Lambert here: Rather like dark matter, of which there is rather a lot.

By Lucian Cernat, Head of Global Regulatory Cooperation and International Procurement Negotiations, DG TRADE European Commission. Originally published at VoxEU.

The types of trade policy instruments that typically capture the headlines are multilateral negotiations, WTO litigation, FTA negotiations, or anti-dumping measures. This column reveals that EU trade policy also relies to a large extent on ‘mini-deals’. The scope and the legal nature of these mini-deals vary considerably, and while most are invisible, some of them may be quite important in terms of their impact on trade. Omitting mini-deals and their impact on trade flows from empirical research may lead to significant bias, due to the large number of omitted policy variables.

When the Financial Times reported on ground-breaking, new research carried out by Claussen (2023) on thousands of mini-deals that have been part of US trade policy for decades, an immediate question arose: Was this an isolated US phenomenon? How about EU trade policy?

The question is quite legitimate, given the complexity of trade policy and its important role in the EU integration process. For decades, the EU common commercial policy has been at the heart of the European integration, a key example of a policy area in which internal and external policies are inextricably linked and where EU integration greatly enhanced the economic welfare and global role of EU member states. The EU common commercial policy typically refers to the collective set of international initiatives and policy actions that directly affect international trade in goods and services, the commercial aspects of intellectual property, public procurement, and FDI. The expansion of international trade made the common commercial policy into one of the Union’s most important policies. Essentially, every measure concerning trade with third countries, as well as every measure intended to influence trade flows and trade volumes, can be seen as part of EU trade policy.

EU Trade Mini-Deals: The Invisible Commercial Policy

Given this large and complex trade landscape, one would expect the toolbox available to policymakers to reflect such diversity. However, the types of trade policy instruments that typically capture the headlines are multilateral negotiations, WTO litigation, FTA negotiations, or anti-dumping measures. However, when following the approach pioneered by Claussen (2023) in the case of US trade policy, it turns out that EU trade policy also relies to a large extent on ‘mini-deals’. Based on the publicly available information in the EU Official Journal, in a recent paper (Cernat 2023) I mapped all the existing instruments falling under the EU trade policy toolbox, from 1962 until 2023. The method used to unearth these mini-deals was to ‘follow the paper trail’, looking at all the existing legal instruments that the EU has concluded with third countries that fall in the remit of trade policy.

Any instrument that has legal implications and involves third countries is published in the EU Official Journal (EUR-LEX). The search tool in EUR-LEX allows for filtering based on several criteria, one of these based on the policy areas to which the legal instruments belong. A EUR-LEX search query for all trade-related instruments that have been published over the years returned over 2,000 entries. Many of these were trade mini-deals covering certain specific elements of EU trade policy. For instance, there are around 200 entries (exchange of letters and decisions of bodies established under existing agreements) pertaining to “origin of goods”. There are also over 400 mini-deals related to technical barriers to trade.

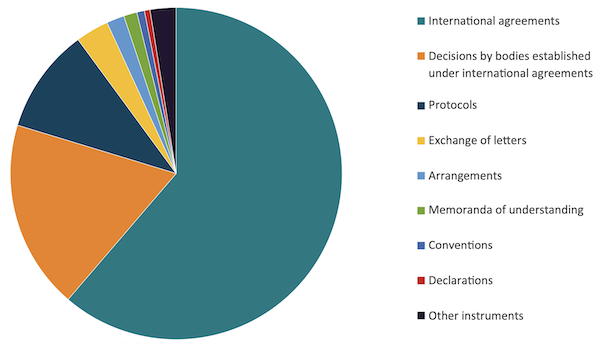

Other agreements are related to specific agricultural commodities (e.g. beef, wine, organic products) or certain SPS measures. There are also mini-deals concerning sustainable trade (e.g. bilateral voluntary agreements on sustainable timber), or trade in industrial products, such as mutual recognition agreements (MRAs) on conformity assessment, agreements on hazardous chemicals, narcotics, waste, and so on. The main types of such trade mini-deals are presented in Figure 1.

Figure 1 EU trade mini-seals: A taxonomy

Source: Cernat (2023).

When comparing the extent of such activity to the number of FTAs, the overall picture is quite telling. Figure 2 shows that the number of mini-deals is huge compared to the number of FTAs currently in force. While it is true that the scope and the legal nature of mini-deals vary considerably and fall short of the deep and comprehensive nature of modern FTAs signed by the EU with over 40 countries around the world, this does not necessarily mean that the cumulative scope of mini-deals (both in number of issues covered and countries that are signatories to such mini-deals) is less impressive.

Figure 2 FTAs vs mini-deals: Comparing the numbers

Source: Cernat (2023).

On the Economic Importance of Mini-Deals

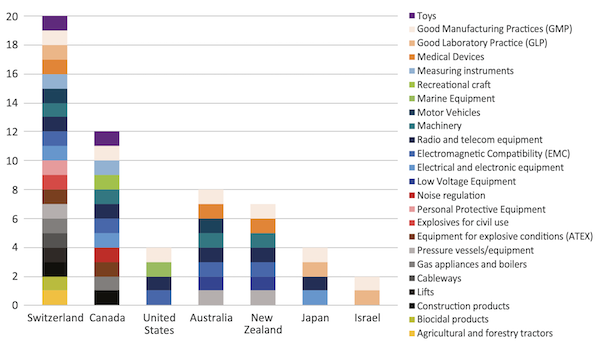

This forensic legal analysis clearly indicates that EU mini-deals are a very diverse and prolific instrument in the legal ecosystem. However, quantity (i.e. the number of mini-deals negotiated) does not represent either quality or content. At one extreme, some mini-deals are purely administrative, procedural paperwork, with no impact whatsoever on the real world. At the other extreme, some mini-deals contain crucial provisions for thousands of EU exporters and importers, affecting billions of euros of trade flows. One special category that illustrates this paradox of mini-deals are MRAs. Unlike FTAs, MRAs are mini-deals specifically designed to cut the unnecessary costs of non-tariff barriers (NTBs) to trade. It does not come as a surprise that mini-deals aiming to reduce red tape and duplication of regulatory compliance costs are a priority for businesses engaged in global supply chains and are high on the trade policy agenda (Figure 3).

Figure 3 Existing MRAs: Sectoral coverage

Source: Cernat (2023).

Let us take the example of the EU-US MRA on conformity assessment. This MRA confers EU exporters the right to place certain industrial products in the US market based on a conformity certificate guaranteeing that the EU product complies with relevant US laws and product regulations on electromagnetic compatibility requirements, for instance. The MRA allows for such certificates to be issued by accredited EU conformity assessment laboratories, without the need for EU products to undergo further testing and certification in the US. The same facility is offered for US exporters of such products to the EU market. Hence, the MRA offers significant bilateral trade costs reductions, without reducing the safety and quality controls applicable to imported products. The economic literature offers robust estimates of the resulting trade gains. Different empirical econometric estimates agree that the existence of an MRA tend to increase the value of exports by 15-40% and the probability of firms to export new products to new markets by up to 50% (Baller 2007, Cernat 2022).

Such trade facilitation arrangements are crucial nowadays for exporting firms, notably SMEs. Trade flows have evolved over time and become increasingly intricate, with countless components crossing multiple borders at different stages of production along global supply chains before reaching the final consumer. While trade flows today face historically low tariffs, NTBs have proliferated. A lack of regulatory cooperation is typically a primary source of NTBs. While regulations play an important role in addressing public policy objectives, such as consumer safety or environmental protection, they may differ from one country to another. Companies and products engaged in complex global supply chains therefore need to comply with a whole range of different national administrative and technical requirements, including testing and certification obligations, which can become an unnecessarily costly trade barrier for millions of exporters. EU exporters offered clear examples of such barriers, as part of a pan-European business survey (European Commission and UNITC 2016).

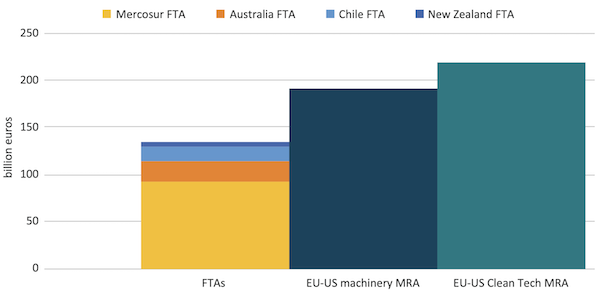

To offer a point of comparison, let us put in perspective the liberalisation potential of several FTAs and two trade mini-deal proposals currently under discussion at the Trade and Technology Council. These proposals aim at the expansion of the existing EU-US Mutual Recognition Agreement to machinery and cleantech products that would reduce certification costs (which are typically higher than existing tariffs in the EU and US on these products). The comparison of trade flows affected by FTAs and these two proposed mini-deals is quite stark: when looking at the trade flows at stake, sometimes mini-deals could become ‘big deals’ (Figure 4).

Figure 4 Bilateral trade value subject to trade cost reductions

Note: The FTA trade data (imports and exports) excludes MFN duty-free trade for the EU and its trading partners. The US MRA on machinery covers bilateral trade under HS chapters 84 and 85. The trade flows potentially covered under a Cleantech MRA is based on the proposals for environmental goods that were submitted by participating WTO members during the Environment Goods Agreement negotiations.

Source: Cernat (2023).

While FTAs cover ‘substantially all trade’ and eliminate most-favoured nation (MFN) tariffs, not all their provisions provide for a direct cost reduction for exporters and importers. In the case of the EU and of many trading partners, a significant share of trade is already MFN duty-free. For instance, over 60% of New Zealand imports are already MFN duty-free, even before the conclusion of the EU-New Zealand FTA. In the case of Australia, the share of MFN duty-free trade is even higher (76%). Similarly, the EU also has over 30% of its imports coming under MFN duty-free tariffs. At the same time, MRAs reduce the unnecessary costs of conformity assessment procedures, that often can be in double digits.

What to Expect in the Future?

The few metrics presented in the previous sections indicated that, while most mini-deals are invisible, some of them might be quite important in terms of trade impact. This raises several policy and analytical questions: Are these mini-deals well-positioned on the EU trade policy radar screen? Are there any blind spots in the current trade policy research?

The answer to the first question is yes – mini-deals are important for the current EU trade policy priorities. There are several recent examples of trade mini-deals dealing with many trade issues that are essential for EU policy objectives and for the functioning of global supply chains. Mini-deals address important trade policy objectives, enabling the competitiveness of EU companies in key sectors (e.g. critical raw materials, clean tech, digital, etc.). The importance of such policy objectives has been recently reiterated by European Commission President Von der Leyen in the 2023 State of the Union speech.

Turning the second question, there is a relative ‘blind spot’ in the mainstream research on trade policy. The importance of addressing non-tariff measures and the need for new framework to analyse how different forms of trade agreements can address these non-tariff barriers has been long recognised (e.g. McCalman et al. 2019). However, most of the existing research and the main analytical frameworks (econometrics, CGE modelling, etc.) used to assess the impact of trade policy on global trade flows simply ignore the existence of these trade mini-deals. In the case of EU trade policy, ignoring the 2,000 mini-deals and their impact on trade flows in our empirical research may lead to significant bias, having such a large number of omitted policy variables.

The ubiquitous nature of mini-deals is not only important for empirical trade economists; it also casts a new spotlight on the relative importance of these neglected trade policy instruments. The best way to understand the importance of mini-deals for a healthy trading system is perhaps using a medical metaphor. The health of a human body not only depends on its DNA, it also critically depends on the microbiome, the thousands of species of microorganisms living inside in our bodies. The existing WTO rules combined with the myriad of bilateral FTAs provide the DNA of the global trading system. But just like our bodies need a healthy microbiome alongside its DNA, a healthy global trading system needs more than just ‘big deals’; it requires a complex mix of mini-deals, the equivalent of a microbiological ecosystem that inhabits the global trading system and gives it the endurance and adaptability needed in a fast-changing business, technological and political reality.

Author’s note: The views expressed herein are those of the author and do not necessarily reflect an official position of the European Commission.