Yves here. Yours truly does not much watch the ponies since there are so many analysts and commentators that do so. But to remind readers, big stock market crashes do not kick off broad financial crises unless a lot of those positions are funded by debt. The post Great Crash reforms in the US limited margin lending, even though there have been some efforts to skirt those rules, such as equity derivates, like the total return swaps that cratered Archegos.

Sadly, it was Greenspan that put the Fed in the business of thinking its job was to protect equity investors. As the Wall Street Journal exposed in 2000, Greenspan was obsessed with what determined the level of stock prices. He did point out in 1996, just as the dot-com mania was starting that the market seemed to be suffering from irrational exuberance. When the Dow did a swan dive, he quickly retreated and talked the markets back up.

We pointed out in ECONNED how Greenspan’s stock market obsession played a role in stoking the financial crisis. After the dot-com bubble collapsed, Greenspan convinced himself it would have a serious real economy impact even though the 1987 plunge had demonstrated the reverse. Greenspan lower policy rates to negative real interest rate level and held them there for a full nine quarters, when the Fed’s practice before had been to drop rates that low only for a quarter in recessionary times. That in turn led investors to scramble for high-yield products. We explained long form how that fed demand for confections like asset-backed CDOs, which consisted largely of the riskiest tranche of subprime mortgage securities.

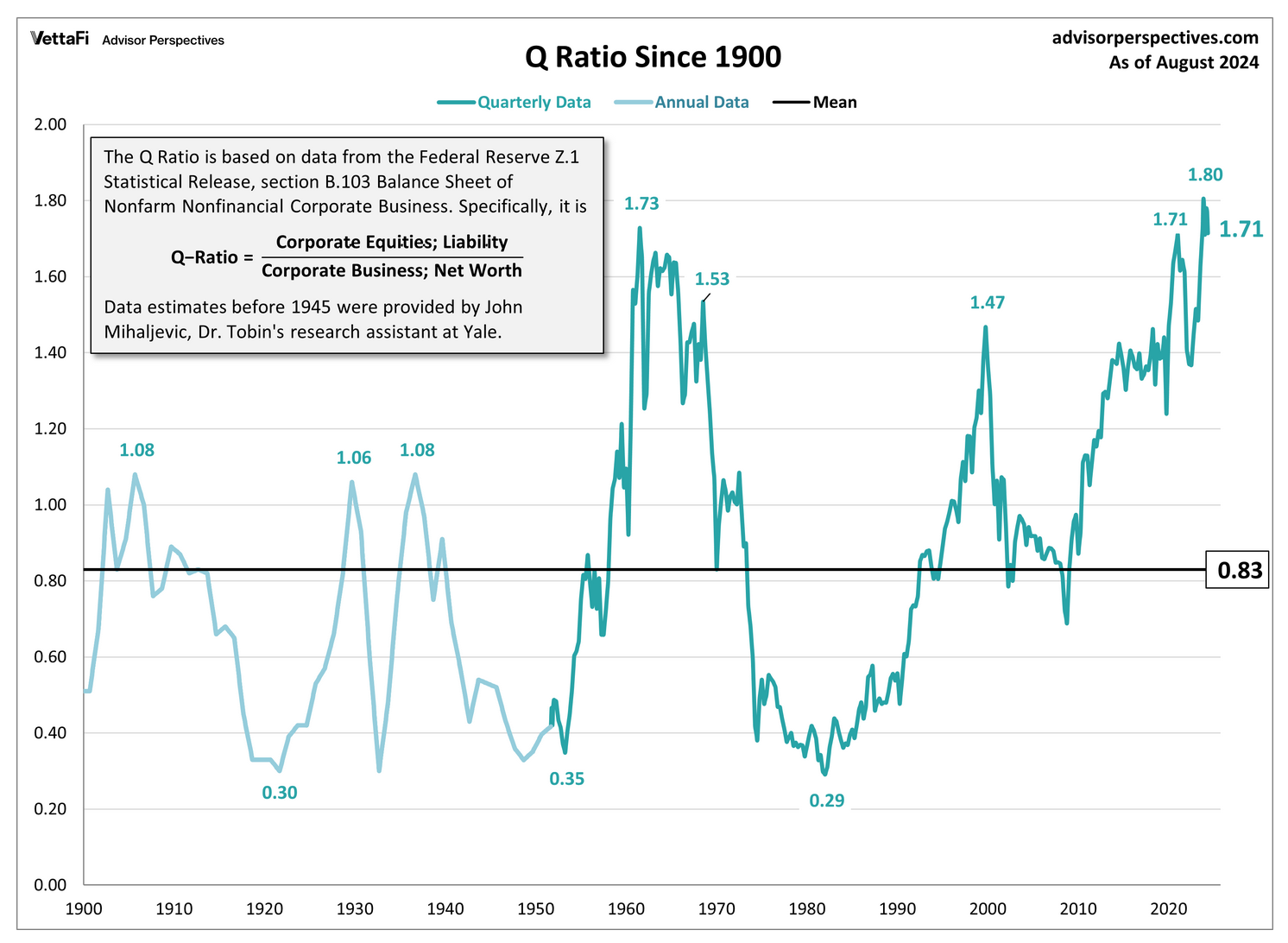

As Wolf (and even the Wall Street Journal yesterday) points out, investor enthusiasm for stocks appears unabated. One issue is that the averages are unduly influenced by the high prices of super sized tech stocks like Apple, Meta, Google and Microsoft. Nevertheless, stocks overall look to be pretty richly valued, using Tobin’s Q ratio as the measure:

It is finally worth remembering that even though the dot-com bubble seemed to be awfully long in tooth, it had a spectacular blowout phase before it went into reverse. There the trigger was an unexpectedly weak earnings report by bellweather Cisco.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

Nvidia, the poster boy of the stock-market mania around Ai and semiconductors, plunged 9.5% in regular trading. In afterhours trading, it dropped another 2.6% to $105.40 a share, for a total drop of 11.7%. The afterhours drop came after Bloomberg reported that the DOJ had sent subpoenas to Nvidia, in an escalation of the ongoing antitrust investigation.

“Antitrust officials are concerned that Nvidia is making it harder to switch to other suppliers and penalizes buyers that don’t exclusively use its artificial intelligence chips,” Bloomberg said, citing its sources.

Nvidia’s market capitalization – which is important because it’s so huge – plunged by $279 billion in regular trading, the most ever lost in one day by one company. Including afterhours trading, it plunged by $342 billion, or by half a Tesla.

But it’s not a big deal because easy-come, easy-go, and Nvidia had similar one-day moves on the way up. The stock is now down 20% from its July 10th peak. And Nvidia wasn’t the only one.

The semiconductor bloodletting during regular hours included:

- Nvidia [NVDA]: -9.5%

- Intel [INTC]: -8.8%

- Marvell Technology [MRVL]: -8.2%

- Broadcom [AVGO]: -6.2%

- AMD [AMD]: -7.8%

- Qualcomm [QCOM]: -6.9%

- Texas Instrument [TI]: -5.8%

- Analog Devices [ADI]: -6.5%

- ASML [ASML]: -6.5%

- Applied Materials [AMAT]: -7.0%

- Micron Technology [MU]: -8.0%

- NPX Semiconductors [NXPI]: -7.9%

- KLA [KLAC]: -9.5%

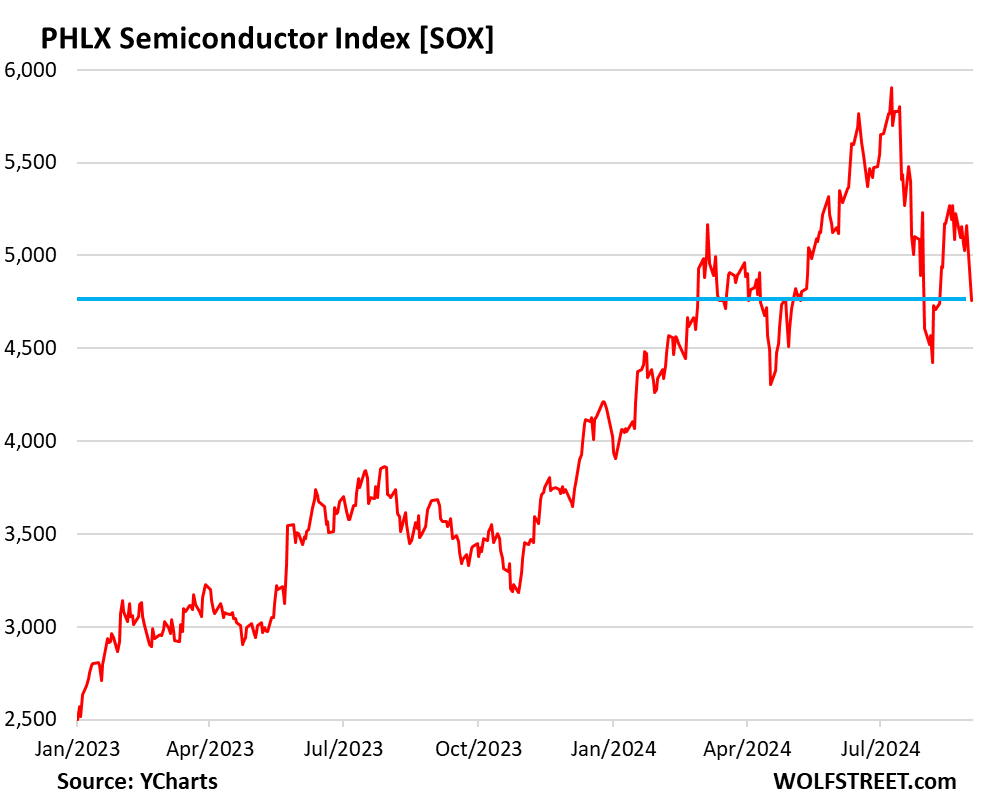

The VanEck Semiconductor ETF [SMH] plunged 7.5%, the biggest one-day drop since the March 2020 crash. The PHLX Semiconductor Index [SOX] plunged 7.8%. So that was a good day’s worth of work on the first trading day of September:

It wasn’t any kind of economic news, such as the sudden collapse of the consumer over Labor Day or the toppling of three big banks on Friday evening or the prediction by AI that the world would end, or whatever, that sank semiconductor stocks – and to a lesser extent stocks more broadly, with the S&P 500 down 2.1% today and the Nasdaq Composite down 3.3%. Instead of collapsing, consumer are doing just fine, and they went back to the punchbowl for refills.

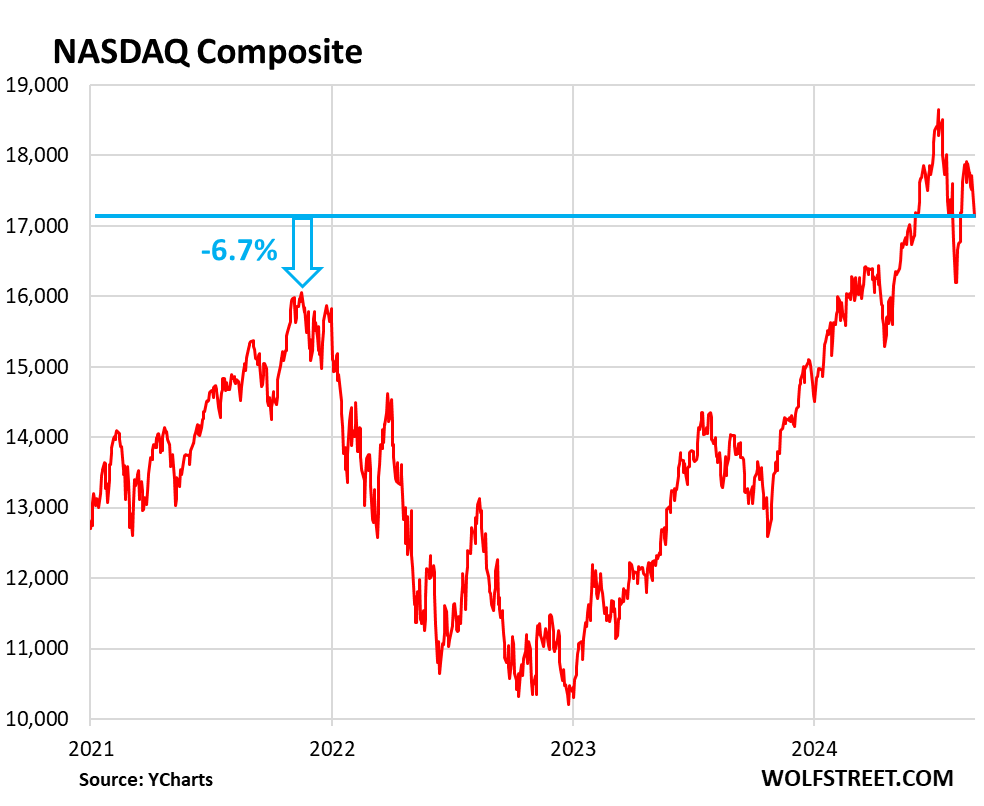

So the Nasdaq composite dropped by 3.3% today to 17,136 and is down 8.1% from its all-time high on July 10.

If it drops another 6.7%, it’ll be back where it had first been in November 2021, with a big sell-off and a generational rally in between. T-bills did better than that since November 2021, but without all the fun and drama.

The action since the July 10 peak is not a good sight:

It’s just that Americans have been more bullish than ever on stocks, after years of huge rallies to where household allocations to stocks as a share of their financial assets reached record highs of 42% in Q2, easily surpassing the then-record of 37% in Q2 2000, according to JPMorgan estimates cited by the WSJ.

Q2 2000 was of course when stocks had begun the Dotcom Bust that would eventually take the S&P 500 down by 50% and the Nasdaq Composite by 78% over the next two-and-a-half years, after which it took the Nasdaq 13 years, including years of QE and 0%, to surpass its Dotcom Bubble high.

But investors consider this now irrelevant. Not going to happen again. Stocks will always go up. The Fed will restart QE every time shares dip a little, etc., etc. With investors so overexposed to stocks, especially to the biggest hottest stocks with ridiculous valuations, such as Nvidia, and overconfident that stocks will always rise, if then something twitches and the selling pressure suddenly surges, then there aren’t enough hardy souls left still willing to buy at these ridiculous prices, and the next layers of buyers – the dip buyers – will have to be enticed with even lower prices. But that has been a rough sport recently.

“This October, stocks have reached yet another record peak as they have every month since 1927! I think I’ll buy another of these horseless carriages — on credit!”

Being in Australia I am astonished that there are no comments before me as there usually are. Yves must be up late, or early. Not sure which.

It’s good to see some froth coming off the insane speculative activity in the market about AI.

However, here in AUS this morning on the news on the way to work they said that the market in the US was waiting for a “data heavy week” to see how big the expected rate cut would be.

It seems the “rate cut” was certain but we just needed to wait and see how much would be given to all the rich people and the stockmarket.

Well, that seems to have imploded a little. I haven’t seen the figures but there is some talk here about reduced consumer spending, despite immigrant driven population growth.

I think the slowdown is still there, under the surface. Maybe no interest rate cut?

People might start leaping out of their office windows. Let’s hope not.

Another article from Wolf Street on the topic of consumer spending: https://wolfstreet.com/2024/08/30/our-drunken-sailors-are-at-it-again-not-at-all-in-the-mood-for-a-slowdown-or-a-recession/

TLDR; American muppets are still powering through.

Jumping out of windows? Instead jump to the end of the article where Wolf mentions that Americans are still adding to their savings even after spending record breaking amounts on spending.

I think the poorest segment of the population is beginning to suffer some hardships based on what we’ve heard from Dollar General’s earnings release, but overall Americans are doing well.

Wolf has a bad habit of looking at aggregated top line data without a lot of consideration of the distributional bifurcations hidden underneath (the “two economies” Jeffrey Sachs referred to in the back half of his recent interview with Tucker Carlson). I don’t believe he’s doing this on purpose, I’m just not sure that much of his core audience is all that concerned about such things and his commentary may be a reflection of that.

The data is the data. Compared to the total population, there’s comparatively very few billionaires in the United States, like how much Netflix and other services can a single billionaire or 100 billionaires consume? By the way consumers have been doing very well throughout the year, so most of the people who were doing well are continuing to do well. If there’s actually a two track economy then it can continue to go on for a very long time and now that the Fed is going to cut rates, expect the party to continue.

The US is running a HUGE deficit, why is it hard to believe that some of that will really trickle down to the masses?

735 billionaire; 21.5 to 57.5 million millionaires. all numbers approx

“The data is the data.” A phase I usually see when glossing over the details to avoid drawing attention to serious issues.

The fact that Trump is doping as well as he is in the polls and Harris is both trying to embrace and run away from her position as VP in the current administration when it comes to economic issues would tend to challenge your position. Additionally if people are “powering” through due to increased debt levels and still high prices in non-luxury items, I wouldn’t hold my breath for this leading to healthier economy. Nor does it provide any evidence of trickle down economics, which has been debunked multiple times.

You’re welcome to pretend that averages tell us anything about the US economy, if that suits your purposes. For myself I lend no more credence to economists blindness to distributions than I do their claims that there is no such distinction as earned and unearned income.

All that market valuation is dependent on a couple TSMC foundries to make their chip designs and being virtual monopolistic sellers of their chip types to the world. Also a lot of first generation East Asians with Ph.Ds.

IMO…as troubled as Intel may be, there is an argument to be made that it behooves players to rally around it.

That’s a piece of it. They’re trying to rally around Intel and throwing money and competitive intelligence at it (including demanding TSMC’s order sheets and sharing it with Intel). Intel is bleeding itself dry trying to catch up with TSMC. But it’s just not able to execute.

The bigger threat is that China has been able to rebuild the entire global tech ecosystem within its own borders within the few years since the Huawei sanctions. And once they’ve caught up or come serviceably close, then China can beat the non-Chinese tech ecosystem on cost, on access to several multiples of high quality STEM graduates, a corporate culture focused on building things that with, and because China doesn’t do arbitrary sanctions against buyer countries.

Whatever happens with the USA and associates, does China like the idea of dealing with a monopoly or would it even matter for them?

Valuations in tech overall and the chip sector in particular have been bloated for some time now. Trees don’t grow to the sky …

I’ve studied a lot of long-term stock charts and NVDA looks like a classic 3-stage “fractal parabola” with 3 distinct rises since the low in 2022. Usually, the third parabolic rise is the last wave, and we get a collapse shortly thereafter. Which may already be underway.

Will this time be different?

I am not able to keep up with the rising cost of living and my savings is going in the wrong direction. The odd thing is most of my friends seem to be in the same boat. Maybe we are just the unlucky ones. Investments seem to be doing fine but still not enough gains to allow retirement before 75 unless something changes. Thanks as always for the great updates.

Classic bias from Wolf, I remember a WolfStreet post from pre-pandemic times exhibiting a very archaic and idealistic view of young people.

Until all asset prices are reset I think this latest tantrum by Wall Street is overdone. There are no fundamentals that support a sudden exit out of semis. Semiconductors will only become more important in this world, so a smart move is to stay invested in semis despite the ups and downs. Over time to trend is up and should remain up.

NVidia was the darling stock of AI hopes. (Adding that NVidia graphics cards are very good.) Now that AI is sort of wobbling as a next-big-thing in investment, it’s not surprising that NVidia is suffering the fallout from the AI pullback. NVidia is caught in the downdraft of AI investing. / my two cents

Wolf, too much data-dependent for his own good.