It’s too easy to be a victim of confirmation bias. And your humble blogger generally steers clear of forecasting since the pros aren’t very good at it. But it nevertheless is noteworthy that Bloomberg is now warning a recession could hit as early as the fourth quarter, and one of the warning signs is one we’ve been calling out, too much complacency.

That bias particularly afflicts the Fed. In the US, as we pointed out early in the current tightening cycle, the Fed has assigned itself the job of tackling this inflation using the blunt instrument of interest rates to kill wage growth. We and others pointed out that this inflation was not created by excessive demand but by supply side issues, some caused by Covid (such as new car production due to chip shortages), then an energy crunch due to sanctions blowback, then labor shortages. The tight labor market has persisted, but headline inflation got a break due to energy prices falling…which has now gone into reverse, with oil analysts debating whether they will breach $100 a barrel.

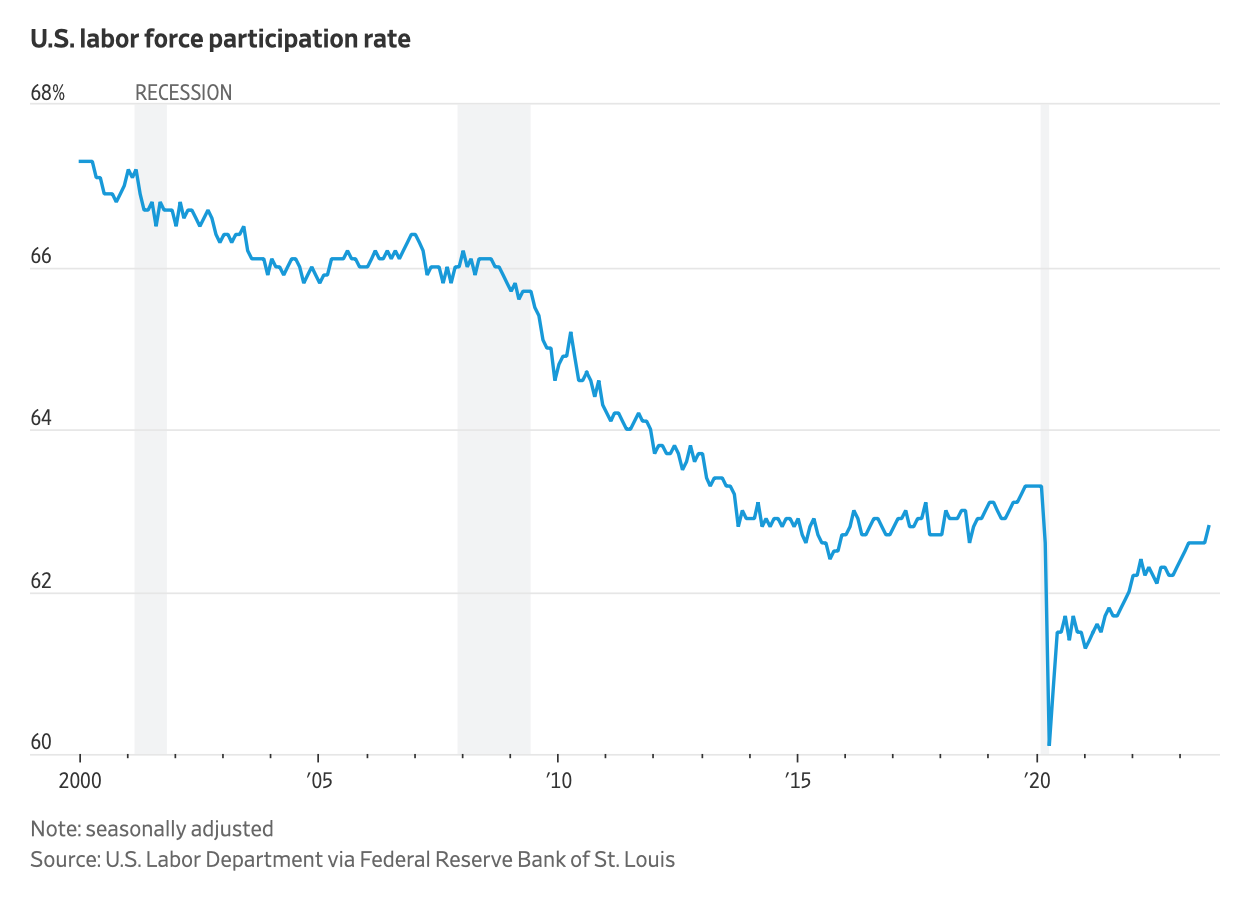

We had warned that the Fed would have to kill the economy in order to increase unemployment, which is how the Fed thinks it regulates overall prices. It seems difficult to accept the widely-touted claim that the boomers retiring is the reason for the low unemployment rate give that prime-age labor force participation is still low-ish by historical norm. You would expect retiring boomers to be offset as much as possible by high emplooyment rates among the prime-aged cohort, but we aren’t seeing that. From the Wall Street Journal:

At a minimum, this pattern suggests that Long Covid has at least something to do with the conundrum of prime age workers not take up the supposed opportunities presented by strong demand for labor. I’ve heard other claim that some two-earner households learned how to get by with one during Covid and decided they want to continue. That is even harder to verify.

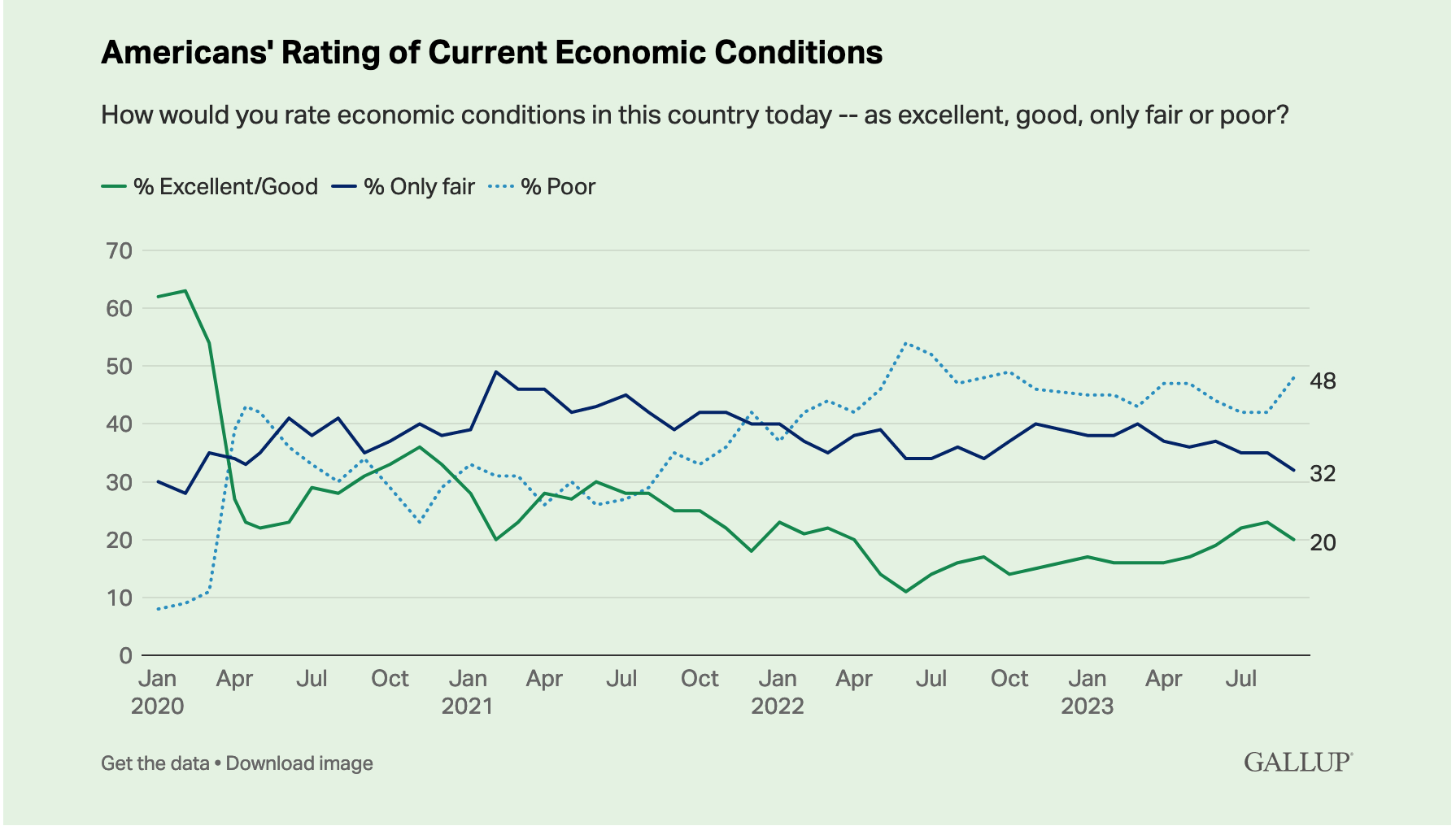

But on the other side of the equation, there is a lot of anecdata confirming the idea that consumers see their personal inflation rate as way higher than what the Fed believes, particularly with recent sightings of big increases in auto and other types of insurance. And this comes after all sorts of surveys show how cash-strapped most Americans are, and that that situation has gotten generally worse since all the Covid special relief programs were phased out. Mind you, most of you have an idea of this general picture, that few Americans are happy with economic conditions in the US:

Even with Team Dem pulling out all stops to stop Trump, that slide does not bode well for Biden’s and Democratic Congresscritters’ prospects for 2024. And that’s before getting to the fact that the US could see bona fide stagflation if growth falters. Bloomberg has a new piece that argues that a recession is pretty probable. I have been saying for a while that econpundits have already been unconsciously signaling that they expect things to go pear shaped. The last time I heard so much talk of a Goldilocks economy was 2007.

And the Bloomberg piece starts with a similar observation:

When everyone expects a soft landing, brace for impact….

A last-minute deal to avoid a government shutdown kicks one immediate risk a little further into the future. But a major auto strike, the resumption of student-loan repayments, and a shutdown that may yet come back after the stop-gap spending deal lapses, could easily shave a percentage point off GDP growth in the fourth quarter.

Soft Landing Calls Always Precede Recessions…

…And Fed Hikes Are About to Bite Hard…

For the parts of the economy that matter for making the recession call — above all the labor market — lags are longer, typically 18 to 24 months.

That means the full force of the Fed’s hikes…won’t be felt until the end of this year or early 2024….

A Downturn Is Hiding in Plain Sight in the Forecasts…

…And That’s Before These Shocks Hit

That assessment is mostly based on forecasts delivered over the past few weeks — which might not capture some new threats that are threatening to knock the economy off course. Among them:

- Auto Strike: …. The industry’s long supply chains means stoppages can have an outsize impact. In 1998, a 54-day strike of 9,200 workers at GM triggered a 150,000 drop in employment.

- Student Bills: Millions of Americans will start getting student-loan bills again this month, after the 3 1/2-year pandemic freeze expired. The resumption of payments could shave off another 0.2-0.3% from annualized growth in the fourth quarter.

- Oil Spike: A surge in crude prices — hitting every household in the pocket book — is one of the handful of truly reliable indicators that a downturn is coming. Oil prices have climbed nearly $25 from their summer lows, pushing above $95 a barrel.

- Yield Curve: A September selloff pushed the yield on 10-year Treasuries to a 16-year high of 4.6%. Higher-for-longer borrowing costs have already tipped equity markets into decline. They could also put the housing recovery at risk and deter companies from investing.

- Global Slump: The rest of the world could drag the US down. The second-biggest economy, China, is mired in a real-estate crisis. In the euro area, lending is contracting at a faster pace than in the nadir of the sovereign debt crisis — a sign that already-stagnant growth is set to move lower.

- Government Shutdown: A 45-day deal to keep the government open has kicked one risk from October into November – a point where it could end up doing more damage….

…And the Credit Squeeze Is Just Getting Started

On the bank side, a lot of shoes could drop. The Bloomberg describes how banks are getting more stringent about commercial and industrial lending. We also have a world of hurt in many sectors of commercial real estate, starting with big city office space. In fairness, many of those loans wound up held by investors, either directly by buying commercial real estate securitizations or investing in private equity credit that hold commercial real estate debt, typically along with private equity debt. But if a few not-small bank were hit with enough losses on commercial real estate loans, it could generate deposit flight and/or counterparties for short term loans limiting exposures.

More generally, it’s an open secret that regulators are engaging in a lot of forbearance by not forcing bank to do much in the way of recognizing the impact of mark to market losses by letting them treat the loans as “hold to maturity.” And that is not crazy if the banks really can leave these holdings be until the Fed decides to ease in a meaningful way. But the longer the central bank stays bloodyminded, the more the odds increase that bank will need to offload some of these holdings at a loss because liquidity needs.

Bloomberg points out that China’s growth weakening is part of the picture. Keep in mind, as we explained long form in Emerging Economies Face Prospect of Worse Than 1970s-1980s Wave of Financial Crises, that there is a ticking debt bomb there that looks set to go off. Developing economies wind up suffering in Fed tightening cycles because they see a hot money exodus, a domestic credit drought, and currency weakness if they don’t increase interest rates. But the higher rates choke domestic activity.

Remember that a emerging economy debt crisis will impair advanced economy lenders too. Lehman almost failed in the 1997 Asian crisis, and the collapse of LTCM threatened to kick off a bigger conflagration.

So the China slowdown matters, not just in and of itself but also for its knock-on effects to developing economies, particularly its neighbors in Southeast Asia. China hawks may be a bit too chuffed that US sanctions and Collective West decoupling/derisking might have something to do with that. From the Financial Times Asia faces one of worst economic outlooks in half a century, World Bank warns:

China’s policymakers have already set one of the lowest growth targets in decades for 2023, of about 5 per cent.

Citing a string of weak indicators for the world’s second-biggest economy, the World Bank said it now expected China’s economic output would grow 4.4 per cent in 2024, down from the 4.8 per cent it expected in April.

It also downgraded its 2024 forecast for gross domestic product growth for developing economies in east Asia and the Pacific, which includes China, to 4.5 per cent, from a prediction in April of 4.8 per cent and trailing the 5 per cent rate expected this year….

Softer global demand is taking its toll. Goods exports are down more than 20 per cent in Indonesia and Malaysia, and more than 10 per cent in China and Vietnam compared with the second quarter of 2022. Rising household, corporate and government debt has further dented growth prospects.

The worsening forecasts also reflect that much of the region — not just China — is starting to be hit by new US industrial and trade policies under the Inflation Reduction Act and the Chips and Science Act.

For years, US-China trade tensions and tariffs imposed on Beijing by Washington benefited south-east Asia, driving demand for imports towards other countries in the region, especially Vietnam.

But the introduction of the IRA and Chips laws in 2022 — policies designed to boost US manufacturing and cut American dependence on China — has hit south-east Asian countries. Their exports of affected products to the US have fallen.

China fans try to put this in context:

Interesting: despite all the talk about China's economy, the latest World Bank report on East Asia and the Pacific clearly shows that since the beginning of the Covid crisis, China has remained the fastest growing economy in the region, with a GDP 20% higher than before Covid. pic.twitter.com/1tBVYmyyZu

— Arnaud Bertrand (@RnaudBertrand) October 2, 2023

But even so, it is China that cut its growth estimate. And it looks as if China getting a cold might lead to pneumonia in some of its key trade partners.

Mind you, none of the things under discussion are more than negative tendencies. But they bear watching, particularly given too many still over-inflated asset prices and dysfunctional elites.

29 comments

If indeed inflation was due to covid and supply issues, why aren’t prices coming down now that those supply chains have been fixed and covid is not what it used to be?

Used car prices have most assuredly fallen. I was similarly hearing with new Toyotas you could not test drive them, you had to buy whatever came in and pay $2,000 over the list price. Home prices have fallen. Lumber prices are down. Aluminum prices are down. Copper prices are down but not dramatically. Prices for most consumer electronics are down.

headline/CPI used car prices (ie, 2 year old cars off-lease) may have fallen, but combined with higher interest rates, absolutely no way ( IMO) has disinflation or deflation hit the bottom half of used cars.

I have no idea how the bottom 33% can find affordable car transport: between finding a decent used car under $10k, auto repair costs, insurance, gas, tires…..absolutely no way the bottom 33% is better off with respect to car transport costs. in my opinion

The issue was which prices have fallen relative to Covid levels, as in supply chain shortage unwind related. New car prices went up and they were scarce due to chip shortages and sold with some features missing, a de facto even bigger price increase. That pushed some buyers into the used car market. That has indeed unwound, which does not mean that over a longer time frame prices are not still high.

See:

https://www.newsweek.com/used-car-market-forecast-prices-fall-1812749

https://wolfstreet.com/2022/09/10/buyers-strike-takes-effect-used-car-auction-prices-plunge-but-still-sky-high-up-nearly-50-from-three-years-ago/

Used Car Prices Continue To Fall — Is It Worth Waiting?

https://www.gobankingrates.com/saving-money/car/used-car-prices-2023-costs-falling-now-time-to-buy/

See re new car prices:

New Car Market: Prices Are About To Plummet — Is Now the Right Time To Buy?

https://finance.yahoo.com/news/car-market-prices-plummet-due-153706713.html

Home prices have fallen?

I still see bidding wars on the very little inventory we have here in SoCal and all time high prices.

https://www.calculatedriskblog.com/2023/10/ice-black-knight-mortgage-monitor-home.html

Here in Tampa Bay home prices are falling precipitously in a stalled market where very little inventory is moving. I just sold my home for well below original listing price. Similar home (4/3) in my neighborhood with more upgrades just sold a day earlier for same price as mine and there are 7 other homes in the ‘hood listed but not moving, all of which have been upgraded. Mine was not move-in ready, but was bigger and is a custom designed and built (by my uncle) mid-century modern which provoked interest and, ultimately, a cash-buy. I feel lucky. After a few declined contracts, I was worried it would not sell at all.

Home prices need to come down!

We just had to replace our 14 year-old Camry hybrid. Most Toyota dealerships here in Outer Pentagonia are charging a $2500 premium over list. They’re justifying that by claiming their used cars are still worth that extra $2500. IOW, they are still treating their “certified” used cars as appreciating assets.

Isabella Weber has been getting attention for her work on “Sellflation”, that is companies seizing opportunities to increase margins when inflation flares up. Input costs rise and yet companies see record profits.

Anecdata:

Regular visit to grocery store is 25% higher over the past two years.

Automobile and homeowner’s insurance up 25% this year, with no claim history except for one deer strike (no fault, supposedly).

Retirement accounts stagnant at best for most of the Biden Administration compared to the previous Administration (including the steep decline early in the pandemic).

National Democrat Party hysteria is warranted.

never in my life have I wondered, “why is chewing gum so expensive?” until last week when I was in the candy aisle.

U.K. anecdata

Just back from buying the following for my 13-year old kid, in his private school designated shop;

One shorts for rugby, one T-shirt for rugby, one track suit bottom piece (general use), one track suit top piece (general use). All these will be ripped to shreds within 3-4 weeks. Cost to me, happy punter; £175.

Talk about captive market murder.

I delighted in wearing white £6 T-shirts from Debenhams for the last 10 years, frugality on steroids, but they’ve shut now. Mrs wants to buy me £50 Gant replacements, I mean £50 for a T-shirt??? What is going on?

If deflation is feared on the basis that the economy collapses as people stop spending waiting for things to get cheaper, why the reverse is not true, that inflation cant be stopped as people keep spending now, knowing that things will be more expensive later?

That is just the elite narrative that is propagandized in the media, and there is no actual historical evidence for this. The real reason is that deflation shifts wealth back from corporations to households and we cannot have that of course.

I agree, they love to demonize deflation although in times of technical improvement and a functioning market prices can drop and increase everyone’s real income.

Nobody talks about how PC prices were deflationary and the economy was booming. You bought a PC because you needed it and just knew that your next one would have more features for the same or lower price.

We’re not buying anything but food, not taxable in California, and essential energy.

The best way to drive down prices and to drive the cause of the problem out of office, is to sit on your wallet or purse.

Buyer’s strike till ’25.

—i’ve heard others claim that some two-earner households learned how to get by with one during Covid and decided they want to continue.—-

Anecdotally, child care (even basic babysitting, nevermind an actual nanny) is through the roof, >$30/hr, in my neck of the woods

so presumably there wouldbe a shift to one-income families to internalize the child care cost.

But IIRC, female labor participation is back at pre-Covid levels.

But male labor participation is, IIRC, below pre-Covid.

And anecdotally, lots of dudes at school pickup, I’d say 45% to 50%.

whether that is because of work from home or some sort of hybrid would be an interesting topic to examine.

Yes, I hear quite a few male coworkers regularly say they have to pick up their kids(s) from school. Most of them work from home.

I should have put up a chart on prime age labor participation. It is back to 2002 levels….which was the dot com bust, the recession Greenspan fought by dropping interest rates to negative real yields and keeping them there for 9 quarters.

Prime age labor force participation is 0.5% higher than Feb 2020, but with boomers retiring, I would expect even more uptake. Note that participation is down over 1% in the 16 to 24 year old cohort, so you have an offset there.

I’ve seen the 25-54 yr labor force participation graph used to indicate that the labor participation in this cohort has exceeded the pre-COVID level: https://fred.stlouisfed.org/series/LNU01300060

It peaked at 83.1% in Feb 2020. It is 83.3% in Aug 2023. What happened to the workers is a longstanding question, and this paper from before the Pandemic in 2017 (Where Have All the Workers Gone? An Inquiry into the

Decline of the U.S. Labor Force Participation Rate) did a deep dive in this.

In any case, it’s hard to believe that over a million dead people, plus the effects of long-COVID which even the CDC recognizes, must play some kind of role in the low unemployment rate.

I can’t find the graph from the UK recently on Twitter that showed an increasing share of the workforce out either with health issues or out as a care provider for someone with health issues. Presumably COVID-related. It was a stark graph, with an increasing trend.

In a depression, the minority of people who are liquid, end up buying lots of properties in bankruptcy (official or merely effectively broke.) At least, that seems to be historically true. A world slump will bring rich people’s money to the safe haven, which is still going to be the US I believe.

(By the way, wouldn’t a massive increase in bilateral trade deals, especially those that result in some countries’ building up useless reserves of weak currencies, effectively shrink the work economy, aggravating a slump?)

So I’m not so sure that the Fed is going to see a world depression as their problem, but a problem for the losers. And therefore, it seems to me the Fed doesn’t see a downside to a depression. It’s not a crisis till the rich people are losing money, no?

And no doubt it will be deemed conspiratorial of me, but tanking the economy to re-elect Trump strikes me as possibly the political goal. Of course my belief that the real shift of support to Trump/Trumpery is by the owners, not the white working class, is unusual.

This was exactly the case in my neck of the woods. We had to buy a house in mid-atlantic area recently, and paid a record high. We’d been outbid on the prior 6 properties by Seattle/CA refugees paying top dollar in cash.

The problem with having a recession while food, housing, gas, and healthcare, during an ongoing pandemic, which is killing or crippling hundreds of thousands, and finally having the Fed fixated on increasing inflation is the compounding effects of both. 2+2+2+2≠8, but is instead 2*2*2*2=16, which means it could be a depression. The last time that happened was in 1929, but we got the New Deal. Today, I doubt that our “leaders” are capable of facing such a crisis, forget about solving it, which means economic collapse and civil war.

I know that this might seem very tangential, but look at how the local, state, and federal governments are not dealing with the current water issues of the cities of Flint, Jackson, New Orleans, and New York, or the whole state of California. Managing water, be it as drinking water, canals for the crops, flood control, storage for droughts, its control is perhaps the single greatest responsibility of any civilization since at least the Bronze Age or before 1200BCE. Likely five thousand, perhaps even seven thousand years. If they civilization fails at that, it will go away. Not disease or war, but water. It really is simple as that.

Since this is so, and the politicians in all the problem cities that I have mentioned are busy ignoring, obfuscating, lying, or taking bribes overs over them, while letting their constituents suffer, just how will they handle another great depression, which is likely? Especially as the causes are of the government’s own actions?

The big issue for the US is that the US government is owned by the rich. Its a plutocracy that pretends that it is a democracy. The fact that the standard of living for the average American citizen is falling is not a problem for the ruling class.

Some of these are necessary. The auto strike is an example. Automotive industry workers deserve a middle class wage. A victory here could set off a wave of union strike actions and further worker unionization in other industries, whereas a defeat might be as damaging as Ronald Reagan’s decision to terminate the employment of a large number of air controllers. A temporary disturbance is better for workers in the long run if the automotive workers can win concessions from the corporate types.

China I would argue is still in better shape. To be honest, I’m thinking that the China fans have a point here.

In the case of a ticking debt bomb, one option for China is the Michael Hudson option of a debt write-off. One lesson I’ve drawn that, reading his works, and that I feel he has emphasized is that if there’s a debt that isn’t going to be paid off, it’s not even worth trying to collect it, as it would inflict needless suffering.

If China is facing deflation, then stimulus spending is the solution for an aggregate demand shortfall. Run deficits to the point where there is inflation and use it on real stimulus, not like the QE policies that the US implemented.

The big difference is that the Chinese government does not answer to the rich, unlike the American government. Xi seems quite willing to crack down on the financial industry, for example. That means that there is the potential, but not the assurance, that decisions can be made for the general Chinese public, not just a small amount of rich people.

China will be fine as the state controls the financial system and GDP is still growing at 5% a year with a stable population. Add a couple of percent inflation and that is a nominal 7% per year, doubling in just over ten years. Property is priced in nominal terms, so if the state limits the yearly price drops to lets say 5% they can cut in half of more the prices of property with respect to nominal incomes in only a few years without creating a property crash. A China crash has been called for by those in the Western media again and again over the past three decades.

You are spot on about the US, the elites are so divorced from the common people they are now at the level of Marie Antoinette. The Dems and Republicans are just a two-headed courtier of the rich. The Chinese state does not answer to the rich.

I’m still a bit uncertain about the whole China business. Though PlutoniumKun and others clearly have shown that some worry is warranted about the Chinese economy, they don’t seem to be suffering from the same “horrid leadership” malaise that Western countries now face. (I mean, Xi worked in collective farms during the Cultural Revolution; is there a current Western leader who has held like, a normal job? At least the communists seem to be in touch, or at least more in touch, with their populace.)

Though yes, clearly China is “slowing down”, this is after being at a breakneck pace for a while. And though this can be seen as a generalized “transition to developed economy” troubles, the fact is: China is huge. Quantity in fact has a quality all its own. I still remain unconvinced by catastrophizing preached by analysts. That being said, a slowdown in China is probably to be very devastating to the rest of the world, especially those places that are highly dependent on its production and consumption.

“And it looks as if China getting a cold might lead to pneumonia in some of its key trade partners.” is a great way to put it.

…is there a current Western leader who has held like, a normal job?

Weirdly enough, I think Justin Trudeau comes as close to that as any and not very close. If I have this correct, he has a B.ED and taught English and Math for 3–4 years in a secondary school in Vancouver. I think it was a private school.

Not the equivalent of Xi in the country but beats anybody else I can think of.

Trucking employment, truck loads and cardboard boxes all down?

https://twitter.com/WallStreetSilv/status/1708650681484161086

In theory for vanilla loan types, mark to market and hold to maturity valuations shouldn’t be too wildly different – correct? If the market is applying a steep risk discount and isn’t just delusional or unduly pessimistic, we’d expect that to be reflected in higher default rates in the long run. (I’m excluding opacity discounts like we’d see for exotic derivative products).

So I’m guessing the reason for large differences is because hold to maturity valuations aren’t all that responsive to a changing macroeconomic risk environment, and get to value according to rosy assumptions (“things will be better once the Fed fixes them”) that may not necessarily be grounded in reality?

From Wolf Street:

Corporate profits are still at a record high: https://wolfstreet.com/2023/09/28/another-recession-indicator-refuses-to-see-a-recession-corporate-profits-without-federal-reserve-banks-hit-record/

And that’s because the “drunken sailors” are still partying: https://wolfstreet.com/2023/09/29/our-drunken-sailors-got-revised-and-updated-but-theyre-still-partying/, and who can blame them since income has been outpacing inflation.

We might have gotten a recession by now if the Feds hadn’t “bailed out” the commercial banks by lending them money at par value for bonds that had lost a fair bit of value.