Yves here. I’m skeptical of models with n = 3 (although the authors claim results would be pretty similar with n = 5. There are lots of other quibbles. Michael Pettis has explained why GDP in China isn’t a good measure of economic activity for China (I ran into that idea when I first started blogging; financial analysts were making heavy use of other proxies like electricity consumption). Second is since they are comparing GDP per capita across East Asian economies, what FX rates did they use? Recall China was pilloried by the US Treasury for years for keeping the renminbi undervalued (the belief that the renminbi was undervalued persisted even after inflation in China and a slow “dirty float” appreciation had taken care of the problem).

Comments from readers with expertise in development economics and/or the economic history of the Asian tigers and China encouraged to pipe up (paging PlutoniumKun).

By Jesús Fernández-Villaverde, Research Associate at National Bureau Of Economic Research (NBER), Howard Marks Presidential Professor of Economics; Lee Ohanian

Professor of Economics, and Director of the Ettinger Family Program in Macroeconomic Research at University of California, Los Angeles; and Wen Yao, Associate Professor of Economics, School of Economics and Management at Tsinghua University Originally published at VoxEU

China’s growth over the last several decades has been remarkable, reshaping the global economy in the course of its transformation. However, it is open for debate whether this process has been miraculous because of China’s rate of growth or because of the sheer size of its economy. This column presents a framework which illustrates that China has not outperformed other East Asian economies when they were at the same stage of their economic development. The authors also suggest an expected trajectory for China’s income per capita over the coming decades.

Few events in global economic history have been as transformative as China’s recent economic growth. China’s real per capita GDP, measured in Purchasing Power Parity (PPP)-adjusted real dollars, surged from 6.6% of the US per capita GDP level in 1995 (when China became a middle-income economy) to 25% in 2019 (the last year of data in Penn World Tables 10.0). Given China’s population, this fast growth has reshaped the world economy (see Naughton 2018 for an analytic narrative of China’s economy over the last several decades).

China’s growth motivates many questions. Was it exceptional in comparison with other East Asia growth miracles? How can we account for it? Are China’s economic policies a model to be followed by other emerging economies? And, perhaps most importantly, will it continue over time?

China in Comparison to its East Asian Peers

To answer these questions, in a recent paper (Fernández-Villaverde et al. 2023) we start by comparing China’s growth experience with that of Japan, Taiwan, South Korea, Hong Kong, and Singapore. 1 We do so by following these economies during the years when each of them get closest to China’s GDP per capita in 1995. 2 To clarify this idea, take the example of South Korea. This economy reached $2852 in 1972. Thus, we compare South Korea from 1972 to 1996 to China from 1995 to 2019. In that way, we aim to understand how each economy performed when the two economies were at roughly the same level of economic development.

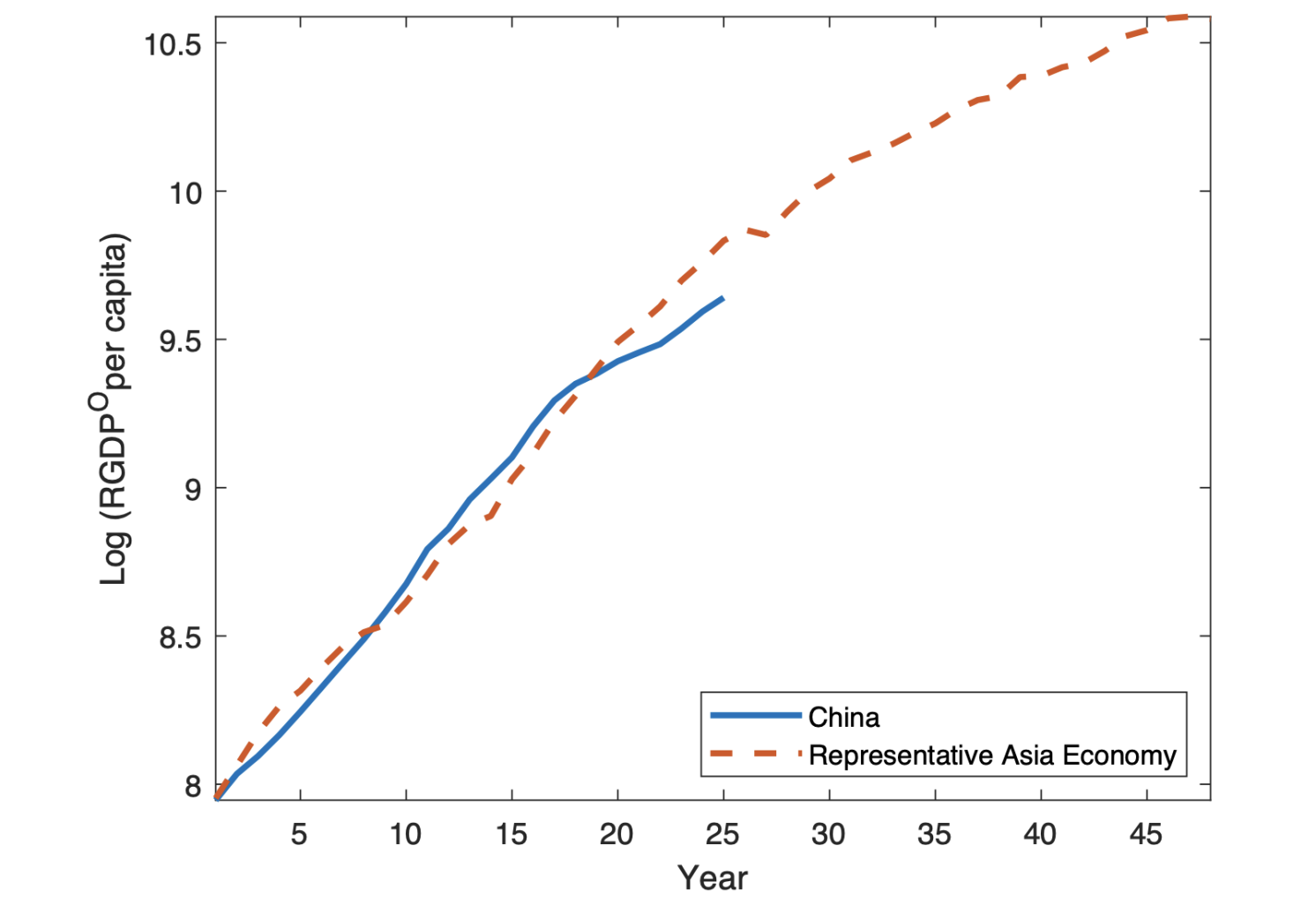

Figure 1 plots the evolution of China’s output per capita against the output per capita of what we call the ‘representative Asian economy’, i.e. the average of South Korea, Taiwan, and Japan (we drop Hong Kong and Singapore from this mean since, as city-states, they might have their own peculiarities; nonetheless, the results are nearly identical if we include them as well). The result is striking. China has performed exactly as the representative Asian economy did when it was at the same level of economic development. If anything, China seems to be underperforming since the early 2010s.

Figure 1 China’s GDP per capita versus the representative East Asian economy’s GDP per capita

We can even strengthen the argument by noting that the world technology frontier was more advanced when China became a middle-income economy than when Japan, Taiwan, and South Korea were at the same stage. China had, therefore, more room to catch up and deliver faster growth. In other words, China’s growth is not exceptional per se (or the product of a particularly insightful combination of economic policies that could serve as a template for other economies) but for the size of China’s population.

Also, Figure 1 suggests a sharp prediction: if Japan, Taiwan, and South Korea’s economic growth slowed down after the first decades of high rates, there is a high probability that China would do the same. Our prediction is not new; Barro (2016) and Den Haan et al. (2013) have presented similar arguments.

A Model of China’s Development Trajectory

This similarity in how the East Asia growth episodes unfolded raises the question of whether a common theoretical framework can offer a unified understanding of development across all these economies. To explore this idea, we postulate a minimalist Ramsey-Cass-Koopmans one-sector growth model augmented with a parsimonious Total Factot Productivity (TFP) catch-up process governed by three parameters that specify: (i) the initial TFP level, (ii) the asymptotic catch-up TFP bound relative to the US, and (iii) the speed of catch-up. We calibrate the model to conventional aggregate targets and to match the observed patterns of TFP growth. While we are agnostic about the specific mechanisms that may be driving TFP catch-up in China or the other growth miracles, our approach provides a simple and transparent evaluation of the growth process in these economies. Moreover, it allows us to predict China’s growth trajectory by extending the TFP process into the future.

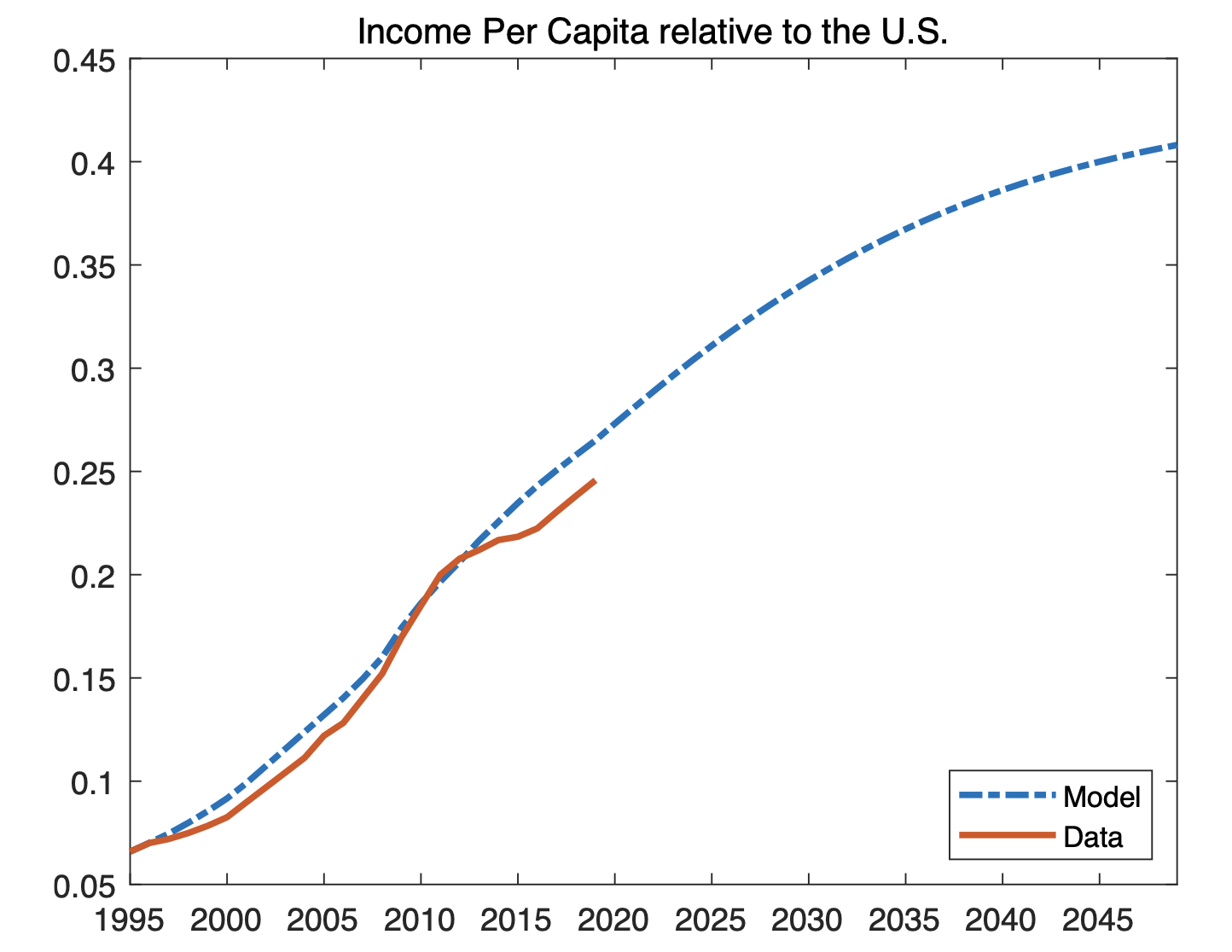

Figure 2 plots China’s GDP per capita relative to the US in the model (dashed blue line) and the data (solid red line). We find that the model matches China’s income per capita growth from 1995 to 2019 surprisingly well. We emphasize surprisingly because the model is so simple; it does not include factors studied in the literature, including sectoral reallocation, financial market developments, industrial policies, foreign direct investment, or trade policies. We do not dismiss the importance of these or other factors. Rather, those factors may be contributing to the process of TFP catch-up.

Figure 2 China’s GDP per capita relative to the US

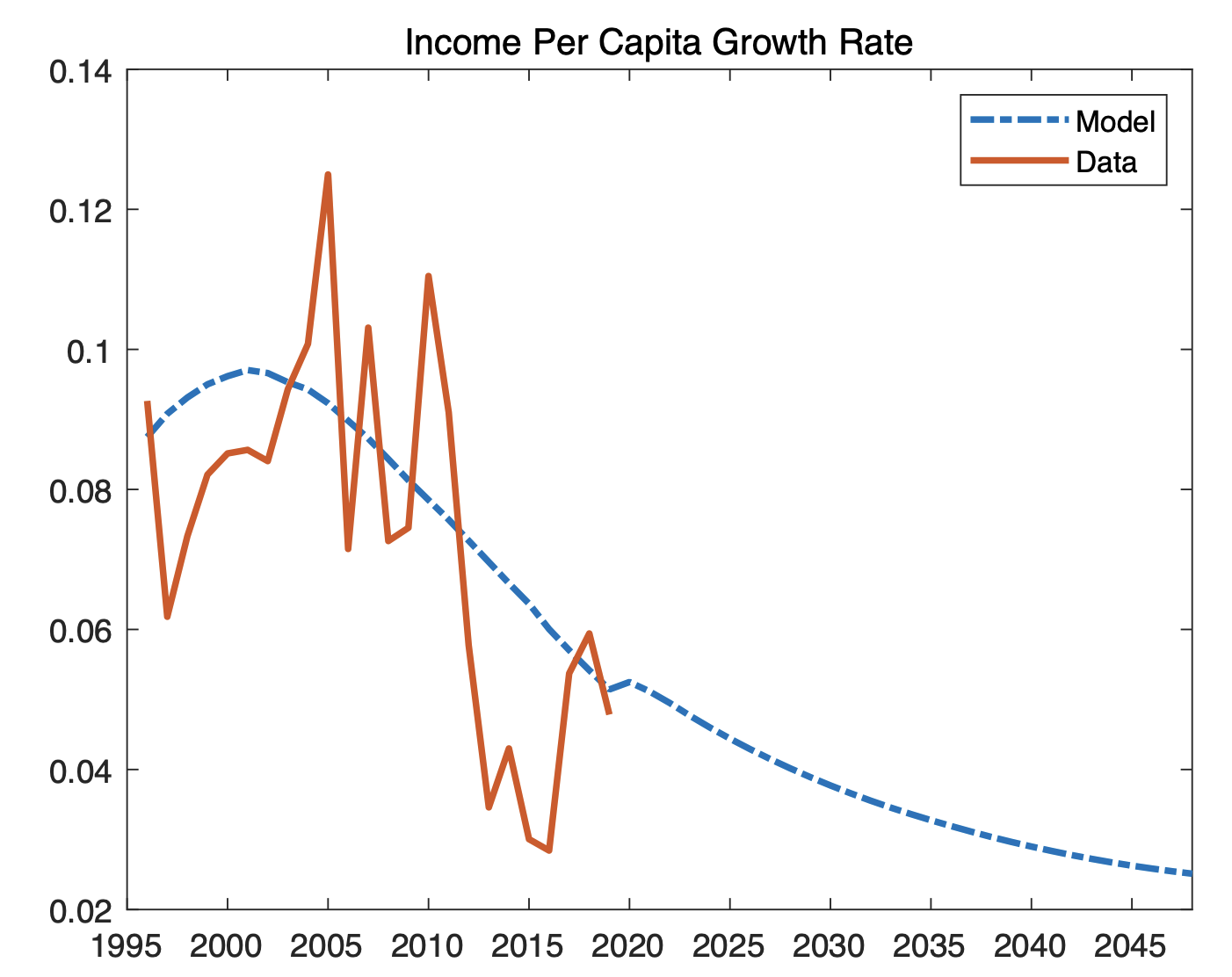

Figure 3 shows China’s GDP per capita growth rate in the model (dashed blue line) and the data (solid red line). Our minimalist growth model again matches the data very well, including the hump shape of growth (we do not have stochastic shocks and, therefore, cannot trace year-to-year fluctuations, just the time-varying trend). Our model can also match the evolution of investment (when we correct the official series as suggested by Chen et al. 2019) and the rate of return on capital.

Figure 3 China’s GDP per capita growth rates

Our main result is striking: neoclassical growth theory can account for China’s experience once we consider TFP catch-up.

This result is important because we can use the model to forecast the future of China’s economy. We use the model and the fitted TFP catch-up process to predict that China’s relative per capita GDP level will asymptote to about 41% of the U.S. level around 2050, reflecting the substantial slowdown in China’s observed TFP catch-up in recent years. Moreover, given China’s forecasted demographics, which we take from the United Nations World Population Prospects, the model predicts that US output will grow faster (2.29%) than China’s (2.27%) by 2043 and that, by 2088, the US economy will be larger than China’s in PPP terms. Notice that, for our statement regarding 2043, there is very little demographic uncertainty left. Given current birth and death rates in China, around 85% of the people who will be alive in China in 2043 were already born by the end of 2022. Slowing TFP growth and a declining population suggest a far-from-booming Chinese economic future.

Model Performance in Other East Asian Economies

We can validate our model externally by asking how well the same model accounts for the experiences of Japan, Korea, Taiwan, Hong Kong, and Singapore. We find that, with some economy-specific recalibration, the model also accounts for these growth episodes. This is a key validation for the model, particularly since the analysis of these other growth miracles covers different institutional and policy environments and many more years than that of China. The much longer period of study for these other growth miracles has important implications for China’s future, as TFP growth continued to decline in all four economies over time. The present of Japan, Korea, Taiwan, Hong Kong, and Singapore is the future of China.

Notice that our approach ignores factors that might be of first-order importance. For example, we do not have a real estate sector that can implode (Zhou et al 2015, Rogoff 2021) or political risk (Szczerbowicz et al. 2019). We see this absence as a virtue, not a sin, of our model. We argue that China has been growing because it is accumulating capital and is catching up with the world’s technological frontier. But China’s technology catch-up is slowing considerably. This fact, combined with a declining population, means that China’s growth can only slow down, perhaps significantly, regardless of what happens with the financial sector or political risk. In fact, the latter might be epiphenomenal manifestations of the tyranny of neoclassical growth: it is easy to grow when an economy is far from the frontier. It is much harder to grow as an economy gets closer to the frontier. However, our forecast may be too pessimistic if China implements new institutional reforms that improve economic efficiency to reverse its declining TFP catch-up rate.

See original post for references

“World technology frontier”

This formula does a lot of heavy lifting, becoming in effect a way for the authors to naturalize and hence justify US dominance. As though the “frontier” were just something natural. Leaving the heavily defended nature of that particular “frontier” completely out of the picture, the authors offer ideological justification masquerading as objective research for the US (tech) war against China.

Watched a conversation between Jeffry Sachs and Alexander Mercouris on Diesen wherein both agreed that it was impossible to hold back technology, to prevent others from using it, because they will quickly invent their own. The implied point that a declining (aging) population in China will slow their development of new technologies kind of reads like a justification for patent protection, etc. But one thing to consider is how technology, unchained development, reaches critical mass and becomes less useful. If I were to analyze China, in my complete ignorance, I would quote Stalin, “Quantity has a quality of its own.” China has managed to coordinate a population of 1.5 billion people and maintain a level of equality that maintains cooperation. So it might not follow the same trajectory of entropy that our western free markets have done. It might achieve a higher level of well being over time – that would be my guess.

It also helps (I think) to actually make things.

This is easily underestimated. I live in L.A. and L.A.’s claim to be a fashion capital is perennially at hazard of being choked out by extinguishing the garment district with its sweatshops. The ability of a clothing designer to “prototype” a design by running around town getting samples made by highly expert craftsmen is critical to the survival of the whole hierarchy of “fashion” in this city.

I cannot help but think that the same hidden dependence governs cellphones. In Shenzen, I imagine you could find a blackmarket iPhone assembled in someone’s garage partly from locally boosted components. Does anyone in the erstwhile Silicon Valley have the option of picking up parts at Frys?

There is a “natural” sequence in production technologies that was highjacked by financial wizardry and there is no recovering what was lost in the U.S. or Europe. There is a reason COVID devastated Italy’s textile tool-making region.

https://www.youtube.com/watch?v=leFuF-zoVzA

Here is someone doing just that from back in 2017.

These days it would be harder, as Apple has all kinds of signature checks on the parts to tag them as belonging to a specific phone or some such.

And thinking about it i was reminded of someone finding an Android tablet back before Google officially certified them, that ran on 2 Nokia phone batteries (Nokia used to use a small set of “standard” sizes of batteries in their phones, that along with the 5V barrel plug charger made it easy to source replacements). And they were even hot swappable.

https://en.wikipedia.org/wiki/Verdoorn%27s_law

There are some questions: why use per capita comparisons? The customary comparisons, except for standards of living, are those of country GDP. Per capita comparisons seem to me valid only if the ease of generating growth comes in step with population size.

The article describes China as “catching up with the world’s technological frontier. But China’s technology catch-up is slowing considerably.” However, China’s record on technology is far more than that of adopting from elsewhere–it has advanced world technology, shown most recently in developments by Huawei. An Australian think tank, using the top 10% of research most cited between 2018 and 2022, found China leading in 37 of 44 wide-ranging technologies. China seems to be returning to its historical tradition in technology, described by Needham and colleagues. (I am not intending here to predict its future growth.)

Thank you for the reference to Needham.

This model is pretty simplistic, but it does match up pretty closely to the reality of most ‘catch-up’ countries, and not just in Asia. I think objective observation of a range of ‘real’ economic growth factors would put China in the middle of the class at best. Its China’s sheer scale that makes its economic performance seem impressive, nothing else.

Since I became interested in China’s rise as a student in the late 1980’s I’ve always mentally tried benchmarking its ‘real’ growth against those countries I’d previously studied, and while the growth was often spectacular to see, it never really matched up that well against the three most impressive fast growth countries, ROK, Japan and Taiwan, or for that matter earlier European examples. In particular, China was a laggard when it came to creating sector leading companies. And its not as if it started from nothing – China developed nuclear weapons in the 1960’s and built jet fighters and space rockets nearly half a century ago. China is also, it should be noted, blessed with rich natural resources and a naturally very defensible geography and had just enough oil to help it grow without having too much and falling into ‘Dutch Disease‘ which has cursed other countries with a little too much of it, such as Malaysia. Even capital shouldn’t have been so scarce – while the KMT ran off with a lot of loot when they invaded Taiwan (yes, it was an invasion), China had a significantly fuller treasury than ROK or Japan in the 1950’s. I well remember the 1970 World Book Encyclopedia that was my main source of knowledge when I was a child describing South Korea as the poorest nation on earth. I recall being kind of shocked as a 12 year old to find out that there were poorer places than in Africa. ROK’s growth from around 1970 onwards is probably the most impressive example in the 20th Century, and all the more impressive given that the country was run by a bunch of pretty vicious right wing dictators for much of that period, none of them known for their intellectual capacity and has almost no natural resources to speak of.

So the most impressive thing about Chinese growth is related to the sheer size of the country. By most measures (and yes, even GDP per PP is not a poor measure of comparison), when you adjust for internal debt growth (which is really just a way of goosing GDP figures) its poorer than most South American countries, Russia, Thailand, Malaysia, etc. Its certainly done much better than, say, India or Pakistan, but by any reasonable comparison its performance in the past half century (or 70 years, as the ending of the Pacific War is probably the fairest benchmark), its all in all been a bit meh, considering its huge natural advantages.

As for the future, you can make a reasonable case for optimism or pessimism. On the optimist side, China has been reasonably good (despite its pretty bad GINI figures) at eliminating the worst poverty and in establishing an excellent basic infrastructure, as well as firm control over issues like corruption and crime and in improving its educational and research systems. I think its in a much better position to deal with demographic challenges than most other Asian countries due to a firmer control on population movements internally and its willingness to choke out parasitic economic sectors – which is a nice way of saying it will make sure its brightest and best are not working as lawyers or in social media companies. Its sheer size also insulates it to some degree from external factors, although it seems unwilling to reduce its dependency on its export sector, which, as Pettis has argued, relies heavily on suppressing domestic demand and wages to protect itself. And there are pretty good reasons to think it will completely dominate key high growth economic sectors in the near future, including car manufacture and energy tech.

But there is also a pessimistic side – the economy is highly imbalanced, which is typical of fast growing economies – much more imbalanced than even 1980’s Japan. While the ‘middle income trap’ was first described as a concept around 20 years ago, the basic principles had been identified by development economists long before then. In simple terms, the structures needed for catch up growth are not the same as for an advanced economy, and historically most countries fail to make the adjustment. Even those that do often find themselves struggling, as Japan has shown over the past 30 years and we may well be seeing in ROK and Taiwan.

A number of China watchers (and I’d recommend everyone reads Aurelian’s outstanding substack this week on why the overwhelming majority of self proclaimed foreign policy experts should be ignored) think Xi was put in power precisely because the Party anticipated that the post 1980’s model would run out of steam and only a very strong leader would be capable of making the structural changes needed for China to regain its momentum. Whether he can do it or not is really anyone’s guess, and I certainly can’t predict it.

I aam watching this young American woman’s travels and life in China for some years now, and personally, I am impressed by what I have seen so far: https://www.youtube.com/watch?v=SMxUwp_oKoQ

Yes, I know that channel. I’ve done quite a bit of cycling around parts of China (and I know lots of solo tourists who have done it over the past 2 decades), and let’s just say the choice of places to film are… selective.

The reality is that you don’t do filming and wandering like that in China these days unless you have a certain amount of ‘official’ approval. Her videos are nice to look at, but provide as much insight into China as a Bali tourist advert gives into life in Indonesia.

A couple notes.

1. All data are PPP, so not affected by exchange rates.

2. There’s a large literature, their bibliography is not comprehensive as they aren’t writing a lit survey. I won’t append my own list, many of which are quite technical, though some (but not all) actually have plain English in the introduction.

3. Key is dynamism, that is, productivity growth. Here are a few key papers that (maybe) aren’t behind paywalls:

• China’s Declining Business Dynamism, Diego A. Cerdeiro and Cian Ruane, February 2022, IMF Working Paper WP/22/32

• China’s Declining Business Dynamism, Diego A. Cerdeiro and Cian Ruane, February 2022, IMF Working Paper WP/22/32

• Population Growth and Firm Dynamics, Michael Peters and Conor Walsh, NBER Working Paper 29424 Oct 2021 [may be harder to access]>

4. Rick Katz, a journalist who’s spent his career writing about the Japanese economy (and got an econ masters to help with that) has a recent substack series on China, good because he brings his Japan background to bear. Mea culpa: we chat periodically, including about his China project. See https://richardkatz.substack.com/

5. Finally, in response to “junez” China is certainly a player in certain fields – I follow China’s auto industry, writing on SeekingAlpha.com – but that doesn’t necessarily translate into economy-wide productivity improvements. See several NBER papers by Lee Branstetter and Guangwei Li, any university library is likely to have access. Made in China 2025 is a long laundry list, doesn’t seem to be doing much, and potentially diverts resources to sectors that catch policymakers’ eyes – “sexy” industries – that are unimportant. And the real issue is services, not manufacturing, because China’s economy is dominated by services (with a disproportionate share in construction).

mike [econ prof emeritus, I taught an undergrad course on China for 30+ years]

Trying to edit when it timed out….

In the auto industry, China is at the leading edge for many technologies such as EV platforms and autonomous driving / driver assist technologies (Tesla is not the leader). For EVs, China dominates battery production, and core players (CATL and BYD are the 2 largest – BYD got its start in cell phone batteries, then moved into electric buses, then into light vehicles) are bringing generation after generation of new batteries to market. Many Chinese suppliers are the leaders in their specific product lines, and much automotive technology resides in the supply base. (All global Tier Is have major R&D centers in China, most in Shanghai, because that’s where a lot of production takes place, and where its easier to find seasoned engineers.)

Yet…yet: the industry has huge overcapacity. So while some individual firms are highly productive, the industry as a whole is weighed down by factories with low utilization. Firms are existing, in a SeekingAlpha article I listed a dozen-plus car companies that have exited the market in the past 3 years; most EV new entrants are selling under 20K units a month, to low to allow profitability and are destined to exit. Ditto a handful of battery companies, late entrants are not faring well.

So being at the leading edge of technology isn’t enough at the economy-wide level if it is accompanied by massive resource misallocation. Yes, at some point the destruction part of Schumpeter’s “creative destruction” will improve aggregate automotive sector productivity. But the industry is already starting to confront a market shrinking due to a population decline and aging (sales peaked in 2017, though 2023 may equal it). Exports will help, but face pushback in Europe (roughly 5% of the overall market in August, and growing rapidly), and low volume sellers in China aren’t likely to be high volume sellers overseas.

I think when the real story comes out of the PRC rise from 1979 to 2020 (Deng to Covid) there is going to be a collective headslap administered to ourselves over our missing the matter of massive, wholesale corruption from the local cadre leader (every 10 Chinese are grouped into a unit with a CCP tasked lead) to the General Secretary of the CCP (the real power job in China). We all talked about the corruption and the emergence of fabulously wealthy oligarchs in the nations of the former Soviet Union because they were so open and ostentatious in their graft and their lifestyles.

The oligarchs in China, on the other hand, came in two varieties, one of which were the CCP Mandarins who kept much of their lifestyles under wraps and as much of their wealth out of China as they could pull off – from San Diego to Vancouver there are few upscale neighborhoods that don’t have multiple houses owned by overseas Chinese trusts. The level of graft was off the charts. A former member-by-marriage of the Chinese CCP elite named Desmond Shum defected a decade ago when his wife, who had been personal secretary to the wife of the then Chinese Premier (#2 guy in the CCP), suddenly was arrested and held incommunicado for years, possibly even now. No charges. No habeas corpus. So Shum got his son and hightailed it to England (he was ex-Hong Kong so British citizenship was a given, I guess).

Anyway, Shum was being interviewed months back about his memoir “Red Roulette” about how much he as a mega-scale property developer would pay in kickbacks when he closed a 10,000+ unit development. His answer, after a notable pause, was 30%. I have just seen estimates that the Chinese residential property market currently has a book value of 57 Trillion Yuan. That’s $800+ billion dollars. If a third of that was skimmed off to the coffers of corrupt officials that would be approximately $266 billion.

Even that may be low-balling the amount of money the CCP Mandarins have taken. When previous president Jiang died in 2022, there were reports that the Jiang family had accumulated a fortune of $500 billion. That leaves even Elon Musk in the dust. Recall that a decade ago the NYT got kicked out of China for an investigative report they published that documented using open legal documents in Chinese county registrars offices that the then #2 guy and his extended family owned $5 billion that could easily be traced; who knows how much beyond this the Times couldn’t trace because of Panama Papers type subterfuge?

In any case, I was in China multiple times on business for my Silicon Valley employers in the mid 1990s so have a small amount of personal experience here. From what I can tell since then the Chinese appear to have ‘over egged the pudding’ to an extraordinary degree; per Michael Pettis, Chinese investment in factories and infrastructure long ago passed the point of economic sense. As with residential estate most conspicuously, China appears to have built *way* more capacity than they need or their consumer demand could justify.

The one-child policy also delivered a ‘sugar high’ to the Chinese economy because the money that adults would have spent on children instead went into savings, which were then tapped to finance the incredible over-investment spree. But most short-cuts have consequences, and the Chinese are now reaping theirs: the numbers indicate that China’s population has not only peaked but that it’s actually 120,000,000 fewer than official census data reported. There may be ‘only’ 1.28 billion Chinese instead of 1.4 billion; that’s a lot of missing people who would otherwise be workers and consumers.

It looks highly likely that China is plateauing and that they will not escape the Middle Income Trap that Taiwan, Korea, and of course Japan did. The CCP will maintain an iron control of the Chinese society in part because that’s the very essence of Leninist regimes and partly because they know that if they lighten up on control a la Glasnost of the old Soviet Union then China will get its long-delayed “color” revolution, fueled by popular anger as the details come out of CCP princeling families and their own ‘Golden Mountains’. There are 90 million CCP members who do not wish to be strung up by mobs from lamp-posts as happened in the worst of the Cultural Revolution.

I think China’s future will be under a techno-surveillance form of ‘market’ communism that keeps that CCP in charge even at the price of urgently needed economic reforms. How China will fare relative to the US and other countries is impossible to forecast with any semblance of certainty because Western populations are rapidly changing as well, and their economies have not been shining successes for nearly 50 years. Beyond that there is the 800 lb gorilla of climate change. There’s a saying in China to the effect that’s it’s way easier to get on a tiger than to get off. We’re about to see another cycle of this. Let’s pray it doesn’t go even more pear-shaped than is already baked in.

P

I’ve read a number of comments and it seems like some people have overly rosy views of the Taiwanese economy. I live in Taiwan, and the number one complaint from friends and acquaintances here is that salaries are too low and real estate prices are too goddarn high. Don’t just take my word for it, go to YouTube etc and you will get the same picture. Young people here really have it hard, many actually work second jobs and they would have to commute long distances because of high rents in the major cities. Yes, there are high paying companies here, but they are mainly in the semiconductor sector, and the high pay is limited to management and engineers. The wealth gap in Taiwan is INSANE. Just a couple of days ago, a guy fatally struck a scooter driver, and then ran off. On the same day, he was found dead from committing suicide, because he lacked the means to provide compensation, https://www.taiwannews.com.tw/en/news/5008838. Not to mention, thousands of Taiwanese have been lured to Cambodia with promises of high paying jobs only to end up as victims of human trafficking, https://focustaiwan.tw/society/202208080026

If that’s what people mean by “escaping the middle income trap”, then I don’t know what to tell you. At least I’ve never heard any Japanese falling for these human trafficking scams. Heck, some people have been caught running online scams in Cambodia, but the victims are usually other nationalities.

Edit: Nearly 90% of Taiwanese people also want to work overseas, https://www.taiwannews.com.tw/en/news/3857035

Maybe the “middle income trap” is the fate of any nation that cannot enrich itself via exploitation of former colonial possessions or the modern analogue by which the West extracts cheap commodities and labor from the “global south”?

That’s an important question. How can a nation maintain high wealth creation without some form of exploitation? Clearly, given the West’s appetite for dismembering the mid-East and more recently Russia, it’s a real problem for us!

As I read the above reports about corruption and mis-allocation, I recall similar stories of U.S. development, especially recently. Do we have similar-scaled corruption here in the U.S.?

China, and middle- and south-Asia are alive to these problems. The BRI is evidence of China’s long-standing and highly-resourced effort to develop new markets. Every few months, I read about new, major steps being taken, not just by China, but the rest of the key economic players in the area, to expand trade and underlying trade capacity, both physical and financial.

They get it. They know they have a problem, and they’re laying the foundations for solving it. Contrast their strategy with that of the West: subjugation, destruction, and exploitation. Not cooperation. Who’s going to win that contest? See Afghanistan and now Ukraine for clues.

And all the while, during Afghanistan and Ukraine, the pace of BRI and the over- arching political integration didn’t slow down; instead it accelerated.

StO (above) pointed out that quantity has a quality of its own. I’ll add “quality has a quality of its own”. By “quality” I mean “policy” and “governance”.

Mao recognized that you have to mollify the oligarchs while you’re building the new system, or they’ll prevent you from building the new. Putin’s strategy with Russia follows this script.

America’s problem is that we don’t have a countervailing force powerful enough to force the oligarchs to contribute to our long-term welfare. Russia and China do.

That’s the force I see playing the most relevant role in how well China and the rest of Asia does economically. The article above just talks about the effects of policy, not the policy that created those effects, and can’t offer a prediction about the future because the ordinal, independent variables are not yet well-defined…. like governance.

Lastly, the tailing off of the Asian tiger’s economies happened at about the same time China’s mfg apparatus achieved critical mass, and invaded all the same export-goods markets the tigers occupied. That is Japan’s story (the “lost decades”) in a nutshell, and that same force will continue to steal market share from all the other Western-aligned producers in the area, and the world at large.

Governance. Effective coordination of the many to achieve focus and then mastery of key capacities. The China twist: create new markets, and stabilize the trading environment. That’s the story-line I’m following.

Last hit: population and demographics. Automation and the rest of the productivity-enhancing tool set has already over-run the need for new workers. Evidence the flood of “bullshit” jobs and make-work resource mis-allocation in all the advanced economies, esp. the U.S.

China will get the problem sooner and more than the rest of the tigers did during their glory days. Population ain’t their problem. Markets are their problem; the key to markets is first BRI and the like (access), and then it’s _new products_ that meet the needs of the _new markets_ (new demand).

Of course, the U.S. and the West at large has that problem, too, but we’re busy reducing and constraining and destroying our access to markets via our horrible foreign policy.

The thing about China that makes me hold my breath is that demand ends so abruptly. The end of demand is not like the long century it took to become an apex producer with all the high tech and efficiency as well as a relentless marketeer. Seems very threatening to have all that energy and enterprise simply deindustrialize and we literally can see that China has been so successful they now have to manufacture demand. I’d just suggest as usual that the demand they need to cultivate is eco social sustainability. The big antithesis. I’m pretty sure it’s on their agenda but I panic at the thought that we, the planet, won’t get there in time.

Well-said, and totally accurate.

StO, when I say “new products” and “new markets” people think I mean a new toaster, sold in Guatemala instead of in the U.S.

No.

I mean products like decentralized mfg’g of products with very long functional lifespans, made of materials that are (not “can be”) reclaimed at end of lifespan.

I mean products (remember, a production system is a “product”, right? You can order one) that produce nearly all the things necessary to run a household, and produce those goods right near the household they supply.

China may, at the moment, want to produce more cars and ships and computers and motorbikes.

What if they elected to produce cookie-cutter village kits that had a greenhouse, office (for remote work) bldg, radio-telecomm, solar (electric and thermal) plant store / repair facility, child care & school, food warehouse, materials depot and general-purpose CAD-CAM mfg’g facility.

E.g. a design that made “local” work. The “product” is delivered on 20 shipping containers, has a crew that stays 4 months for assembly, training & turnover. Costs several (less than 10) $Million each.

Now design (CAD) and mfg’g can happen almost anywhere. Materials stay put. Transport diminishes rapidly; no commute, materials don’t move, mfg’g is right next to demand. Dig up mat’ls once, use forever.

Most CO2 comes from transport and HVAC. If the village “kit” included a appropriate-tech production unit to mfg’r high-R (insulation performance) building panels, you’ve just addressed two of the biggest factors causing biosphere damage.

Do you think there’d be a market for that in central Asia, or Africa?

So, yes, if China hews to the West’s development pattern, even if they do OK, it’s curtains for the ecosystem, and therefore us. Yes, indeed.

And China seems to have more freedom to innovate than here in the West. They move fast. And they have all that hinterland, sitting there underutilized.

So that’s my version of “radical conservation”.

I wonder whether it helps to look at China like the USA but with allowance for the USA’s “exceptionalism”, viz:

– the USA’s income per capita is flattered by the global dominance it achieved post WW2 when its European imperial competitors were prostrated, having been looted (by the US and/or the Nazis). Articles elsewhere on NC posit the reversion to the historical mean with respect to Chinese and Indian share of global GDP: this doesn’t have to be only through their growth but also through USA’s absolute decline.

– income per capita may matter less than the actual distribution. Even with CCP looting, is it possible that the median or modal income (especially if adjusted for transfers or public provision) in China is better than in the USA?

– the USA “contains multitudes” and one phenomenon is that it is profoundly unequal and large areas of its “red states” have not escaped the middle income trap since WW2 either. I wonder how different coastal China and USA are from each other versus their inland states

– every good analysis of China I have seen has always said that its growth has ultimately been about the urbanisation and incorporation into the labour pool of the rural masses and this was a one-time albeit generational boost. If you view the post-WW2 achievements as a Chinese New Deal, what will be China’s equivalent of the WW2 which vaulted the USA above its competitors?

If the aim is a *description of the total state* (as well as what produces further effects and causes), then HDI is a better indicator than GDP, per capita GDP, or anything else. This captures education, life expectancy, income, and other features (by no means complete).

That is, if you go to the list of HDI growth rates in Wikipedia:

https://en.wikipedia.org/wiki/List_of_countries_by_Human_Development_Index

and rank this by “change in 2015”, China would be on top of the list.

It doesn’t give ‘per capita’ data, but it’s easy to see that China should be higher here since per capital growth only differs from absolute growth relative to population expansion.

Since multiplication is distributive, the thing that alters ‘per capita’ from absolute growth rates is population growth. Given a static population (e.g., 10 people), if each person’s income increases by 50%, so does the entire collective since multiplication is distributive. So the ‘absolute size’ does not affect growth rates per capita (assuming a static population).

One can also think of ‘normalization’: dividing by the initial population rate, or initial HDI index, when measuring any kind of other growth. This is in analogy with mathematical ecology, in which ‘per capita growth rate’ of a population is only meaningful if we divide by the initial population size. Consider a simple exponential growth model: P'(t) = r * P_0, where P_0 is the initial population, r is the per capita growth rate, and P'(t) is the change in population over a time. Here the absolute growth P'(t) is directly proportional to the initial population P_0. If we hold the per capital growth rate as *constant*, then there is a nonzero expected absolute growth.

But this should be extended further: divide the absolute growth rate by the initial HDI, the initial degree of dependence on other countries. The problem with ‘GDP growth’ in smaller countries is that their mode of growth is parasitical and completely dependent on other countries, not based on independently producing the sources of growth. So growth has to divided by the initial level of self-sufficiency (this might be measured by the ‘time it takes to reproduce something domestically’, across different industries).

The larger issue is this: quantitative measurements (like per capita population) don’t aim at describing a total state, such as some final experience to individuals. Rather, a model aims at describing total changes and predicting further changes. One way or another, it depends on which distinctions are ‘larger’ or produce further effects and causes, instead of just being a larger physical distinction. (In this way, producing a larger market and gaining total leverage over supply chains is a ‘larger distinction’ than the individual levels of income or even human development.) This in turn requires dealing with many-dimensionality (e.g., the ‘economic growth’ does not matter, if something else like technological dependence or supply chain dependence falls below a specific threshold). One type of many-dimensionality is produced by relations, e.g. within a mechanism. It does not matter what the ‘standard of living’ is in an aircraft engine compared to the cabin of the aircraft, since one produces the quality that the other is acquiring. Another example of the many-dimensionality issue is about initial vs principal variables: one may describe many different variables and use PCA to find orthogonal components (new principal variables) that reflect the maximum variance in the data.

Others have said us gdp is overstated, so us gdp/capita would be too. Beyond that,

The us model has shifted from the 50’s/60’s mfg with strong exports to financial extraction backed up with gunboats and a reserve currency to maintain a 1T+ import deficit. This worked well as the unipolar bully, but might not do as well if/when we transition to multi. We fomented and continue the Ukraine war as what might be a last gasp to maintain the uni role… will we really pivot to a hot war in China right after a humiliating loss in Europe?

Anyway, China, russia and BRICS might see accelerated growth as belt/road projects develop while the us might see rising inflation as import prices rise. However measured, real us gdp/capita would decline if rising import prices become unaffordable to many and us trade shifts towards balance.

A weaker Europe strengthens us vs Europe, but weakens the west.

I think the so-called “middle-income trap” is actually the natural default outcome of modern capitalism. The burden is to explain the cases of those who don’t seem to be in the trap.

I suspect the main way to avoid the trap is usually through some kind of power-political advantage. That’s a bad outlook for world peace.

Or we can get rid of the capitalism. Nobody has yet figured out a good way to do that, though. If only!

Quite possible. As in that this “trap” is a indicator of market saturation, and that any growth beyond that point will need a massive manipulation of the market to force needless spending.

And there is ways to get rid of capitalism, but the capitalists will not like it. And they either are or have the ear of the most powerful politicians on the planet.

Neither South Korea, nor Taiwan, nor Japan – or for that matter Germany (the “model” for Japan”) nor US (the “model” for Germany) followed neoclassic prescriptions. They had all very active states which goaded capital into the most long-run profitable – or “modern” – businesses for the time. And they all protested vigorously against neoliberal market dictatorship, which according to them only was in the interest of the dominating power.

To actually have a description of how they did it you can try Michael Lind for US, Chalmers Johnson for Japan, and Alice Amsden for the rest.