The mainstream media has, until now, played a key role in advancing the Global War on Cash — a war that began with no official declaration but in which propaganda, as with all wars, is a vital weapon.

Last week’s global IT outage appears to have shaken some British media outlets’ confidence in the idea of a fully cashless society. When a content update by the cyber-security giant CrowdStrike caused millions of Microsoft systems around the world to crash on Friday morning, bringing the operating systems of banks, payment card firms, airlines, hospitals, NHS clinics, retailers and hospitality businesses to a standstill, businesses were faced with a stark choice: go cash-only, or close until the systems came back online. From WIRED magazine:

This quickly caused chaos in Australia, whose government has explicitly encouraged businesses to go cashless. Pictures posted on social media showed card-only self-checkout registers at the grocery chain Coles displaying Blue Screens of Death (BSODs). Queues for human-run registers at Australian groceries stretched to the back of the store, according to local media. Some Australian marts simply locked their doors…

Starbucks—whose then-CEO said in 2020 was shifting “toward more cashless experiences”—appeared to have been particularly hard hit. One Kansas-based Starbucks worker posted a TikTok showing that the mobile order system was “completely down.” The machine that the store uses to print labels for cups was also not working. “It just comes out blank every time,” she said, gesturing to the label printer. She tells WIRED that some customers were “upset and very rude” when she tried to explain. A different Starbucks worker said on TikTok that she had to write down every order on sticky notes.

Richard Forno, a cybersecurity lecturer at the University of Maryland, tells WIRED that Friday’s outage demonstrates the vulnerability of our current cloud and internet infrastructure. “Software supply chains have long been a serious cybersecurity concern and potential single point of failure,” Forno says. “Given today’s events, with any luck, perhaps the world may finally realize that our modern information- and often cloud-based society is based on a very fragile foundation that’s not built for security or resiliency.” (A Microsoft spokesperson did not respond directly to this assessment.)

Here on NC, we have periodically discussed (including here, here, here and here) the hyper-fragility of our tightly coupled IT-based societies, particularly on the banking and payments side of things. In March, UK citizens had a foretaste of the inherent fragility of a cashless economy after the payment systems of the country’s two largest supermarket chains, Tesco and Sainsbury’s, went down on the same day. Then, as on Friday, cash provided a vital, albeit imperfect, fall-back mechanism for citizens and businesses.

Cash Does Not Crash

This is one of the most important arguments in favour of cash: the resilience it provides to a country’s overarching payments system. Put another way, cash does not crash. It does not fail in a power cut or seize up during a cyber attack or software outage (though, of course, ATMs might). By contrast, digital payment systems generally need a stable and continuous internet connection and power supply to process transactions.

This is a lesson central bankers in Sweden, one of the world’s most cashless economies, are apparently relearning. From our recent piece, “The World’s Oldest Central Bank Keeps Sounding Alarm on Fragility of Cashless Economies. Are Other Central Banks Listening?”

After playing a part in the wholesale removal of cash from Sweden’s economy, the Riksbank is now trying to reverse some of the damage it has caused. It is not the only Scandinavian central bank to have flagged up the fragility risks of exclusively digital payment systems. In 2022, the Bank of Finland recommended that the use of cash payments be guaranteed by law. Like all Nordic countries, Finland is a largely cash-free economy. But like Sweden, it has begun to see the risks of going too far, too soon.

It seems that certain legacy media outlets may also finally be learning this lesson. In the UK alone, four of the country’s largest newspapers — The Guardian, The Daily Telegraph, The Times and The Daily Mail — have run articles on how the global IT outage has underscored the fragility of a cashless society. The Daily Mail plastered the message across its front page:

From that article:

Critics said the havoc showed the dangers of a cashless world, with almost half of Britons now leaving the house with only their phones as a means of payment…

Dennis Reed, director of the Silver Voices campaign group which represents older people, said: ‘It’s extremely worrying. This should be a big warning for the Government. Obviously it has affected older people particularly, not just with the cash side of things but GP appointments and everything else.

‘If people can’t pay because they can’t use their phone then when systems go down – and they always will – people won’t be able to access vital services, food, and the essentials of life.

‘With this ever-more digital society, we are reliant on it all working. But we have no control over it. We are putting all our eggs in one basket. The future security of the nation is in danger.’

Martin Quinn, campaign director at the Payment Choice Alliance, told The Daily Telegraph: ‘With IT outages happening now at alarming regularity, businesses should be mindful of only taking card payments.

‘However many supermarkets prefer to have self-service card-only tills, which makes cash users feel like second-class citizens, a concerted effort is needed to return to using and accepting cash, because cash never crashes.’

Media’s Role in Global War on Cash

Over the past couple of decades, the mainstream media has played a crucial role in advancing the Global War on Cash — a war that began with no official declaration but in which propaganda, as with all wars, has been a vital weapon. The mainstream and financial media have provided a perfect platform for that propaganda.

In 2007, when contactless payments were barely getting off the ground, Guillermo de la Dehesa, a Spanish economist, former senior civil servant and then-international adviser to Banco Santander and Goldman Sachs, singled out cash as the major source of crime and evil in an El Pais article titled “The Great Advantage of a Cashless World”:

“Without cash, we would live in a much safer, less violent world with enhanced social cohesion, since the major incentive fuelling all illegal activity [i.e. cash]… would disappear.”

In 2013, Mastercard sponsored an Oxford University “trial” into the germ loads found on the banknotes of a selection of global currencies. Mastercard reserved the exclusive right to present the findings of the trial as well as the results of a highly misleading survey on public perceptions of the health risks of cash, which it did in gaudy glory. As the German financial journalist Norbert Häring documented in his article, “How Mastercard Invented the Health Hazard of Cash,“ the global media did the rest of the work.

United States

CNN, March 28: “If you thought dirty money was only found in offshore bank accounts, check your wallet instead. But you may want to wash your hands afterward. […]. An Oxford University study found an average of 26,000 bacteria on bank notes.” Source

Switzerland

Blick, March 26: “Disgusting money: many Swiss find cash unhygienic[.] 64 percent of Swiss people find their cash unhygienic. No wonder, since it is particularly dirty.” Source

The Local, March 27: “[…] a study by researchers at Oxford University concludes that legal tender in Switzerland is among the dirtiest in Europe […].” Source

France

Le Monde, April 1: “Is Cash Dirty?” Source

UK

Metro, March 26: “More than half of Brits fear germ risk from filthy money – with good reason[.]” Source

Etc……

This was just a dress rehearsal for what was to come in 2020. At the very onset of the COVID-19 pandemic, when public panic was surging, a World Health Organization official responded to a question about whether banknotes could spread the coronavirus with a qualified “yes.” In the hours and days that followed legacy media outlets around the world pounced on the comments and magnified them, sparking fears about the safety of using cash.

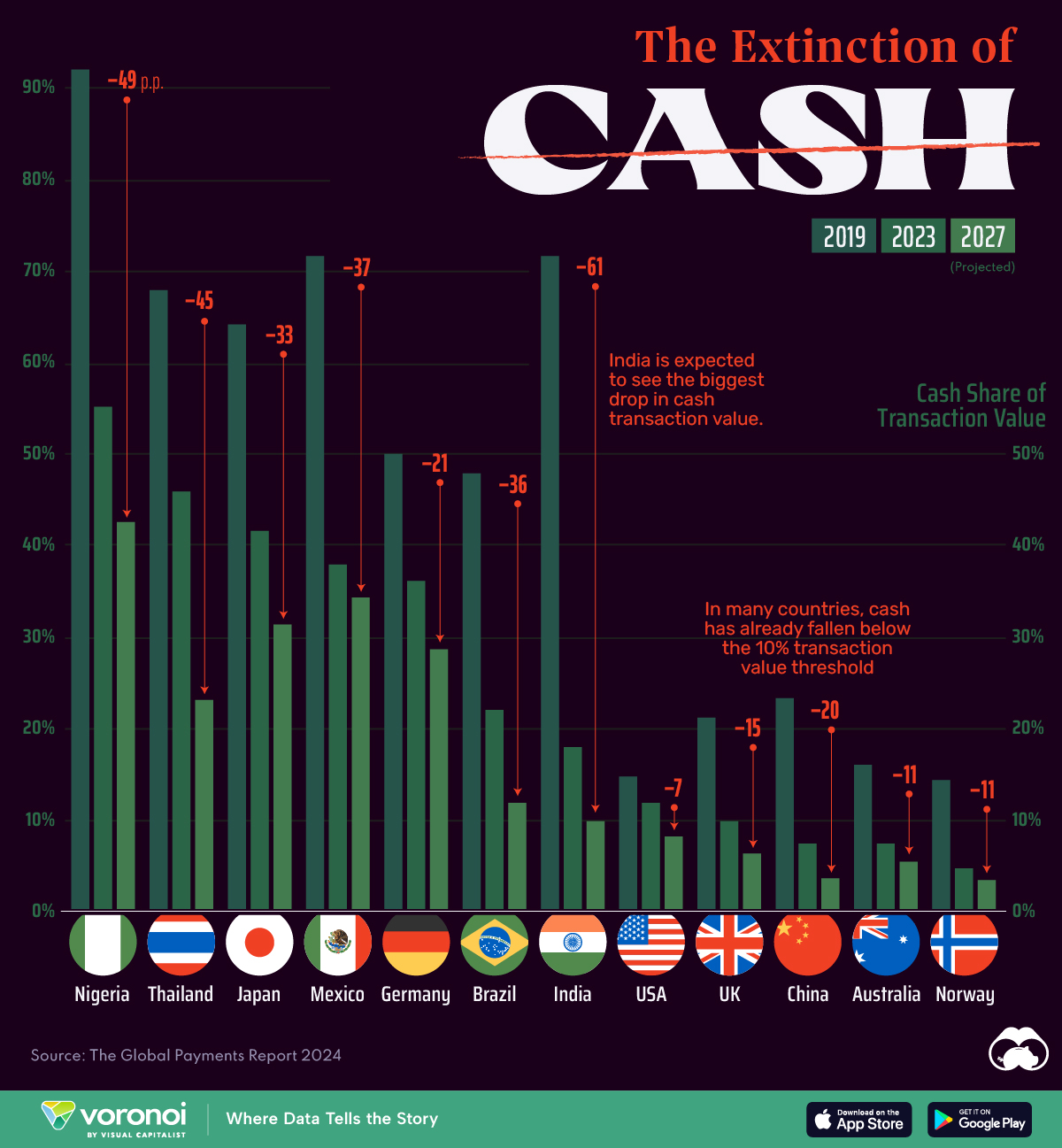

It worked like a dream. As the graphic below (courtesy of Visual Capitalist) shows, four years on cash is being used for transactions far less frequently in most countries, in large part due to the exaggerated safety fears propagated by the media.

Central bankers themselves have admitted that the pandemic played a key role in accelerating the mass abandonment of cash and adoption of contactless, mobile and online payments. As the author and cash advocate Brett Scott notes, since the pandemic the private sector has turbocharged its anti-cash drive, “as Big Finance, Big Tech and Big Retail have weaponised the public’s temporary fear of physical contact to amplify the anti-cash automation agenda that they already had.”

But at the same time, the amount of cash in circulation has actually surged in many jurisdictions. When the pandemic began, central banks around the world recorded a sharp increase in cash withdrawn from ATMs while at the same time registering a sharp fall in transactional usage of cash. Put simply, people still wanted cash but often as a means of storing their money outside the banking system at a time of crisis.

In some countries, including the UK and Spain, the use of cash has staged a moderate recovery in the last couple of years as people’s priorities have shifted from (largely manufactured) concerns about hygiene during a global pandemic to making ends meet amid soaring inflation. But media outlets around the world have continued to churn out articles, columns and op-eds demonising cash and gleefully foretelling its imminent death.

A recent op-ed in the Sydney Morning Herald declared in its title that “Cash is Dead,” only to then ask: “Why Are We Still Pretending to Use It?” — as if the 13% of Australians still using cash on a regular basis are just pretending. In September 2023, the Washington Post‘s Data Department ran a more informative and less insulting piece titled “Paper Checks are Dead, Cash is Dying. Who Still Uses Them?” [1]

Doubts Setting In

But doubts appear to be setting in as the IT outages affecting payments systems become increasingly frequent and larger. The mere fact that some of the UK’s biggest newspapers, as well as other media organisations around the world including Yahoo Finance Australia, are now discussing the inherent fragility risks of a fully cashless society represents an important shift. The Guardian, for example, reports that the Crowdstrike outage has shown the “dangers of a cashless society” — according to cash campaigners.

“There will always be outages,” Ron Delnevo, the chair of the Payment Choice Alliance, told the newspaper. “But if there is no alternative, then the whole thing can collapse around you.”

Last year, cash payments in the UK increased for the first time in a decade, the article notes. The number of people who never use cash, or use it less than once a month, also declined.

In China and the US, businesses have been fined for not accepting cash. In the UK, by contrast, businesses can choose which forms of payment to accept (and which not to). Delnevo told The Guardian that the UK should have a law requiring all businesses to accept cash (within certain parameters), as is already the case in my country of residence, Spain. Unfortunately, that is as unlikely to happen under a government led by Kier Starmer as one led by Rishi Sunak, both of whom are in thrall to the WEF’s techno-tyrannical agenda.

The Daily Telegraph‘s Money Editor, Johanna Noble, argues that people should ultimately have a choice about which payment method to use in each given transaction while warning that the UK is clearly “nowhere near ready to go cashless”:

And do we have to be? Does it have to be binary? Sometimes paying with cash (small shops, the tooth fairy, car boot sales) might be best, while in other circumstances paying by card (getting consumer protection when buying goods or services) will be better.

In May, an editorial in The Guardian cautioned that the most vulnerable in society will ultimately bear the costs of a cashless economy:

Cutting out cash hits the vulnerable hardest: according to a 2020 survey by the Financial Conduct Authority, 46% of the digitally excluded, 31% of those without educational qualifications, and 26% of those in poor health rely on it to a “great or very great extent”. Mencap warned the Welsh Senedd that people with learning disabilities can find it hard to manage money without cash. And there are good, as well as nefarious, reasons to value its anonymising quality: women whose abortion rights have been restricted might find it life-saving.

Businesses should think carefully before refusing cash payments. Governments must ensure that people reliant on cash can continue to use it: in the UK, where thousands of bank branches and ATMs have vanished, the Financial Conduct Authority now has powers to protect access. But even if the supply of notes and coins can be assured, authorities must also ensure that services accept them.

In the UK, there is no law preventing businesses from rejecting cash. Legal tender traditionally has a very narrow definition in the UK, and strictly applies to money used by a debtor to settle a court-awarded debt when offered (‘tendered’) in the exact amount that is owed to a creditor. In other words, if a debtor is offering to settle a debt in court with legal tender such as cash, the creditor is not allowed to refuse it. Shops and hospitality businesses, by contrast, are.

Many retailers, particularly in the more salubrious parts of towns and cities, have taken full advantage of this loophole, despite the discriminatory effects it has on the millions of people who still depend on cash, including the roughly 1.3 million who are unbanked. Whether retailers continue to do this following the global chaos uncorked by one US tech firm’s botched content update (?) remains to be seen [2]. One thing is clear: UK citizens and businesses have had their fair share of warnings about the fragility of cashless economics.

[1] An article cross-posted last week on NC reported that Target had recently become the latest US retailer to stop accepting payments by checks.

[2] It’s too early to tell whether Friday’s global IT outage was the result of an innocent but insanely costly mistake or something far more nefarious. But some of threads of this story are, to put it mildly, a little fishy. For example, the fact that this is the second time CrowdStrike’s current CEO, George Kurtz, has been at the centre of a global tech failure. Also, CrowdStrike was the company that generated the claim that Russia had hacked the DNC, spawning the Russiagate conspiracy theory:

CrowdStrike is the cyberfirm that generated the claim that Russia hacked the DNC, setting off Russiagate. Even though CrowdStrike was working for the Clinton campaign, the FBI relied on it rather than independently investigate the "hacked" DNC servers.

It only emerged four…

— Aaron Maté (@aaronjmate) July 19, 2024

There are also indications that the faulty driver at the root of the global IT outage already existed on Mac, Linux and Windows systems. In the words of Google whistle-blower Zach Vorhies, it was just “sitting there like a ticking time bomb,” waiting to be activated.

This bug was a two-part series.

All it needed was bad data in order to detonate it.

The recent data update, delivered that payload.

/3

— Zach Vorhies / Google Whistleblower (@Perpetualmaniac) July 22, 2024

Apropos the Mastercard survey of dirty banknotes, I remember some years ago, claims that high denomination bank notes mostly had traces of cocaine on them. Not sure how much truth there was in that claim either. Not that I ever had many high denomination notes in my possession to sniff.

I would guess that less wear and tear of high denomination bank notes makes them more suitable for rolling.

I remember reading about Spain having highest perecentage of cocaine-on-cash in Europe, which is explained by them getting uncut stuff fresh from the boat.

No-one seems to mention that it’s the centralisation of the system with one monopolistic provider that led to this fragility.

Agreed. If you are a psychopath, or a criminal who desire to control everything to your advantage centralization makes things much easier. Fewer people to bribe and easier to compel people to do what you want.

We should be imitating “Natural Systems” which are generally decentralized. In a forest, the deer don’t get to dictate to the rabbits what they eat. The foxes don’t get to mandate which trees the squirrels live in. The only systems that are large are very dumb, such as a river which works on a very basic principle. “Water runs downhill”

It’s like no one ever learns from other people’s experiences: https://www.nakedcapitalism.com/2022/06/germany-just-gave-a-timely-lesson-onthe-dangers-of-going-completely-cashless.html

More and more restaurants where I live added fees for credit card usage, so I am consciously carrying more cash when going out to eat. I even carry enough cash to cover the entire bill when dining with friends, for when they themselves forget to bring enough cash.

Outside of restaurants, prices don’t discriminate between cash or credit card. That percentage cashback drives my credit card usage, unless it’s a small local business,

Are you aware of the charges on electronic transactions? Small businesses get dinged very hard and the charges are not visible to the card holder. Due to taxes and other complexities it is difficult for Small business to pass along the costs to the customers. Large businesses are in a better negotiation position so able to get better rates

Small business loves cash

Visa and Mastercard and I am pretty sure Amex too explicitly prohibit businesses that take their cards from charging more for them v. cash. Not that you want to argue with them or hurt a small business, but that is actually a contractual violation and in theory they could have their account cancelled.

In general cash is way better but you have pilferage risk…and my experience with workers stealing cash (my PERSONAL cash, not even “business” cash) has been terrible.

Some local small businesses give a small discounts of 3-5% if you pay cash. A locally owned pizza place, a pet store etc. In addition MOST gas stations here charge a higher price on for credit cards vs. Cash or debit cards and they have 2-tiered pricing signs that say so.

This is California so maybe there is a state law that overrides the credit card agreements.

Same here in my small city in Australia. But I don’t do it for the discount. I hear it all the time, small businesses are struggling with rents going up along with other costs. If my paying cash helps in a very small way, why not do it?

Not to mention not learning from one’s own experiences, as with the Y2.01K bug. From the cited article

It seems likely that cash will slowly evolve out of existence without much propaganda. In addition to discussions such as this, there needs to be more discussions of fail safe requirements and back up power requirements especially for more vital parts of the economic and technology networks. In fact, this is the basis of the failure of self-driving vehicles. The fundamental problem may be the fact that our economy is built on the profit motive and fail safe and back up requirements are going to lessen profits.

Look to Ukraine

Way ahead of US on digital citizen stuff and playpen for Microsoft and keeping all subject info in cloud in servers in Poland

After all Ukraine is de-electrified

Funnily enough they were not concerned when Crowdstrike screwed up Linux servers in April 2024

Maybe too many media groups use Windows and Falcon Antivirus Sandbox so it affected them directly ?

I doubt it is anything more than having Media affected directly that enhanced their interest

I did not remember that incident, so searched for information about it on the Internet. I was stunned by what I learned:

Another disruption, this one hardly noticed, occurred in April when a CrowdStrike update caused all Debian Linux servers to crash simultaneously and refuse to boot. The update was incompatible with the latest stable version of Debian, despite this Linux distro being supposedly supported by CrowdStrike.

[…]

CrowdStrike’s response to the Debian issue was slow. It took them weeks to provide a root cause analysis, which revealed that the Debian Linux configuration was not included in their test matrix.

They officially support the Debian linux distribution, but do not test their software on it? Seems to me those standard licensing terms must be taken literally when stating that “the product has no expressed or implied fitness for a particular purpose” whatsoever.

Now I feel better about having left cash in my pocket on wash day. :)

When rolling coins that I’ve accumulated in cups, jars and other containers, I rinse them first in a colander. The metallic smell is off-putting but dissipates after a while as the coins dry.

As to CrowdStrike, maybe lawsuits will draw out some testimony about the ill intentions.

The capital controls put in place in Greece during the grexit crisis made it difficult to access cash for quite a long time. During that time, even older or digitally excluded people who hadn’t ever needed to use a credit/debit card were forced to learn how to use them. Many have since abandoned cash because of convenience. The state had the added benefit of collecting vat on all those former cash transactions where the seller was inclined not to cut a receipt. That had a “balancing the books” effect so there won’t be any appetite here for keeping a cash economy whatsoever.

As the article mentioned, it is not just payment systems that failed. I showed up for an early veterinary appointment for dog Betsy that day, and found that they had cancelled all appointments because of no access to patient records. The effect on business was like a power failure, except that the lights stayed on and the refrigerators kept working.

Have said it before and I’ll say it again: my Dad’s company now has HALF of all £20 notes being the new King Charles ones. We’ve had polymer notes for a while now so either the Bank of England has had to issue a shedload of extra cash or TPTB have made a conscious decision to replace a significant proportion of perfectly serviceable notes long before they’re due to be retired.

Either explanation raises questions.

Bank notes function as non-interest bearing T-Bills so issuing them helps HMG find itself as Gilt yields rise

This is not universally the case. There are many battery-powered devices which execute and store transactions offline for later upload. Of course, there are other risks associated with that, but the devices generally do still function.

Point taken. Have added a qualifier into the mix:

Thanks.

In 1979 I started a job at the Kansas City Federal Reserve Bank (telecom analyst). During new employee orientation we were told that one of the Fed’s long term goals was the elimination of cash.

Fortunately, they haven’t reached that goal – yet…

Let me just throw this out there for “s—s and giggles.”

The New Improved Federal Digital Crypto Currency: PanOptiCoin.

Stay safe.

Stack deep the three Precious Metals: Gold, Silver, Lead. (Not necessarily in that order of importance.)

Ambrit, you’re a marketing genius. You’d better trademark that name before someone else does :-]

When the digital system is down, it may be worth considering batch processing of digital transactions; then, when the digital system is restored, merchants and banks can deal with it at their leisure. Yes, it is risky for merchants & banks, but if the digital systems are down for an extended period of time, how wise is it to expect society to pay cash?

Besides cash, the problems of a digital system also applies to identification: digital id and/or biometrics. Again, if the digital system is down for an extended period of time, what…. society just stops?

Cash and ID should always have a non-digital alternative…. IMO

This r us an object lessor on single points of failure. These failures will continue until the single points are eliminated, or parallels but different systems are implemented, which is probably never, because because it costs too much..

Think about it – if any digital object can be altered, deleted, blocked or otherwise manipulated, then so can digital cash.

That’s why people flock to physical forms of currency in times of crisis – gold and silver being the most popular ones. It’s no different now, people are acquiring more gold and sliver as they lose confidence in their currencies and because of legitimate fears of government interference and control.

The Crowdstrike outage did just that – it struck the crowd, and reminded everyone of the risks!

But unless you actually hold the gold in your own hand/property, it may just as liable to be unavailable to you in the event of a systems crash. And then you have the problem of security.

There are quite a few accounts of gold not being useful in times of distress.

At the time of the Vietnam War, women of modest or more means would have some of their wealth in gold beads.

Women who were in the countryside and needed to buy food or medicine or pay off potential rapists got way way less than the value of the gold in those trades.

Similarly, in periods of distress in Argentina, the sort of gold that traded were small items like gold rings where the value could be reasonably guesstimated. Bigger pieces, regardless of purity, were regarded with suspicion and hard to trade even when they did trade.

From the Vorhies thread, it sounds like the issue was that the Crowdstrike driver was reading a list of pointer addresses from a deployed data file and dereferencing them. One of them was wrong and pointed to a critically protected area of system memory, which is DEFCON 1 territory for Windows and it correctly shut itself down in response.

Vorhies argues (and I somewhat agree) that the bug isn’t so much the fact that one of the data points was wrong, but that the driver works this way in the first place. It would certainly be appallingly bad practice in most languages, but C++ just kind of forces you to work that way, so it’s hard for me to judge. That said, I would hope that there have been many tools and protections created to guard against this kind of thing since I last used the language many years ago (and his thread suggests there are). Any C++ developers in the commentariat? Is reading a list of pointers from a remotely delivered data file and dereferencing them as dodgy as I think it is?

If you are conspiracy minded (which Vorhies definitely is, if you look at his feed) you could add that it makes a fantastic vector for an injection attack if the data file is compromised somehow (which is true) and then speculate about various state and other actors that with relationships to Crowdstrike who might like to make use of that. That’s getting into tinfoil hat territory for me since it would be immensely risky and very difficult to conceal if it went wrong, but there’s no question the vulnerability exists.