Yves here. This factory building trend, sighted by Wolf Richter, bears watching. It’s a concrete demonstration (pun intended) that there is a serious effort underway to “reshore” manufacturing. However, desire and spending do not necessarily translate into results. Recall the great hyped Foxconn factory in Wisconsin, where they sucked lots of subsidies out of the state and then punted. From CNBC in 2021:

Taiwan electronics manufacturer Foxconn is drastically scaling back a planned $10 billion factory in Wisconsin.

Under a deal, Foxconn will reduce its planned investment to $672 million from $10 billion, and slash the number of new jobs to 1,454 from 13,000.

And remember, this is an established player, as in Foxconn knows how to start up and operate factories. This is not Americans who might be scrambling to find desperately needed factory floor supervisors and higher level manufacturing managers.

Wisconsin did at least restructure the deal and clawed back a lot of the subsidy commitments.

Similarly, Alexander Mercouris has reported long form on the failed US effort to increase 155 mm shell production. In addition to many mishaps which he recounted long form, the bottleneck remains a lack of gunpowder. There seems to be only one factory, in Poland, that makes TNT. The US had decided to move off TNT because environmentally nasty, but the replacements never worked (not sure because they failed as explosives or were too hard to produce at scale and/or reasonable cost).

Admittedly, it’s a somewhat different type of manufacturing, but I was a paper mill brat and my father ran paper mills. Coated paper is very fussy. The coating, in his day mineral clay, is applied when the paper is wet. The paper machines have to operate at very fine tolerances or else the paper breaks, causing costly downtime.

The mills have to run 24/7 except for scheduled maintenance because the capital costs are high.

My father ran startups and turnarounds because hardly anyone in the industry could execute them. He eventually became the head of manufacturing at one of the major papermakers.

The rule of thumb was a successful startup (of a single “machine” as in production line, which cost ~$500 million in 1970s) took two years and cost 20% of the capital costs. An unsuccessful startup was a running money sore.

In other words, erecting factory buildings is the easy part. Stay tuned as to how high the successful opening and production rate is.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

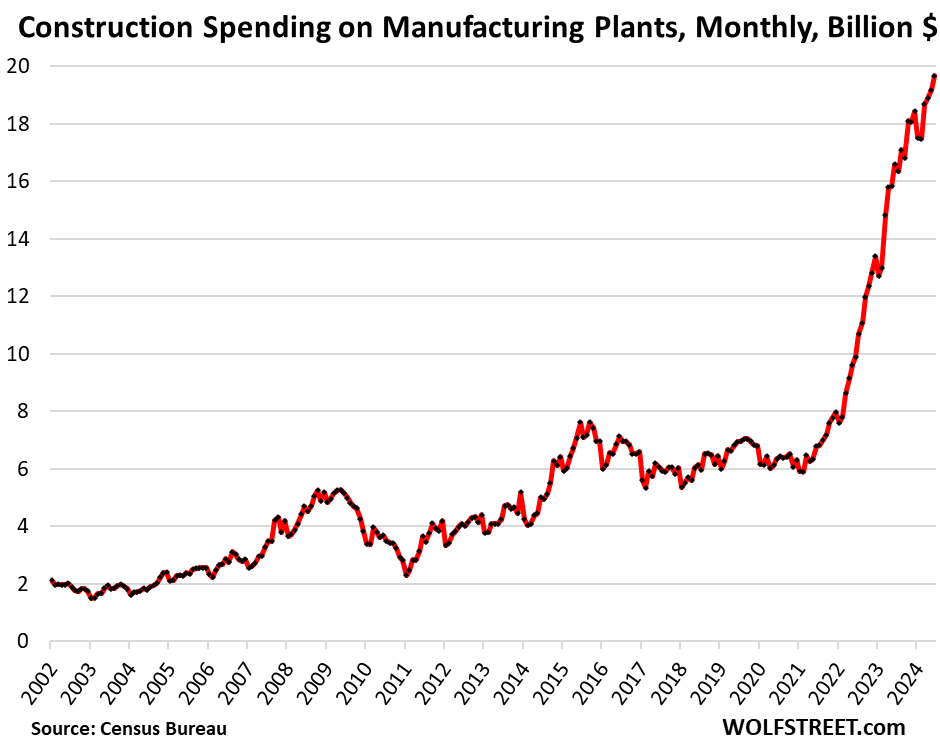

Companies invested a record $19.7 billion in June in the construction of manufacturing facilities, up by 18.6% from the already surging levels in June 2023, up by nearly 100% from June 2022, and up by 209% from June 2019, according to the Census Bureau today.

The investment totals here only cover the actual construction costs of the facilities, not the costs of the manufacturing equipment and installation that can dwarf the construction costs of the building. The total cost of a big chip plant might reach $20 billion, but the construction costs are the smallest part of it. So the total amounts invested in manufacturing plants, including the equipment and installation, are much higher. But here, the amounts only refer to the construction of the plants, and can be seen as a directional indicator of total investment in manufacturing.

In addition to the construction boom of semiconductor plants, a large number of other manufacturing plants have been announced, and continue to be announced.

The explosion in factory construction that started in the second half of 2021 was one of the changes that came out of the pandemic when America’s scary dependence on China became apparent in massive shortages of all kinds of goods, including semiconductor shortages, and unbelievable supply-chain and transportation chaos, that caused corporate America and policy makers to rethink the strategy of endless globalization.

The CHIPS Act, signed into law in August 2022, was part of the movement. While the first awards have been announced, there is lots of stuff left to do, including due diligence, and the cash hasn’t been disbursed yet. That’s still to come.

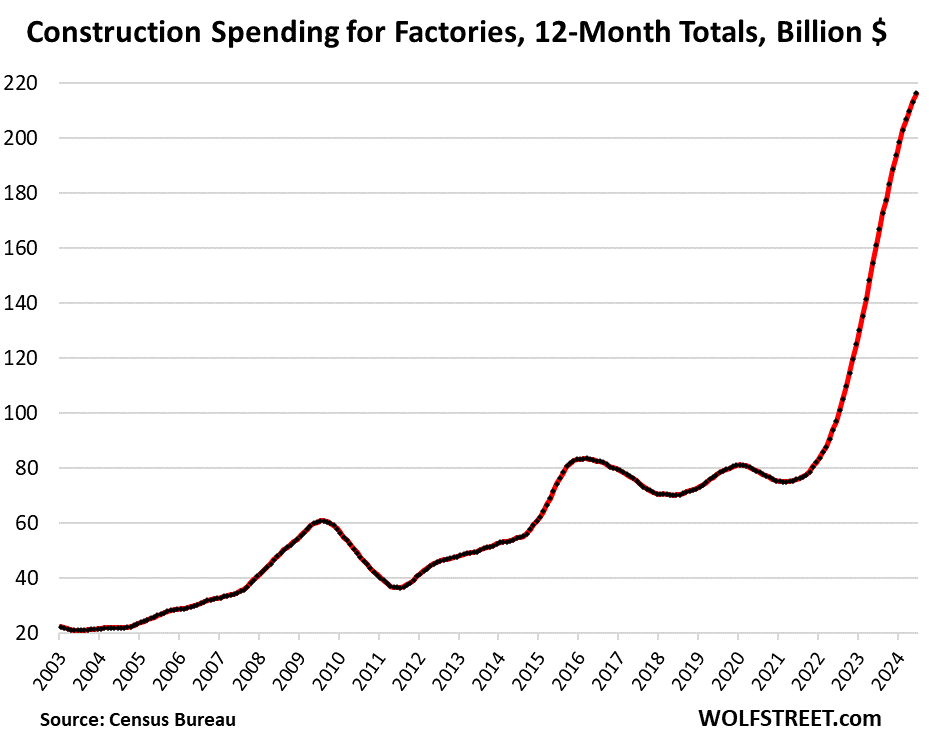

The 12-month total of investment in manufacturing plants jumped to $235.5 billion, up by 19% from the same period a year ago, up by 100% from two years ago, and up by 217% from the same period in 2019.

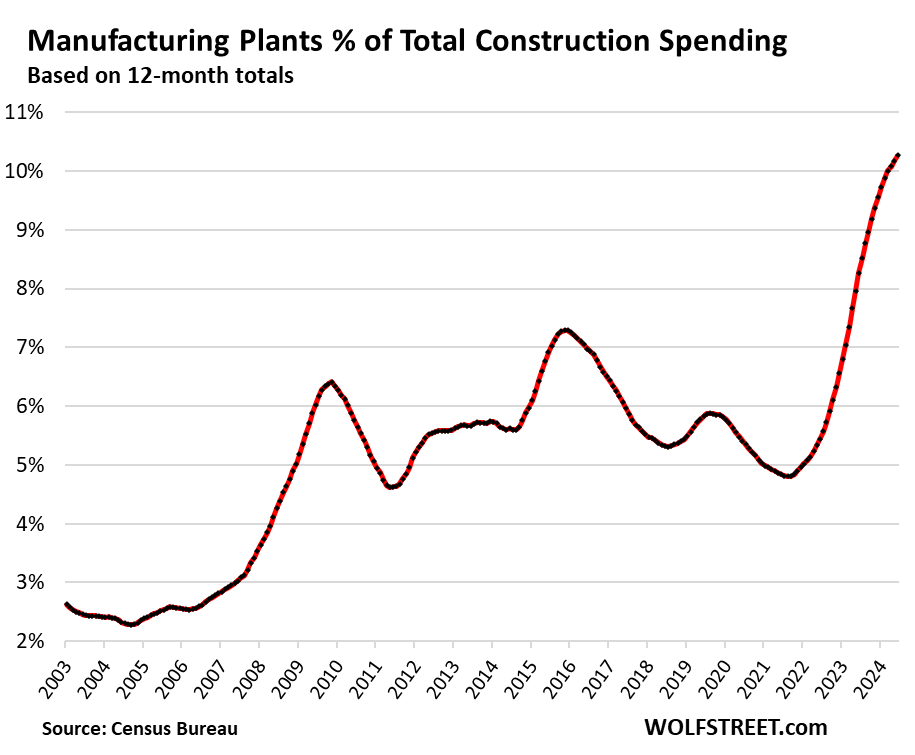

Construction spending on manufacturing facilities now accounts for over 10% of total construction spending in the US, residential and non-residential, from single-family houses to roads and power plants.

It’s all based on the principle that industrial robots cost the same in the US and China, that manual labor is a much smaller cost component in modern automated manufacturing, and that transportation costs (which spiked during the pandemic) and loss of Intellectual Property (IP), which is a given in China, and other risks have to be added to cost equation.

In addition, the increasingly complicated and stressed relationship between the US and China has exposed for all to see that the reckless dependence by US companies on production in China is a fundamental risk, not only for the companies, but also for national security.

No one is going to build a factory in the US to make low-value products, such as T-shirts. It’s all focused on complicated high-value products, such as motor vehicles, chips, electrical and electronic products, heavy components and equipment, etc.

Inflation in Construction Has Abated

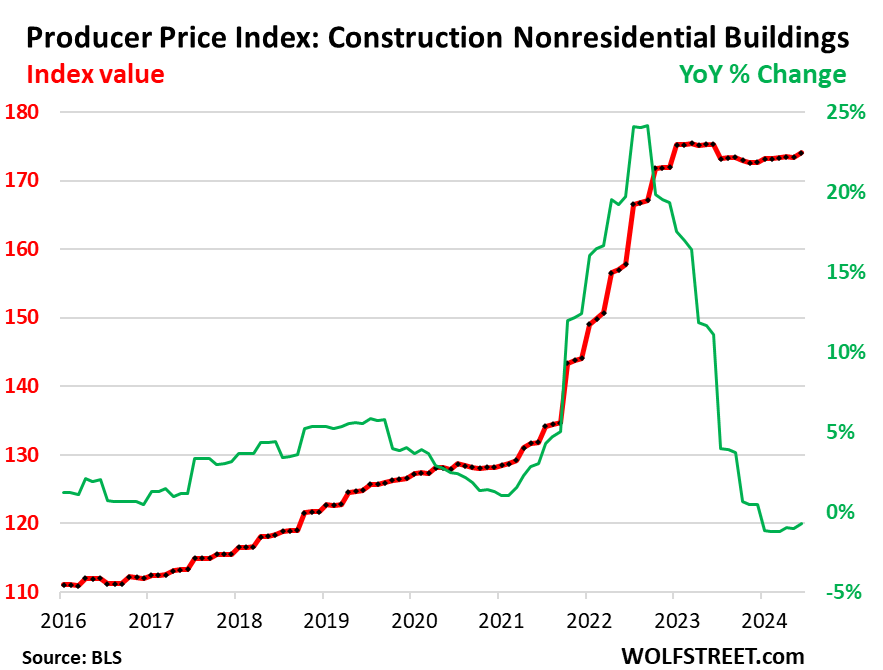

The Producer Price Index for construction costs of nonresidential buildings, after blowing out in mid-2021 through 2022, started plateauing in early 2023 and has remained roughly unchanged since then (red in the chart below).

On a year-over-year basis, the PPI for nonresidential construction has been flat to slightly negative since late 2023, after having spiked by as much as 24% in mid-2022 (green).

I am certainly not an expert, but it seems to me this is probably driven by dumb institutional money looking to make a formula allocation to finance commercial real estate development. Office and multifamily are now way overbuilt, and mall-scale retail is hardly a thing anymore, so industrial is the least toxic looking option. We’ll see in another year or two whether the producer companies actually start filling these shells with expensive equipment and skilled operators.

I’ve been building boxes since 2018 and here in Denver light industrial is collapsing because distribution is drying up. Would love to find some manufacturing but they are still few and far between or happening in cheaper markets. I managed to do a manufacturing job in 2019 then again in 2020 and they were much more fulfilling. Last year we built 1.5 million square feet of spec distribution and that developer hasn’t leased a single space in it…I quit and now on my own doing TIs instead. I can tell you that many of those distribution spaces were not built with enough electrical or gas load to take on manufacturing without having to go back to the utility provider and spending a fortune lol.

To a certain degree I think this is part of a worldwide phenomenon, where increasing concerns about globilization has led to a huge (usually government led) increase in direct industrial investing. Its not just China – countries like Indonesia and Vietnam are investing enormously in direct industrial capacity in both ‘old style’ industries like steel production as well as all trying to hop on board the EV/battery train.

The likely result will be a huge glut in manufacturing capacity in the next major downturn. There will be winners and losers, but a likely outcome will be a major increase in protectionism worldwide. While trade is often seen these days as a China vs US thing, its a lot more complicated – many significant Asian countries are trying to follow the Japan/ROK/China playbook and are not happy about facing what they see as unfair competition. EU/US trade is still enormous and particularly important to Europe. The problem of course is that everyone wants to export, but nobody wants to import. A vast amount of money is at stake and its hard to escape the conclusion that a lot of countries are banking on someone else buying their surplus capacity. Someone will get a nasty surprise.

One point in the US’s favour – while there has undoubtedly been a loss of institutional knowhow in US production, relatively high wages and easy immigration allows the US to import know-how at a scale no other country or region can match. There is a huge worldwide industry involved in the process of getting manufacturing from greenfield to production (lots of established companies are quite bad at this, and they know it, so they hire in expertise for latchkey projects), and that industry is by necessity highly mobile. The engineers and technicians involved in this are well used to hopping on planes to spend a couple of years somewhere different to set up yet another new factory/refinery/chemical plant or whatever. They will be much in demand over the next few years, and I suspect many of them will find themselves in the US.

We treat professional immigrants very badly. I do not expect this process to go well.

Semiconductor factories emit enormous amounts of CO2, deplete water sources for farmers, cause health problems for factory workers, and pollute the waters around the factories with heavy metals. Is America ready to accept that?

https://www.theguardian.com/environment/2021/sep/18/semiconductor-silicon-chips-carbon-footprint-climate

As long as printing money remains our biggest industry, little real production would seem worthwhile to do. Our expected trade deficits are now $4 trillion/year. That represents free stuff right there, not just through cheap foreign labor but the materials, the transport, the insurance – all of it – for free. You can’t compete with free even if that means living with a risky supply chain.

As an update on the Foxconn debacle, Microsoft has stepped in and is constructing a datacenter and training facility on part of the land. The effort is led by Microsoft President Brad Smith, who’s originally from Appleton, WI and is imho sincere about making a significant, long term investment in his home state. Microsoft also promised on-the-job training for 100k workers as part of the deal. Microsoft is buying up parcels and has actual blueprints approved for what the final project will look like. I’m no Pollyanna but this looks like a pretty good result for what was otherwise a total boondoggle. There are a series of stories in the Milwaukee Journal-Sentinel describing just what was going on at Foxconn. It seems there was a change in their business plan that was not communicated to Wisconsin officials and the people in Taipei just thought they could wait it out. One theory is that they counted on the statute of limitations on fraud running out, when they could just cut and run.

https://www.jsonline.com/story/money/business/2022/04/07/foxconn-stalling-development-dodge-30-million-annual-tax-bill/7266263001/

One thing that frustrates me in these discussions is that subsidies almost always take the for of tax breaks. If the project gets called back or canceled the state doesn’t loose anything because the money they gave away was only potential revenue, not actual cash. Making it sound like Foxconn somehow was going to cut and run with a bunch of state cash is an absurd distortion of reality. The state just didn’t get as much income from the project as they expected. Income they never would have received if the project had not happened.

Oh no, that would never happen, political bribery is legal, but our elected officials would never give public resources for private gain to major “donors”. That only happens in those evil “other” countries. The USA is a bastion of Free Markets and Perfect Competition doncha know!

Governor Scott Walker was a statist stooge. That’s how they generally roll up there, Eddie Munster, etc. Trump didn’t even have to insult him in the 2015-2016 primary debates.

US manufacturing productivity has been declining since 2011, or for the last 12 and a half years

https://fred.stlouisfed.org/graph/?g=naRn

January 30, 2018

Manufacturing Production and Manufacturing Productivity, * 1988-2024

* Output per hour of all persons

(Indexed to 1988)

https://fred.stlouisfed.org/graph/?g=m2mx

January 30, 2018

Manufacturing Productivity, * 1988-2024

* Output per hour of all persons

(Percent change)

https://fred.stlouisfed.org/graph/?g=m2mB

January 30, 2018

Manufacturing Productivity, * 1988-2024

* Output per hour of all persons

(Indexed to 1988)

https://fred.stlouisfed.org/graph/?g=naRA

January 30, 2018

Manufacturing Production and Manufacturing Productivity, * 1988-2024

* Output per hour of all persons

(Percent change)

Spending money without a comprehensive strategy seems futile.

Any serious push to onshore manufacturing needs to include education. For example, machinists. Human capital more than physical plants. A really serious strategy would institute single payer insurance and elimination of private health insurance and PBMs, for starters, to reduce labor costs. Being the US, do these as part of the war mobilization for China proposed in the recent defense strategy assessment.

I would become a machine tooling machinist yesterday if someone paid for the training. Not terribly optimistic that the financial onus for training up and specializing won’t fall on workers like it does in most other capacities in the US now, nor optimistic about allowing those who become specialized and skilled on the job at the extremely particular nuances of keeping a factory up and running ably to rise through the ranks, but who knows, maybe things will change. Maybe.

The education for vocational jobs is commonly free in the US Sr Sart looking.

“…However, desire and spending do not necessarily translate into results…”

This is going to be very interesting going forward. State subsidies, “incentives”, tax breaks combined with Federal CHIP grants and subsidies can add up to many billions.

States like Oregon may have to make exceptions to environmental regs. As noted above, the environmental impact of chip factories is very big. I’m not clear on how that would work.

Intel announced layoffs, suspension of dividends, and introduced retirement incentives recently, at the same time they are getting large subsidies and “incentives” https://apnews.com/article/intel-chip-ai-job-cuts-layoffs-loss-e61781e9364b69af63481c34ca5dcd67

I would keep an eye on that as well, to be crude: it might be a great way to swindle billions from the public purse.

Plutonium Kun makes a good point about advantages that the US could enjoy. Plus, in light of increasing tensions with China over the Taiwan issue, the US can politically “rationalize” massive subsidies to make the US more self-sufficient in these areas – national security and al that. Plus it is touted as a huge “job creator”. What’s not to like?

One negative factor is cost of living in the USA. Chip mfg. states like Oregon, have high real-estate and rent costs, and in the USA as a whole, so-called health care is the most expensive in the world, by a significant margin. Very high overhead costs may well have a medium term impact after all the subsidies and construction is over

To be typically skeptical: it remains to be seen if this will all play out as advertized.

So with all this frantic planning based on competition for gain and profits and ultimately aggression worldwide, it would make better sense to create a new forum whereby planning was the means to create cooperation and reduce waste and pollution. And provide for conservation of resources both natural and social. Highways and stoplights instead of high-speed guard rails and vast junk yards.

You are so obviously right. I can imagine what the new forum would recommend…actually items with fewer chips. To enable the items to last. Environmental constraints will restrict the variety the US can make; China/Taiwan are light yrs ahead with variety capacity (decrease the aggression ASAP). Plus all the printing in the world won’t get the dough to us [as I think has been more or less conjectured above]. But when it dawns on people that this must be done, that’s when all kinds of bright folks “in print” [in media] will advocate that we all get together…sit there, and let AI do the talking. That would need to be guarded against. The merit in your way, STO, AFAICS is in how it includes different types in the forum. What such a forum comes up with will likely be close to our last shot, so it might end up if it doesn’t pan out, there’ll be less violence if the path has been determined by a kind of consensus.

The article doesn’t go into specifics on what type of factories are being planned. Just vaguely mentions high end manufacturing. Anyone have ideas on specifics? Or it is all chips?

That was my take and immediately

raised a red flag.

If they were “well-located” the empty CHIPS factory buildings could be repurposed as Amazon Warehouses to store more imports from China and places East and NAFTA.\s

Lucent (AT&T spin off) had a huge plant in Andover Ma. It went bust in early 2000’s, now Amazon hub!

A lot of their retirees in my social circle.

The younger workers not so lucky as the close came with the dot com bust.

Tariffs won’t bring jobs back, huh?

The US is one of the few countries that is not in a demographic crisis.

The US is a major producer of natural gas…. something German firms need.

The US petrochemical industry will continue to expand.

One other thing .. there is a textile plant in NC that makes clothing from plastics…the entire process is ran from start to finish on the same plant.

German manufacturing is relocating to the US for cheaper energy and cheaper labor.

The location of the chip factories in the SW is a head scratcher but it does make some sense if you consider the differences in pay across the border. The US may be trying to leverage the wage differentials to compete with Asian industries that will face issues once this generation if workers begin to retire or age out of manual labor.

Blowing up another countries cheap gas/energy supply so that their firms will re-locate to yours is kind of extreme even for ultra capitalist USA. And it’s a one-off, unrepeatable, measure.

I’m not sure how much natural gas reserves the US has, but it has to be a limited supply. How long will it last as cheap energy? I think I remember reading that US shale oil/gas has only a few years of economic production left, but I could be wrong about that.

Do these numbers discriminate between manufacturing facilities and warehouse/distribution centers? The latter is all I see going up on the sides of highways, but I guess those buildings can be converted to factories fairly easily.

Just read about a midtown Manhattan office building that is 35% occupied, and just sold for about 55 million at auction, after it sold for well over 300 million in 2013. Maybe we can fit the robots in those spaces?

https://www.nytimes.com/2024/08/01/nyregion/manhattan-office-building-auction.html

August 1, 2024

This 23-Floor Manhattan Office Building Just Sold at a 97.5% Discount

The sale price of 135 West 50th Street in Midtown, which is only 35 percent full, was a sign of how much the pandemic upended the market for office buildings in New York City.

By Matthew Haag

In 2006, the hulking office building at 135 West 50th Street in Midtown Manhattan sold for $332 million. Tenants occupied nearly every floor; offices were in demand; real estate was booming.

On Wednesday, it changed hands again, in an unusual online auction — for $8.5 million.

The staggeringly low sale price of the 23-story glass behemoth that was once the headquarters of Sports Illustrated is the latest and perhaps most surprising sign of how the pandemic has upended the state of office buildings in New York City, home to the largest central business district in the United States.

Several large Manhattan office buildings have sold in recent years at steep discounts, some going for less than half of what the previous owners paid, in a market that has yet to hit rock bottom.

But office developers and sales brokers in New York City said they could not recall another large Manhattan building like 135 West 50th that had been sold for so little…

NYT analysis has a lot of problems.

https://wolfstreet.com/2024/08/01/values-of-old-office-towers-go-to-near-zero-but-the-land-has-value-ubs-gets-black-eye-new-york-times-makes-reeking-mess-of-it/

NYT analysis has some problems.

Whoa, yeah, 8.5 million. Amazing.

Jared Kushner should bless the sky that his father in law got elected. Lucky little dude.

The NYT article is shoddy, but the point, as REIT Indexes show, is that the 10-year capital value of the indexes is historically low, returns to shareholders are largely dividends:

https://investor.vanguard.com/investment-products/mutual-funds/profile/vgslx#performance-fees

Yes. only mfg. no warehousing etc. are included. Only making stuff places.

Wolf Richter wrote about that, too. Basically, the NYT got it all wrong.

https://wolfstreet.com/2024/08/01/values-of-old-office-towers-go-to-near-zero-but-the-land-has-value-ubs-gets-black-eye-new-york-times-makes-reeking-mess-of-it/

The land was sold off several years ago and the building retained. Land sale recouped almost the entire amount of the initial purchase price. The reported sale of the building does represent a loss but not nearly the 97.5% being reported. Nice headline, though.

I’ve been watching numerous video blogs about china. This one seems to be well researched.

inside china business, its the name of the youtube channel.

Many points he brings up is that you can build the plant: where does the machinery come from? Where will the thousands of engineers and high tech workers come from?

I don’t see Wolf mentioning anything about the quality of the workers and where will they come from to fill these factories?

Take solar products. Right now its all chinese equipment. Where does the glass come from? China, the aluminum for the frames, china, the cells, china. The majority of the “factories” are actually assembly plants using 100% foreign materials to sell to the US market at higher prices, with 30-40% tax credits paid for by us.

I don’t see how this is a good idea?

One thing I don’t see mentioned much is where these new semiconductor plants are going to get their work force. I wonder if the facilities might not be the easy part.

H1-B Visa holders from India. Intel et al will in time create a massive clamor to increase the annual H1-B quota. You can check the rolls of ASML in Connecticut and San Diego. They employ hordes of H1-Bs. Same deal with Intel in Oregon and Sunyvale and San Diego.

I get this is a side note:

“Similarly, Alexander Mercouris has reported long form on the failed US effort to increase 155 mm shell production. In addition to many mishaps which he recounted long form, the bottleneck remains a lack of gunpowder. There seems to be only one factory, in Poland, that makes TNT. The US had decided to move off TNT because environmentally nasty, but the replacements never worked (not sure because they failed as explosives or were too hard to produce at scale and/or reasonable cost).”

Not familiar with Mercouris’ view, but AFAIK, development of Insensitive Munitions (IM) is a matter of law/policy, and US Army has qualified IMX-101 as the bursting charge in the 155 mm HE projectiles, which is produced at Holston Army Ammo Plant. Note that IM requirements span the entirety of the weapon chain including logistics. So for example includes Modular Artillery Charge System used in the 155s.

In 2003 I had a job at Picatinny Arsenal contractor-consulting in several “acquisition” projects.

IIRC insensitive munitions was put in the spec’s for acquisition contracts I worked.

At the time Army had under 10 facilities in the 155mm “mix”. Those are likely the ones upgraded for increased shell output. Some get new buildings, a lot of new production line equipment, automation, etc. We even (sources) sought import rounds in that time frame.

All are government owned contractor operated (GOCO) semi contracted arsenals.

https://www.army.mil/article/271572/strengthened_army_industrial_base_doubles_artillery_production

From Nov 2023.

Goal is 100K rounds per month by end of FY 2025 (Oct 2025)

I went to bigger and more questionable (“challenging”) DoD “acquisitions” after that short job! Geographic preference!

A pretty poor article from WolfStreet IMHO. Lots of handwaving about using robots to build stuff, without any specifics about who will be managing all those robots. AI? Utilizing robots effectively requires a pretty deep manufacturing know how, something that’s very lacking in America nowadays. It’s just another boondoggle with the following template:

1. Build factory.

2. Buy robots.

……

100. Products coming out.

No worries though, when the time comes they’ll just be converted into data centers.

These figures in this article are not trivial, but they are not enough to make a substantive difference when you look beyond the hype. Construction spending on manufacturing plants has tripled since 2021. If this continues it will eventually make a difference. (As many commentators have pointed out, the difference may lead to a lot of empty space with crumbling roofs, because “if you build it, they will come” may not be valid, but let’s assume this is not so.) However, that amounts to only 10% of construction spending (notice that the construction spending graph begins at 2% to make the increase in spending look much bigger than it is). If the US were really engaged in a project to restore the country’s manufacturing status as of the 1970s, I submit that construction spending on manufacturing plants would be much larger than this.

So it seems very likely that this is not actually going to solve the problem which it is meant to – unless, of course, the hyperbolic line on the graph continues going up. It’s odd, incidentally, that this is happening at a time of extremely high interest rates. It’s also odd that I haven’t heard about a massive increase in manufacturing employment although the process has been going on for three years (that is, since well before the Inflation Reduction Act was signed) which presumably would be hyped if it were happening. I am not an economist nor American, so ill-informed, but it seems to me that there is a funny smell here.

Some of the recent construction spending on plants is probably due to the Inflation Reduction Act; this Feb 21. 2024 NYT article says spending on EV’s in the US has been strong, which has likely driven EV factory construction, but spending on improving the US grid has lagged, though it also says “Companies invested $44 billion last year in domestic clean-energy manufacturing, with more planned in the years ahead.”, both of which the act supports:

“Here’s Where Biden’s Climate Law Is Working, and Where It’s Falling Short”

The Infrastructure Investment and Jobs Act of 2021 is also having some effect according to a Nov 15, 2023 Brookings Institution report:

At its two-year anniversary, the bipartisan infrastructure law continues to rebuild all of America

“Based on our analysis of published White House data, IIJA implementation is just now hitting its stride. Formula and direct federal spending continue to move at a steady pace, already pumping $306 billion into state coffers and direct investment projects. And like an athlete who grows into a game, competitive grantmaking is steadily increasing, with 80% of all competitive funding still left to be awarded.”

So there has been some substantial funding that is likely making its way into the build out of manufacturing since both of these acts have requirements to source parts, labor and manufacturing in the US. Some companies that can’t directly benefit from grants may have started expanding capacity early, expecting a flood of money from the companies that already have the grants, and wanting to be able to compete for it by showing they have the capacity ready to go (a competitive advantage). Perhaps the recent leveling off is due to the potential change in governance in the US this year, but a significant amount of funding has already been awarded.

I am curious how this factory construction breaks down by type of industry? My guess is that much of it is related to natural gas / chemical industries relocating to the U.S. after BIden blew up Nordstream? Also, MIC industries ramping up as a result of the wars in Ukraine & Israel.

Agree 100% with Yves’ comments about how manufacturing — even low tech manufacturing like paper making — requires highly specialized knowledge that may take years or even decades to cultivate. And every time a U.S. manufacturing facility, like Intel, lays off manufacturing workers, and those workers have to turn to driving Uber or selling real estate to survive, that specialized knowledge is lost.

One wonders how much of the increased spending is actually the increased cost of construction – and whether the separately quoted inflation, actually applies to construction costs.

Breakfast for two costs me 30-35 bucks now, compared to less than 15-20 pre-COVID. So, a 200% increase is what one might expect from inflation – a big nothing burger.

If it was a serious article (Instead of rah rah rah – the US is roaring back under its wise and informed leadership), they would have quoted what construction costs are per square meter, or simply reported the trend in the number of square meters built.

As another point, I paid my low-level techs $18/hr pre-covid. I now start at $25. I have heard similar changes in the costs of welders or engineers.

But do I think entities are grabbing all the tax subsidies they can? Absolutely. And will it end like the US bases built in Afghanistan or Iraq – so poorly built that demolition is the only solution?

To report anything in dollars without correcting for the appropriate inflation rate is disingenuous.

Thanks for posting this. It’s nice to see things being built in the states (sorta, maybe, again).

But this shift in America’s industrial policy sidesteps the largest problem with manufacturing in America:

American management and Wall St

American management killed American manufacturing before, and got filthy rich doing it. And when American management finally fell completely on it’s a$$ in the GFC, Obama bailed them all out – nobody went to jail, and nobody even GOT FIRED. Since then American management has been coddled by seemingly endless money either from the Fed or directly injected by the Federal government, and by endless rounds of corporate consolidation resulting in monopolies which feel free to brag about greedflation in Wall St earnings calls.

I fully expect this effort to re-industrialize America to fail, and continue to fail until America can once again have an industrial rather than a finance based economy.

Is it possible the manufacturing buildout is intended to focus on infrastructure? Domestic spending with domestic impact? Uncomplicated nuts and bolts that could serve as a proving ground for methods, and regaining skill sets, with an eye on rapid development at a sustained, but necessary loss? Could tariffs prove useful in such an environment? What ever happened to those giants of European (Deutsch) industry so desperately in need of cheap energy? Where’s the Green New Deal, Build Back Better, etc?

As an aside, imagine Israel had waged war, first with the aim of securing a two-state solution (and the Jewish homeland), and then engaged in genuine diplomacy with the aim of sharing tech and experience, truly blossoming the desert for its inhabitants. Imagine them a leader in the region, admired, deserving of the myth of God’s chosen.

Imagine there’s no hunger… hopefully this didn’t all qualify as homework Yves.

I call BS on the data as misleading. You’re not gonna take an industry efficiently building buildings at a WIP of $7MM/yr for the past 30 years and then miraculously triple the volume of buildings in two. No way. There is simply not that level of excess capacity in the system. Especially labor. Plus, you need a lot of steel to build manufacturing plants and US steel production is 50% less than it was in 2000 and 10% less than pre-Covid.

Much of this covers what I said when the building boom was announced under Trump.

The factory (semiconductors etc) is a small cost which is normally born by the corporation but is now being paid for by the government.

Then there is the infrastructure (which in Texas, Arizona, California etc) will also need to include water supplies for the factory and the imported workforce, roads, rail, airports, hospital, schools, homes.

Then there is the workforce – cost of relocation, current housing costs, health, education etc. Not only does it need to be in the area, it needs to be trained and it needs all the facilities and more that I have listed

On top of all this is the cost of real estate. When the US shipped out factories to the far side of the Pacific, real estate was less than a fifth of its current relative value and the land used overseas was even less. Now real estate, instead of being 1% of costs will be over 20%, which means that the debt for job creation is hard to calculate but is enormous. Expect more of these plans to come to nothing.

Germany is already pulling back on some of its plans as it sees costs spiral.