pharmaceutical stock buybacks were the same proportion of net income as the 474 companies, but, at 54% versus 41%, pharmaceutical dividends as a proportion of net income far exceeded that of all the companies in the dataset. The $747 billion that the pharmaceutical companies distributed to shareholders/sharesellers was 13% greater than the $660 billion that these corporations expended on research & development over the decade. In doing massive buybacks, the pharmaceutical companies undermine their own argument that they need high drug prices to fund innovation, even as they repeat this contention in opposition to drug-price regulation mandated by the Inflation Reduction Act of 2022.

Major industrial corporations control our sources of energy in an era when climate change is placing our lives in jeopardy. The largest US-based oil refining company, Exxon Mobil, has, since the mid-1980s, used high profits from high oil prices to fund the company’s stock buybacks, while its dividends have perpetually increased, whether oil prices are high or low. For the decade 2005-2014, Exxon Mobil averaged $22.0 billion in buybacks annually—by far the highest of any company over that period (the second highest was IBM with an annual average of $12.3 billion)—representing 61% of Exxon Mobil’s exceedingly high profits, reaped from high oil prices. As oil prices declined dramatically from mid-2014 to mid-2020, cash-strapped Exxon Mobil had to rein in its buybacks, which declined yearly from $4.0 billion in 2015 to $155 million in 2021.

The explosion of crude oil prices during the pandemic, from $22.46 in April 2020 to a peak of $119.94 in May 2022, turned Exxon Mobil’s loss of $22.4 billion in 2020 into a profit of $23.0 billion in 2021, $55.7 billion in 2022, and $19.3 billion in the first half of 2023. Aiding the inflation of Exxon Mobil’s bottom line was the slashing of its labor force from 74,900 at the end of 2019 to 62,000 at the end of 2022. With its profits soaring during 2022 and the first half of 2023, Exxon Mobil returned to its financialized form by gifting shareholders $22.4 billion in dividends and sharesellers with $28.3 billion in buybacks. Given the climate crisis, if Exxon Mobil and other major US-based oil-refining companies are unable or unwilling to reinvest their enormous profits from high oil prices in clean energy, then the US government should follow the lead of the European Union and levy a windfall-profits tax on these companies to reallocate the economy’s resources to a fossil-fuel-free future.

Once the global leader in telecommunication systems and the Internet, over the past two decades, the United States has fallen behind global competitors, and in particular China, in mobile-communication infrastructure—specifically 5G and Internet of Things (IoT). The problem is the dereliction of key US-based business corporations to take the lead in making the investments in organizational learning required to generate cutting-edge communication-infrastructure products. No company in the United States exemplifies this deficiency more than Cisco Systems, the business corporation founded in Silicon Valley in 1984 that had explosive growth in the 1990s to become the foremost global enterprise-networking equipment producer in the Internet revolution. Since 2001, Cisco’s top management has chosen to allocate corporate cash to stock buybacks for the purpose of giving manipulative boosts to the company stock price rather than make investments in innovation in communication-infrastructure equipment. From October 2001 through June 2023, Cisco spent $159.7 billion—93% of its net income over the period—on stock buybacks for the purpose of propping up its stock price. These funds wasted in pursuit of “maximizing shareholder value” were on top of the $58.6 billion that Cisco paid out to shareholders in dividends, representing an additional 35% of net income.

Among the technology-intensive companies in Table 1, Cisco is by no means the only one in which corporate financialization has undermined investment in innovation. Of the seven companies that entered the pandemic in downsize-and-distribute mode, the financial condition of Boeing, General Electric (GE), and IBM deteriorated further during it, constraining their financial capacity to do buybacks and even to pay dividends. Through decades of financialization, all three companies—once central to US industrial leadership—have dissipated productive capabilities that could have been invested in technologies that are critical to US productivity and national security. Yet each of these three companies may have proceeded so far down the path from retain-and-reinvest to downsize-and-distribute that they have lost the capacity to invest in innovation.

Founded in 1916, for decades Boeing was the beneficiary of government subsidies and military contracts, before emerging from the 1960s as the global commercial-aircraft leader in the era of jumbo jets. Boeing became highly financialized after its merger with McDonnell Douglas in 1997. Its senior executives’ obsession with the company’s stock yields bears much of the blame for the crashes of its 737 MAX planes in October 2018 and March 2019. From January 2013 through March 2019—up to the week before the second crash on March 10—Boeing did $43.4 billion in buybacks, equal to 118% of net income over this period, on top of 43% of net income distributed as dividends. The company’s stock price hit an all-time high on March 1, 2019. Since the MAX disaster, Boeing’s travails have continued as it has lost global leadership in its competition with Europe-based Airbus.

Founded in 1892, GE’s corporate financialization originated in the conglomerate movement of the 1960s and continued during the reigns of CEOs Jack Welch (1981-2001) and Jeffrey Immelt (2001-2017). Any prospect of reorienting GE to investing in innovation was given a coup de grâce by the predatory attack launched by hedge-fund activist Nelson Peltz (of Trian Partners) from October 2015, leaving GE with no choice but to dramatically reduce buybacks from 2018 and dividends from 2019. GE, a company with critical capabilities in aircraft engines, energy (including wind power), and medical equipment is in the process of being divided up into three separate companies, as Peltz and other corporate predators seek gains on their shareholdings of the company that they have helped to decimate.

Founded in 1911, IBM was known through the 1980s for its commitment to “life-long employment,” but in the early 1990s, in the name of maximizing shareholder value, the company’s resource-allocation regime transformed rapidly and dramatically to downsize-and-distribute. After wasting $88.2 billion on buybacks in 2010-2019, IBM did not do buybacks during the pandemic because, with revenues at about 55% and profits 25% of their levels a decade earlier, the company’s $13.2 billion in dividends exceeded its $12.2 billion in net income. In 2014, IBM—a company that once epitomized US leadership in the computer revolution—paid $1.5 billion to GlobalFoundries, owned by the Abu Dhabi sovereign wealth fund, to take its loss-making semiconductor fabs off its hands. Global Foundries, which was launched in 2009, when it acquired the fabs of US-based Advanced Micro Devices, has pulled back from investing in advanced nanometer chip-manufacturing platforms.

tock Buybacks and US Loss of Global Leadership in Semiconductor Fabrication

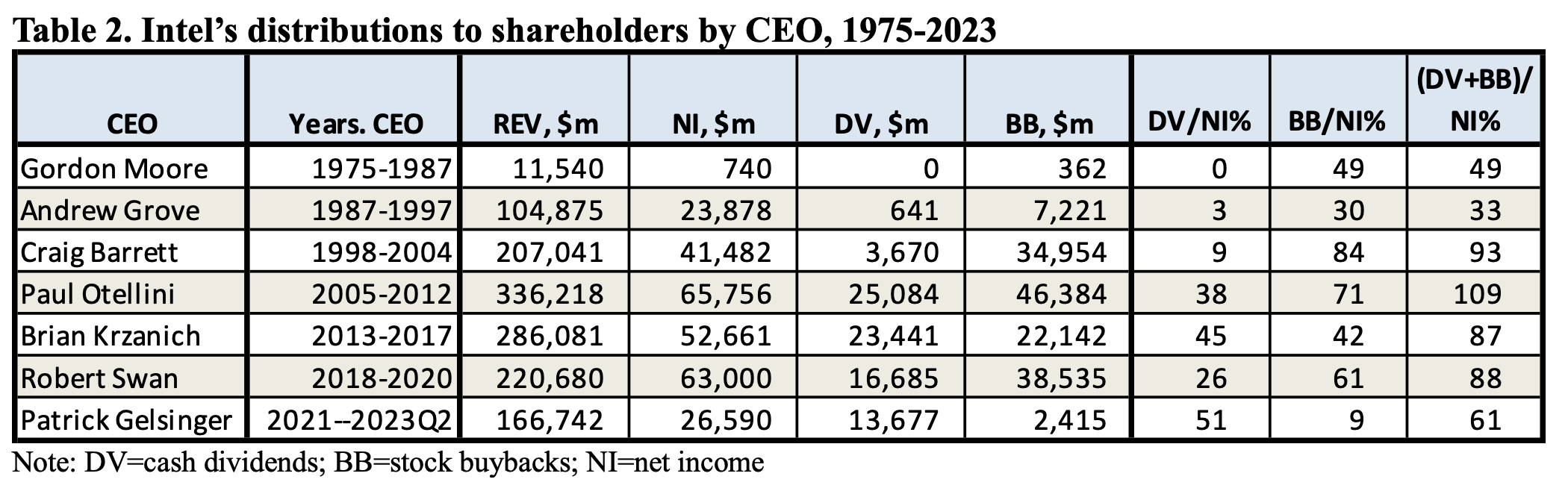

Intel, number 9 on the list of industrial share repurchasers in the decade before the pandemic, was once the world leader in chip fabrication. Over the past decade, however, a financialized Intel fell behind in the face of innovative global competition. Under new leadership, Intel is now seeking to invest in advanced nanometer fabrication facilities with the goal of catching up with industry frontrunners TSMC and Samsung Electronics. Intel ceased doing stock buybacks in the second quarter of 2021 after replacing CEO Robert Swan, a finance expert, with Pat Gelsinger, a technology expert. In a 60 Minutes interview, Gelsinger said that a condition of his taking the top Intel job was assurance from the company’s board that Intel would “not be anywhere near as focused on buybacks going forward as we have in the past.”

In a subsequent interview with CNET in November 2021, Gelsinger was much more expansive and emphatic. He recounted how, before taking the CEO job, he had written a strategy paper for Intel’s board, for which he got their unanimous agreement. “I was concerned,” Gelsinger said in the interview, “about how we get the process roadmap back in shape.” He continued:

We underinvested in capital. I went to the board and said: “We’re done with buybacks. We are investing in factories.” And that is going to be the use of our cash as we go forward. And they aggressively supported that perspective; that we needed to just start investing, and those investments would start creating a cycle of momentum that would get our factory teams executing better.

In the first quarter of 2021, Intel did $2.4 billion in buybacks but subsequently did none through June 2023. Indeed, in the first half of 2023, Intel cut its dividend by 32%, as the company incurred losses of $1.3 billion, with Gelsinger bent on returning to retain-and-reinvest. During 2022, Gelsinger was in the forefront of lobbying for the CHIPS and Science Act, signed into law on August 9, 2022, and since then he has campaigned for Intel to be granted a large share of its $52.7 billion in subsidies. The Act contains guardrails against stock buybacks by companies that receive government funds, which, if they are vigorously enforced, promise to check some major abuses. The prospect for the Biden administration to confront predatory value extraction is much diminished, however, by its appointment of “talent from Goldman Sachs, KKR, and Blackstone” (as the Wall Street Journal puts it) to allocate the bulk of the subsidies. (When the Obama administration put Wall Street financiers in charge of the 2009 auto bailout, workers and taxpayers got taken for a ride.)

One of the reasons why Intel fell behind Samsung Electronics and TSMC was a decision by then-CEO Paul Otellini to reject a request from Apple CEO Steve Jobs to produce chips for the iPhone when it was launched in 2007. In his best-seller, Chip War, Chris Miller notes that, because of that strategic mistake, “Intel never found a way to win a foothold in mobile devices, which today consume nearly a third of chips sold.” Miller attributes Intel’s loss of technology leadership to a “shift in power from engineers to managers” from 2005, when Otellini became Intel CEO. As Miller puts it: “A fixation on profit margins seeped deep into the firm—its hiring decisions, its product road maps, and its R&D processes. The company’s leaders were simply more focused on engineering the company’s balance sheet than its transistors.”

What Miller does not say is that, as shown in Table 2, even under Craig Barrett, an engineer, who preceded Otellini as CEO, Intel had become oriented to boosting its profits for the sake of increasing distributions to the stock market, especially as buybacks. In fact, Miller’s book makes no mention of buybacks or dividends, much less the quest for maximizing shareholder value, in influencing Intel’s resource-allocation decisions.

As for Apple, it initially chose Samsung Electronics to manufacture chips for the iPhone, enabling the Korean company to gain experience, and profit, in fabricating the most advanced semiconductors. When, by 2011, Samsung had become a strong competitor to Apple in the smartphone business, Apple switched its chip outsourcing to TSMC, making that transition by 2015. With its Apple contracts, the Taiwan-based company became the world leader in advanced nanometer chip fabrication. In the second half of 2020, after China-based Huawei had surpassed Samsung and Apple in unit sales of smartphones, Apple became the prime beneficiary of the Trump administration’s coercion of TSMC to cut off sales of advanced chips to Huawei, destroying the China-based company’s high-end smartphone business.

Back in 2010, a prominent electronics-industry journalist, Mark LaPedus, had penned an article, addressed to Apple CEO Jobs, entitled “Apple should build a fab.” At the time, Apple was reliant for chip fabrication on its emerging smartphone competitor, Samsung Electronics. LaPedus recognized that “in an age when real men go fabless, I concede it’s an unconventional idea. You might think it’s absurd. But an Apple A4 fab today could keep the iProduct franchise in hay—and Samsung at bay.”

In August 2011, two months before he died, Jobs passed the CEO torch to Cook, and Apple investing in its own fab was a road not taken. Instead, Apple’s outsourcing of the iPhone’s most critical component helped the Koreans and Taiwanese become world leaders in advanced chip fabrication. In 2021, under pressure from US trade negotiators, Samsung and TSMC began building new state-of-the-art fabs in the United States, at an initial projected cost of $17 billion and $12 billion, respectively. In comparison, the $86 billion that Apple spent on buybacks in fiscal 2021 alone was more than three times the combined US fab investments that Samsung and TSMC announced in that year.

Apple and the Biggest Corporate-Treasury Robbery in History

When, in May 2018, Cook was asked what he planned to do with the $285 billion in cash that Apple was repatriating from abroad as a result of tax breaks provided by the Republican Tax Cuts and Jobs Act of 2017, he replied:

We’re going to create a new site, a new campus within the United States. We’re going to hire 20,000 people. We’re going to spend $30 billion in capital expenditure over the next several years. Number one, we’re investing, and investing a ton, in this country. We’re also going to buy some of our stock, as we view our stock as a good value.

The buybacks that Cook called “some of our stock” amounted to $72.7 billion in 2018 (122% of net income), far surpassing Apple’s previous high of $45.0 billion in 2014. Those buybacks, plus another $35.3 billion in 2015, were carried out at the behest of hedge-fund activist Carl Icahn, who in the winter of 2016 dumped $3.6 billion in Apple shares acquired in 2013 for about a $2 billion gain. At that point, Warren Buffett (on behalf of his company, Berkshire Hathaway) began accumulating Apple stock, amounting to $36.3 billion by September 2018, giving him 5.1% of Apple’s shares outstanding.

In May 2018, Buffett enthused in an interview: “I’m delighted to see [Apple] repurchasing shares. I love the idea of having our 5 percent, or whatever it is, maybe grow to 6 or 7 percent without our laying out a dime.” After having repurchased $32.9 billion in 2017, Apple granted Buffett his wish, with buybacks of $72.7 billion in 2018, $66.9 billion in 2019, $72.4 billion in 2020, $86.0 billion in 2021, $89.4 billion in 2022, and $56.5 billion in the first nine months of 2023 (ended July 1). By January 2022, Buffett’s Apple shares were valued at $160 billion, even after he had sold 12% of his original stake for $13 billion and had raked in another $3 billion in dividends. He now held almost 5.6% of Apple’s stock outstanding, a figure that would have been 6.3% if Buffett had not sold some of his shares.

In all, from October 2012 through June 2023, Apple repurchased $610 billion, equal to 92% of its net income over the period, and, in addition, paid out $147 billion in dividends, absorbing 21% of net income. Apple calls these distributions its “Capital Return Program.” But how can Apple “return” cash to those who have never given the company anything? The only money that Apple has raised from the public stock market in its 47-year history was the $97 million realized from its initial public offering in 1980. For example, not one cent of the $3.6 billion that Icahn spent acquiring Apple’s outstanding shares went to Apple for investment in productive capabilities or any other purpose. The same goes for the $35.3 billion in Berkshire Hathaway money that Buffett used to accumulate 5.1% of Apple shares outstanding. It is ludicrous, therefore, to call Icahn and Buffett “investors” in Apple as a value-creating company. They are predatory value extractors.

Banning Buybacks<

My book Investing in Innovation concludes with a five-part policy agenda for confronting predatory value extraction in US corporations: 1) ban buybacks done as open-market repurchases, 2) redesign executive pay to incentivize value creation rather than reward value extraction, 3) place representatives of employees and taxpayers on corporate boards, and exclude the predatory value extractors, 4) fix the tax system to encourage innovation, and 5) support investment in “collective and cumulative careers,” which can give members of the labor force access to productive and remunerative employment opportunities over the decades of their working lives.

A ban on buybacks is a foundational reform. Notwithstanding the Reward Work Act proposed by Sen. Tammy Baldwin (D-WI) and the Accountable Capitalism Act proposed by Sen. Elizabeth Warren (D-MA), the Biden administration has done little to counter record-breaking buyback activity. Democrats were forced to include a 1% tax on buybacks in the Inflation Reduction Act as a concession to secure the vote of Sen. Kyrsten Sinema (D-AZ) needed to pass the Act in the Senate. She declared that her vote for the Act could be had if the Democrats would drop from it a provision to put an end to the capital-gains tax treatment of “carried interest” income by hedge funds, replacing it in the Act with the 1% buybacks tax with a view to raising $74 billion in tax revenue over ten years.

At a press conference held after the deal with Sinema had been struck, Senate Majority Leader Chuck Schumer (D-NY) explained:

I believe strongly in [closing] the carried interest loophole. I have voted for it. I pushed for it, I pushed for it to be in this bill. Sen. Sinema said she would not vote for the bill, not even move to proceed, unless we took it out. So we have no choice.

Still, Schumer expressed confidence that all Democrats would support the stock-buybacks tax and noted its popularity with progressive Democrats. Nevertheless, Schumer took the opportunity of the Inflation Reduction Act press conference to make his position on buybacks clear:

I hate stock buybacks. I think they are one of the most self-serving things that corporate America does. Instead of investing in workers and in training and in research and in equipment, they don’t do a thing to make their company better and they artificially raise the stock price by just reducing the number of shares. They’re despicable. I’d like to abolish them.

In his 2022 State of the Union address, President Biden proposed a 4% tax on buybacks. That’s far from enough. If the Biden administration insists on taxing rather than banning buybacks, then it should set the surcharge at, say, 40%, with a mandatory toxicity banner on the corporate repurchaser’s website that reads: STOCK BUYBACKS DESTROY THE MIDDLE CLASS.

It is much less risky to, and immediate, to buy back stock than invest in new products.. What should a poor, humble, CEO do, pump up the value of stock temporally, or actually fund Engineers, who have the skill to to create new produces (typically invented by Junior engineers?)

PS: When you find a poor humble CEO not surrounded by sycophants, please let us know where, so that we can view such animal in it’s normal environment).

From a free market perspective, this only works over the long term because these corporations are protected by the government and protected from competition.

The stock buybacks discourse went into overdrive in 2018 because the 2017 tax reform promoted it, but at the same time capex expenditures also went up…probably because of lowered corporate tax but either way this suggests your statement is at least partially inaccurate.

https://www.cnbc.com/2018/09/17/companies-are-using-the-tax-cut-both-to-buy-back-their-own-shares-and-to-invest-in-the-future.html

I am letting this through but do not use the term “free market” in the future. It is inaccurate (as in it cannot exist in the real world) and internally incoherent. You discredit yourself by using it.

It is much less risky to and immediate to buy back stock than invest in new products.. What should a poor, humble, CEO do, pump up the value of stock temporally, or actually fund Engineers, who have the skill to to create new produces (typically invented by Junior engineers?)

PS: When you find a poor humble CEO not surrounded by sycophants, please let us know where, so that we can view such animal in it’s normal environment).

This dovetails well with the previous article on Monday I believe discussing how large organizations end up full of “leaders” that care more about their own success than the success of the business.

So a culture of “yes men” that will tell their bosses up to the CEO that they don’t need these funds for their businesses, so they can be used to buyback shares instead, is the mechanism for this actually happening.

If real leaders were in place that would stand up for the funds as providing a real ROI for the business, then things would be different.

Because those leaders are picked by the board, that in turn are the largest shareholders and thus the biggest beneficiaries of these buyback schemes.

Frankly put, those boards are the true pox on modern capitalism. And you see far more “innovation” happening in companies that are either privately held or where the board is passive. Whenever you get an activist board, things go pear shaped. Yet the same board is isolated from the blowback through the corporate veil.

While the companies on the chart are all S&P 500 index companies, the chart really nails the Dow Jones index.

There is an an unfortunate typo in the first word of the article. I believe it should be “After decades of”.

It is ultimately the consumer that pays for these stock buy backs in higher prices – continually raising the cost of living and doing business is a dead end

Updating the usage of terms of the following writing from an unknown author

From around 1925 –

“In spite of the ingenious methods devised by statesmen and financiers to get more revenue from large fortunes, and regardless of whether the maximum sur tax remains at 25% or is raised or lowered, it is still true that it would be better to stop the speculative incomes at the source, rather than attempt to recover them after they have passed into the hands of profiteers.

If a man earns his income by producing wealth nothing should be done to hamper him. For has he not given employment to labor, and has he not produced goods for our consumption? To cripple or burden such a man means that he is necessarily forced to employ fewer men, and to make less goods, which tends to decrease wages, unemployment, and increased cost of living.

If, however, a man’s income is not made in producing wealth and employing labor, but is due to speculation, the case is altogether different. The speculator as a speculator, whether his holdings be mineral lands, forests, power sites, agricultural lands, or city lots, employs no labor and produces no wealth. He adds nothing to the riches of the country, but merely takes toll from those who do employ labor and produce wealth.

If part of the speculator’s income – no matter how large a part – be taken in taxation, it will not decrease employment or lessen the production of wealth. Whereas, if the producer’s income be taxed it will tend to limit employment and stop the production of wealth.

Our lawmakers will do well, therefore, to pay less attention to the rate on incomes, and more to the source from whence they are drawn.”

Written around 1925