Yves here. Yours truly hates to sound like a broken record, but the de-dollarization enthusiasts are way ahead of the state of play and near-term prospects. Yes, dollar primacy is on its way out due to the US size relative to global GDP declining. And yes, the US is acting like it is doing what it can to accelerate the sell-by date through its excessive use of sanctions to try to get its way.

However, even though Russia and its friends are working hard at constructing payment mechanisms for trade that skirt the dollar and are having increasing success, trade accounts for less than 5% of global foreign exchange transactions. The overwhelming majority is investment-related. We owe readers a post or two on why the dollar use for investment is not as vulnerable as it is for trade.

In the meantime, Wolf Richter provides an update on another issue that we have discussed: that despite much noise-making that foreign investors are supposedly getting leery of US Treasuries due to rising US Federal debt levels, in fact the share held by foreign central banks in total is holding steady. While some states are lightening up, others are purchasing more.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street<

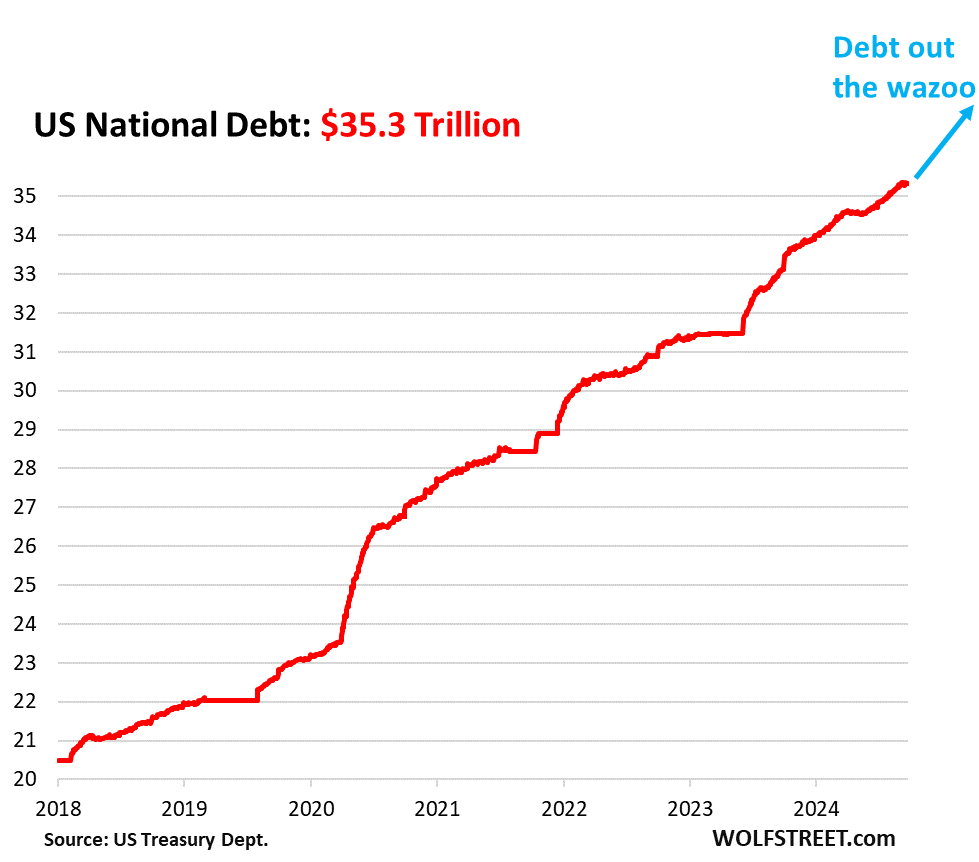

The US national debt has ballooned so fast to $35.3 trillion – by $12.0 trillion since January 2020 – that it’s mindboggling, especially in a growing economy. And every single one of the Treasury securities that form this colossal debt was bought and is held by some investor, and we’re going to look at those entities that hold this Treasury debt.

Who Holds This $35.3 Trillion in Treasury Debt?

US Government funds: $7.11 trillion. This “debt held internally” are Treasury securities held by various US government pension funds and by the Social Security Trust Fund (here’s the SS Trust Fund holdings, income, and outgo). These Treasury securities are not traded in the market, but the government funds purchase them directly from the Treasury Department, and at maturity are redeemed at face value. They don’t involve Wall Street fees and profits, and they’re not subject to the whims of the markets.

The remaining $28.2 trillion in Treasury securities are “held by the public.” At the end of Q2, the time frame we’re going to look at now, $27.6 trillion were held by the public. A small portion of these Treasuries “held by the public” cannot be traded, such as the popular inflation-protected I bonds, and some other bond issues.

The rest – $27.05 trillion – were Treasury bills, notes, and bonds, TIPS (Treasury Inflation Protected Securities), and FRNs (Floating Rate Notes) that were traded and were therefore “marketable.” They’re by far the largest class of US fixed income securities, far ahead of corporate bonds ($11 trillion).

Who Holds the $27.05 Trillion in “marketable” Treasury Securities?

The Securities Industry and Financial Markets Association (SIFMA) just released its Quarterly Fixed Income Report for Q2, which spells out, among other things, who held these $27.05 trillion of marketable Treasury securities at the end of Q2:

Foreign holders: 33.5% of marketable securities. This includes private sector holdings and official holdings, such as by central banks.

Overall foreign holdings have continued to rise from record to record. The big financial centers, European countries, Canada, India, and other countries have increased their holdings to new records. China, Brazil, and some other countries have reduced their holdings for years (we discussed the details of those foreign holders here).

The US Entities That Hold the Remaining 66.5%.

US mutual funds: 17.7% of marketable Treasury securities (about $4.8 trillion), such as bond mutual funds and money market mutual funds. They decreased their share from Q1 (18.0%).

Federal Reserve: 16.1% of marketable Treasury securities. Under its QT program, the Fed has already shed $1.38 trillion of Treasury securities since the peak in June 2022 and as of early September has brought its holdings down to $4.4 trillion (our latest update on the Fed’s balance sheet).

US Individuals: 11.1% of marketable Treasury securities (about $3.0 trillion). These are investors who hold them in their accounts in the US. They increased their holdings since Q1 (from a share of 9.8% or about $2.7 trillion).

Banks: 8.1% of marketable Treasury securities outstanding (about $2.2 trillion), roughly unchanged since Q1.

State and local governments: 6.2% of marketable Treasury securities (about $1.7 trillion), a slight decrease in share since Q1 (6.3%).

Pension funds: 3.7% of marketable Treasury securities (about $1.0 trillion), a decrease of their holdings since Q1 (4.3% and $1.7 trillion).

Insurance companies: 2.2% of marketable Treasury securities (about $600 billion), an increase of their holdings since Q1 (1.9%), reflecting Warren Buffett’s conglomerate, Berkshire Hathaway, which includes GEICO, which has loaded up on T-bills over the past two years through Q2.

Other: 1.4% of marketable Treasury securities (about $400 billion).

The burden of the US debt: These interest-bearing assets held by investors are costly liabilities for the government. Here’s our discussion on the burden of the national debt and what portion of the tax receipts are eaten up by interest payments and how that evolved over the decades: Spiking Interest Payments on the Ballooning US Government Debt v. Tax Receipts, GDP, and Inflation

Thanks Yves and Wolf for the breakdown. Though I have Warren Mosler and Stephanie Kelton whispering to me to fix the the conclusion:

The

burdenblessing of the US debt: These interest-bearing assets held by investors are credits to the private sector, albeit distributed unequally fromcostly liabilities forthe government. Here’s our discussion on the tool that isburden ofthe national debt and what portion of the treasury computer creditstax receiptsare distributed viaeaten up byinterest payments and how that evolved over the decadesNicely said. In fact, Treasuries and ‘cash’ are interchangeable government IOUs – Treasuries being more ‘money-like’ than cash because bank deposits are not fully guaranteed while Treasuries are.

Interest payments (wealthfare cheques) are to some degree ‘real’ though and Mosler’s answers are a permanent zero interest rate, fully guaranteed bank deposits and no tax-advantaged savings.

I need to take another look at the data, though. I had concluded the US national ‘debt’ increases exponentially (why would anyone be surprised) hence comments about it exploding, etc. The thing is, its growth is twice as fast as GDP – again, maybe not surprising in a financialized economy. But maybe I’m wrong? But if not, it paints a picture of wealth inequality being pumped by government debt, which at least I find disquieting.

A timely tweet from the man himself!

Interest on Federal Debt isn’t an issue. When Fed Gov debt matures, the Fed Gov simply rolls it over. And when it rolls it over, it rolls in the interest payout as well (i.e. finances the interest with new debt issuance). Who buys the new debt (with interest on top) to retire the debt that is maturing? The same players that were listed out in this article. So basically they’re paying themselves (or to be more exact, swapping between themselves). On a net basis, the Fed Gov sees no impact to their balance sheet: currency in = currency out.

Consequently the yield (interest rate) doesn’t matter. There is no burden on the Fed Gov.

You are right, there is no burden on a fiat government. But that doesn’t mean there is no burden. The burden is on a society in which the accounting image of debt – savings – is growing (exponentially?) and creating a more unequal nation and concentration of political power.

Good point. Progressive taxes are a good thing in my book.

Separately it gets back to the kalecki levy profit equation. Deficit spending is a big contributor to profit in the private sector nowadays. Reducing deficit spending (i.e. increasing taxes) would make corporate profit more reliant on their own collective investment (i.e. capex spending) as their basis for collective profit. I.e. what the profit equation was originally focused on.

‘Foreign holders: 33.5% of marketable securities. This includes private sector holdings and official holdings, such as by central banks.’

I wondered about this. Could it be that the US government is going to countries and telling them that if they want to get in good with the government and have access to officials, that a good way would be for them to buy up some US treasury securities which would help the US? Scratch my back…

This is not such an outlandish thought. Remember when Hillary Clinton was SecState? If you wanted access to the US government and especially US officials, it was let known that to do so you would need to drop a big load of cash into the Clinton Foundation. Maybe that is where Hillary got the idea from.

This is pure CT and lame CT on top of that and you have fully asked for the ear-boxing you are about to get.

Sorry, that is NOT how it even remotely works. The amounts the Clintons wanted were couch lint to most government players and she could provide access. The amounts for Treasury buys are orders of magnitudes large and Treasury is in no position to provide access. And the buys are either at Treasury auction or open market, FFS.

In fact, China in the past (and may still) buy through London, presumably to get better prices and hide that it is a whale buyer; Brad Stetser back in the day would work thought that to estimate Chinese purchases. The Saudi Monetary Authority sold Treasures even as its sovereign wealth fund, which is independent, was buying them. Etc.

I don’t think they need to. Realistically, if a country is running a trade surplus, it makes sense to recycle those dollars into US treasuries. They are the only asset with the required volume to recycle the surplus dollars into and they are better than just holding dollars as they are interest bearing.

Recycling them into other currencies or Treasury equivalents is more difficult because the volumes are not there, other countries are not issuing debt instruments at such massive volumes. Same with physical assets like precious metals, etc. Not only are the volumes for gold low, but there is a recurring storage cost.

Holding Treasuries is no riskier than holding dollars, so it makes sense.

Agreed. Implicit in this of course that recycling that trade surplus into treasuries (or whatever US assets) allows a balance of payments to be achieved and therefore allows the country’s currency to remain at “par” with the US.

In contrast to say if US surplus currency wasn’t recycled this way such that it was left to actual trade in goods and services to achieve a balance of payments. Ideally the country would pivot to increasing their demand of goods and services from the US so that it matches their exports of such to the US, thus allowing their currency to remain at “par”. But if instead they let their imports stay at prevailing levels, the pair trade of demand of the US dollar in their currency would fall off a cliff. Their currency would in turn become exhorbitantly expensive compared to the US dollar and all those US business models that depend on outsourcing the global supply chain to said country would blow up.

It was a fortuitous trade of pork bellies at The Merc in Chicago.

Thank you Yves for higlighting this breakdown, interesting.

Regarding the slow de-dollarisation. My view is that the dominant factor is the US empire. The empire upholds the dollarisation, the dollarisation in turn is a feedback mechanism to uphold the empire, mainly by threatening trade if the vassals step out of line.

Investments I think need to be seperated into physical and monetary. Physical investments – in for example new factories – are slower processes than trade, so threats should give the unruly vassal more time to adapt.

Monetary investments by placing money in interest-bearing papers, is like placing gold in Fort Knox, it is a bet on the empire. For the government in a vassal state, betting on the empire is also a bet on the empire backing them. If a government fears the opposition more than the empire, placing money and gold in the US weakens their state if the opposition gets into power and tries to break with the empire, giving the loyal vassals a better chance to get back into power. Therefore I think it would be interesting to look at the composition of the foreign debt. It could be the same actors doubling down on the empire.

I could be very wrong here, and am grateful for counterposing views. I am merely trying to sort out the empirical mechanisms. During the decline of an empire its – often hidden – mechanisms come to surface when they break. Figuring them out ahead of time at least gives an understanding as the house of cards come tumbling down.

Not irrelevant but by far the least important aspect. What matters is that the US is a net seller of national assets, be they government bonds, shares of national companies, real estate, agricultural land etc… What consequences? It is enough to drive thirty minutes in one of the many degraded cities, worse than in Africa. Unable to re-industrialize because they have lost their skills, the brightest minds prefer to work on Wall Street with salaries many times higher than in the non-financial industry whose main occupation is the sale of national assets in incredibly imaginative ways. Let simple minds fool their minds with the inessential.

Just to add:

What also matters is that the ideology of privatization of the commons has been spread far and wide through “free trade” agreements and global elites who congregate together at particular universities.

Everybody talks about the USA’s or the West’s waning influence. I’m a little more hardcore. I’ll believe it when I see neoliberal economics buried and other soft power influences fade.

As for Yves’ opening remarks to the article about currency fears, while there are problems, I usually notice the more “hair on fire” alarms in the media are usually followed by a pitch: buy gold or crypto. Fear is the way to sell products.

Well said, when a country buys more than it sells on the world market and pays for it with currency, the country is accumulating debt and losing assets. Foreigners can buy US real estate, businesses or hold American debt in settlement of these trade deficits. The US runs annual trade deficits because its trading partners sell goods and services to it that have a combination of price and quality that make their goods a better buy than America’s. This has led to slower economic growth, which used to be over 4% up to the 1970s and has slowed to about 2% since 2000. With slower growth, federal governments have been running deficits, which have averaged over $1 trillion per year since 2000, and $1.8 trillion in the past 10 years, in order to pump up the economy.

Interesting breakdown, thank you. The two big surprises for me are the US individual and pension fund holdings. I would have guessed pension funds held a much higher percentage and individuals a lower one.

Pension funds thought it would better to become a dump for private equity.

https://www.msn.com/en-us/money/personalfinance/pensions-piled-into-private-equity-now-they-can-t-get-out/ar-BB1ogPlM/

Trump wants to revive manufacturing in the United States, so how will foreign countries find the USD to reinvest into Treasuries? If Trump is successful (which is doubtful), will the Fed need to step in and monetize some portion of US Government debt?

We are an open economy. They can acquire dollars or dollar assets from their dealer banks whenever they want. For foreign entities, they buy treasuries because they are safe and liquid. They do not care about the price.

As Michael Pettis says, this makes the dollar our exorbitant burden.

There’s always the funds flowing out to keep those 800 military bases operating….

And uncountable $billions in foreign aid that gets spent on buying US equipment and ‘services’.

But even if the US were able to revive manufacturing, there’s no chance it would make a dent in the trade deficit. The manufacturing they want to revive is chips and airplanes and machine tools, high end stuff. I doubt anyone is talking about shirts or sneakers or any of the mountain of under $50 junk flowing through Amazon.

Somebody is always hoovering up the currency that the Fed Gov spends into the economy. If it becomes less tilted to our foreign trading partners then it’s more titlted to domestic entities. Don’t need the Fed (as in the Federal Reserve) to step in.

Thank you, Yves.

This reminder of caution with regard to dedollarisation is timely.

What is noticeable is that the people involved, including their western advisers* (usually ex City and Wall Street, often, but not always, on the left and supporters of multipolarity / realists), echo your caution and proceed as such.

*One of the advisers is ex Fed and Bank of England. After a brief stint at a NYC law firm, she began working with Gerald Corrigan at the NY Fed. Both are Irish. She transferred to London to supervise US firms and UK firms with US operations and then joined the Bank of England. Every week, she marches for Palestine in London. In addition, she volunteers at a food bank. She’s firmly on the left. It would be amazing for both of you to meet. You have much in common.

Other than those eager for, and who can blame them for wanting a new global system in place quickly, there’s a lot of disinformation from the usual suspects. Disinformation, the above tries to correct.

In some respects, IMO the importance of de-dollarization has been downgraded a notch or two, by Russia not just completely withstanding Western sanctions, but thriving while doing so. Of course not all nations can expect to get results like Russia for all kinds of reasons, but that we now have a concrete example of a mid-sized economy breezing past USD denial yet barely breaking a sweet and even reeping benefit from them, changes some other nations calculus of the costs associated with saying “No” to Uncle Sam.

While the war doesn’t stop them from going their own way financially, how much they are able to achieve and how fast will be influenced by the weight of the war with NATO and any drag from the battle with Ukraine.

Someone at NC last week, a commenter or one of our esteemed hosts, mentioned MEGO, ‘my eyes glaze over.’

Explanations of the US national debt (when they don’t incite volcanic anger and angst) usually fall into MEGO category.

Along with how the Fed calculates inflation rates and then decides to raise or lower interest rates. The latter was the subject of a discussion on NPR a few days ago, with the presenter suggesting that the public’s preference for ‘kitten videos’ over the Fed’s arcane explanations of their actions, was only natural and indicated a high level of trust in the Fed’s decisions.

Is this opacity actually deliberate? Keep the voters confused and addicted to various ‘conspiracy’ theories and arguing amongst themselves about government debt levels, money creation and the role played by debt issuance, inflation, interest rates, etc., while the Blob does what it darn well pleases, all while issuing pronouncements that rival the utterances of the Sibylline Oracle.

Anyway, thank you for posting this breakdown of the debt. It is a good start.

There is no Illuminati Wizard behind the curtain – it’s just capital accumulation.

Nobody needs to deliberately do anything to Americans. They are pigs at the trough and indulge in filth of their own volition.

Well I don’t know what MEGO stands for but you touch on a facet that has not been discussed here. Most people view inflation as things costing more. It says the same thing but I prefer to think of inflation as your money being worth less. So all things being equal the debt has ballooned as the dollar is worth less but the things it has to support are not.

The (global) System is highly robust. “The debt” is largely notional since it never has to be repaid and is the reward and virtual wage for the US maintaining an Empire of the “rules-based order” which benefits the ruling elites around the world so they tend to buy into it. This System is always increasing in its robustness which is easily folding into AI systems. The problem is that this highly efficient system is vulnerable to humans (particularly in Washington) increasing irrationality as displayed by the current drift into world war.

Just mint the damn platinum con, $50,000,000,000,000.00 worth.

Then just make interest payments and redeem US Treasuries without issuing new debt instruments.

There are some advantages:

* it takes the debt ceiling drama off the table for a generation.

* It has the effect of making the US a less attractive safe haven for foreign capital, because investing in US Treasuries becomes much more difficult and less certain.

* It won’t have a big impact on inflation, since this money reenters the economy slowly as interest payments and retiring debts.

* It knocks the pins out of Wall Street and big banking, leading to a less financialized economy.

* It reduces US hegemony over the international finance system.

* It forces the cat-food commission crowd to STFU.

* It engenders a change in economics as a field, with MMT likely becoming ascendant.

I thought of the coin too, though I didn’t think of all the benefits.

Not sure about the second bullet point. All that foreign money will want to stay in dollars, as the elites know better than anyone about the mismanagement of their local economies, or stay in dollars to protect the exchange rate for their export orientated economies.

Odd that Wolfstreet in this link: https://wolfstreet.com/2023/12/20/are-foreign-holders-finally-bailing-out-of-the-incredibly-ballooning-us-national-debt/ has foreign holdings of US Treasury Securities declining from 33 % in 2015 to 22.4% now.

I can’t tell the reason for the massive discrepancy but above Wolfstreet referred to “marketable” securities.

If we had Earth Bank could we all deficit spend to a dedicated cause?

Technically it is true that the U.S. will always be able to service and repay its debts.

But I question whether it follows that the national debt does not matter.

It strikes me that one important mechanism for increased inequality and the accelerating trend of transferring wealth from the many to the few is the very nature of our financial system

via interest payments on this national debt.

Richard A. Werner has argued that the national debt is the desired result of a system put in place through the creation of a privately owned Federal Reserve 110 years ago. A key ingredient of this system is the extraction of purchasing power and wealth from the rest of the economy, for the primary benefit of a small minority.

How about the government stopping the issuance of government bonds and instead fund public sector borrowing requirements from domestic banks via non-tradable loan contracts.

See Werner “Quantitative Easing and the Quantity Theory of Credit,” (2013)

I’m quite naive in these matters. That said, why would Russia and China be in a hurry to see something as disruptive to world trade as a change in the reserve currency? Wouldn’t their obvious first gambit be to establish means to continue doing business in dollars as usual, but free of US interference?

The extent to which the US is dependent on China to meet its needs makes the extent to which the dollar is the “US Dollar” obscure to me.

“The extent to which the dollar is the ‘US Dollar’ is obscure to me”

Bingo Raymond, you don’t seem all that naive to me!

Thanks Yves and thanks commenters.

I need to learn a lot more about how international finance and trade works.

I am doing my best and these discussions always include several points that nudge me towards understanding.

Excellent stuff.