Yves here. It’s worth keeping tabs on the various elements of elite disconnect with the lives of those they regard as the masses. An obvious one has been the economy, where pundits insist the meal is the menu, and because their preferred measures of labor market health look perky, and inflation has moderated significantly, those who dare say that the natives are unhappy with Biden policies are wrong and/or trying to foment discontent.

Never mind that even if food prices aren’t increasing by much in the US these days, they’ve risen by so much that many still have not adjusted to the higher baseline. Housing is not-to-barely affordable for many. Health care is too pricey and getting more so. And that’s before getting to health care shrinkage via service degradation, such as substitution of less-trained medical professionals for MDs.

A simple alternative metric that shows Biden has done squat for those towards the bottom of the food chain: the percentage of Americans with less than $400 at hand for an emergency is 37%, back at the same level as in 2019, before Biden came to office. That is up from 32% in 2020, during the Covid stimulus period.

Oh, and that factoid does not factor in that you’d have to have $488 now to match the purchasing power of $400 in 2019.

In a bit of synchronicity, Bloomberg columnist John Authers points out this morning that US small business are in a particularly dour mood, and inflation is a big reason why. From his People Are Angry to the ‘Anti-Core’ Over Inflation:

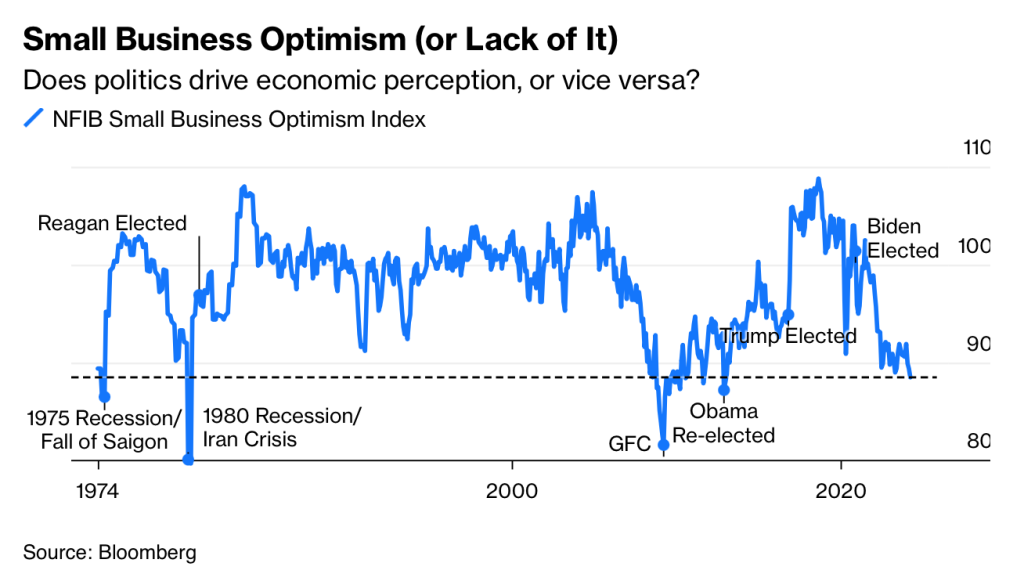

Exhibit A is the usually very useful survey of small business optimism conducted by the National Federation of Independent Business. It’s been running a long time and has a good history as an economic leading indicator. Very few small business owners are bleeding-heart liberals, but this hasn’t compromised the survey in the past. Yet it certainly looks like that’s happening now. Somehow or other, their optimism has just dropped to a lower level than it ever touched during the worst of the pandemic. Indeed, it hasn’t been this low since December 2012, when they had to digest the surprisingly comfortable reelection of Barack Obama:

Other than that, pessimism has only been greater during the Global Financial Crisis, and — much more briefly — the dire days of 1975 and 1980 when the US was dealing with both economic recessions and humiliating international reverses (in Vietnam and Iran). Pessimism was never so deep during the Gulf War, or in the wake of the dot-com bubble, or even the pandemic. Reviewing history, we find that the election of Donald Trump led in swift order to the greatest optimism on record. Greater than the late 1990s? Really?

Nobody doubts that small business leaders are sincerely pessimistic, or that their negativity about prospects brings with it the risk of a self-fulfilling prophecy. If they hold off investments or hiring because of the grim outlook they foresee under Biden, that will be bad for the economy. But would they really think things were this bad if they weren’t viewing them through the polarized lens of 2024’s politics?

Then there’s the issue of US inflation….

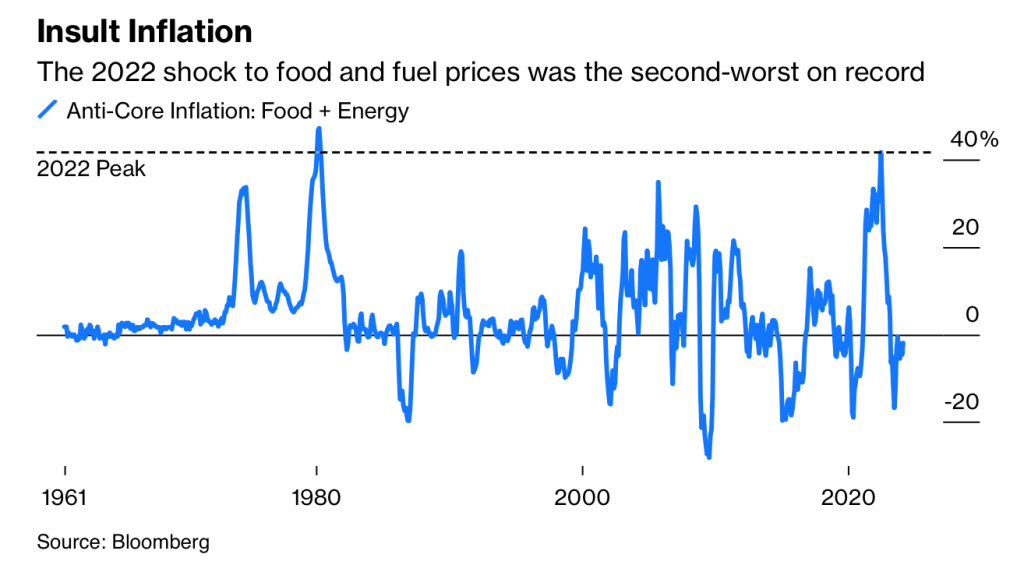

The Bureau of Labor Statistics doesn’t regularly publish a measure for just food and energy. However, they have indexes for both categories stretching back to the late 1950s…Rather than attempt any subtle rebalancing, I produced an “anti-core” index of food plus energy by just adding the two indexes together. I’m sure there are better statistical ways to do this, but there are also many worse ways of gauging just how painful inflation feels to consumers.

This is how year-on-year inflation of this measure has moved since 1961. It’s been hugely variable, but the spike in the summer of 2022 was quite something. Indeed, it was the worst anti-core inflation in 42 years; it was higher even than during the horrors of the oil crisis of the 1970s. This is how bad it looks:

It’s not surprising that a spike of that severity would leave a mark and create a lasting stain on popular confidence in the current administration. However, it’s also important that this measure continues to be very erratic, and has been negative for several months now. Not only is the rate of inflation down, but prices themselves are actually falling. Will President Joe Biden get some credit?

So while Les Leopold’s idea is helpful, it’s still scratching the surface of what needs to be done.

By Les Leopold, the executive director of the Labor Institute and author of the new book, “Wall Street’s War on Workers: How Mass Layoffs and Greed Are Destroying the Working Class and What to Do About It.” (2024). Read more of his work on his substack here. Originally published at Common Dreams

President Joe Biden trails former President Donald Trump by 20 points in the key swing states of Arizona, Georgia, Michigan, North Carolina, Nevada, Pennsylvania, and Wisconsin when people are asked who “is best able to handle the economy,” according to a recentWall Street Journal poll.

To many pundits this makes no sense. During the Biden administration unemployment has been near all-time lows, wages have been rising, and, after a spurt, inflation has been falling. The Wall Street Journal poll also showed that most people say they personally and their states are doing well economically.

Robert Reich, who I greatly respect, tells us not to worry. “There’s always a time lag,” he wrote recently in his newsletter, “between when the economy turns positive and when voters begin to feel more positive about an administration.” He estimates it will take another three to four months for the voter vibes to catch up with the good economy, just in time for the election.

If a corporation takes taxpayer money, it should not be laying off taxpayers.

Economist Paul Krugman blames the disconnect on partisanship: Republicans believe that when a Democrat is in the presidency, the economy must be doing poorly. He urges progressives to celebrate the Biden achievements. “The truth is,” he warns, “the U.S. economy is a remarkable success story. Don’t let anyone tell you that it isn’t.”

Well, I’m about to do just that.

I fear that Reich and Krugman may be underestimating a devastating economic problem that the Democrats have ignored for more than a generation: mass layoffs. And this is a problem that will not go away by November.

In January, 90,309 jobs were cut, according to the Challenger Report. In the high-tech sector, 260,000 workers lost their jobs in 2023, and another 57,000 so far this year. Approximately, 4 million workers have been laid off since Biden came into office.

But wait! Aren’t those job-loss numbers dwarfed by the 14.8 million new jobs created since the Biden inauguration? Won’t that jobs boom soon sink into public consciousness, just as Reich is predicting?

Not likely. That’s because there’s a big difference between finding a new job because you want to and scrambling to find a job because you’ve been laid off. If your factory shuts down in rural Pennsylvania, for example, finding a new job could feel like hell on Earth as you, and a thousand of your former co-workers, scramble for the last jobs at the Dollar Store or Walmart.

You’re not about to reward those in power for the pain and suffering caused by being laid off due to no fault of your own.

In addition to the financial loss, the damage done to laid off workers’ health is considerable. Studies show that:

- Losing your job is the seventh most stressful life event, more stressful than divorce, a sudden and serious impairment of hearing or vision, or the death of a close friend.

- Recovery from the psychological trauma takes two years on average.

- Even for those without preexisting health conditions, the odds of developing a new health condition after being laid off rise by 83% in the first 15 to 18 months.

- Fetal development in pregnant laid off workers can be impaired.

- The risk of suicide, drug addiction, and depression increases.

The U.S. Department of Labor recognizes that “being laid off from your job is one of the most traumatic events you can experience in life.”

If Biden wants to gain more support, he should take a page from Donald Trump and intervene directly to stop mass layoffs. When Trump stepped in and prevented Carrier Air Conditioning from moving a plant to Mexico in 2017, it was widely popular. Finally, a politician stopped a layoff!

Why did Carrier give in? Because of the leverage inherent in the power of the presidency. As the CEO of United Technologies, Carrier’s parent company, put it: “I was born at night, but not last night; I know that 10% of our revenue comes from the U.S. government.”

The federal government awards approximately $700 billion per year in federal contracts. What if the Biden administration added one simple clause: “No compulsory layoffs.”

If corporations with federal contracts want to lay off workers, they should have to buy them out. Layoffs would need to be voluntary. The logic is simple: If a corporation takes taxpayer money, it should not be laying off taxpayers. If that’s too much of a restriction, corporations are free to refuse federal contracts and government subsidies.

That would get the attention of working-class voters.

The blowback from corporate America, of course, would be fierce. Biden would be viciously attacked and accused of every socialist sin imaginable. It would take real nerve to let corporations know that they can’t take our tax dollars and then destroy our jobs.

Franklin D. Roosevelt knew exactly what to say in 1936 when faced with these kinds of attacks during his first term as president:

We had to struggle with the old enemies of peace—business and financial monopoly, speculation, reckless banking, class antagonism, sectionalism, war profiteering.

They had begun to consider the government of the United States as a mere appendage to their own affairs. We know now that Government by organized money is just as dangerous as Government by organized mob.

Never before in all our history have these forces been so united against one candidate as they stand today. They are unanimous in their hate for me—and I welcome their hatred.

I should like to have it said of my first administration that in it the forces of selfishness and of lust for power met their match. I should like to have it said of my second administration that in it these forces met their master.

The country may again be ready for that fight. But are the Democrats?

I proposed this years ago. No publicly traded company can buy back their stock if they had laid off x percent of their employees the previous two years

“Never mind that even if food prices aren’t increasing by much in the US these days, they’ve risen by so much that many still have not adjusted to the higher baseline.”

Dry dog food, Nutro. Pre Covid I bought 40 lb bags for around $50. During Covid I could come close to match that because Pet Store chains offered discounts for in store pickups, but the price was clearly rising.

Today: Those 40 lb bags are almost extinct, replaced by 30 lb bags for $75. I found a 40 lb bag at an online retailer only yesterday, and but it my basket at $87, because they sent me a $20 coupon. The next day (today) it was gone from my basket “no longer in stock” except is was in stock at higher price of $99.

Without discounts, the dog food brand I use (non GMO but sadly not organic only because because organic dog food is insanely expensive) has approximately doubled in a few years time, say since 2020. And discounts fall from the heaven unpredictably so you can’t always count on them.

I could go on about the much greater in crease in dog medication like heart worm and tick repellant which are not priced like the same pricing model of patent human drug. You used to get the much lower from Canada or Australia but that’s dried up. Good lobbyist the pet med people have, probably.

I heavily subsidize my dogs meals with chick, peas, carrots, rice. He inhales them like real food, loves it.

Dogs unlike cats can eat much like a human. Heck, I have seen them eat junk that would make a person, but not them, ill. Cats are obligate carnivores, which means that the pea flour and other cheaper fillers will make them ill. It often is just not immediately apparent.

When buying food for a cat, the only hard rules that I can ever afford is no plants, and usually, no seafood because of the mercury in the often very poor quality “food.” Organic is a fantasy. That means that I am over the proverbial barrel with cats. Buy the “affordable” food that might shorten their lives or buy the (halfway) heathy budget busting food. I really can’t even buy dry food because there isn’t a healthy brand out there. Insane is a good description.

There is precisely zero chance that “nothing will fundamentally change” Biden will ever undertake such a program.

Nothing changes, youmean this?

https://www.youtube.com/watch?v=w_q2LBA38NI&pp=ygUnQmlkZW4gIG5vdGhpbmcgd2lsbCBmdW5kYW1lbnRhbHkgY2hhbmdl

Here’s data from Statista showing the total number of employees that Google had at the end of every year including 2023. https://www.statista.com/statistics/273744/number-of-full-time-google-employees/. At the beginning of 2023, Google said that the company would layoff 12K people, but from Statista’s data they were down only 8K at the end of the year, and I’ve heard from friends that some of the laid off people were rehired or moved to different teams.

I guess what I am trying to say is that the media would report big layoffs but then they would neglect to mention hires except during UE announcements. Also a lot of the layoffs reported in layoffs.fyi etc were GLOBAL layoffs, and this has been pointed out over at Wolf Street as well, https://wolfstreet.com/2023/01/04/layoffs-beyond-hype-no-layoffs-fyi-does-not-track-actual-layoffs-in-the-us-but-media-stories-of-plans-of-global-layoffs-see-salesforce-today-actual-layoffs-discharges-in-the-us-are-still-histor/. I don’t think the US economy is doing amazingly awesome, but it’s solid enough to withstand a 5% interest rate, which in the past would have long caused a recession. The media is screaming LAYOFFS at the top of their lungs just to get people to accept lower salaries, IMHO.

So while Les Leopold’s idea is helpful, it’s still scratching the surface of what needs to be done.

Yes, scratching the surface will not get at the underlying rot in the extant social/economic/political system. And that surface will never be punctured as long as the core political problems are not identified and addressed.

The crisis is now. “No more mass layoffs” won’t get the attention of voters because even the working ones need solutions. The Democrats, especially B

They spent years promising six more months untIl Obamacare was up and running, and they lost. Trump had no business being elected except for the craveness of Team Blue. They eked out a slight win in 2020 and we’re saved in 2022 after promissing to not be so heinous. Instead of proposing solutions, Team Blue is engaged in genocide and telling voters they are idiots for not embracing the rebrand of Reaganomics. Biden is even trying to claim military spending is good for the economy.

Biden needs to come out with a series of proposals and make a public show of firing the dead weight, Buttigieg and Garland. No one in corporate America fears Garland. DeJoy is still at the post office. Pack the courts, but one empty promise is not going to cut it.

Given that the choice is between B or T, is in itself testimony that the underlying structure of the system is broken.

I don’t think that saying “Biden needs” to do x,y, or z has any basis in the world that exist below the “surface” that Yves referred to. These characters are shadows dancing off Plato’s Cave that people refuse to see as such and which they don’t want to endure the struggle of breaking chains and turning to see the painful light that creates the shadows.

Thank you, I fully agree. It seems many are distracted by the media spectacle and lost in the forest for the trees. As you mentioned “…core political problems are not identified and addressed…” My crude analogy is putting a cheap paint job on a broken down car and pretending it runs like new. No need to look under the hood.

Based on past performance, Biden will do nothing. He won’t even legalize/deschedule cannabis. We need to vote for the Dr. West on the left and the right needs to vote RFK, Jr. Full stop. If one is not willing to walk from their party, their party will never serve them.

So in other words, another reason Biden will get crushed in November.

I would also add that any company that wants to do layoffs should start first with the H1-Bs especially those without American graduate degrees. Also these companies that do layoffs should be banned from H1-B sponsorship by the Immigration department. I was let go in December from a company that massively hired engineers in India in the last two years and also opened a new tech center in Pune, India. They also at the same time laid off a lot of American Engineers and hired H1-Bs to replace them here in the US. Biden can do a he’ll of a lot to stop these kinds of labor cost arbitrage skulduggery. In the job hunt now for 3 months I am seeing a new trend where body shoppers like TATA, HCL, Cognizant and others are hiring local people for much lower pay to be placed in companies like Facebook and Caterpillar. They totally refuse to negotiate salary This is an insidious and dastardly technique to push Software Engineer salaries down. These companies need to be sent back to India. They pose unfair competition to local Contractors since they are able to easily import Engineers from India on H1-Bs and other visas. I am sure you will hear the enraged howls of the tech sector if Biden acts to send these companies home to India. Why are American companies creating jobs for Engineers from India?

Based on what I’ve seen from recent immigration legal or otherwise, I feel on secure ground saying one H1-B worker over time = 10 new foreign workers in USA.

Absolutely!

Paul Art: I was let go in December from a company that massively hired engineers in India in the last two years and also opened a new tech center in Pune, India. They … hired H1-Bs to replace them here in the US … Why are American companies creating jobs for Engineers from India?

For the bottom line and also, as per Michael Hudson, because cost of living for American workers is so high (predatory pricing for housing, healthcare, etc.) that American workers are getting priced out of the market.

In short, you have other worries than the Indians. Here’s a new trend. From the Wall Street Journal last week —

https://archive.ph/7RkwQ

‘The British Are Coming for Your White-Collar Job: Surging wages and staff shortages in the U.S. are spurring companies to look across the pond’

‘…“In the old models of outsourcing you’d give the outsourcing company the boring work. But there’s the new breed of outsourcing that is cheaper but also often creative,” said Matt Buckland, who spent two decades as a tech recruiter in the U.K. for companies including Facebook. “You might still give your team in Hyderabad basic Python code. In the U.K. you might give them AI.”

‘…The average salary for a back end software developer in the U.S. is near $130,000, though closer to $175,000 in cities such as San Francisco and New York, according to data from global recruitment agency Robert Half. In the U.K., a developer’s average salary is about $66,000….

‘ “If you’re based in New York or San Francisco it’s now going to be cheaper to offshore to northern England than to Mississippi or Alabama.” … JPMorgan Chase says it is the largest tech employer in Scotland and recently built a new hub in Glasgow to house thousands of employees working on technologies including machine learning. Asset-management giant BlackRock is in the process of expanding its office space in the Scottish capital of Edinburgh, which houses tech-support teams and an artificial-intelligence lab ….’

‘Exports of services to the U.S. have brought in close to $90 billion for the U.K. in the year through last September, according to Deutsche Bank ….’

And so on.

The race to the bottom has plenty of steam left.

Did not know this at all @michelmas. I definitely know the Body Shoppers from India have a strong presence in UK – nephew of mine works for BT in Chennai via Tata Consultancy Services and posted to UK some years back and worked there for almost a year while learning the skills from the senior BT hands and then bringing it back to Chennai. Add Sunak’s Father-in-law Narayamurthy of Infosys fame to the mix and you can definitely wonder if these jobs in northern England and Scotland might soon take wings to Bangalore, Hyderabad and Chennai. The wet dream of the 0.01% to convert the entire world into a single labor market has been realized.

I have now personally given up on the ‘free market’ and regretfully moved into the Defense sector working for the Government. I followed in the footsteps of a close mentor who made the transition decades back.

One of the strange things I observed while working 4 years for the company that laid me off is the wondrous career graphs of the engineers I worked with and helped train in Bangalore. They had and have amazing technical work opportunities. They all became Managers or Senior Project Leads in 2-3 years. Some became Directors. It is true they are worked very very hard but they almost never have layoffs. It made me think – ‘they have sent the America I came to and knew in the 1990s to India and elsewhere’. The funniest part was hearing the Managers in India complain that they struggle to retain the top talent – something I frequently heard in the Silicon Valley of the 1990s.

But I would say that the economy here in the US is still hot – I did get multiple offers that I turned down because my new dictum now is, “I will NEVER work for a private company again”.

Welcome to my world. I’m in insurance and we got whacked at the turn of the century. When I was able to find work the rates had dropped 40% (I am a consultant). I also noticed company’s that had offered salaries in excess of $100K had dropped their offerings by $10 – $12K within a few years after they outsourced. Everybody took a hit whether they knew it or not. And if you were 50 years old or greater you would basically be screwed. I know as I turned 50 when the outsourcing hit and I essentially became a gig worker then.

I was let go in December…

[ Saddening and frightening. ]

Perhaps I am biased but I have solid feeling that Biden viscerally hates doing anything of benefit to ordinary people. He gets into office and the first thing that he does is to renege on that promised $600 when there was no reason to do so. US Presidents in the past would make a point of visiting disaster zones after something bad goes down but Biden has an aversion to being in the same time zone as a disaster zone. He is already on record as saying that he has no sympathy with young people, even though they got him over the line in 2020. He strips away any Federal medial help for people while the Pandemic is still going full bore. And those are only examples off the top of my head. i don’t think that he will do much different over the next seven months and I cannot work out if it is because he thinks that he is always right or because he staffed his White House team with yes people.

“I have solid feeling that Biden viscerally hates doing anything of benefit to ordinary people”

That’s my gut intuition as well.

Where’s the public option, the higher federal minimum wage, the federal mandated sick leave, allowing Medicare to negotiate drug prices etc.

Likely both. My sense, from listening to him speak in interviews, gauging his reaction to any question that really probes, is that underneath the affable Happy Joe exterior lurks a supremely arrogant and entitled individual.

Both Yves and author Les Leopold mention inflation. Together with other issues, Leopold writes, “inflation has been falling” and that, “To many pundits it makes no sense” that voters think Biden less able “to handle the economy” than Trump.

I’m certain few readers are fans of Larry Summers. Nonetheless, a Forbes article by Avik Roy, “Summers: Inflation Reached 18% In 2022 Using The Government’s Previous Formula” is worth a few words especially on the “previous formula.”

Roy raises the question, “So why are Americans ignoring the view of many experts that the economy is doing well?” For Summers and his Harvard/IMF coauthors Marijn Bolhuis, Judd Cramer, and Karl Schulz “rising interest rates are as much a part of inflation as the rising price of ordinary goods.” “Concerns over borrowing costs, which have historically tracked the cost of money, are at their highest levels” since the early 1980s, they write. “Alternative measures of inflation that include borrowing costs” account for most of the gap between the experts’ rosy pictures and Americans’ skeptical assessment.

Roy writes, “The most widely used measure of inflation in the U.S. is the Consumer Price Index for All Urban Consumers, or CPI-U, which is put out by the U.S. Bureau of Labor Statistics (BLS). This formula has undergone numerous revisions from its creation in 1919 to the present day.”

Roy continued, “Most notably, as Summers and his coauthors…point out, in 1983 the BLS eliminated interest costs from its calculations of consumer price inflation. The argument at the time, made by BLS economist Robert Gillingham, was that including home mortgage interest rates in the CPI formula was overstating inflation. Instead, Gillingham argued, the BLS should estimate what homeowners could charge if they rented out their homes, and use that to calculate housing inflation.”

“This change [Owners equivalent rent] had a huge impact on the calculation of CPI, write Bolhuis et al., because the BLS removed housing prices and financing costs from the official CPI formula, even though everyday Americans still experienced those costs in the real world.”

“Bolhuis et al. point out that the elimination of interest costs from CPI isn’t just about housing. “New and used vehicles combine to represent nearly 7 percent of the CPI,” they point out, but “exclude financing costs.” Given that four-fifths of all new cars were purchased using auto loans, this makes no sense.”

“Furthermore, more people buy consumer goods with credit cards than with cash—and yet the interest costs of credit cards aren’t included in the official BLS formula.” “Measurements of the cost of living that exclude financing costs,” Bolhuis et al. argue, “will understate the pressure under which consumers, who rely on credit for many purchases, have found themselves.”

The authors, “then went on to see if they could recalculate the official CPI numbers using a pre-1983-like formula that incorporated the cost of mortgage interest, auto loan interest, and credit card interest on the cost of living.” “They found three things: first, that the pre-1983-like formula led to a dramatically different estimate of inflation in 2022 and 2023, peaking at 18 percent in November 2022.”

“Second, they found that consumer sentiment—as measured by the widely-used University of Michigan Index of Consumer Sentiment—correlated much more strongly with the pre-1983 CPI formula than it did with the modern one that excludes interest costs.”

“Third, they found these differences to be also true in Europe: higher interest rates were correlated with lower consumer sentiment, and vice versa.”

“Consumers are including the cost of money in their perspective on their economic well-being, while economists are not,” the authors conclude.

https://www.forbes.com/sites/theapothecary/2024/03/23/summers-inflation-reached-18-in-2022-using-the-governments-previous-formula/?sh=1318b3872092

“Housing is not to barely affordable for many” – Maybe should be: Housing is barely affordable for many

Genocide Joe? The DT? Again? Still? democracy? WTF? Grumpy Gadfly says:

https://www.youtube.com/watch?v=XbOx8TyvUmI

I added some hyphens. Maybe it comes off better now.

Yes, thanks. Just about every person I talk to here in Nor Cal says the same: that housing costs are nearly unaffordable. For many it is unaffordable and they sleep in RVs, cars or worse. Many of these people work full time. It’s not just alcoholics and drug addicts.

And: the highest electricity costs in the US , and quite possibly the entire OECD: my last PG&E bill charged “off peak” rates of .48 per kWh, and .52 for “peak time” rates.

Food prices are also higher than the rest of the country here, despite most of the food coming from right here in California. Gasoline is the highest in the nation as well, surpassing even Hawai’i

https://gasprices.aaa.com/?state=CA

A few weeks ago, I wrote at NC about losing my affordable housing as well as being diagnosed with an very serious untreatable illness.

Just today I found a safe, affordable place to live. I found it through two people Lambert would call helpers, people I have never actually met but who went out of their way to help me. One of them said, “I want you never to worry about being homeless again.” It is such a wonderful feeling. I am still in shock about it.

I wanted to share this good news with you all at NC. Maybe it will give someone reading my comment the strength to keep going. Reach out and keep asking people for help. You might actually find it.

Just today I found a safe, affordable place to live. I found it through two people Lambert would call helpers, people I have never actually met but who went out of their way to help me. One of them said, “I want you never to worry about being homeless again.” It is such a wonderful feeling. I am still in shock about it…

[ Wow and wonderful. I am deeply moved and grateful for your happiness. Simply wonderful for you and those who have learned from you. ]

Lena that is so great to hear! best wishes to you

That’s great news, Lena. Certainly it will get rid of a lot of the stress that you must have been experiencing. Hope good fortune continues to shine your way.

Thank you for sharing Lena, I wish you all the best.

Ah yes, the quandary of being Joe, or as we are all repeatedly told, better than FDR, and as the economists tell us – the economy is GREAT!

How little can I do to sucker people into voting for me in 2024? Because nothing will fundamentally change!

Obama was so much better at this. (Was this because he was our DEI President, and we could all bask in the glow of that while he just wrecked us? I’m too old to really understand the whole DEI controversy/thingy.)

Well, let me help you then. DEI is the new cover for incompetence.

DEI = Didn’t Earn It.

See, this is the problem I have. Obama clearly won the election so I’m not sure how “Didn’t Earn It” applies in this case. And he’s obviously very smart and very smooth.

He just campaigned one way and then governed completely differently. I’m convinced he put us on track to be a country of rich people, and everybody else struggling. He killed the middle class, especially the blue collar middle class. It’s maddening to hear “progressives” say we need another Obama. If we get another President as effective as Obama, I’m not sure what will be left in our country.

And earn it? Oh, he earned it. Wall St got every buck they spent on this guy and more. He earned the hundreds of millions they gave him because they got trillions in return.

A couple of points: my understanding is that the NFIB surveys are dominated by real estate. With high mortgage rates and the breakup of the NAR monopoly on commission rates, it makes sense that they’re not optimistic. Second, as another reader pointed out, Challenger has never been a good guide to actual corporate behavior.

Third, yes the CPI should include interest payments and fees on all sorts of transactions. The owners equivalent measure of housing costs for homeowners should be scrapped. On the one hand, half of homeowners (a third of all households) have paid off their mortgage and have zero housing inflation in the narrow sense. Most of those with a mortgage have a fixed interest rate and are in the same boat. And who the hell knows what their home would rent for unless they do some market research? (This is what BLS asks survey respondents when they measure housing costs for homeowners).

What the CPI doesn’t pick up is maintenance: new roof, paint, furnace etc.

I agree that voter malaise is more about just because technically I may be slightly better off than I was before the pandemic, my income still sucks and I’m still one root canal away from not being able to pay my rent.

More on Les Leopold here:

https://www.racket.news/p/the-real-book-about-the-white-working

Forget private sector layoffs. “Schools across the U.S. are laying off staff members en masse in a battle to balance budgets as pandemic-era relief draws to a close.”

https://www.msn.com/en-us/money/careers/mass-layoffs-hit-schools-in-multiple-states/ar-BB1l7Bxx

A point to be made here about inflation indexes of all sorts is they need to include the ludicrous school budgets and regular budget increases. I am a clerk in a small town and our entire budget is $1,007,000.00 this year. The next town over, with maybe 10x the population has a budget of $7,500,000.00. The school system is combined and open for approximately 162 days a year. Generously half a year. Its budget is $37,500,000.00 and goes up a million dollars plus a year. Every year it is my largest expense. Not sure where this trend is headed but it doesn’t look good to be a low-income homeowner. I guess in the latest gaffe by HRC I should just get over myself and vote for old Genocide Joe and know nothing will ever change.

I can’t recommend Amy Goldstein’s book “Janesville” enough. It captures this phenomenon with amazing and sincere clarity. It’s thus demoralizing.

It tells the story of layoffs at GM’s janesville wi plant in GFC-great recession. These are precisely the decent paid, blue collar manufacturing jobs that is the vote demographic discussed.

Those lucky enough to land new jobs once laid off from GM got jobs paying 30-40% of their auto assembly work, which meant having to get 2 jobs to scrape by. And these are shit, service jobs at wal mart, fast food etc. The luckiest few managed to keep auto jobs, by commuting to Toledo OH (!). A 9hr drive, i’d guess.

The book’s sub-title is, fittingly, an american story.

USA! USA!

https://www.nytimes.com/2017/04/19/books/review-janesville-amy-goldstein.html

April 19, 2017

In ‘Janesville,’ When the G.M. Plant Closed, Havoc Followed

By Jennifer Senior

JANESVILLE

An American Story

By Amy Goldstein

Over the course of his career, Paul D. Ryan, the House speaker, has been described as a policy nerd, a lightweight, a canny tactician, a dreadful tactician, a man of principle and a man whose vertebrae have mysteriously gone missing.

But in the opening pages of “Janesville: An American Story,” Amy Goldstein’s moving and magnificently well-researched ethnography of a small Wisconsin factory city on economic life support, Ryan is just another congressman, pleading on behalf of his hometown, population 63,000.

It’s 2008, and Ryan has just received a phone call from Rick Wagoner, then the chairman and chief executive of General Motors, to alert him that the company will shortly be stopping all production in Janesville.

The news is too improbable to register. Janesville has a storied place in labor history, changing and repurposing itself as the times required. Barack Obama used its plant as a backdrop for a speech about the economy early on in his 2008 campaign. Most presidential candidates eventually buzz through. The place has been manufacturing Chevrolets for 85 years. The congressman is stunned.

“Give us Cavaliers,” he begs. “Give us pickups.” Any model other than the unpopular SUVs the plant is currently churning out, he means. “You know you’ll destroy this town if you do this!” he yells into the phone…