Lambert here: Cf. Luke 6:20-21.

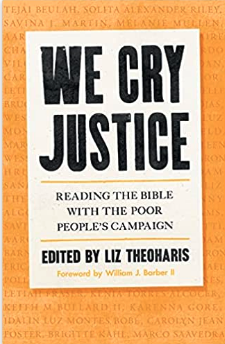

By Liz Theoharis, a theologian, ordained minister, and anti-poverty activist. Co-chair of the Poor People’s Campaign: A National Call for Moral Revival and director of the Kairos Center for Religions, Rights and Social Justice at Union Theological Seminary in New York City, she is the author of Always With Us? What Jesus Really Said About the Poor and We Cry Justice: Reading the Bible with the Poor People’s Campaign. Follow her on Twitter at @liztheo. Originally published at Tom Dispatch.

On the island of Manhattan, where I live, skyscrapers multiply like metal weeds, a vertical invasion of seemingly unstoppable force. For more than a century, they have risen as symbols of wealth and the promise of progress for a city and a nation. In movies and TV shows, those buildings churn with activity, offices full of important people doing work of global significance. The effect is a feeling of economic vitality made real by the sheer scale of the buildings themselves.

In stark contrast to those images of bustling productivity stands an outcropping of tall towers along the southern end of Manhattan’s Central Park. Built in the last 20 years, those ultra-luxury residential complexes make up what is unofficially known as “Billionaires’ Row.” The name is apt, considering that millionaires and billionaires have flocked to those buildings to buy apartments at unimaginably high prices.

In 2021, the penthouse on the 96th floor of 432 Park Avenue was listed at an astonishing $169 million (though its Saudi owner has since slashed the offering price to a mere $130 million). No less astonishing these days, such lavish, sky-high homes often sit empty. Rather than fulfilling any functional role, many serve as nothing more than speculative investments for buyers who hope, one day, to resell them for even higher prices, avoid taxes, or launder dirty money. For some among the super-rich, flush with more money than they know what to do with, Billionaires’ Row is simply an easy place to park their wealth.

Those empty apartments cast a shadow over a city full of people in need of affordable housing and better wages. Reaching from the southern tip of Manhattan into Brooklyn lies the most economically unequal congressional district in the country. To the north, in the Bronx, sprawls the nation’s poorest district. Just last week, the New York Times reported that, based on 2022 census data, “the wealthiest fifth of Manhattanites earned an average household income of $545,549, or more than 53 times as much as the bottom 20 percent, who earned an average of $10,259.”

In New York, where land is a finite resource and real estate determines so much, it is a cruel irony that the richest people in the world are using their capital to literally reach ever higher into the clouds, while back on earth, the average New Yorker, grimly ensconced in reality, lives paycheck to paycheck, navigating a constant storm of food, healthcare, housing, transportation and utility costs.

Abandonment Amid Abundance

Extreme economic inequality, characterized by a small class of the very wealthy and a broad base of poor and low-income people, may be particularly evident in cities like New York, but it’s a fact of life nationwide. In September 2023, the wealth of America’s 748 billionaires rose to $5 trillion, $2.2 trillion more than in 2017, the year the Trump administration passed massive tax changes favoring the rich. The new 2022 census data offers a very different picture of life for the nation’s poor in those same years. In fact, the numbers are eye-popping: between 2021 and 2022 alone, the overall Supplemental Poverty Measure (SPM) rose by nearly 5%, while child poverty doubled in size.

The U.S. Census Bureau uses two measurements of poverty: the Official Poverty Measure (OPM) and that SPM. The OPM, it’s widely agreed, is shamefully feeble and outdated, while the Supplemental Poverty Measure casts a wider net, catching more of the nuances of impoverishment. Still, even that has its limitations, missing millions of people who flutter precariously just above the official threshold of poverty, constantly at risk of falling below it.

That said, the SPM remains a helpful barometer for this country’s attempts to address poverty. Shailly Gupta-Barnes, my colleague at the Kairos Center and a poverty policy expert, observes that, because the “SPM accounts for family income after taxes and transfers…, it shows the antipoverty effects of some of the largest federal support programs.” Considering that, it’s neither an accident, nor a fluke of the market that the SPM just skyrocketed at an historic rate.

The explanation isn’t even complicated. It’s because a number of highly effective Covid-era, anti-poverty programs were callously cut. (No matter that cases of Covid are again on the rise.) When the newest census figures were released in September 2023, Gupta-Barnes explained, “41% of Americans were poor or low-income in 2022, up significantly since 2021, mainly because of the failure to extend and expand tested anti-poverty programs including the child tax credit, stimulus checks, Medicaid expansion and more.”

The take-away from all of this seems clear enough. When the abundant resources of this society are mobilized to tackle poverty, it decreases; when we undermine those efforts, it increases. The more subtle, but equally important take-away: how we measure poverty has massive implications for how we understand human deprivation in our country. As it happens, tens of millions of people who live in regular economic peril are being made invisible by our very tools for measuring poverty. How, then, can we ever hope to address it in its entirety if we can’t even see the people suffering from its iron grip?

The View from the Bottom

In 2022, the official threshold for poverty was $13,590 per year for one person and $27,750 for a family of four — with about 38 million Americans falling below that threshold. That number alone should shock the conscience of a nation as wealthy and developed as ours. But the truth is that, from the beginning, the official poverty line has been based on an arbitrary and shallow understanding of human need.

First formulated in the 1960s, when President Lyndon Johnson’s administration introduced its War on Poverty, the Official Poverty Measure focuses primarily on access to food for its base line and doesn’t fully take into account other critical expenses like health care, housing, and transportation. It is based on an austere assessment of how much is too little for a person to meet all of his or her needs. Because of its inadequacy, millions of Americans badly in need of support have essentially been erased from the political calculus of poverty. More than half a century later, they still remain so, since the OPM has endured not only as a bureaucratic benchmark but as the authoritative reference point for poverty, influencing our conception of who is poor and, on a policy level, who actually qualifies for a range of public programs.

Since the 1960s, much has changed, even if the official poverty line has remained untouched. The food prices on which it’s based have skyrocketed beyond the rate of inflation, alongside a host of other expenses, including housing, gas, utilities, prescription medicine, college tuition, and now essential costs like internet and cell-phone plans.

Meanwhile, over the last four decades, wage growth has essentially stagnated. Since 1973, wages for the majority of workers have risen by just 9%, while actually falling for significant numbers of lower-income people. Productivity, on the other hand, continues to grow almost exponentially. As a result, workers are making comparatively less than their parents did, even though they may produce more for the economy.

This crisis of low pay is no accident. As a start, over the last 50 years, CEOs have taken ever bigger chunks for themselves out of their workers’ paychecks. In 1965, the average CEO made 21 times what his or her workers did. Today, that figure is 344 times more. The reason for such a dramatic polarization of wages and wealth (as so vividly on display in the current UAW strike) is a half-century of neoliberal policy-making intensely antagonistic to the poor and beneficial for the rich.

Over the decades, our economy has been completely reshaped, transforming the kinds of jobs most of us have and the ways we do them. Today, growing parts of our workforce are automated, non-unionized, low-wage, part-time and/or contracted out, often without benefits like health care, paid sick leave, or retirement plans. No one, therefore, should be surprised to learn that such an increasingly stark division of labor and money is accompanied by an unprecedented $17 trillion in personal debt. (And now, with student debt repayments beginning again on October 1st, there is even more needless suffering for those so poor that their economic value is in the negatives.)

In 1995, the National Academy of Sciences recommended the Supplemental Poverty Measure as a new way of assessing poverty and, in 2011, the Census Bureau began to use the SPM. But even that is insufficient. As Gupta-Barnes explains, “Although a broader and preferred measure, the SPM poverty threshold still remains an incomplete estimate of poverty. For instance, according to the SPM, a four-person household with an income of $30,000 is not poor because they fall above the designated poverty threshold. This means that many households living just above the poverty threshold aren’t counted as poor, even though they will have a hard time meeting their basic needs.”

Indeed, right above the 38 million people in official poverty, there are at least 95 million to 105 million living in a state of chronic economic precariousness, just one pay cut, health crisis, or eviction from economic ruin. In other words, today, the low-wage, laid-off, and locked out can’t easily be separated from people of every walk of life who are being economically downsized and dislocated. The old language of social science bears little resemblance to the reality we now face. When the economically “marginalized” are being discussed, it’s all too easy to imagine small bands of people living in the shadows along the edges of society. Unfortunately, the marginalized are now a near-majority of this country.

Poverty Is a Policy Choice

It’s easy to feel overwhelmed, even paralyzed, by such a reality. No one — billionaires aside — is immune from the dread-inducing gravity of the situation this country finds itself in. But here’s the strange thing: deep in the depths of such a monumental mess, it’s possible to discover genuine hope. For if our reality is human-made, as it surely is, then we also have the power to change it.

Ironically, during the pandemic years, before the poverty numbers rose dramatically again in 2022, it was possible to see a notable and noticeable reduction in the numbers of poor Americans exactly because of decisive government action. In 2021, for example, the Child Tax Credit (CTC) and the Children’s Health Insurance Program (CHIP) played leading roles in reducing child poverty to the lowest rates since the SPM was created. The protection and expansion of Medicaid and CHIP also helped mitigate food insecurity and hunger. The research firm KKF estimates that enrollment in those anti-poverty programs rose from “23.3 million to nearly 95 million from February 2020 to the end of March 2023.” And millions of families were able to stay in their homes and fight unlawful evictions during the first couple of years of the pandemic thanks to federal and state eviction moratoriums.

Unfortunately, these pandemic-era programs were sold to us as only temporary, emergency measures, though they were commonsensical policies that advanced the interests of millions of people who had been poor before Covid-19 struck. And unfortunately, alongside Democrats like Joe Manchin and Kyrsten Sinema, congressional Republicans quickly rolled back some of the most striking advances, including letting CTC expire in 2022 (and they continue to advocate for ever greater cuts).

We are now in the midst of what pundits are calling the “great unwinding,” an awkward euphemism for deliberate, brutal reductions to Medicaid expansion in dozens of states. Since April, nearly six million people, including at least 1.2 million children, have been stripped of life-saving Medicaid coverage and estimates suggest that between 15 million and 24 million people may be disenrolled by next spring.

In (harsh) reality, there are at least these two interrelated ways in which poverty is a policy choice. How we choose to define poverty fundamentally shapes how we understand it, while how we govern has enormous consequences for the everyday lives of poor and low-income people. Right now, we’re either getting celebratory messages about the strength of our economy from Democrats or accusatory scapegoating from Republicans. In truth, though, the current bleak reality of poverty is the consequence of decades of neoliberal neglect and animus by both parties.

The pandemic years, sad as they have been, offered a small glimpse of what it would take to confront the needless scourge of poverty in a time of tremendous national wealth. Those investments could have been a first step in launching a full-scale assault on poverty, building off their embryonic success in the pandemic moment.

Instead, the consequences of the rollback of those programs and the threat of yet more cuts brings us to a potential turning point for the nation. Will we continue to condemn tens of millions of us to cruel and unnecessary poverty, while feeding the drive to authoritarianism or even an all-American version of fascism, or will we move swiftly and compassionately to begin lifting the load of poverty and so strengthen the very foundation of our democracy?

I was very pleased by a recent photo of UAW president Shawn Fain wearing a t-shirt with the slogan Eat the Rich. I hope the sentiment catches on.

An interesting and very informative article. I would agree with poverty alleviation programs for the short term, but they would be like sticking one’s fingers in a dike with many holes. The economy needs to be fixed. Growth is 1/2 of what it used to be, the national debt is growing 5-8 times faster than the economy, and inequality is growing by leaps and bounds. But then again, most Americans have been trained to see the poor as lazy, emulate the rich and view government as ineffective.

Good points that I agree with. One thing you might have mentioned is tax policy. Certainly the drop in taxes since the Reagan years has led many to be able to generate dynastic wealth. If Americans believe in any sort of equality among men we should have a very significant level of inheritance taxes so that the children of the rich are no longer rich. We need much higher income taxes and elimination of the huge number of loopholes. I would like a VAT tax which would catch many more people. The root cause here is that our government likes programs because then PMC workers get high paying jobs and can vote democrat. But in the end the lawyers, doctors, psychologists, teachers, insurance companies, health care corporations etc. make good money and the people in poverty stay in poverty using our current distribution system. Tax policy is the root problem causing underfinancing of public services. And this is the same problem we have in Germany. The Asylindustrie is an example.

Thanks for posting this; since my landlord won’t turn the heat on, I am being warmed by my boiling blood.

I like Rev. Theoharris, and the Poor People’s Campaign. However, while I’m sure she wrote for an audience, and it is a solid article, I am becoming a bit tired of reading seemingly endless variations on these introductory facts about American poverty, which unfortunately many educated people are removed from and ignorant of.

Personally, I think it might be more helpful if these explainer pieces would emphasize housing costs as a share of monthly expenses, the degree to which this is a driver of homelessness, and landlordism generally, in order that a progressive policy-oriented approach to tackling poverty might be re-focused, and some basic questions about the legitimacy of rentier extraction could be brought into the arena of debate. Agitation on the issues of poverty and inequality are always welcome, of course!

Thought NYC had rent control in place. What are your suggestions? I decided to take the matter into my own hands and just moved out of NYC. Best decision ever made.

First, congrats on your escape!

My ideal choice for a solution to the contribution by landlords to poverty and homelessness is, unfortunately, prohibited by the fifth amendment (“nor shall private property be taken for public use, without just compensation.”).

I would suggest the building of tenants’ unions to anyone who rents, as a first step, as well as retention of counsel. Beyond these community self-defense mechanisms, and outside of a communist revolution, that the interests of the poor be taken up by “counter-elites”, as Peter Turchin conceives of them (I believe the Rev. Theoharris qualifies) is vital. These folks are the best political representation we (the below 13k/a year crowd) can hope for in a money-dominated legislature.

Seizure of private property using eminent domain has been done many, many times in the United States. There is no practical reason why the cities of New York, San Francisco, Los Angeles, or their own states could not seize enough land to build enough housing. It is on that the wealthy, in the form of developers, owners of rental property, and influential upper middle class homeowners do not want this. Being paid a fair price and having people of the wrong class near you are both un-American for some.

Places such as Vienna and Hong Kong have successfully created practical, affordable, attractive, quality public housing for people in all economic classes except for the very highest or wealthiest. Vienna has been doing this for an entire century. The details as to how this is done differs, but there is absolutely no practical reason that the United States or almost any area within it could not do so as well.

However, corrupt and incompetence prevents this.

I was referring to the “just compensation” part, something feels slimy about paying parasites to detach themselves from the economy. Thank you for providing examples of the mechanisms’ use in other countries, looks like I have some fun reading ahead of me!

I am not sure I would call it fun, but it is interesting. If you do a study of all this, I would suggest also reading about how public housing in the United States was undermined, discredited, and effectively destroyed.

A good example is the Faircloth Amendment or limit. Also funding cuts of places such as Cabrini Green caused their failure. There is also the emphasis on housing support, aside from the mortgage interest deduction, for only the working and poor classes, which ghettoized and stigmatized the efforts. Cramming together the most impoverished into gigantic, isolated projects, unfunded, under-maintained, frequently abusively over-policed or just ignored by the same police, was a political godsend for the anti-housing people. This made cutting funding politically easier to do. The placement of the housing in isolated, often overlarge (for the area) buildings gave the residents little access to transportation, stores, or jobs.

People who do not want public housing of any kind will find many ways and justifications for profitably doing so. What makes public housing successful or at least much, much, much less of a problem in other countries are their avoidance of all of those tactics. Those societies want their society to work for everyone at least somewhat, whereas the upper classes of ours do not.

Rent control in NYC covers only about 16,000 apartments, mostly ones where a person has been living there continuously since 1971. Rent stabilization affects about 1 million apartments.

There have been court cases trying to overturn rent control and stabilization as unconstitutional ‘takings’, although the Supreme Court just refused to hear a recent challenge, so control/stabilization will continue to exist for a while.

And for stabilized units, when they turn over, rents are allowed to be adjusted significantly more than that on controlled units such that most stabilized units have converged on the insane market rate.

You are right about the need to focus on and emphasize housing.

Here’s an article that addresses the issue of Housing First: Social Housing And Housing Justice: Pathways To Housing Decommodification

The article and included links talk about ways to put housing on an equitable footing by placing it outside the market forces of our decrepit capitalist market system. This would be done with socialized housing; see the article, with specific methods and examples, for how that could be done. This is known as decommodification and needs to be done with all goods and services needed for survival: housing, food, transportation, medical care and education through graduate school.

It was always thus. Reading Dickens gives one much information..

The US needed people, and gave land to mostly euro pen people , while imposing Anglo Saxon valuation on nomadic people with no concept of owning land. The spoils of these conflicts were won by the settlers settlers, who would be call invaders today.

Any concept for largess for the poor was an anathema and a poor joke in Georgian (four Georges in succession as Kings ) and the Victorian era and was the accepted way Govern work since William the Concertgoer, if not earlier.

What we are having now appears to be is a reversion to to mean, the way rule was administered for centuries.

That is a society reverting to the history, as was practiced by the Rulers in Britain before the redeeming steps implementer by Queen Victoria spouse, a German Prince, Albert who initiated the changes in British Society, which provided a path to later reformers, despite his early death by an unknown illness.

Albert led a redemption in a society where the mean was “Crush the Peasants” – the Lower Class, the. Working Class.

I second this, and also would add on Brecht. St. Joan of the stockyards, for instance, comes to mind.

Hmmm . . . . so “America” is an “Israel” which succeeded. And so is “Canada” and “Brazil” and “Australia” and so on and so forth . . .

Well, yes and no. While Canada, Australia and Brazil displaced/killed indigenous peoples (natives) perpetrated by Anglo/Europeans hundreds of years ago, Israel was created out of whole Palestinian cloth in 1947. It kills/displaces Palestinians to this day.

Australia is still killing, incarcerating and suppresing its indigenous peoples to this day.

And how exactly was it that Manchin and Sinema got into the position to do this? The “evil Republicans” bs grows thin: yes the Republicans are evil, so are the Democrat.

So, if you’re not bi-partisan in your condemnations, they ring hollow.

Trump politically purchased tax largess to his class with an EU style Social Welfare State Biden and the Democrats have now dismantled: the tax giveaway survives. Tis a puzzlement why the plebes fail to be gruntled…

Trump takes a lot of heat for cutting taxes. However, he got rid of the state and local federal tax deduction and raised the standard deduction. He stuck it to the “Joe Biden” middle class two attorney or attorney/neurosurgeon couples living in million dollar houses in high tax states like New York and New Jersey. He did not stick it to the lower classes who were real middle class and below. He stuck it to the PMC. No wonder they hate him. The cuts expire next year and I think that is one reason the dems are so concerned about this coming election. Their PMC constituents are salivating as they think about getting their SALT deduction back. I always viewed eliminating the SALT deduction as a very liberal and fair move. Why should the poor be subsidizing some PMC’s house in the Hamptons? And if Americans cared about the poor they would not vote as they do.

The Trump tax cuts started to expire last year for everybody making less than $70,000, which is about 70% of the population in my state. They will have expired fully for those households in 1927, while all his tax cuts for the >$70K crowd will remain in place. The GOP made sure under Trump to keep the wealth flowing ever upward.

To blame tax cuts for the inequality is myopic.

What do you blame inequality on?

I was going to ask, who did that?

However, since tax cuts and more war are all the duopoly agrees on, when all else is gone, these will remain.

Neither particularly help the poor.

Deindustrialization has been a huge driver on inequality for people who don’t have a college education. They were shifted into the service sector with lower pay, lower benefits and no pension. Companies just loved deindustrialization, they only had to pay about 5% of what they paid in the states, they had strong bargaining power for taxes, subsidies an regulations. The share of the PMC and stock owners went way up.

Loopholes, handouts to the rich/crony capitalism, unfair monopolies, etc. Bezos has paid 0 in federal income taxes for crying out loud. The tax rate is meaningless when the ultrarich make their money via untaxed capital gains

The work of Michael Hudson has been of great importance to Rev.Theoharis. In her view, the message of Christianity has been perturbed to say that the poor will always be with us and Christians should respond with charity. What she sees in the Bible is that piety can not be separated from economics. For her elimination of poverty by debt forgiveness, giving without the intention of getting anything back are expressed in Deuteronomy 15 and part of the core of Christianity.

This is a fascinating link where Hudson gives a speech at the Union Theological Seminary gathering where Rev. Theoharis is a participant in the discussion.

https://michael-hudson.com/2017/01/the-land-belongs-to-god/

Our present government gathered together some of the big chain grocery store executives in our country and asked them to stabilize their prices. However, I read an article that claimed most big grocery store chains are on another track altogether. See here

I wrote a letter to the President & Chief Executive Officer of EmpireCorp and suggested that he re-consider where this excessive profit should go:

“Maybe the stakeholders and employees deserve consideration rather than the well-off CEOs and shareholders.” This was in reference to the $1 Billion profit Sobey’s made by buying back their shares over three years.

I always enjoyed shopping at Sobey’s but the bloom is off the rose now.

The MMT story is that all money is created by government and must be taxed back to prevent inflation and enable the cycle to continue. But inevitably, some gets syphoned into pools of wealth, expressed as savings. This is not to suggest all savings are bad – the question is whether accumulated capital is being put to productive or speculative use.

Expressed as an equation, government spending equals the sum of cash (and equivalents) and savings, ie, the sum of non-interest-bearing money (cash) and interest-bearing money (bonds).

It’s not rocket science to see there is a problem when more and more money is syphoned and then protected from taxation. Even more when FED policy is to increase the bank rate to protect savings (does anyone really believe it’s to control inflation?) while people without savings are pummelled, especially in a financialized economy.

COVID programs showed that fiscal policy can strongly address poverty but if all the money flows to the wealthy who are then sent 5% wealthfare cheques while help to the poor is temporary and stopped, then we are where we are.

The system is rigged and is rotten to the core.

After having to witness plenty of endtime fanatics bay for the total annihilation of palestine and war with Iran and what have you in various comment sections of YouTube today, it’s quite nice to see this representative of the other side of american christianity as well.

A few solutions: mandate that half the profits earned by corporations with more than 1000 employees must go to employees. Since “average weekly earnings” for nonsupervisory workers were higher in 1969, and Real GDP per capita has gone up by 153%, the additional money went to owners, stockholders, CEOs and top management. The majority have been dropped off a cliff. Raise the minimum wage to over $21/hour for these largest corporations. Increase the highest personal income tax rate to the 1952 to 1960 level, about 92% on income above $4 million. Pass a stiff wealth tax on holdings above $20 million. Build additional public housing. Expand the earned income tax credit. Create a lot of public jobs to build a green energy transition. The economy isn’t going to fall apart if workers receive their just rewards. Economics without greed, part two — my blog — http://benL88.blogspot.com