By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

Long, slow erosion of the US dollar’s dominance. China’s renminbi keeps losing ground, many other currencies gain, as does gold.

The US dollar is still by far the most dominant global reserve currency, among many reserve currencies held by central banks, but its share has been eroding for years, as central banks have been diversifying to other reserve currencies, and also to gold. But the process is slow and uneven.

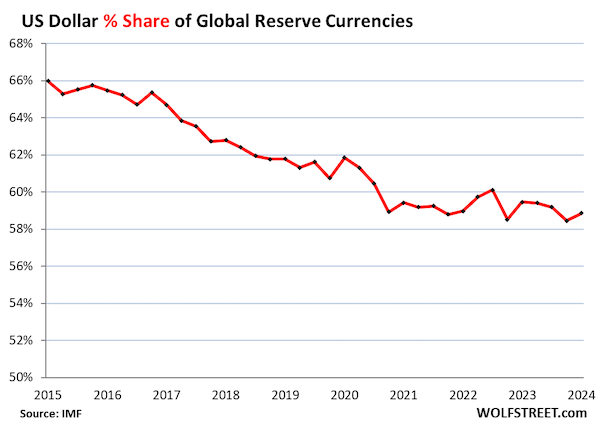

The share of USD-denominated foreign exchange reserves ticked up to 58.9% of total exchange reserves in Q1, from 58.4% in Q4, which had been the lowest share since 1994, according to the IMF’s COFER data released on Friday for Q1 2023.

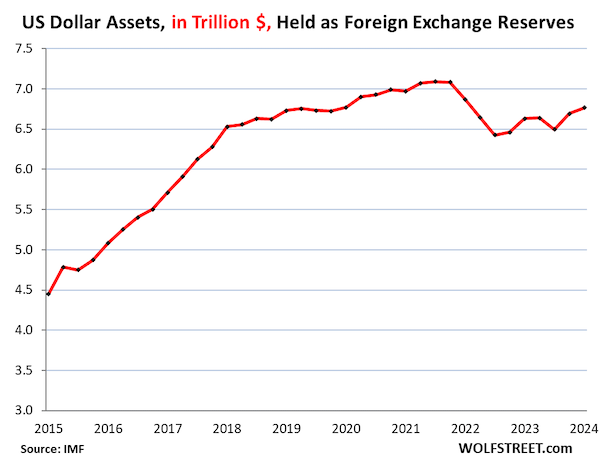

Central banks held total foreign exchange reserves in all currencies of $12.3 trillion in Q1. This included $6.77 trillion in US-dollar denominated assets, such as US Treasury securities, US agency securities, US government-backed MBS, US corporate bonds, even US stocks.

Excluded are any central bank’s holdings of assets denominated in its own currency, such as the Fed’s holdings of Treasury securities and MBS, and the ECB’s holdings of euro-denominated assets.

In dollar terms, holdings of USD-denominated assets at foreign central banks rose to $6.77 trillion in Q1.

It’s not that central banks are “dumping” their dollar-assets – in dollar amounts, their dollar-holdings haven’t changed all that much. It’s that they take on assets denominated in many alternative currencies, and as overall foreign exchange reserves grow, the dollar’s share of the total shrinks.

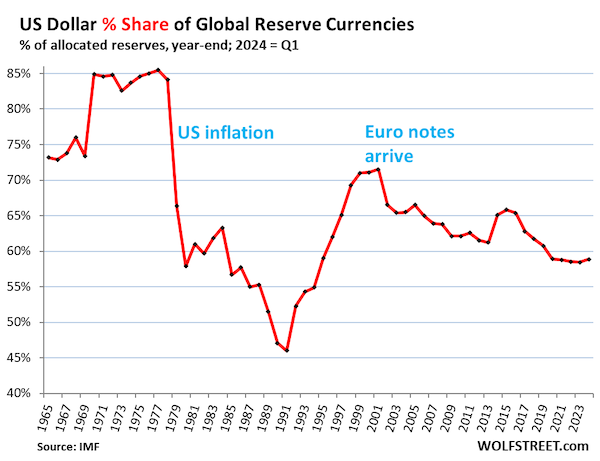

The USD’s share of global reserve currencies has seen a lot of turmoil between 1978 through 1991, when the share collapsed from 85% to 46%, after inflation exploded in the US in the late 1970s, and the world lost confidence in the Fed’s ability or willingness to get this inflation under control.

By the 1990s, confidence returned, and central banks loaded up on dollar-assets again, until the euro came along (share at the end of the year, except 2024 = Q1)

The Other Major Reserve Currencies.

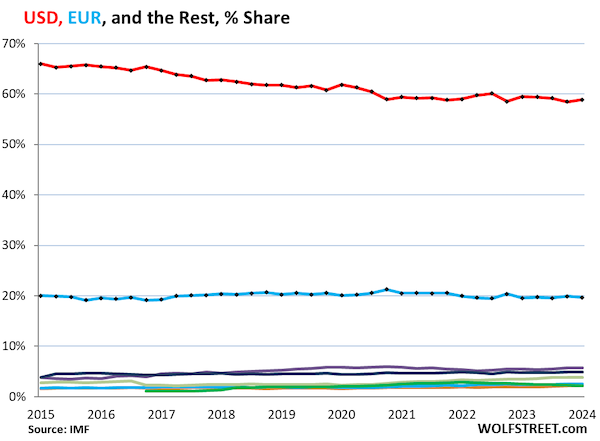

The euro is #2, with a share of 19.7% in Q1. The share has been around 20% for years (blue line in the chart below). The other currencies are the colorful tangle at the bottom of the chart.

What’s hard to see in this chart, but easy to see in the next chart, which holds a magnifying glass over the colorful tangle at the bottom, is that these other currencies, except for the Chinese RMB, have been gaining share, while the dollar has been losing share, and the euro’s share has remained stable. It’s not one currency that’s gaining against the dollar; it’s that a lot of “nontraditional reserve currencies,” as the IMF calls them, are gaining share.

The Rise of the “Nontraditional Reserve Currencies.”

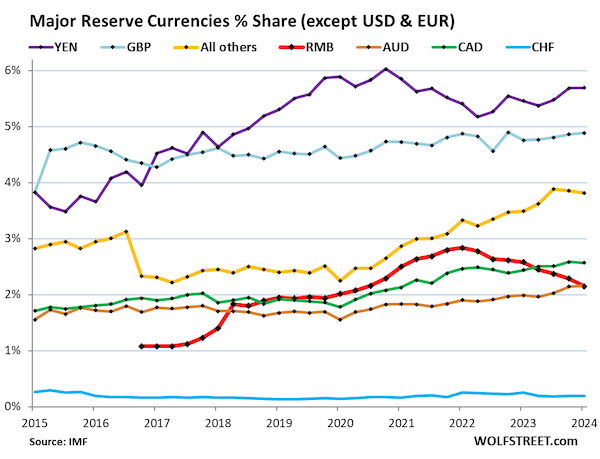

The chart below shows the other currencies magnified. And their shares of the total have been rising over the years.

The exception is the Chinese RMB. China is the second largest economy in the world, yet its currency plays only a small and declining role as a reserve currency. When the IMF, in 2016, added the RMB to its basket of currencies backing the Special Drawing Rights (SDR), many had thought that the RMB would quickly become a threat to the dominance of the USD as global reserve currency. But that has turned out to be not the case.

Depicted in the chart below, by their % share of total foreign exchange reserves in Q1 2024:

- Japanese yen, 5.7%, third largest reserve currency behind USD and EUR (purple).

- British pound, 4.9%, fourth largest reserve currency (blue).

- “All other currencies” combined, 3.8% (yellow). The RMB used to be part of this group. But in 2016, when the RMB joined the SDR basket, the IMF began showing it separately, and as a result of the separation, the share of “other currencies” dropped by the RMB’s share. After that separation, “all other currencies” without the RMB had a share of 2%. This has grown to 3.8% by Q1.

- Canadian dollar, 2.6% (green).

- Chinese renminbi, 2.1%, lowest since Q2 2020, 8th quarter in a row of declines (red), amid capital controls, convertibility issues, and other issues. Central banks appear to be leery of holding RMB-denominated assets.

- Australian dollar, 2.2% (brown).

- Swiss franc, 0.2% (blue).

The IMF found in a 2022 paper that there were 46 “active diversifiers” – countries that have at least 5% of their foreign exchange reserves in “nontraditional reserve currencies.” The list includes major advanced economies and emerging markets, including most of the G20 economies.

The IMF thought that two major factors contributed to the rise of the “nontraditional reserve currencies”:

- The growing liquidity of markets in those currencies, which makes it easier to trade those assets.

- Chasing higher yielding assets elsewhere during the 0%-era in the US and Europe.

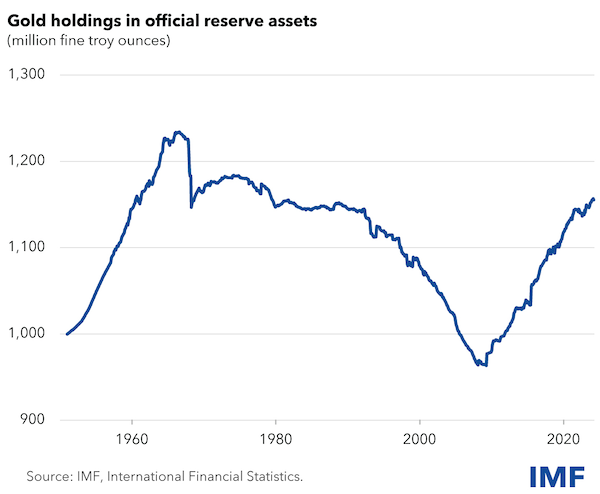

The Rise of Gold as Central Bank Reserve Asset.

Gold bullion is not included in “foreign exchange reserves” of central banks – the data above.

But bullion holdings are in the overall “reserve assets” of central banks. And central banks, after spending decades shedding their holdings, have been rebuilding them for the past decade. According to the IMF, they’re currently at 1.16 billion troy ounces – roughly $2.7 trillion, compared to $12.3 trillion in foreign exchange reserves (chart via the IMF):

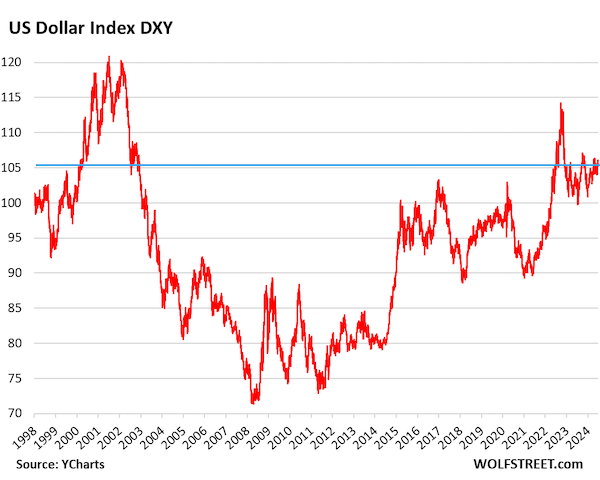

USD-Exchange Rates and Foreign Exchange Reserves.

Foreign exchange reserves are reported in USD. USD holdings are obviously reported in USD, and the holdings in EUR, YEN, GBP, CAD, RMB, etc. are translated into USD at the exchange rate at the time. So the exchange rates between the USD and other reserve currencies change the magnitude of the non-USD assets – but not of the USD-assets.

For example, Japan’s holdings of USD-denominated assets are expressed in USD, and they don’t change with the YEN-USD exchange rate. But its holdings of EUR-denominated assets are translated into USD at the EUR-USD exchange rate at the time. So the magnitude of Japan’s holdings of EUR-assets, expressed in USD, fluctuates with the EUR-USD exchange rate, even if Japan’s holdings don’t change.

Exchange rates fluctuate wildly. But over the long run, the Dollar Index [DXY], which is dominated by the euro and yen, is back at 101, where it had been in 1999 (data via YCharts):

I have heard Dr. Hudson refer to the euro as a satellite currency of the USD. It would be interesting to see a chart that tracks a currency’s importance in world trade and that currency’s independence from the USD to get a better picture of how much influence the USD really has.

As a follow up corollary, how about the Canadian dollar, and Mexico’s Peso, and the “NAFTA” trade block? Seems like that may be all we have, if we believe ‘we’ have any such entitlements at all.

The US is wearing out a lot of hearts and minds.

Seems we need kegs of Kool Aid to float the dollar supremacy.

Is the Euro pegged to the Dollar?

To me, this chart doesn’t show serious movement out of the dollar. The reason is that no real alternative except gold has been developed. But that’s precisely what the BRICS+ countries are working on now. So far, they’re trying to reinvent the wheel, with a lot of nutty proposals getting serious attention.

The dollar will remain strong, given the euro’s problems. The only thing that could threaten it would be a real civilizational break by the Global Majority. That will take a while.

If Hansen is even slightly correct, Mother Nature will help with that correction faster than anticipated.

https://grist.org/science/climate-models-puzzle-antarctica-tipping-point/?utm_source=pocket-newtab-en-us

As David Graeber once said, Japan is a colony of the USA. Europe is effectively the same.

Wolf is overplaying slight wobbles in the charts.

Forgive me for pointing out BOJ incompetence, it could blow out USD bond market due to the reverse of the carry trade. Apparently 20 Trillions of USD assets could be liquidated and this capital repatriated back to Japan. Right now every known vulture fund is shorting Yen on steroids. This so called “colony of the USA” could trigger a credit event. The BOJ is under the stress and cornered, something will break down in capital markets.

Japan is not a colony, it’s a vassal state of the US. Just like Australia, NZ, Taiwan, all the EU countries (plus Norway); and Canada. In many ways, the UK as a Jr. Partner rather than a vassal

Yes I think Kyle Bass called Japan a bug in search of a windshield.

The BoJ can’t hike rates because they’re offsides with all the other central banks who are now talking about cuts. They’ve cornered themselves.

What would be th righr timeframe to understand this currency reserve topic properly? Looking at it from 1965 – 2023 it looks like there is no real stable level but vary wildly. Given that the share of dollars have fluctuated between 45% and 85% and the US has dominated the world under all these levels, I ask myself if it matters at all.

I would be grateful for education in this matter.

To me, what Wolf misses is the structural underlayment of USD reserve status – the US is the world’s largest importer – and floods the world with USD which has to go somewhere. Perhaps de globalization will reduce surplus USD, but I won’t live to see it…..

To focus on the USD, rather than US Treasuries, is arguably a mistake.

I’m inclined to side with Luke Gromen’s perspective (shared in large part by Zoltan Poszar), which is essentially that the post-1971 structure of the USD must be changed back to something closer to the pre-1971 structure, meaning that gold will again become the world’s primary “neutral reserve asset”, replacing US Treasuries, with gold floating in all FX.

For that to happen, gold values would have to be much higher, probably $10-20k/oz

But when one looks at a chart of the world’s central banks accumulation of gold, and disgorging of USTs over recent years, it appears to support the thesis.

The article talks about all USD-denominated assets:

“…Central banks held total foreign exchange reserves in all currencies of $12.3 trillion in Q1. This included $6.77 trillion in US-dollar denominated assets, such as US Treasury securities, US agency securities, US government-backed MBS, US corporate bonds, even US stocks…”

Take a look at this chart of Foreign CB (official) purchases of gold vs US Treasuries over the past ~10 years:

https://twitter.com/LukeGromen/status/1796276901540954572/photo/1

There is a chart in the article above as well. This is also interesting

https://www.cfr.org/blog/chinas-rising-holdings-us-agency-bonds

Many want to see an alternative to USD, but there is a heavy “path dependency” on the current institutional framework that has been in place more or less for almost 80 years; as well as the fact that the US (for the moment) maintains the largest military (threat) in the world. Yves, prof. Hudson and others have talked/written about the huge obstacles and difficulties of building new international financial systems and institutions.

It looks like the “confidence” in the US gov. and USD will have to erode much further in order to force the rest of the word to make a big break with the past. Also, as the ability of the US to project power abroad declines, the fear of retribution will eventually decline, and other countries will be freer to pursue their own interests. If I had to make a prediction: the global majority will be forced to come up with an alternative as the US continues to decline and decay. When will that happen? Who knows? Unforeseen events and all that…

An alternative system will also take a lot of mutual trust among the major international players, and that seems to be a big factor

“It looks like the “confidence” in the US gov. and USD will have to erode much further in order to force the rest of the word to make a big break with the past.”

You mean like the US losing (in a big and visible way, like 4 aircraft carriers on the floor of the S China sea) a war with China? What might China’s demands for peace be? the end of all US tariffs and restraints on Chinese purchase of US farmland? the removal of all those bases? Basically the conversion of the US into a resource colony for China?

That sort of thing?

Is that what your crystal ball says? If that happens, we will not likely be here to write about it, unless you have a very high immunity to radiation.

Nah, sinking the ACs won’t require any nukes. That part should be pretty safe (except for the USN…)

Richard A, Werner has recently raised a fascinating issue and question concerning a BRICS alternative currency and the U.S. dollar.

“Could it be that the much hailed alternative to the U.S. system of hegemony of BRICS countries and a BRICS currency is just another Hegelian dialectic opposite, possibly seen as necessary on the road to a one-world government? For a one world currency to be realistic as proposed for instance by Mark Carney in 2019 at Jackson Hole, the U.S. dollar has to be dethroned. The decision makers behind this are influential enough to make America take those policies that would dethrone the dollar. The chosen tool are central bank digital currencies favored also by Russia and China, not just the Western central planners.” (See his recently published article “The End of the Petrodollar–The True Story,” on his recently created substack).

My head is spinning after reading his article!

The problem with this kind of thinking and conspiratorial articles is that they misunderstand CBDCs as “new currencies” that challenge or might replace the national currencies we have. However, when central banks around the world launch CBDCs, they are not creating a new currency, much less new currencies that could somehow be combined into a single international currency. (We already have the IMF issuing “special drawing rights”, and even the IMF itself admits that they have absolutely no real-world significance whatsoever.)

No one considers US dollars held in banknotes (physical central bank money, which could be seen as bearer instruments) and US dollars held in a bank account (commercial bank money) as different currencies. CBDCs (digital central bank money) are only a new form, like the other two just mentioned, of existing national currencies. An American CBDC (“digital dollar”) is no less national, and no less a claim on the Federal Reserve and no other central bank, than US dollar banknotes.