Yves here. I got an accidental introduction to the prevalence of imperialism via fast food, not through directly noticing the number of KFC’s here (there is at least one McDonalds on Beach Road, but that is pretty certain to be targeting tourists, and there seems to be a good number of local burger shops here if that is your thing). Instead, and I connected the dots ONLY after encountering this post, the clue came via a Thai language course. I am taken with this method (Acquired Language Growth, where you learn like a baby, just watching skits until it sinks in…..after about 700 hours). The instructors make up lively skits so that the viewer can hopefully at least get a drift of the gist.

You will see in Absolute Beginner Lesson 2, about countries, that the teachers chat about what they imagine about when they think about certain countries. At 5:30, they discuss America. You will see KFC comes up first, ahead of the Statue of Liberty (to the amusement of viewers, “Brad Pitt,” introduced in the first segment, is the name of one of their students).

To the more serious discussion. I have to confess I had no idea of the magnitude of US efforts to export US “culture” in the form of junk fast food, admittedly for the good cause of multinational profit.

This post has excellent gumshoe work on how KFC’s parent, Yum! Brands, requires KFC franchisees to buy chicken from Yum! approved factory farms, and how US development banks like the World Banks’s IFC in turn financed those factory farms.

By Alex Park, a journalist and researcher based in California. Originally published at DeSmogBlog

With its unparalleled purchasing power and exacting demands, fast food has long shaped agricultural systems in the United States, Europe, and China. But as major American fast food brands, like KFC, expand into so-called “frontier markets,” taxpayer-funded development banks have made their global expansion possible by underwriting the factory farms that supply them with chicken, a DeSmog investigation has found.

In all, the investigation identified five factory-scale poultry companies in as many countries that have received financial support from the International Finance Corporation (IFC, the private-sector lending arm of the World Bank Group), the European Bank for Reconstruction and Development (EBRD), or both since 2003, and that supply chicken to KFC. A sixth company has benefited from IFC advisory services but has not received financing.

A review of press accounts, financial disclosures, and the companies’ websites shows this support aided these firms’ KFC-linked operations in up to 13 countries in Asia, Africa, and Europe.

In Kazakhstan, both banks helped a Soviet-era poultry factory become a KFC supplier. In 2011, the IFC lent poultry company Ust-Kamenogorsk Poultry (UKPF) invested $2 million in refurbishing housing for chickens, among other projects. In 2016, the EBRD made a $20 million equity investment in the company’s parent, Aitas, to finance the construction of a new facility to raise and process poultry. In 2018, two years after announcing the financing deal, UKPF revealed it had become a supplier to KFC in Kazakhstan. The EBRD sold its stake in the company in 2019.

In South Africa, the IFC helped one KFC supplier bolster its operations across the region. In 2013, the bank loanedCountry Bird Holdings $25 million to expand existing operations in South Africa, Botswana, and Zambia. Country Bird supplies KFC in all three countries, as well as Mozambique and Zimbabwe. Three years later, in 2016, Country Bird also became KFC’s sole franchisee in Zambia.

In Jordan, the EBRD’s technical support and a 2015 loan worth up to $21 million helped poultry company Al Jazeera Agricultural Company upgrade its facilities and expand its retail presence. Al Jazeera claims to produce half the country’s restaurant-sold chicken. It includes the local franchisees of KFC and Texas Chicken (known by its original name, Church’s Chicken, in the U.S.) as clients.

With this Global North-financed fast-food expansion comes a host of environmental, social, and health concerns in regions often unprepared to field them.

“It’s so clear that these investments are not consistent with any coherent notion of sustainable development,” Kari Hamerschlag, deputy director for the food and agriculture program at Friends of the Earth US, told DeSmog.

Providing Financial Security for Fast Food Suppliers

Both the IFC and the EBRD are financed primarily by the governments of developed countries for the benefit of developing countries. The IFC was founded in 1956 under the umbrella of the World Bank Group to stimulate developing economies by lending directly to businesses. Founded in 1991, the EBRD was formed to support Eastern Europe’s transition to a market economy. Since then, it has extended its geographic reach to include other regions.

Development banks often finance companies and projects in regions that more risk-averse commercial banks tend to avoid. The idea is to help grow a company’s operations and lower the risk for private sector investors.

Both of these development banks’ investments cover a range of sectors, including manufacturing, education, agribusiness, energy, and tourism. Because large agro-processors, such as poultry companies, can transform bushel upon bushel of local crops into more valuable products, like meat, they make especially attractive clients.

The world’s largest restaurant company, U.S.-based Yum! Brands, owns KFC, and calls the fried chicken powerhouse, which oversees more than 30,000 locations across the globe, a “major growth engine.”

While Yum does not buy chicken or finance producers itself, like most fast food companies, it requires franchisees — the companies that own the restaurants carrying its brand names — to buy chicken from suppliers it designates. Suppliers tend to be large, vertically integrated operations, often complete with facilities for manufacturing chicken feed and processing and packaging chicken meat.

For poultry companies, a Yum contract is one of the most lucrative prizes attainable, as it virtually guarantees sales at quantities few, if any, other buyers can match. But even when Yum restaurants only account for a small portion of a producer’s overall sales, having a relationship with the fast food giant can make a poultry company more appealing to other buyers. As Bruce Layzell, KFC’s then-general manager for new African markets, said in a 2013 interview with the business magazine Africa Outlook, by becoming a KFC supplier, a poultry company can more easily go on to supply other discerning poultry buyers in its region, like hotels and supermarkets.

“Our suppliers are growing with us,” Layzell said. “We do a lot of work with them, bringing them up to standard … It is an upfront investment that might not be paid off in the short term, but the point is to get in early, lay down the right standards, and build a relationship.”

Even before landing a contract, aspiring KFC suppliers benefit from the assistance of Yum’s global staff of supply chain specialists, who offer advice on how to meet the company’s demanding health and safety standards and increase production to land a deal.

| Company | HQ | Region | Brands Served | Countries in which it Serves Brands | Supporting Banks | Type | Year |

| Myronivsky Hliboproduct (MHP) | Ukraine | Europe | KFC, McDonald’s | Ukraine | EBRD, IFC | Loans | 2003 (first) |

| Ust-Kamenogorsk Poultry (UKPF) | Kazakhstan | Central Asia | KFC | Kazakhstan | EBRD, IFC | Loan, Equity | 2011 (first) |

| Country Bird Holdings (CBH) | South Africa | Africa | KFC | Botswana, South Africa, Zambia | IFC | Loan | 2013 |

| Al Jazeera Agricultural Company | Jordan | Middle East | KFC, Texas Chicken | Jordan | EBRD | Loan | 2015 |

| Servolux | Belarus | Europe | KFC | Kazakhstan, Belarus, Ukraine, Kyrgyzstan, Georgia, Armenia, Uzbekistan, and Azerbaijan | EBRD | Equity | 2018 |

| Sedima | Senegal | Africa | KFC | Senegal | IFC | Advisory |

Fast Food’s Role in Global Agriculture

For a poultry company, a Yum contract and support from a development bank like the IFC can be mutually reinforcing. Formalizing supplier relationships can be a years-long process. Since both Yum and prospective suppliers tend to stay quiet during that time, it can be difficult to determine whether bank support preceded an arrangement with Yum. Nonetheless, bank support has at times coincided with a supplier’s international expansion.

In 2018, for instance, the EBRD purchased an equity stake in Servolux, a Belarussian poultry company, for $11.7 million to finance upgrades to one of the company’s processing facilities. Two years later, Servolux announced a “strategic partnership” with Yum to supply KFC in Belarus, Kazakhstan, Ukraine, Kyrgyzstan, Georgia, Armenia, Uzbekistan, Azerbaijan, and Russia. (Yum has since withdrawn from Russia and severed ties with the country.) The EBRD exited the company, along with all companies in Russia and Belarus in December 2022.

For another poultry company in Southern Africa, success, aided by the IFC, precipitated an entry into a new region. Two years after South Africa’s Country Bird Holdings received a $25 million loan from the IFC to expand existing operations in Botswana and Zambia, where it already supplied KFC, the company finalized a purchase of a Nigerian poultry company, Valentine Chickens and quickly integrated that company’s operations into Nigeria’s KFC supply chain.

Of the six companies DeSmog examined, four made arrangements with Yum after the banks announced their assistance.

The suppliers that benefited from bank support have proven essential to Yum’s expansion. Senegal, for instance, banned imports of frozen chicken in 2006, making local production essential to KFC’s entrance into the country. KFC found a producer, a poultry company called Sedima. Though Sedima was not a beneficiary of IFC financing, the bank “helped the company identify areas in which it could increase efficiency and provided strategic advice,” according to a 2018 report. One year later, KFC opened its first outlet in Senegal, with Sedima serving both as the supplier and franchisee.

Francis Owusu, a professor of community and regional planning at Iowa State University, told DeSmog that development finance institutions like the IFC and the EBRD should rethink how they invest in agriculture. The banks “feel it’s hard to work with small farmers because there are so many of them, they don’t have collateral, so it’s much easier to work with bigger institutions,” he said.

While the banks may tout the anticipated social benefits of their clients’ projects, they do not require their clients to see those benefits through, he added.

“They argue these companies are going to create jobs and sell products to people at a reduced price. As with every trickle-down idea, there’s no way to make sure the trickle down actually trickles down.”

While both Yum and McDonald’s regularly attempt to influence agricultural and trade policy in the United States to ensure a more favorable operating environment for their franchisees around the world, a review of lobbying disclosures in the United States found no evidence that either Yum! Brands or McDonald’s lobbied U.S. officials on matters related to the IFC or the EBRD.

But even, apparently, without involving themselves in bank affairs, the fast food industry has long been a factor in the United States’ interactions with foreign countries. U.S. diplomatic officials are regular guests at the opening ceremonies for American fast food restaurants in developing countries. At the opening of the Senegal KFC, for instance, Babacar Ngom, the founder of Sedima, cut the ribbon while flanked by the Senegalese Trade Minister, Aminata Assome Diatta, and Amy Holman, then Deputy Chief of Mission for the U.S. Embassy in Dakar.

Yum! Brands did not return a request for comment.

The Rise of Industrial Poultry in the Developing World

KFC is a natural, if incidental ally to the banks’ development agenda. It was the first international fast food brand to open in Africa, with a restaurant in Johannesburg, South Africa, at the height of apartheid in 1971, and the first to open in China, with a restaurant in Beijing, in 1987. In 1997, KFC’s parent company, PepsiCo, spun off the fried chicken giant along with Taco Bell and Pizza Hut to form a separate company, called Tricon, later renamed Yum! Brands. Financial analysts largely wrote off the new group’s prospects since the United States — its core place of business — was already saturated with fast food.

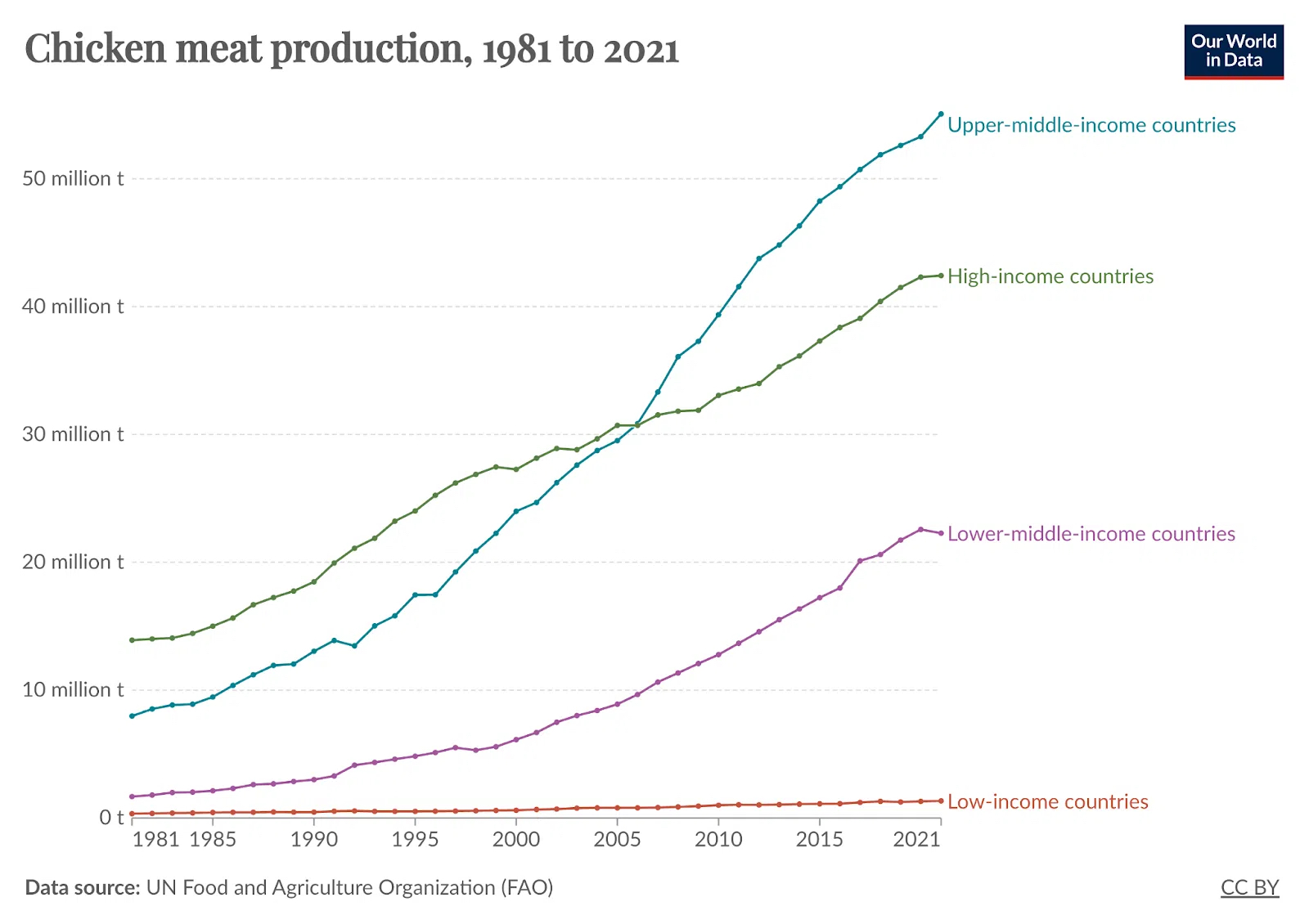

But as household incomes rose in developing countries, Yum found new customers to make up for any losses in its home country. Simultaneously, developing countries, led by Brazil and China, rapidly expanded poultry production.

In a matter of years, Yum went from a risky bet to a Wall Street darling by channeling the global poultry boom into its network of restaurants and satiating a rising appetite for American fast food. As then-CEO David Novak told investors in 2014, the opportunity for expansion in so-called “emerging markets” was “huge.”

“We have three iconic brands and while we have about 60 restaurants per million people in the United States today, we only have two restaurants per million people in the top ten emerging markets, including China and India,” he said. “This is a long runway for international growth and gives us tremendous confidence in our ability to continue our aggressive expansion for many years to come.”

At the time, there were about 40,000 restaurants in 125 countries in the Yum system. Today, the number of restaurants has increased to around 55,000, with developing countries accounting for most of the growth.

Hamerschlag, with Friends of the Earth US, says the development banks should not be so eager to finance livestock operations in developing countries. Large-scale poultry operations, she says, tend to be inefficient users of food crops, like corn, and the people who eat fast food tend to be food-secure middle and upper-class consumers.

Hamerschlag said the IFC typically claims its agricultural investments will enhance food security in developing countries, but that its investments in fast food suppliers showcase a habit of backing projects that benefit relatively well-off consumers instead of poor people. For that reason, helping to build fast food supply chains isn’t just a failure for the poor, she said. It also means undermining the health of developing countries.

“Through its lending, the IFC is, in effect, facilitating the expansion and growth of these fast food chains, which in turn increases access to what are arguably some of the most unhealthy foods,” she said.

Industrial poultry operations are also a startling contributor to climate change. Though the poultry industry is responsible for less greenhouse gas per unit of meat than beef or dairy, its effect on the climate is substantial. In 2015, broilers, or chickens raised for meat, contributed 368 million metric tons of CO2 equivalent to the atmosphere globally, according to an estimate from the UN Food and Agriculture Organization (FAO) — almost six percent of agriculture-related emissions. (The figure includes both direct emissions from manure and indirect emissions related to the production of feed and energy use at farms.) As a 2020 Guardian investigation found, the EBRD’s and IFC’s backing of industrial meat and dairy threatens to undermine their recent commitments to fighting climate change.

The global ascent of fast food and meat, more generally, is also one of the major reasons certain diet-related health conditions once unique to the United States and a few other developed countries have been cropping up in developing regions, like Africa, where local health systems are poorly equipped to treat them. From 2000 to 2016, the global obesity rate increased by 4.4 percent, according to an FAO estimate. In West and Southern Africa, the rate was substantially higher.

“As taxpayer-funded entities, IFC and EBRD should require that the recipients of its low-cost financing are avoidingnegative environmental and social impacts — not worsening them,” Kelly McNamara, a Friends of the Earth US policy analyst, said. “In the food sector, they should invest in companies that support local farmers to produce healthy, sustainable food for the populations who are most vulnerable to food insecurity — not in companies that are profiting from the expansion of urban fast-food chains.”

Global Industry, Local Problems

Neither the IFC nor any of the listed poultry companies returned requests for comment. In response to questions from DeSmog, an EBRD spokesperson said the bank “only works with companies which have a strong sustainability record and are willing to improve their environmental and social practices as well as significantly reduce their carbon footprint. All our projects are structured to meet EU environmental principles, practices, and standards and to address the causes and consequences of climate change.”

Supporters of large-scale meat and poultry operations say they benefit communities by giving local farmers a market for their crops and by lowering the cost of meat, to the benefit of consumers.

But some projects backed by development banks have drawn serious complaints from their neighbors.

From 2003-2022, the IFC and the EBRD provided Ukrainian poultry giant Myronivsky Hliboproduct (MHP) with more than $600 million in loans — support that helped the company become one of the largest agro-processors in Ukraine. After Yum entered Ukraine in 2012, MHP began supplying the nation’s KFCs through a chicken processing plant near Kyiv. In 2020, that plant began supplying Ukrainian McDonald’s and another plant, further west in Vinnytsia Oblast, joined the fast food company’s list of certified suppliers.

But years of relentless growth, underwritten by the IFC and the EBRD, have taken a toll on Vinnytsia’s environment and its residents. In complaints filed with both banks’ independent review mechanisms, neighbours of the sprawling complex alleged that MHP’s open-air manure pits have polluted the air and water, killing fish and jeopardising the health of local residents. (The resolution process is ongoing. MHP has denied wrongdoing.)

As MHP joined the war effort by supplying food to Ukrainians in their hour of desperation, the IFC and the EBRD stepped up their investments, committing an additional $230 million to refinance bonds and keep the company running.

In response to questions regarding MHP, the EBRD spokesperson said, “MHP is a long-standing client of the Bank, and as such abides by our stringent social and environmental standards. Being the biggest producer of poultry meat products and one of the top edible oil producers in Ukraine makes it a company of vital importance to Ukraine’s and global food security. MHP also plays a crucial social and economic role in Ukraine, which becomes especially important while the country is at war. It should also be noted that MHP’s key poultry production facilities in Ukraine obtained permits to export their products to EU countries and passed the assessment by relevant authorities of compliance with the EU requirements (including animal welfare requirements).”

Ukrainian KFCs, meanwhile, have also remained open for business. As a note posted on the KFC Ukraine website reads, KFC’s suppliers, or “background heroes,” in Ukraine are almost entirely local companies.

The Future of Food Is Chicken

Poultry already holds the top spot among global meat production. Given its myriad cost efficiencies, adaptability across regions, religions, and cultures, and its relatively low emissions per unit of meat when compared to beef or pork, we can only expect chicken to take up an even greater role in humanity’s diet in the future, says Ambarish Karamchedu, lecturer in international development education at King’s College London. But fulfilling a rising global hunger for chicken — raised on factory farms — will inevitably come with a steep cost for biodiversity and for people, he says.

As Karamchedu told DeSmog, the global rise of chicken means developing countries will account for an increasingly large share of the world’s poultry production and consumption, complete with all the pollution and inhumanity the industry entails.

It’s a trend that will likely continue with help from taxpayer-funded development banks such as the IFC and the EBRD, both of which have already pumped billions of dollars into efforts to bring industrial chicken operations into low and middle-income nations.

These taxpayer-supported banks are financing much more than just a fast food chain’s global dominance. But the world does not have to accept that fate, Karamchedu told DesSmog.

“We must contest the rise of industrial poultry on multiple fronts, for the sake of animal and human labor and the environment that suffers to create a fried chicken leg wrapped in spiced breadcrumbs,” he said.

If anyone wants further reading, Maryn McKenna Big Chicken is an excellent history of antibiotics and factory farming.

Someone once described the major fast food companies as commodity traders with restaurants attached. Yum! seems to have a particular focus on vertical integration, which I guess makes sense if you want to protect the company from the normal cycles of price changes, not to mention squeeze more out of franchisees.

Much as I intensely dislike them, they are clearly one of America’s most popular inventions – nearly every country has its copies of McD or KFC or BK, Bhutan and North Korea being the only significant countries I can think of that have avoided the lure. The main Irish one, Supermacs, famously fought (and won) one of the longest legal battles in history over the ‘Mac’ name. There are any number of restaurants that look vaguely KFC like around the world – friend chicken isn’t exactly a tough product to copy – but I guess the main company keeps it edge by ensuring it gets the cheapest meat through sheer buying power and control of the supply.

Even those countries that have surrepticiously sought to keep the US ownship out have surrendered to the principle. The KFC’s in China are owned by a Chinese company, also called ‘Yum!’ which has a licensing agreement with the main Yum! Likewise, many familiar US brand chains in Japan, ROK, etc., are actually local companies with loose licensing agreements – usually after the US company fell foul of the unwritten rules of those countries domestic economies – i.e. local retailing is for locally owned companies only, it doesn’t matter what international law says. This is maybe one reason why those big chains don’t lobby too aggressively in trade agreements – they know that what matters is their brand and profits – if they have to give up notional ownership of the restaurants, they are ok with that so long as they get a share of the profits.

But the overall impact on the planet and health is pretty grim. In some countries (the Gulf States as an example), this type of food has pretty much taken over the nations diet. Even the French eat a surprising amount of McD. This will keep going for as long as we externalise the cost of cheap meat, raised from super cheap soy and corn. The reality that these chains can serve a burger or chicken meal for a lower cost than its possible for anyone to sell, say, a salad or even a falafel meal shows how messed up our food system is.

I do wonder if/when the externalized cost of say, a global poultry borne influenza epidemic exacerbated by factory farming practices and funded by the US government in a roundabout way, the same government that may have to pay to fight it, will ever be accounted for in the cheap cost of those drumsticks, or if instead all those additional costs, steps and dangers will be considered part of the productive economy at home.

“Much as I intensely dislike them, they are clearly one of America’s most popular inventions – nearly every country has its copies of McD or KFC or BK, Bhutan and North Korea being the only significant countries I can think of that have avoided the lure.”

I suspect there is some kind of symbolism there, of having made it into some sort of club.

Even before the cold war, there was this worship of Americana. And the cold war amplified it. And more recent decades has it taking on a kind of hypernormalization, if i get the concept right.

Demolition Man: Taco Bell wins the franchise wars.

https://youtu.be/4cF6D8zDa9U?si=5obnTZ2pdxxy9NAc

A college friend said his family knew the real Colonel Sanders (not the one on TV) and back then KFC was pretty good although I wouldn’t go near one these days. Around the same time Proctor and Gamble across the river in Cincinnati was inventing still more junk food in the famous Pringles.

But even though Americans are now of huge girth I sense that the fast food craze is in decline with the possible exception of McDonalds. They once were places where teenagers worked and they now are expected to support the working poor adults with resultant price increases that those same heartlanders must find difficult. Easier to just open a bag of fattening chips at home.

Sounds like from the article the poor overseas don’t eat there either. Perhaps this fad is on the way out.

I worked as a teenager in a KFC in 1976. The split was about 50-50 adults and teenagers. I don’t remember were it was just a job for teenagers. Plenty of adults worked fast food back then. I think maybe some corp. messaging going on there.

Damn, when I thought I’d heard/read it all. Such a blatant destruction of food quality , supply chains, and local agriculture. Yes, I’ve read about the IMF/world bank since the 80’s, but had no idea in this area they were even wrecking havoc.

KFC has been a powerhouse since the 1950s.

The day our family entered Canada by ship in Aug 1959, the first restaurant we went to was a KFC that very day before heading off to our town 150 miles away where my father had secured a job.

So eleven years later, I’m back in the UK for graduate work, and with other Canucks, got an apartment in Wimbledon. Two hundred yards away was the KFC, and frozen McCain French fries in giant sacks peeked out from the back. McCains, a Canadian spud supplier from the province next door to the one I’d lived in for the past decade had a history in Britain.. McCains couldn’t sell spuds in Blighty because of skin diseases like, er, blight, so they peeled ’em, chipped them, froze ’em and shipped ’em over. Just awful compared to English chips/fries made from King Edward potatoes, and the chicken was often raw on the few occasions I patronized the place. Yuck. The Brits who got a franchise simply had no clue about food safety, never having been in the “restaurant” business before. Always better in those days to get haddock and chips from a proper chippie, but their opening hours were limited. That’s how KFC prospered in the UK, by being open when chippies were not. Even today, typical opening hours for chippies are “Lunch 12pm till 2.30pm, Dinner 5pm till 8.30pm”. Sitting ducks for KFC after the cinema/movies in 1972, when MickeyD still hadn’t crossed the pond. And the outright laughably awful Wimpey’s was the only alternative. Those places were just dreadful, a nightmare.

Back home, in ’76 I helped design and install new electrical gear in a KFC “store”. The owner of five outlets told me the business was “revolutionized” because the purveyors of the Dirty Bird franchise had learned how to cut a chicken into 8 parts instead of 7. Halleluja! Insta-Profit. Now it’s 9, btw.

Joined an electrical utility in 1982. New workmate was a Chinese Malaysian from Kuala Lumpur. That place was KFC Central, according to him. Good food all around them, but the lure of KFC was strong for young people.

Today, the nearest outlet to me is, funnily enough, the first I modified electrically almost fifty years ago. It is owned by South Asians who are notably parsimonious with the condiments and at producing any semblance of taste whatsoever. Once a year I give it a go, and it is ALWAYS a total disappointment. Their “gravy” resembles river mud, and no part of the chicken beyond the legs and wings is recognizable; they appear to be from a specially bred KFC pygmy chicken. Well, you see, no antibiotics allowed in Canadian chicken feed, so we get wood pigeon-sized chickens in return.

However, in real terms, the price of KFC has declined. When the stuff was half decent, here in Canuckville in 1969, a two piece with fries was on cheap on Tuesdays for 85 cents instead of 99. Now, the same special is $2.99. Even accounting for smaller portions and inflation, that’s cheap. Perhaps the chickens are force-fed?

When the Colonel went to meet his maker back in 1980, my brother and I happened in on a KFC the day after, and quipped “Heard the Colonel kicked the bucket!” The staff were outraged! Amazing. Loyalty where none was deserved.

It’s been all downhill quality-wise since then. But the lure of the brand to the uninitiated seems boundless. The mid ’80s rumours of the specially bred and modified three legged KFC clucker haven’t materialized yet. But I bet they’re still trying! DNA splicing and AI, y’know.

One final thought — The repeal of the Lord’s Day Act (no shopping on Sunday) only happened here in the mid 1980s. We were laggards to the almighty dollar and shop till you drop routine. When did the religious USA first go shopping on Sundays? Strikes me that was when Big Bizness took over and neoliberally began to ruin all our lives, when money became king over people. The same amount of spending spread over 7 days instead of 6 meant increased expenses for store owners. No wonder minimum wages stagnated for decades.

I remember the excitement of the first KFC diabetes SAD chicken franchise opening in Munich in early 1970s. Crap then, crap now. Wienerwald had better, cheaper, healthier chicken. Crap industrial US food is a world wide health threat.

“Silent Coup” by Claire Provost and Matt Kennard gives an overview of how institutions like the IFC and EBRD distort markets and economies to further corporate Western capitalism — even when their declared purposes are to benefit peoples in Third World countries. The book also covers other institutions and lawfare techniques that enhance corporate capitalism and investor protections such as:

ICSID – International Centre for Settlement of Investment Disputes

CDC – Colonial Development Corporation

SEZ – Special Economic Zones

SAPs – Structural Adjustment Programs

PRSP – Poverty Reduction Strategy Papers

The points you raise about development banks supporting fast food giants like KFC are fascinating and rather unsettling. It seems we need to reassess the implications of such financial support, not just economically, but also socially and environmentally. This makes me wonder how similar strategies are employed by other multinational corporations in different sectors, like the beverage industry. For instance, an analysis of all pepsi products and their global strategies are more concerned with profit then they are environmental issues. This might provide a broader context to the discussion on corporate global expansion and its diverse impacts.