The European Union on October 4 took a big step in its budding trade war with China. Member states voted to enact new tariffs on China-made battery electric vehicles of up to 35.3 percent. They will be imposed on top of the 10 percent duty already imposed on car imports and is to remain in place for five years. Beijing is already responding by imposing its own tariffs on European brandy and is also conducting investigations into imports from the EU of dairy products, pork, and large-engine cars.

European officials are expressing shock that Beijing is retaliating.

“I find these measures incomprehensible. There is no justification for them,” said Sophie Primas, Junior Trade Minister of France, which will be hit hardest by Beijing’s move on brandy.

What Is De-Risking? Who Is Pursuing It and Why?

In a moment of truth the EU’s top diplomat Josep Borrell recently admitted that “Europe must not oppose itself to China’s rise, because this rise is a fact. China … is at the cutting edge of all technology.”

And yet Europe goes down the path of “de-risking” from China nonetheless.

European Commission President Ursula von der Leyen who coincidentally pioneered the term “de-risking” is largely running the show. While she was by all accounts a complete failure as German defense minister (2013-19), she has found her niche as Commission president, successfully organizing the EU’s executive arm so that she wields almost complete authority in ways that previous rulers attempting to bring all of Europe under their control could only dream of. Her reign in likely aided by the fact she has no problem bending the knee to Washington. No doubt, the US is looking forward to more of what Ursula says will be a tough “foreign economic policy” in her second “mandate.”

EU member states added new instruments to Ursula’s toolbox during her first five-year term, such as the Foreign Subsidies Regulation, International Procurement Instrument, an Anti-Coercion Instrument, the Corporate Sustainability Due Diligence Directive, and the EU Critical Raw Materials Act. Taken together, they mean Queen Ursula can slow trade with China to a trickle if she or her partners in Washington see fit.

Her “de-risking” playbook has three stated goals: to protect the EU economy from outside encroachments, to promote its competitiveness, and to partner with “friends” to mitigate its vulnerabilities. In practice, however, it equates to economic confrontation with Russia and China while encouraging a wholesale takeover of Europe by the US.

Prior to her humiliating 2023 trip to Beijing, von der Leyen elaborated on her “de-risking” strategy in a speech on EU-China relations at the Mercator Institute for China Studies and the European Policy Centre. Here’s a key excerpt:

The starting point for this is having a clear-eyed picture on what the risks are. That means recognising how China’s economic and security ambitions have shifted. But it also means taking a critical look at our own resilience and dependencies, in particular within our industrial and defence base. This can only be based on stress-testing our relationship to see where the greatest threats lie concerning our resilience, long-term prosperity and security. This will allow us to develop our economic de-risking strategy across four pillars. The first one is: making our own economy and industry more competitive and resilient.

The second pillar is using her new tools, the third is more “defensive” tools (Ursula loves tools), and the last is alignment with partners, and we all know who that is.

There is a belief in Brussels that Ursula and company largely constructed pillar one and two during her first five-year term, and now it’s time for three and four, but it’s hard to square that with reality.

While Washington and Brussels’ agendas unsurprisingly overlap, the EU continues to be much more exposed to China than the US for both exports and imports, with the latter increasingly “strategic.” Gone are the days of China’s imports consisting of textiles, shoes, and furniture. They are now pharmaceuticals, chemicals, and critical raw materials.

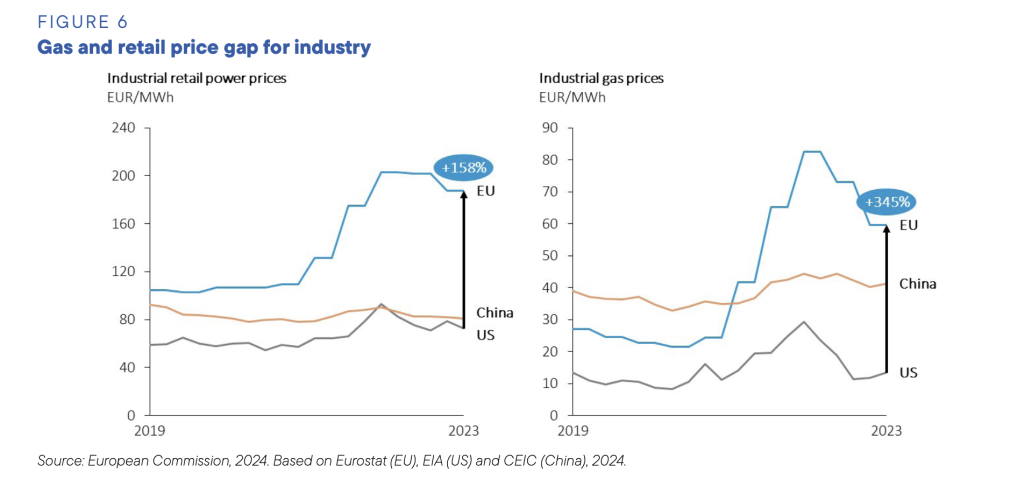

Von der Leyen likes to tout her tools like the bloc’s Net-Zero Industry Act (NZIA), which aims for the EU to process 40 percent of the strategic raw materials it uses by 2030. The NZIA allows projects to bypass many environmental and social impact reviews, but there’s no budget, and the policies do nothing to change Europe’s disadvantages, which include a lack of subsidies compared to the US and China and much higher energy costs thanks to their “de-risking” away from Russian energy. One might think that disaster would serve as a warning, but Ursula and company are plowing ahead with “stress-testing our relationship to see where the greatest threats lie concerning our resilience, long-term prosperity and security” despite not having the EU “economy and industry more competitive and resilient.”

About that stress-testing. It’s strange that the trans-Atlantic relationship is never put to the same test as with Moscow and Beijing. Second, is this some new form of international relations that Ursula is pioneering? Intentionally damaging ties with world powers in the name of stress-testing? That line of strategic thinking seems to be widespread in Brussels.

The German Chairman of the International Trade Committee (INTA) at the European Parliament sums it up when he argues that “sometimes you have to put a gun on the table, even when you know that you might not use it.” Even if we discount Chekov’s gun principle, are there not other downsides to that strategy, such as the other side thinking you might use the gun and shooting you?

Is this a wise course of action when the EU relies on China for more than 90 percent of its supply of certain drugs, chemicals and materials — and in some cases there are no substitutes?

Similar to the whole Russia fiasco, it won’t be people like Lange and Ursula taking the bullet, but the working class across Europe. Somehow that never gets factored into these bright ideas like stress-testing.

Is De-Risking Proving Effective?

Two charts from an August report from the Peterson Institute for International Economics show how the EU is more reliant than ever on China.

A few observations of the above charts courtesy of the Conversable Economist:

In short, these patterns seem to suggest that imports not coming from China to the US economy are, in a substantial way, ending up in the EU economy instead. This pattern suggest that if the goal of US trade policy is to reduce China’s footprint in the global economy, it is unlikely to do so. Indeed, given that imports often pass through the production process in several countries on their way to a final product, it’s plausible that some Chinese exports are going to Mexico and the EU, being incorporated into other products, and then ending up as US imports.

Both of those observations would suggest the near impossibility of “de-risking” from China. It currently produces 90 percent of the active material for EV battery cathodes and 97 percent of the active material needed for anodes. It also assembles 66 percent of the world’s EV battery cells. This means China has unrivaled leverage over the entire automotive supply chain. That’s why the German auto sector was so opposed to the EU kicking off a trade war with China. As Adam Tooze explains the charge that the German auto industry erred by becoming “dependent” upon the Chinese market is completely wrong headed:

If you are in the business of making cars and selling cars at the global level, which is the aspiration of a VW and the German high-end marques, but also the likes of Toyota and, perhaps, GM, then being in China is not a basket you do or don’t put your eggs into. China is not a market that you can derisk from, or balance with other markets. It is the market, it is the country where both in terms of trends of consumption and production, the future of the global industry is likely to be decided.

EU businesses’ unwillingness to voluntarily de-risk is why we see Ursula and company stepping in to force the EU to wall itself from China.

***

Another part of the EU’s efforts at de-risking and competitiveness involve the struggle to produce chips in the bloc.

The world’s largest chipmaker, Taiwan’s TSMC, is working on an $11 billion project in Dresden, a venture that’s touted as a major step towards the EU’s goal of having more microchips made in Europe. Germany’s car industry could benefit from the chips rolling off a domestic production line, but the EU had to pick up about half of the tab in order to get the project off the ground, and there are doubts about its long-term viability.

An Intel plant in Magdeburg, Germany, was supposed to be Europe’s only facility making the most advanced computer chips and be operational by the end of the decade, but Intel postponed the $30 billion investment ($10 billion of which was to come from German state aid) to reduce its spending amid the company’s financial woes, and there are reports that it’s a coin flip whether Intel abandons the project entirely.

There is an effort to blame labor unions and high wages for the problem but it chiefly comes down to two issues. The first is high energy costs. Due to the EU’s decision to cut itself off from Russian pipeline gas, it faces uncompetitive energy costs.

Enormous amounts of electricity are needed for the supercomputers or chip-making factories to function properly. In addition to the EU’s high costs, there are loads of uncertainty about energy supply in the future, which is a no-no for business investment.

There are also problems finding enough workers. After decades of elites shipping industry to China, it’s not easy to flip a switch and make the necessary skilled labor appear.

All that offshoring is coming back to bite Western capital now. Beijing is hardly to blame for taking what was being offered, but now that it’s ready to turn around and sell advanced clean tech solutions, the West says no thanks, we want to be in control of the Green future. Problem is, that’s easier said than done.

De-Risking Downsides

There are many.

If you’re concerned about democracy, there is a major downside to the de-risk mania. As evidenced above, European countries continue to cede even more sovereignty by giving Ursula and the Commission various new tools to conduct the de-risking efforts.

If you’re concerned about Germany, a trade war with China adds to the endless bad economic news from the country. A day after the country marked 34 years of unification, the tariff vote might go down as another milestone. The country’s auto industry, which has driven Germany’s economic rise since its post-WWII economic miracle, is in big trouble, and a trade war with its biggest market (where German cars were already on the decline) won’t help. While the German political class offers some rhetorical dissent to the de-risking strategy (Chancellor Olaf Scholz made a show of his opposition once it was clear the measure was going to pass), they have fallen in line despite the complaints from the auto industry. Meanwhile, Belin sends warships through the Taiwan Strait. Why? It must prove its bona fides as US, British, French, Dutch and Canadian warships all recently made the journey.

The country is nearing a breaking point as insurgent political parties on both the left and right that favor less Atlanticism and repairing ties with Russia and China continue to gain ground, and Berlin considers undemocratic responses to keep them at bay.

If you’re concerned about climate change, the de-risking strategy is a setback for the deployment of more “clean” technology. A decarbonized economy sounds great, but even the most optimistic timelines admit that possibility is years away and requires massive amounts of investment. It gets harder to pay for as economies are struggling, government budgets are broken because of energy costs, and you’ve walled yourself off from the country producing most of the green products.

More local production is a worthwhile goal, but there’s the not-so-minor inconvenience that China increasingly dominates most stages of the global green technology industry. Here’s Adam Tooze discussing Brian Deese’s call for a Clean Energy Marshall Plan in Foreign Affairs:

As Deese gamely observers: “The good news is that most of the technologies necessary, from solar power to battery storage to wind turbines, are already commercially scalable.” Yup! this is true. But the problem from Washington’s point of view is that it is not the US that is leading that commercialization. But China. On a huge scale. Against US resistance.

The EU will no doubt hurt China with a trade war as China is reliant on the EU to absorb its excess capacity in clean technologies, but it will be cutting off its nose to spite its face.

And this is really the crux of the issue. The EU is not prepared to “de-risk.” It is not possible to simultaneously embrace neoliberalism while pursuing an industrial policy. The result — intentional or not — will be evermore vassalage to the US, which might be in a better position than the EU but faces its own neoliberal-industrial conundrum.

The EU’s de-risking plan with China appears even more ill-fated than the one with Russia. That’s because while other gas supplies are available — albeit less reliable and more expensive — that will be less so with critical materials, which China dominates.

According to SWP, Germany’s extremely ambitious goals in the area of the green energy and mobility transition alone can hardly be achieved without economic exchange with China. Here we can see why:

Who Benefits?

Several of the myriad crises that Europe finds itself in today (energy, deindustrialization, vassalage to the US due to confrontational policy towards Russia, and going down a similar path with China) can be traced to the desire of the bloc’s elites along with those in the US to control the green tech of the future. Serbian President Aleksandar Vucic recently stated the obvious when explaining the reason for the European elite’s belligerent policy towards Russia is because it has all the resources that Europe wants control over.

Like that failed strategy, which produced many beneficiaries — few of which were in Europe — so too will the strategy to “de-risk” from China.

Hungary, which continues to receive Russian gas (and has the lowest electricity costs in Europe) might be able to capitalize. (There’s a reason Brussels detests Orban so much).

Hungary currently receives nearly half of China’s foreign direct investment into the bloc. China’s battery giant, CATL, is making its biggest-ever overseas investment of approximately $9.7 billion in the country, and EVE Energy, another Chinese battery manufacturer, is making a $1.32 billion investment to produce large cylinder batteries.

Türkiye, which is in the EU customs union, is getting a $1 billion production facility from electric car giant BYD and is in advanced discussions with Cherry Automobile for another.

But we’ll have to wait and see. The EU is considering attempts to wall off backdoors into the bloc market, as well. In the eyes of Brussels, these unwelcome “concessions” in places like Hungary are a security threat since China is a geopolitical rival of the EU. In response, the EU is considering strengthening its Investment Screening Mechanism, which would give Ursula and the Commission the power to prevent such deals.

The biggest beneficiary to the EU’s de-risking efforts, however, is likely to be the US.

Western battery makers and other clean tech companies are increasingly moving to the US due to lower energy costs and subsidies. China de-risking could be another boost for US LNG. That’s because what the EU is doing by going down the derisking path is effectively saying that it does not want Chinese clean technology. Couple that with the resistance to Russian energy and it means an extended reliance on LNG.

Perhaps ironically, among the biggest proponents of the China de-risking strategy are the German Greens. I say perhaps because their policies — intentional or not — frequently lead to decidedly un-green energy outcomes just as they did when Germany cut off Russian pipeline gas, closed its remaining nuclear power plants, and started burning more coal to make up for the energy shortfall.

Should critical materials increasingly get caught in a trade war between Europe and China, there will be middlemen — like those selling Russian oil to Europe at a markup — eager to step in and profit while Europeans face high prices and less competitiveness.

Competitiveness. That word is thrown around a lot in Brussels these days, and we’re getting a clearer look at what the remedies are going to be. That’s where the US is really set to benefit.

The argument of Queen Ursula, Mario Draghi and company is that Europe needs more concentration, more “productivity” and more privatization in order to build technological supremacy. In other words, it needs to double down on neoliberalism and become more like the US — increasingly by selling off assets to US firms. That will have to be a story for a future post, but for now it’s enough to say, that’s a shame.

Even after decades of neoliberal reforms, Europe might still lag in competitiveness as measured by capital interests but those computations of course don’t take into account its still-superior quality of life — from better population-wide healthcare and work-life balance to more unions and less economic inequality.

All these upsides for labor are of course downsides for capital. If the first Cold War was a time when Europe built its welfare states, the second appears poised to finally bring them crashing down.

A simple question here but, do tariffs help to boost productivity in any way or form?-Being supposedly this one of the purported objectives of de-risking. Just asking. Come on Mario, Ursula pipe in!

‘Beijing is already responding by imposing its own tariffs on European brandy and is also conducting investigations into imports from the EU of dairy products, pork, and large-engine cars. European officials are expressing shock that Beijing is retaliating. “I find these measures incomprehensible. There is no justification for them,” said Sophie Primas, Junior Trade Minister of France, which will be hit hardest by Beijing’s move on brandy.’

Everything old is new again. Ten years ago the EU, along with the US, announced a whole raft of sanctions against Russia to screw with their economy if not wreck it. But not that long after the Russians launched their own counter-sanctions against the EU and they were visibly shocked that Russia could actually do such a thing and it cost the EU billions. I had the impression at the time that they never actually expected it as in at all. And now I read that the exact same thing has happened once again but with China instead of Russia. These EU minions have the memories of goldfish.

Please stop insulting goldfish. The EU is busily self destructing and should not be interfered with. Russia has nationalism, religious fervour and intelligence in common with the Irish. Olaf Scholz cutting off imports of Russian fossil fuels as ordered by Washington

is as close to self immolation as it is possible to get. I have close German relatives who venerate Washington and fail to grasp that the US enjoys weakening both Russia and the EU.

The answer is that there is a competency crisis in the Western world. The governments of Western nations are led by people who are utterly incompetent and who have no understanding of how things work. It’s easy to tell by their lack of skill in sanctions and everything else. Much of this is attributed to the rise of the PMC in the Western world.

China is now too far ahead in manufacturing and there is no sign of the elite in China making the kind of dumb mistakes the Western elite made, such as embracing neoliberalism. If anything, the Chinese are going in the opposite direction. The Western MSM is trying to vilify this:

https://www.bbc.com/news/articles/crl8xee75wgo

The issue is that the Western media serves the rich. The European elites don’t serve their people. They are both incompetent and utterly corrupt. The fact that they are hurting their own nation’s viability does not faze them in any way.

There is no serious plan for reducing Europe’s energy costs nor match China’s industry. It would take a level of competence and public service the elite in the West don’t have.

I think these people know perfectly well that retaliation is coming. They just need to fake moral outrage as a psyop.

The EU tariffs on Chinese electric vehicles increase in a stepwise fashion from 17% to 38%. The tariff is company-specific and depends on the European Commission’s estimate of how much state aid a Chinese company receives.

https://www.reuters.com/business/autos-transportation/eu-lays-out-its-china-ev-tariff-calculations-2024-07-04/

It would be interesting to see if the Chinese are going to apply similar counter-tariffs. Those could also be producer-specific and depend on estimates of how much agricultural subsidies went into the production of pork and dairy products.

It is also a bit unclear if the European Commission’s collection of detailed information about the operations of non-European companies should be regarded as state-backed corporate espionage.

China already has very high tariffs on imported cars. This is why nearly every big name builds most of their cars for the Chinese market in China. The only scope they have within the rules is to increase tariffs on bigger luxury cars (which is why Mercedes Benz is so against this trade war).

Information on how China subsidises car (and other manufactures) is widely available open source, it’s not really a secret. The arguments are over how to interpret the known data. It can be hard to distinguish a genuine long term investment by a public body from a subsidy.

The mind struggles not to perceive the NZIA’s anagram. The fourth reich is family blogging with us, right?

“China is a geopolitical rival of the EU.”

That those running the EU actually believe this is evidence of their utter cluelessness. The “EU” (and who is that, anyway?) isn’t even sovereign within its own region, let alone able to project force in the wider world beyond. It’s not even capable of controlling its own borders.

It is more accurate to say that China is a geopolitical rival of their master.

They have chosen servitude …

It not just about tariff. It is part of a series of interlocking steps. IIRC, the United States used tariffs for over 150 years to build up its own industries especially heavy manufacturing as well as to protect the precious little it started with over two centuries ago. The British Empire did spend over a century discouraging the manufacturing of nails by the colonies.

The world dominating and war winning manufacturing ability of America was generations of works. Creating and maintaining manufacturing was also necessary to supply the military when the United States’ military was a joke and getting most of its weapons from countries in Europe, which the country was either at or threatening to do so half the time. If one is talking about efficiency, assembly line manufacturing in the United States started with flintlock and caplock muskets before the American Civil War; the initial greater setup cost for manufacturing large numbers of weapons at the same time was paid for by the superior quality and individually lower cost-per-unit with the ability to keep a supply of interchangeable parts for repairs being really appreciated by the military. It was much easier for someone to use a screwdriver right at the front or at least the local depot then sending it back to the experts to hammer in parts that sort of fit.

Ultimately, the goal was to make making American manufacturing profitable enough to both avoid being dependent on the Europeans and for local American manufacturers to pay American workers to buy their own stuff, which made developing American research labs specifically and education generally necessary.

That required preventing the British or anyone else from undercutting them. But again, in the longer term, it also required paying American workers to both develop the skills needed for American goods and to buy the same goods. Refusing to pay for the training and the ability to buy quality doesn’t work; that is what neoliberalism is.

thank you JBird4049.

tariffs protect your sovereignty, standard of living and technology. ben franklin was the originator of the american system.

andrew jackson tried to tear it down. lincoln resurrected it. woodrew wilson tore it down again, FDR and truman resurrected it.

and it was chipped away till bill clinton completely gutted the american system, and the markets have reigned supreme since.

china understands the american system, it is one of the most protected economies in the world.

article one, section eight of the constitution clearly states the american system is the law of the land, the job of the federal government is to charge tariffs, duties, excise taxes, regulate commerce between nations, regulate business.

https://www.nakedcapitalism.com/2019/08/inflation-data-shows-tariffs-are-not-a-tax-on-consumers-but-on-foreign-us-corporations.html

Inflation Data Shows Tariffs Are Not a Tax on Consumers but on Foreign & US Corporations

Posted on August 15, 2019 by Yves Smith

———————————————–

THANK GOD FOR TARIFFS,

tariffs do not cause depressions.

there has been no tariff related inflation.

tariffs raise wages.

tariffs give democratic control over trade.

tariffs reverse poverty caused by free trade.

tariffs protect the wealth of a nation.

tariffs promote research and development.

tariffs help labor create a high standard of living, its called a civil society.

tariffs do not blockade ports, otherwise where does all of that tariff money come from.

TARIFFS ARE EXPANSIONARY ALSO.

tariffs are like a universal income for the poor.

tariffs are a tax on the wealthy

tariffs are a boon for the poor

tariffs actually lower import prices, and keep them low

without tariffs, the wealthy can charge more for imports, they do not have to worry about claims of import price manipulation.

Tariffs and export taxes slow down the speed of capital: Tariffs and export taxes promote industrialization: Tariffs and export taxes promote food stability and local supply chains: Tariffs and export taxes are ecologically sound: Tariffs stabilize employment and communities

this is a work in progress.

In the mixed economy of The New Deal, a managed capitalist economy could be directed toward efficient production of public goods to reduce the labor cost for efficiency gains tied to capital investment, all while raising standards of living.

It’s that last part the capitalists can’t stand, it’s the reason they ended the mixed economy and expropriated economic planning back to the private sector.

It started in earnest when Reagan brought the Sullivan & Cromwell mob that had been running the empire abroad home to implement the first Powell Doctrine, the one from the eponymous Memo. The Clintons were opportunistic sociopaths riding the fascist wave Reagan unleashed.

Sorry, this started as a rambling response that got worse, to Ignacio at 7:00 am

A sort of weird extension of compsrative advantage, no?

First, you find cheaper/better producers of goods abroad.

Then you find cheaper workers and laxer regulations abroad.

Then you find better consumers abroad.

After all these, what use is the home country again? Of cpurse, this wouldn’t happen if the economies were static. But they are not: often, comparative advantages build upon themselves and, if you start dismantling them, thibgs can go downhill fast.

Neoliberalism eats the seed corn and starves the farmer to fill its pockets with inedible gold, the Midas road to wealth.

The European Commission led by bankers and psychophants (sic) is the model for global corporate governance and every day that goes by I’m gratified that trumps axing the tpp on day one of his admin threw a spanner in the works of these useless eaters.

This combined with the africa post before it proves that they have yet to give up, however, and I can only hope that the stars will align in planet earths favor.

Conor, for those looking to understand the deeper currents of current historical processes, this is a superb snapshot. It captures much more than just the “derisking downsides” narrative.

Conor should submit this piece to the Financial Times. Big heads would explode around the globe.

VDLiar just follows orders. The EU is toast, Xi and Putin’s long term strategy is to wait for it to whither and break and then welcome Germany back to their embrace. The US has removed a competitor but its not China or Russia.

Is the EU more exposed than the US? Probably due to the cost of energy. And because the dollar is the global currency. And because the US has a massive military and the EU does not. And because the European leaders are vassals waiting to be gladio-d if they step out of line.

I am skeptical of the massive improvement all the complex trade stat manipulations seem to show with China, the US-China deficit continues to grow, and that doesn’t include the massive effort to flow Chinese goods through third countries.

https://tradingeconomics.com/china/balance-of-trade

OTH, the complex trade stats are good for political headlines.

thank you Conor, towering statement,

“All that offshoring is coming back to bite Western capital now. Beijing is hardly to blame for taking what was being offered”

yep, i have said it for decades, china took what was offered. i would have to. anyone with even the slightest intellect, could see what was going to unfold.

what towering intellectual mental midgets like bill clinton, tony blair, gerhard shroeder and a host of other elite white supremacists, have made such a mess, the blowback from the inevitable, predictable collapse of free trade, will make the last two collapses look like just a minor dust storm.

another towering statement,

“It is not possible to simultaneously embrace neoliberalism while pursuing an industrial policy.”

absolutely spot on.

ever see the tree stooges short where they build a house, at the end, curly looks at the door which was installed sideways, and says it looks pretty good.

clintonomics is so engrained i feel the next steps will be, all labor rights out the door, we already have forced prison labor and debtors prisons, and productivity keeps falling. time for 6-7 day workweeks, no over time nor minimum wage, 12-18 hour shifts, then outright slave labor. and productivity will still fall.

the fascists finally won WWII in europe, and the confederates finally won the civil war in america.

all of this is a snapshot of a global capital depression like the black and whites of the Oklahoma exodus to California. there was no place left for common capital to go in the US in 1930. And today the world has progressed to a similar point. Investment capital sucks up all the oxygen until it starts to gasp. Unless you are wise enough to have a mixed economy which is responsive to demand. and etc. China is offering us solutions. We should accept them. It could be a sea change.

Thanks Conor, important post.

The Ukraine-Russia conflict may not have worked out per plan, but one wonders how many American neocons were concerned that an independent EU connected to Russian resources would have challenged America too much and see a destroyed Ukraine and de-industrialized EU as almost as good a result. (Are you watching all this Taiwan?)

Again, just astonishing to watch EU leadership double down on such failing actions, but I watched American leadership take actions which wrecked American industry and destroyed it’s middle class for multiple decades so I guess I should not be so shocked.

Having shot themselves, with both barrels, in both feet and shins, the EU is now working its way up to its knees.

Economic suicide has become its speciality, showing the rest of the world how not to behave.

Germany is going to award Biden its highest civilian honor, the Grand Cross of the Order of Merit.

https://www.yahoo.com/news/biden-set-visit-berlin-next-163326047.html

Betray an ally, blow up Nordstream 2, wreck the German economy, get a medal from the folks you family-blogged. You can’t make this stuff up.

The political economy of the EU was based upon: (i) trade surpluses generated by selling high end goods to China and the US; (ii) discounted commodity inputs; (iii) the preservation of European (specifically French) influence on Africa; and (iv) the realisation of increasing economies of scale within the EU itself.

These pillars were under stress prior to 2022: China was moving rapidly up the value chain, the gradual disintegration of US hegemony risked higher input prices, there were signs of increasing restlessness within Francophone Africa under Hollande, and in default of true risk pooling there were diminishing returns to the generation of internal economies of scale (especially in such a mature market). All of these pillars have disintegrated since 2022. The EU thought that the Ukraine war could be used to stimulate further moves towards integration that would permit it to establish a greater level of strategic autonomy. The reverse seems to have happened: the calculations of European leaders have been, in Gandhi’s phrase, a ‘Himalayan blunder’. In the geopolitical game of musical chairs, victory inevitably belongs to those regions which have the demographics, the credit and, above all, the natural resource endowments. Europe has none of these things, and the decision which will likely soon face it is whether to be an appendage of the US or of the Sino-Russian combination (the second alternative would entail an acutely problematic revolt against the US, so seems rather less likely).

I don’t think the EU will necessarily collapse, but it could – as others have noted – become ever more like the Holy Roman Empire (especially after 1648), in which there are circles of influence comparable to the ‘imperial circles’, and in which it subsidies into little more than a legal and administrative construct. In strategic terms Europe might perhaps become ever more like 18th century Venice, eking out a diminished, comfortable and yet increasingly parlous existence under Habsburg (read US or Sino-Russian) tutelage.