By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

Tsunami of issuance meets Fed QT, Skittish Foreign Buyers, and US buyers demanding to be compensated for the risks of out-of-control deficits in an inflationary environment.

Yields of longer-dated Treasury securities have surged by about 150 basis points since April this year, from about 3.5% to above 5% for 20-year and 30-year yields, and to just below 5% for the 10-year yield, which has caused a historic bloodbath for holders of these securities and bond funds, such as the TLT. There is now a lot of navel-gazing in some quarters as to why this jump in yields could possibly have happened. And here and there, some fancy theories are getting trotted out.

But it boils down to supply and demand. Supply is a tsunami of Treasury securities being issued as the government has to borrow unspeakable amounts to fund its scandalous deficits even in a strong economy.

And this tsunami of supply must find demand. Yields must rise until they meet demand. Yield solves all demand problems. There will always be demand if the yields are high enough, so it’s not a question of finding buyers, but at what yield those buyers can be found.

And that’s what we’re looking at: To what level will 10-year yields have to rise to entice even me to buy some of them? For me, 10-year yields are not there yet. And as each wave of issuance gets bought, new buyers need to be enticed with sufficient yields.

Obviously, something could change that would lower yield expectations by potential buyers, such as inflation miraculously vanishing or something scary happening that will make even an unappetizing 10-year yield look better than the alternatives. But we’re not there yet.

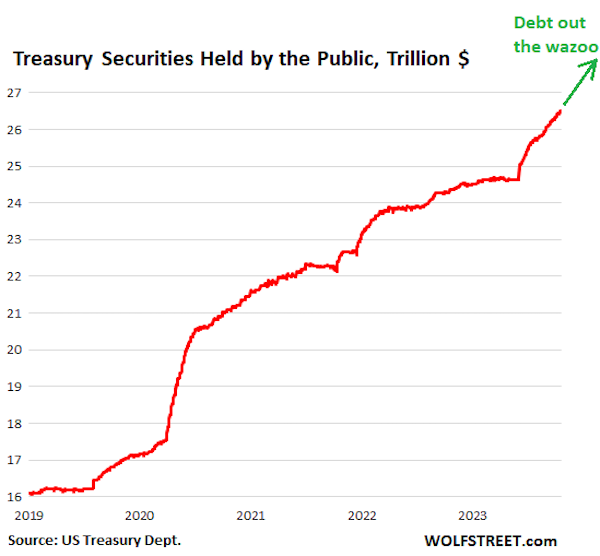

Here’s the tsunami of supply.

The total amount of Treasury securities outstanding has now reached $33.6 trillion. Of that amount, $7.1 trillion are securities held by government entities, such as government pension funds, the Social Security Trust Fund, etc. They’re not traded, and those entities buy the securities directly from the government, and so they don’t have a direct impact on supply and demand in the market.

The remainder, $26.5 trillion, are Treasury securities held by the “public.” The public includes foreign holders, the Fed, banks, bond funds, insurance companies, individuals, and me (only T-bills so far).

These securities held by the public spiked by nearly $1.8 trillion in the five months since the end of the debt-ceiling standoff, and by over $10 trillion, or by 65%, in five years, from $16 trillion in January 2019 to $26.5 trillion now!

This new issuance of $1.8 trillion in five months needed to find buyers. And yields must rise until every last one of these securities is purchased by the “public.”

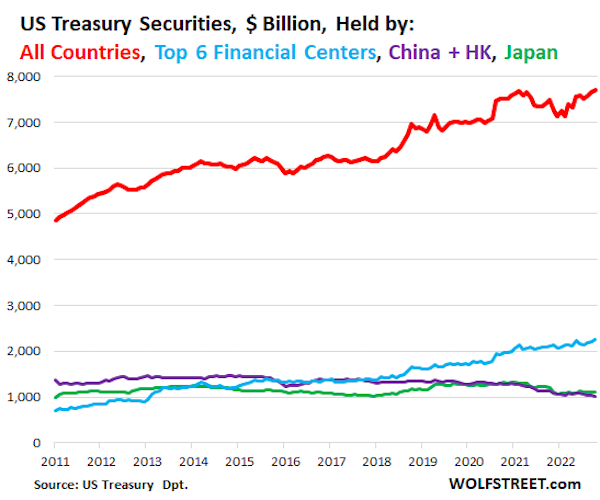

And here is demand by the biggies: International holders and the Fed.

International holders are still buying but not keeping up. They increased their holdings of Treasury securities to a record $7.71 trillion in August, as of the latest TIC data by the Treasury Department (red line in the chart below):

- Japan, #1 US creditor, increased its holdings to $1.12 trillion (green).

- China and Hong Kong combined, #2 US creditor, further reduced their holdings to $1.01 trillion (purple).

- The top six financial centers (London, Belgium, Luxembourg, Switzerland, Cayman Islands, Ireland) increased their holdings to a record $2.27 trillion.

So on net, foreign holders are still adding to their stash of Treasury securities, with some, such as China and Brazil, unloading; and with others, such as the biggest financial centers, India, and Canada, adding to their stash.

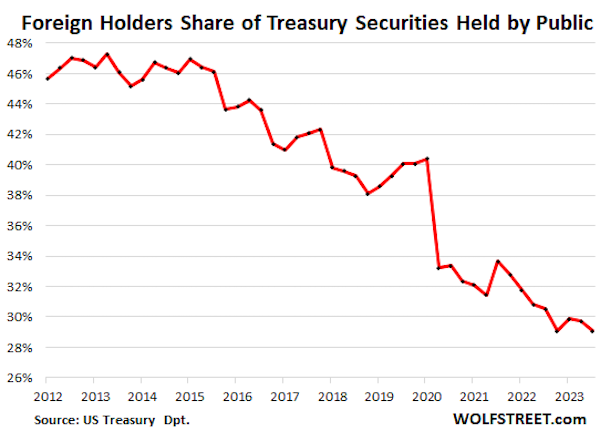

But they haven’t kept up with the US government debt that has been ballooning at an incredible speed in recent years, with trillions whooshing by so fast they’re hard to see.

And so the share of foreign holders of the US debt held by the public has plunged. Ten years ago, they held 45% of the public US debt; but now, despite the increase of their holdings over this period, their share has dropped to 29%.

In other words, they’re still adding, but not nearly fast enough to keep up with the growth of the US debt. And other buyers have to be enticed with higher yields to fill the gap.

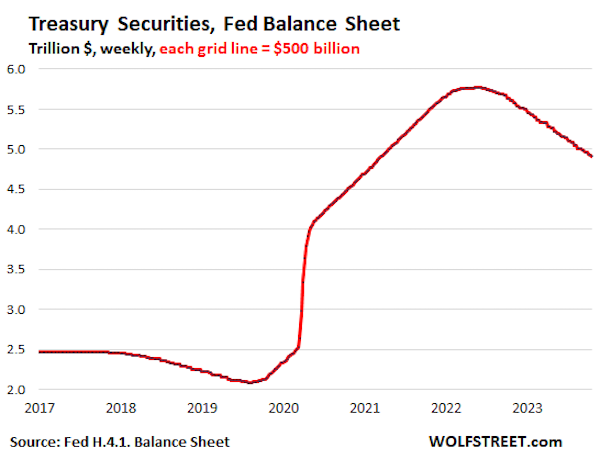

The Fed, oh dear. During the huge binge of QE, when it interfered in the bond market on a daily basis by buying trillions of dollars in Treasury securities of all kinds over the years, the Fed turned into the biggest most relentless bidder in the bond market, thereby repressing yields across the yield curve. Then it ended QE, and did the opposite, QT.

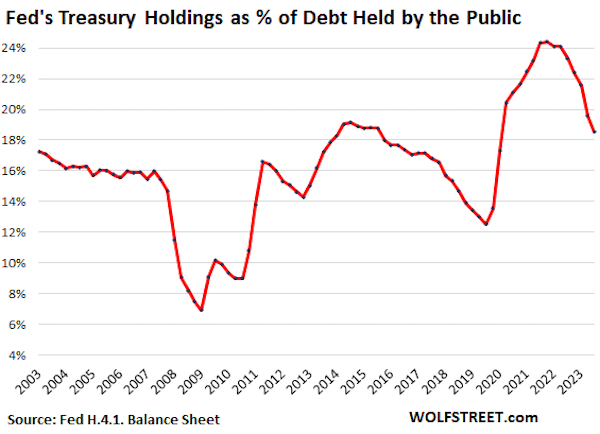

Since ramping up QT to full speed last September 2022, the Fed has been shedding Treasury securities at a rate of about $60 billion a month by letting maturing securities roll off the balance sheet without replacement. Since the peak, it has unloaded $840 billion in Treasury securities, with its Treasury holdings shrinking to $4.91 trillion (we discuss the Fed’s QT in detail monthly, most recently here).

Going from QE, which in the end ran at $120 billion a month, to QT of $60 billion a month, represents a swing of $180 billion a month.

When the government refinances the securities that mature, including those that the Fed held, it must borrow new money to pay off existing creditors, including the Fed. Since the Fed is not buying securities to replace those maturing securities, other buyers must be enticed with higher yields to pick up the slack.

And the share of the Fed’s declining Treasury holdings as a percent of the ballooning pile of government debt held by the public has shrunk to 18.5% currently, from 24.4% in October 2021:

That leaves the rest of the buyers – banks, bond funds, insurance companies, pension funds, other institutional investors, and individuals – to deal with the tsunami of issuance.

Some of them are forced buyers; but others are reluctant buyers that want a decent yield to compensate them appropriately for the risks posed by out-of-control government deficits in an inflationary environment, and they’re looking at the current bloodbath of investors, including banks, that had bought two years ago, and they’re not overeager to bid, but they will bid if the yields are high enough, and that’s what we’re looking at.

Coming to a theater near you, it’s a follow up to that baseball movie hit “Field of Dreams” and corn farmer Ray. The sequel is to be titled “Yield of Dreams”. Auction your wares, and they will come. They most certainly will come, Ray. \ sarc

I’m not a future projection type of analyst, more a detail in the weeds analyst, but I have a cynical bent for yields moving higher still as we circle the calendar into 2024. The odds look to be good or “higher for longer”. Few in DC seem capable of math at any basic level, and the impact of interest rates is lost on most of them.

We must print the money that will fight the wars that will save the $ingularity from humanity!

Yeah, fight the wars and finance others. Over a trillion a year to be made available for DoD, plus all the special appropriations for Israel, Ukraine etc.. but “we’re bankrupt” when it comes to healthcare, infrastructure, education, housing. We have a declining average life-expectancy curve to maintain…

https://www.foxbusiness.com/economy/yellen-says-us-afford-support-two-wars-america-stands-behind-israel-period

at the very long end, >20 years, the Treasury does not issue a lot debt relatice to the overall amount.

the bulk of US borrowing is in the 0 to 7 years range.

It doesn’t take much selling/demand destruction for the yields to go nuts at the far end.

Of course when there demand for 100 year, near zero interest govt bonds (see Austria), the US Treasury didn’t even bother issuing a lot more 30 year debt.

feature, not a bug. see Wall Street primary dealers.

And surprised that wolf didn’t mention the elephant in the room…China selling down UST/not recycling its USD into UST.

see DC rhetoric re. taiwan, chip sanctions, and 2014, 2022 sanctions against RU

Well, he did briefly mention and show a graph: “International holders are still buying but not keeping up…. China and Hong Kong combined, #2 US creditor, further reduced their holdings to $1.01 trillion (purple).”

When China saw what we did to Russian assets at the beginning of the Ukraine war, I bet that really got them into the sell/not recycle mode that can be expected to continue for a looong time.

Agreed, it’s not like China can dump all its USD assets at once, it’s going to take years, and then there is the problem of what is the alternative to the Treasury Standard?

Maybe that’s why the Belt and Road program is attractive to China. Even if the investment in B/R has a low return it is still higher than confiscated Treasuries.

I understand gov’t deficits represent private surplus, but this massive deficit spending seems really inflationary since so much is spent on things of low value, like the military industrial complex’s corruption. This spiking gov’t debt and interest payment seems like a really bad sign given the low roi of gov’t spending. I would have been interested to see what percent of federal spending go to interest on the debt – last I checked it was quite high.

5% still seems like I’m not even treading water, but a lot better than nothing with my principle hopefully-supposedly-guaranteed.

So many signs seem to be flashing red for the usa right now.

Us Debt Clock has the interest on the debt as $670 billion, https://usdebtclock.org/ . In 2020 the interest on the debt was about half that number. Interest on the debt will go up in the next year as the current deficits and old debt are turned over at the new rate. I have heard it will get to $1 trillion per year in the not too distant future.

Here are interest payments as a % of tax receipts from a late August WolfStreet article–about 36% recently but below the 50% levels of the early 80s or late 80s/early 90s. The recent trend is sharply up.

https://wolfstreet.com/2023/08/30/curse-of-easy-money-us-government-interest-payments-v-tax-receipts-average-interest-on-treasury-debt-debt-to-gdp-in-q2/

Thanks for the link. I find it interesting that interest expense as a percent of GDP was around 5%; back when the national debt was 50% of GDP and interest rates were in double digits. Now gross debt is 120% of GDP and interest rates are at 5%, if they remain at these levels, they will be taking an ever larger share of GDP.

I don’t see anything on the horizon to increase economic growth, or reduce the size of the deficits. FY 2023’s deficit @ 5% added $110 billion to interest expense. Next year, and the years after will bring much the same.

The US is going the way of Italy, where government debt is higher than 100% of GDP and interest rates are higher than nominal GDP, so the debt just keeps growing as the deficit cannot be closed without crashing the economy. The answer is either “yield curve management” (aka Japan) or let inflation rip but that will destroy the dollar. Then add on the massive amounts of personal, business and financial sector debt (and student loans now reactivated).

The Ukraine War now looks even more stupid, as the Russia sanctions pushed the world to move from the dollar and the Chinese to speed up their selling of their US Treasury mountain – just when the US needed more buyers for US debt. And now even more debt to fund Israel.

Same setup as the 1970s “Guns and Butter” expenditures that led to the US dropping gold convertibility and fixed exchange rates. That get out of jail free card has now been fully played out and the options available now are all much, much worse.

But since most of the deficit is from DoD, military and related expenditure, it ends up being sent overseas, and held in foreign central bank reserves, and likely contributes very little to domestic inflation. As we have seen from other posts here on NC, the source of most of the inflation is not from gov spending. but from monopoly price gouging, market manipulation, post-pandemic issues etc. We just came out of an unprecedented QE ZIRP phase as well.

An awful lot of that ends up in the hands of the MIC corporations and their employees and shareholders, as do the moneys from US allies being forced to buy US armaments, so it does contribute to US inflationary pressures.

Yeah, asset price inflation, not CPI. The “dollar glut” gets recycled into stocks, bonds, real estate etc.

MMT is not in evidence in this piece, but I think the vast military spending is mostly graft, with very little consumption of material resources, and therefore not so likely to cause inflation. Of course you might regard it as a jobs program for part of the population, who thereby have money to spend into the real economy, and compete for goods.

You are forgetting the multiplier effects, the employees of the MIC corporations get to spend those wages in the real economy. As do the shareholders to some degree (a lot will be saved or invested in real estate, equities etc.).

Also, producing something like an F35 is extremely resource intensive, graft can be a very inefficient user of resources.

Excellent article, my only quibble is where Wolf says the government has to “fund its scandalous deficits even in a strong economy.” I have a problem with the word strong. BEA.gov has the US economy growing at just under 2.5% in the last 4 quarters. This looks good when considering that the economy has had average real GDP growth of 2.1% since 2000. But to me, when the government runs up $2.2 trillion in debt, close to 9% of GDP, during that same period; one mus question how much of that growth is due to government spending and how much is due to private investment? Growing with debt is okay if the all that money is going into productive investment so the economy can be stronger in the future, if it is just going to keep the bills paid, it will come back to bite as larger interest payments without a larger economy.

What an accomplishment for the B admin. (not) What does he plan to run on next year? The economy? Improved health in the country? World peace?

The tbtf banks weren’t cleaned up after 2008-9 and here we are, plus new wars. / oy

Sometimes you need to only run against something “orange man bad” instead of offering something GOOD to the voters instead. Both political choices are as appealing as a dog’s breakfast, given their age and policies.

Looking at those charts, all I can think of is that the future is so bright you are going to need shades.

It looks like J. Powell’s marching orders might be to preempt a worse crash by foaming the runway with… inflation. If we could just get straight talk it would be wonderful. But we get gobbledegook about raising interest rates to tame inflation as if inflation were the problem. It could become the problem if there are too few goods, but all by itself too many dollars (with adequate supply of goods) will serve to deflate the debt load. Gradually, not suddenly. And one of our goals as rational actors is to align the value of the dollar with other currencies. The key word, of course, is “rational.” Right now, with all our absurd military expenses, printing dollars and kiting bonds is the solution to keeping our economy going while we adjust to a multi-polar world. And, I am firmly convinced that our current military adventure is all about controlling oil. Either way, gradually or suddenly, we are headed for a dollar that has an average value among other currencies. And the good thing at the present time is that we are investing wisely in the clean-up of the environment so our “productivity” will actually be productive. Long term. I’m still optimistic enough to believe that green astroturf won’t be able too fool people and we will actually stay focused. That’s how I make sense of Powell’s fedspeak. And Biden’s recklessness.

Minting the $100 trillion dollar coin would solve “both” problems, debt and interest on debt.

Then bye bye US dollar and hello massive inflation. Dumping $trillions into an economy with limited resources and massive deindustrialization, and a workforce decreased by long COVID, is a quick way to an inflationary spiral and a crashing dollar exchange rate.

But then if we re-industrialize with new industries that reduce, reuse, recycle, repair and detoxify our national slag heap of a country we will have a robust economy based on sustainability. Robust, as in well vasculated, feeding all levels of society and leveling out our absurd inequalities – which were created because we didn’t understand how to create and maintain equality and ecology. We are better now.

NO! The coin would allow the USG to wipe out debt and interest payments. It would reduce the interests rates and thereby ease inflation and encourage investment thereby also easing inflation.

Total cumulative deficits:

FY20: $3.12T

FY21: $2.77T

FY22: $1.38T

FY23: $1.69T

The tsunami was in FY20 and FY21.

Sorry but I am not sure where your numbers came from. The US Treasury has a web page called Debt to the Penny https://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny It has the following values.

FY20: $4.2T

FY21: $1.38T

FY22: $2.5T

FY23: $2.24T

My source https://bipartisanpolicy.org/report/deficit-tracker/

I didn’t use this as a source, but it agrees with what I was using: https://fred.stlouisfed.org/series/FYFSD

Interesting. St. Louis Fed gets its numbers from the Office of Management and Budget. I have been using the US Treasury – since they are responsible for ensuring the bills get paid.

Personally I think it’s foreign central banks unwinding treasury holdings to feed local demand for euro-dollars to cope with the effect of the dollar getting strong compared to other currencies. Which has the byproduct of keeping the peg of their currencies to the dollar stable.