Yves here. Rob Urie was so gracious as to provide an overview to his piece on how the US cooked its own goose with its embrace of neoliberalism. Not that a happy ending is likely for the rest of the world. As he wrote:

This piece is motivated by lefties working in development economics claiming that capitalist development theory is the only route to economic development.

Unless China actually builds a consumer society, which it has so far failed to do, its development strategy is bugger thy neighbor.

And if it does, the environment is toast.

By Rob Urie, author of Zen Economics, artist, and musician who publishes The Journal of Belligerent Pontification on Substack

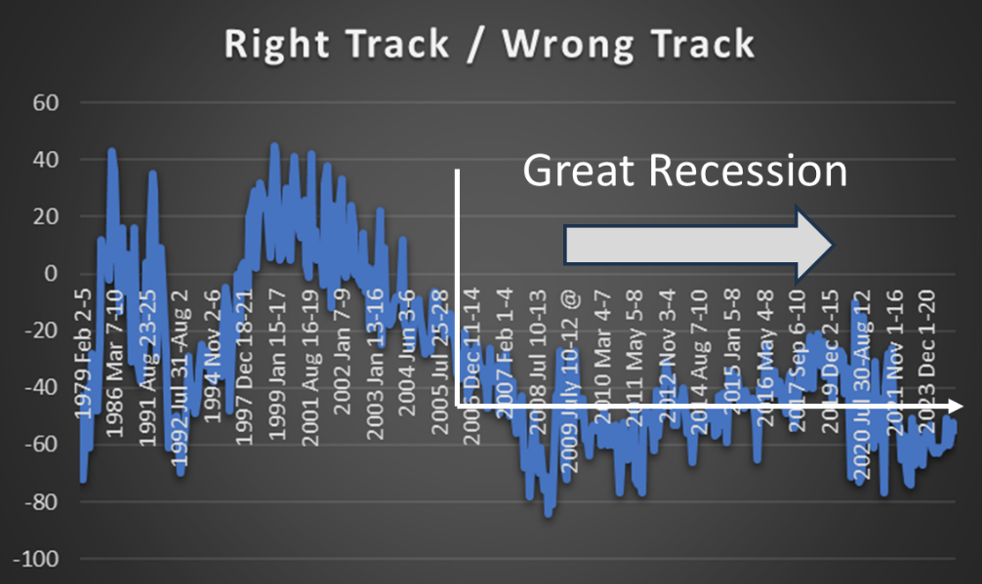

The middle of a war that is threatening to go nuclear and a genocide might seem a strange time to take a detour into economics. But the economics have bearing on the wars. The two-and-one-half World Wars of the last century each trailed periods of capitalist / imperialist expansion that were followed by crises. Several of the graphs below illustrate that, as was the case in the 1930s, the Great Recession caused a deeper and wider crisis of capitalism than has been admitted in the West.

Following the ethos, or zeitgeist if the term is more accurate, of his day, US president Joe Biden supported the policies— the neoliberal iteration of free trade, that are now widely blamed for rising trade tensions between the US and China. What mainstream Western accounts miss about these epochs is that rising class tensions within and across nations has defined them as much as nationalism. It is in the political interest of national leaders to deflect blame for policies gone awry by blaming other nations.

Biden, representative of his time and place, likely had no concept of the implications of the trade policies that he supported (NAFTA, for one). The relevance of this in the present is that, without having understood the economic policies that he supported in the past, he has little to work with intellectually to tie his past actions to current trade tensions. The point: disappearing and / or misrepresenting the history— for whatever reason, that brought events from past to present makes diagnosing problems and crafting workable solutions close to impossible.

While the following seems self-evident, it apparently isn’t. The economic advantage that China has lies in history, not supply and demand graphs. The Chinese studied what had worked economically, and what hadn’t, across the West and took what worked while leaving aside what didn’t. Logically, this speeds up of the process of capitalist development, or whatever form of government the people of China wish to claim. The US had the same opportunity that China did to revisit the history of capitalism. But Americans don’t ‘do’ history.

At the time that China was admitted to the WTO (2001), the US and China were in opposite corners in terms of conceptions of economic organization. The US was deep in the grip of ‘free-trade’ fever, the quasi-religious theory that societies are economically self-organizing given certain conditions. Unburdened by this particular religious leaning, the Chinese were free to plan roads leading between factories and ports, the organization of supply chains to minimize frictions, and how to develop the Chinese economy.

With respect to developing the Chinese economy, China joining the WTO was a watershed event that is addressed in more detail below. The point for present purposes is that the actions of the governments of both the US and China with respect to trading with one another were based in diametrically opposed conceptions of economic organization. Outside of class relations, the Chinese had no reason to care what the Americans did with the gains from trade with China, assuming that there were any.

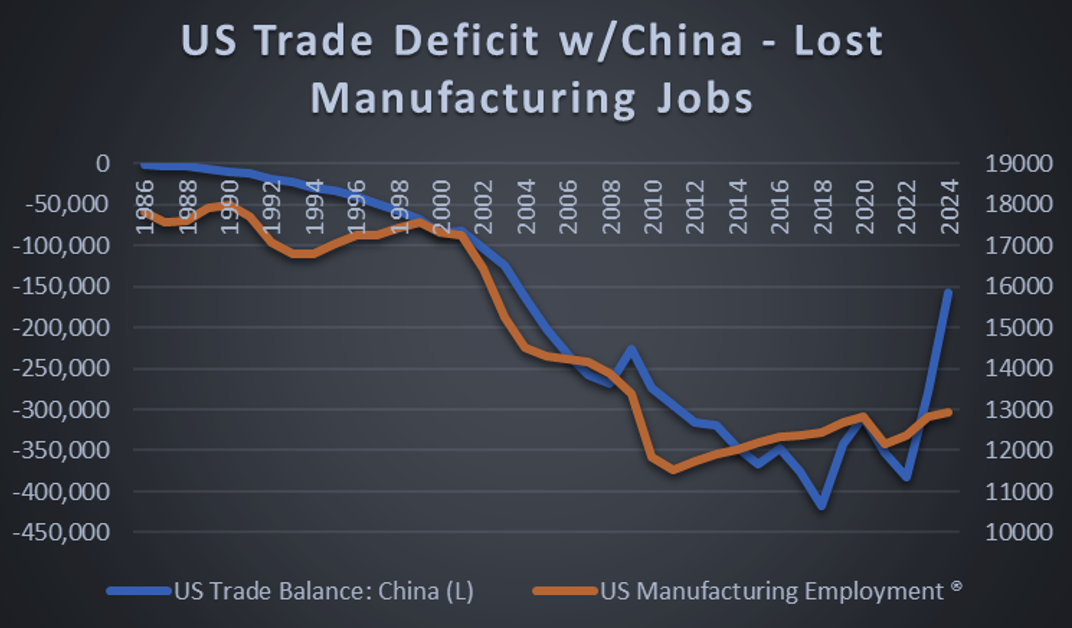

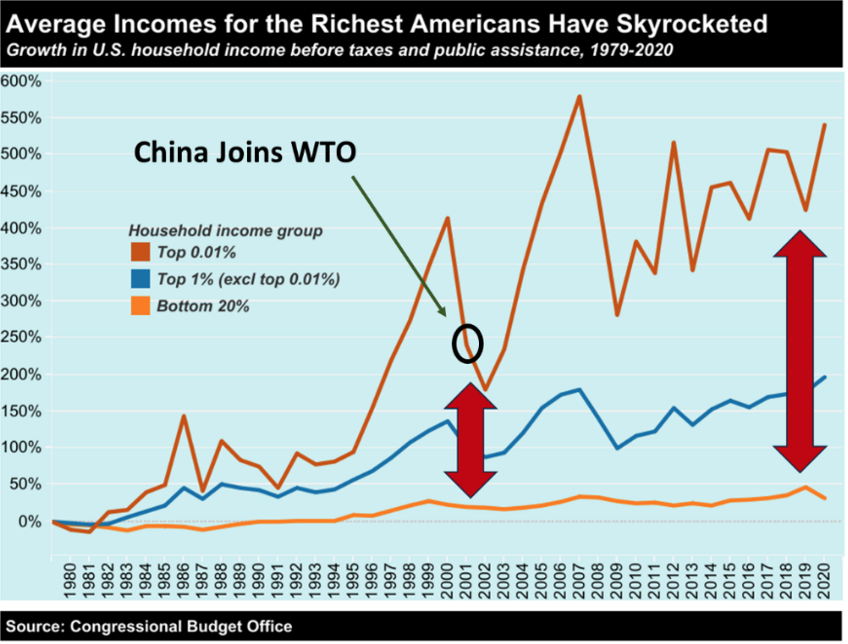

What the Americans did was to fire four – five million industrial workers (graph below), leave one-third of the US to the ravages of economic decline, and put all of the gains from trade with China into the pockets of the oligarchs and business executives who sponsored NAFTA and China’s entry into the WTO (graphs below). China didn’t do this. What it did was to make the most of new access to US markets under the terms of membership in the WTO. By the time that the Biden-Harris administration was forced by political circumstance to put forward an implied industrial policy, ‘beat China,’ the US war with Russia was underway.

This breezy, if not terrifically uplifting, introduction is needed to frame the nature and targets of the critique. The hope and promise of the BRICS is that a different path of economic development can be found. But the division of the world into trading blocs has different meaning than their just coming into formation. The dissolution of an old order is underway. With a political party in the White House that is apparently too stupid to understand that lobbing missiles at Moscow is an act of war, the old order isn’t going to go quietly. Nor can it.

At present, it is the Americans who are threatening the world with nuclear annihilation. Guessing whether or not the Russians are bluffing with respect to the use of nuclear weapons would be clinically insane if the American political leadership had any idea what it was doing. But it doesn’t. Again, senior administration officials appear to have been surprised that the Russians objected to their bombing Moscow. The question of how they would react if Russia were to bomb Washington, DC has conspicuously never occurred to them.

In 2001 China was admitted to the WTO (World trade Organization). Shortly thereafter, between four and five million industrial workers in the US found themselves without jobs as a third of the US was being transformed into a dystopian hellscape by economic decline. As the facts have it, China followed standard capitalist development economics. The question to ask is why the Americans who supported the policy thought it was a good idea?

![]()

Graph: China was admitted to the WTO in late 2001. From that point forward manufacturing employment in the US fell in lock-step with the US Trade Balance with China. China was allowed to flood the US with low-priced consumer goods as part of its export-led growth strategy. Doing so made economic sense for China, but not for the Americans. The ‘temporary’ strategy by China was allowed to permanently displace US-based manufacturing. Units (L) USD, thousands, (R) persons, thousands, Source: St. Louis Federal Reserve, Census Bureau.

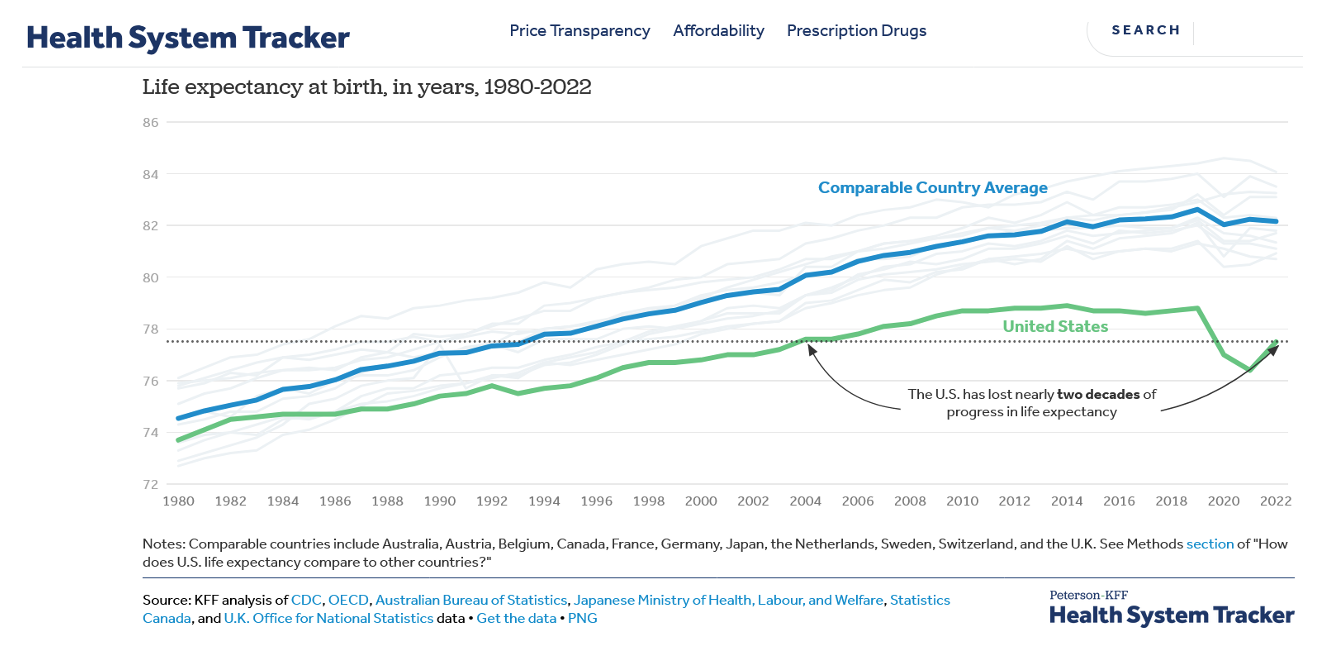

Part of the conceptual challenge for Americans in understanding what happened— and why, comes from incessant state and commercial propaganda insisting that the US is a functioning state. In the rarefied environs of the people running the place, it is a functioning state. The rich in the US live as long as ordinary citizens do in peer nations (graph below). The poor in the US live 10 – 15 years less than the average in peer nations. The ‘political’ question then: is the worthy goal to extend the lives of the poor or to shorten the lives of the rich?

Off color joke with a point: Adolf Hitler was in the Fuehrer Bunker in the final days of the Third Reich when he looked around and asked, where in the fu*k did all of these Nazis come from? This is the US at present. Following five decades of planned deindustrialization, the lightbulb is suddenly turning on that, to the extent that the stuff that capitalism produces is needed, the US has jettisoned its capacity to produce it. The precise idiocy that motivated this logic— that the US would be the ‘manager’ of the world and other nations would be ‘our’ workers, seemed just as stupid four decades ago as it is today.

However, calling policies stupid doesn’t get us very far. History has demonstrated that these policies benefitted the few and immiserated the many. The question then is how the American ruling class 1) concluded that deindustrialization was a good idea, and 2) how it convinced the rest of us to go along with their program? The answer to this relatively narrow formulation can be stated in one word: economics. The American ruling class bought Francis Fukuyama’s ‘End of History’ thesis because it placed them on the ‘winning’ side of history.

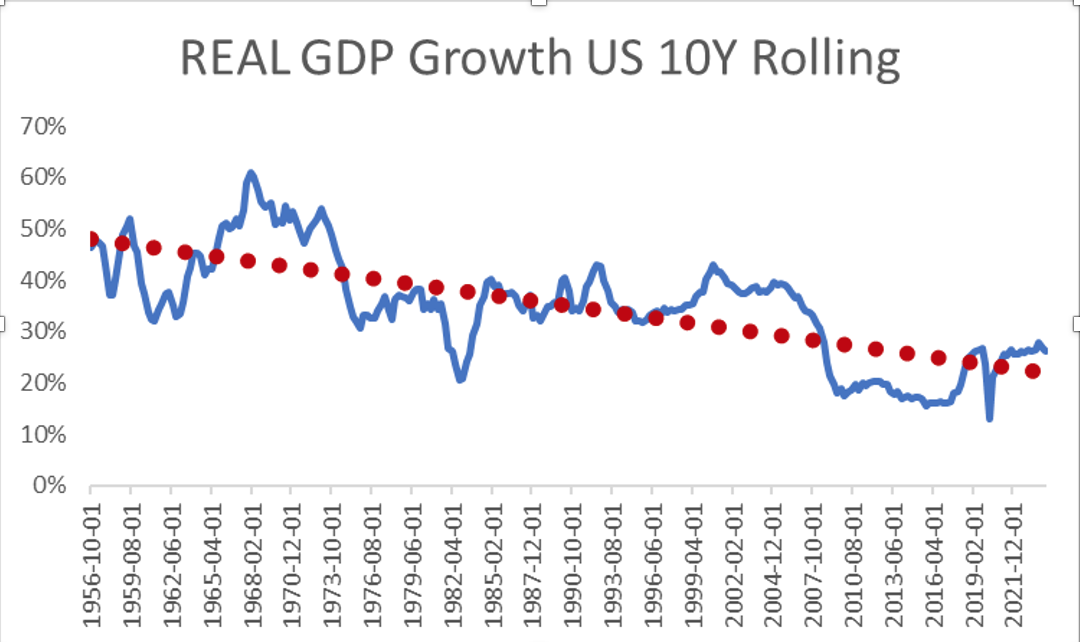

Graph: in 2001, the year that China was admitted to the WTO, the economic argument inside the US was that ‘free-trade’ was the quickest route to vast riches. In fact, the rate of Real GDP growth in the US has been declining since the Reagan Revolution. While there are complex historical reasons for the decline, the ideological endorsement of so-called free trade wasn’t qualified with historical exceptions. The claim was that it works, but it didn’t. At least not for those who weren’t rich at the outset. The GDP growth rate in the US has been falling for five decades now. Source: St. Louis Federal Reserve.

While Fukuyama is superficially the anti-Marx by claiming that history had ended, the concept of time that he was working with came from capitalist economics. Marx’s conception of history emerged from an unrelated conception of time. To repeat, these aren’t competing theories of time. They are unrelated. This point is brought to bear below in addressing economist Joan Robinson’s critique of the neoclassical Production Function. But the larger point is that capitalist economics is a belief system built upon a foundation of quicksand mixed with rusty nails.

This would all be academic if it were no more than academic. The Americans promoting wars are claiming an economic basis for the current conflicts— economic competition with BRICS (Brazil, Russia, India, China, South Africa) countries. However, this competition isn’t discrete in the sense put forward. The US helped facilitate the economic rise of China motivated by a quasi-religious conception of international trade (‘free’ trade). The conceptual particulars were neoclassical, while the political economy they emerged from was neoliberal.

Briefly, neoliberalism is a version of l’etat, c’est moi (the state, it is I), or whatever benefits the rich and powerful, benefits ‘us all.’ Western economists don’t tend to be that clear on how neoclassical economics was a necessary precursor to neoliberalism. The ‘self-interest’ of neoclassical economics has one meaning in the context of dispersed power and another in the context of concentrated power. When the rich control the state, as has unambiguously been the case in the US over the last five decades, what benefits the rich becomes state policy.

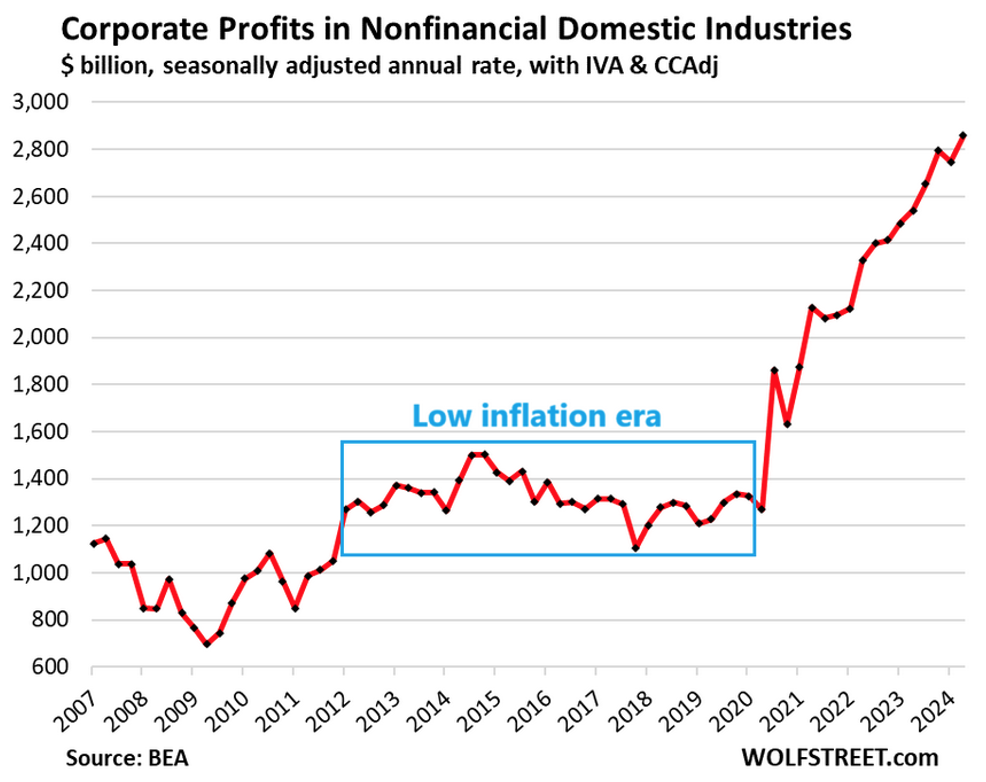

Graph: from 2020 to 2024, four years in graph time, Corporate Profits in Nonfinancial Domestic Industries rose from $1.25 trillion USD to $2.85 trillion USD, a 128% increase. Depending on how inflation is being estimated, this rise in corporate profits could explain most or all of the current epoch of inflation is the US. What this means is that it wasn’t inflation at all. It is extortion committed by firms with pricing power combined with there being no one to stop them from doing so. This is evidence of the un-free trade for the rest of us that US ‘free-trade’ policies have wrought. Source: wolfstreet.com.

If there had been any period over recent decades when the political class in the West that was promoting ‘free-trade’ had asked 1) what is it? and 2) understood why, according to ordinary capitalist economics, the necessary conditions for it would be so onerous and intrusive that the neoliberal version would clearly be understood to be a fraud, US imperial decline might be on a gentler path today. Actual free trade requires institutional guardrails to prevent the rich and powerful from being ‘free’ to rob, abuse, and exploit the not-rich and the not-powerful. But that wasn’t the version that you heard, was it?

This practice of using partially and selectively realized economic policies to force political agendas ‘works’ through bait-and-switch. For instance, what is to be made of claims that millions of poor people have been lifted out of poverty by trade policies when the analyses stating so are missing credible deductions for what was lost in the process? Few would publicly object to the prior were it not for the latter. Simply ignoring relevant and related costs doesn’t make them disappear. But it does leave them to fester.

Graph: Life Expectancy at Birth, the most inclusive measure of life expectancy, is a strong indicator of the overall wellbeing of nations. Around 2008 something happened, likely economic in nature (Great Recession), that caused life expectancy to first flatten, and then to fall dramatically, relative to peer nations. American politicians claimed that the problems were quickly resolved and that the economy has fully recovered. However, Americans currently live five years less than the citizens of peer nations. What this implies is material societal decline for significant swaths of the US. The math doesn’t work any other way. Source: healthsystemtracker.org.

The political choice at present is to resign ourselves to accepting the consequences of this powerlessness, which now includes the very real threat of nuclear annihilation, or to find the social leverage needed to end the wars and restore functioning governments to the West. As the facts have it, a plurality, if not a majority, of Americans would jettison official Washington into deep space if we could. And the great mystery of why politicians in the US serve their donor’s interests, and not ours, has at last been solved. The answer: that is how the campaign finance system was set up to operate.

What neoliberalism did accomplish was to turn American imperialism inward. NAFTA and the so-called ‘free-trade’ policies of the 1990s and 2000s were / are critical turning points in an ongoing class war in the US. Put forward in the American press at the time (1994, 2001) was the idea that these policies would affect economic outcomes in other countries. And they do. But through class divisions inside the US, the policies were equally intended to keep the existing https://www.youtube.com/watch?v=O7gin6fEiFE ruling class at the top of the economic heap.

By way of metaphor, as yours truly argued in the environmental realm most of a decade ago, piecemeal reforms open up space for malevolent actors to prevent needed changes from gaining political traction. Over subsequent years, the pundits promoting environmental reforms found the ear of the Biden administration. Proven-to-be-ineffective ‘tax incentives’ (executive bonus pool transfers) were passed. Then the US launched the most environmentally destructive war against Russia in human history.

The claim inside the US is always, always, always that if it hadn’t been for actual history, the American plan would have worked. Deep into the GFC (Global Financial Crisis), true believers on Wall Street continued to claim that if it hadn’t been for ‘government interference,’ the GFC wouldn’t have occurred. This argument emerged from ideology, from projection of how ‘the economy’ works in theory, not from history.

The logic of applying top-line definitions like ‘rich’ and ‘poor’ to nations may make sense for economically homogenous nations. But the US isn’t an economically homogenous nation. It is a few extremely rich people surrounded by an astonishingly large array of people who are no longer getting by. Life Expectancy (graph below) is currently five years less in the US than in peer nations. By this metric alone, the US is a failed state. Nations simply don’t experience the decline in Life Expectancy that the US has outside of severe social decline.

It took five decades of malign neglect to bring the US to its current state. The motivating logic, to the extent that any existed outside of (capitalist) religious fervor, was that the billionaires who ‘made’ their fortunes through inheritance and direct and / or indirect (e.g. military) Federal subsidies, didn’t want to pay taxes. When Bill Clinton ‘ended welfare as we know it’ in the mid-late 1990s, he didn’t end socially dubious subsidies like (consequence-free) Federal bailouts for Wall Street and favored industries like Big Tech. What he did was force the reserve army of the unemployed into labor markets to lower wages for his oligarch friends.

China’s economic development strategy of the last three decades, called ‘export-led growth,’ is premised on / in a capitalist conception of economic development. In this model, there are stages of development that nations go through on their way to American-style capitalist nirvana. In the early-stage, nations invest in capital equipment and organize their societies to produce goods for export to more developed countries. The profits from exports finance the build-out of broader economic production as the consumer societies needed to support this higher stage of capitalist development are formed.

In 2001 China was admitted to the WTO (graph above). This opened up Western markets to imported consumer goods from China. The move sent China’s export-led growth into overdrive. Those living in the US during these years will remember an avalanche, a veritable tsunami, of low-priced consumer goods from China suddenly flooding American stores. At the same time, manufacturing in the US imploded. Within a few years of China joining the WTO, four – five million manufacturing jobs in the US had disappeared.

In China, a large number of newly employed Chinese workers were lifted out of poverty by the policy. From China’s perspective, as well as from that of development economists, the export-led growth strategy 1) materially benefited a significant number of Chinese workers, and 2) supported the development economics that had been deployed by China to do so. Missing from the policy analysis was the loss of manufacturing jobs in the US. The workers in the US who lost jobs from the policy were not rich, even though rebalancing from rich to poor is part of the motivating logic of the policy.

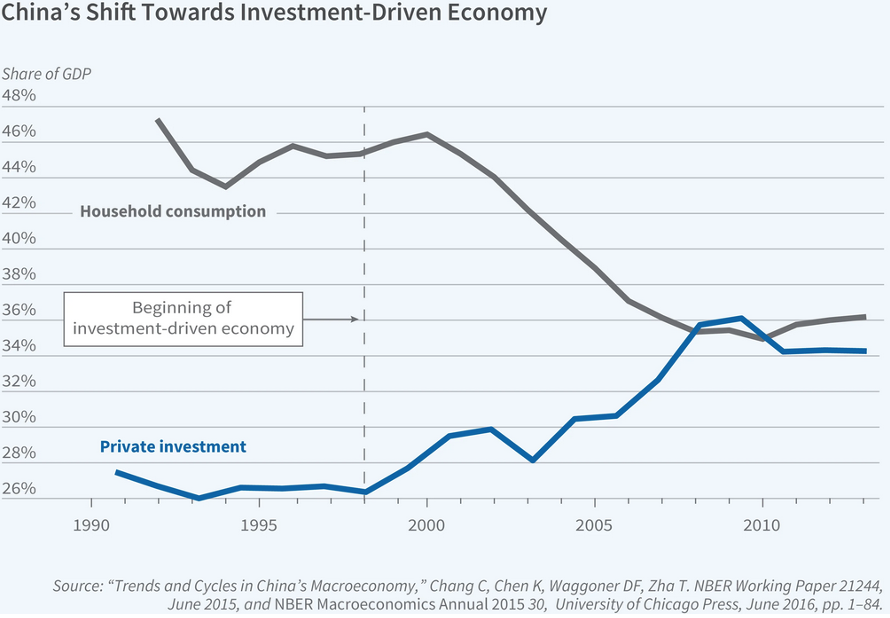

Graph: while the future is unwritten, China’s efforts to date to create a consumer economy haven’t borne fruit. With GDP as the denominator, Investment (export-led growth) has risen as a percent of China’s GDP while Household Consumption has fallen. While in economic time, this may just signal steps in a process, it is impossible to ignore the geopolitical consequences. Failed politicians in the US are citing China to explain the growing catastrophe that is the US. This is why Western imperialism has boom and bust cycles. The politics eventually catch-up with the economics. Source: NBER.org.

In the early 1950s, an economist named Joan Robinson tried to unpack the metaphysics— without calling it such, behind what is called a Production Function in capitalist economics. A Production Function is a conceptual tool created to help economists determine the optimal mix of labor and capital in economic production. The problem that Robinson ran into was that the variables in the Production Function exist in different time-space than the world outside of it, making its results misleading. Readers with an interest can go the link in this paragraph, the explainer on the ‘Cambridge Controversy’ here, and my book Zen Economics, in which I address the implausible premises of both capitalism and capitalist economics.

This in turn came down to competing conceptions of time that place economic analyses outside of history. Consider, the ‘comparative statics’ used by capitalist economists implies simultaneity—that once the conceit of static time is applied, all existents exist together in a static present that isn’t implied by history. This relationship is wholly invisible to anyone who hasn’t previously been introduced to it. Multivariate analyses, including the relationship between dependent and independent variables, simply assume that models developed from capitalist ideology capture the essential structure of the world.

Time invariance is the more improbable of the conceits here. Time invariance means that the data used by economists exists and acts independently from time, and with it, history. Consider China’s export-led growth strategy. There existed the economic theories that posited particular outcomes (economic development) from China’s policy. And those were the outcomes that were looked for. But what about the decimation of American manufacturing and the destruction-through-neglect of the American heartland? No one was looking for it, so it wasn’t found.

Graph: while politicians in the US have claimed that the Great Recession was ended while Barack Obama was still in office, political disaffection in the US has remained at crisis levels. In fact, Right Track / Wrong Track polling follows economic conditions reasonably well. What the graph indicates is that for poll respondents, economic conditions have been at crisis levels since the early hints of the housing bust started in 2006. Source: gallup.com.

Through the application of history, the premise of time invariance can be seen to be political. Within the premise, the world behaves as predicted (by design). Outside of it, chaos was the product of the policy choice and chaos reigns. China’s development program did what it was expected to do. But it also did a whole lot more. This may well be the fault of China’s American ‘partners.’ But policy analysis that ignores it is economic malpractice, or worse.

Within the canon of capitalist development, the next step for China is to build out its consumer economy (graph above). Should China fail to do so, the industrial production that is now lifting Chinese workers out of poverty will encounter increasing resistance from external producers. The economic logic here involves basic supply and demand. If China newly produces goods without developing offsetting demand, then more is being produced than people want to buy at the market price. This ‘crowds out’ competing producers by pushing prices lower.

Environmentally minded readers have likely already considered the problem of eight billion humans driving their SUVs from their McMansions to the mall to buy crap they don’t need with money they don’t have. That (and World Wars) is capitalism. From the graph above, China’s efforts to date to move to stage two in the development process haven’t accomplished the task. This is likely the impetus behind the face-slapping contest in the Western business press over the fate of China’s EV (electric vehicle) industry.

The environmental rationale for quickly distributing China’s EVs to foreign markets is that they are low-cost, reasonable-quality, alternatives to gasoline powered cars and trucks— an environmental ‘bird in the hand,’ if you will. The American objection to that plan, and the reason for the 100% tariff recently imposed on Chinese EVs by the Biden administration, is that the existence of China’s EV industry will prevent ‘American’ EVs from being produced. Why? Because the Chinese are structurally lower-cost producers.

The point: when the narrow logic of the economic development models determines policies, one set of policies emerge. When history— e.g. the pathetic state of the US auto industry, meaning fat, lazy, and stupid, is considered alongside American pay-for-play politics, another set of policies emerges. Either way, the union of China with the US in a production conundrum means that the global outcome will be a product of the union, and not of one country alone or the other.

To infer this back onto the impact in the US of China’s development strategy, it is the union of Chinese workers benefiting and American workers having the livelihoods and communities destroyed that defines the policy outcome, not one or the other. Should China imagine that lopsided development is achievable, that would be a political conclusion based in political logic. The Europeans are backing away from implementing the tariffs on Chinese EVs favored by the Americans. So again, different premises yield different policy conclusions.

It was over at Jacobin a while back that their economics correspondent gave away the current ‘left’ development model. (Apologies, no listing appears in my search, therefore no link). It read like the economics of American economist Milton Friedman circa 1965 cobbled to the admonition that environmental concerns exist to keep poor people poor. But again, history comes back to bite. Ninety-nine percent of the current human population of the world is being made poorer by industrial pollution. It is but a few oligarchs who are reaping the benefits.

It was none other than ever charming Larry Summers, who offered in 1991 that poor nations are ‘under-polluted,’ who used what appears to be the same logic as the author at Jacobin. Summers quickly retracted the memo and has tried repeatedly to disown it, reportedly due to pushback over that very subject. His argument was that it’s cheaper to pollute in low wage countries because— tautology alert, lower wages mean that life, which is threatened by pollution, is cheaper there. If price = worth, low price means low worth. A charming aside is that most of the economically displaced workers in the US are now worth nothing, as are your children.

Economist and New York Times opinion writer Paul Krugman has been the go-to guy by establishment journals looking for comments on trade economics, and an attack dog for the discipline, for most of his adult life. He was present and active during the free-trade religious revival of the 1990s and 2000s. To his credit, Krugman argued early on that the only socially legitimate rationale for ‘free-trade’ required that gains from it be redistributed. Unfortunately for the rest of us, he never appears to have pushed the issue in his meetings with policymakers.

His logic in this regard was solid. National trade policies are in theory negotiated for the benefit of nations, not the already rich. And even amongst oligarchs and corporate executives, Wal-Mart was by the nature of its business in a position to benefit from US trade with China, whereas US Steel wasn’t. But again, no plans were actually made to redistribute these gains, and no systems were put in place to make doing so feasible. So, Krugman has the out of having stated that the gains from trade should be redistributed, while having stood by the policies knowing that they weren’t being redistributed.

Graph: the point of this graph can be seen in the vertical red arrows at its center and right. The arrow on the right representing the passage of time, is much larger than the center arrow. Interpretation is that the rich in the US got much richer since China joined the WTO, while the rest of us have seen little benefit. The problem for the rest of us is American oligarchs, not the Chinese government. While there were true believers in ‘free-trade’ amongst the oligarchs and business folk, none have apologized for their poor judgment and / or offered to share their gains. Source: inequality.org.

In the present, capitalist economists continue to promote their religious views within a frame which they know bears little to no relation to the world in which the policy results are expected to occur. If I, your author, had destroyed the livelihoods of five million workers and turned one-third of the US into a dystopian hellscape, the offsetting benefits would be moot. That is something that you simply do not do unless you are an American political leader or an oligarch. And the contrary posture that doing so ‘was worth it’ belongs in the rogue’s gallery alongside Madeleine Albright’s gentle ministrations to vulnerable Iraqis.

Since 2001, China has been subjected to multiple waves of economic sanctions by the US. To understand how misguided the back-and-forth with China is, the US can’t use either its own or China’s supply of EV’s because most of the US lacks the charging infrastructure needed to make reliable travel in EVs possible. Further as the graph of corporate profits above illustrates, ‘American’ firms are raising prices on essential goods like food, transportation, and housing because they can, not because their costs have risen.

An analogy would be to lock a group of executives in cages and then see how much they would be willing to pay for food and water. After a few days, they would pay everything that they have because if they don’t, they die. Welcome to hell.

Last, Gilbert Doctorow correctly explains here that it was the Americans that recently invaded Lebanon and have been launching attacks against Iran. American weapons, American money, American troops, American planes and ships, American logistics, it’s an American operation.

Excellent article. It is important to note that US deindustrialization was already happening before China entered the WTO, it is just that China has such a huge population, and now such a huge economy, it completely changed the game and used all that foreign investment to develop their whole economy. Now, in response to China’s rise the US is using tariffs and friend-shoring. US imports from Mexico are up as are imports from Vietnam – so are Chinese exports to both countries – because they are being supplied Chinese made components for assembly. This doesn’t help American workers, there are no jobs in it for them, there will be higher prices, but somehow the wealthy will still end up getting more than their fair share.

The writer makes an important point about China needing to increase its own domestic consumption. When China runs huge export surpluses China is selling its goods and taking debt in return. Unless its trading partners are able to sell goods and tradeable services into the Chinese economy, their ability to purchase Chinese goods will stagnate. If Chinese consumption rises at the cost of corporate profits, there will be less inequality, less reliance on export markets and a greater ability to buy foreign imports.

The point about deindustrialization preceding China joining the WTO is important. By appointing Paul Volcker to Chair the Fed, Jimmy Carter implemented a de facto strong dollar policy through Volcker’s interest rate increases. Doing so crushed US manufacturing before NAFTA was implemented by making goods produced in the US more expensive through the higher priced USD.

Further, Volcker’s preferred metric of inflation was industrial wages. He raised interest rates until he began to see a fall in industrial wages. Given the eighteen month lag between changes in Fed policy and impacts in the economy, even if Volcker had initially been correct with the strategy (he wasn’t), he held the policy in place for too long.

Many thanks for this and your brilliant article. If I recall Volcker was appointed when Carter fired five cabinet officers as his administration struggled in mid-1979. The victims included W. Michael Blumenthal, whom Carter replaced with Fed chair Miller. This caused Blumenthal to quip famously that “when the falling curve of the President’s popularity intersects with the rising curve of interest rates it is time for the Treasury Secretary to go.”

As you will know, the killer was perhaps not only the decisions made by Volcker as their inter-relationship with the federal budget which in early 1980 was projected as being nearly 50% higher than previously anticipated. The budget had grown because the downturn had raised demand for welfare, whilst interest payments increased thanks in part to Volcker’s policies. In addition, Brzezinski had persuaded Carter to ramp up military spending in response to the Iranian revolution. All this, in turn, led the markets to demand ever higher interest rates because they thought that the growing budget would increase inflation. These developments therefore reinforced each other.

We now face the possibility of another oil shock caused to the US government’s Middle Eastern policy leading to a further inflationary spike, higher interest rates (which will again crowd out the budget) together with ever higher military spending, and with the markets *perhaps* demanding ever higher rates to offset the potential inflationary impact of a ballooning budget. Many thanks again!

Rob, thanks for the great writeup. It’s sickening to see that even today, the “pundits” are heaping praise on Volcker for “fighting” inflation. And the Fed keeps playing with interest rates thinking it will have an effect. The blind captain at the helm!

Yes the 70s were interesting times, the US had to go off the gold standard, there were two oil price shocks, along with labor fighting capital to maintain real incomes and capital fighting everyone to increase their profits. Volcker’s role seemed to be weakening labor so capital could triumph.

In the meantime, corporations were changing the playing field by moving more production offshore – the last year for the US to have a positive balance of trade was 1975. The 70s paved the way for Reagan’s message of freeing free enterprise by reducing regulations, weakening labor and lowering taxes – all which would revive investment in America and make the country great again. When I went to look at average Real GDP growth for the Stagflation 70s and Reagan’s Revival 80s, there was hardly any difference, 3.2% in the 70s and 3.1% in the 80s; although I don’t think there is a neoliberal out there who would believe it.

Thanks again for the article.

It is worth recalling that trade relations with Japan during the 70s and early 80s were an epicycle of US defense policy in East Asia. The automobile industry here was sacrificed to keep our “unsinkable aircraft carrier” politically stable. The Commerce Department always deferred the the Defense Department.

This is a good point that doesn’t get enough attention. Following WWII, the US assumed the role of guardian of Western policy while acting as an imperialist power around the world.

In the present, economic confrontation with China and the other BRICS is considered a matter of national security by the military.

But why would civilian leaders cede the power to define the situation to the military? And what form of government does doing so define?

The US military is a business enterprise that has the capacity to end human existence in an hour or two. That is why not-authoritarian states keep the military, including their intelligence agencies, on a relatively short leash.

You don’t need a degree in economics to understand that neoliberalism and the national interest are antithetical concepts. The US got the results it wanted. If taking wealth and power away from billionaires could build a stronger industrial base than China, do you think Washington would do it?

“When the rich control the state, as has unambiguously been the case in the US over the last five decades, what benefits the rich becomes state policy.”

If there was a point where it became unambiguous, I’d say the Gilded Age.

By then, the country was tolerating a group being called the 400 families, flaunting concentrated wealth. There was media that helped shape the narrative. There was the Social Darwinism used to “scientifically” justify this concentration.

China needs to move from state capitalism to state socialism – and from there to socialism. I think they understand this. They also grasp that WAR is the strategy that the USA will adopt to try and get out of the mire it has enmeshed itself in. That’s why Doctorow may be right. If you look at the trading channels this is what the speculators are speculating….

Outstanding article. Particularly liked point about Krugman (like other free trade theorists who said the total Pareto pie would grow even if losers were compensated) acknowledging need to redistribute while knowing it wouldn’t happen. Also liked the point that we don’t have EV infrastructure to use Chinese EVs. Finally, it was interesting to hear Nima ask other guests what the thought about Doctorow’s argument that U.S. is in control of the Lebanon war. Larry Johnson and Chas Freeman said no, it’s Israel, with what I thought were rather weak anecdotal arguments. AIPAC has power over Congress because the elites let it.

AIPAC is a tool of Neocons to neuter domestic opposition to foreign policy, especially that affecting its largest military base. Chk out Michael Hudson’s reporting in yesterday’s NC.

The US is struggling to hold on to its largest military base: Israel. It began building it in the wake of the ’70s oil embargo.

Thank you so much for this! Yes, foreign policy is invariably the outworking of domestic tensions. Much of the problem may stem from the historic tension between deductive and inductive reasoning. Deductive reasoning uses a priori thinking to form specific conclusions. Inductive reasoning, by contrast, uses observations as the basis for developing principles. We see this tension between Malthus and Ricardo at the start of the 19th century, and between Cunningham and Marshall at its end. Ricardo and Marshall won hands down. The upshot was that deductive reasoning triumphed with disastrous consequences for the World. Within the economics profession we see evidence of this triumph in the marginalisation and frequent exclusion of economic history from economics faculties and the production of vast numbers of economics papers which pay little or no attention to the evidence provided by experience. The victory of deductive reasoning secured the paramountcy of free trade doctrine within the UK (though, tellingly, not within much of the rest of its empire).

The German historical economists were not so doctrinaire (or stupid). List noted that Britain had succeeded in gaining commercial supremacy courtesy of the navigation acts, tariffs, monopolies and other mercantilist ruses. Why should Germany not follow suit? His conclusions were affirmed by Hildebrand, Knapp, Knies, Roschner, Schmoller, etc. As the 19th century wore on, it became painfully evident that the Germans historicists were right and the British political economists were wrong. Alas the success of Marshall over Cunningham in Cambridge delayed the turn of the UK from unfettered free trade for another generation, by which time the UK was on a permanent slide.

Alas, deductive reasoning also triumphed in the US (absent isolated centres of historicist thinking, such as the Wisconsin school). Paradoxically this triumph was founded upon inductive assessments of US economic performance in the 1930s: the Depression was a crisis of over-production, and therefore the US needed to use its victory in WW2 to impose free trade on the rest of the ‘free World’ to forestall a reversion to Depression conditions, much as the UK turned to free trade in 1846 in order to suppress domestic dissent by providing workers with a ‘free breakfast table’. Very quickly, however, free trade doctrine in the US became an ideological end in itself rather than a means to an end – a strange outcome for a country which grew rich on the back of high tariffs.

Just as free trade was used by the British landed classes to conserve their privileges whilst also forestalling revolution, so it has been used by US plutocrats to maximise their returns whilst buying off the disintegrating ‘working class’ with cheap imports and cheap credit. However, free trade is a two edged sword and is subject to rapidly diminishing returns: the British landlord class found itself eviscerated after 1870 when domestic agriculture was overwhelmed by cheap imported grain, the transport of which had been made possible by British investment in US railroads. So too, after the GFC the US plutocracy faced a crisis of legitimacy as the domestic bargain which had secured their accelerating profits faced implosion. Why did US economists believe that the same thing could be done all over again and that there would be different results?

So in order to avoid a domestic reckoning, the US plutocracy is racing up the escalation ladder with China and Russia. It is not merely that they are stupid, per Mr Urie, but that they are also deeply evil.

PS: For my money, the best critic of apriorism and deductive reasoning in economics was Terence Hutchison. He was especially savage towards Hayek, Mises and Wieser, though Robinson (who could be notoriously dogmatic) was not spared either.

Splendid article. I plan to circulate the link widely.

According to The chart provided the US’s GDP began its descent in the early ’70s following the oil embargo and the Powell memo.

Coincidentally, at about the same time the US’s interest in Israel became very keen. Something to do with having a base for controlling ME oil? In the years following Israel has become the US’s BFF.

“…it wasn’t inflation at all. It is extortion…”

I’m copping that line.

“Within the canon of capitalist development, the next step for China is to build out its consumer economy (graph above). Should China fail to do so, the industrial production that is now lifting Chinese workers out of poverty will encounter increasing resistance from external producers.”

Neither graph above nor below is relevant–perhaps a graph is missing? This claim caught my eye given the plethora of YouTube videos showing massive improvement in Chinese internal consumption (also known as living standard), especially on a PPP basis – my SWAG is the median Chinese lives better (and longer) than the median American (one paycheck from homeless).

I recall reading on NC that for its development state, Chins’s internal consumption is growing very nicely, and moreover, China’s government is very proactive towards non-fossil fuel energy (which can be interdicted by the US), installing annually more than the rest of the world combined by far.

Environmentally, we are all screwed unless the developing world goes straight to renewables, e.g., Nigerian energy usage growth without concurrent US manufacturing job losses. Yes, there is connection (China growth, manufacturing job losses, and precariat impoverishment), but it seems likely the latter would have happened in any case – I blame the Berlin Wall’s fall ushering in the Unipolar moment, which allowed neo-conservatism to take over – not China related).

—–

Minor unrelated quibble, the right-track/wrong-track downward trend began in 2000/2001 around the time of the first Iraq (neo-con) war. picking the zero crossing in 2006 is fairly arbitrary.

A very enjoyable and worthwhile to read article.

To the point about the rise in Chinese consumption, articles stating that it is rising have appeared every few years for at least two decades. The value of the graph in the piece is that both consumption and investment are scaled by their proportion to GDP. With investment in the graph rising and consumption falling, the quantities are relational, not absolute. The point: articles claiming that Chinese consumer demand is exploding higher can be true, but if the rate of rise is lower than that of investment, China is investing more in capital equipment than in consuming consumer goods.

Neoliberalism in its current incarnation started in the early 1970s in the US, two decades before the fall of the Berlin Wall. Go back and read the economics journals of the time. The arguments and methods are quite primitive. Jimmy Carter started deregulating US industries for competitive reasons soon thereafter.

In the graph of China’s consumption and investment, they are related through GDP, making the values relational, not absolute. There is no doubt that China’s consumption has risen. At least one article a year has appeared since the 1990s claiming that this is the case.

Question: how large is this rise in consumption relative to how much China is producing? Unless it is adequate to solving the problem, assertions that it is rising are substantively irrelevant.

With investment continuing to rise (as a portion of GDP) and consumption falling (relationally), China’s industrial capacity is rising without offsetting domestic consumption.

This asymmetry can persist for a while, but eventually it will be resolved either economically or politically.

thanks Rob, awesome as usual!

what happened pre 1993 was reversible, although it would have taken decades, it could have been done. we did it before. the civil war reversed the fortunes of the free traders.

they got back into power courtesy of the proto fascist woodrew wilson. who’s crack pot polices created another capitalist debacle leading up to another world war.

we reversed those crack pot polices with smoot-hawley and the new deal.

however, from 1993 onwards, what bill clinton and his wall street allies accomplished is not reversible under current conditions.

america is now a police state, at constant war with the world for the benefit of the free trading oligarchs.

look at Rob’s outstanding graphs, in most cases, you see 1993 as the year of the start of the extremes we all see today.

we will not bite the bullet and admit that what bill clinton did is not reversible. and start all over to try to gain our standard of living and technology back, in a way that is not environmentally intrusive.

https://www.nakedcapitalism.com/2023/11/restructuring-of-the-global-economy-michael-hudson-alexander-mercouris-glenn-diesen.html

” the United States decided it didn’t want to compete. And this goes back to the Clinton administration in the 1990s. The Clinton administration’s objective, and that of the Democratic Party, was basically a class war against labor. How do we lower the wages of labor so that we can increase the profitability? Well, the way America had of lowering the wages of labor was, let’s hire Asian labor, especially Chinese labor. Let’s let Chinese into a trade relationship with us into the WTO. And then instead of having to bid up the price of labor in our industrial centers, Detroit and the South and the Midwest, we’ll hire products made by Chinese labor that will keep down wages here. And America can be in a post-industrial economy.”

————————————

Putin did not make bill clinton sell out america: the idiocy of free trade, half the population of america was let go to fend for themselves by bill clinton, biden voted for free trade with china. He is now trying to launch a war against China over the consequences of his own policy. Many of us knew better at the time.”

“half of the nation had their livelihoods destroyed by the neoliberal ‘center’ suggests that political dissolution was the goal of deindustrialization. Missing as explanation is the utter stupidity of the people now running the US. Joe Biden voted to admit China to the WTO (World Trade Organization). He is now trying to launch a war against China over the consequences of his own policy. Many of us knew better at the time.”

——————-

https://www.counterpunch.org/2023/09/11/will-it-be-socialism-or-barbarism-for-the-twenty-first-century/

“Liberal Democrats bore significant responsibility for the election of Donald Trump via their economic policies.”

———————————————

https://www.iatp.org/sites/default/files/Full_Text_of_Clintons_Speech_on_China_Trade_Bi.htm

———————————————————-

https://www.epi.org/blog/nafta-twenty-years-disaster/

“The Chinese studied what had worked economically and what hadn’t across the West, and took what worked while leaving aside what didn’t.”

On a deeper level, and following the arguments of Branko Milanovic’s in “Capitalism Alone,” communism may have allowed an earlier China to abolish feudalism, regain economic and political independence and build capitalism, duplicating the same role played by the bourgeoise in the West.

Milanovic maintains the communism was the only movement that could achieve structural transformation as well as political independence for China. In other words socialism was a stepping stone toward a particular form of capitalism, not communism.

Excellent discussion. However, I think that we need to delve a little deeper into the “why” questions.

The late Kevin Phillips, in his 2006 Wealth and Democracy, concluded that America’s Gilded Age oligarchs were ostracized in the wake of the 1929 Wall Street crash. Roosevelt’s New Deal and the alliance against fascism heaped blame on the wealthy. Even under Eisenhower they were shamed into paying high progressive taxes. Then came anti-establishment counter-culture of the 1960’s, adding insult to injury.

By the 1970’s the American oligarchy had enough of being on the “outs,” as articulated by tobacco apologist and Supreme Court Justice Lewis Powell’s angry 1971 memorandum prepared for the U.S. CoC. Following Powell’s roadmap, the heirs of the Gilded Age soon had their own “Greed is Good” Summer of Love under Reagan, Friedman, and Greenspan.

Unfortunately, Bill & Hill Clinton’s outsider/nerd resentment of the “deplorable” classes bought Reagan’s toxic libertarianism lock, stock, and barrel — dismantling the New Deal and eventually buying the DNC out of bankruptcy after Obama’s end-run around the party in ‘08. As described by the late Sheldon Wolin in his 2010 Democracy, Inc, the American oligarchy’s class-hatred has fully metastasized into our current system of Inverted Totalitarianism in which government serves only the wealthy.

The millions who have been dispossessed have been deprived by television and the intersewer of any meaningful class consciousness and their only revolutionary impulse is to kill themselves and each other with the drugs and guns that our streets are awash with.

Story of two Communist regimes 1989 – one PR China with GDP $500bn and the other GDR with GDP $160bn. One nation had 1119 million people and the other had 17 million.

One nation fell into arms of rich successful U.S.-aligned West Germany and received attentions of Treuhand which effectively deindustrialised it and obstructed foreign investment which might compete with West German business

China opened up to Western Investment to learn and develop and assimilate on a path to national renewal and global re-assertion of China in the world

Today the contrast between Germany and China is blatant and the scale of China‘s ascent can be seen in Chiba holding 25% Daimler Benz or simply having kept German economy afloat since 2008

The West simply financialised itself into perpetual debt cycles and daisy-chained obligations re-hypothecating nominal values without underlying tangibles

Thanks. Really great article.

About your answers to the comment by ISL from October 8, 2024 at 11:52 am.

You write :

“With investment continuing to rise (as a portion of GDP) and consumption falling (relationally), China’s industrial capacity is rising without offsetting domestic consumption.

This asymmetry can persist for a while, but eventually it will be resolved either economically or politically.

… if the rate of rise is lower than that of investment, China is investing more in capital equipment than in consuming consumer goods.”

The following part of your comment is manifestly correct : “This asymmetry can persist for a while, but eventually it will be resolved either economically or politically”.

But your affirmation, that “China is investing more in capital equipment than in consuming consumer goods”, is manifestly not taking into account its political strategy.

China was investing in equipment and more particularly in real estate construction until the end of 2019 when it radically shifted its flux of credit from real estate to industrial R&D and the equipment of new technology outlets. See the following graph” that was used by Charles Gave in a debate titled “On ne peut pas sauver l’Occident” where he rebuts Vincent Strauss at 34 min.47sec.

In sum, observing that the West was preparing to wage war to impeach it to become “the new center of gravity of Western-Modernity”, China decided to shift its state banks’ flow of credit from the real estate sector to industrial R&D. Within a short few years the effort precipitated the success of its green energy production and its green energy transportation sectors. When the West understood, by the beginning of 2024 that it had been beaten in these sectors, it scrambled to find a response. But China had forecast this Western response and had decided to focus on sales to the Global South with localized production centers.

This is how China planned to resolve the asymmetry you talk about by decisively defeating the West at its own game. But Western analysts will discover the facts after reality imposes their price and three to five years down the road the ultimate price will appear to be the collapsing of Western societal institutions that will free China and the Global South from the Western imperial drive that suffocated them for centuries.

Don’t you think that the Chinese population will be thankful for their leaders prescience ?

A must view YouTube channel for those interested in a comparative industrial policy, that shows how China’s is strategic in defining the future it wants, while the West is merely following the gyrations of the market and is thus always late to catch the ball.

Today’s video reinforces the argument I made in my last post. It is about China’s robotic automation strategy “Why isn’t China exporting robots?”.