Yves here. Recall that Richard Murphy is a UK commentator, and so his concern about deflation is based on the UK perspective. The last time analysts were concerned about deflation was in the wake of the financial crisis, and there was some discussion of how deflation in the Great Depression made the economic devastation worse. Recall that Irving Fisher’s seminal paper on how debt deflations caused depressions was published in 1933. The critical elements of the dynamic are that deinflation makes it rational to refrain from spending and investment, since things will be cheaper later. That dynamic reinforces contractionary conditions.

The rational place to be as an investor is in cash and extremely safe assets. And borrowers get squeezed since the real cost of their indebtedness rises in deflation. The higher level of defaults amplifies the downdraft.

Moreover, commentators have pointed out that deflation can be exported via lower export prices. That might sound good until you consider that they undercut domestic providers. So what might seem salutary on a small scale can become detrimental.

And in case you think the US is growing too quickly to be at risk, not everyone agrees (hat tip Chuck L):

Another “Blockbuster” Jobs report.

Courtesy of the most creative statisticians government money can buy.

Half the jobs are fake. The other half are government jobs. And there’s been zero new jobs for native-born Americans since… 2018 🤯

How do they get away with it?… pic.twitter.com/5D7PhAbAso

— Peter St Onge, Ph.D. (@profstonge) February 7, 2024

By Richard Murphy, part-time Professor of Accounting Practice at Sheffield University Management School, director of the Corporate Accountability Network, member of Finance for the Future LLP, and director of Tax Research LLP. Originally published at Tax Research

China is suffering deflation, as has been reported this morning:

🇨🇳#inflation #China #reporting

China – consumer inflation CPI (Jan)

m/m = +0.3% (expected +0.4% / previously +0.1%)

y/y = -0.8% (expected -0.5% / previously -0.3%)Traditionally, the media write about deflation in China

The fall in consumer prices in January was the strongest… pic.twitter.com/75KSrAVMSA

— FinNews (@FinNews_) February 8, 2024

In Western economies, like the UK, we have an obsession with inflation because deflation is something that we know almost nothing about as a lived experience. However, we should be worried. Deflation is much more dangerous than inflation and is entirely possible in the UK in the next year or two.

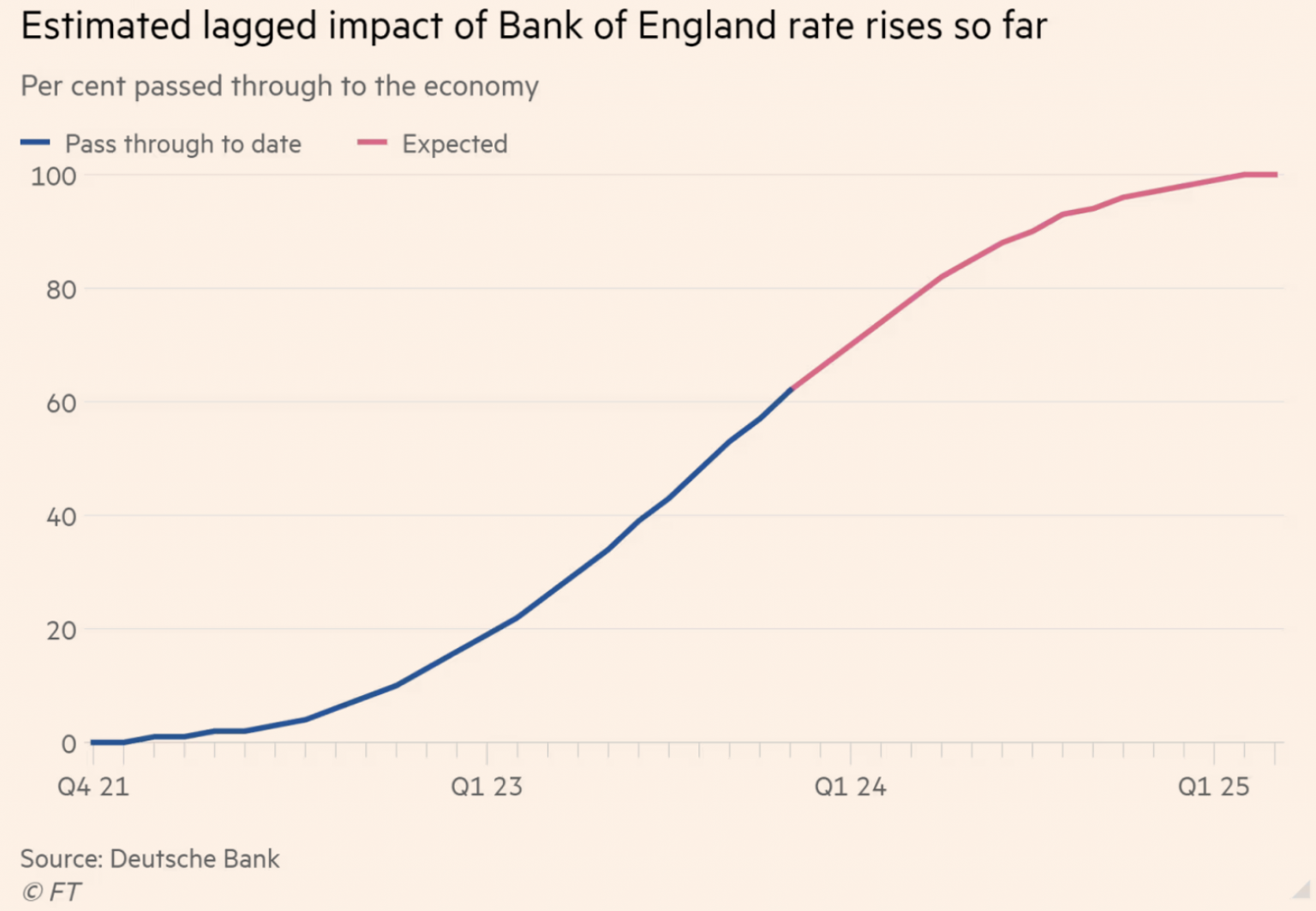

Take a look at this chart, published in the FT this morning that suggests that a significant part of the economic impact of the interest-rate rises put in place by the Bank of England has yet to have an effect, even though we now know that from May this year onwards, inflation in the UK is expected to be less than 3% a year and to remain that way, at best.

High interest rates, which the Bank of England insist must persist, are intended to create a recession by reducing demand, increasing unemployment, and by increasing the cost cost of capital, which cuts the rate of investment. The result is supposed to be significant downward pressure on prices. However, what we know is that those price changes are already falling in scale, significantly. With much of the Bank’s recession-creating effort still to have an impact, the chance that we will have deflation is quite high as a result.

Deflation is dangerous for three reasons.

First, the real cost of repaying loans increases, which penalises all businesses and households that are dependent upon loan finance to make their plans possible. They have to cut their expenditure as a result.

Second, falling prices discourage investment because people defer purchasing decisions in the hope that they can buy things more cheaply in the future.

Thirdly, these two factors do, in combination, put significant pressure on spending capacity, meaning that a steady downward spiral within the economy develops.

As I have long argued, the Bank of England never needed to increase interest rates to tackle inflation because the inflation we had was of a sort that would never have been addressed by interest rate rises and would, in any event, always have passed without any such changes. Now, though, we face the risk of a substantial overshoot by the Bank of England that is very likely to result in a serious recession and potentially in deflation as we follow the path that China is setting.

Economic incompetence of this magnitude takes some effort to deliver.

I find it more than a little disingenuous when Central Banks speak of “price stability” while seeking a 2% inflation target. Inflation is a tax on the poor for the benefit of the rich.

The poor live paycheck to paycheck and have no savings so inflation per se scarcely affects them at all.

Assuming that wages inflate along with prices, yes. If prices inflate and wages don’t, and there’s no fat left to cut, the poor start cutting meat. Or to put it in literal terms, when they have no luxuries left to cut, they start cutting necessities instead.

True, the poor can’t suffer financially (aside from debt, assuming lenders provide it), but they can suffer in the old-fashioned way: By suffering.

“Assuming that wages inflate along with prices, yes.”

Something that is hardly a given outside of unions with fangs.

Inflation or deflation, the people hit the hardest are those with the least buffer and no access to the those in power.

My observation is that every time inflation becomes a factor, there is a political and media battle to work out who assumes the cost – businesses (by raising wages in line with inflation) or workers (if businesses succeed in holding wages at pre-inflation levels).

How that plays out can vary market by market and depends heavily on the relative bargaining power of business and workers. The poor generally have very little (absent unions looking out for their interests) and often end up getting the short end of the stick.

Empirically speaking, real wage growth for the poorest did not cease in the high inflation sixties and seventies but rather following the neoliberal turn when inflation-targeting, the acceptance of permanent unavoidable unemployment, and disempowerment of the unions among many other factors broke the bargaining power of labour.

Can you explain why you think that? The poor experience price inflation of goods directly, and because of other factors, have no way to mitigate those increased good costs. If I have a single family house, I can buy things in bulk and store them, smoothing out my costs for consuming goods like food, toilet paper, candy, liquor, etc. If I’m poor, and have no storage space in my apartment, or no safe storage space, and I’m paid irregularly, then I’m exposed to increased prices for materials I consume with no options to mitigate inflation. Again, if I have two cars, one electric and one ICE, and gas prices spike, I have the option of using the EV. A poor person experiences inflation on a daily basis with no options to protect themselves, seeing their earnings diminish as their purchasing power erodes for essential goods. That’s one of the reasons why it is so expensive to be poor.

Ever had to go to the food bank to feed your kids because your once sufficient pay check could no longer buy a full week’s worth of groceries. That’s inflation.

Biden sanctioned Russian grains, cooking oils, diesel for tractors, fertilizer, crude oil, metals and other things…that causes inflation.

The poor should celebrate however, they are doing their part in the fight for for Ukrainian democracy and high MIC stock values.

Food banks are where you learn how to cook whatever weird mix of food that they give you. Never did use the expired package of dried Korean seaweed. Which reminds me of the need to donate to the local food bank. Still poor, but thankfully, I have not had to use one in several years, and I really should pay it back.

Michael Hudson IIRC calls inflation a boon for debtors, footed by creditors. Future payments and interest become less valuable as more money in circulation drives prices higher.

All well and good, in theory. People get paid more, demand increase and prices respond. Problems come up when price increases are driven by something other than demand, like shortages or gouging. Wages lag rather than lead prices and people struggle to stay afloat.

I have no idea whether 2% or some other number is a decent inflation target. It’s a shame that the numbers have become politicized to the point where the data can’t be trusted and is completely unhelpful.

I’ve seen a handful of of links at NC that suggest (or state outright) that inflation hits the poor harder. That makes sense for a number of reasons. With less discretional income it’s harder for the poor to reallocate for increases in the cost of necessities, which are factored out of some inflation models anyway.

And goods with a longer supply chain should expect more markups between production and the shelf. Where every link increases its take as a percentage of cost, a couple of extra bottlenecks in the chain can have exponential effects at the point of sale. I’ve noticed in the last 18 months that supermarket prices have crept up to comparable with the farmers markets and Natural Grocers. And the main courses at our rotating menu, locally sourced, organic, James Beard finalist restaurant are now comparably priced to the $18 meal deal at Taco Bell.

The influence of inflation on equality is pretty complex, and depends very much on the type of inflation and other circumstances. For many middle income families in the 1970’s, inflation was a huge benefit – it wiped out mortgage debt. It didn’t hit the poorest so hard either when the overall economy was doing well, as it pushed wages up at the bottom.

However, unless you happen to be in high debt with your interest rates lower than inflation, then its pretty bad news when those in the middle or bottom levels can’t get inflation matched pay rises.

Deflation, however, is bad news for nearly everyone, with the possible exception of those with some form of fixed income (such as fixed rate pensions).

In 1st year economics, we all learned about the price curve in which supply and demand are balanced.

Basic observation, prices going down to match demand is deflation. If prices are never allowed to go down, because Deflation is Evil, then there goes the entire 1st year of economics education in University into the garbage.

1st year economics also told us that markets are rational, so……

I long ago realized that Micro and Macro 101 were nothing but propaganda and indoctrination.

‘rational man’ Quite the joke when you think about it. And it is all based on that, or it was when I was studying econ.

Homo Economicus…

Well worth a look if so inclined at economists who point out logical issues with the mathematical foundations of economics. Lars Syll is one. Those curves are one example. I would summarize as the simplifying assumptions needed to make math work results in models that say little about reality.

Not even simplifying, completely made up models that do not like up with reality what so ever. Steve Keen has long rants about all the wrongs of mainstream economics.

No, disinflation if the rate of prices increases declining.

Deflation is prices in general falling.

Deflation is destructive. Look at the 1800s, where the US regularly had periods of deflation and a resulting long depression. It led to farmers’ protests and to back the dollar with silver to allow for money supply growth to prevent deflation.

If the potential consequences weren’t so dire, I’d say it’d be an “interesting” thing to experience. As Warren Mosler points out a lot, so many of our historical points of reference are when countries were on fixed exchange rates. I’d hope that because we’re increasingly comfortable with crediting bank accounts with dollars ex nihilo, the effects of a deflationary shock would be short. But with Congress and the Executive (and his Treasury) completely at odds, who knows!

IIRC, the Long Depression of the late 19th century was also called the Great Depression until the Great Depression arrived, which indicates just how bad a severe, two decades long deflationary period can be. Japan is another example of how hard it is to get out of a deflationary spiral.

We do know that deflation or the threat of deflation is popular with politicians. The standard cure for deflation is tax cuts and more government deficit spending. Inflation requires an increase in taxes and cuts in government spending. Since the fiscal cure is unpopular they leave it to the fed and the interest rate cure.

Eventually the rentiers will jam us all down the deflationary hole, but let’s remember that China has just had a huge endogenous shock. Housing and real estate contributed to 20-30% of GDP and just fell off a cliff. So, they have apparently responded by boosting investment in manufacturing. I don’t know how that works. Anyway, you don’t need to cite Chinese economic data when England is a basket case on its very own.

The Chinese are investing enormous sums in increased production capacity – the result is that the world is about to be hit with an almighty wave of cheap goods from China, which is good news for many consumers, but is likely to be highly deflationary for pretty much everyone, and probably for China too as there is no indication whatever that Chinese consumers can take up the slack.

Bloomberg also reports today that there seems to be a worldwide wave of Chinese investors selling up property outside China, probably to fill in financial holes left by the property crunch (or possibly even to try to make a killing by buying up cheap apartments in China).

So whichever way we look at it, Chinese domestic economic policy is becoming at least as important to the world as US economic policy. Unfortunately, the days when they more or less matched up (the US being artificially willing to take in China’s artificial surplus), seem behind us.

The fact that deflation self perpetuates because we will get a better price if we wait for a while is basically predatory. But it is so instinctive it really is what all hunters do. Track down their prey until it is sufficiently exhausted, go in for the kill, rinse, repeat. Free market easy money. I’m doubtful that China is that simple minded because their brand of capitalism seems to prevent that kind of destruction left to rot in the sun. The chart is only a window of the longer term objective where y/y has a longer wave than m/m but the two really aren’t that divergent from the center. Just my interpretation as a chart idiot.

China is different economically, really different. I know that such a superb economist as Branko Milanovic disagrees and looks at China as capitalist and Paul Krugman looks at China as failing at being capitalist, but China is actually socialist with Chinese characteristics and that means that Chinese planning works differently than say UK or Euro Area planning.

China went through the entire period of high Western inflation with minimal inflation or even some price index declines. However, China grew through the period and just finished with a 5.2% year of growth and planners expect about the same for 2024. At the same time, China is working against the economic attacks of the US which are meant to undermine Chinese technology advance and so Chinese growth.

As far as I understand, for all the pressure, the Chinese economy is remarkably healthy and able and China intends to extend that health to partner Belt and Road countries.

I suppose that Brad DeLong could be correct about China, after literally decades of being wrong about a crashing of China. A little deflation could be a severe warning sign, but I expect another fine year of Chinese development.

https://english.news.cn/20240208/ffcc066c64ca4a20868a6e7915237415/c.html

February 8, 2024

“New farmers” sow seeds of hope for modern farming

BEIJING — For thousands of years, the Chinese idiom “face to the soil and back to the sky” has been used to describe the agricultural toil of farmers. Now, this traditional farming method is coming to an end as China accelerates efforts to build a robust agricultural industry.

A viral video doing the rounds across China’s social media recently showed how agriculture has quite literally moved into the fast line. A man is seen feeding free-range chickens in the hills of Wenzhou, east China’s Zhejiang Province, from the comfort of his track car, with the chickens in hot pursuit.

The clip quickly gained traction online, with one netizen noting, “It saves both time and effort. Farmers are so relaxed now.” Another particularly enthused commenter said, “I even want to buy a ticket for this modern chicken-feeding experience.”

The roots of China’s status as an agricultural country run deep. Over the past few decades, however, farmers’ gazes are just as likely to be focused on smart devices as the soil beneath their feet thanks to the agricultural modernization drive. Today, tech-based farm facilities are a common sight across rural China, and more and more “new farmers,” both veterans who are willing to embrace advanced technology and well-educated young people with new ideas and farming skills, are springing up.

At an olive grove in Wudu District of Longnan City, northwest China’s Gansu Province, modern farming methods have brought earth-shaking changes to the land, which is considered one of the birthplaces of China’s farming civilization.

With the roar of their engines, transport trucks loaded with fertilizer and farm tools climb slowly along a silver track to terraces bursting with olive trees. Zhao Ciping, a resident in Hejiaping Village in Longnan, easily unloaded two bags of fertilizer and a rotary tiller from the transport machine and headed for his olive grove.

“Our elder generation of farmers would move fertilizer up, and fruit down these steep slopes, and mostly relied on human labor, too. Not only was it exhausting work, but also it was dangerous,” the new farmer recalled. “Thanks to the government, the transport track was built here last year.”

Developed by the local agricultural machinery department and universities, the transport system can carry 200 kg of goods at a time, and climb 500 meters in 11 minutes, which significantly reduces production costs and improves industrial efficiency, according to Zhao Haiyun, director of the Wudu District’s olive industry development office. Currently, a total of 106 transport tracks have been installed in Longnan, stretching 66.7 km…

And also thanks Chuck for @profstonge. How refreshing.

I’d love to see a bunch of charts that tracked the administrations official lies about the economy overlapping the real statistics.

https://www.imf.org/en/Publications/WEO/weo-database/2023/October/weo-report?c=223,924,132,134,532,534,536,158,546,922,112,111,&s=PPPGDP,&sy=1980&ey=2023&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2023

Gross Domestic Product based on purchasing-power-parity (PPP) for Brazil, China, France, Germany, India, Indonesia, Japan, Russia, United Kingdom and United States, 1980-2023

2017

Brazil ( 3,019)

China ( 20,335)

France ( 2,997)

Germany ( 4,412)

India ( 8,277)

Indonesia ( 2,894)

Japan ( 5,248)

Russia ( 3,819)

United Kingdom ( 3,057)

United States ( 19,477)

2023

Brazil ( 4,101)

China ( 33,517)

France ( 3,869)

Germany ( 5,538)

India ( 13,120)

Indonesia ( 4,393)

Japan ( 6,495)

Russia ( 5,056)

United Kingdom ( 3,872)

United States ( 26,950)

https://fred.stlouisfed.org/graph/?g=16LR4

August 4, 2014

Real per capita Gross Domestic Product for China, Germany, India, Japan and United States, 1977-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=16LRa

August 4, 2014

Real per capita Gross Domestic Product for China, Germany, India, Japan and United States, 1977-2022

(Indexed to 1977)

I’ve seen *lotsa* articles & videos recently claiming that China’s economy is collapsing, but I’m not buying it (even at deflated prices :) ) – yet. Partly, because it seems like wishful thinking from sources desperately trying to pretend that Everything Is Fine; partly because it’s part of a terrible trend in “Journalism” where they report What [“Experts” claim] Is Going To Happen rather than What Has Happened; and partly because I think the Chinese Government has far more effective Macro tools than US & Western Governments do.

Not coincidently, Ian Welsh has a post today titled “Western China Economic News Is Totally Deranged” which reinforces my skepticism.

https://www.ianwelsh.net/western-china-economic-news-is-totally-deranged/

Is he wrong?

Ian is an intelligent man who, though humanly fallible like all of us, is rarely wrong.

‘I’ve seen *lotsa* articles & videos recently claiming that China’s economy is collapsing, but I’m not buying it (even at deflated prices :) ) – yet…’

Thank you so much.

The point is the Chinese, drawing on the learning of a 5,000 year old civilization now numbering 1.4 billion, really know how to do stuff.

Cambridge’s Joseph Needham wrote 27 monumental volumes on Chinese scientific advance, showing just how capable the Chinese have historically been. So why not again now, as the last 45 years of remarkable economic development have shown?

They do not # 1.4 billion. China has already admitted to over counting by 100 million on their 1 child policy generations. There has been a lot of good work on their consumption of vaccines to find out their actual birth rates. I can not recall the study at this time.

Well documented ‘Chinese’ history doesn’t go back to 3,000 BC. And I’m extremely dubious of claiming the series of polities in China constitute a singular civilization stretching back even half that time (by means of comparison, Italians aren’t Romans, though they’re directly descended from them and maintain some degree of continuity with them).

On top of that, I think notions of supposedly deep and universally understood ‘cultural wisdom’ are essentially bunk. It seems far more likely to me that Chinese economic policy is shaped by studying events of the last century or so, especially the Soviet experience and trying to not follow the same path. Not because of harkening back to some vague ‘5,000 old learning’.

Very much agree – even a very superficial look at Chinese history shows that so called long term patterns are rarely what they seem at first glance. The one thing though that makes China unique is that geographically its mostly fairly flat (essentially, two huge riverine plains), which has meant its been ideal for quite centralized water based civilizations, in contrast to Europe or the Middle East or SE Asia, where natural geographic barriers tended to create smaller and more fractious societies. Most attempts to ascribe specific ‘cultural’ or ‘political’ factors to development are pretty meaningless (not that they are unimportant, its just that the hard realities of economic development and creating productive economies tend to have their own internal logic that overwhelm any cultural variations). Its easy to focus on apparent differences, but in reality Confucius capitalism isn’t really all that different from Islamic capitalism or Shinto Capitalism or whatever else you are looking at. Dubai, Tokyo, Shanghai and San Franciso all look quite similar these days for a very good reason.

As you say, the key element in understanding China now is looking at more recent history, in particular the failures in adopting Soviet style economics and Beijings systematic study of successful development models, especially in Asia, and its selective application of those models. There is really very little new in China’s economic model that hasn’t been seen elsewhere in Taiwan, China, ROK, or before that, Germany and other ‘catch up’ economies.

My understanding of ‘Chinese’ history is that it’s basically a series of kingdoms, interspersed with chaotic periods that everyone politely agrees to ignore because it disruptes the continuity narrative, that each claimed to be a Dynasty inheriting the Mandate of Heaven from the previous self-proclaimed Dynasty. This then gets tied up in modern Han nationalism, where ‘Chinese = Han’, which doesn’t quite know how to deal with Dynaties run by Mongols or Manchus. And then there’s also the other self-proclaimed Dynasties that get ignored because they lost out and weren’t able to sell their propaganda inserting themselves into the supposedly unbroken line of continuity.

‘5,000 years of culture’ is a multilayered propaganda effort. First ancient and medieval imperial justification then filtered through modern nationalist needs.

Very much this.

The irony of course is that many people who will loudly proclaim themselves as anti-imperialists buy 100% into these myths.

The Peter Zeihan-like commenters, or worse, the Epoch (Falun-Gong) Times keep saying the same “end us nigh” stuff about China. What’s weird is they don’t get tired of repeating that stuff.

I text my friends or former students there and ask them what they see day to day (I know, small sample size of my Western friendly contacts) and they often don’t know what I’m talking about, literally.

Needham also accepted at face value that the biggest ships of the famed early Ming dynasty Treasure Ship fleets were vast wooden monsters that modern Chinese naval engineers have demonstrated would have broken up in a heavy wind. The Chinese are more or less like the rest of us – full of it. Premier Wen Jiabao warned way back in 2007 that the economy was unbalanced, unstable and unsustainable. Trouble was, before they could make tracks in addressing these issues, the GFC hit and the Chinese governments at every level doubled down with construction of housing and infrastructure as the response. Michael Pettis has written extensively on this for years and is very much worth looking up.

Supposing the Chinese know stuff, here is the “Nature Index” for February 2024:

China just passed 4 million domestic invention patents, of which more than 40% are classed as high-value, but only a short while ago prominent academics were telling students that the Chinese could not be technologically innovative. High level theory, research and development publication shows 3 of the top 5 science publishing institutions to be Chinese, 7 of the top 10 to be Chinese and 11 of the top 20 institutions.

https://www.nature.com/nature-index/institution-outputs/generate/all/global/all

The Nature Index

1 September 2022 – 31 August 2023 *

Rank Institution ( Count) ( Share)

1 Chinese Academy of Sciences ( 7437) ( 2224)

2 Harvard University ( 3672) ( 1123)

3 Max Planck Society ( 2621) ( 655)

4 University of Science and Technology of China ( 1853) ( 638)

5 University of Chinese Academy of Sciences ( 3162) ( 634)

6 French National Centre for Scientific Research ( 4343) ( 612)

7 Nanjing University ( 1431) ( 599)

8 Peking University ( 2226) ( 587)

9 Tsinghua University ( 1827) ( 580)

10 Zhejiang University ( 1449) ( 549)

* Annual Tables highlight the most prolific institutions and countries in high-quality research publishing for the year

From what I seen, for the long term technological innovation depends on a lack of central control (repression), a relatively flat society in wealth, rewards from being innovative, enough stability to develop the resources to be innovative such as an educated or knowledgeable society.

China often has the wealth, the knowledge, and the stability, but the repressive, centralized government too focused on long term stability over everything else as well as periods of corruption and the resultant massive wealth inequality slows inventiveness and crushes its advances. I am seeing a similar process in the West today, only without any of the intelligent management that China often showed despite its recurring problems.

Western civilization and its antecedent or related civilizations such as Greece, Rome, Egypt, Sumer, Akkad, and Assyria, all had issues of eventual over centralization in wealth and power, corruption, intra elite power struggles, and with Greece and Rome an eventual denigration of physical labor and practical knowledge partly because slavery and serfdom. A society that depends on the forced wealth creation and extraction of others, or an extremely centralized power structure that suppresses change, even intellectual, for the benefit of a wealthy few will become stagnant and often brittle, unable to deal with challenges that will happen.

I mean the steam engine, mechanical clocks other mechanical devices were developed by them, but never developed as Europe did after the Middle Ages. For several centuries each, Greece and then Rome were on that path. They had all the tools needed to become the modern West centuries before the modern West became, but they, or really the elites, threw it away.

If you are a wealthy overlord, having tons of slaves is more immediately useful and less threatening than an fancy device or new idea. There is no real incentive to fund them and a good incentive to repress them especially if stability and remaining in power is the most important thing regardless of the costs otherwise.

Also, just look at the corrupt in Western science, the denigration in science and practical technology and skills as well as the ideas of quality and making a living in creating, instead of grifting. It is just a repeat of the past and something China will or is facing today especially if this centralization of power and wealth continues.

Some civilizations do overcome this and survive, including China and the West, but it is not a sure thing that they continue doing so, or that the struggle to do so will not crush the civilization almost into the mud, or even the bedrock, before success.

Well, China’s economy was never based on slavery the way the economies of Greece or Rome were.

Though the political system and power within it was nominally very centralized for much of China’s history, certainly the last thousand years in comparison to european feudalism, it was also to a very significant part rather non interventionist and not particularly top heavy.

The number of public officials managing the Empire was positively tiny considering the size of the realm and it’s population.

There obviously were successful, private business people, many of whom became quite wealthy, fabulously wealthy in some cases.

But they never managed to subordinate the government to their collective class interest to the degree even pre modern western plutocrats did.

The Chinese Empire certainly never followed policies like the systematic enclosure of the commons in early modern capitalist Europe.

Centralisation of power and centralisation wealth the way we think of in Western plutocracies don’t necessarily always go hand in glove, there is often conflict between them.

While the imperial chinese government mostly had a relatively hands off approach to actual governing, when it did actively intervene, it much of the time did so to prevent the growth of concentrated economic power and landownership.

Generally agriculture was where it was most active by far.

This obviously was a measure to promote “stability” and helped prevent the rise of a politically potent, entrenched plutocrat oligarchy that could have threatened the power of the Emperor and the imperial beraucracy.

But the small Farmers that were not gobbled up by latifundia or systematically reduced to sharecroppers or deliberately and nigh universally robbed of the ability to cover their own needs instead of just producing on demand for faceless global markets probably tended to be pretty appreciative of such measures.

Indeed this system was heavily criticized by admirers of western plutocracy for preseving a huge class of small farmers that did not fit capitalist efficiency requirements.

Though there was nonetheless lots and lots of productivity increases and the government DID help promoting those and of course build and improve irrigation systems, artificial waterways, projects to turn swamps into arrable land and so on.

Today of course we would rightly call many such projects ecological extremely destructive, but what really were the alternatives back then?

They also bought up huge amounts of grain helping to prop up prices and prevent or limit speculation and helped prevent farmers to not fall into depth and have to sell off their land.

At times the state actively helped farmers that HAD been forced to do so to buy it back, even if families had lost their ancestral Lands a couple generations earlier already.

Of course a big part of the huge grain surpluses the government bought were put in storage and distributed to the hungry in times of a bad harvest.

“Victorian Holocausts” describes these “inefficient” measures, going back to the earliest times of Imperial China and how without doubt they saved countless millions of lifes over the centuries, and as long as the imperial administration halfway worked continued to save millions in China while the stonecold, malthusian freetrade fanatics of the British Raj deliberately allowed millions upon millions to starve to death in India and many other places.

Even earlier the author describes the vastly different reactions of two contemporary monarchs, the Yongsheng Emperor of the Great Qing Dynasty and that of France’s mercantilist Sun King Louis XIV.

You can surely guess which one of them comes out looking better if one considers not allowing one’s subjects to starve to death as something commendable for a monarch to do.

Obviously the Emperor had a huge palace (usually a whole bunch in fact), tens of thousands of servants and an army, the public officials surely lived rather well, at least the higher ranks, though there was a tendency try and seriously reduce expenses, like the founding Emperor of the Song Dynasty deliberately reducing the size of the imperial palace to a fourth or even sixth of what it had been under the preceding Tang Dynasty as well as regularly trying to reduce taxation, with founding emperors often trying (sometimes with considerable success lasting several generations) to fix the taxrate in place and forbid their successors from ever raising it.

In the earlier dynasties a lot of corvee labour was demanded, later ones largely tried replacing it with taxation and actually hiring and paying the workers.

Slavery actually did exist, but on a comparatively tiny scale.

The situation of those slaves varied from dynasty to dynasty, largely dependent on the founding emperor’s views on the subject.

At several points slavery was generally forbidden but usually re-legalized by a new dynasty, especially if that dynasty was founded by conquerors from Central Asia, where arguably it was deeper rooted in nomadic and semi nomadic warrior societies (where capturing slaves was standard procedure in tribal warfare) than in China proper.

There were occasional utopian experiments with trying to enforce radical economic equality, like under Emperor Wang Mang, an usurper taking over for a while from the Han Dynasty, though they unsurprisingly didn’t last long, such as when the Han were restored after Wang Mang’s death.

Some radical attempts were religiously motivated, by forms of Buddhism and Taoism, especially during times when the empire had dissolved into a number of smaller kingdoms.

There was at least one ruler who was a radical Buddhist pacifist who abolished the death penalty, mostly dissolved the army and put most of the state’s income into building temples but also hospitals for people and animals and other wellfare measures (imitating famous indian Emperor Ashokar Maurya), and was eventually forced to step down by his ministers who saw that they would inevitably be conquered by their less saintly neighbours, which of course duly happened shortly thereafter.

As good as any a place to stop, I guess I’m trying to say is that it to me seems like serious oversimplification to reduce China’s political and social history to a relentless, unidirectional march towards ever increasing centralisation of wealth and power largely indistinguishable from the West, with the presumptions that those things inevitably always and everywhere march in lockstep in very similar and predictable ways.

Really, really nicely expressed. Thank you.

The way in which Xi Jinping draws on cultural tradition in telling stories:

https://twitter.com/thinking_panda/status/1644368570141507584

ShanghaiPanda @thinking_panda

President Xi told a story to President Macron:

Chinese ancient musicians Yu Boya and Zhong Ziqi’s friendship was strengthened by music. Boya played a piece of music that only Ziqi could understand, demonstrating that true friendship requires mutual understanding and appreciation.

11:56 AM · Apr 7, 2023

This story implies that… In international politics, mutual understanding and appreciation are key to building strong relationships between nations… by valuing and respecting each other’s differences, nations can find common ground and work together towards common goals.

https://pbs.twimg.com/media/FtH6VGWaEAEL0vA?format=jpg&name=small

Despite having different political systems, ideologies and histories, both China & France are major powers with significant geopolitical and economic influence.

Both countries should seek common ground while respecting differences; together maintain peace and prosperity for both nations.

Darmok and Jalad, at Tanagra!

I recall reading other statements by Xi or other Chinese leaders that are allegorical – like CA’s – but they must recognize that outsiders don’t share the rich history of such stories and are unlikely to get the point. I sure hope the US State Dept has people who can explain these stories to our leaders (though sadly, I doubt our “leaders” would take the time to listed and understand, when they really need to get back to their fund-raising calls).

Thank you for all this. I knew nothing about the pacifist Buddhist emperor. History really is weirder and more interesting than fiction.

I must say that I am guilty of trying to extrapolate trends or rhythms from over four thousand years of history and multiple civilizations resulting in extreme oversimplification. I still see a repeat process of the concentration of wealth and power, then increasing corruption and efforts to remain in control by clamping down on change, which prevents the civilization from dealing with change and if not destroyed, the ruling regime or system is. The specifics are different, but the pattern remains, which is why I think what I see happening right now is generally accurate. But the future is not preordained by the past, it is just strongly suggestive.

Here is to hoping that our current civilizations are like the rare ones in the past that manage the reforms needed to meet the extreme challenges ahead and remain not only cohesive, but truly functional as well.

In the article you linked there’s a link to his previous article: China Is Transitioning Economically, And So Far, Successfully that provides data and analysis.

Yes, the Chinese, who even know how to count, really do number 1.4 billion: *

https://fred.stlouisfed.org/graph/?g=1g4Ar

* 1,412,175 billion in 2022

Those of us who have been following the economic developments from China have been in a state of catatonic shock for decades. In my case since 1994… as is well known, that was the year inflation in China reached 20 something percent, and every economist in the west said the Chinese miracle is over …..I have been chastened and humbled since then; there were potentially severe adjustment problems, and all of us, without exception, forecast a hard landing. The general western media coverage was quite hysterical, indeed, even gleeful, as one can imagine. The ensuing macro-management was masterfully effective…Within 3 years inflation was down to zero, while growth rate rarely dipped below 9%!! Since then China’s economy has grown 20-fold in dollar terms, about 700% in real terms and more than 10-fold in PPP terms!…i now know not to second guess and sit in judgement upon a macroeconomic leadership that has carried out the greatest economic transformation in world history….Regarding housing and housing finance: here too one gets a feeling of constant déjà vu about the housing bubble, the impending crash etc. Most of the factors, albeit not all, which were relevant in terms of arguing against a housing crash more than 10 years ago are still relevant today – Significant and robust URBAN population growth, relative to housing construction, together with double digit REAL ANNUAL urban wage growth; Pent up demand due to backlog of quality housing; few alternative investment opportunities; socio-cultural importance of housing and home ownership bias, e.g. for newly weds, implying a higher price income ratio in equilibrium; low level of of linkages to the financial markets in terms of securitization, derivatives etc, as well as low LTV ratios, implying low contagion possibility through financial channels;

the achilles heel of china lies elsewhere…

Actual question:

How do you get deflation when you are primarily dependent on imports?

If the price of imports remains stable or rises, which is dealt with either with substitution or inflation.

The UK is primarily an import economy (unlike the United States).

“How do you get deflation when you are primarily dependent on imports?”

Should this interesting question refer to China, a partial answer is that China has almost always had a trade or current account surplus. Also, China has worked to develop domestically what would be especially expensive imports:

https://www.imf.org/en/Publications/WEO/weo-database/2023/October/weo-report?c=924&s=BCA,BCA_NGDPD,&sy=2000&ey=2023&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2023

Current Account Balance and Balance as a percent of Gross Domestic Product for China, 2000-2023

https://news.cgtn.com/news/2023-02-17/China-rolls-off-first-domestic-high-efficiency-heavy-duty-gas-turbine-1huP7qwZxTi/index.html

February 17, 2023

China rolls off first domestic high-efficiency heavy-duty gas turbine

China’s first domestic air-cooled heavy-duty gas turbine with the highest energy-efficiency level was rolled off the production line in Qinhuangdao City of north China’s Hebei Province, marking a breakthrough in the country’s heavy-duty gas turbine manufacturing technology….

Will deflation save the environment though? I have a hard time believing that necessities will fall in price beyond a certain point, after all people will still need to eat, etc. If deflation were to take hold, environmentally destructive companies won’t be able to pay their debts, and they would go down the dumpster.

“Second, falling prices discourage investment because people defer purchasing decisions in the hope that they can buy things more cheaply in the future.”

I really dont understand this economic theory.

When has anyone delayed a decision in expectation of falling prices. TV prices fall but no one waits for them, you buy a TV when you need one, same for appliances, computers etc.

The opposite also should be true with inflation, people should rush to buy now evth because it will cost more tomorrow but they dont.

These theories are nonsense.

Why cant we have just price stability, 0% inflation or deflation ?

I also never really bought the conventional wisdom that ‘deflation is bad’.

The problem is when inflation moves up (transfer of wealth to debtors like last year) or when it moves down (transfer of wealth to investors).

The correct inflation target should be 0% because it is morally right that $1 of work today should be redeemable for $1 of work in the future. You shouldn’t have to put your capital at risk in an investment to maintain purchasing power.

Richard Murpy has been in favour of higher inflation for a while (recall his articles on GDP targetting). He wants to make a political choice that savers should be penalised for the benefit of everyone else.