Patient readers, I cannot put up the post I planned and researched because I suddenly got very sick with something I hope is only food poisoning. So I will put up this cross-post instead. Apologies! –lambert

By Violaine Faubert, Economist at Banque De France, Nathan Guessé, a graduate student in economics at ENSAE and Institut Polytechnique de Paris, and Julien Le Roux, Senior Economist in the European Relations Unit in Directorate General Statistics, Economics and International of the Banque de France. Originally published at VoxEU.

The energy transition will require large quantities of the critical raw materials mined and processed in countries that are geopolitically distant from the EU. This column documents the ownership interests in extractive companies, information essential for accurately assessing the EU’s strategic dependencies. Investors from outside the EU control a significant share of the capital of global listed companies involved in the mining of cobalt, copper, lithium, nickel, and rare earths, underscoring the need to enhance the EU’s strategic autonomy and devise a metal-specific strategy going forward.

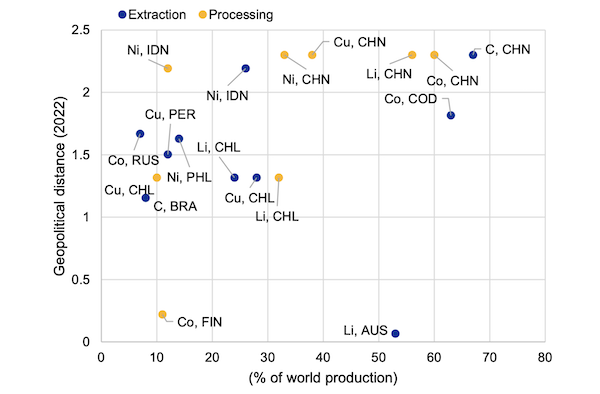

The EU has enacted recent legislation aiming to increase the security of its supplies in critical raw materials (CRMs) and make itself more strategically autonomous (Critical Raw Material Act 2024). While the energy transition will require large quantities of CRMs, the mining and processing of CRMs is concentrated in countries that are geopolitically distant from the EU (see Figure 1). For instance, 73% of all cobalt is mined in the Democratic Republic of the Congo (DRC), 69% of rare earth elements are mined in China, and half of the global nickel supply is mined in Indonesia (USGS 2023). This concentration of supply raises concerns that dominant countries may use their market position as leverage to pursue other strategic priorities (Buysse and Essers 2023), highlighting an urgent need to strengthen the EU’s raw material strategy.

The geographical concentration of production is compounded by a concentration of firms controlling the supply of CRMs, yielding oligopolistic market structures (IRENA 2023). A handful of multinational companies and state-controlled or state-owned enterprises (SOEs) dominate a considerable share of global production. For instance, the top four mining companies control around 55% of cobalt output, while the top five mining companies control 80% of lithium global output.

Figure 1 Share 0f World Production of EU Imports (x-Axis) Compared with the Geopolitical Distance of CRM Producers From the EU (y-Axis)

Note: The geopolitical distance reflects state positions toward the US-led liberal order, based on a dynamic ordinal spatial model, using UN General Assembly votes as inputs. The indicator has no unit and ranges from zero to six. Only the two main producing countries are shown for each mineral and production stage. C denotes natural graphite, Co cobalt, Cu copper, Li lithium, and Ni nickel. AUS stands for Australia, BRA for Brazil, CHL for Chile, CHN for China, COD for the Democratic Republic of the Congo (DRC), FIN for Finland, IDN for Indonesia, PER for Peru, PHL for Philippines, and RUS for Russia.

Sources: Bailey et al. (2017), European Commission (2023), and authors’ calculations.

Non-European Investors Control a Significant Share of the Capital of Listed CRM Mining Companies

While the geographical concentration of resources is well documented (IRENA 2023, Javorcik et al. 2023), the ownership interests in extractive companies is less so. Yet documenting the sources of control of mining companies is essential for assessing strategic dependencies. Building on Leruth et al. (2022), we design a comprehensive database documenting the origin of shareholders of global listed companies involved in the mining of cobalt, copper, lithium, nickel, and rare earths (Faubert et al. 2024).

We develop several indicators to map the geographical origin of capital owners, including production and market capitalisation-weighted holding rates, complemented by indicators focused on majority holdings. All indicators suggest that non-European investors control a significant share of the capital of listed CRM mining companies.

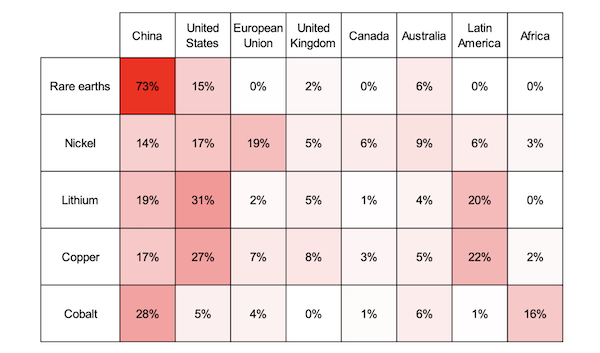

Figure 2 summarises ownership rates by investor origin for cobalt, copper, lithium, nickel, and rare earths. China’s leading position is especially notable in the extraction of rare earths, cobalt, and, to a lesser extent, lithium. By contrast, European investors hold limited stakes in CRM mining companies. The EU’s relatively high stake in the nickel sector partly reflects investments located in Cyprus representing Russian interests. Besides China, investors from the US also have significant holdings, especially in the lithium and copper sectors. Although Latin American investors hold a significant share of the capital of firms producing lithium and copper, they are underrepresented with respect to the region’s share of global production. The weight of Australian investors is relatively limited for lithium given the importance of the country’s lithium resources. Indeed, while Australia accounts for half of the world’s lithium production (USGS 2023), two of its biggest lithium mines are owned by Chinese companies.

Figure 2 Production-Weighted Holding Rate in Critical Raw Materials Listed Mining Companies

Note: The EU’s holdings in the nickel mining sector, which includes an estimated 15% share for Russian investors, is closer to 4% when excluding European investors representing Russian interests. The EU’s holdings in the cobalt mining sector, which includes an estimated 3% share for Russian investors, is closer to 1% when excluding Cypriot investors representing Russian interests.

Sources: Refinitiv and authors’ calculations.

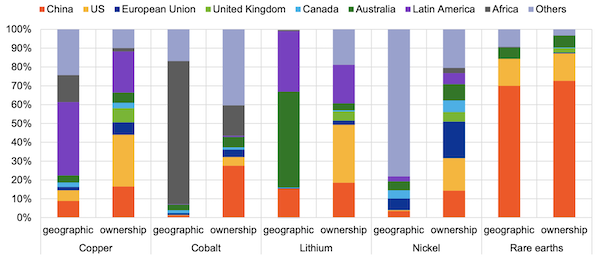

Figure 3 highlights the discrepancy that can prevail between the geographical concentration of production and that of investors analysed through firm ownership. US investors and, to a lesser extent, EU and UK investors play a greater role in copper and lithium supplies compared with the production located in their respective countries. By contrast, Chinese investors have significant stakes in nickel and cobalt companies, while these minerals are predominantly mined in Indonesia (nickel) and the DRC (cobalt). In contrast, for rare earths, production and capital ownership are aligned, with both the US and China being major producers and investors.

Figure 3 Geographic Concentration of Production and Ownership

Note: Nickel production is geographically concentrated in Indonesia, resulting in a substantial contribution from the ‘others’ category in the bar chart that breaks down nickel production by region.

Sources: US Geological Survey, Refinitiv, and authors’ calculations.

Strategic Investors Play an Important Role in the Exploitation of CRMs

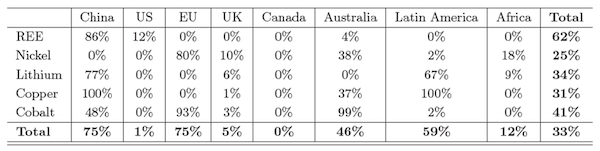

Table 1 documents the preponderance of strategic investors such as state-owned enterprises and other strategic investors (including founding families, board members, or management teams) in the ownership of firms involved in the mining of rare earths, and, to a lesser extent, in the mining of cobalt, lithium and copper. Chinese investors are overwhelmingly strategic investors, which concurs with the literature (IRENA 2023). Indeed, strategic investors account for 86% of Chinese investors’ holdings in the rare earths sector. Strategic investors also play an important role in the exploitation of lithium and copper resources located in Latin America. Strategic investors account for 67% of Latin American investors’ holdings in firms extracting lithium. Overall, the last column of Table 1 confirms the predominance of strategic investors for rare earths companies, which are largely owned by Chinese investors. Strategic investors also own more than a third of the capital of firms involved in the mining of cobalt, lithium, and copper. For instance, two strategic entities (Chile’s Pampa Group and China’s Tianqi Lithium) control half the capital of Sociedad Quiımica y Minera (SQM), the world’s second largest lithium company.

Table 1 Share of Strategic Investors in CRM Mining Companies In 2022

Note: Strategic investors account for 86% of Chinese investors’ holdings in the rare earths sector.

Sources: Refinitiv and authors’ calculations.

Conclusions and Policy Implications

Our database provides an overview of ownership interests in listed CRM companies, against a backdrop of increasing geopolitical tensions. Although the EU’s CRM Act aims to reduce strategic dependencies by diversifying the EU’s supplies, it does not address vulnerabilities associated with the concentration of mining capital. Indeed, the CRM Act sets diversification targets at producer country level. Such targets do not address concentration risks linked to capital ownership. However, assessing concentration in the mining sector through shareholdings data shows a very different picture compared with the geographical mine location. Hence, our database could be useful for identifying vulnerabilities linked to capital ownership and for refining diversification targets.

The CRM Act also aims to improve the EU’s capacities in extracting, processing, and recycling critical raw materials. Developing the European mining industry will require substantial funding from private sources (Hache and Normand 2024). In light of the EU’s commitment to strengthen its economic security, assessing the sources of control of European mining companies is paramount for gauging supply and geopolitical risks within the EU. Against this background, our results suggest a need for increased transparency regarding the sources of control of new mining projects announced in the EU.

Overall, our analysis underlines the need to enhance the EU’s strategic autonomy and suggests the need for a metal-specific strategy. In particular, our database could be instrumental in guiding investment decisions, should European entities seek to increase their shareholdings in major CRM firms.

Authors’ note: The views expressed are those of the authors and do not necessarily reflect those of the Banque de France.

Feel better! Get well, Lambert!

Please be well.

China issues regulations on rare earth administration effective October 1

June 30, 2024

Chinese Premier Li Qiang signed a decree of the State Council on Saturday, unveiling a set of regulations on rare earth administration set to take effect on October 1.

Rare earths consist of 17 elements that are hard to find in large quantities. These elements are widely used in high-tech products ranging from flat-screen TVs to lasers and hybrid cars.

According to the regulations, China will promote the high-quality development of the rare earth industry and encourage the research, development and application of new technologies, materials and equipment.

The regulations stipulate that the country will pay equal attention to resource protection and the development and utilization of rare earth elements through overall planning, ensuring security and boosting technological innovation and green development…

The reference link:

https://news.cgtn.com/news/2024-06-30/China-issues-rare-earth-administration-regulations-effective-October-1-1uQxnERj6sE/p.html

June 30, 2024

China issues regulations on rare earth administration effective October 1

https://news.cgtn.com/news/2023-09-18/Scientists-advance-application-of-efficient-rare-earth-mining-technique-1nc6N9yLDLW/index.html

September 18, 2023

Chinese scientists advance application of sustainable rare-earth mining technique

Chinese scientists, who have developed a greener and more efficient mining technique to recover rare-earth elements (REEs) from weathering crusts, expect to advance the application of the new technique for the sustainable harvest of natural resources, according to a scientific evaluation meeting in Meizhou City, south China’s Guangdong Province.

Ion-adsorption rare-earth deposits are a primary repository of heavy REEs. These deposits are currently mined via the ammonium-salt-based leaching technique leading to severe environmental damage with a low recovery rate.

To address the problem, a research team led by He Hongping from the Guangzhou Institute of Geochemistry, Chinese Academy of Sciences, has designed an innovative REE mining technique called electrokinetic mining (EKM), which enables the green, efficient and selective recovery of REEs from weathering crusts.

The feasibility of EKM was demonstrated by He’s team via laboratory-scale, scaled-up and field-scale experiments last year. Now, they have launched the first industrial trial and successfully built a demonstration project with 5,000 tonnes of soil.

Compared with conventional techniques, the EKM technique achieves a 30-percent increase in recovery rate, an 80-percent decrease in leaching agent usage, a 70-percent decrease in mining time, a 70-percent reduction in metallic impurities in the obtained REE leachates and a 90-percent decrease in ammonium emissions, according to the team.

He’s team has published 11 papers * based on the results in Nature Sustainability and other journals…

* https://www.nature.com/articles/s41893-022-00989-3

EKM mining was originally developed in Australia for copper extraction within groundwater soaked seams, but doesn’t seem to have been applied commercially. The basic principle behind EKM has been around a long time.

There doesn’t seem to be a lot of information available on the new Chinese system, but the problem with EKM is that it is very water intensive – essentially the ore needs to be crushed and soaked in water before the current is applied. This is problematic for its use in water stressed areas, and its not clear that the utilised water can be economically cleaned. Its all well and good claiming a 70% reduction in metallic impurities in leachates, but that’s meaningless if you have increased the quantity of leachate exponentially.

That said, the extraction of rare earths from spoil rather than virgin rock makes a lot of environmental sense – most rare earths are found as trace elements in other mineral seams. There are lots of proposals out there for extraction/treatment systems, but all are in one way or another problematic.

My dear Lambert! Get well, be well, stay well. Now to read the (cross)post.