Lambert here: Say it’s not so!

By Harald Hau, Senior Chair at Swiss Finance Institute, Professor of Economics and Finance at University Of Geneva, Tim-Ole Radach, Student at TU Dresden, and Marcel Thum, Director at IFO Dresden, Professor of Economics at TU Dresden. Originally published at VoxEU.

The Credit Suisse crisis illustrates how poor governance can lead a large bank into a crisis despite compliance with capital requirements. Recent research on supervisory board competence in banks has provided interesting new insights. This column updates an index of supervisory board competence for a sample of German banks and compares their performance in 2023 versus 2008. Although competence measures have improved for most banks, large gaps remain across banks and also between public-sector and private-sector banks. Bank supervisors should systematically measure, track, and report bank board competence and its alignment with a bank’s business.

The global banking market is once again experiencing turbulent times. Following two bank failures in the US, Credit Suisse, one of the major European banks, suffered a liquidity crisis in March 2023 after a decade of both poor governance and disappointing performance. In his book on the failure of Credit Suisse, Swiss financial journalist Dirk Schuetz (2023, p. 57) makes the following assessment of the appointments to the Board of Directors in 2015: “Roche boss Severin Schwan was appointed as the new Vice Chairman [of Credit Suisse], a proven pharmaceutical expert without in-depth financial knowledge. Or Silicon Valley entrepreneur Sebastian Thrun: a luminary for self-driving cars but hardly for ailing balance sheets. […] For the first time in history, probably the wildest of all major global banks was led by two non-bankers – and the banking expertise on the Board of Directors was meagre. And the supervisors from FINMA nodded off all personnel decisions.”

Is the lack of financial expertise on the board of Credit Suisse and its ultimate failure a pure coincidence? Or is supervisory board competence an important factor in determining long-term bank risk?

Study Results on the 2007/08 Banking Crisis

From a legal perspective, a competent supervisory board is responsible for ensuring that competent managers on the management board have the day-to-day business under control, that the right incentives are in place at the bank level, and that a business model is pursued with a sustainable balance between profitability and risk. To fulfil these tasks, however, the members of the supervisory board must also understand the banking business, and particularly the complex products and risks in the global financial markets.

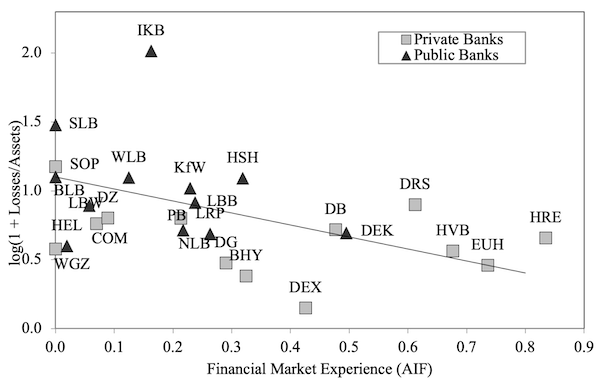

However, banking and financial market expertise is by no means a given. During the financial crisis of 2007/08, we were able to show in a much-cited study that the competencies of the supervisory boards of German banks differed greatly (Hau and Thum 2008, 2009). The more competent the supervisory and administrative boards were, the lower the average losses suffered by a bank during the financial crisis (Figure 1). The differences between private and public-sector banks were striking. The boards of directors of many public-sector banks lacked a deeper understanding of complex financial products, which also explains the disastrous performance of Sachsen LB, Bayern LB, and HSH Nordbank.

Figure 1 Correlation between financial market experience and losses during the 2007/8 financial crisis

Notes: DB = Deutsche Bank, COM = Commerzbank, DRS = Dresdner Bank, DZ = DZ Bank, HVB = HVB Group, HRE = Hypo Real Estate, EUH = Eurohypo, PB = Postbank, DG = Deutsche Genossenschafts-Hypothekenbank, WGZ = WGZ Bank AG Westdeutsche Genossenschafts-Zentralbank, SOP = Sal. Oppenheim jr. & Cie. KGaA, DEX = Dexia Kommunalbank Deutschland AG, BHY = Berlin-Hannoversche Hypothekenbank AG, LBW = LBBW, BLB = Bayern LB, KfW = KfW Bankengruppe, WLB = WestLB, HSH = HSH Nordbank, NLB = Nord LB, HEL = Helaba, LBB = Landesbank Berlin, DEK = Dekabank, LRP = LRP Landesbank Rheinland-Pfalz, SLB = Sachsen LB, IKB = IKB Deutsche Industriebank AG.

Source: Hau and Thum (2009)

This relationship between competent board supervision and bank performance has been examined in several studies in recent years (e.g. Cuñat and Garicano 2010, Pereira and Filipe 2015, Fernandes et al. 2016a, b, Locatelli et al. 2018, Mizan 2018, Pereira and Filipe 2018, Mavrakana and Psillaki 2019, Ayadi et al. 2019, de Andres et al. 2020, Ellul and Yerramilli 2013, Fernandes and Fich 2023, Kanojia and Priya 2016, Jin and Mamatzakis 2018, Boadi and Osarfo 2019, Al-Matari et al. 2022, Magnis et al. 2023). In summary, the studies across countries and different time periods show that competence on the supervisory board is associated with better bank performance. In view of the complexity of modern banks and financial markets, competent supervision can no longer be carried out comprehensively by individual persons. Supervisory boards must, therefore, have a broad range of expertise and should cover all relevant areas of the banking business (Fernandes et al. 2016a).

Can Board Competence Be Increased through Regulation?

Following the financial crisis in 2007/8, Germany adopted a new legal basis for the appointment of supervisory board members. Since 2009, Section 25d (2) of the German Banking Act requires that the members of the administrative or supervisory board “as a whole must have the knowledge, skills and experience necessary to perform the supervisory function and to assess and monitor the management of the institution or group of institutions or financial holding group, financial holding company or mixed financial holding company.” The Federal Financial Supervisory Authority (BaFin) can check the qualifications and independence of the members of banking supervisory boards, monitor the composition of the supervisory boards and demand transparent reporting from the banking supervisory boards on their activities (risk assessment, compliance, and corporate governance). BaFin also has the power to impose sanctions on bank supervisory boards following the amendment to the German Banking Act.

Was this legislative initiative successful? Or was this reaction to the previous financial crisis merely a political lightning rod that, due to a lack of regulatory implementation (by BaFin), has remained without any real consequences for the actual professional competence of German bank supervisory boards? These questions have prompted us to update the original competence survey from 2009 to 2023. Has there been an improvement – not least thanks to legislation?

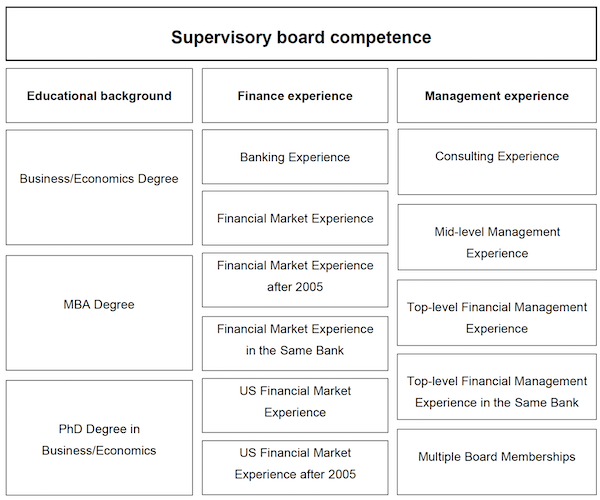

As the quality of corporate control by supervisory and administrative boards cannot be observed directly, we use the same indirect measures as for 2008 to examine whether the supervisory boards at least have the necessary skills to monitor managers and update these board competence measures for 2023. We use 14 different biographical criteria for the monitoring potential in the supervisory boards of banks. The variables capture the educational background (three indicator variables), financial experience (six indicator variables), and management experience (five indicator variables) of a supervisory board member; see Figure 2. Financial experience includes, for example, whether a member has banking experience, whether the member has financial market experience, and whether this experience was acquired recently. For each affirmative answer, we assign one point and sum these to a total value for each board member. The overall competence of the supervisory board is calculated by averaging across all supervisory board members. For each bank, we then create both an overall index and sub-indices for each of the three groups of variables (education, financial market, management).

Figure 2 Indicator variables of supervisory board competence

Source: own calculations.

Not all of the banks examined in Hau and Thum (2009) are still active or operate in the same form. The original sample consisted of 29 German banks with total assets of more than €40 billion in 2007. Five banks have since ceased operations (Hypo Real Estate, WestLB, Sachsen LB, Dexia, Sal. Oppenheim), and seven others have merged with banks already included in the sample. Two banks have changed their name and legal status: HSH Nordbank was privatised as Hamburg Commercial Bank and Berlin-Hannoversche Hypothekenbank AG now trades as Berlin Hyp AG. The current sample thus comprises 17 banks, of which nine are private, and eight are organised under public law. Despite these changes in the last 15 years, the updated sample for 2023 still covers eight of the ten largest banks in Germany in terms of total assets.

Development of Supervisory Board Skills in German Banks

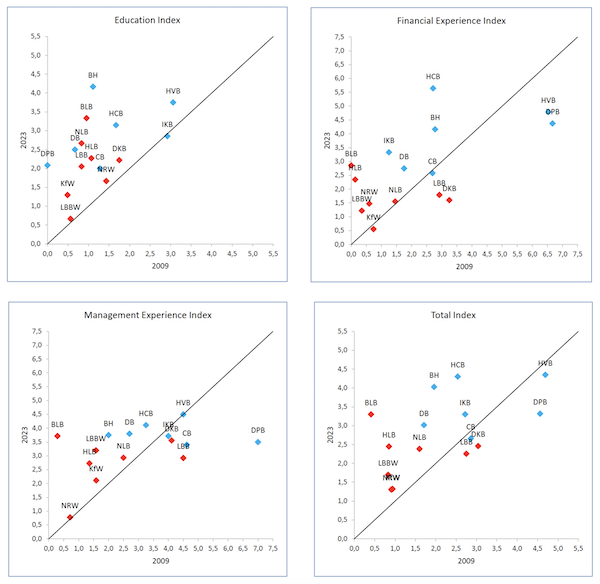

Figures 3, Panels A-D show the supervisory board competencies for each of the banks available in the dataset in the years 2008 and 2023. The first three figures show the sub-indices for education, financial market experience and management competence separately. The fourth figure provides the aggregated overall board competence. The board competence measures for 2008 and 2023 are shown on the horizontal and vertical axes, respectively.

Figure 3 Supervisory board competence, 2008 vs. 2023

Notes: BLB = BayernLB, BH = Berlin Hyp, CB = Commerzbank, DKB = DekaBank, DB = Deutsche Bank, DPB = Deutsche Pfandbriefbank, HCB = Hamburg Commercial Bank, HLB = Helaba, HVB = HypoVereinsbank, IKB = IKB Deutsche Industriebank, KfW = KfW, LBB = Landesbank Berlin, LBBW = LBBW, NLB = NORD/LB, NRW = NRW.BANK, ♢ = public-sector bank, ♢ = private bank.

Source: own calculations

We highlight the following insights: First, the competence measures have increased slightly for most banks. If board competencies were unchanged, the points would lie on the 45-degree line. As most of the points are above the 45-degree line, the competence measures in all three sub-categories are slightly higher today than in 2008. Overall, however, the gap between the qualified and less qualified supervisory boards remains enormous. Secondly, the ranking of banks is highly persistent over the 15-year period. A rank correlation test rejects the (null) hypothesis that the 2008 and 2023 ranks of banks in terms of overall board competence are independent (with a p-value of 0.07). Higher persistence is particularly noticeable in the case of financial market experience: banks with a relatively high level of financial market experience in 2023 (compared to other banks) were generally also doing well in this indicator in 2008. Thirdly, the boards of directors of public-sector banks lag the supervisory boards of private banks in terms of financial market expertise and management expertise. Although the public-sector banks have slightly improved (as seen by a point just above the 45-degree line), the scores for the public-sector banks in 2023 are still much lower than they were already in 2008. Improvements in board quality for public sector banks have thus been disappointing and suggest that the lessons from 2007/8 have not been learned when it comes to board composition.

Conclusions

The financial crisis of 2007/8, with its high losses by German public banks, motivated our original study on the nexus between bank board competence and financial performance. In the following 15 years, this research question was taken up by numerous other academic studies and replicated for various countries with modifications. The vast majority of the studies examined here found a statistically significant correlation.

In Germany, the idea that board competence matters has also been enshrined in law: Since 2009, supervisory board appointments have had to be approved by BaFin, with candidates required to have the “knowledge, skills and experience” to perform their supervisory function. However, this legal requirement has had little impact in practice. Fifteen years after the major financial crisis of 2007/8, the average quality of supervisory boards has improved only slightly. The quality of public banks, in particular, remains below average and woefully low. What we see is that bank supervisors (like BAFIN) are often reluctant to fulfill a legislative mandate and opportunistically opt for a lax implementation.

What are the policy implications of these empirical findings? There is a strong public interest in more competent supervisory boards, particularly in banks in which the state is the main owner, as the taxpayer is liable here. However, even in the case of large private banks, a lack of supervisory or administrative board competence often poses a systemic risk to the entire banking system, as the Credit Suisse case impressively demonstrates. We recommend that bank supervisors systematically measure, track, and report bank board competence and its alignment with a bank’s business. Moreover, more supervisory accountability is required if existing regulation on board qualifications is to be implemented with the rigor it deserves.

Thank you, Lambert.

What a surprise.

Failed British bank Northern Rock, or Wreck as I call it, was based in Newcastle upon Tyne and found it difficult to get not just good quality board members, but senior officials able to challenge the board, provide skepticism etc. up there.

It’s not just banks and at board level. The likes of Equitable Life, based in Buckinghamshire, and Woodford Patient Capital, based in Oxford, struggled to get staff of sufficient quality and able to call out senior management in the provinces.

Exposure to, and involvement in, US financial institution M&A would show echoes of those problems. One popular issue that I saw was some dominant executive cowing the senior management into blindly supporting programs instead of encouraging more open assessment and discussion of risks and rewards. That latter reward aspect translated too frequently into stock options, or even just staying employed, without sufficient consideration of staff, communities, long term viability or similar plausible issues.

Competence is not the primary problem for both boards and management; it is the agency problem. Boards members and managers who run banks into the ground through excessive risk taking are never forced to disgorge the extra profits and bonuses accrued from profit measurements that fail to incorporate the present value of risks.

I would note that we already know how to make boards, and for that matter senior executives more diligent and competent, and the lessons are over 150 years old.

Specifically, the gradual changes in marriage laws in the USA in the 1800s created a real world experiment in the effect of personal risk on behavior of bankers. (I blogged about this in 2018. Why does NC not post Blogspot links anyway?)

Short version: Before about 1800, the wife had no assets, they all belonged to the the husband, so, for example, the family jewels, and the house given by her father when she got married belonged to the husband.

Over the next 50 or so years, this changed.

If corporate boards of directors and senior managers were more likely to be held personally liable for the failures of their companies, and if this risk allowed for a significant reach back in time, then they will be less likely to behave recklessly.

Currently, board of directors seats are comfortable sinecures with good pay for very little work.

If one adds personal jeopardy, we will stop seeing things like Elon Musk’s pet BoD at Tesla, because it will be their tuchas on the line.

Another tack may be for tax structure to reward partnerships in financial institutions, and discourage incorporation. You may recall how, in the 60s and 70s, the bond dealers one by one converted from partnership to corporation. An enormous increase in leverage followed.

I’d just change the corporate bankruptcy code.

An additional benefit would be that officers at companies who declare bankruptcy to break labor contracts (GM and the airlines) would find their bonuses and extreme compensation clawed back.