Yves here. In my usual role as house skeptic, I have to pour a some cold water on Wolf Richter’s enthusiastic endorsement for running your own business and the generally hyping of being an entrepreneur as virtuous….for what I think are not great reasons. Note that this occurs in Wolf’s articles below, with the opening question about running your own business as “being your own boss” which in America is seen as having more status as working for someone else (except in PMC circles, where social status is nearly always tied up with the name of the institution you are affiliated with). As someone who has done a lot of survey research, this framing is not neutral.

Here, it is for the opportunity to get rich. In Japan, entrepreneurs are revered because they create jobs. There is the additional romance in the US of greater autonomy, which given that employers seem to be becoming more oppressive and micro-managing over time, would make getting out from under their thumbs seem awfully appealing. That is confirmed by the continuation of work-from-home, despite the desire of many employers to end it. It amounts to a fairly successful white collar labor action against micro-managing bosses and long commutes.

At least as of 20 years ago (I have not seen this factoid updated) the most common characteristic of people who started their own business was that they had been fired twice. That makes sense given the high failure rate of startups; it ought to appeal more to those who found paid employment to be awfully risky. There is a lot to be said for being on a corporate meal ticket if you can put up with the politics and need to at least feign being agreeable: no need to worry about paying overheads, steady income, limited administrativa demands.

My sister-in-law, who made much of being an entrepreneur, failed at three different business ventures and is now back as an employee. This is despite being a very good salesperson. My consulting business lasted 15 years, so in terms of official statistics, it would be deemed a success for operating more than ten years. Mind you, I never set out to have my own business; I was looking for a job after a splashy gig with the Japanese did not work out (not that it would have long term but the guy who hired me was diagnosed with liver cancer 10 days after I arrived, which put a big spanner in the works). People I knew from McKinsey called me with potential assignments,. After two years of that, I concluded I was in the consulting business. Nevertheless, the market for consulting changed a lot after the dot-com era and it became harder for me to find opportunities for my sort of work.1

In addition, Wolf is what is called a lifestyle entrepreneur, which is typically a solo operator or someone with perhaps only a single support staffer. The dynamic changes if you have staff, even if only 1099s and/or part time, who depend on your for income.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

“Everything else being equal, would you rather – be your own boss or work as an employee for someone else?”

This question that Gallup asked is dear to my heart. I’ve been my own boss at the WOLF STREET media mogul empire since 2011. It has been the most enjoyable job I’ve ever had. Flexible hours? I’ve never worked as many hours as I have been in recent years, but it doesn’t seem like work because I have a blast. Long vacations? This is a 24/7 business, I’m the only underling, and I have the worst slave-driver boss in the universe who makes me go on vacation with a laptop and work. It has been financially rewarding, but not right away.

Another massive benefit is that ageism doesn’t exist for me. All that matters is how well I do my job. I don’t have to worry about getting sacked by a 35-year-old, to be replaced by someone who’ll be like a breath of fresh air or whatever.

So I’m hugely in favor of being your own boss. But I also see the financial risks. Many small businesses struggle; they’re a lot of work for the owner, and often not financially rewarding. And when they run out of the owner’s money, they get shut down. That’s the fate of many. But many others become very successful.

“You can’t always get what you want, you can’t always get what you want… but if you try sometimes, well, you might find, you get what you need…” comes to mind. The Rolling Stones nailed it.

The answers to the question whether you’d like to be your own boss were astounding:

- 62% would rather be their own boss

- 35% would rather work as an employee for someone else.

Turns out, wanting to be an entrepreneur isn’t the wish of some small risk-seeking group of crazies, but of nearly two-thirds of adult Americans.

The survey was based on 46,993 members (18 and over) of the Gallup Panel. Of them, 6,986 self-identified as business owners; 4,030 said they have seriously considered owning their own business; and 35,167 said they have not seriously considered owning their own business, according to the study.

Financial Risk

Those that want to be their own boss were asked: “How much financial risk would you be willing to accept in order to become your own boss?”

Starting your own business is risky, everyone knows that, and many such efforts don’t work out. But over half (52%) are willing to take a “fair amount of risk” or a “great deal of risk”:

- A great deal of risk: 14%

- A fair amount of risk: 38%

- Only a little risk: 37%

- None at all: 11%.

Why Start a Business?

Among people who either already own a business or want to start a business, the two top motivations were #1 being your own boss and #2 making more money. So, more control and more money (both in bold):

| Most Important Reasons for Starting/Wanting to Start a Business | Business owners | Want to start a business |

| You want to be your own boss | 57% | 60% |

| An opportunity to earn more money | 54% | 60% |

| Desire for a more flexible work schedule | 42% | 45% |

| To pursue a passion project | 30% | 45% |

| To fill a need in the market for a specific product or service | 23% | 20% |

| To make a positive impact or change in the world | 19% | 36% |

| Someone you know encouraged you to start a business | 15% | n/a |

| You wanted to leave the corporate world | 15% | 22% |

| Family or generational expectations | 14% | 16% |

| To support your community | 11% | 24% |

| Someone you know wanted to be a business partner with you | 10% | 10% |

| Laid off or lost previous job | 9% | n/a |

| Concern about job becoming obsolete because of technology | 3% | 9% |

| Unhappy in current job | n/a | 19% |

| Friend/Family member encouraging you to go into business with them | n/a | 10% |

| Other | 8% | 4% |

Most Helpful Resources for Starting a Business

Business owners were asked which of the following had been particularly helpful in being able to start your business. The #1 and #2 most helpful resources are in bold. Note #3, personal savings. We’ll get to the three in a moment:

| What was particularly helpful in being able to start your business? | |

| Prior work experience in the industry/field | 60% |

| Encouragement from people you know | 57% |

| Personal savings that could be used to fund the business | 45% |

| Personal or community networks (mentors, chamber of commerce, etc.) | 29% |

| Software and other technology to assist with routine business tasks | 20% |

| Funding through loans | 12% |

| Training programs on how to run a business | 10% |

| Other | 6% |

| Government programs or services to help business owners | 6% |

| Funding through investors | 4% |

Obviously, #1 (prior work experience) would be a great resource to have: If you already know what you’re doing, you’re way ahead. In my case, I’d never run a website, had no idea how to do that, had no idea how to make it get traction, and didn’t know anyone in the business. That was a tough place to start from, and is not recommended. It took more time and ate up more resources. But it eventually worked out.

Obviously, #2, encouragement, is great especially from your family who will have to deal with the fallout. My wife encouraged me because she got tired of listening to this stuff that I’m now publishing. But others looked at me askance, and some essentially ridiculed my efforts.

Money

Obviously, #3 – personal savings – is super helpful. Even if the business doesn’t require a lot of upfront investment, it’s possible that revenues aren’t materializing right away, or maybe for years, and personal savings have to be used to tide the owner over until the business starts generating enough cashflow.

I would have never started my business without enough savings. The risk I was willing to take was not making significant amounts of money for a few years. I would not have been willing to risk becoming homeless or whatever. So if the business makes enough money right away – such as consulting in your prior industry with your former clients – great. If it doesn’t, personal savings are key.

The alternative to personal savings is money from equity investors. And then you’re not really your own boss anymore because now you have a board of directors to answer to. But enough money from investors can perform all kinds of miracles – such as hiring lots of expensive staff and renting a fancy office long before the business generates the first cent of revenues, and some of the biggest companies today started out that way.

Not Enough Money

People who would want to start a business, but haven’t done so yet, cited financial reasons as the #1 and #2 biggest obstacles. And the #3 obstacle was seen as “inflation,” which is interesting in its own right.

| The biggest challenges or obstacles you think you would face in starting a business? | |

| Lack money needed to start a business | 60% |

| Concerns about the personal financial risks of going into business | 50% |

| Inflation | 33% |

| Needing to learn more about starting/managing a business | 33% |

| Lack of confidence that business would succeed | 26% |

| Government regulation, permitting, bureaucracy, red tape, etc. | 25% |

| Access to business loans | 24% |

| Interest rates on business loans are too high | 22% |

| Lack of time/Time management | 18% |

| Marketing or customer acquisition challenges | 17% |

| Family situation (e.g., health, child or elder care) | 13% |

| Difficulty finding employees | 11% |

| Access to technology and equipment needed to start a business | 11% |

| Feeling alone or isolated as a business owner | 7% |

| Supply chain | 6% |

| Limited technical knowledge | 6% |

| Loss of unemployment benefits | 5% |

| Family expectations | 5% |

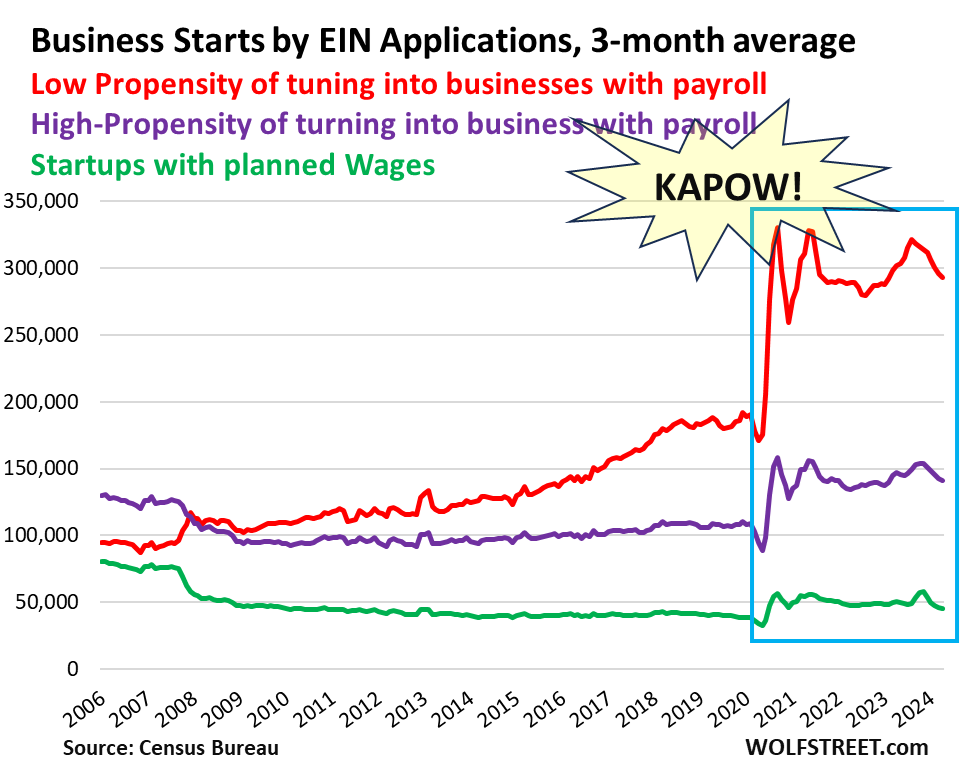

The KAPOW! Moment During the Pandemic Continues

Whether it was the extra time, the free money, or pretending to work from home… for whatever reason there was a huge spike in new business formations, starting in the summer of 2020 and reaching a very high plateau. And then new business formations have continued to move along the high plateau, against all expectations.

New business formations in April were still up by 48% from April 2019, based on the three-month average of applications for federal Employer Identification Numbers (EIN) with the IRS, according to data by the Census Bureau.

A business only needs an EIN if it has payroll, if it is a corporation or partnership, and for some other purposes (trusts, estates, etc.). An EIN is not required to be self-employed or to start a business that doesn’t have employees; the owner’s Social Security number is enough. An EIN was not required to get PPP loans during the pandemic; a Social Security number was enough. This data here covers only EIN applications for typical businesses. EIN applications for trusts, estates, tax liens, etc. are removed from this data.

The Census Bureau categorizes EIN applications based on the data submitted in the application.

Businesses that have a high likelihood of creating a significant payroll are categorized as “High-Propensity Business Applications” (HBA).

About 32% of all EIN applications have been HBAs, and the number of these applications is up by 33% from 2019 (purple line)

Businesses indicating a date for the first payroll are categorized as “Business Applications with Planned Wages” (WBA), a subgroup of HBAs. They’re ready to hire and have funding to meet that payroll. These businesses are most likely to grow their payroll and become significant employers. Only about 11% of EIN applications fall into this category. And the number of applications is up only 13% from 2019 (green).

The biggest increase came from businesses with a low propensity to end up with a significant payroll, tiny shops, similar to the WOLF STREET media mogul empire, with entrepreneurs essentially striking out on their own. They accounted for about 68% of all EIN applications, and the number of applications was still up by 58% from 2019 (red line).

In April, there were 432,517 total EIN applications, including 139,496 High Propensity Applications (HBA), of which 44,875 had planned wages (WBA). The remainder, 293,021 applications were from businesses with a low propensity to end up with a significant payroll.

The chart shows the KAPOW! moment in the summer of 2020 that has barely let up since then though the pandemic-era free money is long gone. The red line is astonishing – businesses with a low propensity to become significant job creators. It represents Americans striking out on their own, often only on a wing and a prayer.

____

1 Citibank used to divide its sales types into beaters (ones who found opportunities) versus baggers (the ones who closed the sale). Yours truly was a terrible beater but a very very good bagger.

Thank you for this article with a detailed discussion of the survey results, it was an interesting read.

For me, it is curious but not surprising that in the survey about the biggest expected challenges, finding customers registers only at #10, with 17%.

About a decade ago, I started my own business, which I run to this day. Through these years, I have had many, many discussions with other people who had started their own business, were planning to do so, or dreamed of doing it one day. My anecdotal experience corroborates the survey above. Still, I never understood this tendency to neglect what I think is one of the most important aspects of running a business: customers!

My take on Wolf is that he was already independently rich (“personal savings”) before starting Wolf Street. Having read many of his articles over the years, I can only conclude that overall he has been a pretty savvy market investor. He did make a mistake shorting the market a couple of months after the Fed’s bazooka during the pandemic, but I think overall he has made quite a bit more than what he has lost. Heck no one has a perfect record when it comes to the market so making the wrong call here and there is par for the course.

Everything else is never equal. The choice will depend on the abilities of everyone in a specific context of time and place.

The economy needs the contribution of boss and employee. Those in charge of managing the economy has to make sure that both would earn a decent living whatever their choice is.

In the current context of the neoliberal polarised economy the two choices are bad. Both boss and employee are bound to fall victims to debt bondage.

Everything else is never equal.

I was thinking the same thing. A paid employee is almost necessarily doing a subcomponent of a larger task/business. There’s no plausible way that subcomponent would translate on its own as business. It’s irrational to expect to quit your job, turn around, and do the exact same thing as a an entrepreneur

There are three types of people in the world: 1) Those who work for income, 2) those who partially work for income but a good percentage of their income is investment income, and 3) those who do not need to work, can live entirely from the proceeds of investment income, property or securities. Business owners are 2), Piketty has shown the majority of the wealthy are 3), are no longer wealthy by virtue of being the industry or company owners or inheritance, but are now wealthy mainly by virtue of the fact they can live solely on proceeds.

I have a theory that at least a percentage of the people who disappeared from the workforce during the pandemic became 3), instead of that house they were saving for, impossibly out of reach, they put everything into financial instuments or trading. So nevermind wealth and status, isn’t there a class of people who are aiming to remove themselves from the labour grid so they are no longer subject to the vagaries of the market conditions, employers, companies?

This class will not show up on Wolf’s surveys.

The unemployed might account for a substantial portion of those, too. The unemployment figure we are given measures how tight the labor market is; it measures the phenomenon for the practical purposes of employers, which is a reason it leaves out those who are no longer trying. If we were measuring actual unemployment, and not the labor market, we’d use the BLS workforce participation rate and employment-population ratio. From some napkin math a year or so ago, I’d worked out that actual unemployment among the working age population is close to Depression levels; it’s just been invisiblized by combinations of stigma, disinterest, and lack of representation and inclusion.

“…the working age population is close to Depression levels….”

If you’re talking absolute numbers, possibly true. The population and labor force were much smaller in the 1930s than today. If you mean the current unemployment rate is close to the unemployment rate during the 1930s, its not even close. Today’s rate is officially 3.9 % Unofficially, possibly more. The unemployed in the 1930s numbered between 25% and 30% of the labor force.

As per Es s Ce Tera’s category 1, plus Yves’ note of entrepreneurs being revered because they create jobs (and I would say not only in Japan), it might be useful to distinguish between those whose activities create a multiplier effect of economic activity, including jobs for others, versus those who make a living working for themselves.

The former would be entrepreneurs, the latter self-employed.

I believe calling self-employed people entrepreneurs is an American thing, telling ourselves that there’s really no difference between my making a living from my website and Steve Jobs making a living doing something with computers.

To complicate matters further, there’s the “gig economy” (I’m not myself au courant enough to know whether that term is still in common use.) Are Door Dash workers and Uber drivers counted among the self-employed? Would a typical Uber driver maintain a balance sheet and a set of books that might tell him or her whether the scheme is making or losing money once vehicle maintenance, insurance, etc. is honestly reckoned?

I am glad to see this piece here @ NC.

I think Wolf Richter covers the bases fairly well. This comment by Palm and Needle above is worth considering further:

One of the key success factors of any new enterprise is the relationship between savings (available cash) and the amount of time it takes to get to cash-break-even (revenues equal costs). The key determinant of that is:

The core principle here is the “value proposition” between the offerer of the product and the buyer of the product.

Is the value to the customer greater – by far – than what the customer has to pay to get it (incl time, effort, and cash-out (price))?

This is where start-ups usually beach their canoe. They run out of cash before they find the magic intersection between what the company can do/offer, and what enough customers are willing to buy.

Becoming the company that can deliver the product, and find the customer (that set of wants) is … hard. Almost everyone struggles with that, and it’s a continuous struggle.

So the motivations to be an entrepreneur or a self-employed are interesting – they provide the motivation. Wolf speaks to this some, but I’d like to emphasize it and state that what tells the final story is “how well and how soon do you find the intersection between what you can do/be, and what the customers want enough to pay you for”.

Because that’s so hard (generally) to do, start-ups run out of cash before they find sustenance in the marketplace. They die from the vengeance (right word!) of the Cash Flow Monster.

That’s where the risk is, and it’s unfortunately what most start-ups are the worst at.

Long ago, I saw a survey that demonstrated that actual entrepreneurs, as opposed to the wanna-be sorts, understood that to have a business, you had to have customers. That was the foundational requirement. Next was whether you could serve their needs profitably over time.

I did not have the energy to work up a suitable degree of scorn about the notion that a business should be about the owner’s desires and not his customers’ demand.

My uncle, who recently passed away of old age, was a vet and while he had a traditional vet office that help all sorts of everyday pets, he himself specialized in large animals. I used to love getting the opportunity to ride out on calls with him. I fondly recall one call which was a ways away, mean lots of talk time in the truck, where he told me his secret to being successful… Don’t focus on what you can charge your customer, focus on offering the best service you can at a fair price. If you do that, the money will just follow.

From what a see, a lot of small business be your own boss entrepreneurs are tragic cases or people who, for whatever reason, are supported by spouses until all the money runs out.

A lot of the franchise scams and MLMs, for instance. To the comment above, I think gig work relies mostly on people who want a side hustle and imagine they have a bit more control with DoorDash than with a restaurant or fast food chicken place.

Where I am, a lot of rideshare and delivery workers are families or a couple and a roommate who are on duty 24-7. Occasionally one of the tech companies mumbles about not allowing this, but it always happens.

One of the Storm the Captial crusaders had lost a business, in that she was scammed by a pool cleaning service franchise.

Wolf has a hole here. OR, he considers setting up a pyramid scheme or scam a legit business.

To your point, in NYC there were a lot of small retail stores selling costume jewelry. I can’t recall seeing more than one customer in any of them. Store fronts are cheap nowhere in Manhattan.

A friend of mine said not well patronized retail stores in Manhattan fell into one of two categories: businesses backed by rich hubbies to keep their wives busy or fronts for money laundering.

The grass always looks greener on the other side, but not all entrepreneurs make it. You have no steady income, no bonuses, no benefits, no paid time off. It would be easier for you to work for a better boss than to start your own business.

Don’t overlook an intermediate solution. Young people bailing out of the college and debt peonage system can succeed in very lucrative jobs that involve transportable skills. Think trades and union support structure instead of the jungle of gig futility.

Apprentice, journeyman and similar paths can provide some comfortable lives as long as one does not insist on living in glamourville and consuming fad items. In other words, those paths can lead to more satisfying lives for the participants and their families. Many readers may have seen examples.

“Everything else being equal, would you rather – be your own boss or work as an employee for someone else?

I don’t think this always means you want to be an entrepreneur, it just means you don’t like to be exploited.

I think when people say they want to be their own boss, this means they want more control over their workplace. As a small business owner, you often have another boss, mostly its your customers, or your bank, or the government…… but you do have more control over your workplace.

On the second top reason, It doesn’t take to to much to see when you rent your labor as an employee, you lose out in the profits generated by your labor, the owner of the business gets it. Better to keep it yourself, you make more money. Kinda like saying it’s better to own a house and have rights to the appreciated equity versus renting a home.

So, another way to look at it, everything else being equal, do you want workplace control and rights to the profits of your labor, or do you prefer to rent yourself to an authoritarian organization so they can make money.

I’ve been self-employed (though I wouldn’t call myself an entrepreneur, per Lord Google’s definition) for a little over two years now, I still have no idea what profit is, nearest I can figure it’s “unearned income,” which, even now as the person who (theoretically) stands to profit from the profit, strikes me as nothing more than theft.

As a good businessman, i am open to having my opinion on the matter challenged/revised/replaced, get me hooked on them greenback dollars again…

A friend of mine who was always self-employed (and occasionally had an employee) once told me that “if you want to work for a real ***hole, go into business for yourself.” I think much of that was from having the boss (you) telling the employee (you) that “no you can’t have a day off and will have to work mandatory overtime every day this month including weekends”.

Another good source of —hole employers is working for Family. I speak from experience. On the other hand, I can imagine Dad’s frustration at dealing with that ungrateful, self-absorbed little cretin he had spawned, and then had the misfortune to ’employ.’

You want to know another reason for all those business startups in 2020? I’ll give you one guess. PPP loans. The amount of fraud that program generated is appalling.

Understanding at a young age that Amrika’s capitalism is a plantation slave economy and that I did not want to play by those rules, I fell into something that allowed me to have TIME if only adequate money. I sought to avoid the 50 week year, the 40 or more hour week, the long con that Amrika was selling that many in the 1960s were seeking to avoid.

Travel to poor countries taught me about adequate and enough, particularly material things. Most Amrikans have no clue.

And it taught me a little deception, because the punitive Calvinist doctrine is really quite ruthless about those who want their time over money unless greed has made them rich.

Having been fired a few times, and failed at business once, I will note that the determining factor in all this is usually chance. Sometimes one is lucky, other times not. Being prepared makes one ready to take advantage of good “luck.” Being unprepared makes one fully at the mercy of circumstance.

My experience is that ‘business’ is equal parts technical proficiency and social skills. Someone has to do the actual work and someone has to hunt the work down.

The subject of the distribution of available resources is another, long debated subject.

Stay safe all. Coming up is the Summer of our discontent.

Aggregate demand creates jobs. Try being an entrepreneur offering something nobody buys.