Yves here. As the saying goes, “If you must forecast, forecast often,” I assume to increase the ability to cherry pick times when you got it right. As far as the election is concerned, recall that in 2016, conventional wisdom had it that a Trump win would produce a market swoon. It did but only very briefly, and then reversed into a very nice rally.

There is a school of thought among hard-core conservatives that “they” will crash the indices if Trump wins, both to take the air out of elevated prices and to make it more difficult to govern. But since big business appears to be getting more comfortable with Trump coming back to office, “they” may not have enough in the way of followers to execute their stock swan dive scheme.

A more likely event would be some sort of Democrat-launched October surprise….say a war? Could Bibi hold off from his plan to attack Lebanon that long, for instance?

By Marco Albori, Alessandro Moro, and Valerio Nispi Landi. Originally published at VoxEU

Equity markets are already expecting an increase in volatility before the US presidential election. This uncertainty may add to the already high macroeconomic uncertainty. This column analyses the economic implications of changes in US election odds through the lens of financial markets. A higher likelihood of Trump’s election (1) increases the volatility in the US bond market, (2) decreases equity market volatility and boosts stock prices, and (3) reduces the oil price. Thus, financial markets expect a Trump administration to be relatively more market-oriented than Biden’s, less focused on environmental concerns and on the sustainability of public debt.

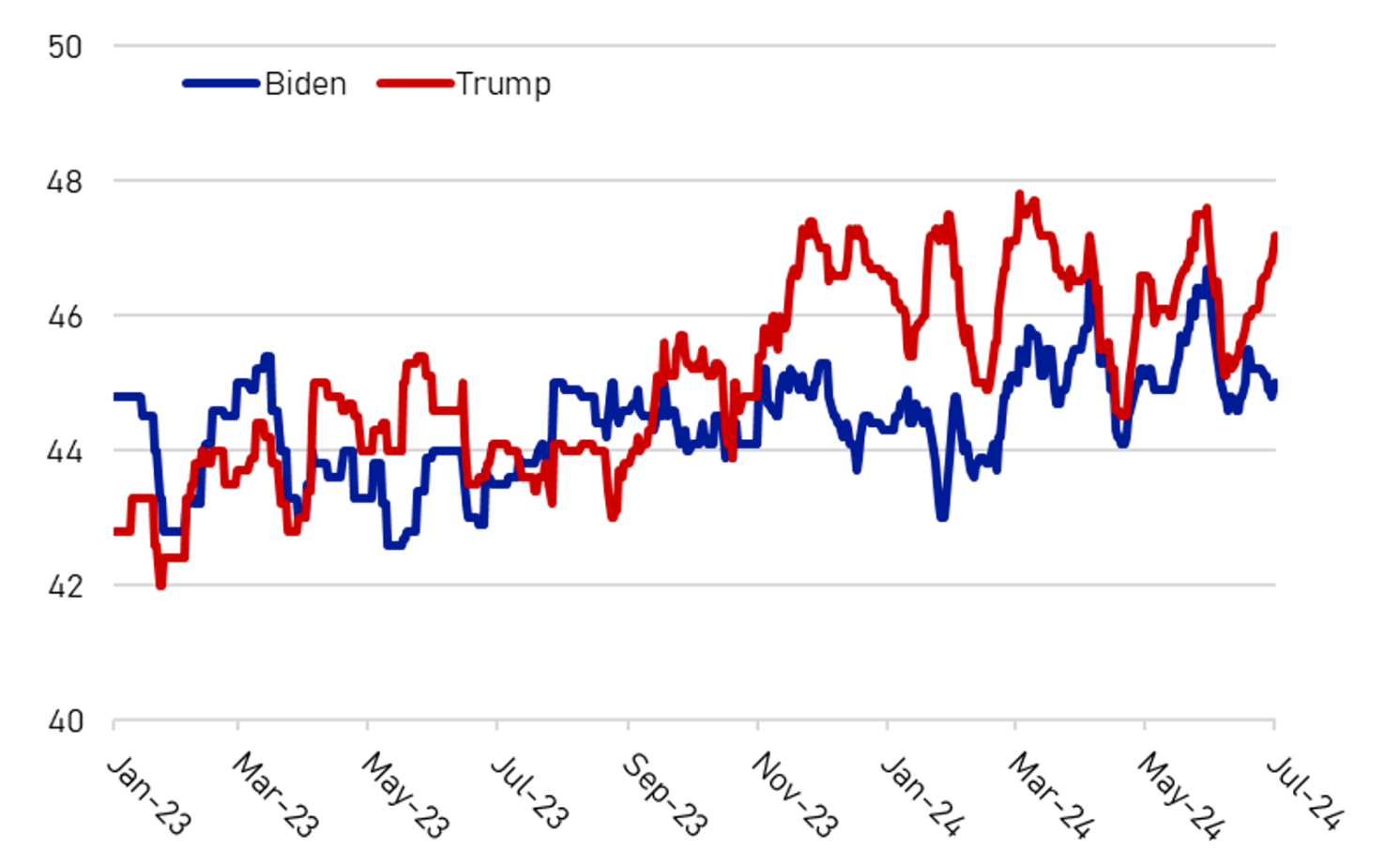

The US presidential election that decides between Joe Biden and Donald Trump takes place on 5 November 2024. Platforms and personas of both candidates offer ample reasons for markets, as well as specific segments within them, to react to news in anticipation of the probable outcome of the vote. 1 The candidates’ agendas differ in key aspects, for instance regarding energy, fiscal, and trade policy: Biden plans to reinforce the US green transition and increase taxation on corporations and high earners; Trump plans to strongly reduce environmental spending, introduce incentives for more domestic oil and gas production, and reduce tax rates. Moreover, Trump has already proposed to tighten the US tariff policy, especially toward China, even beyond the recently introduced tariffs on goods connected to clean energy, semiconductors and metals. These differences imply uncertainty in future policies in key economic areas. As the gap in the polls between the two candidates is not large (Figure 1), there is ample room for markets to form and update views on most likely outcomes; as shown in Rodden et al. (2020), the combination of close elections and polarisation brings about large increases in economic policy uncertainty in the US.

Figure 1 US electoral polls calculated as averages across pollsters (data in per cent)

Source: Bloomberg. Last observation: 1 July 2024.

We show that election-related uncertainty is indeed increasingly priced in futures contracts. Equity markets expect an increase in volatility around the election date. Bilateral exchange rates vis-à-vis the dollar also feature a higher expected volatility around the election date, especially for currencies of countries more exposed to the risk of a tariff war and tightened immigration policies in the case of a Trump re-election.

We then set up a daily structural vector autoregressive (SVAR) model to estimate the effects of the increase in the probability of a Trump re-election on a wide set of financial variables, finding that the response of most indicators is consistent with Trump’s proposed policies: more market-oriented, less environmentally friendly and less tilted on public debt sustainability. Our contribution, using financial instruments to gauge investors’ assessment of political risk and exploring its implications from a macro-finance standpoint, fits in the literature on the effects of political uncertainty on financial markets (Moramarco et al. 2020, Pástor et al. 2014, Veronesi and Pástor 2017).

Volatility Related to the US Election

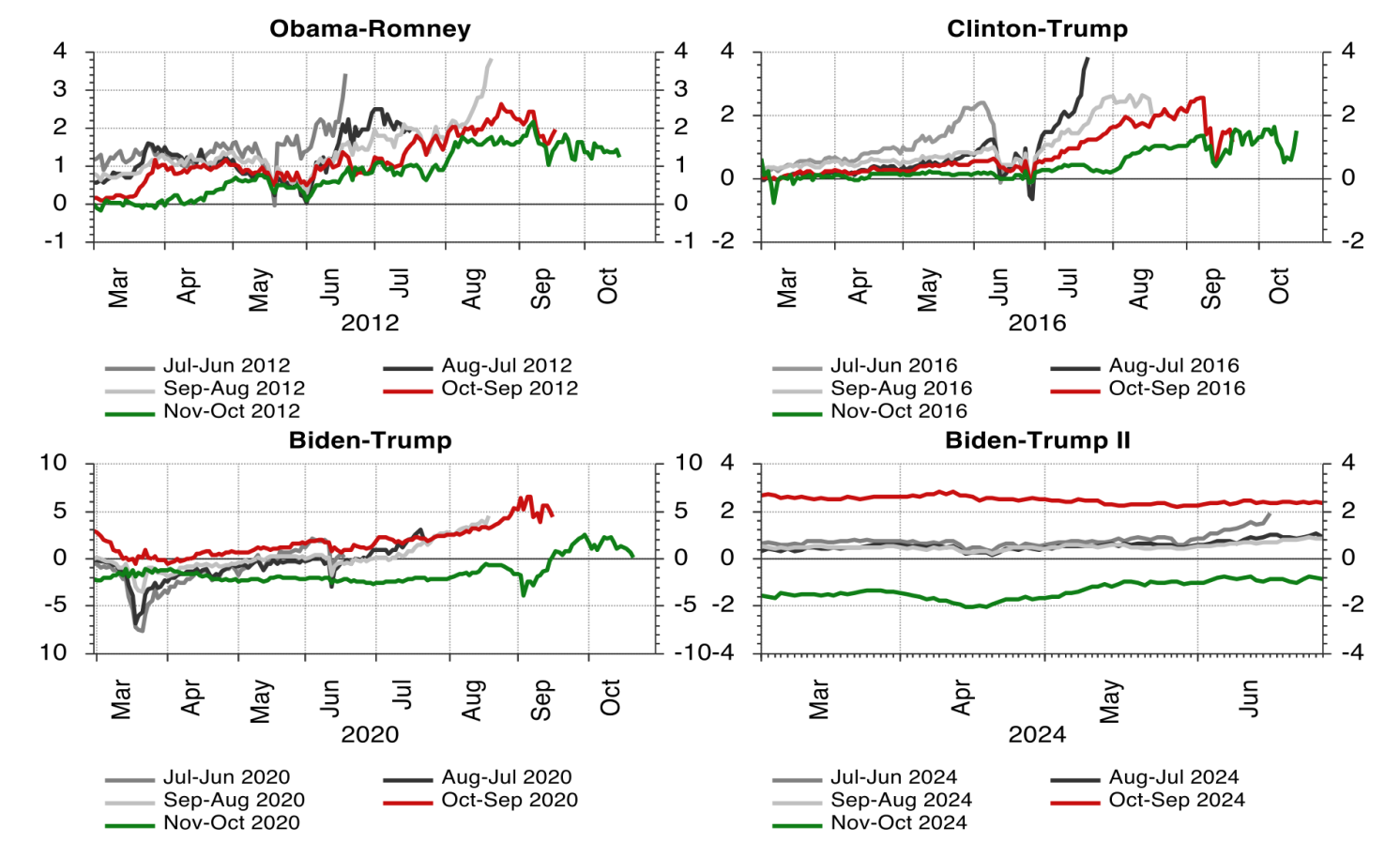

First, we describe some stylised facts on the volatility in financial markets around the next US election date, an approach inspired by the analysis of Kelly et al. (2016). Equity markets are expecting an increase in volatility around the election date. Compared to the Obama-Romney (2012) and Clinton-Trump (2016) electoral competitions, US election risk has emerged earlier. Since March 2024, futures contracts tied to the VIX — measuring expectations of near-term swings in the S&P 500 equities benchmark — have been pricing-in a rise in market volatility in October (with respect to previous months) and a fall after the election date in November (Figure 2). 2 The same dynamics of expected volatility stood out in 2020, when Biden and Trump first competed for the presidency. 3 Instead, in 2012 and 2016, markets started to expect a comparable rise in volatility in October only three months before the elections, and they did not anticipate a fall in November.

Figure 2 Implied volatility in equity markets (in percentage points): Comparison across electoral years

Note: The figure shows the differences between the price of futures contracts on the VIX expiring in two consecutive months. The futures contract expiring on a given date captures the implied volatility over the subsequent 30 days.

Source: Refinitiv. Last observation: 1 July 2024.

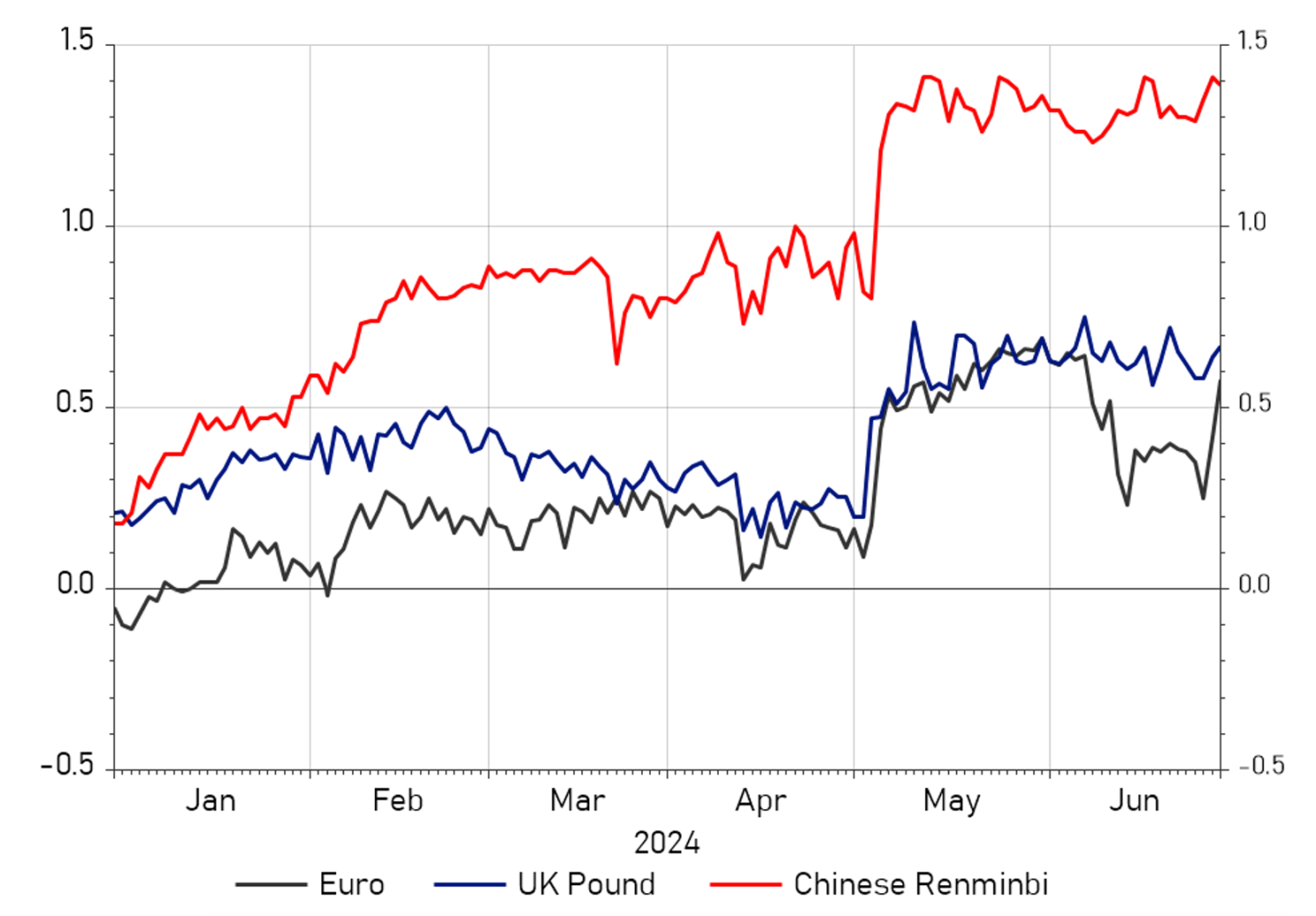

Currency markets (FX) also expect high foreign exchange volatility around the US vote. 4 To measure this phenomenon, we take the implied volatility extracted from options expiring in six months (i.e. after the elections) on the US dollar exchange rate to the main currencies, minus the implied volatility extracted from the same options expiring in three months: a positive difference emerging in the latest months (from May 2024 onwards) reveals expectations of an increase in foreign exchange volatility close to the election date. 5 Expected foreign exchange volatility around the US elections is particularly pronounced for the Chinese yuan, the country more exposed to the risks of a potential tariff war (Figure 3). Nonetheless, the expected increase in volatility for the euro and the sterling vis-à-vis the dollar has also been on the rise since May. A possible rationalisation of these results is that a Trump victory arguably implies a more protectionist trade policy: Trump has already proposed a 10% import tariff across-the-board and supposedly he is also considering a 60% tariff on imports from China.

Figure 3 Implied volatility in currency markets (data in percentage points)

Note: difference between the implied volatility extracted from the six-month and three-month options on USD bilateral exchange rates.

Source: Refinitiv. Last observation: 1 July 2024.

Effects of a Likely Trump Re-election on Financial Markets

To assess the impact of an increased likelihood of a Trump re-election on financial markets, we estimate a nine variable, daily VAR model on the 3 January 2023 to 1 July 2024 period. 6 We include the following variables: the Citigroup US macro surprises index to control for the state of the economy; the logarithm of Trump’s election likelihood, computed as the ratio between the voting intention for Trump and that for Biden, which is our key variable of interest; the logarithm of the Brent oil price; the logarithm of the Move (which measures bond market volatility); the logarithm of the VIX (which measures equity market volatility); the ten-year government bond yield; the logarithm of the S&P500; the logarithm of the US nominal effective exchange rate (NEER; an increase denotes a US dollar appreciation); and inflation expectations (five-year, five-year forward inflation expectations).

We identify a shock to Trump’s election likelihood using a recursive ordering based on short-run zero restrictions (Cholesky decomposition) with Trump’s election probability ordered second after US macro surprises. The identifying assumption is that the Trump’s election likelihood is cleansed by the daily changes in US macro surprises because those may lead voters to revise their decisions in the polls while, conversely, these surprises are exogenous with respect to election odds. We further assume that financial markets can respond to elections odds within the same day whereas election odds may be affected by financial developments only with a lag.

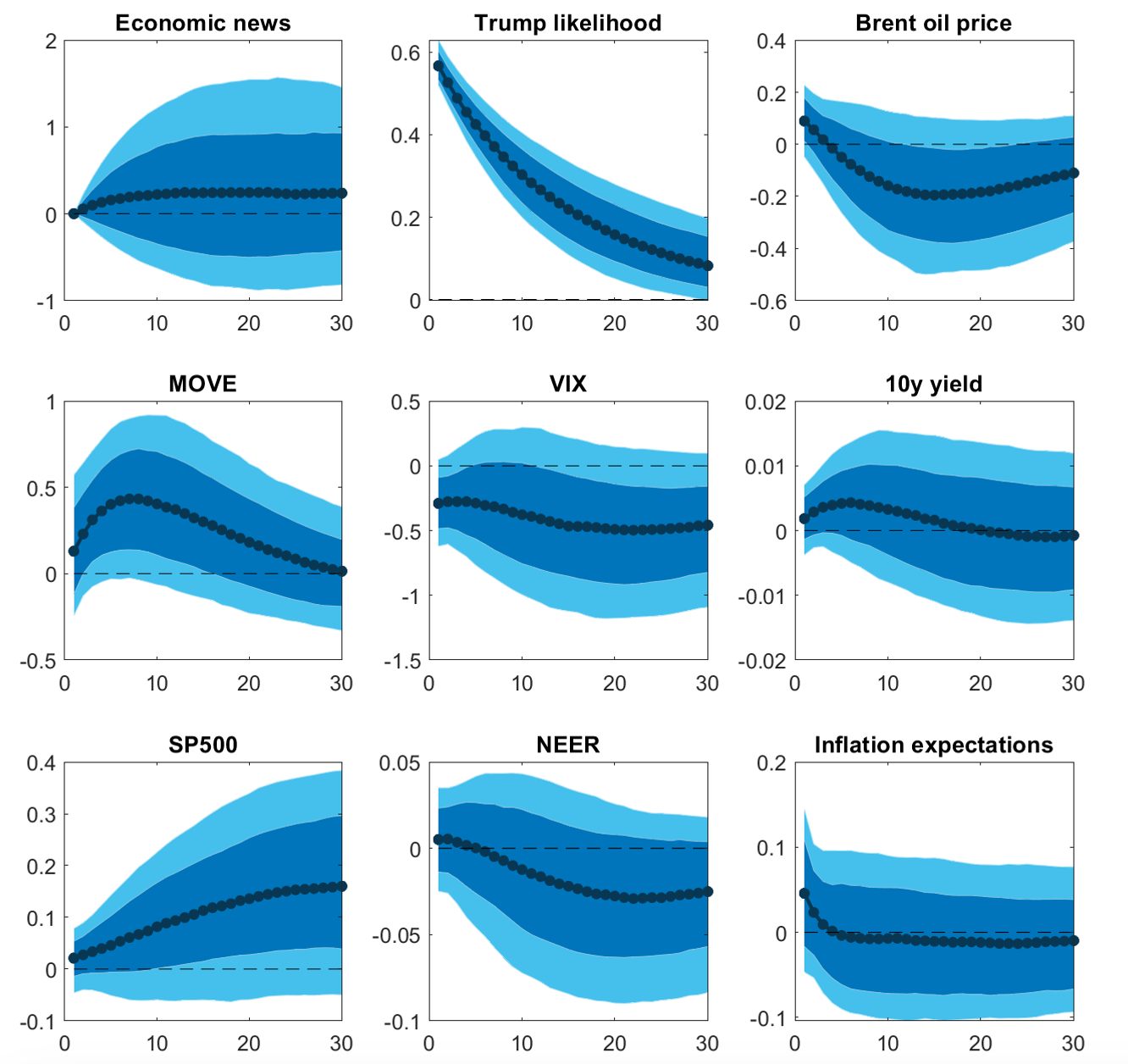

We find that a one standard deviation shock to Trump’s election likelihood, which corresponds to an increase in the odds by about 0.6% on impact (Figure 4), leads to an increase in the volatility of the US bond market: this might suggest that markets are pricing-in a higher credit risk, perhaps because of expectations of higher budget deficits should Trump be elected. Instead, a higher probability of Trump’s election is associated with a lower equity market volatility and higher stock prices, which is coherent with the more pro-market attitude of the Republican candidate.

Figure 4 Effect of an increase in Trump’s election likelihood

Notes: This figure shows daily impulse response functions and 68-90% confidence intervals. Responses are in per cent, except for the ten-year yield (percentage points), and economic news (index).

The shock also leads to lower oil prices in line with higher expected supply of fossil fuels, likely reflecting Trump’s scant interest in environmental matters, his scepticism of renewable energy, and a positive attitude toward strengthening the domestic commodity industry. 7 Finally, the effects on the exchange rate and inflation expectations point to a small depreciation of the US dollar.

In a different specification we also include, one by one, the stock indices for individual sectors. We find the semiconductors, software, and defence-related industries to be the sectors most positively affected by a higher Trump likelihood of re-election. Probably, these are the strategic sectors that will benefit more from a higher degree of protectionism under a new Trump administration. We also estimate a model including corporate spreads (both on investment grade and high-yield bonds) and find that an increased likelihood of Trump’s election leads to higher spreads. This might be perhaps the result of expectations of higher budget deficits, increasing perceived risk in the sovereign segment and inducing a repricing of corporate bonds, consistent with our baseline results.

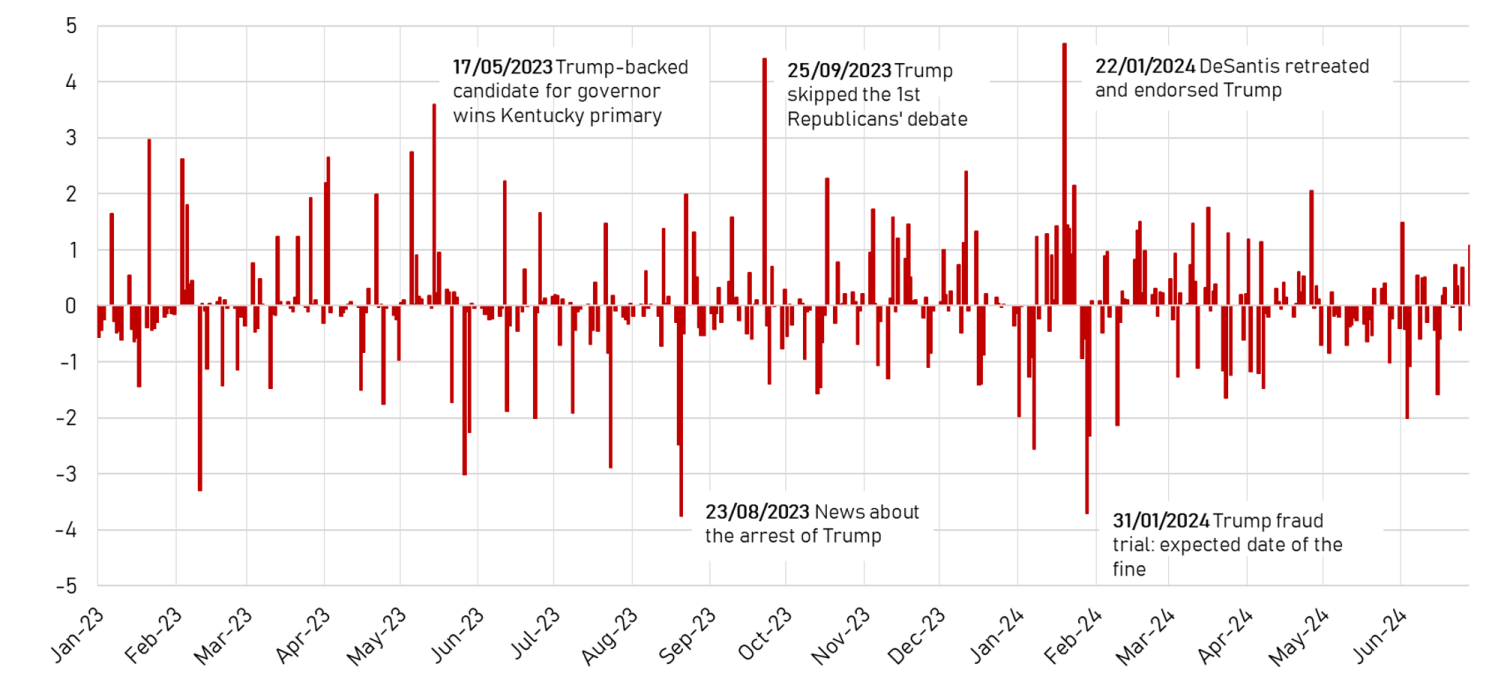

Figure 5 Trump’s shocks retrieved from the structural vector autoregression (SVAR) model

Last, we check whether the identified shock captures relevant news concerning the unfolding of the electoral competition. We plot the series and label some of the largest identified shocks (Figure 5). These spikes correspond to news concerning either the Republican campaign (when Ron DeSantis dropped out the presidential race in January 2024), or Trump’s legal issues (his arrest in August 2023, and news about the fine concerning a fraud case in January 2024).

Authors’ note: The opinions expressed in this article are those of the authors and do not necessarily reflect the views of the Bank of Italy.

See original post for references

Since it’s obvious that Joe B. is not electable and Democrats will not win in November, then PPT – the price protection team can step back, relax and let the market works it magic without any manipulation. Moreover, it’s the perfect time to flush down all the hidden issues into the open and be done with it. Apparently about 50% of small cap stocks are technically insolvent, so let the market sort it out.

Humans are often quite irrational, and markets, as constructed by humans, reflect this. The mass media frenzy, the contrived election spectacle and drama just add to the circus and heightened emotions. Especially in the post TBTF era, the de-regulated, institutionally corrupt nature of markets today, I would say this is even more true than before. Most people have been indoctrinated by academic econ textbook ideological fiction, and still believe markets operate as described. In practice, markets appear to be manipulated and therefore corrupted.

I would argue that there will be little substantive policy change when/if the DT becomes puppet emperor again – just like last time. There will be a lot of bloviating and hot air, but not much else. There was very little substantive policy change in reality during DT’s first term, and the same when JB took over. JB even said don’t expect any change. .

I don’t see how DT or any other elected puppet emperor can affect market fundamentals in physical terms, except for launching massive economic warfare (so-called sanctions) or a military confrontation. As we know, Congress and legislation has more affect on the fundamentals of market performance. However, it is perception and expectation that counts, and this is based largely on emotion and a cult-like belief in political ideology. It looks like there is more emotion than reason involved, but I’m no psychologist.

Quoth the Emperor: “Drill Baby, Drill.” The “Markets” may not change, but the rest of

us groundlings are gonna be in deep trouble.

It seems clear that, short of World War III (not that I’m ruling that out), the most impactful government decision to be made now is to retain or relax the Fed’s stranglehold on current interest rates.

I’m no expert, so correct me if I’m wrong. But I had the impression that Trump’s jawboning kept Powell’s urge to raise rates in check, up to and including threats to strip Powell’s independence and remove him that were decried as a dictatorial power grab, and that ended when Biden took over.

If that’s so, the question now is: Is this the same Trump, or is he now a domesticated pro-corporate beast who won’t do it again?

I think you’re adding too much here. Jerome Powell, and six other individuals are members of the Fed Board of Governors. Each member is picked by the president and approved by the Senate. Separately, among the 7 board members, the Fed chair and two vice chairs are chosen by the president and confirmed by the Senate.

It’s important to note that Powell is not the boss but as chairman he is only the public face of the Fed. The Fed conducts business like the Supreme Court, that is, the majority of governors or four of the seven members will decide the issue and not Powell alone.

The governors each have a 14 year term, the chairman 4 years. I have no idea how Trump could fire Powell without creating a crisis. He can replace Powell at the end of his 4 year term with a new chair but Powell will still remain on the board.

I expect Trump will be predictable, he’ll take credit for good news and blame Powell for any bad news, especially around interest rates and maybe a weaker dollar because Trump wants to push exports. Whoever Trump has in mind at Treasury is also crucial.

Thanks. This sounds better informed than I am.

Oh yes, the Fed, how could I forget? it is the Fed (representing the interests of oligarchy) that has most influence, in general, on markets. The DT talks so much BS; contradicts himself so often, and displays such a profound level of (willful) ignorance, that it is hard to take seriously, I doubt it changed Powell’s mind.

Donald Trump calls for Taiwan to ‘pay’ for its own defence – Financial Times

https://archive.ph/Sftpf

Shares of Taiwan Semiconductor Manufacturing Company, the world’s largest chipmaker by sales, dropped 2.4 per cent after the Republican nominee said in an interview with Bloomberg published on Tuesday that Taiwan “stole our chip business” and “should pay [the US] for defence”, referring to the implicit security guarantee provided by the American military.

“You know, we’re no different than an insurance company,” Trump added. “Taiwan doesn’t give us anything.”

Interesting times…indeed…

Donny has a different definition of “transactional” then much of the establishment oligarchy.

“Taiwan doesn’t give us anything”, except for the 92% of chips made there.

The betting should not be on whether Trump wins the election, but how big of a landslide his win is going to be. And, especially, if he gets the Republicans both houses of Congress, which would be really consequential.

Biden is cooked, but by waiting so long to acknowledge that and find a replacement, the DNC has booted away any small chance it had of retaining the presidency. If they convincingly lose both the House and Senate, giving us a one-party state, they should be disbanded. I’m not sure the markets are factoring in a sea change like that.

What difference does it make? Like we have a choice. The media controls the discourse, control who appears on “debates” we have no say in the contrived spectacle

I don’t think the DNC really cares about winning, the two parties seem content to hand the ball back and forth every 4-8 years. It’s how they raise money.

If Trump’s AG lawfares their top echelon into the dirt, they may change their minds. The playbook always seems to be that the Dems let the genie out of the bottle and then the Republicans get full use out of it.

Hmmmmm…….trump has never managed to “win” with a majority of voters. Even HRC got 3 million more voters than he did. What I am seeing, is that outside the looney far right bubble, trump has become rather tiresome.

Even so, I hesitate to predict a likely winner.

Biden or Trump. Is that the best the Oligarchs could get for their money?

What mattered in 2016?

Grossly underestimated the cheating needed in some districts, and severely over cheat…….

2024, will under perform in all around cheating.

Actually, the oligarchy would be hard pressed in finding two more subservient candidates for the job.

“Heads we win, tails you lose, baby!”

Anyone, and I mean anyone, who thinks they can predict the future better than flipping a coin is full of it — and this is well documented (other than meteorologists for the 40 hours after they run the computer models).

That said, no matter how this plays out, the investing strategy is to be “the reaction to the reaction”. Almost certainly the knee-jerk reactions will over play their hands and that will be an easier way to make some money.

Yep. I remember in 2016, US stock futures dropped by more than 800 points when it became apparent that Trump was going to win the election. And in response, illustrious “economist” Paul Krugman wrote the following (at https://www.nytimes.com/interactive/projects/cp/opinion/election-night-2016/paul-krugman-the-economic-fallout):

“It really does now look like President Donald J. Trump, and markets are plunging. When might we expect them to recover? … If the question is when markets will recover, a first-pass answer is never.”

The actual answer, of course, was less than 8 hours after markets opened. This is one of the many reasons I never listen to Krugman.

“Anyone, and I mean anyone, who thinks they can predict the future better than flipping a coin…”

Forgive me, but were this remotely correct there would be no science, and indeed there is science.

I think there is a difference between using science to understand deterministic processes vs. random or human behaviors.

Weather prediction is one example. We can predict the weather with some skill out to 7-10 days but after that it all falls apart.

Markets being based on human behavior are fundamentally irrational.

Did I misread this article, or did it say that Trump is perceived as more pro-market than Biden?

Biden’s a dangerous social democrat leftie commie running around nationalising everything and destroying the free market? Wow, if he ran on that ticket he could sweep the country. (Or get shot.)

Could someone explain to we commoners the importance of America’s Presidential Elections in 2024? Both parties are knee-deep enthralled by the Oligarchs. It’s the Oligarchs who control the US Financial System. That includes The FED.

Whichever Party wins serves the whims of those Capitalists, while negating millions of US Citizens who are severely in debt to Big Creditors; including The Rentier Class of buzzards via Energy, Technology, Health Care, and Real Estate. Hundreds of thousand homeless, millions without jobs, millions with part-time jobs that can’t possibly survive the costs of living in America.

Let’s make a comparison: China’s government largely keeps control of the money sieve while paying close attention when one of their Billionaire gets out of line. China produces vast amounts of products and largely serves the need of its citizens, while in America, our citizens are in last place to be served.

Our upcoming Election will serve no benefit to the common man in the US.