Before I begin this article, a caveat. Cuba is one of the countries in Latin America with which I am least familiar, having regrettably never visited the country nor had much contact with it. It is also a country with a complex history that is going through a very painful economic transition that is certainly not helped by the US’ ongoing 61-year embargo. But this story is, I believe, one that needs telling, particularly in light of the broad global trend of governments and central banks seeking to undermine or even eliminate cash as a means of payment and replace it with far more traceable digital forms, including CBDCs.

“Money is the oil fueling the economy’s engine. If the amount of oil needed is not supplied, it breaks down.”

At the beginning of this year, as readers may recall, the Central Bank of Nigeria (CBN) took a series of drastic measures to restrict access to cash in a desperate bid to boost cashless payments, in particular its floundering central bank digital currency (CBDC), the eNaira, among other objectives. As with India’s brush with demonetisation in 2016, the result was widespread chaos and economic pain — in a country where 63% of the population was already poor and 33% unemployed. The lives, jobs and businesses of untold numbers of people were upended. Economic growth spluttered and inflation surged to an 18-year high.

In March, the central bank finally suspended the monetary experiment, but only at the dogged insistence of Nigeria’s Supreme Court. Weeks later, the central bank’s governor, Godwin Emefiele, was suspended from office by the country’s newly elected President Bola Tinubuand and taken into custody by Nigeria’s secret police. He now faces 20 criminal charges including misappropriation of funds. Even more embarrassing, the CBN, now under new management, just released a report warning that the eNaira — one of the main reasons for the CBN’s demonetisation program — could represent a threat to financial stability.

Now, it looks as if the Cuban government wants to take a leaf out of Nigeria’s playbook. At the end of this month (October 2023), cash will no longer be accepted at any gas stations in the country, reports Agencia Cubana de Noticias, the government’s official state news agency:

With the incorporation of the provinces of Havana, Matanzas, Villa Clara, Ciego de Avila, Camagüey and Holguin to the schedule for the elimination of cash in the sale of fuel in gas stations, this process, which began on September 1, will conclude on October 31.

The Cimex S.A. Corporation, in charge of fuel commercialization in Cuba, published today on Facebook the dates scheduled for each of the establishments in the referred provinces, so that throughout the country will be used exclusively electronic means of payment for the purchase of fuel.

Instead of cash, citizens and businesses will be able to use “chip cards [that] have been implemented for the state and non-state sector, magnetic stripe cards (national and international), disposable prepaid cards with six denominations (25, 75, 125, 250, 500 and 1,250 pesos in national currency), electronic pins through the Transfermovil payment gateway, and the rechargeable chip card.”

Local and Foreign Currency Shortages

Unlike in Nigeria, Cuba was already suffering from an acute shortage of both local and foreign currency well before the government’s introduction, in early August, of measures aimed at promoting electronic forms of payment, increasing access to formal banking services and restricting the use of cash. In May, the island’s Minister of Economy and Planning Alejandro Gil acknowledged that there was a lack of paper money, because “the level of demand is great and the capacity we have to introduce new paper money does not satisfy the demand.”

He also remarked that physical notes are expensive to print, issue, store and process, adding that Cuba “must invest in the banking of transactions, because we gain in transparency, security and control, and operations can be monitored for the issue of taxes.” And a whole lot else, of course, which is ultimately one of the main selling points of the cashless economy for governments around the world, particularly those that are rapidly losing control of their restive populaces.

On August 2, the Cuban government passed a raft of measures banning state and private businesses — yes, they do exist in the country — from using ATMs and placing a 5,000 peso (around $20) on cash withdrawals, among other things. As in Nigeria, they are making an already difficult economic panorama a whole lot worse, particularly for many of the recently established small or micro businesses. From Havana Times:

When the Cuban Government announced in early August that it was taking a leap towards electronic payment systems and a “cash-free” society, red flags began to appear for emerging small businesses on the Caribbean Island, Reuters news agency reports.

The most alarming thing for many budding business owners was the 5000-peso maximum daily withdrawal limit, approximately 20 USD, for businesses, a measure that the Government said was intended to steer Cubans towards digital transactions, by bank transfer, online payments and bank cards.

These changes were necessary to stop cash shortages, officials at the Cuban Central Bank said, while the rapid drop in the peso’s value and prices increasing also contributed to draining bank reserves and ATMs.

Big Obstacles

What the Cuban government is essentially doing is refusing to provide the cash the economy needs to function — and what’s more, at a time of surging demand for cash. While encouraging the adoption of electronic payments and access to formal banking services are both admirable goals, what the government seems to believe is that “it can force banking services on its population and implement a digital payment system in just six months,” notes a recent article by Cuba Horizontes, an initiative of the Colombia Law School’s Cuba Capacity Building Project:

It expects this to happen in a country with one of the most backward telecommunication infrastructures, and with one of the most underdeveloped banking and payment systems in the region, and with an elderly society.

Not only do they seem to ignore that advances in banking services and digital payments would take years, or decades, but also that public trust is an essential element for success.

This was a lesson learned in the hardest imaginable way during Nigeria’s recent experiment with demonetisation. As I reported in June, the hugely destructive experiment did irreparable damage to public trust in the country’s central bank and banking system, which is ironic given that lack of trust is one of the biggest obstacles to public adoption of the country’s floundering central bank digital currency (CBDC), the e-Naira.

In Cuba, public trust is also a major issue. When the central bank first announced limits on daily and monthly money transfers earlier this year, many people decided it was better to keep their money under the mattress. According to the news website El Toque, the reduced hours of the banks (9:00 am to 3:00 pm), the acute shortage of ATMs (100 of the countries 168 do not have any) forced many to withdraw the money at once and have kept it at home since.

As in Nigeria, the more difficulties Cubans face in accessing their own funds, the less likely they are to trust the banking system. A similar thing is happening with many private businesses, reports Havana Times:

Even before these new restrictions, Cuban business owners were facing what might seem unsurmountable obstacles, such as blackouts and Internet cuts, fuel shortages and no legal way to change large sums of local currency into USD, which are needed to import merchandise from abroad.

[One business owner] says that three days after the rules were implemented the bad news came: many suppliers began to announce that they weren’t accepting bank transfers, only cash from now on because they were afraid they’d lose access to the paper cash they needed to operate, the exact opposite of what the law wants to do.

Cuba is currently in its worst economic crisis since the “Periodo Especial” of the 1990s, which began at the beginning of the decade with the dissolution of the Soviet Union, the country’s sugar daddy (consistently accounting for around 70% of all trade, including, crucially, oil and gas), and continued until the end of the decade when Hugo Chavez’s oil-rich Venezuela emerged as Cuba’s primary trading partner and diplomatic ally.

The latest crisis comes after two and a half years of sweeping economic reforms. On January 1, 2021, Miguel Díaz-Canel’s government declared monetary unification. From that date on the convertible peso, or CUC was no longer accepted as currency, though it could be exchanged for the Cuban Peso, or CUP, any time before the end of 2021. The CUC had been in limited use since 1994, when its value was pegged 1:1 to the US dollar.

The Diaz-Canal government also began allowing Cuban citizens to incorporate small and medium-sized businesses with up to 100 employees. The move came 11 years after Raúl Castro passed a reform allowing the self-employed working in 83 different job classes to hire staff other than relatives. As Al Jazeera noted in July, “the private sector is roaring back, bringing with it more productivity but also more inequality to the island nation.” More than 8,000 SMEs have been registered since the 2021 reforms.

But the country has also suffered a collapse in its currency, a huge surge in prices of just about everything, acute shortages of food, fuel and medicine, and constant power blackouts. Although the economy grew by 1.8% in the first half of the year, it remains 8 percentage points below where it was in 2019, before the pandemic. One of the reasons for this is the collapse of tourism, its second biggest source of foreign exchange (the first being remittances), since the COVID-19 pandemic.

61 Years of Economic Siege

Of course, a lot of Cuba’s economic woes can be pinned on the United States’ 61-year embargo of Cuba’s economy, which was first launched by John F Kennedy in 1962, has been supported by every US government since and was intensified by the Trump administration in 2020. From Jacobin:

The economic effects of the more-than-sixty-years-long embargo on Cuba alone are devastating. By one count, they have cost Cuba more than $130 billion. Not only does Cuba’s neighbor to the north, the largest economy in the world, refuse to do business with Cuba, but the United States also freezes Cuba out of systems of global commerce and trade via its influence in and control over international banking and financial networks.

In 1960, a US official spelled out in a memorandum that the purpose of US policy regarding Cuba was “to weaken the economic life of Cuba . . . [to deny] money and supplies to Cuba, to decrease monetary and real wages, to bring about hunger, desperation and overthrow of government.” Government overthrow has not been forthcoming, but everything else has been a stunning success. Cuba now serves as an example to the globe of what happens when you refuse to follow Washington’s orders.

If the sanctions weren’t bad enough, add in COVID-19, a disaster at the island’s largest fuel depot in Matanzas, and the redesignation of Cuba as a state sponsor of terrorism (SSoT)) by Donald Trump’s administration on the way out the door — along with the introduction of twenty-two additional restrictive measures, all upheld and continued under Joe Biden — and you’re left with a full-blown crisis on the island. The hurdles Cuba faces in procuring even the simplest humanitarian supplies — such as needles and syringes to vaccinate their population with any of Cuba’s five self-created COVID vaccines — often prove insurmountable in the immediate term.

In 2022, 185 nations voted to condemn the economic embargo for the 30th year. Just two countries, the US and Israel, voted against and another two, Brazil, then under the yolk of Bolsonaro, and Ukraine, abstained.

Galloping Inflation

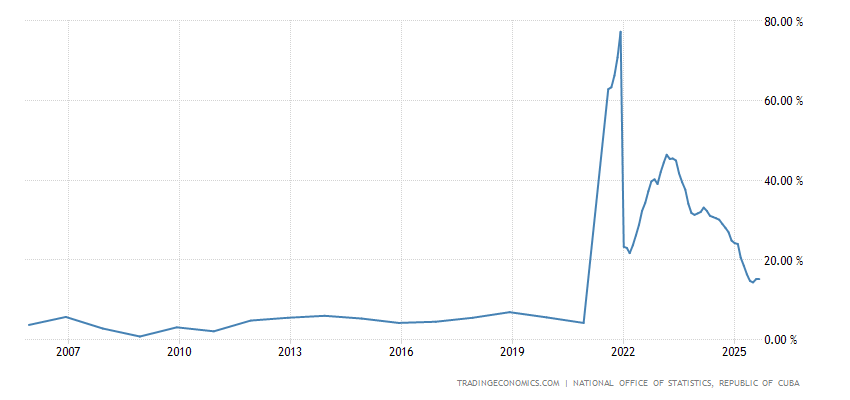

Cuba is now suffering from galloping inflation, with the consumer price index currently at just over 40%. Food inflation is almost double that, at around 70%. In 2021, inflation reached an all-time high of 77%. From Trading Economics:

The real inflation figures are actually significantly higher than the official numbers, according to some sources. As Cuban economist Pedro Monreal notes, the problem is not just inflation but also the fact that consumer prices are rising much faster than salaries and pensions.

In May, the island’s Minister of Economy and Planning, Alejandro Gil, described inflation as the most complex problem the country faces. The higher it rises, the more cash the economy needs. And the more cash the economy needs, the higher inflation rises. To try to break this cycle, the government is determined to bring cash back into the banking system by dragging the country through decades’ worth of financial and technological development in the short space of half a year. The results are unlikely to be positive, notes Horizonte Cubano:

Money is the oil fueling the economy’s engine. If the amount of oil needed is not supplied, it breaks down… Forcing the use of banking services by its population and the digital payment system, as proposed by Cuba’s Central Bank, is highly recessionary.

Oh i think blaming Trump for intensifying it is cheap. Was there not a bill introduced back in the 90s that basically forbade any company trading with USA to trade with Cuba?

Enforcement of that particular bill was officially waived every couple of years, but Trump chose to enforce it and ended the waiver.

True: We can’t blame any one person for the policy, it is decades-long. (unilateral sanctions are an act of war, and makes a mockery of intl law).

DT did tighten the noose, but JB said no changes in policy, so there we are.

Same for Iran, Venezuela etc. The policies seldom change over different US regimes

One part I may have to take a contrarian view about. In it, after describing the conditions that Cuba is forced to deal with because of the US sanctions, it says the following-

‘Cuba now serves as an example to the globe of what happens when you refuse to follow Washington’s orders.’

I would contend that if Cuba buckled under and let the US back in to run things once again, that conditions for the majority of Cubans would be far worse. You would have all those Cuban-Americans come back in from Florida to seize land and property based on sixty year-old dodgy documents, the mafia may move back in like the good old days with the hookers & casinos and US corporations would would buy stuff up on the cheap and shut down any industries so that they could not compete with US businesses. When Castro was sick some time before he died, US officials were talking about bulldozing central Havana and building ritzy malls, hotels, etc. there instead and pushing the poor people out. But then Castro got better, dagnabit.

Sorry to see that the only objection to cashless societies is that so far they have not worked, meaning that such attempts have resulted in econmic chaos. That is not a good reason to oppose a cashless system, since theoretically such kinks could be worked out. A better reason to oppose such a system is the preservation of democracy. A centraized cashless electronic monetary system would have many advantages — in a just world. But this is not a just world, and the danger of allowing a government to gain such powerful control over individual financial activity is monumental. With a flick of a button, you can be shut down, made totally helpless, have no money to buy food, shelter or travel. If you are not a “good citizen” you can be disciplined by having your funds blocked. Your bank deposits could be charged negative interest without the option to withdraw your money and place it elsewhere. You could be prevented from buying “undesirable” or “unapproved” products or buying airline tickets to unapproved places or supporting unapproved people or causes by the simple expedient of making expensitures for such purposes electronically undoable. Of all the possible tools of government tyranny, an elecronic cashless society under government control might be the worst.

Very well said. Totally agree. Pointing out that the cbdc systems don’t work well yet or are being introduced with incompetence misses the biggest point.

I’m surprised that cuba is doing this. it makes the economy extremely reliant on stable electricity which can be sabotaged. Physical cash is so much more resilient than 100% electricity and internet connectivity dependence.

Why would Cuba decide this is worth it? Is social control really worth the risk for them? With the US showing decades of willingness to sabotage their economy it seems super risky.

“It makes the economy extremely reliant on stable electricity which can be sabotaged.”

And it’s not just sabotage. Hurricanes blow through Cuba with alarming regularity. Even though the Cubans do very well at avoid loss of life during such events, it’s not at all uncommon for power to be out for days in areas that are hit hard by the storm.

Unless you keep skads of cash in a “mattress”, this potential alreay exists and the “patriot act” made it even worse for US citizens. If the government targets you for any reason, they can freeze your assets on some pretext. Most of us who have financial assets have them stored electronically. I keep enough cash to get me through an emergency that lasts maybe a month or so, the rest in investments/interest bearing accounts. Only the very wealthy can afford to keep enough cash to matter hidden away.

Thanks, I get almost no news of cuba and cubans. CBDC seems like a really bad idea to me but I guess it’s nice to have some smaller economies give it a try…proxy war cbdc edition I guess, but I’m just another ugly american…

Perhaps applying a cashless tracking system to fossil fuels in order to track CO2 emissions, and to eventually provide tools for the state to limit personal emissions, might make sense in a world facing climate chaos. However, this seems to be primarily a short term policy that Cuba was forced into — a lesser evil economic choice forced on them by US sanctions.

Thanks for this post. Offering context, in this case the broader cost and impact of the US decades-old embargo (which includes sanctions to foreign companies trading and / or investing in Cuba, most recently Mexican PEMEX) is very relevant to a clear understanding of this crisis. The Trump administration didn’t start these policies, but they made the sanctions tighter and broader. There is no questions that the Cuban economy and more generally, Cuban society can’t function normally while these sanctions are in place. However, the current government lacks creativity and has been extremely ineffective in dealing with the recently more aggressive US policies towards Cuba. The issues here are beyond what I can try to add in one comment, because of the complexity and the historical roots of these problems.

The economic measures announced by the current Cuban government, some of which were formulated and published more than a decade ago (as part of a document known as the “Lineamientos”) have been badly implemented, if at all. The best example of this wrongheaded and clumsy implementation was the elimination of the CUC (a sort of convertible Cuban peso brought into the economy during the 1990s crisis, which was very effective as a store of value and, for over a decade, enjoyed a relatively stable exchange rate with the USD).

The disappearance of the CUC has turned the USD and the Euro into the de facto currencies to keep, buy and sell anything of value. The changes from the top have been extremely slow, partial, and timid and fall short of the Cuban population expectations and needs. The migration of Cubans towards the USA, via Central America and Mexico has been in the order of hundreds of thousands during the last couple of years. Hundreds of Cubans are showing up regularly, every day, at the Southern US border.

Inflation in Cuba is totally out of control (I have suffered it firsthand earlier this year) and the government does not seem prepared to do something effective to try to control it. People in Cuba are suffering, badly, and this is particularly bad for the elderly and those earning the insufficient government wages. My guess is that this move towards electronic forms of payment is both a government impulse to try to control the enormous amounts of hard currency moving outside of the banking system (which is obvious among other things, in the thriving black market for currency exchange), and a decision taken because the state simply doesn’t have enough resources to even print new bills.

My personal experiences in Cuba: In 2009 I travelled around Eastern Cuba for 3 weeks, staying in Holguin, Camaguay, Bayamo, Trinidad and Santiago. I hired people to speak Spanish to me for a week in each of Holguin and Camaguay. The stores were full, everything I could buy in Canada I could get there, flat screen TVs, kitchen appliances, clothing, food, etc. The choice for consumer goods was limited, usually only one international brand name per item but they were available. Travelling around by bus was easy. People who had access to foreign currency lived well, others much less so but basics were available to all: food and services such as healthcare and childcare. Went back a few years later and everything was much the same. The people were very welcoming and friendly.

Then Covid hit.The tourist industry collapsed and foreign currency dried up. Tourism is the country’s main export.The price of diesel fuel also rose a lot making travel more difficult and unreliable. I have since been back a few times, to resorts only, and am told stores are nearly empty, including for many foodstuffs, and prices are way up. Life has become very difficult and as DJForestree reports many people have emigrated to the US. With the end of Covid restrictions tourism has recovered a fair bit so hopefully living conditions will improve.

Interestingly Alexander Mercouris reported a few months ago that Russia plans on making large investments in Cuba, in part to make it a distribution centre for their exports to Latin America.