Yves here. Investors seem to have decided all is well despite many banks sitting on unrealized interest rate losses on Treasuries and potential or actual losses on commercial real estate loans, particularly second tier office buildings, so-called Class B or C. Despite arguable excessive optimism, it’s not as if these problems look likely to go away any time soon.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

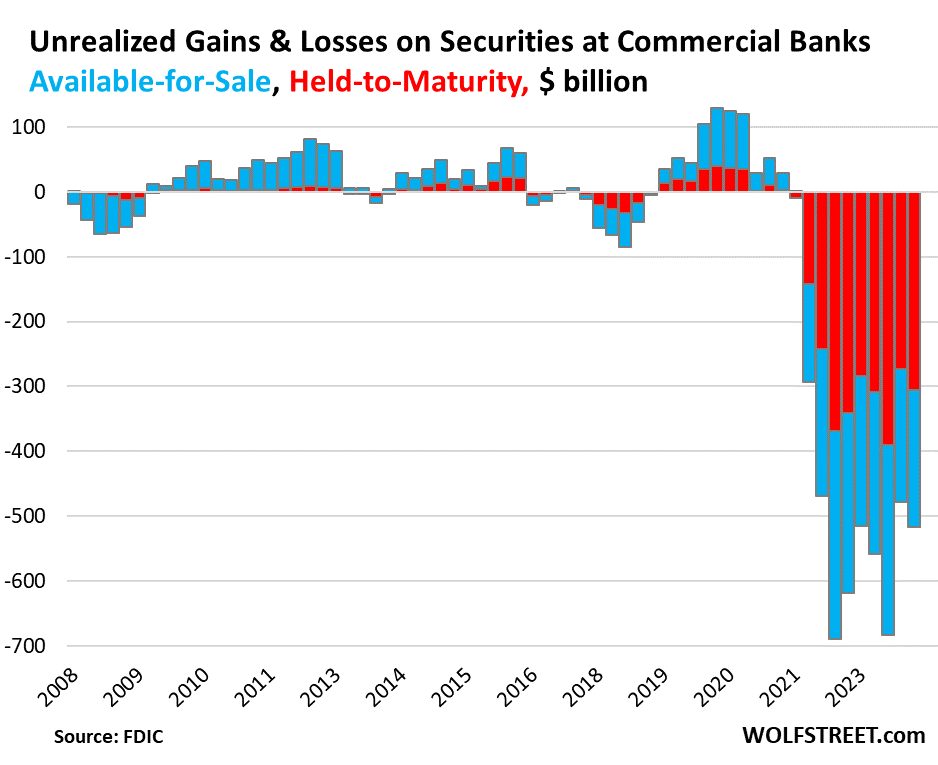

In Q1 2024, “unrealized losses” on securities held by commercial banks increased by $39 billion (or by 8.1%) from Q4, to a cumulative loss of $517 billion. These unrealized losses amount to 9.4% of the $5.47 trillion in securities held by those banks, according to today’s FDIC’s quarterly bank data for Q1.

The securities are mostly Treasury securities and government-guaranteed MBS that don’t produce credit losses, unlike loans where banks have been taking credit losses, particularly in commercial real estate loans. These are pristine securities whose market value dropped because interest rates rose. When these securities mature – or in the case of MBS, when pass-through principal payments are made – holders of these securities are paid face value. But until then, higher yields mean lower prices.

These unrealized losses were spread over securities accounted for under two methods:

- Held to Maturity (HTM): +$31 billion in unrealized losses in Q1 from Q4, to a cumulative loss of $305 billion (red).

- Available for Sale (AFS): +$8 billion in unrealized losses in Q1 from Q4, to $211 billion (blue).

HTM securities (red) are valued at amortized purchase cost, and losses in market value don’t hit income in the equity portion of the balance sheet, but are noted separately as “unrealized losses.” It’s with these HTM securities, and HTM accounting in general, where the problems reside.

AFS securities (blue) are valued at market value, and losses to due changes in market value are taken against income in the equity section of the balance sheet.

Rate-Cut-Mania Soothed the Pain, but It’s Over

Yields on longer-term securities began plunging in November and bottomed out early this year amid general Rate-Cut Mania. The plunging yields caused prices to surge, which caused the unrealized losses in Q4 to drop from the massive levels in Q3.

But in the latter part of Q1, Rate-Cut Mania began to subside, yields rose again though not back to October-levels, and so the unrealized losses in Q1 rose as well.

The $5.47 Trillion in Securities Held by Banks

During the pandemic money-printing era, banks, flush with cash from depositors, loaded up on securities to put this cash to work, and they loaded up primarily on longer-term securities because they still had a yield visibly above zero, unlike short-term Treasury bills which were yielding zero or close to zero and sometimes below zero at the time. During that time, banks’ securities holdings soared by $2.5 trillion, or by 57%, to $6.2 trillion at the peak in Q1 2022.

That turned out to have been a colossal misjudgment of future interest rates. The misjudgment already caused four regional banks – Silicon Valley Bank, Signature Bank, First Republic, and Silvergate Bank – to implode in the spring of 2023 when spooked depositors yanked their money out.

In theory, “unrealized losses” on securities held by banks don’t matter because at maturity, banks will be paid face value, and the unrealized loss diminishes as the security nears its maturity date and goes to zero on the maturity date.

In reality, they matter a lot as we saw with the above four banks after depositors figured out what’s on their balance sheets and yanked their money out, which forced the banks to try to sell those securities, which would have forced them to take those losses, at which point there wasn’t enough capital to absorb the losses, and the banks collapsed. Unrealized losses don’t matter until they suddenly do.

The value of securities held by banks ticked up in Q1 to $5.47 trillion, after having already ticked up in Q4, but is still down by $786 billion, or by 12.6%, from the peak in Q1 (purple in the chart below).

HTM securities have declined steadily from the peak in Q4 2022, and dipped further in Q1, to $2.44 trillion, down 12.7% from the peak (red).

AFS securities rose for the second quarter in a row, to $3.02 trillion but remain 26.4% below the peak in Q1 2022 (blue).

Several factors make up the decline of securities on bank balance sheets from the peak, including:

- The portion of securities of the collapsed banks that the FDIC sold to non-banks are no longer part of it.

- Banks have written down AFS securities to market value.

- Some securities matured.

- Banks may have sold some securities.

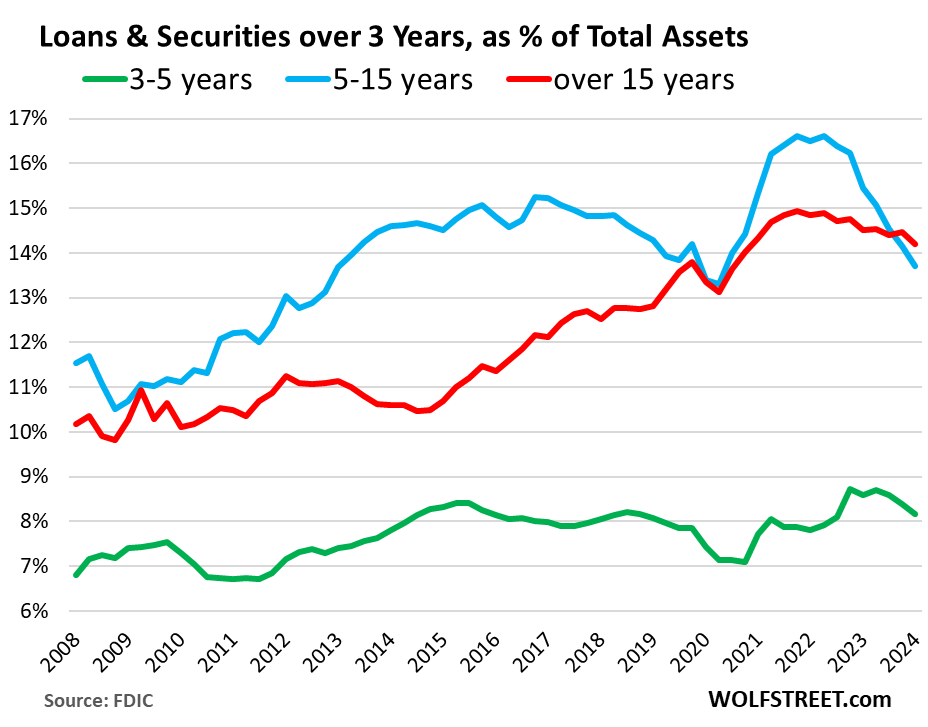

The Longer Till Maturity, the Bigger the Interest-Rate Risk

Interest rate risk — the risk of falling prices as yields rise — increases with the term of the security or loan. The 30-year Treasury securities sold in the summer of 2020 have lost the most in market value, while 5-year Treasury securities sold at the same time are now just a year from maturing and are trading at small losses from face value.

To gauge this risk on bank balance sheets, the FDIC provides data on securities and loans by remaining maturity:

- Least risky (green): 3-5 years: 8.2% of total assets.

- Riskier (blue): 5-15 years: 13.7% of total assets, lowest since Q2 2020, after substantial declines.

- Riskiest (red): 15+ years: 14.2% of total assets, lowest since Q2 2020.

SVB writ large. The Fed cavalry will arrive of course. Those banksters gotta have their yachts.

Probability of the US Dollar maintaining its value in 10 years? Nil. Heck it will not even take 10 years. I realize this is not the “debt jubilee” that Michael Hudson often alludes to, but a jubilee will be coming for everyone, and because the rich owes the most moolah, can someone tell me what will happen to wealth disparity after the BIG forgiveness?

I can’t see Trump or Stein agreeing to bail out the banks, where every other president would

Socaljim. I suspect the wealthy already own most of the “real” assets (land, businesses, etc). So the wealth disparity is likely to persist if the dollar becomes worthless.

Asset = Liabilities + Equity. A person can own a house with a 30 years mortgage, but until the later is fully paid off, the bank can always repossess the house if the “owner” were to default on mortgage payments. Same principle when it comes to rich people, because they too “own” a lot of assets by borrowing huge sums of money.

The unrealized losses on AFS and HTM debt securities held by banks main effect is vastly increasing the risk of a liquidity crisis. The money that has been invested in these low yield securities is effectively off limits for years (often 5 years or more according to the charts) and if cash is needed, say like with SVB needing to cover a significant decline in deposits, reclassifying these securities on the balance sheet will be very painful, particularly the HTM securities.

This all this serves to amplify risk in the financial system. As businesses and consumers struggle more their balances held at banks tend to be reduced, increasing the demands for cash, making it far more likely you could tack on a banking crisis to a garden variety recession. The Fed is playing with fire by keeping rates elevated for an extended period, but really doesn’t have a lot of other option in the face of elevated inflation. It would be more effective to fight inflation fiscally by reducing the deficit either through higher taxes, lower government spending, or both, but that would require an organized and functional legislature the sort of which the US currently doesn’t possess.

Predicting the future is a waste of time, but I see a possible scenario with something breaking in the economy, made worse by banks failures, with the Fed riding to the rescue by bringing back QE and ZIRP, pumping lots of liquidity back into the system. This will lead to a second round of inflation as bad or worse than that of 2021-2022.

what deficit are you speaking of? because if its the budget deficit, that’s a irrelevant number. if its the trade or balance of payments deficit, that’s real money.

free trade, the wars because of free trade, tax cuts for rich parasites, deregulation, privatization, slashed social safety nets, jim crow laws, all the stuff that creates massive UN-payable debts.

typical banana republic stuff.