Yves here. Just when the Fed thought it might have killed the economy enough for it to lower rates, groaf is back! Mr. Market still believes that at least one cut before this year is in order. But investors have had a way of getting considerably ahead of what the central bank is ready to do.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

Our Drunken Sailors are back at it, but in moderation, so to speak, their feathers largely unruffled by interest rates.

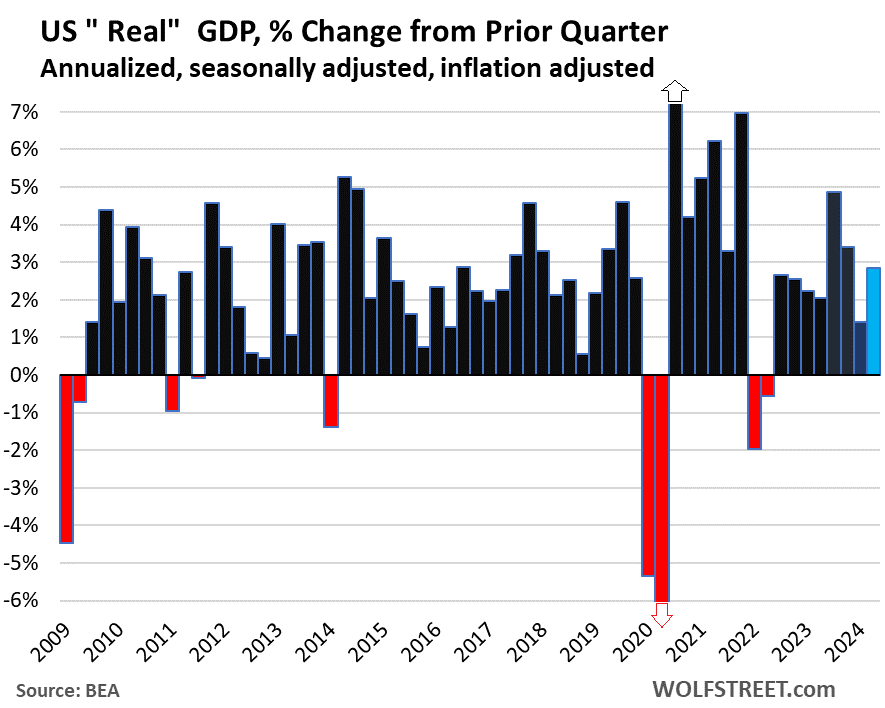

GDP, adjusted for inflation (“real GDP”), rose by an annualized rate of 2.8% in Q2 from Q1, doubling the growth rate in Q1 (+1.4%), according to the Bureau of Economic Analysis today.

By comparison, the 14-year average annual growth rate is 2.2%. So the 2.8% growth rate is well above average, and pretty good for the US economy.

We said at the time of the feeble Q1 release (+1.8%, now revised down to +1.4%) that it was driven by a “blip”: a decline in federal government consumption and investment, which turned out to be correct, it was a blip, it bounced back in Q2 (+3.9%), as we all knew it would because the drunken sailors in Congress are not suddenly slowing down.

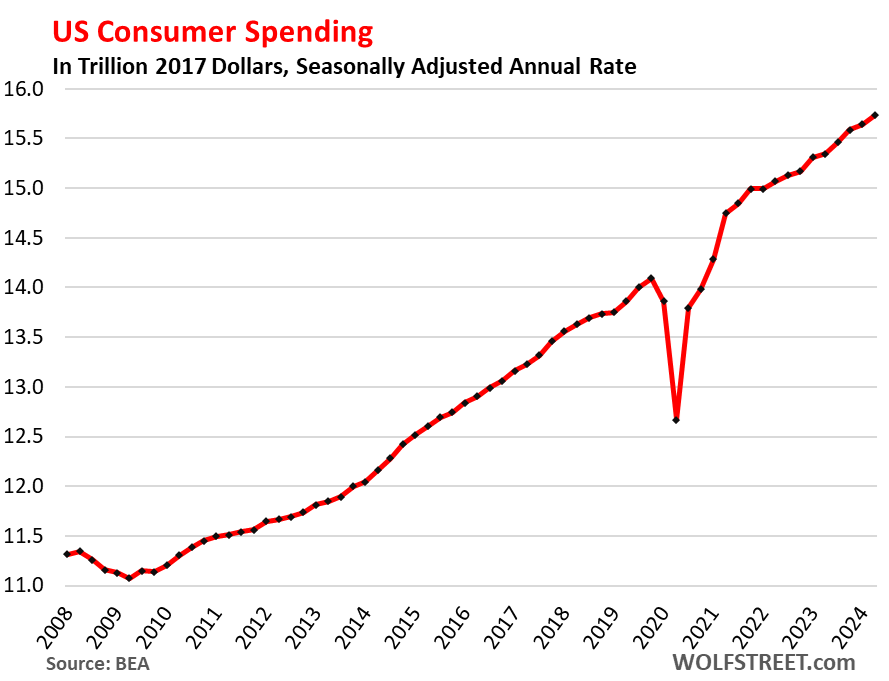

- Consumer spending (69% of GDP): +2.3%, on a 4.7% surge in spending on durable goods (motor vehicles, recreational vehicles, household durable goods, etc.). Services +2.2%; nondurable goods +1.4%.

- Gross private investment (18% of GDP): +8.4%, amid an 11.6% surge of investment in equipment and a 1.4% decline in residential fixed investment.

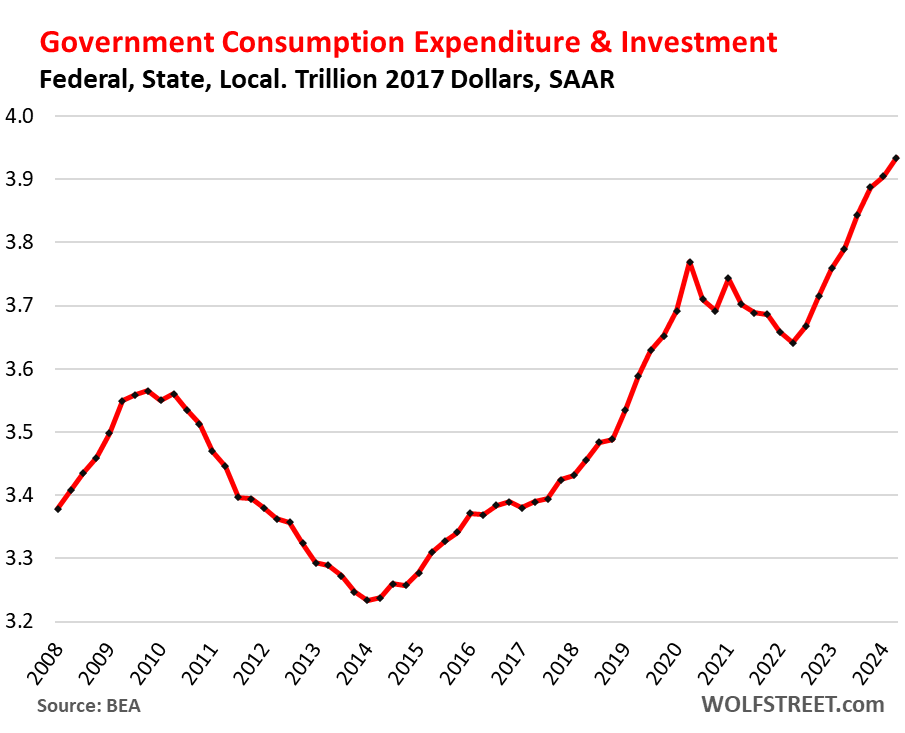

- Government consumption and investment (federal, state, and local, 17% of GDP): +3.1%, after the 1.8% increase in Q1. Federal government +3.9%; state and local +2.6%.

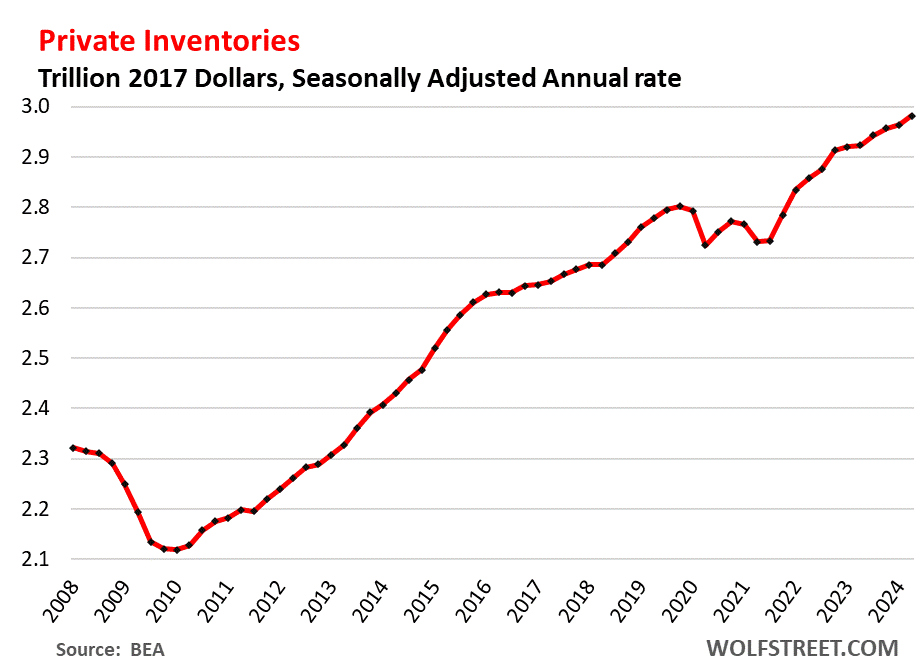

- Change in private inventories investment added to GDP growth in Q2 after dragging on GDP growth in Q1.

- Trade deficit worsened by a big chunk for the second consecutive quarter, on surging imports to meet strong US demand for durable goods. Imports drag on GDP.

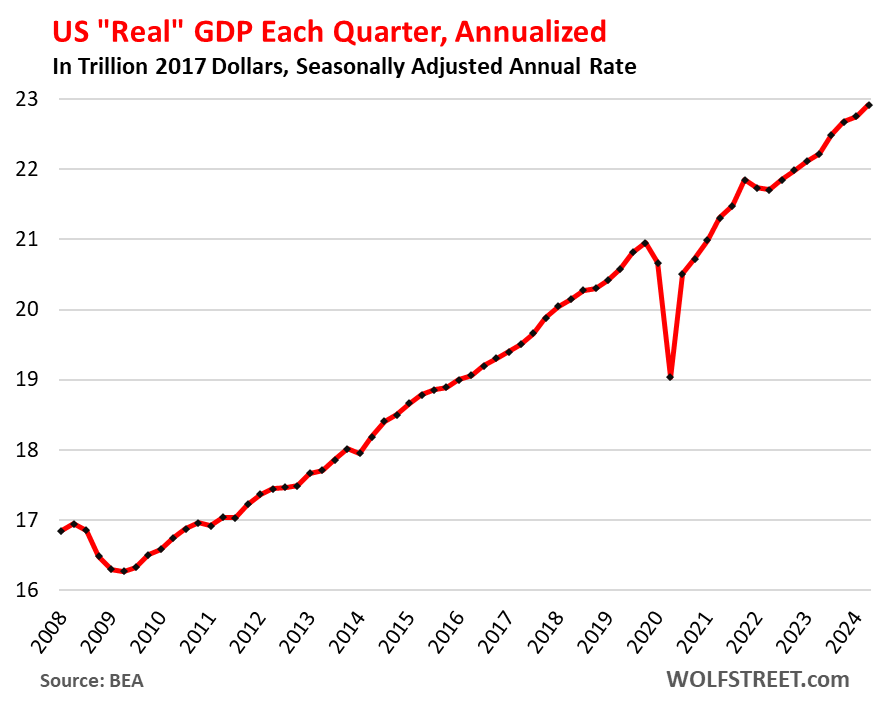

The actual size of the US economy: “Current-dollar” GDP (not adjusted for inflation and expressed in current dollars) rose by 5.2%, to $28.6 trillion annualized.

This $28.6 trillion of current-dollar GDP represents the actual size of the US economy, measured in today’s dollars, and is used for the GDP ratios, such as the US debt-to-GDP ratio.

“Real” GDP in dollar terms, adjusted for inflation and expressed in 2017 dollars, rose to $22.9 trillion annualized in Q2:

Consumer spending on goods and services rose by 2.3% in Q2 from Q1 to $15.7 trillion annualized and adjusted for inflation, an acceleration from the Q1 growth rate of 1.5%. In Q2, consumers re-stepped on the accelerator.

- Services: +2.2%.

- Durable goods: +4.7% (after the 4.5% drop in Q1), driven by motor vehicles, household durable goods, and recreational vehicles and goods.

- Nondurable goods: +1.4% (after the 1.1% drop in Q1), with increases in food, beverages, and gasoline, and a decline in clothing and footwear.

Our Drunken Sailors are back at it, but in moderation, so to speak, their feathers largely unruffled by higher interest rates:

Gross private domestic investment jumped by 8.4%, to $4.25 trillion annualized and adjusted for inflation, a sharp acceleration from Q1 (+4.4%) and Q4 (+0.7%). Of which:

Fixed investment: +3.6%, of which:

- Residential fixed investment: -1.4% after the +16.0% spike in Q1

- Nonresidential fixed investments: +5.2%, the fastest growth in a year:

- Structures: -3.3%.

- Equipment: +11.6%

- Intellectual property products (software, movies, etc.): +4.5%.

Finally back to the peak in Q1 2022 of the free-money pandemic spike:

Government consumption expenditures and gross investment rose by 3.1%, to $3.9 trillion annualized and adjusted for inflation, up from the 1.8% growth rate in Q1.

Federal, state, and local government consumption and investment accounts for 17% of GDP (state and local governments account for 61% of government spending, the federal government for 39%).

This does not include transfer payments and other direct payments to consumers (stimulus payments, unemployment payments, Social Security payments, etc.), which are counted in GDP when consumers and businesses spend or invest these funds.

- State and local governments: +2.0%, to $2.42 trillion.

- Federal government: +3.9%, to $1.51 trillion, up from -0.2% in Q1.

- Defense +5.2% (to $846 billion)

- Nondefense +2.2% (to $668 billion).

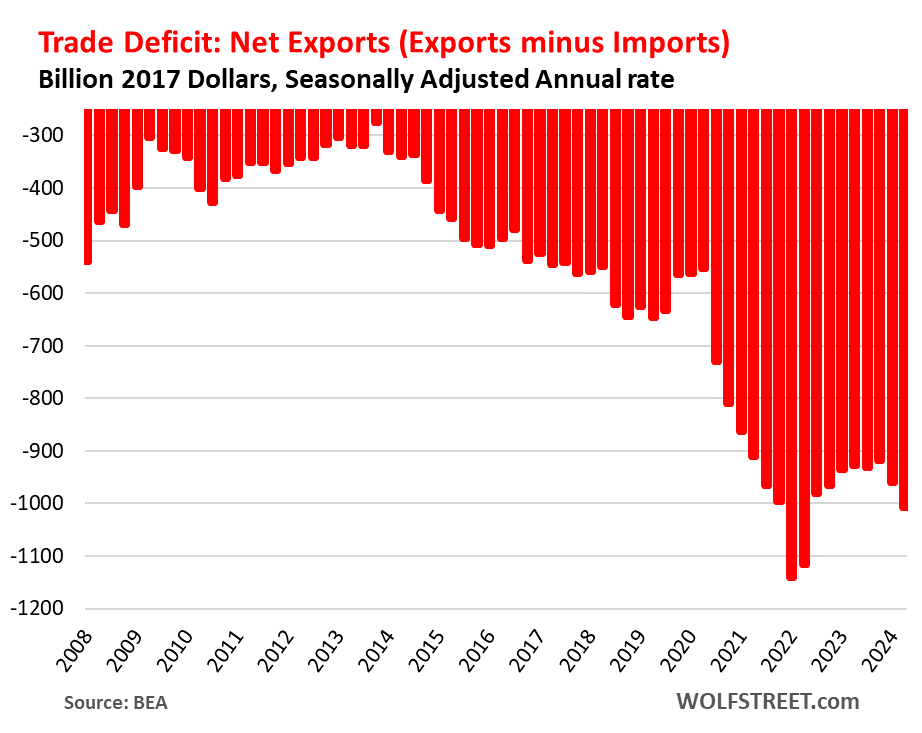

The Trade Deficit (“net exports”) in goods & services got more horrible:

- Exports: +2.0%, to $2.55 trillion

- Imports: +6.9%, to $3.56 trillion, of which goods +7.7% and services +3.6% (services imports includes spending by Americans traveling overseas).

- Net exports (exports minus imports): -4.7%, to -$1.01 trillion.

Exports add to GDP. Imports subtract from GDP. Exports are much smaller in dollars than imports, hence the trade deficit, or negative “net exports.”

The worsening imports dragged GDP growth (+2.8%) down by 0.93 percentage points. If imports had remained at the same horrible level as in Q1, rather than worsening further, GDP growth would have been 3.7%, instead of 2.8%.

Change in private inventories: Inventories rose by 2.4% annualized in Q1 to $2.98 trillion. An increase in inventories counts in GDP as a business investment. In Q2, the faster rate of increase added 0.82 percentage points to GDP growth, after the slower rate of increase in Q1 had subtracted 0.42 percentage points from GDP growth.

Excellent summary. It is important to note that government spending includes borrowed money and normal revenues. When government spending is increased by normal revenues it is being paid for through taxes and fees – no net change to liabilities. The amount borrowed in the last quarter was $450 billion, that spending both adds to the size of GDP and to liabilities, plus interest to be paid in the future. 2.8% growth with a balanced budget is a different number than 2.8% growth with a 6% growth in liabilities.

the federal deficit for FY2024 will be >6.5% of GDP*. That is insane—even for Keynesians—when we have full unemployment. (and don’t forget that this isn’t due to more social-welfare spending, much of this is due to more military spending and greenwashed subsidies)

When combined w/interest rates, this is a financial “speed ball.”

If/when the next recession hits, the US is going to go full “zombie Japan” given the large private-consumer debt load and little savings for the bottom 50%—most of American “wealth” is locked up in the top 0.5% in illiquid financial assets.

* https://www.cbo.gov/publication/60419 see table 1-3

What is a “Keynesian”? Nowadays political and economic terms are thrown around and meanings are ambiguous, or have shifted over time. JM Keynes would not recommend deficit spending during “full employment” in the first place. He would not recommend massive military deficit spending either, but rather spending during a recession on domestic programs that have a “multiplier effect”.

The USD is the imperial currency, used worldwide. Japan is a vassal state, so comparing the US to Japan is not helpful. The bought-and-paid-for Congress crooks know that they can spend “like drunken sailors” as long as other countries accept USD and USD still remains the dominant reserve currency worldwide.

The ultimate Keynesian, Trump will be back soon enough. He’ll easily double the deficit to 13% if need be, since he will be playing with house money.

more dismal anti-science

We have economic “groaf” hurray! (I’ll use that term in future)

Monopoly and oligopoly price gouging and market abuse, health care and pharma extortion, MICIMATT spending and funding genocide and proxy wars, formalized and legal financial fraud… all this counts as economic “groaf”. By these measures, the US is the most “perduktiv” economy in the world.

And just wait for the new Soylent Green markets, we aint seen nothin yet – we gonna get in on the ground floor and “make a killing” (sorry for the macabre humor)

Speaking of drunken sailors: a good friend of mine recently retired as a merchant mariner (SUP), he seemed to play the stereotype role right down to the last detail: after a 3 month tour of the Pacific on a ship, SUP members can still request a lump-sum payment as a check, bank deposit, or cash. He would always request a cash payment (many thousands) and roll it up in a giant bankroll and put it in his pocket – he called it a “grub steak”. He would then go on a drunken bender, frequenting brothels, buying everyone drinks etc. until the “grub steak” was gone. He would then show up to the hiring hall, very hung-over, to get another ship and repeated the process. He is a walking stereotype, but he is quite honest about it. So, this anecdote shows that the stereotype does exist. I told him to write a book about his international escapades as well.

FOMC meeting next week…where all manner of economists and market nerds alike can wade into the ever-loving details of Federal Reserve minutiae. Saw a few commenters yesterday on CNBC, making a call for their first targeted cut next week.

Eh, seems a little fast…it works against this narrative as well about the strong US economy. I’m still in the camp for one cut perhaps two, if they should choose to start in September. I do think Chair Powell’s patient approach, that in retrospect put them behind inflation pressures late 2021, may actually serve the Federal Reserve reasonably well this year. We don’t have a disastrous payroll report, and earnings season is in full swing. I can’t see a cut next week, from the cheap seats and my armchair analysis if you will.

Looking at Bloomberg the coupon for this weeks 5 year bond auction came in at 4%, there has been a general trend down in coupons achieved for a while now. The writing is on the wall and the Fed usually keeps faith with the bond market. But as you say maybe not next week.

I agree with your sentiment. Thank you for articulating so expertly and succinctly.

Cheers

Yesterday the durable goods orders missed by a lot, but here it talks about a big increase. Is this a difference between durable goods “orders” and durable goods “spending”?

This is my comment about the miss of the durable goods orders, down 6.6% month over month, reported in yesterday’s water cooler.

https://www.nakedcapitalism.com/2024/07/200pm-water-cooler-7-25-2024.html#comment-4076928

Q1 GDP last print might argue for a rate cut.

Q2 first estimate does not suggest a rate cut, unless you see that new federal debt in Q2 is more $ than current $ increase in GDP.

Too much, often about 60% of federal consumption, is DoD, only needed during threat to homeland. Not threats to Kiev or Tel Aviv.

Federal debt service is the largest claimant for a rate cut, as well as soon needing the Fed to buy t bills….

the fed can’t stifle rates. they’re standing .well below the rate of market inflation as it stands, so why borrow when it’s a loss guaranteed to hold that paper.

the fed cannot over rule congress, either.

congress created the problem with the intention to never pay back a dime they ever borrowed. does anyone actually think they can stop them. as if it isnt too late already.

blaming a patriarchal capitalist price gouging wont win you any gains either, until you can find a market in used virtue signaling.

no, this is pandemic supply destruction and other cult spend on climate and victimization leagues.

– pardon the grammar; shift key use creates a problem –

almost forgot – rates rise during war.

IMHO, isn’t this groan (growing!) at the expense of the EU and other vassals who are being punished to sanction the Russians and Chinese?