This is Naked Capitalism fundraising week. 216 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, PayPal. Clover, or Wise. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year,, and our current goal, supporting the commentariat.

Yves here. Reports on the China effectively squeezing the rare earths market and the lack of robust alternatives oddly skip over the way the US ceded its position in the rare earths market, with the US decline significant decades ago. From a 2010 post:

Reader James S. highlighted a useful article at the MIT Technology Review, “Can the U.S. Rare-Earth Industry Rebound?” Our only quibble to this solid piece is its summary, which underplays some critical aspects of the article:

The U.S. has plenty of the metals that are critical to many green-energy technologies, but engineering and R&D expertise have moved overseas.

In fact, the while the article does discuss US versus foreign engineering expertise in rare earths mining, it describes in some detail how difficult rare earths mining is in general (more accurately, not the finding the materials part, but separating them out) and the considerable additional hurdles posed by doing it in a non-environmentally destructive manner. Thus the rub is not simply acquiring certain bits of technological know-how, but also breaking further ground in reducing environmental costs.

And this issue has frequently been mentioned in passing in accounts of why rare earth production moved to China in the first place. It’s nasty, and advanced economies weren’t keen to do the job. China was willing to take the environmental damage. For instance, the New York Times points out:

China feels entitled to call the shots because of a brutally simple environmental reckoning: It currently controls most of the globe’s rare earths supply not just because of geologic good fortune, although there is some of that, but because the country has been willing to do dirty, toxic and often radioactive work that the rest of the world has long shunned.

From the MIT Technology Review:

Getting from rocks to the pure metals and alloys required for manufacturing requires several steps that U.S. companies no longer have the infrastructure or the intellectual property to perform….

In the 1970s and 1980s, the Mountain Pass mine in California produced over 70 percent of the world’s supply. Yet in 2009, none were produced in the United States, and it will be difficult, costly, and time-consuming to ramp up again…

The two mines that will be stepping up production soonest are Mountain Pass, being developed by Molycorp, and the Mount Weld mine, which is being developed by Lynas, outside Perth, Australia. Mountain Pass has the edge of already having been established. But the company cannot use the processes used in the mine’s heyday: they’re both economically and environmentally unsustainable.

Several factors make purification of rare earths complicated. First, the 17 elements all tend to occur together in the same mineral deposits, and because they have similar properties, it’s difficult to separate them from one another. They also tend to occur in deposits with radioactive elements, particularly thorium and uranium. Those elements can become a threat if the “tailings,” the slushy waste product of the first step in separating rare earths from the rocks they’re found in, are not dealt with properly…

Mountain Pass went into decline in the 1990s when Chinese producers began to undercut the mine on price at the same time as it had safety issues with tailings. When the Mountain Pass mine was operating at full capacity, it produced 850 gallons of waste saltwater containing these radioactive elements every hour, every day of the year. The tailings were transported down an eleven-mile pipeline to evaporation ponds. In 1998, Mountain Pass, which was then owned by a subsidiary of oil company Unocal, had a problem with tailing leaks when the pipeline burst; four years later, the company’s permit for storing the tailings lapsed.

Meanwhile, throughout the 1990s, Chinese mines exploited their foothold in the rare-earth market. The Chinese began unearthing the elements as a byproduct of an iron-ore mine called Bayan Obo in the northern part of the country; getting both products from the same site helped keep prices low initially. And the country invested in R&D around rare-earth element processing, eventually opening several smaller mines, and then encouraging manufacturers that use these metals to set up facilities in the country.

Back to the current post. A second issue is the US negligence in either providing for or otherwise funding and supporting sources of supply in vassals loyal allies, given the importance of rare earths to defense production. But given how the inability of the US and its NATO allies to meet Russian military production and how the output gap is widening in favor of Russia, again shows how our putative leaders cannot plan their way out of a paper bag.

By Jennifer Kary for MetalMiner, the largest metals-related media site in the US according to third party ranking sites. Originally published at OilPrice

- China’s restrictions on rare earth mining and exports have disrupted global supply chains and driven up prices.

- US businesses, particularly in the defense sector, are vulnerable to these disruptions due to their reliance on Chinese rare earths.

- Diversifying supply chains, investing in domestic production and recycling, and exploring alternative technologies are crucial strategies for mitigating risks.

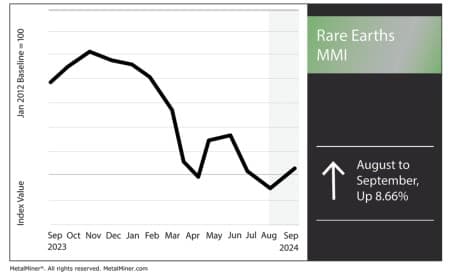

The Rare Earths MMI (Monthly Metals Index) managed to reverse and pull up by 8.66% after experiencing steady declines since May. Numerous parts of the rare earths index reversed price action, including neodymium and terbium oxide. China’s recent crackdown on rare earth supplies has caused a shift in the global market, creating significant bullish sentiment in the short term, the trends of which covered weekly in MetalMiner’s newsletter.

China’s Crackdown on Rare Earths Causing Price Increases

Over the past few months, China’s crackdown on rare earth minerals and its broader regulatory tightening have sent ripples through global markets. China has long dominated the rare earths market, producing around 90% of the world’s refined rare earth output. This dominance allows Beijing to exert significant influence over global supply chains for critical minerals like neodymium, praseodymium, and dysprosium, elements vital to the magnets used in everything from electric cars to wind turbines.

One of China’s main centers for the production of rare earths, Jiangxi, is among the provinces that spearheaded a four-month campaign against illegal mining activities. While crackdowns on illicit mining benefit the market in the long run, they also drive up rare earth prices in the short term.

The Supply-Demand Crunch

Many expect the demand for rare earths to keep rising with the push for green energy. In fact, some analysts predict a supply-demand mismatch due to this continued global growth. China’s recent actions to crack down on illegal mining and tighten regulations have placed some fresh strain on the global REE market.

Some analysts predict that the rare earth market will shift from a surplus to a global deficit by the end of 2024. A smaller number also anticipate a potential global shortage of 800 metric tons of NdPr, a critical component of permanent magnets, by year’s end. Meanwhile, China’s decision to reduce production quotas for rare earth elements will likely widen this gap and push prices higher.

U.S. Defense Sector at Risk

China’s restrictions on exporting rare earth processing technologies have also caused supply chain issues for defense contractors, making it harder to secure a reliable source of materials. Businesses like Raytheon and Lockheed Martin need rare earth elements for fighter jets, radars, and missile systems. Aware of this vulnerability, the U.S. Department of Defense has warned about the national security risks tied to a heavy reliance on Chinese rare earths.

What U.S. Businesses Can Do to Mitigate Risks

While the reliance on Chinese rare earths presents challenges, U.S. companies have options to reduce their exposure and prevent financial losses.

For starters, U.S. companies must expand the diversity of their supplier networks. Nations like Australia, Brazil, and Canada also hold significant rare earth reserves and continue to ramp up production. In recent years, companies like Australia’s Lynas Rare Earths have become key alternative suppliers, particularly for neodymium and praseodymium.

Meanwhile, the U.S. government continues to actively encourage domestic production of rare earths to reduce dependency on Chinese suppliers. MP Materials, which operates the Mountain Pass rare earth mine in California, plays a key role in this effort. The U.S. Department of Defense has also invested in building local rare earth processing plantsto ensure the country can source these resources domestically.

Another strategy involves recycling rare earth elements from products that have reached the end of their life cycle. Although rare earth recycling technology is still in its early stages, it holds significant potential as a long-term solution to supply chain challenges. Companies in industries like tech and automotive, which handle large volumes of rare earth-containing products, can benefit from investing in recycling infrastructure to recover these valuable materials from outdated electronics and vehicles.

Umm … USA is nowhere close to resources vs Russia and China, hence the panic over the poor state Ukraine up for sale. Not that orthodox was all about making a few rich and call in natural lmmao …

I work in mining – any company that does this would have to determine where the reserves are for a specific mineral or element on the periodic table.

We do have a lot of these resources in the Western world, but getting a mine set up and the processing would take years.

Depending on what is being mined, a lot of work in mine exploration and geology would have to be done. Then the legal approvals and environmental work for the mines.

There is likely a lot of industry specific knowledge and very specialized information that the Chinese have on the processing that would take the West years to do. The Chinese have a near monopoly, which means there are going to few other nations with the know-how to do it. The neoliberals may look down on those who don’t work in finance or computer software, but there is a lot of challenge to processing specific minerals. It would probably take years to get the quality up to the standard needed and certifications.

This would be a difficult project to justify for a Western private for-profit company.

1. First, because of the fact that if the Chinese trade war is somehow resolved, then Western mines would become noncompetitive. Western mines often closed because they weren’t cost competitive.

2. Second because hard rock mining is a very capital intensive industry and it takes a long time to build up the specific knowledge, which means a lot of money. Hardrock mining can be a very unstable industry and bankruptcies are quite common. I always keep my resume polished.

3. Third, there is no assurance of demand – for example if the military is the largest customer for that mineral, then the demand could very well change due to political changes and perhaps a resolution of any Cold War with China or Russia.

That makes it hard for a private company to justify – especially because more mines are now owned by private equity or publicly traded, where short term profit is paramount.

Some of these could be resolved with state owned mines or massive subsidies (that probably dwarf the CHIPS Act – and that’s assuming private companies don’t take the money and don’t deliver or use them to buy back shares), but the others are not easy to resolve.

Then there’s the matter that the West has a shortage of trained personnel in mining, a shortage of skilled trades, and the industry has a bad reputation among young people as a difficult / dirty industry to get into, where one has to work far away from many cities.

I don’t think that the neoliberals and neocons have really thought this all through. By the way, I’m scratching the surface of the problems – this would be an article long otherwise. There’s also going to be big inflation.

The bottom line is, depending on the element / minerals, we may have the resources, but the barriers for mining and processing is enormous. It’s likely insurmountable if you are talking a short time period (ex: a decade), unless society puts an enormous amount of resources in.

Bluntly, the neocons and neoliberals have made a mistake comparable to their energy sanctions war against Russia. It’s not that we don’t have alternatives to say, Russia or China, it’s that it would take time to develop the capacity and it won’t be cost competitive.

Thanks.

My view is the west is the high cost producer of everything real, whether chips or metals or furniture. And cutting ourselves from row will make it all worse. On the plus side labor shortages will drive salaries, maybe keeping pace with permanent inflation.

I get the feeling the ruling class will do everything possible to drive down salaries, no matter what. We can already see this with the union busting and the neoliberal economic reforms. The loss of Western hegemony will make them more desperate and the mask of Western democracy is being removed.

Excellent analysis. I have geologist friends who can attest to lack of current expertise in hard rock mining ventures. Google ‘Mountain Pass Mine’ and you can read all about the history of REE in the US.

It’s only a matter of time before the Russia/China alliance dominates science and manufacturing.

China is already quickly making leaps and bounds in science, so I agree.

In my view, the 3 dominant areas that they need to catch up on are semiconductors (China can’t make a domestic EUV), aerospace (still working on their own passenger jet), and submarine technology.

Other Western trackers say the US is in rapid decline in technology leadership.

https://www.aspi.org.au/report/aspis-two-decade-critical-technology-tracker

Note the very rapid progress of China.

Thank you very much for this informative article. I must confess to knowing almost nothing about rare earth minerals and naively assumed they were mostly found in Africa.

Many thoughts flashed through my mind as I read your introduction and the article. How stupid is the US leadership to antagonise the supplier of 90% of the world’s rare earths? Especially, given the MIC needs them for the weapons we plan to use throughout the world – including against our number one adversary, China! Then I wondered, why is China even selling us their rare earth minerals/metals? Wouldn’t the Pentagon be a little handicapped without their fighter jets, radars, and missile systems? Then I thought, maybe this is a good thing! Fewer weapons in the hands of “children playing with matches” and all that. If the US wastes their current supply of weapons on Israel and Ukraine, they might not be able to start wars directly with China, Iran and Russia. Ultimately, this could be a win!

And then the last thing I pondered was the thing I always think about when I read descriptions of the filthy, polluting mining needed to extract green energy minerals/metals from the Earth – When are we going to accept that we have to use less – and have less?

One of the key problems for processors of rare earths is that demand is extremely hard to predict, even over the medium term. There is a remarkable churn of technology now in renewables in particular, leading to a very short boom bust period in the demand for any one material (not just rare earths, this extends to minerals like lithium, cobalt,copper, etc). As one example, the recent surge to prominence of Li-fe-PhO over Li-ion batteries has upended expectations of demand for material such as cobalt in the space of just 24 months or so. This uncertainty is a key reason why industry has been so reluctant to invest in processing without direct government aid (which is the norm in China). On the subject of China, as the article alludes, recent regulatory upgrades have led to what may have been mass unintended shut downs of many smaller mining operations. Its unclear as yet as to what implications these have for supply.

Another ‘unknown’ is that its often forgotten that while some rare earths are vital for renewables, they are also vital for ICE engines and fossil fuel extraction (plus catalytic converters). Platinum, palladium and rhodium are absolutely vital for fossil fuel production (they are used as cracking catalysts in oil processing).

One key point which isn’t always appreciated – rare earths are actually badly named – they are extremely common worldwide and are a common byproduct of mining for other minerals. The choke point in supply is mostly processing, not extraction. Another general ‘unknown’ is how much can be recirculated by way of recycling, either of existing products or of mining spoil (the latter is a major source of some rare earths).

Your insights here add another line of criticism against the “just on time” and instant benefits so ingrained the Western philosophy of commerce and economy. That, IMO, is what kills such recycling economy that you mentioned which strongly depends on public support. It needs investments but is mired in uncertainties.

Allow me to take issue with “REE aren’t actually rare” mindset.

I’ve worked on two REE plays as a geologist. One of the projects had a deal with Molycorp(-se, they went bankrupt) to process my monazite (REE phosphate) ore from AZ even though Mountain Pass ore is bastnatite (REE carbonate), so I have direct experience in the field. The other is Bear Lodge in WY which is still being developed, and I am not currently involved.

Saying that rare earth elements are common is not true. REE are generally evenly distributed in most minerals as trace elements , meaning tiny (ppb) amounts are present in nearly every rock. Even the aforementioned nasty processing methods will not remove these elements from any rock, or even any processed rock. The REE need to be geologically concentrated, just like any other metal, in order to be of use. The monazite ore I had in AZ had bulk REE measured in %, not ppb. That’s a concentration of about 1 million times more than what’s in a typical rock. That’s rare.

Let me give an example. Iron is one of the most common elements in rocks and it’s easily separated from an ore via magnets, yet iron mining is not ubiquitous.

REE are similar. The elements themselves are in nearly every rock, but finding concentrations of REE that can be mined are rare.

Interestingly tungsten (wolfram), which is rarer than most rare earths is not so considered as such by some classifications. So the concentration of the element we want to extract is critical for viable processing. I feel curious. Which geological traits/conditions favour high concentrations of rare earths? Are these found in igneous rocks exclusively or in others as well?

They are mostly found along hydrothermal vents, so associated with volcanic activity. When weathered, they can be found in clay deposits (these are the heavy rare earth deposits that China and Myanmar are well known for).

Lanthanum, the most common rare earth, is more abundant than silver.

As I understand the petrology, REE are usually concentrated by hydrothermal fluids coming from low-silica potassic igneous rocks. The AZ project was a didn’t have a known source and my site was a placer. The area was known for gold found in tonalite and andesite rocks. The WY project was in carbonatite and phonolite rocks also associated with gold.

Carbonatites are really strange rocks. Phonolites and tonalites are also uncommon rocks, just not strange. Identifying any of these in the field takes some debate with colleagues to be sure that the rock is what you think it is, because none of them are common and all look like other types of rock. Even when you know they’re there it takes some time before you are confident enough to pick up a sample and know its a carbonatite, tonalite, phonolite.

Understand that all of these elements are found together and have similar chemical characteristics. Separating them out from a rock is challenging but separating them from each other is the big job.

In my entire career as a geologist, I’ve never seen tungsten ore in the field or have worked with anyone who has. All I know is that it’s dense.

I think Jack Lifton (c.f.) was one of the Molycorp contacts I had, if my memory serves me after 14 years.

Mining projects are fun until they go bankrupt, which most do.

About ten years ago, when working for Deutschlandfunk (German public radio) in Mongolia I got asked whether I could do something about rare earth deposits in Mongolia. The Chinese mine cited above Bayan Obo is in Inner Mongolia the adjacent province to the Republic of Mongolia. The name by the way is Mongolian and can roughly be translated as Rich Cairn.

Nothing came of it but while doing research I discovered that Japanese and German companies where leading in converting these rare metals into industrial goods like magnets et al. The Chinese – having cornered the rare earth production- were forcing these companies to transfer production and know-how to China if they wanted a constant supply. That triggered the interest by Deutschlandfunk. Nothing came of the story. The Chinese move ten years ago was premature as it made Japan and Germany scramble to find new suppliers. The Chinese – who still needed their Japanese and German suppliers – realised their mistake and relented. By now though I suspect the Chinese have enough know-how themselves and don´t care anymore if the West opens new mines. They most likely can produce those high grade goods themselves.

Thank you Tom67. Very interesting commentary which adds to the discussion.

https://english.news.cn/20240704/dc62e9d455c049ba9102c5925c1f23a1/c.html

July 4, 2024

Chinese geologists unearth novel minerals at world’s largest rare-earth mine

BEIJING — Chinese geologists have discovered two new minerals at the world’s largest rare-earth mine in northern China, the Chinese Academy of Sciences (CAS) has announced.

The two new niobium-scandium minerals, named as Oboniobite and Scandio-fluoro-eckermannite, were discovered in the Bayan Obo deposit in the Inner Mongolia Autonomous Region. The discovery was made through a collaboration between the CAS Institute of Geology and Geophysics, Inner Mongolia Baotou Steel Union Co., Ltd., Baotou Research Institute of Rare Earths, and Central South University, the CAS publicity office confirmed with Xinhua on Thursday.

Li Xianhua, a CAS academician, on behalf of the CAS Institute of Geology and Geophysics, announced the findings, noting that the International Mineralogical Association has confirmed their status as new minerals and approved their naming, according to a CAS press release.

Niobium and scandium are both extremely rare strategically critical metals. Niobium is mainly used in special steels, superconducting materials and aerospace industries, while scandium is widely used in aluminum-scandium alloys and solid oxide fuel cells…

With the Chinese restricting the sale of rare earths, is this the Chinese giving a shot across the bow of the US to warn them to think through their ideas to going to war with China? Rare earths is just one dependency but there are many others and if the US gets into a fight with China, I doubt that China will be honouring any deliveries of military spare part or components to the US. Trouble is that the neocons could never be bothered to learn about industrial capacity in their fight with Russia so I do not think that they will bother to learn about such quaint things as resource needs as it would be seen as being beneath them.

The ignorance of this article, and of the commentators is an excellent example of the Dunning-Kruger effect. The sole issue with producing rare earth products outside of China is COST!!!! We, outside of China, still have the skills to explore for, mine, refine, fabricate, and manufacture rare earth enabled products, but it’s more expensive to do it here than in China. The economic illiterates who, for the moment, lead the Western governments simply say, “We’ll subsidize,” but then the problem begins: Who should we subsidize? Visualize a donkey hitched so it faces the wagon and the wagon driver yelling, “Giddy up,” and you have a perfect metaphor for the situation.

Sorry, not buying it. And you do not get to smear the commenters here by shouting over them and namecalling. This is bad faith argumentation in the extreme. You produced NO evidence, making your remark below acceptable standards here. I will not approve another one from you like this one.

You are ignoring that there are skills involved that we have ceded. You could make precisely the same argument about restarting the furniture industry in North Carolina and it is equally false. The US is having difficulty in other “reshoring” efforts due to the lack of skilled workers:

https://www.industryweek.com/talent/education-training/article/21243760/manufacturings-back-is-to-the-wall-on-skilled-labor

Industry Week makes it sound easier than it is. This is not just about “skill” in the sense of a general good level of competence, as in, say, being sufficiently math-literate to be able to read blueprints and other schematics, or be comfortable learning new software, but having the sort of know-how you acquire only through working in the operations of a particular industry.

My father did startups in an industry with plenty of similar operations all over the US. He was nevertheless one of the very few who could get them done on time and on budget. And in his capital-intensive industry, a bad startup would hemorrhage costs on an ongoing basis. So you don’t get to come here and carry on about costs. What he did was demonstrably hard, yet still VASTLY easier than bringing what would now effectively an entirely new industry due to teh US, due to the total lack of incumbents with expertise.

As for cost, the simple disproof here is defense industry needs. Arms makers produce wildly fussy devices at inflated costs. They can afford to pay hefty premiums to get needed inputs. Companies in that sector will pay well over market prices if they have to. That should be able to justify a small scale industry in the US, particularly if there were able to get some environmental waivers. The fact that we don’t see that, or any intent to go in that direction, is a challenge to your thesis.

I worked for a long time in the rare earth business, the US never really had rare earth separation technology. Molycorp could never make high purity rare earths consistently (its the reason NdPr blends are what is normally used in magnet manufacture – it was what was available for a long time). The other US separation plant in Texas used French technology and French engineers.

Back in 2011 and 2012 when the Chinese first started to heavily restrict export of rare earths, I had a number of discussions with the Defense Logistics Agency and they were of two minds. On one hand, there were groups within DLA that weren’t concerned since the Pentagon’s needs are relatively small compared to the market (if they even really know how much they need…) and they knew that they could just pay more to get to the front of the line. Other groups were less optimistic and considered stockpiling. The first group won out.

If you dig into the supply chain, there are three items that are of primary importance to the defense industry: polishing powders for optics, SmCo magnets, and Nd magnets. The first has never been made in the US, the second relies mainly on suppliers in the US and the UK, and the last was never really made in the US in reasonable quantity and quality.

The old saying use it or loose it still applies. If a skill is not used, the know how will dull, because there is a big difference between the factory floor smarts and some technical manuals. Plus, the people only get older and they move to different things…

Yves

Your ad hominem arguments don’t work. I have been working in the critical minerals/metals industry as a scientist, engineer, manager and commentator since 1962. I am the chairman of the Critical Minerals Institute. If you would bother to Google my name, you would have known that.

Jack Lifton

There is no ad hominem here. I made a substantive argument. I also called you out on the failure to substantiate your claims and your bullying. Those charges are accurate and you continue to validate them.

And I do know that you are an expert. so you make a further false attack.

You have yet to make a substantive response to ANY of the arguments made here.

That is a classic example of the appeal to authority fallacy, merely citing credentials and no providing any justification to support their argument.

This site is RIFE with accurate debunkings, by site authors and commenters, of authorities. You are persisting in making comments below the standard stipulated by our written site Policies, which above all feature making good faith arguments. Your continued insistence that we take your views on faith is the antithesis of that.

The neocons and bean counters who have taken over policy in the West don´t understand any of the above. And I don´t mean Mr. Lifton. I think he doesn´t understand how much skills in the West have atrophied. Take BASF and their chemical factory in Ludwigshafen which also happens to be the biggest chemical factory in the world. They´re giving up and relocating to China because evidently nobodys going to ensure (and certainly not the German “goverment”) a constant supply of carbohydrats at foreseeable prices. And that is although the US would gladly subsidise the relocation and certainly guarantee the requisite supplies of raw materials. The reason being that you can´t find the needed labour in the US. It is quite amazing to me how nobody in the US seems to see that China is taking huge advantage of US policy vs. Ukraine. Totally short sighted and give and take a few more years and China will regard Europe and the US as we used to regard China a mere 30 years ago.

So, if you are an expert on the subject, why not back up your insulting, abrasive comments with some evidence then? Otherwise, it looks like you are just tooting your own horn and insulting the site and commentariat. If that is your intention, you did a cracking job, I would venture that most here think you are a right “tosser”. So much for establishing credibility eh.

Earlier this year, The Wall Street Journal really hyped the discovery of rare earths at Halleck Creek, Wyoming. https://www.wsj.com/articles/wyoming-hits-the-rare-earth-mother-lode-natural-resources-policy-china-mining-8e559cec?mod=Searchresults_pos5&page=1

Turns out that the WSJ got out a little over its skis, as the find turned out to be much less significant, though not trivial. https://globalaffairs.org/commentary-and-analysis/blogs/american-rare-earths-find-comes-short

Back to the drawing board. . ..

…and the talings pile to extract those rare earths would be as natural as the mountains in Wyoming.

For fundraising week, someone should highlight the Commentariat again….

Love it how there is a vast reservoir of people lurking in the shadows able to provide first-hand anecdotes about any random topic of the day—like actual geologists!

Sadly I believe that I have not encountered an actual geologist since my one geology class in college. That’s America’s 21th century economy in a nutshell

Yes.

Yes, when ‘redleg’ mentioned how he transitioned from his miltary training, to land surveying, to engineering—on another topic , I assumed civil engineering. Turns out its geologic engineering (or some such). My geology friends nodded in agreement at his comments above.

The surprises reading this site are endless. Go Donate!!!

Engineering geology! Essentially moving stuff* around and putting it back.

The surveying background gives me a huge leg up when it comes to field mapping.

* mostly dirt and water.

I wouldn’t have misconstrued your geology chops if you hadn’t indicated ‘engineering’ in prior post. My geology friends are all highly technical/science based buggers and don’t consider themselves ‘engineers’. One was a ‘hard rock’ prodigy, but ended up being employed by the fracking industry for the money. Best to you.

What’s the difference between an engineer and a geologist?

A geologist doesn’t think he’s an engineer.

Yes, subsidies are already flowing (in Canada as well). But as Yves and others have pointed out, there are still barriers to be overcome and it is still doubtful if that is even possible. We’ll see…

Even if these are overcome, there are other challenges the US faces in producing high-tech weaponry to rival Russia. Even meeting recruitment goals for the military is problematic.

https://www.newsecuritybeat.org/2023/10/circumventing-chokepoint-produce-rare-earths/

https://foreignpolicy.com/2024/05/09/united-states-critical-minerals-mining-workforce-china/

https://www.globaltimes.cn/page/202309/1298364.shtml

September 17, 2023

Chinese scientists make key breakthroughs in rare earth mining

A team from the Chinese Academy of Sciences revealed major breakthroughs in rare earth mining at a meeting on Sunday. The discoveries will help shorten mining time by about 70 percent, reduce the impurity content by 70 percent and increase the recovery rate of rare earths by about 30 percent.

The findings were made by He Hongping’s team from the Guangzhou Institute of Geochemistry, Chinese Academy of Sciences. They presented the research results at a scientific evaluation meeting in Meizhou City, South China’s Guangdong Province.

This new mining technology is mainly applied to the mining of weathered crust rare earth ores, a characteristic resource in China. It aims to solve the problems of present in-situ leaching technology in ecology, resource efficiency, and to promote efficient and green utilization of rare earth resources in China.

Professor He’s team creatively developed a new way of using electric currents to extract rare earth elements (REEs), compared to traditional methods which uses ammonium chloride as leaching agents to extract REEs. The new technology is more environmentally friendly as it avoids soil contamination caused by leaching agents, which responded to the Chinese government’s demand for environmental protection and green and efficient mining.

With a 5,000-ton earth-moving scale demonstration area, professor He’s team was able to test his findings on soil and achieved design outcomes on the ground. This key technology and its results have helped He’s team publish 11 high-level papers in journals such as Nature Sustainability, * and to obtain 7 patents for inventions. Citing a report from Nature Sustainability, Anouk Borst, a geologist at KU Leuven called the strategy “A game changer, providing that it is feasible on a large scale.” …

* https://www.nature.com/articles/s41893-022-00989-3