Yves here. Confirming Wolf’s account of the reaction to the unexpectedly strong new jobs report and labor data revisions, the currency market has reacted as if the Fed rate cuts are off the table for now. Emerging market currencies fell markedly.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

Pandemic distortions and millions of migrants suddenly entering the labor market, who are hard to track, have wreaked havoc on labor-market data accuracy.

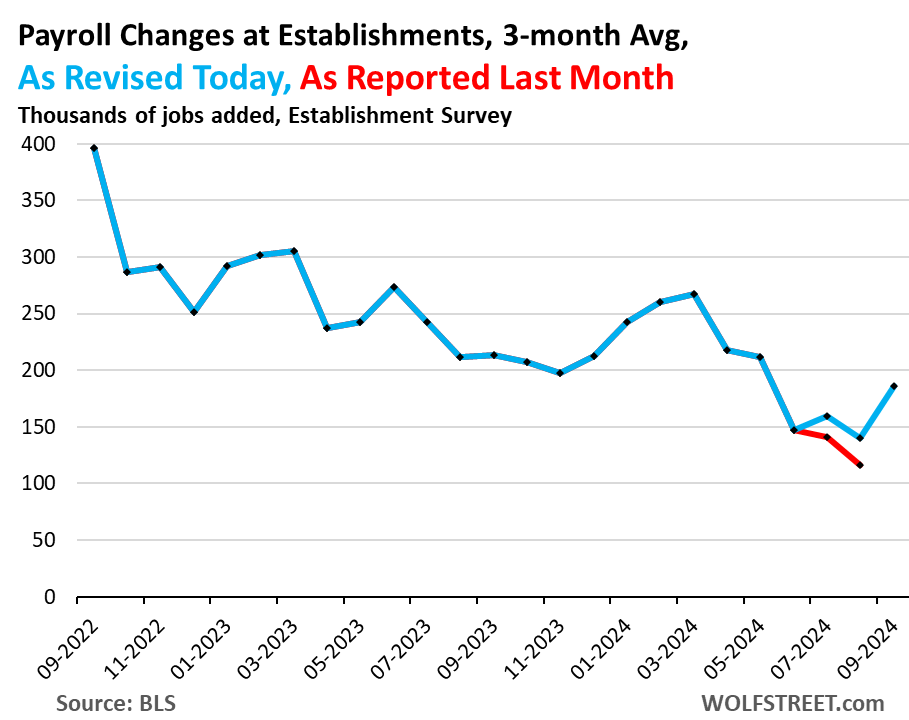

Payrolls at employers rose by 254,000 jobs in September, and the down-revision last month for July was re-revised up a lot, and August was revised higher too, so the three-month average jumped to 186,000 payroll jobs created in September. And the three-month average for August – which had been reported as 116,000 at the time, a scary and sudden deterioration with the revisions that caused so much consternation – was revised up to a half-way decent 140,000.

Turns out, the sudden deterioration of the prior two months were a false alarm. The labor market is just fine, creating a decent but not spectacular number of new jobs, and the unemployment rate dropped for the second month in a row, and wages jumped, and the Fed doesn’t need to cut any further, given the inflation pressures already building up again — though it will likely cut further, though maybe at a slower pace than previously anticipated.

The blue line shows the three-month average of jobs created as reported today. The red segment shows the three-month average as reported a month ago:

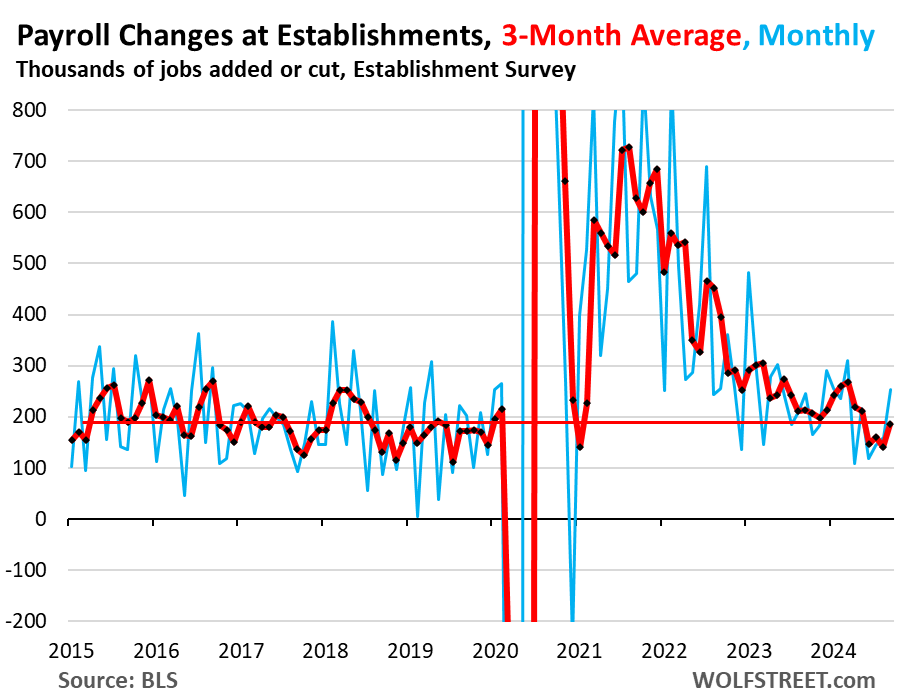

Here is the long view, as revised: The three-month average is right in the sweet-spot of the strong labor market in 2018 and 2019.

Clearly, the frenetic pace of hiring after the pandemic is over, and the labor shortages are over. The pace is back to a healthy strong job growth.

This picture matches other data showing that layoffs and discharges remain very low. Companies in aggregate are creating jobs at a decent pace, and they’re hanging on to the employees they’ve got.

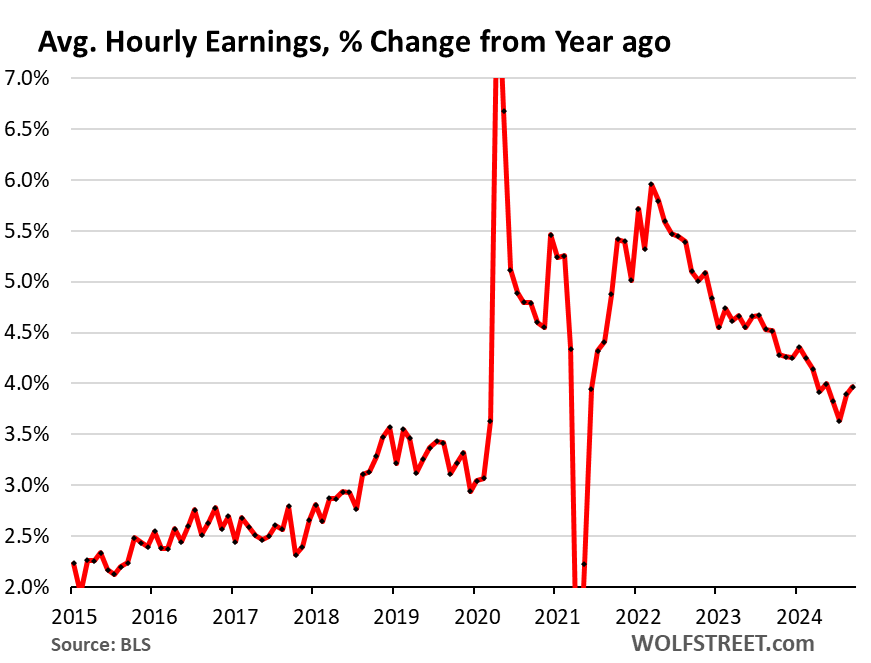

Average hourly earnings were also revised higher for August to a hot 5.6% month-to-month annualized, from 4.9%. And in September, they increased by another 4.5% annualized from the upwardly revised August, which caused the three-month average to increase by 4.3%, the highest since January. The three-month average has been increasing steadily since April (red line). This is based on the survey of establishments.

The 12-month increase of average hourly earnings rose to 4.0% in September, and August was revised higher to 3.9% (from 3.8% as reported a month ago). Those two months combined show the fastest acceleration since March 2022, and are well above the peaks of the 2017-2019 period.

So in terms of inflation – and what the Fed has been worrying about – this accelerating wage growth is not going in the right direction anymore.

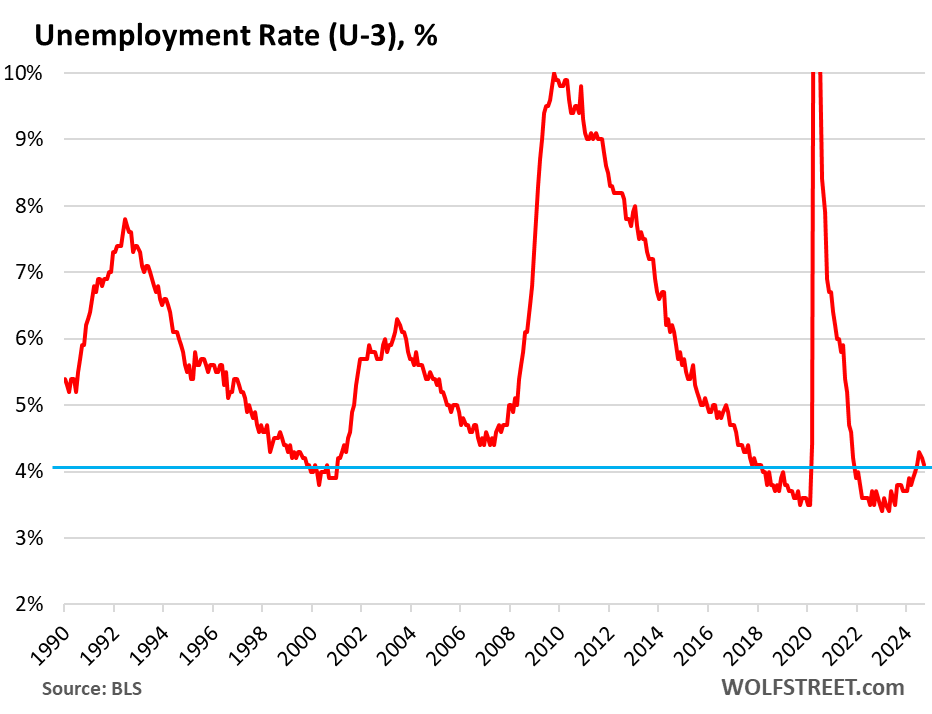

The headline unemployment rate (U-3) dipped to 4.1%, the second month in a row of declines. 4.1% is historically low, but is up from the period of the labor shortages in 2022. This is based on the survey of households.

The unemployment rate is now below the Fed’s 4.4% median projection for the end of 2024 and for the end of 2025, according to the Fed’s Summary of Economic Projections released at the rate-cut meeting.

The weakening of the labor market that the Fed projected in justifying the 50-basis point cut has reversed, been revised away, or failed to happen.

The unemployment rate is also where the massive influx of immigrants over the past two years – estimated at 6 million in 2022 and 2023 by the Congressional Budget Office – shows up: Those that are looking for a job but have not yet found a job count as unemployed. And their influx into the labor force has caused the unemployment rate to rise from the lows last year.

A rise of the unemployment rate caused by a surge in the supply of labor is a different dynamic than a rise of the unemployment rate caused by job cuts and a reduction in demand for labor, as we would see during a recession:

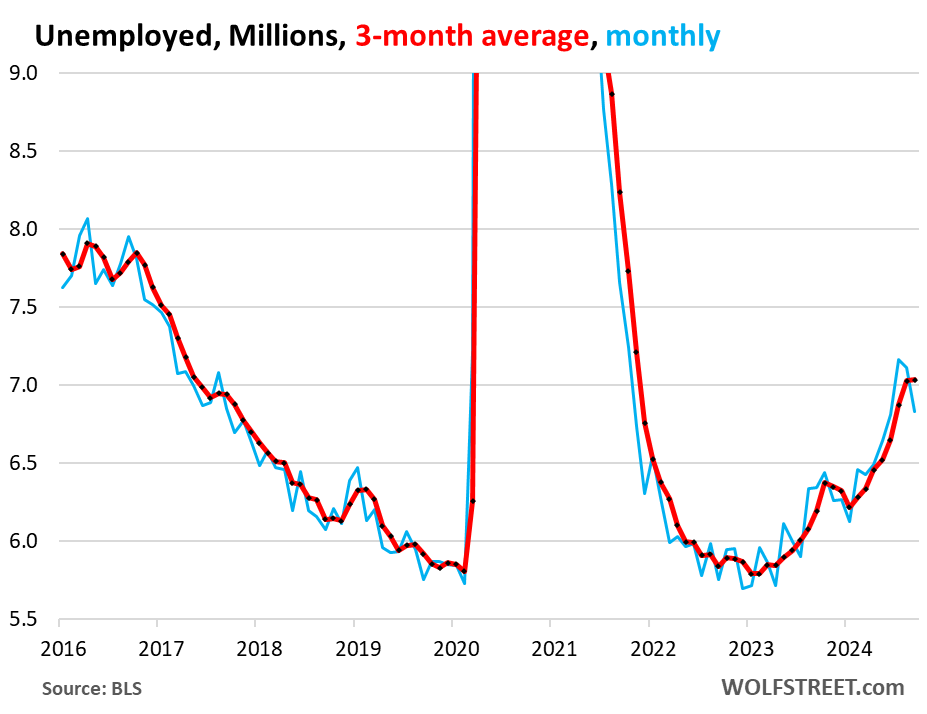

The number of unemployed people looking for a job fell for the second month in a row, to 6.83 million. The three-month average inched up to 7.04 million.

The unemployment rate (chart above) accounts for the large-scale growth of the population and of the labor force over the decades. This metric here of the number of unemployed does not take into account the growth of the population and the labor force, and over the decades, a growing population and labor force entails a growing number of people looking for a job.

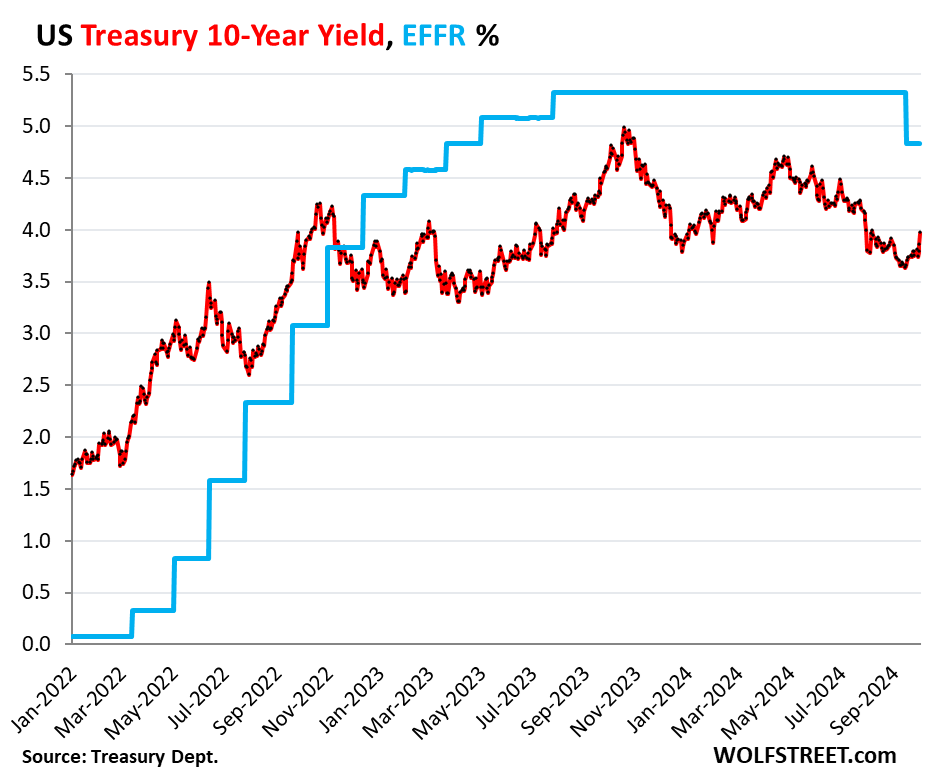

And the bond market woke up.

Upon the news that the labor-market scare last month was a false alarm, and that aggressive rate cuts to save the labor market are not needed, and that wage growth is contributing to general inflation concerns that we have already seen in the Consumer Price Index for August and July, and in what companies have said about raising their prices, and in the pricing power that companies still exert…

Well, upon the news, the bond market woke up, and the 10-year yield jumped by 12 basis points to 3.97% at the moment, the highest since August 8. Since the rate cut, the 10-year Treasury yield has risen by 27 basis points.

Very curious this. We see the “immigrant” influx daily now here in the North American Deep South. Almost every labour heavy job is now conspicuously manned up with Hispanics around here. I passed a roofing crew last week and the workers were all speaking amongst themselves in Spanish. I am tempted to walk up to one of these crews and yell out “Imigra! Imigra!” and watch the scramble.

Related to the above, I wonder how these fabulous wage increases are being divided up among the “working” population. For example, I am seeing a sudden uptick in street corner begging. I am told by an acquaintance that the homeless encampment on 4th Street is growing again as new “occupants” filter in from the surrounding environs. Even the local coppers seem to be more “mellow” when it comes to the homeless.

Welcome back to the Mauve Decade.

Stay safe.

It is curious. The big swings in data in monthly “revisions” is not exactly confidence inspiring nor are the almost constant Zero Hedge accusations of politically motivated manipulations/outright fraud, in jobs reports. My economic lessons at University of Chicago tell me if there is growth and job creation, “monetary” is King so he must be entering the economy somehow and that matters more than interest rates even if they are “high”, so look what the Fed is doing regarding “liquidity” or whatever they call it. The population is getting old. In my 20’s, almost anywhere you went you’d see similar age people in large numbers which made dating easier. Now in 60’s, still seeing similar aged people in large numbers. Mush less so 20’s. And just yesterday, I too saw a roof being stripped of its old shingles by a gang of men speaking Spanish while walking the dog. The economy still seems strong – my house in Massachusetts went under agreement this weekend after a bidding war over asking, and in Tennessee homes rarely see bidding wars but sell briskly. Tennessee has a notable presence of older probably partially retirement population but if you talk to kids (especially young single guys) you work with in Massachusetts they all know about how affordable shelter is in Tennessee because they know friends who moved here because of it. One thing we seem getting closer to, with our entire political class in Washington focused almost exclusively on their imperial wars and can’t be bothered to address what we the people care about, at some point things will snap when delays in needed infrastructure collide to present a great big bill to the nation, maybe triggering a panic in Mr Market.

Back to the drawing board. The government for the people, by the people no longer exists. Maybe it never did.

The past seems a tad to bright when you think about the facts of Manifest Destiny and how monstrous that cancer has grown.

Our current Mass Mind Managers would love for us to think it never existed. That way, we would resign ourselves to the possibility that it never will exist.

For a narrow example of that basic possibility, if the New Deal never actually happened, then no such New Deal can ever happen in the future.

So lets stop thinking about it. Lets just be more cynical.

I think that there is more of a connection between the immigrant influx and inflation/resource shortages than either party is willing to concede.

With current birthrates, there is some level of immigration that would just keep the US population stable. That should probably be the policy goal. But we all know that commercial big business interests need groaf at any cost, including environmental degradation and resource shortages.

I’m really not feeling great about all the housing stock that just got wiped out in W. North Carolina and to a lesser extent South Carolina and Florida. Where are those people going to go? Atlanta? We have too many folks here and the lifestyle would not suit those from rural areas. Particularly older folks. Less supply of homes means higher prices, all other things being equal.

Some politician ought to make the case that enough is enough, 330M residents is “full capacity” for the country and with birth rates plummeting, all that is needed is to limit ALL immigration (legal and illegal) to some number per year and we’d stay at current population levels. It’s literally just math.

Here I am agreeing with Yves from a March NC post:

“Many of us, and I include myself in that cohort, have attributed the large-scale Central America exodus to the US destabilization of many countries in the region.”

When your trade policies, currency hegemony and oft violent political meddling creates poverty at the periphery, you are literally creating the conditions that will drive people to the US to escape the suffering you have inflicted on their countries.

Agreed. What if instead of blowing billions on Ukrainian weapons, Israeli hookers & blow we sent that money to Central American countries as direct economic aid? Preconditioned on keeping people gainfully employed in their homelands.

How would that drive down wages here in the US?

I think you’re missing the point.

The policy is doing exactly what it is intended to do..

It’s a two-fer: install client regimes abroad friendly to your corporate exploitation of resources over there while simultaneously providing said corporations with cheap and compliant labor to exploit at home …

Blowing billions on Ukrainian weapons, actually means putting them in the pockets of rich Americans. which is what capitalism is all about. It’s a free market. Working as intended.

Freudian slip alert: *emergency* market currencies fell markedly.

Would those be the shekel and hryvnia or did you have something else in mind? :-)

Haha, Freudian autocorrect.

Fixing.

The first thing that came to my mind when seeing the headline: ginned up numbers right before the election. I’m probably just being too cynical. Things are great again and going to get greater.

You and Lily Tomlin. She tried to be cynical and couldn’t keep up.

Looking at historical behavior as one predictor of the future, I also expect downward revisions.

After the coronation, of course.

It’s just one anecdote, but a good lady friend of mine from India just signed an offer letter from a US company two weeks ago. She has a very good job in India but had decided to try her luck in the US job market while visiting his fiancee in the United States. Lo and behold, after interviewing at a bunch of companies, she got an offer for 500K USD a year, a VERY SIGNIFICANT bump from her total compensation in India, and no it’s not from one of the FAANG companies.

Wolf has written about this before, but those big layoff numbers that people have been seeing in the media include employees OUTSIDE the United States, and when people INSIDE the United States get rehired, you don’t see the media reporting those because good news don’t sell. Anyway if companies are willing to pay the big bux for people from other countries to work in the United States, the overall employment situation has to be good, but that does not jibe with the NC commentariat, because Wolf just does not understand aggegrates and some such ……

“..And time yet for a hundred indecisions,

And for a hundred visions and revisions,

Before the taking of a toast and tea…”

T.S. Eliot

It’s all gravy, then hike the rates again.

Slightly on same subject – the labor market is different in Massachusetts vs Tennessee. In Massachusetts, the hired help at Home Depot Lowes Walmart goes from mentality challenged (greeters) to those who struggle to tell you which isle you can find items. English speaking skills uneven. In Tennessee, the hired help is younger sharper better English no mentally challenged.

Would that be Martha’s Vinyard? Nantucket?

Never been to either. Just mainland Massachusetts.

I’d say it IS a significant bump. Where’s the offer from? a (drug) cartel? You must be knowing some real wealthy friends!

Of the opinion that statistics can be be manipulated in ways that I am not privelege to (Hail AI), what caught my attention as an untitled observer was the settlement of the dock strike with a huge wage increase. Two takes: 1) Unions (collective barganing- an anathema to ‘capitalists’ ) in critical industries can sometime exercise clout (boeing should consider) and 2) Others in the labor market might reason if them why not us. Back to statistics, supposedly inflation is under control, but if wages spike then won’t that be reflected in prices. E.G. Living in Alaska, some 90% of the goods shipped to the state come through the Port of Anchorage. The West Coast dock workers didn’t strike, but I will bet they watched their brothers and sisters on the east coast get a raise. I will also make a bet that in the future things, like bananas, will cost more in Alaska. As a senior, i.e in a group of individuals who tend to have fixed incomes, I pay attention to things like this What say those with PHDs in economics?

Recall that the looting class has stolen all the productivity wealth gains from the working class for at least two generations, and used that capital to buy up everything of value, like housing, health care, education and the rest of the political economy. https://www.epi.org/productivity-pay-gap/

Amazing that there’s not been a huge push to “re-allocate” until very recently. And that so many propagandized mopes resent any of their working chums gaining some slightly larger fraction of the the real wealth of the nation.

But we mopes in the Condign West are so brainwashed that we automatically drag each other down instead of organizing together.

So the scenario plays out over and over:

The CEO joins the workers and PMCs at the table. There’s a large plate of fresh, warm chocolate chip cookies in the middle of the table. The CEO grabs the plate, eats all but one of the cookies, pushes the plate back in the middle and says, “Better look out — the person next to you wants that cookie,” gets up and leaves.

Maybe the mopes won’t fall for it this time?

USA! USA! USA!

The scenario is getting to the point where the CEO just pushes a plate of crumbs back to the middle of the table.

Never enough. In their minds, they have to eat more cookies than the next CEO, not the workers.

RE: PMCs: Persian Music Center, I assume? https://www.acronymfinder.com/PMC.html

Persian Magic Carpet, and also

https://en.wikipedia.org/wiki/Professional%E2%80%93managerial_class

Remarkable, a decidedly net good for the stawks but possibly not that great for investors who went possibly into the mode to add duration ( increase exposure on the maturity curve to Bonds and US Treasury alike ) made ever since these previous two months reports were announced.

Hard to figure out. And those increases to average hourly earnings, like wow and stuff is my only reaction thus far.

Zerohedge claims the entire increase was government workers. If true, that puts a different spin on it.

https://www.zerohedge.com/economics/behind-todays-stunning-jobs-report-record-surge-government-workers

They lie.

Who lies? The people who answered the survey or the survey collectors or the survey processors or the people who report the numbers?

And how do they lie? Since they release public data that you could investigate yourself. Are they making up fake people? Removing people who are unemployed? Just changing people’s employment data?

I can never figure out whether I should laugh or cry (especially here) when I see statements like this from people who have no insight about how these processes work, but rather a kneejerk assumption that a mildly positive employment release must be a lie (although it begs the question why did they just start to lie this month and why not last month). There’s plenty to criticize in what the BLS puts out, but it’s not in the data collection (which also faces a lot of challenges which are structural) but rather in how they choose to define things (like using the U3 as the reported unemployment rate instead of the U6).

LOL!

The Ross Perot guide to Answering Embarrassing Questions – Calvin Trillin (from Deadline Poet)

When something in my history is found

That contradicts the views I now propound

Or shows that I am surely hardly who

I claim to be, here’s what I ususally do:

I lie.

I simply, baldly falsify.

I look the fellow in the eye,

And cross my heart and hope to die –

And lie.

I don’t apologize. Not me. Instead

I say I never said the things I said.

Nor did the things that people saw me do.

Confronted with some things they know are

true.

I lie.

I offer them no alibi.

Nor say “you oversimplify”

I just deny, deny, deny

I lie.

I hate the weasel words some slickies use

To blur their pasts or muddy up their views.

Not me, I’m blunt. One thing that makes me

great

Is that I’ll never dodge or obfuscate

I’ll lie.

When did Trillin write that? During the Clinton-Gore propaganda campaign for getting NAFTA passed?

I tend to agree. I wouldn’t take as gospel government reports as they are highly politicized, especially close to an election. The Biden administration has been disseminating falsehoods across the board since day 1 of that administration. Nothing that comes out of the Executive Branch should be taken at face value.

@Adam, 1:41pm

I agree with you Adam. I don’t know much about how exactly the US figures are determined but I am quite familiar with the Canadian ones. From past readings authored by Statistics Canada I understand both countries use quite similar methods although definitions do differ. It is not credible to state the US numbers are false unless you can show the surveys and data collected are biased or manipulated somehow. Certainly they may be incorrect due to unusual occurrences as Mr. Richter points out. But I do not believe massive manipulation occurs. It would be too complicated and involve far too many people to keep it secret.

That said, definitions can be changed to alter the headline number. This was done by the Nixon administration decades ago to lower the unemployment rate before an election by, I think, one half percentage point. However that definition change did not corrupt the system. It did suddenly alter the Canada-US ratios and was explained in a Statistics Canada publication at the time.

It will be interesting to see how wage growth and job numbers are distributed by industry and region. There are still a lot of tech jobs being destroyed and a lot of people who were making big salaries haven’t landed in new positions.

Prior discussions of wage gains showed that they still weren’t making up for decades of relative stagnation, and they went mainly to management.

While schadenfreude over a displaced set of techbros is something I can get behind, I have to say that my anecdata disputes claims all is great in the US as suggested by these latest numbers. I don’t know what to believe or who to trust. I also don’t think it matters much. Whether numbers justify a policy or not, the people in power will get what they want. It’s nice when they can hide behind some shred of evidence to support their position. But not having the supporting evidence won’t stop them from demanding more rates cuts or other goodies from government.

My gut tells me there will be a lot of revisions for 2024 data after the election.

Headline “needed” buys into false Fed narrative that there is anything good to accomplish with rate rises, well, for anyone who is not living off net interest income.

The 30 year completely reversed after the Fed announced cuts (up 42 basis points since, and it increased 27 basis points yesterday). I know the cuts were already baked in, but it looks like the market is not expecting the cuts to continue.