Economist Mario Draghi has held a lot of roles: Goldman Sachs executive, the European Central Bank president, and unelected prime minister of Italy. He’s now continuing his decades-long mission to remake Europe into a neoliberal paradise for the financial class as a sidekick to European Commission President Ursula von der Leyen.

That’s the best way to read his much-anticipated September report titled “EU Competitiveness: Looking Ahead,” which was requested by von der Leyen and coincidentally gave an economist’s stamp of approval to all of Ursula’s goals as commission president. It’s also why the roadmap laid out by Draghi is so important: it reveals much of the policy goals of the EU, which have long been underway and are set to continue. And it’s not pretty.

I wrote about the nonsensical energy policy contained in the report and alluded to Draghi’s ideas on productivity in a recent review of Ursula’s China “de-risking” strategy. Here I want to focus on the central theme contained in the title: competitiveness.

What are Draghi and company talking about when they talk about competitiveness? More local production, better quality of life for citizens, more competition? Of course not. It’s the opposite. And it promotes the doubling down on self-created crises like energy policy and looking to create new ones via a trade war with China. While tariffs on Chinese products aren’t necessarily a bad idea, it’s difficult to argue that the EU is really trying to protect industry for three reasons:

- If they were, they would be trying to get Russian gas flowing again. The lack of it has made EU manufacturing uncompetitive.

- They cannot simultaneously pursue neoliberal policies like austerity and an industrial policy. They’re certainly doing the former while saying they want to do the latter.

- They are escalating a trade war with China while being wholly unprepared as many products they rely on from China like certain drugs, chemicals and materials have no substitutes.

What Ursula, Draghi, and the European financial-political class are after isn’t more competitiveness at all; they’re seeking to complete the makeover of the EU into a neoliberal paradise (or hellhole depending on your viewpoint), which means less democracy, the further destruction of labor, and looking a lot more like — if not outright owned by — the US.

Europe now relies on the US for security, the US for (fossil) energy and the US for demand …

to rephrase an old trope about Germany https://t.co/0lxEdquQCn pic.twitter.com/m2aaIiYQn5

— Brad Setser (@Brad_Setser) October 18, 2024

Let’s look at some key points of Draghi’s prescription for more competitiveness.

More Concentration

The EU says it needs a ton of money for investment. Indeed that is what Ursula’s Commission has been calling for, that’s what the big report from Mario Draghi called for, and what hundreds of other similar reports want too, but it does not appear to be forthcoming.

So what they turn to next is a walling off from the East and a wholesale selloff to the US in order to help create the large firms they argue are necessary to build technological supremacy. How is this strategy already playing out?

The EU-US Trade and Technology Council is currently hard at work getting EU regulations in line with American interests. The EU is already dominated by US IT companies that supply software, processors, computers, and cloud technologies and we can expect more of that as Draghi and Ursula call for more mergers and acquisitions and more US private equity and venture capital.

US Secretary of State Antony Blinken calls the United States’ allies and partners “force multipliers” and “a unique asset.”

Assets, indeed. As more European companies struggle due to high energy costs and long-stagnant economies driven in large part by the EU’s obsession with austerity, they’re increasingly becoming the focus of merger and acquisition specialists from the US. CDI Global reports the following:

In recent years, a marked increase in cross-border mergers and acquisitions (M&A) by US companies in Europe has emerged as a notable trend. This surge in transatlantic investment signifies a strategic shift by American firms, grounded in the USA, aiming to harness the diverse advantages and lucrative opportunities presented by European markets. From established corporate giants seeking expansion to agile start-ups on the lookout for innovative growth pathways, numerous compelling factors drive US businesses to explore European bargain-hunting ventures…

A significant allure for US companies investing in Europe is the potential for acquiring assets at bargain prices. Economic uncertainties, geopolitical fluctuations, and evolving market dynamics have led to decreased valuations of European companies in recent years. This creates a favorable environment for US investors, allowing them to purchase valuable assets at more attractive prices than those typically found in the US market.

In addition to favorable valuations, Europe offers relatively lower costs associated with labor, research and development (R&D), and operational expenses. European countries often provide substantial subsidies, tax incentives, and grants aimed at fostering innovation and business development, reducing the financial burden on US firms.

US private equity giant Clayton Dubilier & Rice destroyed the UK’s fourth largest supermarket chain in a few short years. Warburg Pincus joined a consortium to snatch up T-Mobile Netherlands a couple years ago. US-based Parker Hannifin is taking private the UK aerospace and defence group Meggitt. Gores Guggenheim grabbed Swedish electric carmaker Polestar.

The private equity firm KKR, which includes former CIA director David Petraeus as a partner, took home the fixed-line network of TIM, Italy’s largest telecommunications provider. German energy service provider Techem was just sold off to the US asset manager TPG, and Germany’s awful economy is increasingly making its companies more likely targets for takeovers. The spooky Silicon Valley company Palantir is already making itself at home in the UK National Health Services, and it’s knocking on the door in Italy. Meera Shah, a senior corporate finance manager at Buzzacott and member of the Corporate Finance Faculty’s board, explains:

“Selling assets into the US has always been a fairly chunky part of what we do, but even with that track record, we’ve seen a significant increase in inbound interest from the US. There have been months where up to one third of the businesses we’ve sold have gone to US buyers.”

Guarding against China and Russia while the US strip-mines Europe is apparently a good thing because letting the US take over Europe means a successful “de-risk” from China and Russia.

Well, except for the people who live in the EU.

Take the example of TIM in Italy. As mentioned it already sold off its fixed line network and plans to unload even more assets soon. Telecom is one sector Draghi focuses on, lamenting the lack of concentration. Europeans have too many options, he says, but this idea that the EU needs consolidation (led by US firms as it so happens) in order to be more competitive begs the question: competitive for whom?

Italy has one of the world’s most competitive telecom markets, with monthly subscriptions for full-fiber landline services, which usually include unlimited Internet, priced as low as €20 to €25, about a quarter of what most US consumers pay.

So could a telecom behemoth that has a monopoly in the US and Europe feasibly be more competitive with Chinese companies? Maybe in profits or company value.

Would it help lead to technological supremacy as the other part of the argument goes? There are reasons to doubt that.

The story of TIM is instructive. The company used to employ 120,000 people compared to 40,000 (and dwindling) today and had “a strong innovative capacity” boosted by cutting-edge subsidiaries such as the Torino-based Centro Studi e Laboratori Telecomunicazioni. The company’s downfall began three decades ago when Italy came under EU control and Telecom Italia was privatized. As journalist Marco Palombi writes at Il Fatto Quotidiano (translation):

However, this disaster began thirty years ago when “the mother of all privatizations” was deemed necessary for Italy to respect the parameters of the Maastricht Treaty. There was no industrial plan, just the requirement to raise cash. It is the first of many financial choices that destroyed an industrial giant.

So the EU helped soften the target up before the US swooped it for the kill. It’s a process that continues today, and upcoming austerity in the EU will do so again:

The four largest €zone countries will all run contractionary fiscal policies in 2025. France, Germany, Italy, Spain represent ~75% of €zone GDP and have tight trade links with others. They will all go for budget cuts when the €zone economy is already weak.

Not far-sighted… pic.twitter.com/GJfDuGOclh

— Philipp Heimberger (@heimbergecon) October 23, 2024

Here I’m going to rattle off some quotes from the Draghi report with limited comment as I think they’re self-explanatory and to keep this post from going too long. One thing to keep in mind when reading Draghi’s wisdom, however, is that automation is considered productivity growth and therefore equals competitiveness.

Less Labor Law for “Innovative” Companies

…the EU should support rapid growth within the European market by giving innovative start-ups the opportunity to adopt a new EU-wide legal statute (the “Innovative European Company”).

This status would provide companies with a single digital identity valid throughout the EU and recognised by all Member States. These companies would have access to harmonised legislation concerning corporate law and insolvency, as well as a few key aspects of labour law and taxation, to be made progressively more ambitious, and they would be entitled to establish subsidiaries across the EU without incorporating separately in each Member State.

Free Rein to AI and Tech Start Ups

Regulatory barriers to scaling up are particularly onerous in the tech sector, especially for young companies [see the chapters on innovation, and digitalisation and advanced technologies]. Regulatory barriers constrain growth in several ways.

First, complex and costly procedures across fragmented national systems discourage inventors from filing Intellectual Property Rights (IPRs), hindering young companies from leveraging the Single Market.

Second, the EU’s regulatory stance towards tech companies hampers innovation: the EU now has around 100 tech-focused laws and over 270 regulators active in digital networks across all Member States. Many EU laws take a precautionary approach, dictating specific business practices ex ante to avert potential risks ex post. For example, the AI Act imposes additional regulatory requirements on general purpose AI models that exceed a pre-defined threshold of computational power – a threshold which some state-of-the-art models already exceed.

Third, digital companies are deterred from doing business across the EU via subsidiaries, as they face heterogeneous requirements, a proliferation of regulatory agencies and “gold plating”04 of EU legislation by national authorities.

Fourth, limitations on data storing and processing create high compliance costs and hinder the creation of large, integrated data sets for training AI models. This fragmentation puts EU companies at a disadvantage relative to the US, which relies on the private sector to build vast data sets, and China, which can leverage its central institutions for data aggregation. This problem is compounded by EU competition enforcement possibly inhibiting intra-industry cooperation.

Finally, multiple different national rules in public procurement generate high ongoing costs for cloud providers. The net effect of this burden of regulation is that only larger companies – which are often non-EU based – have the financial capacity and incentive to bear the costs of complying. Young innovative tech companies may choose not to operate in the EU at all.

Less Sovereignty

The lack of a true Single Market also prevents enough companies in the wider economy from reaching sufficient size to accelerate adoption of advanced technologies. There are many barriers that lead to companies in Europe to “stay small” and neglect the opportunities of the Single Market. These include the high cost of adhering to heterogenous national regulations, the high cost of tax compliance, and the high cost of complying with regulations that apply once companies reach a particular size. As a result, the EU has proportionally fewer small and

medium-sized companies than the US and proportionally more micro companies [see Figure 7]. However, there is a close link between the size of companies and technology adoption. Evidence from the US show that adoption rises with firm size for all advanced technologiesxii. Likewise, while in 2023 30% of large businesses in the EU had adopted AI, only 7% of SMEs had done the samexiii. Size enables adoption because larger companies can spread the high fixed costs of AI investment over greater revenues, they can count on more skilled management to make the necessary organisational changes, and they can deploy AI more productively owing to larger data sets. In other words, a fragmented Single Market puts EU companies at a disadvantage in terms of the speed of adoption…

More “Disruption”

A better financing environment for disruptive innovation, start-ups and scale-ups is needed as barriers to growth within the European markets are removed [see the chapters on innovation, and investment]. While high-growth companies can typically obtain finance from international investors, there are good reasons to further develop the financing ecosystem within Europe. Very early-stage innovation would benefit from a deeper pool of angel investors. Ensuring sufficient local capital to fund scale-ups would concentrate the spillovers of innovation within Europe. Increasing the appeal of European stock markets for IPOs would improve funding options for founders, encouraging more start-up activity in the EU. To generate a significant increase in equity and debt funding available to start-ups and scale-up, the report proposes the following measures. First, expanding incentives for business “angels” and seed capital investors. Second, assessing whether further changes to capital requirements under Solvency II are warranted, which establishes capital adequacy rules for insurance companies, and issuing guidelines for EU Pension Plans, with the aim of stimulating institutional investment in innovative companies in selected sub-sectors. Third, increasing the budget of the European Investment Fund (EIF), which is part of the EIB Group and provides finance to SMEs, improving coordination between the EIF and the EIC, and eventually rationalising the VC funding environment in Europe. Finally, enlarging the mandate of the EIB Group to enable co-investment in ventures requiring larger volumes of capital, while also enabling it to take on more risk to help “crowd in” private investors.

Learn from Hyper-globalization which Decimated Labor by Embracing AI which Could Decimate Labor.

The key driver of the rising productivity gap between the EU and the US has been digital technology (“tech”) – and Europe currently looks set to fall further behind. The main reason EU productivity diverged from the US in the mid-1990s was Europe’s failure to capitalise on the first digital revolution led by the internet – both in terms of generating new tech companies and diffusing digital tech into the economy. In fact, if we exclude the tech sector, EU productivity growth over the past twenty years would be broadly at par with the US. Europe is lagging in the breakthrough digital technologies that will drive growth in the future. Around 70% of foundational AI models have been developed in the US since 2017 and just three US “hyperscalers” account for over 65% of the global as well as of the European cloud market. The largest European cloud operator accounts for just 2% of the EU market. Quantum computing is poised to be the next major innovation, but five of the top ten tech companies globally in terms of quantum investment are based in the US and four in China. None are based in the EU.

Overhaul Education “Skills Investment” With a Focus on Training Workers to Become Productive Tools for Capital:

The EU should overhaul its approach to skills, making it more strategic, future-oriented and focused on emerging skill shortages. The report recommends that, first, the EU and Members States enhance their use of skills intelligence by making much more intense use of data to understand and act on existing skills gaps. Second, education and training systems need to become more responsive to the changing skill needs and skill gaps identified by the skills intelligence. Curricula need to be revised accordingly, also involving employers and other stakeholders. Third, to maximise employability, a common system of certification should be introduced to make the skills acquired through training programmes easily understandable by prospective employers throughout the EU. Fourth, the EU programmes dedicated to education and skills should be redesigned, so that the funding allocated can achieve a much greater impact. To improve the efficiency and scalability of skills investments, the disbursement of EU funds should be coupled with stricter accountability and impact evaluation. In parallel, it is proposed to adopt specific interventions to address the most acute skills shortages in technical and STEM skills. A particular focus is needed on adult learning, which will be key to update worker’s skills throughout their lives. Linked to this, vocational training also needs a broad reform across the EU. Specific sectors (strategic value chains) or specific skills (both worker and managerial capabilities) will require complementary targeted interventions. For example, it is proposed to launch a new Tech Skills Acquisition Programme to attract tech talent from outside of EU, adopted EU-wide and co-funded by the Commission and Member States. This programme would combine a new EU-level visa programme for students,graduates and researchers in relevant fields to stimulate inflow, a large number of EU academic scholarships, in particular in STEM subjects, and student internships…

While the Draghi report was almost comical for its refusal to address the reasons behind the EU energy crisis, it was also an incredibly sad read. That’s because it ignores the disadvantages of chasing Draghi and Ursula’s brand of competitiveness and productivity.

The transatlantic crowd doesn’t have to look far for what all these policy prescriptions would mean for Europe: it would become more like the US. And there are plenty of downsides for all the workers who form the backbone of “competitiveness” of such a change.

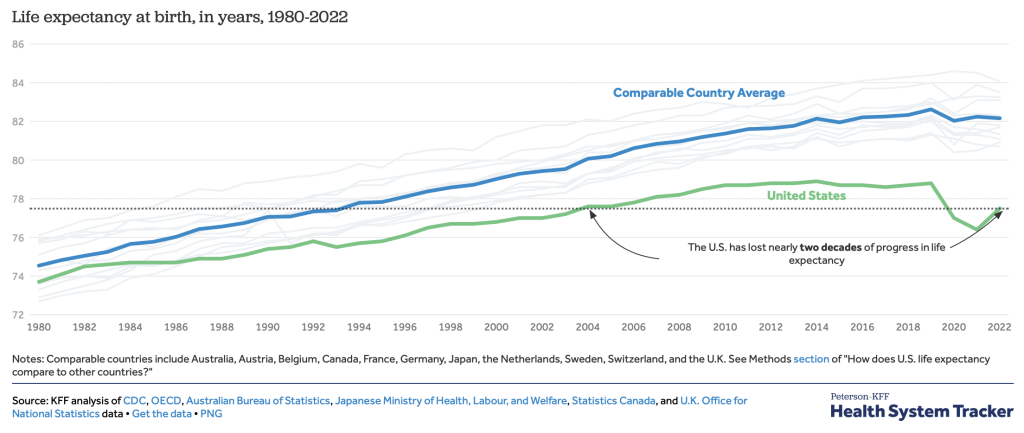

Draghi actually mentions the healthcare sector as an example of where the US outcompetes the EU. How is that competitiveness measured? By things like productivity and profit. And not, of course, by data like this:

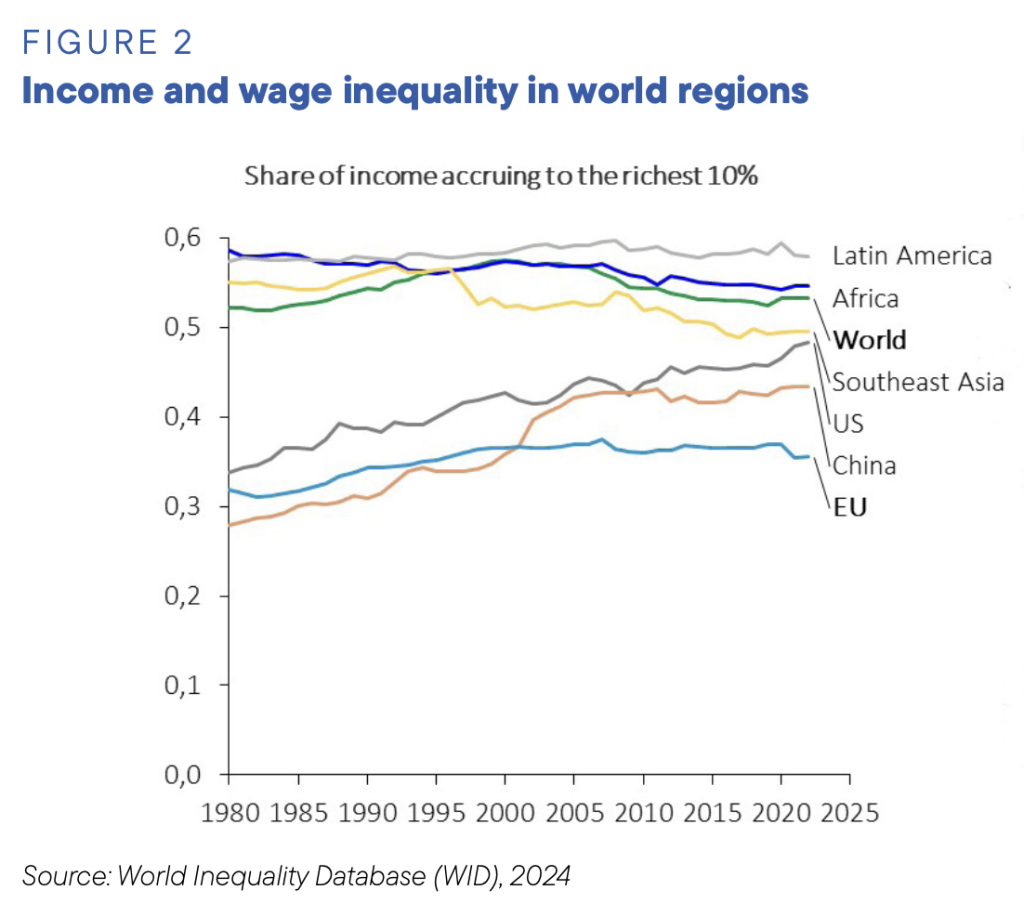

How about wealth inequality?

That graph there is probably as good an explanation as any to answer the question of why the EU elite want to follow the US model. For Ursula, Draghi and capital these are signs of being uncompetitive, and their solutions are coming: lower wages, a more flexible workforce (preferably machine), more private equity, more privatization, more asset-price bubbles, and more over-indebtedness for the bottom 90 percent.

In certain places in the EU, such as Italy, this process has been ongoing for decades dismantling what the communist party and trade unions helped build out of the rubble of WWII.

The good news is that’s typically a long tear down process (although the crises are coming more frequently nowadays). The EU moves methodically through the byzantine layers of bureaucracy and push and pull with national governments dealing with what’s left of the unions. That means there’s time to halt the march of financialization and reverse course. The bad news is it’s like boiling a frog who fails to notice the slow deterioration of quality of life until it’s too late.

Helloween is upcoming: maybe add some stuff to your outfit that also have some practical application also after Helloween in Brussels?

https://woodworkingnut.com/2015/10/30/how-to-make-a-guillotine/

They aren’t becoming like the US because unlike the US, they want to run large trade surpluses and rely on exports to drive growth instead of domestic demand and consumption.

This is what all this “competitiveness” talk is about; how can we get real wages and labour costs down so we can export more. That isn’t really what the US model is.

Exports to who? And for what purpose?

“The report recommends that, first, the EU and Members States enhance their use of skills intelligence by making much more intense use of data to understand and act on existing skills gaps.”

So bigger and moar data is the answer, huh? If you ask me, the fact that these clowns can’t tell what the problem is by opening their eyes and looking out the window so to speak is the cause of their malaise. But instead they want to collect all the data and look very closely until they finally discover the Virgin Mary’s face on that piece of toast. There’s go to be a pattern in there somewhere!

Go down to the pub and ask around and they’d probably have a far better understanding of how they cocked everything up.

“Draghi actually mentions the healthcare sector as an example of where the US outcompetes the EU.”

https://fred.stlouisfed.org/graph/?g=1p7yP

January 15, 2018

Life Expectancy at Birth for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2017-2022

https://fred.stlouisfed.org/graph/?g=1p7yR

January 30, 2018

Infant Mortality Rate for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2017-2022

@ CA at 8:09 am

Pretty jarring that Draghi cites US healthcare an an example to follow. It is the most expensive and inefficient healthcare system in the West. The US devotes 18% of GDP to healthcare and still manages to leave 100 million people under-insured or entirely uninsured. Comparable countries devote 9 to 11% and cover everyone. That wasted 8% of GDP, an astonishing $2.2 trillion, stems from overpriced everything (doctors, hospitals, pharmaceuticals) and useless testing. The grotesque inefficiency does show up in oversized profits for companies profiting off the backs of the sick and dying. Healthcare should be not-for- profit.

That Draghi cites US healthcare as an example to follow invalidates whatever argument he may be making. No need to go any further in his analysis.

If you look for profits and you are a shareholder or on some of those institutional boards, what is not to like?

That was my first though: in US they make much more profit, so they outcompete the Europeans, who still stupidly think in terms of providing good healthcare for all.

Gun deaths are another area where the U.S. is a clear winner, WAY above anybody else. Surely we can make sure to get rid of pesky gun laws in the EU and bring those backward Europeans into the civilian killing fields. Mario and Ursula, as the leaders of Europe, you’d better hop to it!

Conog G: Draghi actually mentions the healthcare sector as an example of where the US outcompetes the EU. How is that competitiveness measured? By things like productivity and profit. And not, of course, by data like this

Madness. Worse than that, stupid

.

Meanwhile this just in–

Volkswagen plans to close at least 3 German plants and cut thousands of jobs:

Europe’s largest carmaker tells works council it would slash pay by 10%

https://www.ft.com/content/a7721c5f-164d-4793-b413-1bd8dd45f1a1

Archived: https://archive.ph/fDeD8

‘The restructuring would mark the first closure of domestic plants in the company’s 87-year history and set up a battle with unions. VW has 10 plants and 300,000 employees in Germany.

‘VW has warned that radical measures are needed as Europe’s largest carmaker faces intense competition in China, slowing sales across other major markets and the need to navigate the costly transition to electric vehicles. It recently issued its second profit warning in three months, blaming a “challenging market environment”.’

And in China, conversely, the Xiaomi EV Factory, 100 percent robotics producing every 72 seconds 1 car that’s superior to and cheaper than anything the Germans can manufacture —

https://www.youtube.com/watch?v=yezR-mH12xs

The EU is dead. Its leaders are just too stupid to know it.

Germans can’t afford to buy VW cars and so VW had to rely on being able to sell cars into the enormous Chinese market.

The fundamental problem is Germany produces far more than it affords itself to consume. For a country where so much of the economy is based around the production of expensive cars so many people can only afford to buy used or at best low end models like Skodas or Opels. It’s ridiculous.

I went to a Volkswagen dealer a few months back while waiting for an appointment nearby. I was astonished by just how awful the new models are. It seems like they’ve completely hollowed out the slightly above-average quality they once were known for and there’s not a consistent design marker across the vehicles. Compared it to an “MG” (Chinese bought and relauched UK marque) dealer and the difference is astonishing. Those are cheap cars by price but looked pretty good and had solid panels, doors, etc.

I’d also say that the current line-ups from the other German brands suffer from similar loss of cachet and dilution of brand value. Look at the recent BWMs for instance. Ugly and over-teched. It’s a sad day for German car enthusiasts.

@Bugs 8:39 am

Consumer Reports gives Volkswagen cars poor evaluations. It even recommends avoiding the 2024 Jetta. It also gives a poor rating to most Mercedes although a few models do get an average grade.

Despite your view of BMW it is the German brand they like the most, with several models getting very high ratings. They also rather like the Audi which gets rather good ratings.

Audi made great cars. The 2014 Q7 SUV we drive is probably one of the finest mass-market internal combustion cars. Rock solid diesel engine, all wheel drive, air suspension, famously precise/dead (take your perspective) handling, capable of 130mph on the autobahn in quietly thrilling comfort for seven passengers. All with only a modest amount of techno bells and whistles. Handbrake is manual, everything important controlled with knobs and switches etc.

Unfortunately that Audi is dead. Now the cars have enormous screens and crappy cost-accountant engineering and an eye watering price tag. My friend has bought a succession of Q7’s and regrets selling his 2014 model for the last two upgrades.

At the other end of the spectrum, my mother wants to replace her Golf and has found that the car she can drive blindfold (owned every model since 1982) has been replaced with touchscreens, electronic handbrake etc and she has no idea how to drive it. Plus the price is extortionate for such a compromised driving experience, including a very cramped angular interior. She is looking at trading down to a Polo or moving to VAG’s cheaper Skoda brand, which still has manual handbrakes.

VAG has spent its time and money building plastic toy electric vehicles nobody is buying, declared its existing customers and their preferences obsolete and treated them with contempt. On the one hand, I like them emotionally – British officers famously rescued the company post WW2 – but they deserve their comeuppance. I hope their workers are not made to pay the price of the mismanagement….

Hitler is spinning in his grave: what they have done with his brandname car…

So VW is not selling that much in China any longer, eh? It is not that the Chinese cars are inundating EU markets. True, they did take over the Russian market, but VW left and it is known that nature abhors vacuum…

And in China, EVs are going strong, something VW is not known for…

Of course setting up the EU to be pillaged by the US and its citizens impoverished will likely cause a lot of dissent as there will be a lot of unhappy campers. But luckily the EU is all over this problem-

‘European Commission President Ursula von der Leyen writes in her recent report that the EU should create a new intelligence body to deal with external threats.’ After all, the BRICS beckons.

https://sputnikglobe.com/20241025/plans-for-new-pan-european-intelligence-agency-highlight-efforts-to-federalize-eu-1120679764.html

That’s right. Ursula wants to create a sort of EU CIA because, you know, it has worked out so well for Americans. Based in Brussels I bet. With a budget of tens of billions of Euroes each year to crack down and spy on the people of the EU lest they rebel. Countries like Moldova, Georgia and Serbia are taking one look at all this and are saying ‘Nope!’ After all, the BRICS beckons.

Thank you for this presentation of the strategic direction the EU is taking. To me it seems, when we consider it in relation to the USA, more like a vassal-suzerain relation than imitation. In the late 90s and 00s European nations were much more likely to disagree with the USA on foreign policy and Americans hated them for not joining their wars. In the same period Americans expressed real fear if the power of the consolidated EU market and trading block. Back then the EU bloc had ambition to peer status. No longer. I think Draghi’s strategy shows what changed.

Back then America was in a liberalization phase. American businesses sought and got new global labor and consumer markets. But that was thrown in reverse in 2017. What’s happening now is the US is seeking to a) limit the growth and technical development of China/Russia and competition from them, b) gather its vassals back so that they do the same, c) do the extractive financial capitalism (plundering the commons and corporate raiding) it has done to itself also to its vassals.

c) requires what Draghi calls “competitiveness”, by which he means deregulation and incentives to make sale of European productive and real capital more attractive to trans-national investors.

So in one sense this is Europe making itself more like the US but in another it is very different because of the asymmetry of ownership, policy power, and flow of gains. It will be the dollar, not the euro, that gets propped up.

This leaves the question as to why European leaders chose to accept this subordinate position.

As to the “why” of it, my guess is gigantic bags of cash provided to said leaders, whether literally or in the form of well paid sinecures. Maybe a villa thrown in here or there.

I think that’s part of the answer. Another part is that the job selects for and rewards the psychopathy and raw will to power that people like Draghi, UvdL, Macron, etc. express.

The “why” of the subservience EU governments to the US was addressed on Glenn Diesen’s substack yesterday. Quoting, with edits, from commenter Kouros:

“The watershed year was 2002, when European countries except UK, which is by and large not a European country, refused to endorse and join in the US attack on Iraq, making this enterprise an illegal war from an international UN stand point.

Since then the US has poured enormous resources into grooming future European leaders (and Canadians as well). Scholarships, fellowships, all sorts of bribes, all sorts of files for potential blackmail have been created for hundreds and thousands of individuals in Europe.”

This was confirmed by the man who ran the US State Department at the time, retired Lt-Col Wilkerson, Chief of Staff to Secretary of State Gen. Colin Powell. He describes how the decision was made to interfere “overtly and covertly” in European elections.

See The Duran, August 6, 2024 at https://www.youtube.com/watch?v=UnPl1ETy_C8, beginning at 41:46.

I read that Diesen’s substack with interest. I thought it nicely described the state of affairs but I was not so satisfied with the way it explained this as a consequence of postmodernism and constructivism. It’s easy to bash academic theorists and their fans because they are so funny but it’s not so easy to realistically blame the prostration of Europen politics on them. It was a huge policy shift, largely uniform across Europe. If academic postmodernists and constructivists really have that power then all we need do is switch career and change the propaganda.

The system of carrots and sticks (grooming and blackmail you mention) are not new but may have been stepped up a good deal in the frame you described. I think Michaelmas makes a good point too.

But Diesen’s article also set out the rhetorical tricks of oversimplification and moral confrontation. We a good series of training YouTubes that show how that stuff works and how to handle it.

Thanks for the Duran reminder!

Lets see what he lays on the table.

Btw one of those German candidatess who were “groomed” after having messed up their career, Cem Özdemir. He was considered dead in the water 20 years ago.Then he came back…

https://wikispooks.com/wiki/Cem_%C3%96zdemir

re: Wilkerson and THE DURAN

see also the show from 24th of October

https://theduran.com/us-elections-imperial-overstretch-colonel-lawrence-wilkerson-alexander-mercouris-glenn-diesen/

It´s funny I had immediately started at said TC: 41:46 not noticing that it was the wrong show.

But it was nicely terrifying cause Wilkerson at around 38:00 speaks about how US StratCom right now – of course – is discussing most likely quick escalation to the nuclear threshold against China because it´s the only way to keep alive a military victory.

They are sick. But we already know that. And if I decide to protest at some WMD site because I don´t want to die in WWIII I am being dragged to court. And the judge starts to talks about obstruction of law enforcement and administrative reasons instead of the extinction of our species.

Go figure.

Don’t forget blackmail. Soooo much cheaper. And why having all that SIGINT infrastructure if you won’t use it…?

Or Grooming from early on…i.e. Rhodes Scholarships and all sorts of fellowships, and you assess them and pick the pluckier ones…

I think I have heard Hudson make the same claim — that the European misleadership class is bought and paid for on top of having been groomed by CIA cut-out NGOs and complicit professoriats in European universities who promulgate the cult of neoliberalism. All with a dash of kompromat to corral any waywardness …

.Tom: In the late 90s and 00s European nations were much more likely to disagree with the USA on foreign policy and Americans hated them for not joining their wars … Back then the EU bloc had ambition to peer status. No longer. I think Draghi’s strategy shows what changed.

The 2008 Global Financial Crisis and, specifically, the credit swap lines that the Fed then extended to European central banks, which ‘saved’ those countries’ economies from collapse, have been, I suspect, a big factor in ‘what changed. Consider Deutsche Bank’s then-centrality to the German economy and the parlous state it was discovered to be in in 2008, for example.

So those countries’ economies, and their political leaderships, were saved by the Fed’s swap lines. But at the price of now being owned, I suspect.

~

It’s an analogous historical moment, in a way, to the 1971 ‘Nixon Shock’ when the US went off the gold standard and then-Treasury Secretary John Connolly told the Europeans that the dollar is “our currency but your problem.”

Then, the US, precisely as a result of its own bad behavior, was rewarded with the enormous global power of having the world reserve currency be its fiat currency, of which it could essentially print as much as it wanted. (cf. Michael Hudson’s Superimperialism, which got him the gig at Herman Kahn’s Hudson Institute.)

And so, again, in 2008, precisely as a result of its own bad behavior, which caused the GFC, the US was rewarded with enhanced global power, due to the Fed’s ability to print dollars and feed them to the vulnerable Europeans.

The world is not fair, of course.

That’s a very interesting thought. The GFC and Euro debt crisis making clear to Europols who’s boss. Reminds me of the Gnomes of Zurich.

Is there a study (or a particular essay by Hudson or someone other) that lays out this connection of 2008 triggering a big loss in European independence? Or do I have to dig into nc?

It appears to have much more to it than Diessen´s policy-shaping by ideology. As a marxist one would have to remind him that it´s always ideology and policy that build on economics not the other way around. So before Wilkerson´s certainly interesting details would be effective that material leverage has at first to be created.

At least here in Germany the unions are a sad joke. The biggest industrial union is IG Metall. Whereas in former times union representatives had been chosen from the rank and file today they are usually university educated “leftists” who have never worked with their hands. I put “leftist” in quotation marks as they have no clue of economics but are often woke as hell. Their idea of “social justice” has no semblance to economic justice. Their leaflets are written in so called “gender sensitive” language which might be easily understandable for sociology majors but difficult for the major part of the work force that neither has higher education nor grew up with German as mother tongue. That this kind of thing is possible at all is due to the fact that the leaders of the union have perfected the art of subverting the democratic process by which union delegates are selected. Basically the leaders select the delegates and the delegates the leaders. It is a self referential process that reminds one of the unions in the former GDR.

But that is not all. If at least the union would demand a decent pay rise that compensates for inflation but that is not the case. Their current demand is a paltry 7 percent which is a slap in the face of workers as two years ago the base pay was hardly raised at all. Instead people got lump sums of 2000€ each year which wasn´t taxed. The 7 percent will not even compensate for inflation. And that if the 7 percent will be granted which is not guaranteed at all.

People are leaving the union in droves. A good friend, a highly skilled mechanic who works in the same factory (1400 employees) for nearly 40 years told me that he had never seen such dissatisfaction. A few weeks ago, at the annual assembly of all workers, the union representative from the district of Nordbaden cwas booed from the stage when he attacked the AFD. People are completely riled up and they are turning to the AFD. The left – or more precisely what poses for the left – is thoroughly discredited.

And consider the German employers countered with offering only something like a 1.5% raise! At least IG Metall rejected that but 7% is FAR too low. Needs to be double digits.

And it is not just blue collar factory and production workers – in most large German companies IG Metall also covers white collar engineers and others, so even people with university degrees and even PhDs. In Germany the companies are able to employ PhD engineers for €75K a year and yet the companies STILL complain that pay is too high!!!

this all sounds like speeches that bill clinton made in the 1990’s. when he was warned that his free trade/free market polices were actually a race to the bottom, his response was almost to the letter of the current E.U. leadership.

get big or get out. retraining, automation, the era of big government is over, yadda yadda yadda.

these people are cranks, and crank science is what they peddle. and cranks will simply keep doubling down.

the cranks think that the rich are the true drivers of the economy. so everything they do will backfire, then they will double down.

wash, rinse then repeat.

https://books.google.com/books/about/The_Race_to_the_Bottom.html?id=kh3CX8CScOgC

Get this book in print▼

The Race To The Bottom: Why A Worldwide Worker Surplus And Uncontrolled Free Trade Are Sinking American Living Standards

Front Cover

Alan Tonelson

Basic Books, Apr 29, 2009 – Political Science – 248 pages

“With the end of the 1990s economic boom, The Race to the Bottom deftly explores how the United States has entered a no-win global competition in which the countries with the lowest wages, weakest workplace safety laws, and toughest repression of unions win investment from the U.S. and Europe.

Tonelson analyzes how the entry of such population giants as China, India, and Mexico into the global market has accelerated the erosion of wages and labor standards around the world. And he describes how an ever-larger share of this low-wage competition is hitting not just sectors like apparel and toys, but also many of America’s highest wage industries like aerospace and software.

Tonelson explains why the re-education and retraining programs touted by many political leaders offer little but false hopes to most U.S. workers as he outlines the real decisions Washington needs to make to ensure long-term prosperity for the U.S. and the rest of the world. Updated with a new prologue from the author.”

You certainly stay on message, I’ll give you that.

does the E.U. leadership sound different than what occurred in the u.s.a. in the 1990’s? after all, that is what the results will be that they are agitating for.

same thing occurred under thatcher/blair in the u.k.

cranks all!

Oh, no. I don’t disagree.

I’d use another word than cranks to describe them, though.

That old rogue James Goldsmith saw this coming in the early ‘90s when he wrote The Trap

https://www.goodreads.com/book/show/2091182.The_Trap

https://www.youtube.com/watch?v=wwmOkaKh3-s

Those reports are a load of buzzwords that have zero meaning.

They want asset bubbles.

They are talking about being competitive in generating more unearned income.

They’ll pull numbers out of their butts and call it “productivity”.

Mikel: They want asset bubbles …They’ll pull numbers out of their butts and call it “productivity”.

Truth.

It will be interesting to see how these affect the election landscape in Europe, mainly France and Germany, where the electoral control is already starting to crack. Unlike US and UK, most of Europe’s electoral system is not well suited for imposing this agenda and populist parties are already part of the mainstream.

Ironically, social media is a big factor here, because for most part US media companies hate to police discourse in non-English languages because it requires them to hire local workforce instead of some South Asian sweatshop. So non-English policing is quite lax because it’s so much more expensive to crack down on.

If France or Germany breaks for the populists it will be very difficult to push through any of these policies, and it may spell disaster for VdL herself.

Around the time the Cold War was ending someone mentioned that the EU was, chiefly, set up to be a way the the US could control Europe. I saw it as a way for Europe to become more prosperous and peaceful after centuries of wars and rivalries. I was wrong. I can see it now. To be blunt, it would not be wrong to say that the whole thing, after the Cold War ended was exactly a CIA (and their numerous tribe-members including the finance oligarchs) to destroy Europe and make it a community of vassals. I used to respect Europe’s politicians because they provided a good life for most people particularly compared to the US.

What I do not understand is why don’t European people note that the US has had, for a decade, a lowering of life-spans and a increase in poverty and an endless seach for world-domination through coercion and bribes. What happened to European intellectuals and universities? Are they also subject to coercion as are most US institutions of higher learning? Are these Europeans just weak and intimidated by the US?

Fortunately we, in the USA, have a chance for some changes if Trump can win and even if Harris wins and the US gov’t becomes so corrupt it will fall into itself. Europe may well follow.

I think another question that needs to be asked is the following:

Why does the US want to become more like the EU?

Because I see this in multiple regards: Suppression of free speech (particularly on controversial topics where people oppose the “conventional wisdom”), transgender rights (in particular, biological males in women’s athletics and prisons), terribly flawed energy policy (pushing hard for renewables without considering the storage requirements; pushing hard for EVs when we lack the batteries, the charging stations, a big enough grid to run the charging stations, and enough dispatchable generation assets to keep that larger grid reliably energized with all of the extra loads), bungled foreign policy, accusing all political opposition of being Nazis (and occasionally engaging in lawfare to keep said opposition suppressed), etc.

Is the EU copying the US, or are the EU and US joined together hand-in-hand, merrily skipping down the “woke green road,” where ideology rules over reality in decision-making processes?

Both ignoring reality seems to be a part of it:

https://open.substack.com/pub/gaiusbaltar/p/a-civilization-beyond-reality

I thought that the EU was largely a neoliberal project from the beginning which is why it destroyed Greece’s economy, and the austerity measures that are being promoted by Germany end up being adopted as the EU’s economic policy.

Hepativore: the EU was largely a neoliberal project from the beginning

The EU was explicitly founded and conceived by von Hayek’s Mont Pelerin Society OG members to be a frickin’, frackin’ neoliberal project. So, absolutely.

Yes — see William Mitchell’s Eurozone Dystopia for all the gory details

https://www.goodreads.com/book/show/30343868-eurozone-dystopia

There is no other way for the elites of a democratic nation to legitimately live in the luxury of a Third World dictatorship than to emulate the neo-feudalist United States.

The whole point of US sponsorship of European integration under Acheson, Clayton, Harriman and their successors was that there would be a United States of Europe (USE) which would be the mirror image of the USA, and because it would be the mirror image with the Soviet bloc to its east, it would not be a strategic competitor. More especially, in the period 1945-48 there were grave fears of a relapse into Depression conditions in the US if US manufacturers could not export their surpluses to Europe. The USE would therefore be an essential vent, and it was necessary to increase Europeans’ bargaining power, via Marshall Aid and the European Payments Union in order to create an effective vent.

However, by 1951/52 the massive and immediate success of the EPU (created in 1950) had led some US policymakers to question where it was all going. Already US surpluses were being undermined by the cost of maintaining a permanent US military establishment in Europe and by the rapid re-industrialisation of Germany. Hence US sponsorship (including by Acheson) of the Pleven Plan for a European Defence Community, when that failed, the inevitable turn for the integrationists (who had developed significant momentum) was to an economic community, and the Beyen Plan recognised that as it was France which had nixed its own plan for a EDC, it would be necessary to bait France by including a high common external tariff and a farm subsidy programme. Unlike the Pleven Plan the Beyen Plan was not developed with close US involvement. The Agriculture, Commerce and Labor Departments were aghast, but the State Department prevailed: discriminatory tariffs would be accepted if it kept Western Europe free from communism. There could still be a USE, and US military spending in Europe could be used as a bargaining chip to beat down the tariffs, quotas and subsidies.

Of course, this did not happen. The US continued to remonstrate as it slipped further into deficit. Now the boot is on the other foot. The resurrection of the real or imagined threat to the East and the Europeans’ entrapment in their own rhetoric has given the US suasion it has not possessed for decades. The Europeans have been ‘encouraged’ to barter a defence shield in exchange for the ‘equalisation’ of the trading relationship as the IRA subsidies and expensive US LNG exports negate, and perhaps more than negate, the EU’s CET and CAP. As European economies fade they increasingly lack the means and economic space to construct their own military shield, making them that much more dependent upon the US shield, and giving the US ever more suasion. This, then, allows the US to sanction the existence of an EU which is more like the USE originally envisaged by Acheson in 1949-50, as bulwark of the West and, no less, as a vent for US exports. Moreover, if the EU/UK slips into deficit this will allow the US to offset its heavy deficits with China (against which it cannot exercise like suasion), and so preserve dollar hegemony for a little longer. Indeed, Europe may come to play much the same role that India played in the waning decades of the British empire: as a critical vent and focus for surpluses used to offset deficits elsewhere (which was critical for the effective operation of sterling as a reserve currency between the 1880s and 1930s).

Just as Adenauer and de Gaulle played Eisenhower, Kennedy and Johnson, so Biden and Trump have been playing Macron and Scholz. Horses for courses.

Thank you, Froghole.

If I understand you correctly then this is how I see the Russia Ukraine war as a win for the US even if it is a military win for Russia.

Many thanks! If it is a US victory, it may prove to be a Pyrrhic one. A financial bleed of Europe risks a reaction in time. It is possible that efficient narrative management and the co-option of pliable elites (in which the US is now so adept) may help to camouflage the reality of any drain from Europe to the US for a period, but such narratives cannot be sustained for ever, and may risk a still more violent reaction against US suasion in the longer term. The drain may result in Europe being unable to restore any form of autonomy, but it might certainly try to do so by playing off – or attempting to play off – the US against the Sino-Russian bloc or might even capitulate to the latter in due course, especially if the US becomes a decreasingly attractive economic, moral and political alternative to Sino-Russian or Eurasian influence.

Moreover, US ‘success’ in Europe has coincided with a serious loss of influence in the Global South, as policy in West Asia has compromised US soft power still further by proving beyond all reasonable doubt the essential racism of US policy, and as the Sino-Russian bloc becomes a more appealing alternative. The suppression of European strategic autonomy is a poor substitute for the decline of US suasion in the Global South, not least because Europe has scant mineral endowments, and Europe – whose post-colonial influence in the Global South has collapsed in lock-step with that of the US – mattered to the US at least partly because of its leverage over mineral endowments in Africa, a leverage which has now disappeared. If the Global South turns ever more decisively away from the West for capital, the West will be deprived of high yield debt revenue streams from the Global South, which may make it proportionately harder for the West to help fund the preservation existing living standards. Of course, an increasingly debilitated Europe may provide alternative high yield debt streams for Wall Street, but again that risks turning Europe away from the US.

Europe may therefore become more of a rampart for the US, but it is not a sufficient rampart, and not one equivalent to the massive strategic strength in depth which China has courtesy of its affiance with Russia and the large flotilla of countries, especially in Eurasia, over which it has been exerting a massive gravitational pull. Ukraine and Israel may therefore help to turn much of the West against itself.

Cheer up a bit folks. Europe still does have elections and my read of the recent EU, France and German elections is that the neolibs barely held on. Once the defeat by Russia in Ukraine sinks in the whole rotten leadership will likely be gone.

Europe has elections. So does Georgia.

Elections are only valid if the CIA endorses them.