This is Naked Capitalism fundraising week. 259 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, PayPal, Clover, or Wise. Read about why we’re doing this fundraiser, what we’ve accomplished in the last year, and our current goal, supporting the commentariat.

Yves here. This post, without giving a time frame, confirms the warning given by former Israeli general Yitzhak Birk, in a Haaretz op ed, that Israel would collapse in no more than a year if the Axis of Resistance kept up its war of attrition against Israel. Birk was referring more to military sustainment and rising internal schisms. But the deteriorating state of the economy is yet another pressure point.

This piece if anything understates where things are headed. First, it does not tease out how the continuing need to keep more soldiers mobilized will weigh on the economy. Second, it does not acknowledge the number of Israelis who have left since the war started, which is an immediate loss of both workers and demand. Keep in mind that many believe that tech workers, whose skills are in high demand, are over-represented among those who’ve departed. It is not clear how many might return. The attraction of Israel was that it enjoyed European living standards and was a supposed safe haven for Jews. If one or both remain in question, many of those who fled may never return.

Third, another source of potentially lasting damage is business closures, which this article explains, not surprisingly, are significant and expected to increase.

Finally, this article skips over a topic covered by some links in our Links feature going live shortly today: that Israel is setting out to wreck what is left of the West Bank’s economy.

By Amr Saber Algarhi, Senior Lecturer in Economics, Sheffield Hallam University and Konstantinos Lagos, Senior Lecturer in Business and Economics, Sheffield Hallam University. Originally published at The Conversation

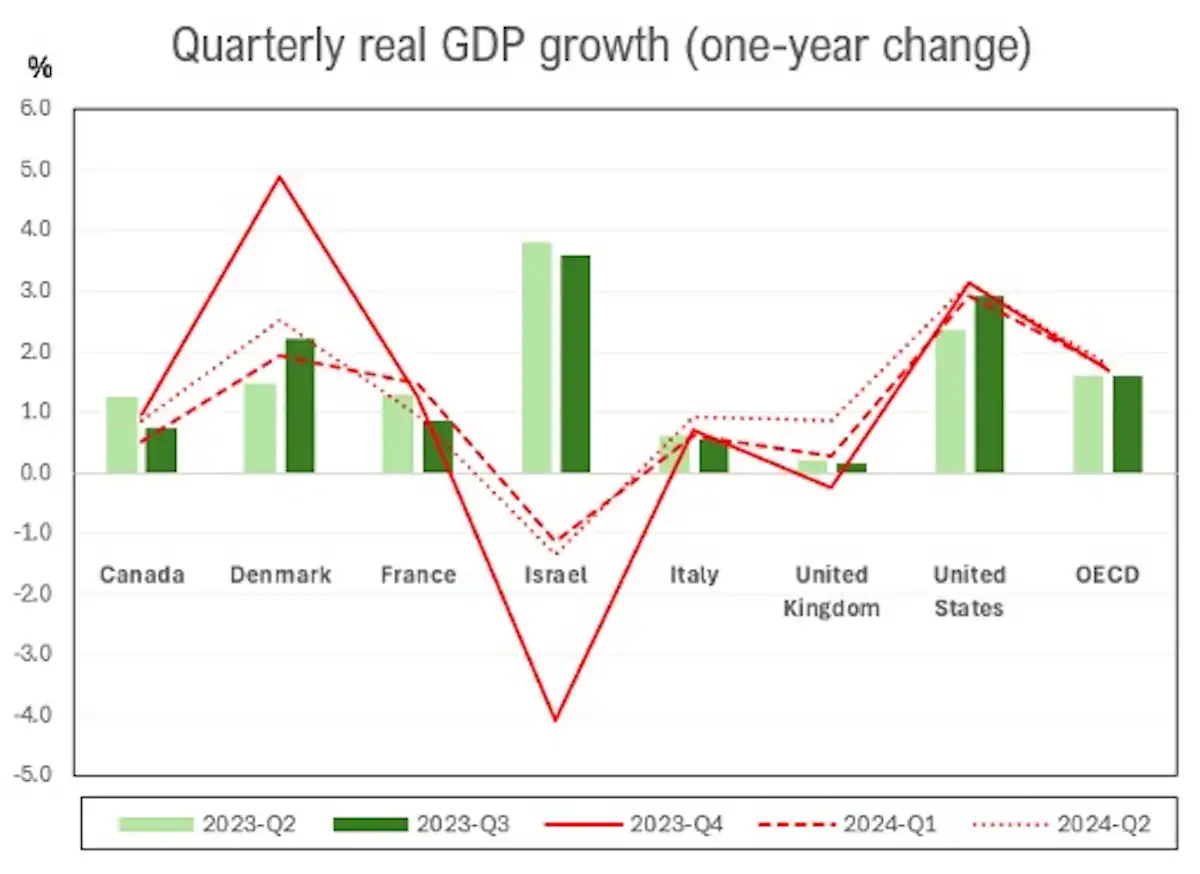

After 11 months of war, Israel is facing its biggest economic challenge in years. Data shows that Israel’s economy is experiencing the sharpest slowdown among the wealthiest countries of the Organisation for Economic Cooperation and Development (OECD).

Its GDP contracted by 4.1% in the weeks after the October 7 Hamas-led attacks. And the downturn continued into 2024, falling by an additional 1.1% and 1.4% in the first two quarters.

This situation will not have been helped by a nationwide strikeon September 1 that, albeit very briefly, brought the country’s economy to a standstill amid widespread public anger at the government’s handling of the war.

A graph showing the quarterly GDP growth for several OECD countries alongside the OECD average. Israel exhibits the most extreme fluctuation, with a sharp decline between October and December 2023. Amr Saber Algarhi & Konstantinos Lagos / OECD, CC BY-ND

A graph showing the quarterly GDP growth for several OECD countries alongside the OECD average. Israel exhibits the most extreme fluctuation, with a sharp decline between October and December 2023. Amr Saber Algarhi & Konstantinos Lagos / OECD, CC BY-ND

Israel’s economic challenges, of course, pale in comparison to the complete destruction of the economy in Gaza. But the prolonged war is still hurting Israeli finances, business investments and consumer confidence.

Israel’s economy was growing fast before the start of the war, thanks largely to its technology sector. The country’s annual GDP per capita rose by 6.8% in 2021 and 4.8% in 2022, much more than in most western countries.

But things have since changed dramatically. In its July 2024 forecast, the Bank of Israel revised its growth predictions to 1.5% for 2024, down from the 2.8% it had predicted earlier in the year.

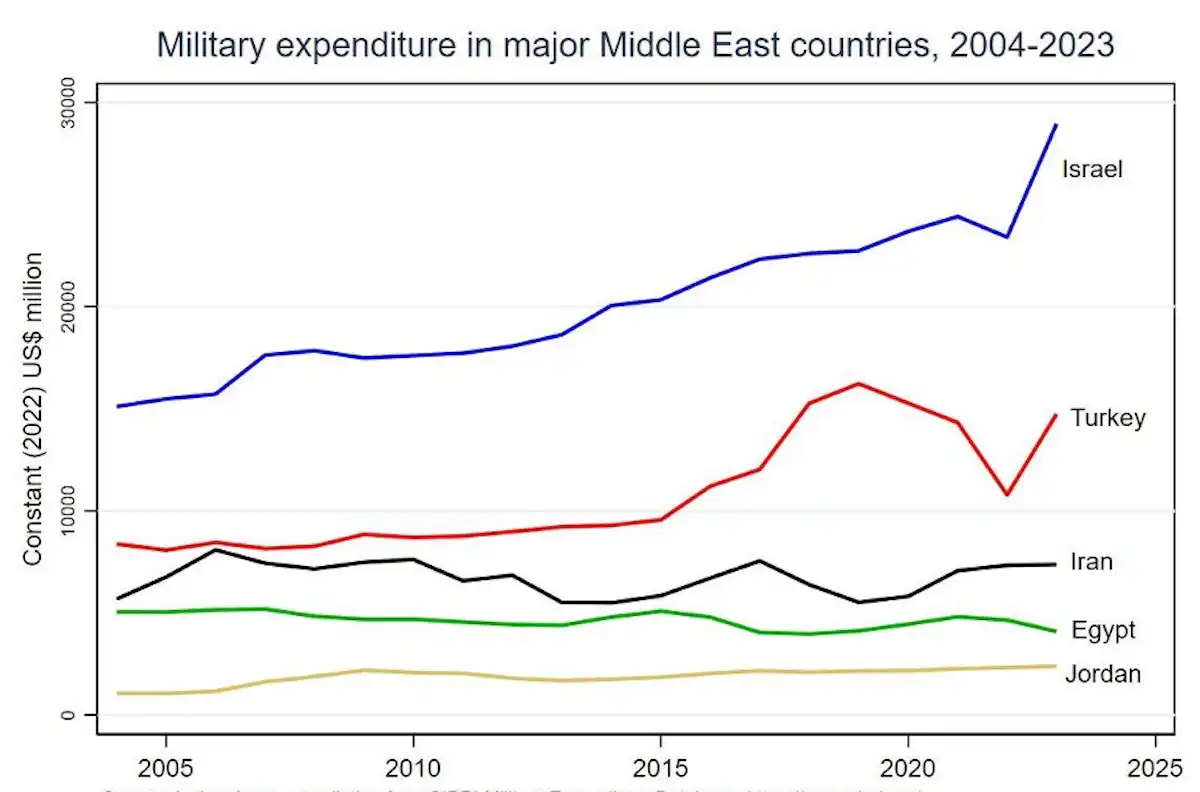

With the fighting in Gaza showing no sign of letting up, and the conflict with Hezbollah on the Lebanese border intensifying, the Bank of Israel has estimated that the war’s cost will reach US$67 billion by 2025. Even with a US$14.5 billion military aid packagefrom the US, Israel’s finances may not be enough to cover these expenses.

This means that Israel will face tough choices about how to allocate its resources. It might, for instance, need to cut spending in some areas of the economy or take on more debt. More borrowing will make loan repayments larger and more costly to service in the future.

Israel’s deteriorating fiscal situation has prompted big credit rating agencies to downgrade the country’s status. Fitch loweredIsrael’s credit score from A+ to A in August on the grounds that an increase in its military spending had contributed to a widening of the fiscal deficit to 7.8% of GDP in 2024, up from 4.1% the year before.

It could also potentially jeopardise Israel’s ability to maintain its current military strategy. This strategy, which involves sustained operations in Gaza aimed at destroying Hamas, requires boots on the ground, advanced weaponry and constant logistical support – all of which come at a great financial cost.

Israel’s military expenditure has consistently been the highest in the Middle East region. Amr Saber Alarhi & Konstantinos Lagos / SIPRI Military Expenditure Database, CC BY-NC-ND

Aside from macroeconomic indicators, the war has had a profound impact on specific sectors of Israel’s economy. The construction sector, for example, slowed down by nearly a thirdin the first two months of the war. And agriculture has taken a hit, too, with production down by a quarter in some areas.

Roughly 360,000 reservists were called up at the start of the war – though many have since returned home. More than 120,000 Israeli have been forced from their homes in border areas. And 140,000 Palestinian workers from the West Bank have not been allowed to enter Israel since the October 7 attacks.

The Israeli government has sought to fill the gap by bringing in workers from India and Sri Lanka. However, many key jobs are bound to remain unfilled.

It is estimated that up to 60,000 Israeli companies may have to close in 2024 due to staff shortages, supply chain disruptions and waning business confidence, while many companies are postponing new projects.

Tourism, although not a key part of Israel’s economy, has also been severely affected. Tourist numbers have dropped dramatically since the start of the war, with one in ten hotelsacross the country now facing the prospect of shutting down.

How this War Affects the Wider Region

The war may have battered Israel’s economy. But the effect on the Palestinian economy has been far worse and will take years to repair.

Many Palestinians living in the West Bank have lost their jobs in Israel. And Israel’s decision to hold back most of the tax revenueit collects on behalf of Palestinians has left the Palestinian Authority strapped for cash.

Trade in Gaza has also ground to a halt, which means many Palestinians now rely on aid. While, at the same time, vital communication channels have been cut off and crucial infrastructure has been destroyed.

The effects of the war have stretched beyond just Israel and Palestine. In April, the International Monetary Fund said it expected growth in the Middle East to be “lacklustre” in 2024, at just 2.6%. It cited the uncertainty triggered by the war in Gaza and the threat of a full-blown regional conflict as the reason.

A flare-up in violence in Gaza has inflicted economic damage on an even wider scale than this before. Israel’s bombardment of Gaza in 2008, for example, pushed up the price of oil by nearly 8% and caused concern for markets all over the world.

Israel’s war in Gaza, which is fast approaching its first anniversary, is taking a heavy economic toll. Only a permanent ceasefire can repair the damage and pave the way for recovery in Israel, Palestine and the wider region.

The very last element affected by this economic shock will be the Israeli military. It is already being shored up by US loans and weapons and will continue to be even if the entire Israeli economy implodes. The US kept Iraq, Afghanistan, and Syria going long past their rational point, and I think Vietnam and its colossal costs are also relevant here. The present US/IL escalation strategy and ongoing genocide are in no fiscal jeopardy.

I beg to differ. First on the list was boots on the ground. Many commentators have pointed out, and we raised the issue in or intro, that keeping enough men in service to deal with the Hamas operations and the elevated post-October 7 threat is imposting a cost on the Israel economy, both directly via their military service taking them out of the workforce, and second, via service-age adults leaving the country to escape being called up. Second, the US is running out of weapons thanks to the war in Ukraine, and told Israel that Ukraine had priority for very limited Patriot deliveries. Israel is already running out of tanks and ammo despite US assistance:

The US and the EU/NATO will supply Israel with weapons and economic aid just as they have done in Ukraine. Both Israel and Ukraine have unsustainable economies that will be buoyed by aid from abroad. The Empire will not let both outposts go in either region go down easily but Washington is, probably, willing to negotiate the end of the Ukraine War but will never allow Israel to go down no matter the cost. Israel will be funded by the US if no one else even if there are, in the US, millions on the streets or dying of starvation (maybe I exaggerate a tad).

Israel will evolve, if their ideology doesn’t change, into a warrior state as reservists learn the craft of war and learn to enjoy and become addicted to killing and torturing “the other” whoever that may be. Israel will not, in my view, move away from their policy of ethnic cleansing/genocide. Born out of, in many ways, the deep hatred of Europeans for Jews in the early part of the 20th century (not limited to Germany), they have taken that hate, distilled it, and drank the vile stuff and here is the result.

I don’t think you get it. The US can want Israel and Ukraine not to go down all it wants. But desires and the real world are two different things.

You are operating from the fallacy that the US is omnipotent and has ample weapons reserves. Neither is true. It is just about out of Patriots and Patriot platforms. It is having to send JSSMs, which it no longer makes and has only in comparatively limited supply, to Ukraine, because it is pretty much out of other missiles.

As the economist Herbert Stein said, “That which can’t continue, won’t.”

Where I see a distinction is that Ukraine is fighting a party that can fight back very effectively and overwhelmingly. It’s not just that the US is not omnipotent, but that it is actually weaker than Russia in terms of projecting power in Eastern Europe and Central Asia.

In contrast, it doesn’t cost as much to defeat Hamas as it does to defeat Russia, no offense to the Gaza fighters but they are less numerous and less well supplied. The horrifying end goal that I perceive Netanyahu’s government as aiming for is the comprehensive ethnic cleansing of large parts (all?) of Gaza and the West Bank. As repugnant as that is morally, it is feasible in industrial and economic terms.

Israel can then have an economic boom by building beachfront resorts in Gaza (I think they have a 2035 plan, and Jared Kuschner is excited for it), and getting a lot of foreign aid from Germany and the USA.

Of course, I would rather think that soon the Israeli military is going to mutiny, or Blinken will find his moral compass and impose a ceasefire, but I don’t see that happening, and unfortunately I think there’s a high probability of mass starvation / annihilation of the population of Gaza.

When there’s maybe a trace population left, they can declare a ceasefire, I think they’ll be brazen enough to do that, but I don’t know if they’ll be brazen enough to give out a Nobel peace prize.

The IDF disagrees with you:

https://edition.cnn.com/2024/06/20/middleeast/hagari-netanyahu-destroy-hamas-israel-intl/index.html

None other than the authoritative Foreign Affairs said Hamas is winning: https://www.foreignaffairs.com/israel/middle-east-robert-pape

As we and others have pointed out, Hamas and its fellow travelers worked out that both the US and Israel are set up to wage short, air-power heavy wars. So they went underground, making themselves largely impervious to airpower, and are conducting precisely the sort of campaign the US and Israel are not prepared to fight, a war of attrition, and on top of that, heavily using asymmetrical warfare techniques.

No one thought the VC would prevail early on in the Vietnam war either.

Israel is having much more luck wiping out defenseless Palestinian women and children than it is defeating Hamas. Sadly, Israel does look perfectly willing and able to continue the genocide for as long as it takes.

“Blinken will find his moral compass”. Just managed to turn away from my laptop in time. You owe me a cup of coffee.

Thank you!! Yes, when pigs will fly li’l Antony Blinkered will find a moral compass outside of Zionist extremism.

Many thanks for this detailed report on the Israeli economy. You have mentioned more than once that the attraction of Israel is a (1) safe place for Jews and (2) European levels of economic development. These are important characteristics to keep in mind as Israel inevitably goes into a social and economic crisis.

The irony, too, is that after years and years of horsing around in Lebanon, the Israelis now have some of the same problems that they inflicted on Lebanon. Ahhh, the great wheel of the law turns, and what goes around comes around.

In watching Sarde after Dinner on YToob, I have listened to the hosts and guests talk about how hollowed out the Lebanese economy is. One sees a seemingly comfortable and well-developed country in which per capita income is dropping and dropping. Wikipedia puts Lebanon’s per capita PPP at 15,500 USD, with Israel at 52,000 USD. Hmmm. I heard one guest assert that PPP in Lebanon may only be 3,000 USD.

The second issue is safety. The hosts and guests on that series have estimated the Lebanese diaspora at numbers as high as 15 million. One wonders about Israelis with ease of access to other countries. Lebanese come and go as political tensions rage and relent and as the economy grows and declines.

About the only thing I can say is that the vital signs of Ukraine, after the tender mercies of the US of A and NATO, are even worse.

That 15 million diaspora would include 3rd, 4th, and 5th generations going back to the time of the Ottomans, and even then is pretty high. Of 1st and 2nd generations, a 2-3 million figure would be more probable. One quality of Lebanese emigrants is that they tend to adapt quite well and assimilate into a host country’s culture more readily than some other groups. Very little of the ‘return to the homeland’ amongst them.

No doubt when the time comes, the Israelis will go looking for a bailout from Uncle Schlemiel. Congress would never dare refuse Israel all the billions that they need and Netanyahu can point out that they were voting blocks of some $60 billion for the Ukraine so surely they can do more for plucky, little Israel. And he can actually stand up and say that any loans will be paid back unlike hose to the Ukraine – but won’t say that they will be using the billions that the US sends Israel every year to do so.

A schlemiel is a klutz, someone who’s clueless. A schlimazel is a guy who is just loaded with bad luck.

So, a shlemiel is the guy who walks into a tree and scares a big bird. The schlimazel is the guy the bird poops on.

Now explain “Freier.” https://www.haaretz.com/2007-01-28/ty-article/thou-shalt-not-be-a-freier/0000017f-e3ad-d38f-a57f-e7ffa5630000 And it’s common for the disdainful Israeli to refer to the US as “Uncle Sucker,” referencing the common Israeli’s understanding of the term.

The US ruling class and “electorate” is a bunch of putzes and freiers, when it comes to being hoodwinked and robbed blind and being willing accomplices to murder by the Zionists.

And to my mind, most of what the Zionists are doing to the Palestinians is just murder. Genocide, the term, somehow seems to even sanctify the murders.

Except that in German, thanks to ETA Hoffmann, a Schelmihl is actually a schlimazel….

Sounds like “avoid foreign entanglements” was good advice. At least the British Empire made their elites fabulously wealthy for a time until the price of world wars had to be paid. And to be sure many contend that our American empire does benefit our own elites and even Walmart shoppers by controlling the world militarily.

But unlike England we have never been dependent on the rest of the world for food and materials even if we have allowed ourselves to become so recently. Which is to say America always had the avoid entanglements option and one might argue that was even the mainspring of the revolutionaries. England needed us more than we needed them.

What has really happened is that large parts of America have been colonized by our own elites and we in the South saw that one hundred years ago as New Englanders “off shored” their textile industry to the impoverished South until China offered a better deal. Now we are being colonized by German auto companies who can pay lower wages here than in Europe.

And Israel has in turn colonized our elites. It’s a system that is begging to be wrecked and seemingly on its way to being so. Avoidance can be good unless you know all the fine print.

I find the parallels between Israel and Ukraine interesting. In both cases a war of attrition has replaced what was hoped to be a fast, high-impact success (in Ukraine, it was an economic attack). Now they run out of people to fill the boots, the economy is in free fall, and the desperate, cornered leaders only hope is an escalation that draws in the entire US/NATO military and potentially goes nuclear. Behind both the realistic limits of imperial power are exposed, which is a greater threat than any weapon system. So the empire must trot out new systems and escalations via press release and promise, trying to maintain an appearance of control. Walter Kirn referred to it as ‘Bombing the map’ recently.

Just as Russians returning from Western countries are supporting the current boom in Russia, it seems time for us to expel Israelis to save the Israeli economy from collapse.

Since the Israelis will never learn how to live next to other people, let alone exist in harmony with another race or religion. When America runs out of money, bombs to donate or patience with them where will they go, Who’d have them, who would want them?

There are other Freiers in the world. Putin treads very gently around the Zionists, Russia has had problems with Zionists and people of the Talmud for generations. Then you got Milei, weeping at the Western Wall in his white yarmulke. The Pope is their friend, and other heads of state and national and local police and various large corporations and media are also. I wonder what ties to South Africa remain.

Our very own government has determined that the Israelis are the third principal espionage threat to the US. https://www.timesofisrael.com/new-nsa-document-highlights-israeli-espionage-in-us/ And as long as the Zionists have their very own strategically ambiguous nuclear arsenal, they have all of us by the short and curlies.

Anyone remember the USS Liberty? https://www.military.com/daily-news/2022/06/08/were-fed-it-survivors-of-uss-liberty-look-answers-55-years-later.html

Third!!! How about clearly first and there are no countermeasures deployed and no enforcement of FARA and no dialogue whatsoever about how dangerous it is to have dual citizens manipulating the levers of power in the US while the president snoozes and the VP boozes!

Look at our “allies” they are all in flames, and we are pouring fuel on the fire. Public perception is turning. If they fail to impose their censorship regime the mass awakening will continue. If they succeed there will be revolution, watering the tree of liberty once more and such.

My understanding of economics is too low to understand how a country can have 500k leave ( January—probably a million now), mostly tech workers and mostly the better paid, something like 10% of the population, toss another 500k working-age people into the military and only face a few percent economic shrinkage.

Not to mention, it closed one of its (three) major (bankrupt) ports permanently, lost 50,000 small businesses in a tiny nation (many months ago, this kind of thing tends to snowball), and lost tens of billions of foreign direct investments.

Now, if it were my business and there were an auditor, they would suspect I have two sets of books.