Yves here. The sorry and at least until the Fed relents, worsening state the US housing market, undermines the Biden Administration cheerleading over the state of the economy. Many people are subject to close to obligatory sales: death, divorce, disability (lower income making house unaffordable), and job-related relocation. This is not just an inconvenience but potentially damaging to anyone caught with a house they can’t sell or sell well. For instance, Mountain Brook, Alabama is somewhat market-condition insulated due to having a public school system rated in the top 1% of the US and pretty affordable home prices relative to incomes of the local afflueza. The house next door to ours, which was an updated house, unlike my mother’s, took 60 days and two price reductions to sell, the last to a discount of over 7% to the original asking price. Imagine how this translates now, both to less well-protected markets and the further increase in mortgage rates.

Do readers have sightings? Are there pockets in the US where houses are still selling without too much in the way of seller price concessions, say due to high buyer demand (like a major corporation moving operations there)? After all, real estate is always local….

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

All that makes sense, but why are there still any cash-out refis when people could take cash out via HELOCs, without losing a 3% mortgage?

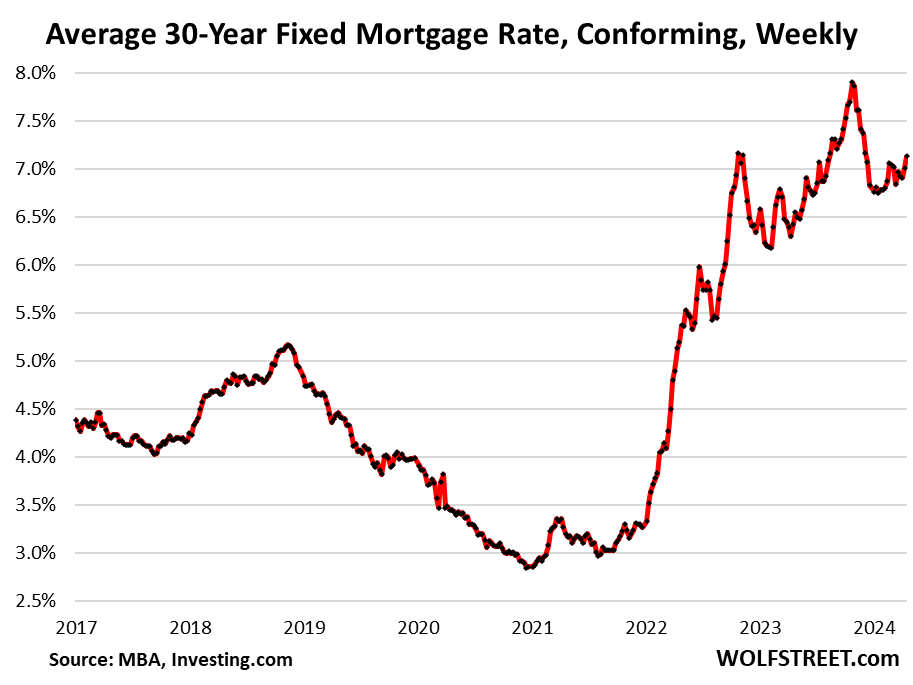

Mortgage rates continue to trudge higher from the abandoned Rate-Cut-Mania low. The average conforming 30-year fixed mortgage rate rose to 7.13% in the latest week, the highest since early December, according to the Mortgage Bankers Association today, as the 10-year Treasury yield has re-surged amid the Fed’s vigorous backpedaling on its December rate-cut visions after the presumed-vanquished inflation raised its ugly head again.

The MBA’s measure of the average 30-year fixed mortgage rate has risen 37 basis points from the Rate-Cut-Mania low of 6.76% in early January:

Still going higher. A daily measure, produced by Mortgage News Daily, which leads the fray by a few days, surpassed 7.13% a week ago and hit 7.50% yesterday, the highest rates since mid-November when Rate-Cut Mania was two weeks old. Today it’s at 7.43%. At the end of October, this measure kissed 8% for a day.

Housing market still frozen because prices are still too high

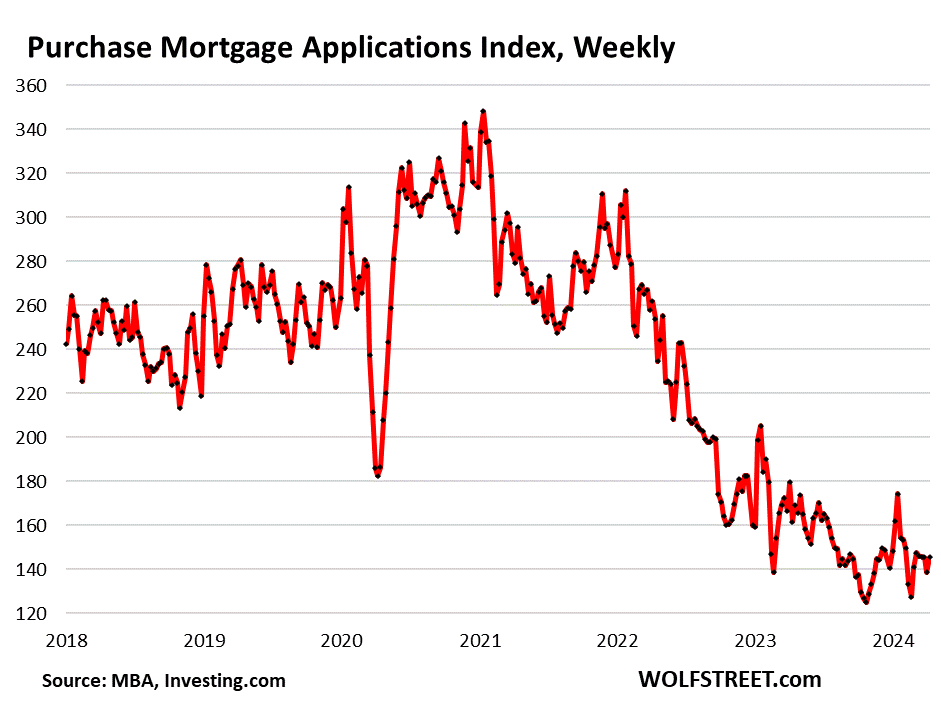

Mortgage applications to purchase a home have been wobbling near the record lows set in November and then again in February in the data going back to 1995. The cute mini-spike after the holidays during the waning days of Rate-Cut Mania only lasted a couple of weeks, though it created all kinds of hoopla, and didn’t really budge much from the record lows.

This is how far mortgage applications to purchase a home have plunged from the same week in the prior years – a sign that the housing market remains frozen because prices are still too high. While many potential sellers are still thinking that this too shall pass, many potential buyers have gone on strike:

- From 2023: -10%

- From 2022: -43%

- From 2021: -51%

- From 2019: -48%

The low level of mortgage applications to purchase a home tells us that sales of existing homes will continue to drag along the low levels that have been in effect for over a year:

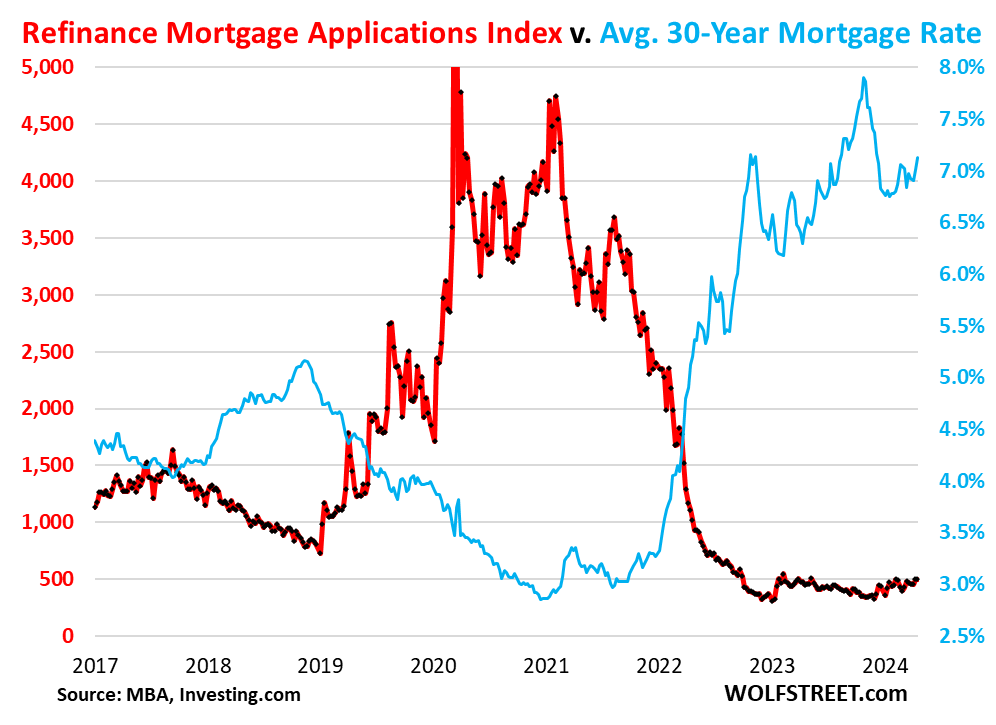

Mortgage applications to refinance a home have been wobbling along historic lows for 18 months. They had seen a huge boom during the 2.5%-3.0% mortgage-rate era, and as mortgage rates began to rise in the fall of 2021, when the Fed began to pivot from raging inflation being just a “transitory” nothingburger to the fastest rate hikes in decades and the biggest QT ever. The mortgage market saw this coming and rates shot higher from these record low levels, and refis began to plunge.

In the latest reporting week, refis were down by 66% from the same week in 2019, and by 84% from the same week in 2021.

Why are there still any cash-out refis? Because people don’t know about HELOCs?

No-cash-out refis vanished almost entirely as mortgage rates have surged, as you’d expect.

But as you’d not expect, there are still cash-out-refis, though volume has plunged. This according to data from the AEI Housing Center.

Cash-out refis (brown stripes) have accounted for nearly all refis for over a year. Non-cash-out refis, in solid brown, have essentially ended (chart and data via AEI’s Housing Center):

Which is puzzling. It just doesn’t make sense. If people have enough equity in their home to get a cash-out refi, they could instead get a HELOC for the cash-out amount. If they need $100,000 to fund a big emergency, or want $100,000 to fund a bet-the-farm startup or a crypto Hail-Mary gamble, why not get a HELOC for $100,000 at 7% and keep the old 3% $500,000 mortgage? Would save a lot of money over getting a 7% $600,000 new mortgage.

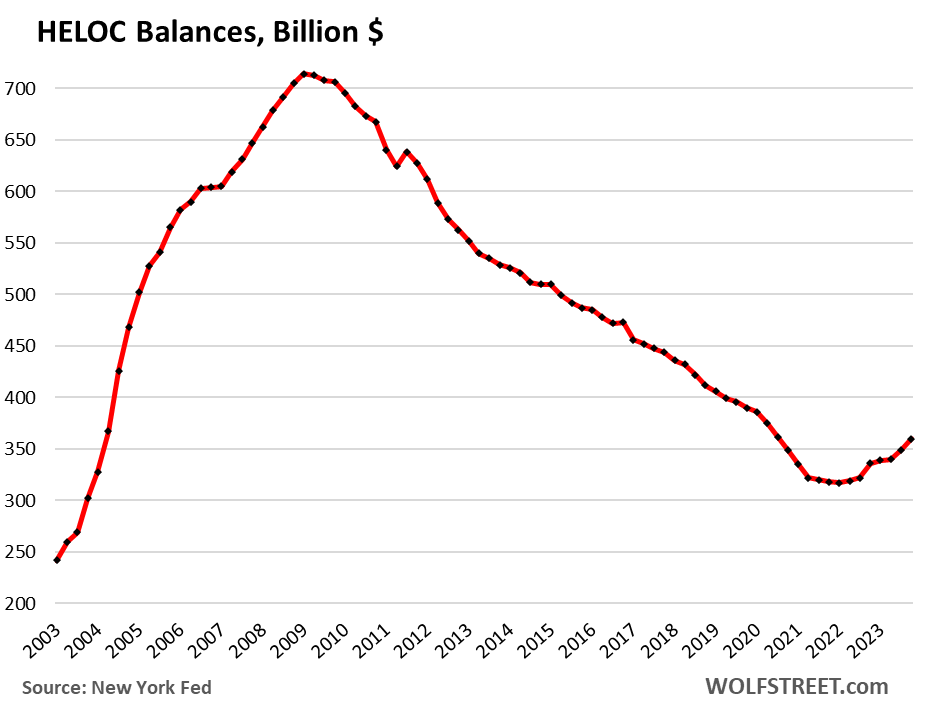

HELOC balances have been rising, so some people are following this strategy. But why were there still any cash-out refis at all? They should be down to near zero, logically speaking, with HELOCs taking their place. Perhaps because people don’t know about HELOCs? Or because people can’t do math?

HELOC balances remain low, but after declining for 13 years from the peak in 2009, they turned around in 2022 when mortgage rates began to surge and as refis began to plunge. Since that low in Q1 2022, through Q4 2023, outstanding HELOC balances increased by $43 billion, according to New York Fed data.

Speaking from experience in the past month, FL is absolutely brutal for sellers.

The flood maps were just redrawn in 2022 and entire counties are now considered literally underwater, uninsurable.

Property taxes have gone up 20% in the last year alone. And, most people selling are dead, meaning they had their property taxes locked in the early 1990s. The new owner will see a fun increase of 200-300% on revaluation!

Insurance prices are completely bonkers because of roofing fraud and other scams. Most people think it’s because of hurricanes but that’s actually not the main cost driver weirdly. Something like 75% of the entire nations insurance litigation happens in FL.

Add to the mix the obvious, that current owners are locked in at 3% and have no reason to sell and you would think it is nearly impossible to find a house.

But people are still buying!! I don’t know how or why but FL has huge in migration right now. Our realtor said that yes they are seeing fewer buyers in some areas but in places with standard suburban sprawl like Sarasota new builds are still flying off the shelves.

After they built that mall off of I75 in Sarasota, traffic became a complete dumpster fire. I don’t miss it. It was expensive to live there back then!

Well there’s two sides to every market as in when prices fall, buyers benefit, and because they will be buying at a lower price, they are less likely to default on their mortgage payments thereby contributing to a more stable market. There’s also all the additional expenses that come with owning a house like repair costs, and insurance, all of which have risen due to inflation, so I think it makes sense that housing prices are currently too expensive.

My guess is that most of the hurt will come from people who thought that WFH was going to be permanent while everybody else will be fine. Obviously there’s no guarantee if the economy were to crash big time, but with the US Government running a yuge fiscal deficit, as Wolf said, be prepared for higher for longer.

Hidden housing costs skyrocketing, https://mishtalk.com/economics/auto-and-home-insurance-maintenance-costs-soaring-and-people-are-angry/

Definitely a sellers market in the Washington DC area with little inventory.

Agree. On my street just this week in Montgomery County, immediately north of DC. About 1,200 sq ft. ranch with semi-finished basement. Renovated for sale. Not lived in since renovation. Asking price was a reasonable price. House put on market Friday, open house on Saturday. Pending on Monday. Cash offer made at asking price, no contingency, no inspection, close in 14 days was beat by someone else. Five offers. Lots of interest at open house.

Curious how much over asking it went for. Will need to wait a few weeks before Zillow updates.

I’m in MoCo too. The new 5000 sq. ft. McMansions asking $2+ million seem to be sitting on the market but the smaller, older homes from the 50s and 60s sell fast (albeit for still close to $1million).

Yes I live in a smaller older home and surprised they are all going well above asking and close to a million.

Government jobs. There is more stability. As long as people can keep monthly payments low, they expect to be able to sell at a stable price in the worst case if they have to move or lose a job because someone will be there covering the bank note.

This is part of the reason the Republicans (the Democrats too) in the area were so virulently anti-Trump. They are terrified he will move government spending. The Maryland side is reasonable, but the bedroom communities of Northern Virginia are godawful.

In the early 90’s, it looked like someone set off a neutron bomb in Northern Virginia. Interest rates going up or moving government spending will dramatically alter the market.

>>>>But why were there still any cash-out refis at all? They should be down to near zero,

logically speaking, with HELOCs taking their place.

My older neighborhood is on fire w/housing remodeling. Try comparing pre-Covid new kitchen/bathroom costs w/current costs.

1. If you’re (not a boomer looking to downsize) locked into your mortgage at 4%, you are not moving….and taking a HELOC now is worth it because you don’t want to deal w/a 25 year old kitchen anymore.

2. Very few buyers are willing to move into a fixer-upper. If you want maximize your home price, it has to be in hotel-like, move-in ready condition otherwise the seller is leaving an arbitrage opportunity for a flipper to come in, put in a new kitchen and baths, new HVAC, then selling it for a profit.

So I bet that for many before they sell their old home, they take out a HELOC for renovations on the reasonable bet that they will recoup their renovation costs and then-some.

Oh that sucks. I was considering hedging some of my savings into a granny flat addition that could be rented out for extra income. I figured that the slow housing market plus low interest rate would stop people from renovating. Of course it makes more sense that instead, people would just HELOC for the nicer kitchen/bath for the house that they now can’t afford to get out of.

Tax the heck out of non-primary residences and prices will come down. Problem is that money is relentlessly funneled to the top with no mechanism for correction.

We are governed by and for rentiers.

House next to me sold to a Microsoft millionaire. I’m sure it was an all cash transaction.

I wonder how much of current house sales are not getting loans as traditional mortgages, but are using cash or some non-traditional finance means (i.e PE or big corporate finance)..

The north fork of Long Island is seeing minor price reductions and decreased volume, but prices are still insanely high compared to pre-covid. I bought in 2017 for $350k and refi’d to shorten to a 20-year, no cash out mortgage in 2021; Zillow etc. claim my house is now worth $600k. Given that family lives close, my mortgage is 2% and my youngest kid has 5 more years in the school district, we don’t entertain selling. Frankly by the time I might be willing, future Superstorm Sandys may have made the place uninsurable and crashed prices.

A climate catastrophe, totally plausible, is what it would take to destroy home prices locally. The north fork is a special place, beautiful, surprisingly rural and yet convenient with tremendous basic services (hospitals, doctors, schools); its appeal is broad and deep. Moreover, there’s so many rich people living within a couple of hours of us (rich in both an absolute sense and relative to most of the people who work here) that it’s hard to understand what will force prices down much; those people can always afford to buy here. (North Jersey, NYC, Nassau County, and western Suffolk County are all at most a three hour drive, and Connecticut through Boston are all a 1.5 hour ferry plus up to a 2 hr drive. That geography contains a lot of rich people, and the entire north fork has maybe 25,000 housing units)

Local government is trying to tackle the affordable housing crisis on many fronts, including trying to return hundreds of airbnbs to year round rentals or year-round owner occupied units, but the scarcity of the land is real with such dense population centers all around.

Where we live in Philadelphia, prices have come down from a peak during summer of 2022, where a neighbors corner property sold for roughly $445,000, while standard evaluations sat at $250,000 the year before. Since then, we have leveled at the previous eval amount. Properties have been up for sale for longer, many sellers have settled in for the long haul and, if it is any indication, don’t even have yard/garage sales as before (hanging onto possessions rather than buying new???). Inflation and lack of jobs to migrate to from the current one affect all young people, while retirees hunker down and count pennies.

Philly always struck me as kind of unusual; it was the only major city I visited back in 2016 and again 2019 with a substantial number of for-rent signs. For a city with tons of amenities, I found that surprising, that at that time the cost of renting was cheap. I even met someone fleeing from Nashville because Philly was cheaper! I imagine the Rittenhouse Square area prices have held up for purchases.

Just bought a house in MN a couple months ago, and I’m here to say nothing has changed. The house we closed on was listed on Friday, we put an offer in on Saturday, and there were two others by Monday. Our condo, which typically takes longer to sell, was sold in around 10 days. I also do accounting for a contractor in the single family construction industry and business is still booming. The national builders are still going full speed ahead. It’s pretty simple, really, with existing homes so expensive it makes newly constructed single family and townhomes far more competitive on price. With everything so expensive and with the laundry list of problems problems plaguing urban centers people are way more willing to move out to newly converted farmland on the outskirts of town too.

I should elaborate and say any hose priced appropriately is gone almost as fast as its listed. The only houses that sit are those which are way overpriced.

My oversimplified take: most people, including the Fed, are treating the housing crisis as a demand side problem when it is primarily a supply side issue. There just isn’t enough housing to go around. Higher rates hit developers too, and it changes the math on which projects they will and won’t accept. If the government really wanted housing costs to go down, they’d be doing everything they could to subsidize and encourage the construction of single and multifamily housing, preferably affordable housing. I got the current housing crisis wrong for a long time and a lot of other people did too. There are those that make a strong case that housing has been systematically underbuilt since the 08′ crash, and now the chickens are coming home to roost. I tend to believe them at this point.

In certain suburbs of Cleveland, Ohio, houses are selling in 24 hours for prices $10,000 to $20,000 (and maybe more) over asking. Real estate has been quite the bargain here in the rust belt for many years, but jobs are not plentiful and salaries are low. What this means in real terms is that a nice old front-porch colonial in good condition that sold for $100,000 in 2000 and for $55,000 at sheriff’s sale 8 years ago went for over $250,000 on the day it was listed last weekend.

Sorry, one addendum. We’ve waited years to buy a house and the logic for finally pulling the trigger went like this:

1) We will refinance our way out of the interest rate as soon as rates go down. If they do not go down in the next few years, there was no point in waiting anyway.

2) Housing prices are function of a buyers ability to make the monthly mortgage payment, and this is determined by debt-to-income ratio. Obvious, sure, but if rates come down and buyers can make the payments on these mortgage at 7% rates at these prices points I find it incredibly unlikely that prices will drop when rates go down. Seems to me that these prices are the new normal.

3) It would take a massive spike in housing inventory even to get to 2019 levels. This is also unlikely to occur.

4) Being highly invested in real assets like a single family home and taking on significant mortgage debt provide ample insulation against the effects of inflation, should it persist or get worse.

We know a couple people who bought after the interest rate went up and that’s pretty much their logic. Their rents had spiked and they figure at least buying a house gives them some control over their housing costs . They’re just hoping to refinance when interest rate goes down.

Nobody is selling their house right now unless they absolutely have to or are boomers downsizing. Pretty much everyone who bought their house before 2020 would be paying at least double their monthly mortgage if they bought the same house in 2023-4.

I have a family member who bought a new build in the Research Triangle area in late 2021 for $700K and Zestimate now puts the place at $950K. Very little inventory in Central PA and upstate SC, which are other areas that I’m familiar with.

The same family member opted to rent out their old townhouse in the same area, bought in 2015 for $220K. Zestimate for the place is $440K. The previous owner bought the place as a new build in 2003 for $196K.

Watch out for sky-rocketing real property taxes. Ask for the tax bills and assessments over the past 15 years. Chart an x-y graph. YOIKES!

Where, precisely, will the money come to cover that, fuel costs for puttering around, food costs, yada bada bo-bada? Not a good look, on any horizon, through my poop-tinted spectacles.

Indeed, the whole research triangle area has been insane; It was at one point during the Pandemic a top destination, even above Austin, for moving to. In 2021 stuff was selling prior to listing, dozens of offers. I haven’t looked at inventory there lately, no idea the state of things now.

I still remember 2021-22 when REITS or some distant investment company started buying up all (it seemed) the nice smaller houses in my uni town for over asking prices…by a lot. It altered the entire market. Valuations skyrocketed in the property tax assessments. Mortgage rates were still low then. A lot of those houses were refurbished and let out as rentals. Now mortgage rates have gone up. Sellers still expect to get over asking price starting from a much higher baseline. Houses aren’t moving too well. Stories in the newspaper. And this is the hot time of year for housing sales.

What goes up must come down? Up like a rocket, down like a stick?

I am now selling a condo in northern Fairfield county in Ct.. Just had a long meeting with my agent over comps, trying to determine the asking number. Scarcity rules the market here, most fairly priced homes go really fast. I may be the only unit for sale in my complex when it gets listed. Prices were stagnant for years after I caught the bottom in ’14, but WFH and I think Boomers with cash who want to be near the grandkids in their really good schools really juiced the market. What was an exurban commute is now much more tolerable with Zoom. Lucky me.

Oh, and short term rentals and even some longer term rentals have little effect on pricing here because they are legislated away by local laws and condo rules.

We are still in the grips of the short term rental bubble, around 325 out of 1,100 housing units in Tiny Town are available for you to live la vida local, if only for a weekend.

I’m paying $7200 a year for insurance coverage on our pad, and it wouldn’t be all that different for most rental homes, and that amount is about what you could expect to garner in your best month of being a would-be Hilton in the summer when Sequoia NP is most busy during the magic 100 day stanza from Memorial to Labor Day. More than likely you don’t live here, so you’ll need somebody to take care of things, and that’s another 25% off the top with their commission.

Almost single-handedly, every home that has come up for sale the past decade had a bidding battle between AirBnB’ers and they took the average price of a home from $250k to $450k in the bargain.

When we moved here 20 years ago it wasn’t uncommon to see homes sit on the market for years, we’re isolated and living amongst nature isn’t for everybody, most like the appeal of concrete, asphalt & concertina wire, I get it.

If these short term rentals ever show up on the market en masse, there’s no way the traditional market could ever handle them, and not one existed in Housing Bubble Numero Uno.

$7200 to insure “the pad” you said would be 100k here a while ago while waxing poetic on the simple mountain life anyone could have…

What’s your house worth? Quick search says 1mil at that price for insurance….

Everybody in fire-prone areas in Cali have seen the whip of massive increases, my sister in SD got whacked hard and then went shopping and found out that nobody would insure her, and she’d best grin and bear it, the big check to the insurance company, that is.

You almost get the idea the major insurers see California FAIR plan egregious rates as a template in what to charge.

The thing is, I like my action much better here in the midst of a predominantly oak savanna, versus her eucalyptus environment of ready to burns.

From your observations, how frequently are the AirBnB properties rented? I’m north of you in a well known resort town in the Sierras and am in a solidly residential neighborhood. My estimate is that 10-20% of the properties in my neighborhood are some type of vacation rental. Most seem to be empty most of the time (with one exception). Rental prices are $400-$500 per night plus fees and taxes. Not any bargain to rent a 3br house 10 miles from where the action is in an ordinary residential neighborhood and the rentals that occur seem to be in on Friday night, out Sunday morning.

And on the subject of insurance, managed to get renewed for an additional year, albeit with a 4x increase in the deductible (effectively self insuring for anything except a total loss) for only a 40% increase in the annual premium. Anticipate being cancelled next year and that the California FAIR plan (that’s the fire insurance portion only) will probably equal 150% of the total current year’s insurance.

They tend to be pretty full from Memorial Day to Labor Day and certain holiday periods (Thanksgiving-Xmas to New Years break and President’s Weekend) everything else is a race to the bottom to see who can underprice their place enough to get somebody in it.

There is the equivalent of a Motel 8 up in the main part of the park @ $350 a night peak season, so it isn’t difficult to get people to pay $250-300 a night in the foothills and in high season that house gets booked 26 nights.

It’s more like 5-8 nights a month in off-season.

My brother-in-law has a couple of short term rentals here, and his wife told me at the end of the day, its a marginal deal, she’d rather sit on her behind and get 5% interest from the bank for the money instead.

According to those in the know, there’s a lot more vacancies than usual…

Thanks for the update and information.

How are REITs not flaming out in this interest rate environment? How is it that PE is immune to rapidly rising interest rates? Magical accounting? Imaginary mark to market valuation? There is a doozie of a bailout coming.

There is definitely some fraud mixed in there, probably enough to create content for another two seasons of “American Greed.”

REIT-wrecks tend to take a while to submerge below the seas, though.

It’s been a stretch since ZIRP.

Historic Neighborhood in Indianapolis:

Between 2020 – early 2023 I would say half of our street turned over in ownership.

Late 2023 – current: not a single house in our neighborhood has changed hands or been for sale. Everyone is stuck in the same situation: 3% mortgage and no where to go if they sell.

And the tax man is reaping those increased valuations – our property taxes went up another $500/year.

Upper Valley of NH/VT still super hot. Whole state of NH is. No hope for regular people. There’s been a huge influx of out of staters over the past 5 years and it’s out of control. Traffic has gotten very bad, and the area is changing for the worse overall. It’s being destroyed.

Will completely attest to what Petal has written about the Upper Valley for both sides of the Connecticut River.

We are starting the process of selling a rental house which was actually the first place we bought 30 years ago. The low inventory is not limited to here but statewide. Anecdotally supported by checking around where my daughter lives in Northern Vt and a spouse that works in the field with people experiencing housing crisis in the Upper Valley region.

It’s a multi pronged problem with many, many reasons why more inventory is not being built. Plus, as ridiculous as prices are for houses when available, they are cheap compared to the areas people are leaving. So they think it’s a deal.

The young people starting out now are family blogged. And it’s killing what made so many small towns so wonderful. Multi generations of families living in the same area, being able to stick around because the grandparents could break off a number of acres from the back forty so the kids could build a house. Fostered a real sense of community and helping each other out.

suburban Houston here… prices exploded in 2021-mid 2022, and then with the rate hikes leveled off. Home sales slumped but kept chugging along.

More recently it seems everyone who listed a home jacked their asking price $50K-$100K over where things had leveled off at the start of 2023.

It’s insane. Sales have slowed way down finally, but I have seen some shocking ones. Lately it seems sellers are lowering their asking price gradually.

higher end home sales, like for people in the $500K+ range seem to be doing okay around here. I guess more cash buyers?

If the almighty buck loses hegemony, there will be a race to get rid of them, and opportunities to buy real things few and far between.

We might see the craziest housing bubble imaginable as $’s scramble to prove they still have some worth.

I’m talking a tired 1964 3/2 in Torrance fetching $85 million, that sort of thing.

That’s when the gold price goes up…

I would LOVE to see NC ‘further investigate’ real estate property taxes, various systems, laws, rates and approaches across the States- maybe even internationally.

I live in what was a sleepy college town in the amenity-laden Northern Rockies. We appealed our 2021 reassessment, successfully, two years ago- proposed land value increase of 237%.

Appealing again, two years later, for a proposed increase of 301% on land. (They are making up for the relief we achieved in 2021?). My wages have not increased 301%.

Anyway, we have no transaction tax on sales and purchases. Our state has no sales tax. We have a wobbly two-legged stool. Longer-tenured owners (we have a 1995- basis when we built our home) are subjected to ‘market’ valuations, re-appraisal every two years.

My beef with that is we have not realized the gain. I am still earning dog-poo Little Appalachia of the Rockies wages. Folks point out that we are ‘sitting on a gold mine’. I disagree, we have not made a trade, we have not determined the market value of our property by an arm’s length transaction. Until that point, all I have is mortgage payment receipts, groaning tax bills, maintenance, and a roof over my head.

No banker in their right mind would do an asset – based loan— she would look at my meager income, my cash-flow, wince, and say I am fully extended. I would frankly add and dim sum- just look at my monthly budgeted outlay for property taxes and home-owners insurance!

Another hidden unacknowledged area of rampant untenable inflation.

Anyway, I believe that appraisal- based taxes are just wrong headed. The taxes should be based on real market transactions, not contrived data speculating on a phantom transaction. This perhaps would add to real estate stickiness, but I doubt it. The number of long-time residents here is a minority. It seems to me that there is NO local real estate activity driven by local basic economic fundamentals- it is driven by outside strong economies that migrate in and disrupt the local cost basis, folks either seeking refuge, or speculating on ‘the come’.

I look around the west for my next home. I will not be able to stay here due to real property tax increases- which to me seems un-American- (although more and more I realize it is quintessentially American) Guess what? It is happening EVERYWHERE, and not just the west.

Property tax increases drive up rents as well. We have lots of new housing in town, none of it is affordable. We have lots of working class jobs unfilled- labor class cannot afford to live here on the local wage base. And capitalists are unwilling to let loose of their extracted excess labor value gleaned through their employees. We have literally broken our local economy.

Is it the 8 Billions? The US is the third most populous nation-state.

I believe it is lagging inflation from Hank Paulson’s huge cash injection in autumn 2008, further hypothecated and multiplied over over a decade, driving up the costs of every asset class and service. That hot money seeks a home, and we have wealth aggregation like nobody’s business.

Then the huge cash injection by Trump, congress, and Biden during covid as gas on a fire….

The bubble that I worry about is that of the increasing number of have-nots, across all genders, ages, races and creeds. When that one pops, on top of resource scarcity, warming, warring… as my neighbors to the north would say,”Katie! Bar The Door!”

There are so many daunting challenges on the road ahead.

As the Asian female driver exclaims on the cartoon sitcom “Family Guy”, as she launches into a lane change on a multi-lane urban highway, “Good Luck, everybody!!”

(Aren’t race and gender based jokes fun?!)

Like you said plus Hope you don’t mind a little add from me -speculative market valuations lead to speculative market manipulations and speculative bubbles based on speculative leveraged debt until the speculative foundation is overburdened by the speculative structure above

Through my experience – I do my best to eliminate all debt that incurs interest – get rid of high interest to low interest … but for sure…stay out of the debt game as it will swallow you up – High property prices are not good for the cost of living and trying to stack real estate on mortgages which max-out equity will come to nothing when “cashing out” – the business of banking is to extract the most in interest on the debt they so generously extended to you – and the more you are willing to take on the better…. it does not matter how overpriced to market the asset you put up for collateral is – the banks need to keep juicing prices to keep increasing their take – they are in the business of selling debt. Realtors will always claim the market good with rising prices because they get a bigger vig with every sale – keep the turn over. With millions homeless and millions of empty homes and rental units unoccupied – it does not paint a healthy picture – particularly when large entities are buying up the market, creating a false low supply high demand chart.

The first Great Depression — like most, saw only the ‘stackers of property and wall street speculators’ doing the high dive to the street. The common folk took a hit but, in their already impoverished state, not much changed – as I recall from Studs Terkel’s book Hard Times.

and from earlier – before the Great Depression…we have this 1923 situation resembling of 2008

“Legal Gambling

The gloom is fading from the real estate situation. More nibbles during the last few weeks than the last three years. If January brings us good rains, this next year will open the door to the sunshine – a case of rain bringing the sun.

It is to be hoped, however, that there will never be another boom. The crash of the boom of 1923 was due to the same causes that wrecked the wall street stock market. People sold what they did not own. They made a payment down in the hope of getting the property off their hands before it began to burn. Real estate fell into the hands of sharp-shooting gamblers who had no interest in land. To them it was just a pile of blue chips on a roulette wheel.”

I think we’re already in a bubble. Robert Schiller still updates a chart of housing prices compared to inflation. He looks back at housing prices all the way to the 1890’s. Price history suggest housing isnt supposed to be that much above inflation.

Well we’re way past 2008 territory now. The only gleam of ‘hope’ is the housing market has stalled for almost two years nationally with inflation factored in.

I thought it would of crashed several times by now and got it wrong each time so I can always be made a schmuck this year.

In the meantime, home builders in the neighborhood are heroically tearing down old homes and replacing them with mansions. The city has never lifted a finger to stop this. The whole debate has been to stop multifamily construction.

I’ll post that chart data when I get back home…

https://shillerdata.com/ (It’s fig 3-1)

I’m in northern NJ. Ostensibly, a suburb of NYC about 30 miles west of Manhattan. There is no inventory. Prices have vaguely stabilized meaning there’s no insane price leaps like back in 20 or 21 but there does seem to be an incremental rise and most go for asking or a little over unless it’s a really unrealistic asking price. Most houses are sold within 2 weeks. We sold our 2bed/1bath for $430k in a nice little town 10 miles closer to NYC back in May of 22. Those people put in some work on it, floor refinishing and painting, no real remodeling and due to job relocation, had to sell it in June of 23 for $475k. Our realtor says that the market is still hot with no real slow down.

As far as HELOC goes I tried to get one in March but was turned down because I’m a freelancer even though my credit score is through the roof and I make good money. I suspect that the gig economy is not helping workers with their credit!

I had to relocate for work. Still trying to sell my house in New Orleans since Jan. I’ve had exactly 2 people even come and do a walkthrough. Had an open house about a month ago that no-one showed up for. Have tried dropping the price once by $5k and another by $15k and got nothing. Rates are sky-high (relatively speaking). Property tax is going up and Insurance is now ridiculous (literally, a 130% increase last year). The escrow portion of my mortgage is now higher than the principle + interest. My total monthly mortgage payment increased by over 50% even though I’m still locked in at a 3% interest rate.

I second the, “insurance and taxes Escrow portion of PITI payment nw exceed principal and interest”. That is a Tell on housing inflation.

We just closed out our escrow reserve service with our loan servicer. As we are on an avery two year tax appeal schedule, we need to be in control of writing the check to the treasurer- Paid In Protest.

Can’t leave that to the servicer, core-logic, and just-in-time electronic delivery of cash to the County.

I think the big boys call it a cash-flow problem. The trickle down done stopped.

When I was a mortgage broker, I used to joke that the clients came in broke, and left Broker.

When one looks out the window from a plane flying over Florida, one sees only houses…and apartment buildings…zero industrial buildings or areas..so, it wont take much for the state and federal economy to collapse due to a climate catastrophe or the degradation of the dollar….there is simply nothing to back up the sickly overpriced homes with their sickly overpriced maintenance and insurance costs…

As long as realtors keep describing the market being up as “great” while not paying attention to local wages, they’re actively contributing to the destruction of the economy. Just take a look at the housing market around Denver. Valuations are way, way up. Property taxes are way, way up. Wages not so much. They just had to force through an increase to the minimum wage or no one would be able to afford anything in the city.

The Evangelicals seem to have a good fix for this. They all get together and build a parsonage for the Pastor who cannot afford to rent or buy in a pricey neighborhood. Happened in our neighborhood. They hired professionals for some of the work but most of the rest, they did it themselves.

South Florida is totally hosed. Prices are nuts for a variety of reasons (who the hell even wants to live here; I sure as hell don’t, but, you know, family), insurance is a disaster, taxes are a hot mess, and the most galling thing to me is that the vast majority of new construction (and plenty of existing inventory) is plagued with the disease of HOAs (which throws in a basically unknowable set of expenses you have to keep an eye on, because unaccountable power structure). The HOA here (I barely know, considering mgmt company changes) has done exactly one good thing, and I don’t know if you need an HOA to do it: negotiate favorable fixed rates for high speed internet with the ISP. Otherwise, they’re good for a steady stream of passive aggressive bullshit mailers and legally questionable fines.

Ugh. And rentals? Please. Even if you DON’T get saddled with a place owned by PE, you’ll instead get some small time landlord who wants to fund a lifestyle after the actual expenses get paid.

I guess I’ll wait to inherit, but then I might have to fight the rising sea for space.

I hate this place.

Logan utah here. We are a desirable college town. Prices exploded over the last 4 years. Wages are stagnant. Outside money and folks fleeing blue state hell hole California drove prices for years. Lots of blue state employers moved here too, but pay is peanuts. Funny how that works. Luxury new home is ok. Most building is luxury homes and apts. Rents are high as are any purchase. Locals priced out and new money buyers sitting the sidelines on all but the million plus range. Add in 25 million newcomers, and the locals are all done here, no wage growth, can’t buy and rents go up.

“why are there still any cash-out refis”

Cash offer takes the house. Then, then buyer does cash-out refi with their fully paid for house. This assumes they have cash up front, or access to it. After the sale closes they need some of the cash back.

Most house sales I’ve been hearing about are “all cash” offers, whatever that really means. Without that, you don’t get a house.

After 08 there were lots of people with paid for houses who were doing cash-out refis and putting the cash into Munis paying more than the mortgage rate.

Here’s how an average young person feels about buying a house in America:

The Way Is Shut: https://youtu.be/oJ5uPobxRjg?t=90

If you are an uncrowned king with a magic sword, you have a chance…

Wife is semi-active (maintains license and membership in local Board of Realtors and broker arrangement) here in Honolulu (Oahu). We don’t seem to have the bidding wars of the past, put prices have remained steady and correctly priced/marketed properties sell. Of course will be interesting to see the fall-out from the commission structure changes.

O.

M.

G.

I must be way out of touch (in spite of selling one abode and buying another 2 years ago). Who can afford either $500,000 and $600,000 mortgages? Is this just a PMC thing? No one I know could pay the monthly PITI on a $500,000 mortgage for more than a couple of months before big Trouble-with-a-T would set in.

And isn’t the yuge national debt a reason why rates should come down? Or is the plan for the government to go bankrupt so it can have an excuse to eliminate Social Security and Medicare/Medicaid?

The more insane mortgages aren’t out there, but we are still discussing 30 year mortgages. Keeping the payment low is the game with the expectation everything will stay stable with inflation worst case. Naturally, homeowners with large notes will oppose new stock, and banks will oppose new stock as it will damage the likelihood of payments being made as people experience calamities. Banks are still in the business of selling mortgages.

This is more like glorified renting.

Suburban Los Angeles County. Houses are mostly sitting for a while and prices are down from the peak 2 years ago when the houses never even got a sign up before they sold. There are 3 houses near mine that been on the market for more than 60 days. They are 25-35 year old houses that have been at least somewhat updated and are listed in the high $900’s. One house did sell recently. It had a unique flag lot, was 25 years old, clean and well maintained but NOT updated and sold for 915K.

Festering buboe in the groin of America here. (North American Deep South.)

We are seeing thirty and forty year old single family houses in the older suburbs being bought and renovated and then renting for a semester or two to college students and then sitting empty for another six months or more before renting out to what almost look to be ‘group homes.’ The telltale sign is a cluster of automobiles parked in front of the house at night, every night. Seemingly, each house dweller has his or her individual auto. We also see what looks to be extended families sharing a house now. Several cases of that within a half of a mile from our dwelling. Local online banter keeps mentioning a thousand dollars a month rent for a single bedroom apartment. This seems to be the “new normal” around here.

The local elites are still employing a strategy of tearing down older but repairable houses. The number of empty lots interspersed among older homes keeps growing. I spoke to a man who had made noises about making an offer for a newly empty lot next to his home. He stated that the asking price was exorbitant and the owners would not even listen to offers below that price point.

So much for the old style of “Middle Class.” Now it’s back to the days of the Haves and the Have Nots.

Homes are selling quite briskly in my Metro Detroit suburb, with a good percentage selling in 1-2 weeks. There are quite a few price drops in the listings, but as far as I can tell most of the price drops occurred after only a few weeks on the market. Lower cost homes and condos ($180,000-$300,000) don’t seem to be selling any more quickly than higher priced homes.

There are more $1,000,000 homes selling here than I can ever remember, and so far I haven’t noticed a lot of price drops for them. The ones that are taking the longest to sell are a few $1,000,000 homes in less desirable locations and a few gorgeous but unappreciated historic farmhouses. I’m also shocked at the amount of new home construction in the area. 2-5 years ago only a few new homes would hit the market at one time. The percentage of new homes is up considerably now.

I should add that although my suburb is considered to be desirable, it’s certainly not close to being one of the fanciest or most fashionable. Real estate prices jumped considerably 1-2 years ago. The prices have dropped and/or stablized since then, but real estate still seems to be priced too high. I can easily see a market correction coming in the not too distant future.

I am moving next week to a job there in the Warren, MI area and was pleasantly surprised at the prices in the Sterling Heights area. It seemed you could get a decent house for < $300,000.

That is true. In my westside suburb a mid-1970’s ranch with 3 bedrooms and 1 1/2 baths is selling for $350,000, which seems pretty high to me compared to the recent past. We’ve seen a lot of price fluctuations over the last 30 years. For example, when we bought our home in the early 1990’s prices dropped right after that, and we would have had to have lived in it for 10 years before we could sell it for at least our purchase price.Just based on lifetime experiences I think prices could get considerably lower soon.

I sold the family manse, in Florida, last October. My parents had built it in 1960 for $19000 including the property. I bought it from my mom in 1999 for $100,000 and sold it for $550,000, which was a 25% drop from the original asking price… and it was the only offer I got. I feel very lucky to have sold and obviously won’t complain about the profit regardless of the price drop. I downsized significantly and paid cash for a property worth half that. The market had stalled out at the time. Seems to have picked up a bit when the rates were reduced but now seems stalled again and with the insurance problem in Florida I think it will stay stalled, maybe for a while.

I had been following the market thru Sach’s Realty podcast, the host of which spoke plainly and accurately. He strikes me as politically conservative but was worth listening to, imho. I tuned in again this week and was very surprised to hear his guest, John Rubino, express some very “left” ideas especially about the economy, the Biden wars, Israel and Ukraine, etc., and it might be worth a listen to readers here: https://www.youtube.com/watch?v=w0MteVPipjA&ab_channel=SachsRealty

I do not know who John Rubino is, but he talks sense.

At the end of the above Sach’s podcast the host comments that the viewership had rapidly declined from 2000 to 50, said that had never happened before. Speculation about censorship and one comment from a viewer who said his connection to the live broadcast (originally Tuesday evening) had been cut.

Asheville, NC home being sold in the next few weeks because of a death in the family. Was purchased in the 80s for $130,000 and will likely sell for $500,000. Already several offers from the neighbors, and the realtor said it will sell fast.

Whitestown, IN – I am seeing houses staying longer on the market and price reductions. Prices went up from 2017 to 2023 significantly like almost doubling. The area has seen and is still seeing tremendous growth in commercial property construction.

The Government should get into the market and start building houses. In fact I would say that the Government should be prepared to step into almost every sector of every market when even the slightest hint of gaming by the Fat Cats starts to show. Any time demand for an essential for life and health exceeds a certain point the Government should immediately step in and become a source of supply. My house is worth several times what I paid for when I bought it 7 years back but this does not make me happy at all. My thought always is, my daughters cannot afford to buy a house here like I was able to. A house is a place to live, not an asset. We need an Army Corps of Engineers equivalent for house building. I remember way back in India (in the 1960s-70s when it used to be Socialist) we moved to a suburb of Chennai (Madras) and while my parents built a house, we saw the Government build hundreds of thousands of HIG (High Income Group) and MIG (Middle Income Group) flats all around our neighborhood which were cheap and affodable and adequate. Fast forward to the 1990s and the complete takeover of the country by the Capitalist BJP of Modi and zero investment in affordable housing – property prices in our neighborhood skyrocketed by several thousand percent.