Yves here. This is the second post we have run of late that questions the thesis that peak oil will set in before 2030. Here the argument is that key sources of overall energy demand have been ignored, and that demand will perpetuate fossil fuel use. Separately, the powers that be are trying to increase the use of electricity from solar panels without having addressed needed grid investments or how to address base load needs. This planning failure will also slow the shift away from oil and gas.

By David Messler, an oilfield veteran, recently retired from a major service company. During his thirty-eight year career he worked on six-continents in field and office assignments. He currently maintains an independent training and consulting practice, and writes on energy related topics. Originally published at OilPrice

- The IEA predicts peak oil demand in 2028 due to the shift towards cleaner energy technologies.

- OPEC disagrees, forecasting rising oil demand driven by increasing energy needs in emerging economies.

- Two key factors often overlooked in oil demand forecasts are the growth of the middle class in emerging economies and the energy demand for artificial intelligence.

It is fairly common nowadays to see relatively near-term estimates for a point at which demand for petroleum-based fuels begins to decline. The term often used to describe this “tipping point” is Peak Oil Demand. When I say “near term,” I mean right around the corner if you look at an estimate published last year by the International Energy Agency-IEA, an intergovernmental agency headquartered in Paris, France, and originally established after the Oil Embargo of 1973 to help cushion against future oil shocks. This agency has expanded its mission to a fairly broad remit over the years since, and it is not the purpose of this article to detail all its endeavors. One role we will highlight is that of the one it plays in gauging and advising member governments on energy security and energy sources for the coming years.

In that capacity, the IEA in a report entitled, Oil 2023, and published last year settled on 2028 as the year past which the use of petroleum fuels will begin to decline.

“Growth in the world’s demand for oil is set to slow almost to a halt in the coming years, with the high prices and security of supply concerns highlighted by the global energy crisis hastening the shift towards cleaner energy technologies, according to a new IEA report released today.”

This view is largely shared, particularly with respect to liquid motor fuels, by other agencies and organizations that produce long range estimates. The U.S. Energy Information Agency-EIA, Rystad, and Det Norske Veritas- DNV, all show this category tailing off rapidly in the 2030s as electric vehicles assume larger shares of passenger vehicles. We will call this the “Bear Case” for liquid fuels.

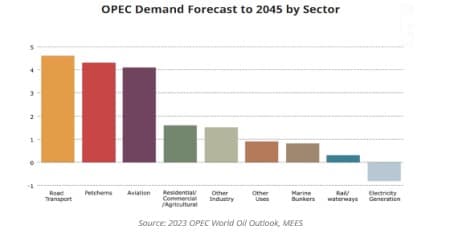

As you might expect the Organization of Petroleum Exporting Countries-OPEC, disagrees with this view. In fact in their recent report on oil demand outlook, published in Nov 2023, they see oil demand of all kinds, except for electricity generation, rising from ~105 mm BOPD in 2025, to 116 mm BOPD in 2045. This forecast show use of oil as a road fuel continuing to be the largest source of demand increase for this period.

The report notes that “the divergence between the IEA and OPEC outlooks is largely due to assumptions regarding the speed at which internal combustion engine vehicles will be replaced by electric vehicles.”

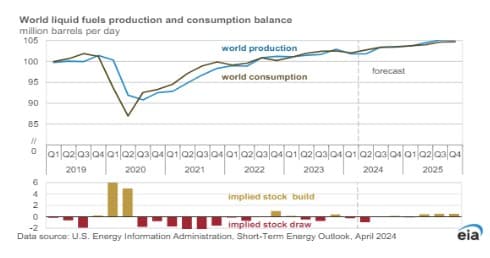

What is interesting is that it is very difficult, if not impossible, to see a production trend being established that would support the bear case. In the U.S., we are pumping at a rate of over 13.2 mm BOPD and still importing ~6.7 mm BOPD to feed our nearly 22 mm BOPD daily habit. The U.S. Energy Information Agency-EIA forecasts in their monthly Short-Term Energy Outlook-STEO that by the end of 2025, global production and demand fall into a fairly tight balance at 105 mm BOPD. That certainly isn’t a long-term trend, but as is often said, the long-term trend is made up of a bunch of short-term ones. For my part, I would say that the trend line in the STEO graph below matches the OPEC estimate more closely than the other three.

Both of these notions cannot be true. Which is the correct assumption about future oil demand? Or are they both wrong? What are two factors these two disparate views of oil demand are not taking into account?

The first answer lies in how you interpret the growth of the middle class in China, India, and Africa in terms of energy demand and the final form it will take. The second is the advent of energy demand for Artificial Intelligence (AI), an entirely new source of demand that is just now starting to appear in energy demand forecasts. I discussed one possible outcome of this demand for U.S. natural gas in an article in March 2024.

To be clear, I am not arguing that AI demand will directly impact crude oil demand as a primary source. Most analysts are factoring renewables and natural gas to meet AI demand. What will impact demand for WTI and other baskets of crude is the relationship to light oil production in the U.S. and the associated gas that’s produced along with it. We will leave that discussion for a future article and refocus on our basic topic. What could oil demand actually be when accounting for growth in currently underserved but upwardly aspiring lower classes?

Then there is the Bull Case for oil. Arjun Murti, a well-known energy commentator and partner at energy analyst firm Veriten, as well as a former Goldman Sachs energy analyst, discussed future energy demand in a recent podcast on his Super-Spiked blog. In the episode titled, “Everyone is Rich,” Arjun posits what the impact on world energy demand would be if everyone was as energy-rich as the “Lucky,” 1.2 billion people that live in the Western World. More specifically, Arjun asks what it would mean for the other 7 billion people in China, India, Asia, and Africa to have the lifestyle that Americans, Canadians, Europeans, and a few other countries enjoy. The answer he comes up with on an absolute basis, 250 mm BOPD, using a reference point of 10 bbls a year!

Where are we now? The U.S consumes ~22 bbls of oil annually per capita while China consumes 3.7 bbls per capita. Indians use just 1.3 bbls per annum. That’s a pretty wide gap, and as Arjun notes, “economic growth and energy growth are one and the same. You do not get economic growth without adequate energy.”

One of the arguments put forward by the Peak Oil crowd is that efficiency growth Gross Domestic Product (GDP), and energy substitution will bend the curve on oil demand, as noted in the 2030’s, and spell the twilight of fossil fuels. Arjun points out that there is simply no evidence this is happening using data compiled by Goldman Sachs through 2019. Efficiency gains never lower the amount of energy needed to produce an additional dollar of GDP, above 2.7% GDP growth. A point rarely hit in modern times. To close that gap and attain growth you need more energy inputs. Oil.

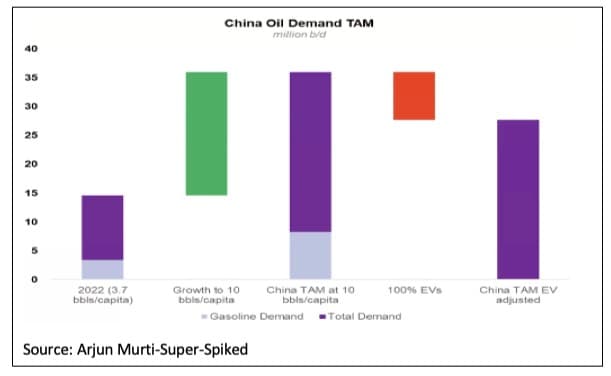

Looking at Arjun’s graph below, which uses China as an example, we can see with their present demand of 3.7 bbls per capita which equates to about 15 mm BOPD. With 10 bbl per annum added on for growth in the middle class, you get to 35 mm BOPD to meet Chinese energy demand. Even if China attains 100% Electric Vehicle-EV penetration, not something Arjun (or I) believe is possible, you still have 27 mm BOPD of oil demand. According to SP Global China produces about 4.1 mm BOPD, leaving a gap of about 11 mm BOPD they must import to meet present-day demand.

A point that leads me to what Arjun noted as the ultimate demand limiter and why, although countries that will surely desire to increase their oil usage may not be able to do so. Geopolitical limits to imports. Quoting Arjun, “There is no precedent for countries importing 20-30 mm BOPD” to meet their energy needs. The U.S., before the advent of shale production was importing over 10 mm BOPD as recently as 2005. That’s what we know is possible.

It should be noted that India is in a similar fix and for it to meet Arjun’s 10 bbl per capita standard for being rich, they must import 35-45 mm BOPD. We just don’t know if this can be done from both a logistical and sheer capacity of supply basis. As the EIA graph above highlights global oil production has increased only about 3 mm BOPD since 2019. In order for the world’s poor to become richer, a great deal more oil will have to come to market.

Your Takeaway

The message of the growth of the middle class globally often gets lost in the constant blare of climate change and energy transition noise. The fact remains that the world we live in today and the one likely to exist at mid-century, runs on oil.

The notion that the world can quickly and painlessly transition to other forms of energy has developed some, not holes, but gaping craters in recent times. Offshore wind farms are being canceled as costs mount. Car manufacturers are delaying implementation of EV rollouts due to lack of interest from consumers. Communities impacted by siting of solar farms are pushing back on land use as they propose to gobble up large tracts for this purpose.

Roger Pielke, another well-known energy commentator and author, in a post in his Substack, The Honest Broker, cites a White Paper by Vaclav Smil that discusses our energy transition progress to this point-

“All we have managed to do halfway through the intended grand global energy transition is a small relative decline in the share of fossil fuel in the world’s primary energy consumption—from nearly 86 percent in 1997 to about 82 percent in 2022. But this marginal relative retreat has been accompanied by a massive absolute increase in fossil fuel combustion: in 2022 the world consumed nearly 55 percent more energy locked in fossil carbon than it did in 1997.”

Balanced against this lack of progress in substituting oil for other forms of energy is the fact that the world’s energy supply is in a tight balance with demand at present. If the poor of the world make even modest progress toward Arjun’s 10 bbl per annum prognostication in the coming years, the Bull Case for oil will certainly asset itself.

“Peak oil demand” strikes me as less important that peak oil supply, and the more demand there is the more of that non-renewable supply disappears.

Supply, demand, and price.

Exorbiant price per barrel will open marginal prospects, but at some point will also force substitution.

Messy deal… no perfect substitute for oil yet discovered- nothing so portable and energy-dense like oil.

My view is oil has allowed humans to overshoot the earth’s ‘normal’ carrying capacity of humans and their ‘thneeds’. We are in for a world of hurt as we de-populate and modify lifestyles and demands.

And the notion of de-growth is SOOOOO popular!

“Exorbiant price per barrel will open marginal prospects”

Indeed. Observed that when many a plan for fields in the Barents Sea was proposed before the Saudis got involved in funding the Syrian debacle and the price came tumbling back down.

Do we* think that the deplorables / useless eaters are gonna sit on their hands while the MOTU design and execute a Mass Extinction “lawn mowing” to fix their supply and demand woes? Looks like “turtles all the way down” I reckon.

* “What you mean ‘we’, paleface?” (Tonto to the Lone Ranger)

Seconded.

And I think we have to ask ourselves what purpose this idea was meant to serve, as well as how it’s come to be wielded. “Growth in the world’s demand for oil is set to slow. . .” has a soothing quality, in the end signifying little about our real prospects. The critical calculus–if we still need one–is use equals units of output and x amount of sustained warming. . . not getting us anywhere near targets OR the salvation of many billions of people. (I think that the first real spectacular deaths of people, in insane numbers, may come in Northern India.)

We’re in the middle of the end, not the beginning of it. They knew in the 70s, and I well remember my first year in grad school, 2003, watching a researcher cry over the implications of her research on the warming of the Siberian tundra. I think we might be far better served now if the brunt of efforts in response involved efforts at things like local growing, and transport that might remain available through big breakdowns, the redevelopment of basic needs skills wrested from people over time. Development is uneven/patchy, and survival will be the same. Localities that prepare, that really prepare, may–may–do best.

What I am always anxious to append to any such discussion is the fact that the US military is the world’s biggest polluter, fighting and being maintained so that it can keep fighting and consuming, in what might well be the world’s most destructive circle. Bombs bursting in air, and jet fighters coursing through it, keep things nicely heated, if not outright irradiated, whether the burgeoning middle classes in Jamaica are being disciplined to join the consumer treadmill with an electric or a hybrid car.

Any discussions on this subject get very murky, very quick. (Notably, I found Naked Capitalism back in 07/08 via a link from The Oil Drum). I have not heard anyone honestly discuss US production for a good 10 years. Everyone I know believes we are a net exporter (until I crush their beloved fantasy-lol).

So before you begin any conversation about oil production or peak oil- whether supply or demand, you must first answer the question: What is oil production?

A geologist is going to think in terms of crude production.

Refiners will think in terms of crude plus condensate (C + C) that sometimes includes refinery gains.

Pipeliners will talk about liquids (vs gas)

Politicians will talk in terms of all liquids (which includes bio fuels, coal gas conversion, natural gas conversion)

Economists will talk about Barrels of Oil Equivalent (BOE)

Now to me, the only way to talk about oil production honestly, is to talk of crude production (Goes to my priors given I actually studied geology, even if I never did anything with that education professionally). The other things are not oil. All of the other actors include these other feedstocks because it benefits them to do so, economically or politically, but those other feedstocks are not equal. I have not followed production lately, but it may very well be the case that we have actually already passed peak oil (crude production), but various private, state, and international agencies can make it difficult to know real production numbers due to obfuscation, confusion (regarding what is defined as oil), and outright lying. This is before you get into the fact that some of the remaining giant or super giant oil fields that are starting to be exploited more have contamination issues (such as vanadium) that mean they can only be refined in very specialized refineries, of which there are very few (this is the main reason they were not heavily exploited before now) and this also limits production volumes, even if there is lots of oil to refine. Every sign I see tells me we are starting to scrape at the bottom of the barrel (pun intended). All this is to say that I tend to be very skeptical of any production numbers I hear or read.

Yeah, i seem to recall that the original “peak oil” concept was peak supply. This based on ROI, as remaining fields required more energy put in (structures able to withstand harsher weather patterns, deeper wells, etc) compared to the amount of oil to be extracted.

As for peak demand, i find myself once more invoking Jevons Paradox. Particularly fitting this time around, as he was observing the use of coal in England. As the efficiency of boilers etc improved, the total amount of coal used also increased. This because the improvements allowed for new uses.

Thus i suspect that EVs etc will just result in the oil being used elsewhere until it become too expensive to continue to do so due to rising extraction costs and lagging ROI.

Additionally, and as distinct from private transportation, most goods transportation, especially in the US, but also in Europe and probably elsewhere (and including as a special aspect, sea transportation) is based on the Diesel engine. There is currently, as far as I can tell, almost no provision to replace this complex system with alternative power.

It wouldn’t be impossible – ships can quite easily incorporate wind power where available, but there are also implications for timeliness, and materials availability for a mass conversion to, say electrical cabling for land use.

I am no expert in this subject, so maybe someone with more expertise would like to chip in here.

Various experiments are taking place though. Volvo fitted a stretch of Swedish highway with overhead wiring. This to allow their trucks to function much like a trolley bus on the highway, and use battery elsewhere.

And there are already cargo ships out there using modern sail like solutions when on the open ocean. I think i saw an article recently on how much the owner of one such claimed they had saved in fuel costs.

Others are pondering moving to ammonia for ship fuel, as the refueling with will be handled by professionals anyways.

Except peak oil was originally predicted for 1995, 2005, 2005, 2006…..the forecasts have all gotten it wrong.

https://en.wikipedia.org/wiki/Predicting_the_timing_of_peak_oil

These stats eloquently illustrate the “harvest” reaped from Happy Motoring:

Americans consume 6 times the oil as the Chinese whose economy is now larger than the U. S. We devour nearly 20 times what Indians use.

Insanity.

But, but, electric vehicles will change all that! :)

Those figures are per capita – the US uses around 25%-30% more oil in total than China and around four times the amount used in India. The more telling figure is that the US uses around twice as much per capita as the average developed country. Its notable that growth in oil use in the US seems to have stalled or possibly gone into decline since Covid – most likely due to higher vehicle efficiency, plus the impact of higher prices.

Yes. And oil isn’t the only thing to worry about. There is also coal (https://www.worldometers.info/coal/coal-consumption-by-country/), where China’s consumption is 40% higher than the US on a per-capita basis and is nearly 6X on an absolute scale.

This is why China’s total CO2 emissions are more than twice that of the US. Per capita they’re still significantly lower, but China’s CO2 emissions per capita have risen sharply in recent years, while in the US they’ve been falling since 2004 (albeit much more slowly than we’d like).

Peak Oil is as much a certainty as the known laws of physics are.

And it will be due to supply, not due to demand. Renewables have come as additions to fossil fuels, not as replacement.

If predictions of it for dates that we have already passed turned out to be wrong, that is because nobody (at least based on public information) has a good idea what the reserves actually are.

But finite they are, and a few decades here and there with respect to the exact date of the onset of terminal decline do not matter all that much in the grand scheme of things.

Rather than a few decades, why couldn’t it be a few centuries, since we do not have the true picture? I am not questioning that we live in a finite planet, but we don’t know what we don’t know?

It kinda matters for the people living right now. Had peak oil occurred 2 decades ago as predicted, would we be seeing things like “AI” due to the lack of energy? How about Covid? Would it have spread as quickly, since presumably air travel would be severely restricted?

It won’t be centuries for the following simple reasons:

1) Discoveries peaked globally way back in the 1960s. The uncertainty is about the size of the already discovered fields

2) We have seen plenty of terminal depletion (all of the continental USA conventional fields, North Sea, Mexico, etc.). It is mostly the Middle East and Russia that are keeping things going, plus fracking. So basically there has been an underestimation of actual reserves in OPEC countries (not surprising, there was never any good data on those), but that is not going to be by orders of magnitude, but by some kind of linear factor

3) Demand continue to grow, so depletion accelerates. 40-50 years ago the current reserves would have lasted twice as long as they would have at current rates of consumption, because consumption was only half what it is now.

Also, COVID is in fact a symptom of Peak Oil, but few people have the capability to see it. Including in the Peak Oil crowd, which mostly ignored to issue, or even launched into denialism, and that was quite disappointing to see, as it was a perfect illustration of the kind of systemic decay that develops as a result of resource constraints starting to bite. What happened is that Western society simply didn’t have the surplus to both keep the rapacious oligarchy happy and contain the virus, even though the virus was eminently containable. In China they didn’t have the same kind of rapacious oligarchy so they contained it for a while; eventually they caved in too, but they showed that it was a fully solved technical problem. But the West refused to apply the solution, and that doomed the whole world.

Back in the early post-WWII decades, if they had the same technology we have now (especially mass testing), they would have contained it in the West too. What changed?

What changed is that back then we were on the left hand side of the Peak Oil curve and there was plenty of surplus. So resources could be mobilized to deal with such a crisis, and society as a whole was much better organized, again, because there were plenty of resources to run it on.

We have been able to keep oil production going at high levels with fracking, offshore oil, and other tricks, but the net energy we get is much lower; meanwhile the demands on resources from the oligarchy have increased (all those private jets, megayachts, etc. didn’t really exist back then, nor was the size and the ecological footprint of the wealthy enclaves as large as it is now), as has the consumption by everyone else (needed to keep the masses placated and to maintain stability). Something had to give, and that something was physical and social infrastructure. This is why you live in a decaying society with crumbling physical infrastructure and destroyed institutions incapable of solving problems. Such as containing viruses.

Ultimately it comes down to availability of resources. Redistribution towards the common good is only possible if you have an enlightened elite or enough surplus. The former is very rare, so it mostly comes down to the latter, and if there isn’t such a surplus, there is no redistribution.

P.S. The whole history of public health in fact is the story of the oil age too. Elites started making concessions to the masses right at the time in the second half of the 19th century when the oil age began and we were pumping the stuff out at ever increasing rates (to the point that we didn’t even know what to do with it) and at fantastically favorable EROEI values. That peaks with the elimination of smallpox in the 1970s (right when the US hit Peak Oil), and now public health is dead. Not a coincidence.

I don’t like to ad hominem, but when someone writes an article quoting for its primary information on oil demand a director of ConocoPhillips (Arjun Murti) and the widely debunked climate change denier Roger Pielke, then I’d rather go back to the original document.

The IEA report is actually a model of clarity and well worth reading for anyone with even a passing interest in the topic (which should really be all of us). Its prediction of a flattening of energy demand is primarily based on a gloomy outlook on growth – for India and China to achieve the sort of middle class oil demand outlined in the OPEC report would mean an enormous increase in domestic demand over what we’ve been seeing. It also assumes that China, in particular, would willingly put its future in the hands of Opec, as they’ve been struggling to maintain domestic oil production.

The IEA has a long history of being very bullish on oil and gas demand, and has consistently underestimated renewables. This may have changed, but when you read the actual report it clearly states that if anything it considers its projections on economic growth for the next 5 years to be on the optimistic side, especially with the potential for further oil price shocks and rising interest rates. For this article to be correct, you have to assume that India will increase its growth rate very significantly, to around 7% per annum, something its consistently failed to achieve – additionally you have to assume that China will shake its domestic consumption out of its current stasis and start matching GDP growth, something it hasn’t done for many years.

There’s a reason for the blare. What do these people not understand about endless crop failures?

What’s with the shift in the meaning of “peak oil”? The term has a longstanding definition. At least one of your commenters appears to be using the original definition. Those referring to peak oil demand should at least always include the “demand.” Hope you are well, Yves.

So it is completely logical to expect a militarist strict control of supply by rationing and quotas to now establish itself. To allow the supply of oil to be controlled by demand is absurd. It would be, is becoming, catastrophic. I’m pretty sure it’s time to come clean on the oil wars now in full blast. To pretend they are wars for freedom and human rights is an insult to even the dimmest intelligence. Genocide anyone?

I love the way these prognosticators proclaim that oil brown or tan is a fashion that is so yesterday, and that the new hot trend is electric blue….assuming that everything else remains the same and we can continue increasing the energy squander….because capitalism. Overshoot is the problem. My first exposure to peak oil was at dieoff.org.

He speculated that there would still be oil in the ground when humans have returned to the Olduvai Gorge. Those humans will probably not know what oil or electric are.

Abiotic oil.

All planets outgas CH4. It is part of the way they are made.

On Earth when it runs into ocean bottoms, it becomes clathrates, a very useful booster to the tsunami weapon … on land, when it reaches impenetrable rock, it gets warmer and under more pressure. It polymerises into octanes etc etc.

Oil’s peak? Maybe in 500 years.

Economists and liars … hard to tell them apart?

It doesn’t matter if oil is abiotic or not, it all comes down to one thing, how are you going to extract the oil out? If there’s like almost infinite amount of oil near the earth’s core, no one will be able to get to it, because of engineering challenges and ….. having to use oil to extract oil. If you expend 5 barrels of easy to get oil to get 9 barrels of hard to get oil, you are still worse off, and when you’ve run out of the easy to get oil, then what? You are still done.

There will still be oil at the end of days, heck, there’s probably oil under your feet, but if it’s just one barrel, no one’s going to bother to dig it out, because it’s just not very economic.

Oil = food = population. We’ve all seen the geometric increases tailing off.

Simplistic but so far, that has been true. For the last decades, it is less true. Still plenty of demand for Africa and Asia.

Paper never refused ink … Duelling lies and predictions … when will the wars end?

I don’t really know what I think about peak demand/aupply, as the definitions are often shifty.

But it’s worth noting that this piece is written with a fairly heavy load of phony consultant-speak hyper confidence in its discussion of renewables development:

“Offshore wind farms are being canceled as costs mount. Car manufacturers are delaying implementation of EV rollouts due to lack of interest from consumers. Communities impacted by siting of solar farms are pushing back on land use as they propose to gobble up large tracts for this purpose.”

These are pure corporate lobbying talking points. No data about number of wind farms in the pipeline vs cancellations and delays, no real analysis about whether consumer “lack of interest” is permanent, or whether EV sales are slowing in isolation or overall sales are down. And the assumption that these are permanent irremediable trends, excluding the possibility that they are inevitable points of conflict in attempts to alter large social and economic structures.

And, for that matter, no analysis of political and lobbying spending by his colleague Arjun’s employer and clients. Who exactly opposes the wind farms, anyway? Who exactly fights against public charging stations, anyway?

He may be right – status quo pessimism is always warranted and the global economic trends he’s looking at are very large. But on the renewable side of the piece, there are heavier doses of bluster, handwaving and anecdata than you would expect from a credible argument by an expert.

Car manufacturers are delaying implementation of EV rollouts due to lack of interest from consumers.

Where is this happening? Are we seeing a US-centric view here?

What share of new cars are electric?

Lowest-cost energy today is provided by wind / solar / batteries. PV and battery prices are dropping precipitously as manufacturing and technology improves. This trend is undeniable, and won’t be stopped by wishful thinking on the part of fossil-fuel companies. Developing countries will need to implement charging infrastructure (probably with Chinese help), and in return will have cheaper, more-reliable cars than people in western countries. Anyone without the sunk-cost of oil refineries, gas stations and fossil-fueled power plants would be foolish to invest in them now.

I expect a lot of articles will be published about the shortcomings of wind, solar and batteries. It’s been a while since I heard about the recycling crisis of dead solar panels (fine pile of scrap aluminum ya got there. I’ll take it!). Range, cold-weather, battery-life are being sorted out as we speak. The inexorable logic of the marketplace will punish anyone clinging to fossil fuels and nuclear power.

We have in fact run articles about the solar panel waste problems, that they are NOT being recycled.

You are right that this needs to improve. I find only 25 recycling locations in the US (https://www.energy.gov/eere/solar/solar-manufacturing-map). California has a program aimed at large-scale projects (https://werecyclesolar.com/recycle/), and there are periodic panel drop-off days in Sonoma County – In fact the next one is tomorrow! https://zerowastesonoma.gov/materials/solar-panels. California has classified scrap panels as hazardous waste, so I guess they figured they needed to make it possible to dispose of them somehow. I’d guess they go to China to be dismantled, with aluminum / copper being smelted, and the rest scrapped over there.

Solar panels never be as easy to recycle as beer cans, but there is some real money in the scrap panels. By the time the current crop of panels are junked, I think people will figure out how to make money on them.

For a little bit of perspective, consider replacing a 305 watt PV panel with a coal-fired power plant. The solar panel will generate 9000+/- kwh over it’s life. The power station produces 1600 pounds of coal ash generating that amount of energy. That makes a few pounds of plastic and silicon seem less daunting to me. The coal plant also produces 10 tons of CO2 to generate that much power.

In Europe, solar panels are designated as e-waste.

As for comparisons of energy sources, Hannah Richie did a nice overview. Even this probably understates the issue of coal vs solar, as around 2-5% of coal ash is flue residue which is highly toxic and very difficult to dispose of.

Solar and wind turbine waste is basically a rounding error when comparing them to coal and other major waste streams in terms of either volume, mass, or toxicity. And thats assuming a worst case scenario of minimal recycling.

The key is the supply of affordable oil, not demand. As this supply shrinks, demand falls because the oil yields less profit, making alternatives more affordable (alternative fuels or less growth). Already global economic growth has slowed in recent years since the global peak of conventional oil was reached in 2006. It’s looking to many of us that the persistent inflation going on now, even with supply chains fixed, is a sign that we’re reaching limits to growth.

Now I’m curious about the historic numbers, but this is what California is doing right now. https://www.caiso.com/todaysoutlook/Pages/supply.aspx#section-supply-trend

This is the time of year when residential AC units aren’t working too hard, and the PVs and windmills are generating tons of power, so the renewable future looks pretty rosy. With batteries getting cheaper and better at a shocking rate, the bump at the end of the day from batteries will keep getting bigger, faster than most people appreciate.

How’s this for a different perspective? New capacity coming online in the US for power generation is almost exclusively solar, batteries and wind power. Still a bit of natural gas, and it looks like someone commissioned a nuclear power plant (ratepayers be damned). https://www.eia.gov/todayinenergy/detail.php?id=61424

Transportation shifting to renewables will be slower. The 7% market share of EVs will grow faster, as range increases and cost decreases. This will happen faster than most people expect. At 3 million new cars per year in the US, we’d need at least that many new EVs per year to hold oil consumption flat for cars. Current numbers are at 1.2 million per year, so it will take a few years to hit that mark, but it will happen sooner than most people expect.

In less wealthy countries, affordable EVs and renewables will reduce the cost of transportation substantially. Avoiding the payments to OPEC countries for oil or gasoline imports will improve the standard of living and hasten the arrival of peak oil.