Yves here. Many experts have described how stock buybacks reflect perverse incentives by allowing corporate executives to engage in stock price manipulation for the benefit of their own paychecks and stock incentive deals. The SEC made the mistake of authorizing stock buybacks in 1982. Its recent efforts to force more disclosure of buyback activity to make sure that companies were complying with its safe harbor rules was successfully challenged in court for failing to consider costs and benefits. The SEC can probably overcome this hurdle but it is yet another administrative burden.

An illustrative critique of stock buybacks comes in Profits Without Prosperity, from the Harvard Business Review in 2014. Its opening paragraphs:

Five years after the official end of the Great Recession, corporate profits are high, and the stock market is booming. Yet most Americans are not sharing in the recovery. While the top 0.1% of income recipients—which include most of the highest-ranking corporate executives—reap almost all the income gains, good jobs keep disappearing, and new employment opportunities tend to be insecure and underpaid. Corporate profitability is not translating into widespread economic prosperity.

The allocation of corporate profits to stock buybacks deserves much of the blame. Consider the 449 companies in the S&P 500 index that were publicly listed from 2003 through 2012. During that period those companies used 54% of their earnings—a total of $2.4 trillion—to buy back their own stock, almost all through purchases on the open market. Dividends absorbed an additional 37% of their earnings. That left very little for investments in productive capabilities or higher incomes for employees.

So with the SEC not able to make even modest changes to its buyback rule, and not inclined to really rock the boat by rolling it back, the heavy lift of tax reform is more viable, which means not very.

By Jessica Corbett, staff writer at Common Dreams. Originally published at Common Dreams

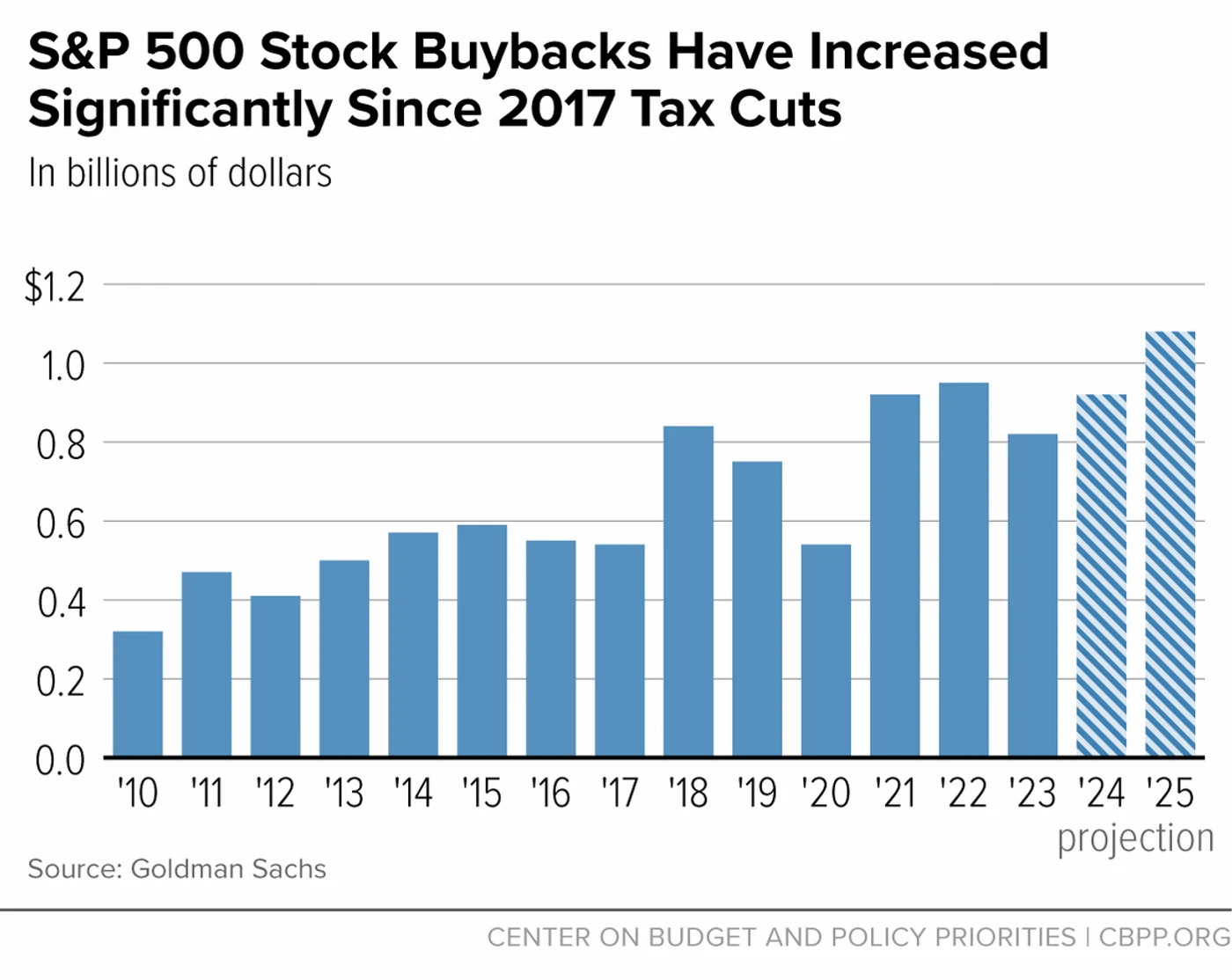

With a battle over congressional Republicans and former U.S. President Donald Trump’s 2017 tax law brewing, a progressive think tank on Monday published an analysis that points to the surge in stock buybacks as proof that federal policymakers should raise the corporate tax rate.

When Trump—the presumptive GOP nominee to challenge President Joe Biden in November—signed the Tax Cuts and Jobs Act, slashing the corporate tax rate from 35% to 21%, he declared that “corporations are literally going wild over this, I think even beyond my expectations.”

Chuck Marr, vice president for federal tax policy at the Center on Budget and Policy Priorities (CBPP) wrote in his new analysis that “other studies have shown that the corporate rate cut overwhelmingly benefits high-income people and has failed to deliver to workers the benefits its proponents promised.”

He referenced research from the American Enterprise Institute, Brookings Institution, and University of North Carolina as well as the Joint Committee on Taxation and Federal Reserve Board that exposes how the law hasn’t lived up to the GOP’s claims.

“The fact that it also launched massive buybacks is a further reason why policymakers should revisit the rate cut next year—part of the larger course correction needed in the nation’s revenue policies as major pieces of the 2017 law expire,” Marr argued.

Buyback is a term for when a company purchases its own outstanding stock to reduce the number of shares on the market and increase the value of the remaining ones, a practice that further enriches shareholders.

“Excluding the pandemic-induced recession in 2020, buybacks have been markedly higher every year since the 2017 law, and are projected to top $1 trillion in 2025 for the first time,” Marr noted, citing Goldman Sachs.

Some companies—such as John Deere—have even laid off workers while buying back stock, as Common Dreams has reported.

“The fact that corporations have significant excess cash beyond their investment needs and are using it to further enrich already affluent shareholders suggests that partially reversing the corporate rate cut, as President Biden has proposed, poses little risk to investment or the broader economy,” Marr wrote. The president’s proposed rate is 28%.

“Policymakers have an opportunity to move away from corporate tax cuts that haven’t delivered on their economic promises and toward a tax system that raises more revenue through progressive policies like increasing the corporate tax rate,” he explained. “They can then use those revenues for investments to make the economy work better for everyone, such as an expanded child tax credit and Earned Income Tax Credit, childcare, and housing.”

Marr also urged lawmakers to go even further and “raise the excise tax on stock buybacks to 4% from the current 1%.”

The CBBP is far from alone in framing the looming expiration of some tax cuts as a chance to pursue more progressive policy. In fact, the center is part of a coalition led by Groundwork Collaborative that is calling on Congress to “use the expiration of these provisions as an opportunity to address long-standing problems with our tax code, not just to tinker around the edges.”

Some progressives on Capitol Hill—such as Sen Elizabeth Warren (D-Mass.), who supports a wealth tax targeting the richest Americans—are also seizing the moment.

Warren said earlier this month: “It’s time to stiffen our spines. President Biden is right: If the 2025 tax bill doesn’t call on the wealthy and giant corporations to shoulder a bigger share of what it costs to run this country, Democrats should reject it outright. No more Trump tax breaks for billionaires.”

Stock buybacks have always struck me as a form of insider trading. Corporate exec orders buybacks to jack up the stock price to boost his already obscenely bloated ‘compensation.’ Seems to me any literate fifteen year old could do that or do I miss the special genius?

The goal of the ridiculously rich is to reduce taxes on them to zero. Gee! Weren’t ancien regime French nobility and the clergy exempt from taxation? Taxes were for the Third Estate, you know the deplorables. IIRC, that did not end well for the tax exempt.

Buybacks should be made illegal again they serve no legitimate business purpose and take away from cash which should be invested in productive activities.

The “we’re returning capital to shareholders” is BS. It a non productive way to boost EPS.

Another Financial Engineering ploy….

How about repealing SEC Rule 10b-18, adopted in 1982, which legalized stock buybacks. (Provided a “Safe Harbor”)

As a way of accelerating it, suspend the rule pending a regulatory review.

Then, frog march executives out of their offices for insider trading.

I can dream, can’t I?

Not hiding something in that god forsaken tax code.

Just make buybacks illegal again.

Sigh, why do sites like Common Dreams still act like Biden or any Dem is actually going to do this. We all know how this plays out, if Biden “wins” but doesn’t have the house and the senate then we’ll be told he reallllly wanted to do it but those gosh darn Republicans just wouldn’t let him. And if somehow the Dems get control of the House and the Senate with the required number of seats to steam roll over fake filibusters, then a couple of Dems will be designated the new Manchin and Sinema and they’ll vote against it.

So either these media sites are staffed with idiots, or it’s all just a sheep dogging exercise, like David Sirota telling his followers that the best way to screw corporate democrats and the party bosses was by voting…for Joe Biden and the corporate democrats and party bosses.