This is Naked Capitalism fundraising week. 150 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year,, and our current goal, strengthening our IT infrastructure.

Yves here. I hate to inject a note of realism, but comparing past crises to our current ones looks more than a tad optimistic. First, none of the past crises were what some now call a polycrisis, with our climate change inaction an overarching, existential threat. Second, it was not that long ago in historical terms, that both labor and manufacturing were more fungible than now, increasing adaptabilty. Third, many critical supplies, from electronics to pharmaceutical, depend on extended supply chains. Those are at risk in any severe downside scenario. Fourth, James posits that Covid Is Over. Finally, James posits competent responses when as we and increasingly others are discussing, there is a collapse in executive functioning all across Western economies.

By Harold James, Professor of History and International Affairs and the Claude and Lore Kelly Professor of European Studies Princeton University. Originally published at VoxEU

To many observers, the globalised world seems to be coming apart, with scarcity fuelling deglobalisation and conflict. But to economic historians, concerns about global supply and security look surprisingly familiar. This column takes the long view of global upheavals, from the 1840s to the Great Depression, the Global Financial Crisis, and the Covid pandemic. When fundamental items such as food or fuel become scarce, prices rise, requiring new channels of production and distribution. Supply crises generate new institutions and market innovations, showing the way to productive adaptation.

Today it appears to many observers that the connected or globalised world is breaking apart, that deglobalisation is a consequence of a profound political push for de-risking. Shortages are driving ubiquitous anxiety about supply and security. Acute food shortages produce famine, infectious diseases spread among undernourished populations, social unrest flares up, political systems are challenged and destroyed. The attention of the world focuses on particular geographic hotspots that dominate the geopolitical imagination. The Dardanelles – the passage between the Black Sea and the Mediterranean – assumes global significance, a thin needle connecting the grain producing areas of autocratically controlled central Eurasia to hungry or starving consumers.

To the economic historian, the current angst that supply scarcities are fuelling deglobalisation and conflict is familiar. The shortage scenario has replayed regularly over the past two centuries: at the end of the 1840s, during WWI, and of course in 2022. In the 1970s, the Middle East became the focus of an intense global debate about energy security. The traumas engendered by inadequate food or energy supplies, fears that they are controlled by hostile or malign or simply alien powers, the challenges that the coordination of effective domestic and foreign policies pose to governments: these constitute the fundamental drivers that make humans more willing to reimagine how human ingenuity and new techniques might be used to solve problems and connect peoples across the world. Crises which at first sight look purely devastating – bringing only death and destruction – prove to be transformative.

It is a well-known fact that the globalisation process has ups and downs, and that different waves of globalisation have unique characteristics (O’Rourke and Williamson 1999, Baldwin 2019). Policymakers and economists try to learn from past crises: both the Global Financial Crisis of 2008 and the Great Depression produced an extensive literature on the impact of past experience (Eichengreen 2015). One of the most difficult exercises involves choosing the right analogies. The aftermath of the outbreak of the Covid pandemic in 2020, for example, was characterised by an application of the monetary and fiscal lessons of the Global Financial Crisis. Was that the right analogy?

We should distinguish, first, between supply and demand shocks. Economists analyse the influences on key indicators – output and prices – by differentiating between influences that affect aggregate supply and factors that shape demand. A supply shock changes the ability of producers to make goods that add to overall output, and directly affects prices, quantity inputs, or production technology. A negative supply shock reduces inputs and increases prices. A positive shock increases inputs and lowers prices. The supply shocks thus move the equilibrium price level and equilibrium output in opposite directions.

By contrast, a demand shock affects spending by buyers, whether individuals, businesses, or governments. It might be expected to affect output and production: a positive shock leads to more economic activity, while a negative one diminishes activity. But in this case, equilibrium prices and output move in the same direction: up when the demand shock is positive, down when it is negative. Financial crises that emerge out of a malfunctioning or ill-constructed or badly regulated financial system are simply negative demand shocks, destroying the ability of individuals and businesses to buy products, and pushing down both prices and production. These are unproductive crises.

The course of globalisation was interrupted by two serious and very negative demand crises, in each case brought about and amplified by financial turbulence: the Great Depression of 1929–1933, and the Great Recession after the 2007–2008 financial crisis. Each brought some measure of deglobalisation, which was much more extreme in the case of the Great Depression.

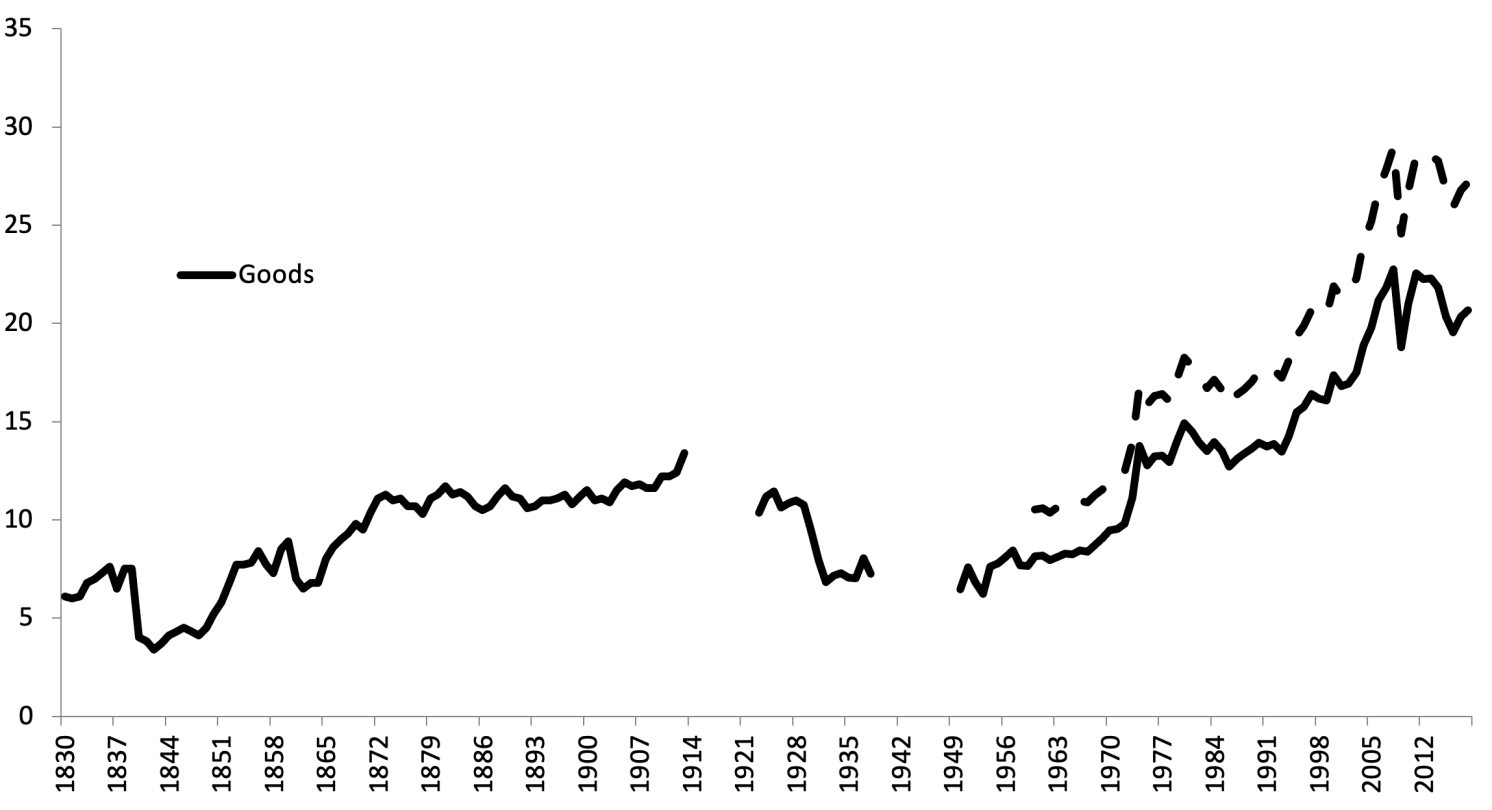

On the other hand, the two largest globalisation surges, measured in a conventional way by the increasing share of production that was traded internationally (Figure 1), followed major supply shocks: in the mid-19th century after the severe food shortage of the 1840s, and in the 1970s after the oil shock.

Figure 1 Ratio of global exports to GDP (percent)

Notes: Catão and Obstfeld (2019).

Negative supply shocks may just be temporary, in which case we can expect a short surge in inflation, then a deflationary interlude, and a relative return to normalcy or the pre-shock pattern of price behaviour. Negative supply shocks may also be persistent, with expectations that the price of the scarce good will remain permanently high: modelling of that scenario suggests that the long-term effect on underlying or core inflation, after an initial spike, would be a small augmentation. Finally, the shock may be the beginning of a long-term upward movement in the price of the scarce good; in this case, modelling suggests that the core rates of inflation would continue to rise (Blinder and Rudd 2013). All modelling efforts of this sort assume that there is a clearly discernible pattern. However, the big historical shocks that shifted the course of globalisation were quite different. They were not normal or predictable events. They brought substantial dislocations. Their outcomes were uncertain. They caused profound political trauma.

In these circumstances, the responses by intelligent people struggling to see what the future might hold actually transformed the structure of production and distribution. The radical character of the shock spurred a search for alternatives: new products, but also new mechanisms to move goods.

When fundamental items such as food or fuel become scarce, prices rise, requiring new channels of production and distribution. A central question for politics is how to respond to the challenge of dramatic price movements. The yoyo moves lead to revolutions in government as well as in business organisation. The supply crises thus generate new institutions and market innovations, but also states that are stronger and extend their capacities. Such institutions change the way people conceive of interactions or of the economic process.

Some systems are so rigid that they are completely destroyed by the economies of shortage: the brilliant Hungarian economist Janos Kornai strikingly captured the mechanism by which scarcities, and the hoarding and dysfunctionality they prompt, undermined and finally destroyed centrally planned (communist) economies (Kornai 1980).

Thinking about the resilience of systems also leads gradually to reflections on the relationship of national systems to the rest of the world. Recognising that pandemics or climate change are global threats should produce coordinated global responses. Crises appear to emphasise how globalisation must be guided or managed. Sceptics will quickly point out that reality is more complex. Covid frequently prompted people to think in terms of national self-interest: America First.

The turn to trade protectionism and heightened competition between powers set the scene first for the aggressive use of energy supply as an instrument of blackmail, and then for Russia’s attack on Ukraine in

2022. Other global challenges, too, provoke new forms of nationalism and protectionism. Even climate change, like Covid-19, might be used to build strategic advantages: in particular, northern countries –Russia especially but also Canada and Norway – may be beneficiaries of warmer temperatures and easy navigation through the Arctic. In consequence, geopolitics appeared omnipresent in the wake of the pandemic and the response to the war in Ukraine. A geopolitical mindset limits the capacity to produce coordinated responses, leaving globalisation on the defensive, on the retreat. At the same time, a new reality is emerging.

The key question for governments, but also for the whole of society, is how to respond, in crises, to the possibilities offered by technical change. Technical change occurs constantly, but is not always used efficiently or productively. In practice, over the long history of globalisation, there have been extended gaps between a potentially transformative innovation and its wider useful diffusion. Matthew Boulton and James Watt produced a better steam engine in 1776. But the first railroad in Britain, the short Stockton-to-Darlington line, opened only in 1825 to connect collieries to the North Sea; the first steamship, the paddle-driven SS Great Western of Isambard Kingdom Brunel, crossed the Atlantic in 1838. Only in the middle of the 19th century did railroads open up interior spaces all over the world and steamships carry goods globally. Orville and Wilbur Wright flew a powered, heavier-than-air machine in North Carolina in 1903, but it was only in the 1960s that the jet aircraft opened the way to large-scale transportation. Aniline was isolated in 1826 by Otto Unverdorben, but only in 1854 did the reduction method developed by Antoine Béchamp allow the large-scale production of dyestuffs. Medical or pharmaceutical uses took longer: a derivative (sulfanilamide) was synthesised in 1908 with extensive antibacterial uses. Other medical discoveries required even more time to reach across the world: Edward Jenner developed the practice of vaccination against smallpox in 1796, but it was 1977 before smallpox was completely eradicated. Jenner’s son, sisters, and wife all died of tuberculosis, a disease for which a vaccine, Bacillus Calmette-Guérin (BCG), was first used in 1921.

The durations between when new innovations are developed and applied might be changed by new political constellations. One revolutionary driver, the container ship, was developed in the 1950s but only had a significant impact on shipping costs and practice in the 1970s because of changes in the regulation of carriers and their interactions with shippers. Big disruptions, notably wars, limit trade but also drive an intense search for quick solutions, such as the synthesisation of nitrate production for explosives and crop fertiliser in WWI, and the development of penicillin in WWII. It is wrong to see the dissemination of technology as a steady, evenly paced process. It is distinctly shaped by government priorities, choices as to why certain products matter: railroads, steamships, aircraft, vaccines, and so on.

Especially at moments of crisis, we feel uncertain about the future, its meaning and direction. Bankruptcy is decided not by the long-run viability of an idea or business concept, but by an ability to meet immediate financial requirements, or by the way assets and liabilities on a balance sheet are interpreted. It is precisely at moments of doubt and hesitation that individuals, governments, and markets are open to influence by persuaders: powerful analysts, interpreters, and rhetoricians who can provide some light and who claim to know the future. The responses then help to shape how the future develops. At the moment, there are multiple possibilities or trajectories. If we consider these in static terms, we will think of multiple equilibria. Keynes wrote of how “the uncontrollable and disobedient psychology of the business world” determined the marginal efficiency of capital (Keynes 1936).

The combination of technical and geographic change has always required competence, and that demanded learning: looking to a future by learning from a dismal past. In the gloom of 1919, when the globalised pre-war world seemed to have completely collapsed, Keynes feared that “All this makes it increasingly probable that things will have to get worse before they can get better” (Keynes 1978 [1920]). But a survey of historical experience suggests we learn most when – as in the 1840s and the 1970s – the present is most dismal. Globalisation is reshaped, neither destroyed nor revived in its old form, through the relearning. And supply crises show the way to productive adaptation.

See original post for references

Interesting article, and the author does point to a lot of useful historical situations to take into account, especially with regards to the time it takes for any given technology to be widely disseminated. But it does seem to commit the sin of positing that “because things went one way in the past, then they will go the same way in the present” which is anachronistic (not to mention undialectical). Yes, crises are always also opportunities: as the etymology shows, the original Greek meant “turning point of a disease”, which indeed may mean an adaptation and recovery; but it may well mean failure and death.

It’s clear that the author has economic crises in mind, but this seems to be a bit narrow-sighted? Maybe taking a longer or more diverse look at history would show that often times crises end up in collapse and the end of previous states and institutions: the Western Roman empire sure didn’t endure the fourth century well, for once; nor did the Tsarist system in Russia manage to navigate the multiple crises of the early twentieth century. One could argue that what came afterwards, such as early feudal institutions, the Catholic Church, and the Soviet Union, respectively, were in a sense adaptations and thus “successful” in a sense. But they were also so vastly different from their predecessors that I find it hard to make the argument.

Dismal “Science” is too right. An awful lot of wishful thinking here, I believe.

I’m surprised at the things he doesn’t take into account here like:

* AGW (Anthropomorphic Global Warming)

* World population in the years he focuses on and how that growth has affected the entire World Ecology.

* Human Pollution, including advanced technical pollution lasting for generations.

* Resource wars based on future estimates of AGW damage while doing little about the effects of same today

* Changes in world currencies and how they’re managed by Central Banks

* Economic Trade Sanctions against other countries by the country issuing the dominant world currency with controlling interests in various World Banks.

* World handling of the pandemic response in favor of Corporate Profit and not in the interest of the general population.

* Health Care systems based purely on profit

* Useless Social fighting, particularly “Woke” Gender BS occurring across the West as opposed to much more serious issues

* Rampant, deadly, drug abuse and suicides across the West

* Geriatric Leadership still fighting irrelevant mid-20th Century Battles

More of course, and poly-crises never really existed to the extent they seem to do in today’s world. Overall I think it was a pretty useless “Big Picture” examination. Dismal, as in it’s the best economists like this can come up with.

Bang on — this was my immediate reaction as well. The facts of AGW, the environment, ecosystem (upon which, human survival fundamentally relies), and resource depletions imposed, in the context of a still-growing global population of 8e9, energy and material constraints, are all completely ignored. Adaptation? LOL. The introduction of new technology always brings with it unintended or unforeseen consequences, and technical “solutions” at their core can not remove fundamental limitations imposed by material and energetic balances.

Yes, in the big picture (“long view”) we’re all dead.

Yes, me too. I kinda think this piece was economics on Prozac. My one big mental boggling is definitely the profit motive. Let’s just eat up the entire planet – it’ll look great on the balance sheet. Nothing dooms us more inevitably than the industrial profit motive. 8 billion people all trying to make a profit? It’s as if profit is a new term for survival. But all that transmogrified wealth is two steps backward, one step forward. If we can split the atom why can’t we split profit from prosperity? The best direction to go is not innovation – innovation is good but what kind of innovation? Human prosperity is only viable in a balanced environment and maintaining a balanced environment requires considerably more discipline and dedication than our profiteering instincts include. Imo it requires an entirely new kind of “economics.” Top down incentives, local participation, dedication and good science and open information.

“Crises which at first sight look purely devastating – bringing only death and destruction – prove to be transformative.”

This aphorism sounds like a reshaping of a common Nietzsche aphorism. Gosh! As the world wanders into a polycrisis as Yves described the contrast between past crises and the present world situation, James does indeed seem a “tad optimistic”.

“The aftermath of the outbreak of the Covid pandemic in 2020, for example, was characterised by an application of the monetary and fiscal lessons of the Global Financial Crisis. Was that the right analogy?”

Is James recalling the actions of the CARES Act in this statement? If so, I suppose the same monetary and fiscal lessons were applied. Both the Global Financial Crisis and the financial crisis of the Corona pandemic in 2020 were used to pass a fair amount of the government’s spare change into the needy hands of the FIRE Cartels. However, I do not recall the passage of any laws or regulatory actions that addressed the root causes of the Global Financial Crisis and I still cannot think of anything the CARES Act did that addressed the supply chain issues that resulted in the shortages early in the ongoing Corona pandemic. Other than Rahm Emanuel’s aphorism “never let a crisis go to waste” I am not sure what “monetary and fiscal lessons” found application in either crisis.

“However, the big historical shocks that shifted the course of globalisation were quite different. …

On the other hand, the two largest globalisation surges, measured in a conventional way by the increasing share of production that was traded internationally, followed major supply shocks: in the mid-19th century after the severe food shortage of the 1840s, and in the 1970s after the oil shock.”

I fail to see the relation between the food shortage of the 1840s [the Irish Potato Famine? Corn Laws?], the 1970s oil shocks and the rise of globalization in the Victorian era or in the Reagan-Thatcher era manifestations of Neoliberalism into our present times.

James certainly has an interesting take on past and current events — however — I do not think I will be looking beyond this post for any of his books or papers.

Paul Virilio

We are facing the emergence of a real, collective madness reinforced by the synchronization of emotions: the sudden globalization of affects in real time that hits all of humanity at the same time, and in the name of Progress. Emergency exit: we have entered a time of general panic.

The Administration of Fear

It certainly is reassuring that previous incidents of global shocks have resulted in world wars.

And any evidence of competence in the operation of the West is certainly well hidden.