Lambert here: Hard to see why “engineering” in “financial engineering” doesn’t have air quotes around it.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street.

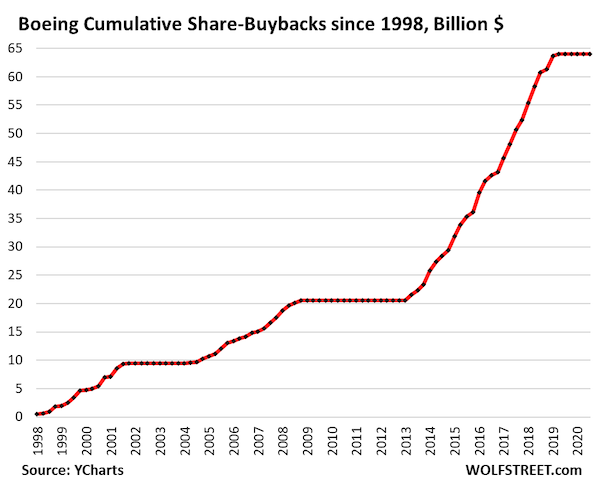

Boeing, which has booked net losses every year from 2019 on, totaling nearly $32 billion, and which has borrowed huge amounts of money over those years, bringing its short and long-term debt to $58 billion while gutting its stockholder equity, now a negative $23.6 billion, has been in dire need of lots of cash to burn, after it wasted and incinerated $64 billion in cash on share buybacks to pump up its shares.

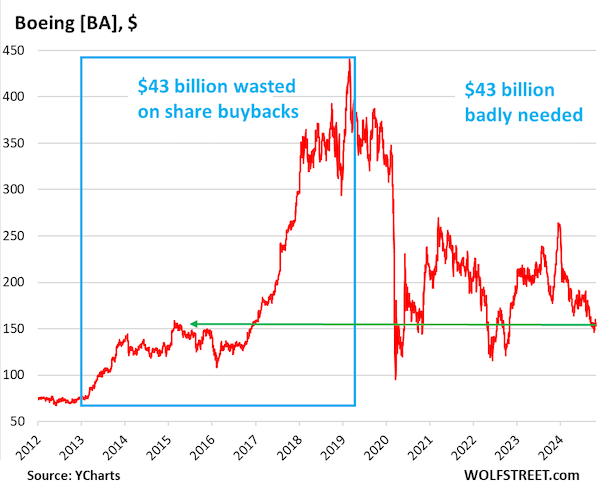

The company’s infamous pivot from aircraft engineering to financial engineering to please Wall Street has turned into a devastating mess, including for shareholders. Wall Street loved it at the time, and the shares soared by 500% between 2013 and the peak in early 2019. But since then, shares plunged and have given up most of the gain, and are back where they’d first been 11 years ago.

So today, after days of rumors about a share offering, Boeing announced a huge stock offering that will undo some of the devastation that the share buybacks wreaked upon its balance sheet, and it will dilute the bejesus out of current shareholders.

It will sell 90 million common shares (about $14 billion at the current share price) and $5 billion of mandatory convertible preferred stock that will qualify as equity for credit rating purposes. So that’s about $19 billion. It also granted underwriters the option for an additional 13.5 million shares ($2.1 billion at the current price). And according to a term sheet seen by Reuters, it can increase the mandatory convertibles by $750 million.

All combined, it would increase the total equity raised to $22 billion.

The mandatory convertible preferred stock is being marketed to investors with a dividend of 6.0% to 6.5%, and a premium of 17.5% to 22.5% to the stock’s closing price on Friday of $155.01, for when they convert into common shares at or before the maturity date of Oct. 15, 2027, according to Reuters.

This offering brings in sorely needed equity capital that the company had so recklessly incinerated with share buybacks before 2019. And it would largely fill in the huge hole that is its negative equity of $23.6 billion.

If Boeing actually raises the entire $22 billion, it would undo about half of the devastation of its balance sheet wreaked by the $43-billion wave of share buybacks in 2013-2019. That wave of share buybacks caused shares to spike by 500% into early 2019, pushing them from $75 to $450.

Now they’re at around $153 at the moment, where they’d first been in February 2015, down about 66% from the peak, just a hair from qualifying for a pedestal in our pantheon of Imploded Stocks (data via YCharts).

The dilution of existing shareholders from the share offering is going to be significant: There are 618 million shares outstanding, and adding the 90 million shares being offered today would dilute existing holders by about 15%. That’s before the conversion of the mandatory convertibles and the option of 13.5 million additional shares granted to underwriters. So if and when Boeing is actually profitable again, the earnings per share will be diluted by at least 15%.

Boeing stopped the share buybacks in 2019 as its difficulties mounted after two of its misbegotten 737 Max 8 aircraft crashed. Instead of wasting and incinerating $43 billion on share buybacks in 2013 through 2019 and $20 billion in the decade before the Financial Crisis, for a total of $64 billion, the company should have developed a brand-new plane to replace the 737. It should have fired the financial engineers and hired some aircraft engineers (data via YCharts).

Boeing’s corporate credit rating is currently one notch above junk at Moody’s (Baa3), S&P (BBB-), and Fitch (BBB-). There were fears that the cash-flow problems, production and quality issues, the huge amount of debt, and the ongoing strike by 33,000 workers that shut down much of the production in September, would trigger a downgrade to junk (our cheat sheet for corporate credit ratings by ratings agency).

A junk credit rating would make it even more difficult and costly for Boeing to raise the funds it needs to cover its massive cash bleed and to pay off the $12 billion in debt that is coming due in 2025 and 2026.

With the equity raise as outlined today, the company will have some limited financial breathing room, and will likely avert a near-term down grade to junk, so one day at a time. But it won’t resolve the production and quality issues around its aircraft, its labor woes, and the decades of damage that financial engineers from the top down had done to the company.

I don’t see how Boeing can get itself out of the mess that they are in. The financial engineers are running Boeing so they are hardly going to fire themselves. It is a case of the people steering Boeing into a flat spin are unable to pull it out of it because they know only financial solutions. And they did it themselves. Consider that Boeing’s main workshop is in Seattle, Washington but the company headquarters is in Arlington, Virginia – at the opposite end of the country. Until the idea of financial engineers running a corporation is discredited, there is no solution for Boeing. Well, unless they are hanging out for a government bailout that is.

“Well, unless they are hanging out for a government bailout that is.”

If the govt. felt it was necessary for auto makers (example), it’s not a far-fetched speculation.

Exactly. But it would much easier if The Federal Reserve were to just buy Boeing’s stocks directly. That would spare our congress criters the unpleasant optics of openly supporting an unpopular bailout. And I’m sure Jerome & Co. know enough folks who would benefit from doing this that their social lives and reputations could breath easier. Problems solved. Who needs Congress to authorize government spending when we have today’s Federal Reserve?

Yes, it must be emphasized that Boeing has become a gigantic financial grift with factories attached.

Which makes me wonder what the government might get in return, even if it did decide to bail Boeing out. How long would the factories stay attached? Does anyone in management even know how to run them properly?

America already has a ruinously expensive healthcare system that doesn’t deliver any actual healthcare. Why not an aerospace industry that doesn’t produce any planes?

I suspect that an example of creative destruction would help guide institutional investors towards firms which are being managed to make enough profit to enable them to survive in a continual state of readiness to scale up quickly over the longterm rather than being the playthings of rent seekers, borrow and buyback artists whose primary resource is the cash to pay lobbyists to corrupt a bent and broken political system which barely has anything approaching a tangential relationship to the people it purports to represent.

Letting Boeing go down would give others the opportunity to acquire the company’s physical and IP assets at or below market value and, most likely, make better use of them. All of the reports I’ve read in the long years since the “Boeing furlough” was the precursor to outsourcing to, inter alia, China indicate that Boeing has failed to maintain it’s worker’s skillsets at anything like a sensible level for a company not in a doom loop. It would also be a warning to others.

As a general point, it might be sensible to take R&D and military production out of private hands and either nationalise the sector or regulate the industry as tightly and effectively and as purposefully as the Russians, Chinese and Iranians regulate theirs. Or, better yet, scale back the US’s ambition to be a destructively incompetent global hegemon and settle for being a continental power with the ability to set an example to the world in terms of the quality of it’s social and physical infratructures and the vitality of it’s spiritual, moral and democratic political life. Now, there’s a thought.

There’s too much warmongering going on for the government to let them go down.

They can merge with whatever Chrysler is now and bring back the Plymouth Superbird with the nosecone and back wing.

If I recall, Lockheed was about as badly run in the 1970s and needed outright US Government intervention. Lockheed may not be paragons of brilliance right now, but they made it through fine (eventually). Boeing may be able to do the same.

The plan is presumably to rely on the fact that the US government cannot afford to not have a large passenger plane producer that that it fully controls, because of the geopolitical implications, in addition to all the military considerations that make the company too important to fail.

Thus the company will not be allowed to run its current trajectory to the logical end, no matter what.

There is no doubt in my mind that Boeing and its shareholders will get bailed out. There are many precedents in “Bailout Nation “. Intel will also be bailed out. The groundwork for that has already been done.

Any simple way to find the average price paid in the buybacks? That would say whether they lost their pants in the buy and sell. Also I presume the prices in the graph are nominal dollars so the buybacks in real terms were that much more expensive. It looks awful.

Although very long term China will take over the aerospace industry and Boeing has destroyed most of its skill set with early retirements, layoffs and cost cutting (except for the top executives), and the entire structure of the company is based on a Harvard business school model with a little Jack Welsh thrown in they are the only maker other than Airbus that can do large long distance planes. The stock price is in the toilet and earnings are non existent. It might be a good buy right now. And Uncle Sugar is not going to let it fail for a number of reasons especially because the South Carolina assembly plant is in Jim Clyburn’s district and it was put there for a reason. The Black Congressional Caucus will make sure the bailouts are big and bigger especially if Harris wins and the Dems hold congress. And Boeing covered its bets by making Nikki Haley a board member and rich. I think she left the board but not empty handed for sure.

This is crazy pants bananas. I wish someone would do the same type of analysis for Intel.

Boeing is a defence company, and used to be one of the most important.

The US wants to go to war with China, no easy target.

Why allow one of your major sources of weaponry to go belly up? And bailouts won’t necessarily help if they just serve to enrich the financial mismanagers.