Yves here. With so much news and so many hours in the day, I must confess to having missed when UK prime minister Rishi Sunak started advocating for freeports, years before he became head of the government, and has recently implemented. These are a Seriously Bad idea, as in they effectively created lawless zones for commerce (admittedly parties would have to agree on the legal jurisdiction for any agreements they had consummated), and so of course the sort of thing diehard libertarians would advocate.

Freeports appear to be a UK answer to some of the problems caused by Brexit. Their appeal is that they are easier to implement than going back to the EU and entering into selective deals to remedy the damage. But as you will see, they are set to do collateral damage for their own.

First, from the New European in February:

The very name “freeport” had just the ring that an ambitious, young, right-of-centre politician could use to launch himself into frontline politics. Along with the smooth exterior and personal wealth to fall back on, Rishi Sunak needed a Big Idea….

So it was that in November 2016 Sunak teamed up with the Centre for Policy Studies to present the Freeports Opportunity paper that would announce him as a serious political thinker. Turning our ports into freeports would “provide an almighty boost to British manufacturing” and “fill the sails of the post-Brexit economy”.

Outside the UK’s own customs borders, even if within the country geographically, freeports would enable goods and commodities to be imported tariff-free and refashioned into products incurring lower tariffs when brought into the main economy or re-exported (so-called “tariff inversion”). …Today, he looked to the United States and its 250 “free trade zones”, citing success stories such as Nissan’s vehicle assembly plant in Tennessee. “By using tariff inversion,” he explained, its output had hit 640,000 vehicles a year.

What Sunak had missed, alas, were trade developments in Europe since ancient Delos that make the US a meaningless comparison. Where tariffs are common on imports into the US, they are minimal in Europe and the UK: non-existent within the customs union and, even outside it, trivial on UK imports from EU countries (first under transition arrangements and then under the UK-EU 2021 trade and cooperation agreement). Rolled-forward and new post-Brexit trade agreements with other countries around the world also keep tariffs to a minimum.

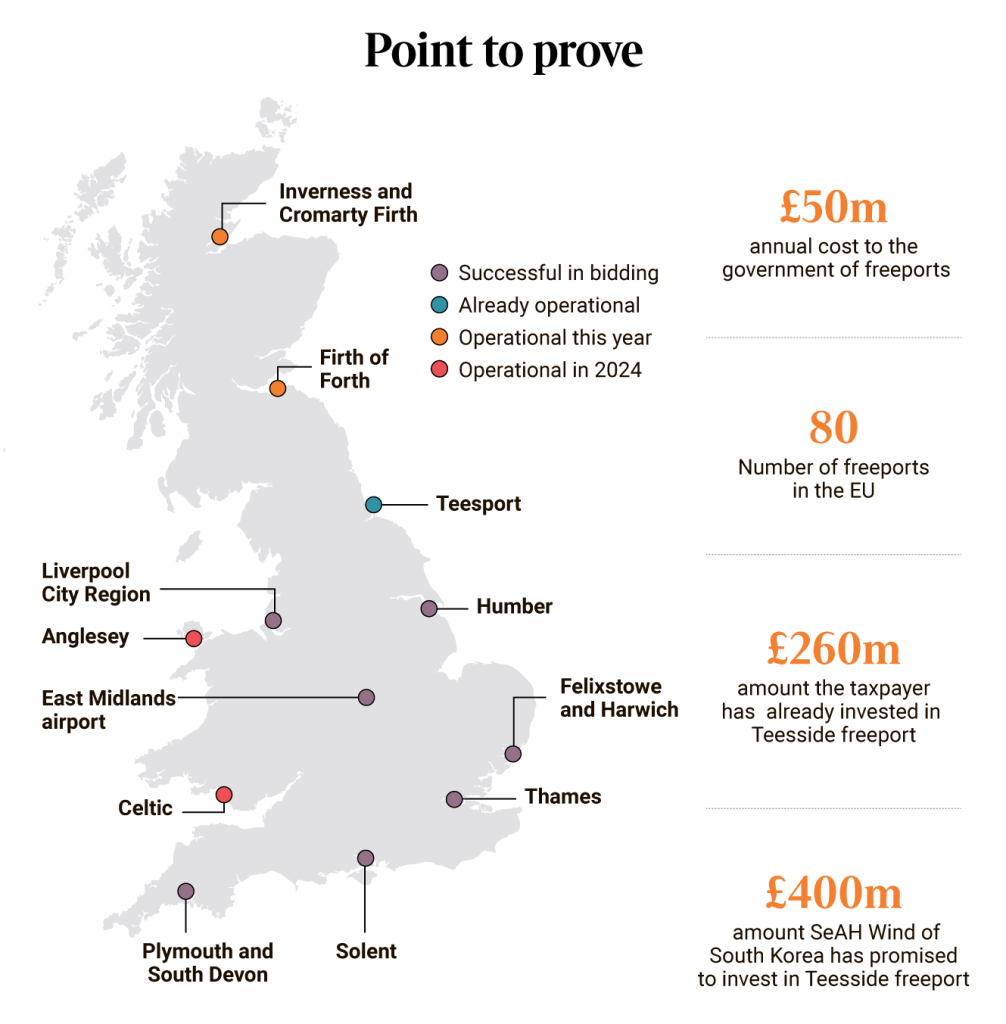

Although his freeport model was thus built on an entirely false premise, Sunak arrived at the Treasury in 2019 determined to push the policy through. By the spring of 2021, the eight English freeports had been named (four more in Scotland and Wales are in the pipeline). Foremost among them was Teesside….Nearly three years on and, with the exception of Teesside, very little has happened at the UK’s freeports. They are struggling even to find ways of spending the £25m “seed funding” handed to them by Whitehall. An ongoing parliamentary inquiry into freeports and investment zones recently heard from Peter Holmes, an academic, that the only business he had been able to identify as benefiting from the freeport advantage of tariff inversion was the dog-food industry….

The freeport game now, insisted Gove, was about investment incentives. The 2021 cohort were given a range of tax and business rates reliefs lasting five years. But even these are economically impotent, since they simply divert investment from one location to another.

The sort of good news is that because UK tariffs are low, the freeport scheme has not gotten all that far. But as the article elaborates, with supporting detail, the response has been to throw more money at investment subsidies. But the big winners so far indeed have been investors….but in property deals in Tessside. So there’s ample motivation to extend what amounts to a vehicle for looting.

And as the headline suggests, there is plenty of cause for concern if enough money is thrown at freeports for them to operate at more than a not-very-consequential level:

At the same time, freeports present serious security risks. Customs and border processes are substantially outsourced to private companies delegated as “responsible authorities”. At Liverpool freeport, for example, the “responsible authority” at one of the two customs sites is a maker of body-building supplements. On Teesside, the authority is a local shipping broker, but physical security at the customs zone perimeter is run by a family firm with a record of tax dodging, employing the owner’s son, who is not long out of jail after an 11-year sentence for serious organised drug crime.

The relative lack of border controls at freeports poses inherent risks – from drug and people smuggling to gun-running, money laundering, wealth concealment and much else. These have long been recognised. The EU clamped down on its version of freeports just before Sunak introduced his, citing a “high incidence of corruption, tax evasion [and] criminal activity”.

Note that the “body building supplements” is not as benign as it might seem. Over the years, body building aids sold openly and later cracked down on in the US include ephedra (a source of ephedrine and pseudoephedrine which can be used to cook meth), thyroid, and gammahydrabuterol, which is now a Schedule 1 drug.1 And that’s before getting to the sale of diverted or potentially adulterated or fake steroids, human growth hormone, and other performance boosters.

The Times was also critical, albeit using measured language. From a late 2023 article:

In March 2021 Rishi Sunak, when he was chancellor, announced eight sites in England that had been successful in bidding for freeport status: East Midlands airport, Felixstowe & Harwich, Humber, Liverpool City Region, Plymouth & South Devon, Solent, Teesside and Thames. The freeports were afforded financial benefits to “stimulate growth”: tax reliefs for businesses; the retention of 100 per cent of business rates by local councils, where typically a percentage would go back to Whitehall; simplified customs arrangements; and no tariffs on goods entering or leaving a freeport customs sites if imported.

Other growth levers at their disposal include arrangements to speed planning permission grants; seed capital amounting to £300 million; and targeted trade and investment support. Each freeport is a maximum of 28 miles in diameter and zones have sites where special customs measures are in place and one to three “tax sites” where the tax and business rates reliefs apply…

Small and medium-sized enterprises (SMEs) are concerned that they miss out on the benefits because they cannot afford to move into the freeport zones and the supply chains are not strong enough to include them…

The government has tried to address such concerns by creating “investment zones”…However, according to a survey from Make UK and Barclays, to be released this year, investment zones have proved just as opaque.

So again, notice more subsidies. The article also discussed whether freeports created jobs as opposed to merely stealing them from other spots.

Back to the Times’ final section:

Tuesday’s hearing ended with quickfire questions: “Are the incentives long-term enough?” “No.”; “Are the incentives big enough?” “No.”; “Is governance too opaque?” “Yes.”; “Will the current policy framework help the government meet its targets for levelling up?” “No.”

With economists unconvinced, the freeport policy has yet to prove itself.

The freeports have gotten back in the news since Sunak has been talking them up in the context of the upcoming Parliamentary elections as an accomplishment of sorts:

The Freeport’s and special economic zones give workers fewer rights, remove environmental controls and give large corporations years of tax exemptions. Billions of our money is being pumped into them.

— Jeremy F (@jeremyf1965) June 23, 2024

Oof! Great question on “how Brexit has denied young people a future”

Sunak says they can just work in the Teeside Freeport. pic.twitter.com/r3GULEBJHf

— Mike Galsworthy (@mikegalsworthy) June 20, 2024

To put this more simply: freeports are an example of the Singapore-on-Thames, or less charitably, buccaneering Britain post-Brexit model. Yet we see how a libertarian schem is serving to suck fund out of official coffers. Funny, that.

Now to Richard Murphy.

By Richard Murphy, part-time Professor of Accounting Practice at Sheffield University Management School, director of the Corporate Accountability Network, member of Finance for the Future LLP, and director of Tax Research LLP. Originally published at Fund the Future.

I have, as usual, published a new video this morning in which I suggest that Rishi Sunak’s very limited legacy will include the creation of freeports. They are, however, deeply dangerous places where the normal rule of law is suspended for the benefit of financial capital, usually at cost to the workers in the places and the communities that host them. As such, they undermine democracy. What could possibly go wrong?

The audio version of this video is here:

The transcript is:

Freeports are dangerous.

That, as an opening claim goes, is a big and bold one, because we have quite a lot of freeports in this country now, but they do nonetheless represent a significant threat to our well-being.

Why is that?

What is the problem with a freeport?

Look, let’s describe what a freeport is.

A freeport is a place where regulation of the normal sort that applies within the country is suspended for the benefit of those who are running businesses in that location. So, almost invariably, therefore, free ports exist to provide benefits to companies, employers, and those who are undertaking trade. And they do so by suspending the normal rules of taxation, and sometimes on other matters, like environmental protections, or employee protections, or whatever else.

Now, why should we have parts of the country where we deliberately suspend normal laws? What is the benefit of that for everybody else?

And why should some people be subject to lower levels of protection during the course of their working life because they work in a freeport compared to what they would have if they worked outside the freeport?

And that’s most especially true when no freeport has an advertised boundary. In fact, finding the border of a freeport is something that is incredibly difficult to do because these are, well, almost imaginary spaces. A few warehouses here, a warehouse or so there, ring-fenced inside a planning zone which is itself loosely described on a map, but which has no obvious border.

These freeports are figments of planner’s imaginations. Planners of all sorts; tax planners, regulatory planners, those who wish to plan to abuse environmental protection, those who most definitely want to abuse the rights of employees. And the danger is that when you create these things, and now most especially, put them under the control of private sector companies who are tasked with administering the reduced regulation in these areas in a way that is, well, to their best interest, not to the best interest of society at large, you end up with something which is particularly pernicious that is ruled by corporations.

Rule by corporations is a form of fascism. That is exactly how Mussolini described it as, in effect.

So let’s be clear. Whilst the free ports we have provide relatively limited exemptions from regulation at present, their very existence is a threat to the democratic control of this country by the government. And for that reason, they’re deeply pernicious and as dangerous as tax havens have ever been to the effective control of democracy over the well-being of most people in this world.

___

1 My endocrinologist said the crackdown on GHB was entirely unwarranted. It produces a higher quality sleep than any Rx drugs, is out of your system in four hours, and can be whipped up in a kitchen. The scare was over the threat it represented to OTC and Rx sleep aids.

Thanks Yves. I am reminded of a posh dinner hosted by my tutor at Cambridge who dished the dirt on the land ownership of certain major East Anglia ports (yeah certain Cambridge colleges are richer than Croesus and there are lots of grounds for questioning their motives when it comes to freeports).

The trouble is that nobody in this election is remotely interested (if not readers of this site!). Unless it is yet another meme-worthy mis-step by Sunak.

Here in the red wall people have totally switched off. Not even the Daily Mail is getting traction. We’re just waiting to see what effect turnout on 4th July has on the Labour vote.

You might be interested to hear what the guys from The Duran have to say about the present political situation in the UK-

https://www.youtube.com/watch?v=TW5_I89HfKU

You know that things are bad when Nigel Farage looks like a good option.

As for these Freeports, you can see that it has scam written all over it. If they were really serious, they would have set up a single one first, perhaps at Teesside. It would be a chance to work out what laws and regulations should be applied, how customs meshes with it and all the other factors at play when setting up one in a British setting. Then, when the model has been worked out and is operating with the inevitable problems worked out, then would come the time to start setting it up elsewhere. Instead, the intent was to spray these things all over the British Islands and as far as I can see, the true purpose of a Freeport is to funnel public money via government subsidies into private corporations with little accountability. They may as well send that money to the Ukraine.

Had something similar proposed in Oz with magical thinking the past few days with the conservative opposition saying that they should build nuclear reactors all across Australia. But when asked for details, no idea how many tens (hundreds?) of billions it will cost, how much electricity it will actually generate, how many decades it will take to build them, what to do with the nuclear wastes or anything else except let’s build nuclear power plants all across Oz.

Thanks Rev Kev. Interesting video but I am reminding myself of what I got right and wrong regarding the 2017 election. Purely by chance, I had run a political national survey just before Theresa May called the surprise election. I used my data and beat the bookies and psephologists (leaving aside the “alternative” model YouGov also got right) to make money on the result. Unfortunately I made a side bet based on what I wanted….which lost me the money I made on the data-based bet. Lesson learnt.

My central point is that there is HUGE uncertainty here due to Farage. MSM are making bold claims. Some of them will call it right. But almost certainly for the wrong reasons. Things on the ground are very very weird. PS I understand the Aus nuclear power issue…..they need to build the plants high up with lots of water…..which is pretty much 0% of accessible Australian territory.

I concur with Murphy: neoliberalism is kind of fascism.

Agreed. Though the Emperor’s New Clothes has been in operation here in UK ever since circa 1990.

On 4th July if I’m in a good mood I’ll vote Green, if in a bad mood I’ll spoil my ballot (as I’ve done before) writing something across my ballot like “you’re all idiots”. UK should follow Australia and have compulsory voting so we know WHY the non-voters never showed up.

(I have dual UK/Aussie citizenship).

Yes, agreed, Ignacio. Plus the tory Party is in essence a scam scheme for looting the wealth of the country and moving it to tax havens. Luckily for us and unfortunately for the US, Rishi has already enrolled his children into school in California. But the damage is done – we will have to wait and see if Starmer has the will to close these piracy nodes down – I’m not optimistic, as the ‘Labour’ Party is in full ‘replacement capitalist party’ mode.

I have experience with Free Ports, or Zones in the Panama Canal Area. This works well for Panama and is a source of income and jobs (world’s 2nd largest after Hong Kong). My involvement was professional in building a new port on Colon, or Caribbean, side on land owned by a pal. My expertise being tangential to building the breakwater, yet nevertheless sought because I was trusted (cannot overestimate the value of knowing people, and being known).

Anyway, many, many, many jobs are happening within the free side as industry is developed and businesses make money (and yes, this is the very point). For Panama, the growth of good paying jobs has been of inestimable value and is considered *the* major benefit.

How will this play out in the UK? Cannot say, and I certainly won’t argue with those who say it will play out badly, but at the same time, I hate seeing the whole concept being thrown under the bus without a countervailing view.

Me? I’m thinking perhaps the English can add a certain flavor, or English-characteristic that will make the return as beneficial as proponents hope. After all, the English know a thing or two about making money (and I doubt any of it has been forgotten). Worse that happens? The projects fail. Won’t be the first or last time. But if they work out, then good jobs will follow. And this alone makes it worth the risk in my opinion.

So as someone with an entrepreneur mindset (nothing ventured, nothing gained), it seems reasonable to give it a try. Especially as my experience in starting businesses is 100% of the time there were good arguments for why I shouldn’t, yet 100% of the time I’ve made very good money and created very good jobs.

You do know Panama is a money laundering center? Particularly for the Colombian drug cartels? So yes, I am sure being a banker and transit hub for drug-runners is a great business.

https://www.citizen.org/wp-content/uploads/fact-sheet-panama-major-center-money-laundering.pdf

good for you Yves!

Please explain why ‘rules for thee, but not for me’ is in any way ever OK.

You can’t run an equitable society when the rich don’t have to follow the same rules everyone else does.

And I do wish entrepreneurs would stop patting themselves on the back for ‘creating jobs’. Having some guy rake in profits off the back of others’ labor really isn’t the only way to run a society and keep people productively occupied. It’s just the best way for the few people who want to get rich at others’ expense.

Quinn Slobodian’s Crack-Up Capitalism is a good analysis of this, too. His subtitle says it all: Market Radicals and the Dream of a World Without Democracy. Not that functional democracy is really a thing in most “democracies.”

Methinks we’ll be lucky if this is nothing more than a looting scheme. We’ll lose a couple of (tens of) billions before government loses interest as everyone and their buddies have cashed out.

What I’m more worried about is this scheme as a model for privatised governance, outside the reach of bureaucracy (labour and environmental laws) or judicial review even. A sort of Halliburton / Coalition Provisional Authority for the homeland. Next time they won’t bother passing mote anti union or anti protest laws, they’ll just declare more and more parts of the country as part of a freeport. A bit like how many “public spaces” in London are mostly private land where homeless people and protesters can easily be excluded.

I can never heard the word “freeport” without immediately thinking of the nexus between piracy, capitalism, globalization and tax havens …

The Pirate Organization: Lessons from the Fringes of Capitalism by Durand and Vergne

Pirate Nests and the Rise of the British Empire, 1570-1740 by Hanna

Treasure Islands: Uncovering the Damage of Offshore Banking and Tax Havens by Shaxson

“…deeply dangerous places where the normal rule of law is suspended for the benefit of financial capital, usually at cost to the workers in the places and the communities that host them…”

“Freeports”

Slavers always talking about their “freedoms.”

Here in jockistan, the wee free element of the post salmond husk of the SNP decided these are wonderful and proclaimed them to be ‘green freeports’.

To my mind they look like seasteading on dry land

We did have this policy at the end the last century, and it was a disaster.

Energetic new thinking tends to disdain hard learned lessons from recent history

Professor Baird puts the situation clearer than I could:

They are not ports and will never be green

From the above link:

The east india company was run along these lines.

The free port’s “free” is equal to the Congo Free State’s “free”.

the maniacs came to power in 1993.

Sunak is just a creature that was unleashed on us by the likes of bill clinton, tony blair, and other assorted corporatists.

in reality, the 2008 real estate bubble pop was just the inevitable results of clintons gutting of the new deal and Gatt(smoot-hawley), proving his free trade policies were a complete bust and unsustainable.

the economy has still not recovered, it can’t, as long as we free trade, and are unwilling to take the bull by the horns, and reverse the eight year reign of terror, called the clinton administration.

https://www.dissentmagazine.org/article/the-legacy-of-the-clinton-bubble/

Dissent

The Legacy of the Clinton Bubble

Timothy A. Canova ▪ Summer 2008

“the nation’s fiscal policy was constrained, public investment declined, critical infrastructure needs were ignored. Moreover, the Fed’s stop-and-go interest-rate policy encouraged the growth of a bubble economy in housing, credit, and currency markets.

Perhaps the biggest of these bubbles was the inflated U.S. dollar, one of several troubling consequences of the Clinton administration’s free-trade policies. Although Clinton spoke from the left on trade issues, he governed from the right and ignored the need for any minimum floor on labor, human rights, or environmental standards in trade agreements. After pushing the North American Free Trade Agreement (NAFTA) through Congress on the strength of Republican votes, Clinton paved the way for China’s entry into the World Trade Organization (WTO) only a few years after China’s bloody crackdown on pro-democracy demonstrators at Tiananmen Square in Beijing.

During Clinton’s eight years in office, the U.S. current account deficit, the broadest measure of trade competitiveness, increased fivefold, from $84 billion to $415 billion. The trade deficit increased most dramatically at the end of the Clinton years. In 1999, the U.S. merchandise trade deficit surpassed $338 billion, a 53 percent increase from $220 billion in 1998.

In early March 2000, Greenspan warned that the current account deficit could only be financed by “ever-larger portfolio and direct foreign investments in the United States, an outcome that cannot continue without limit.” The needed capital inflows did continue for nearly eight Bush years. But it was inevitable that the inflows would not be sustained and the dollar would drop. Perhaps the singular success of Bill Clinton was to hand the hot potato to another president before the asset price bubble went bust.

Financial Deregulation under Clinton

Risk-Based Deregulation

The Mother of All Deregulation

Chickens Come Home to Roost

History should deal harshly with Bill Clinton. Throughout his terms, real wages stagnated, manufacturing and service jobs moved overseas in large numbers, and the middle class was squeezed. With the federal government asleep at the wheel, there was a significant rise in predatory lending practices by banks and mortgage companies. By Clinton’s final years in office, all of these trends had contributed to an ominous rise in delinquencies and foreclosures on subprime mortgage loans. This was particularly pronounced in urban America. In Chicago, for instance, foreclosures on subprime mortgages rose from 131 in 1993 to more than 5,000 in 1999.

“Unfortunately, the myth of the Clinton economy has too often served to limit discussion about the political forces behind the present crisis in the Washington Consensus. For instance, Hillary Clinton, in promising a high-level emergency panel to recommend ways to overhaul at-risk mortgages, proposed in March that such a council of wise men should include two of the people most responsible for undermining the integrity of financial markets, former treasury secretary Robert Rubin and former Federal Reserve chair Alan Greenspan.”