By Hjalte Fejerskov Boas, a PhD student in Economics at the University of Copenhagen, Niels Johannesen, Professor of Economics and Business, Professor of Economics at University Of Copenhagen, Claus Kreiner, Professor of Economics and Director of Center for Economic Behavior and Inequality (CEBI) at University Of Copenhagen, Lauge Larsen, PhD student at Department of Economics, University of Copenhagen, and Gabriel Zucman, rofessor of economics at the Paris School of Economics. Originally published at VoxEU.

While the financial secrecy of offshore tax havens has historically created ample tax evasion opportunities for wealthy individuals, automatic information exchange between tax authorities is an ambitious attempt to make tax enforcement possible. This column summarises describes how information exchange creates large improvements in tax compliance through repatriation of offshore wealth, self-reporting of offshore financial income, and audit efforts targeted offshore evasion.

In the past decade, more than 100 countries – including all significant offshore financial centres – have adopted automatic exchange of bank information. They now systematically collect information about bank accounts owned by foreigners and automatically provide this information to the relevant foreign tax authorities. The information exchange concerns personal financial wealth, whether held directly or indirectly through a holding company, a trust, or similar.

The objective of automatic information exchange is to curb offshore tax evasion, an important policy challenge in a globalised world. Empirical research documents that personal wealth in offshore tax havens amounts to trillions of dollars (e.g. Zucman, 2013), that it belongs overwhelmingly to the very wealthiest individuals (e.g. Alstadsæter et al. 2018a, 2018b, 2019) and that it has – at least until recently – largely evaded taxation.

In a recent paper (Boas et al., 2024), we study the effects of automatic information exchange on tax compliance. Our laboratory is Denmark, where we create a unique data infrastructure covering all the 300,000 information reports on foreign bank accounts received by the Danish authorities, matched to micro-data on income, wealth, and cross-border bank transfers for the roughly 5 million adult taxpayers.

Repatriation

We first ask whether automatic information exchange induced taxpayers with offshore bank accounts to repatriate assets, levering the transaction data on money transfers from tax havens.

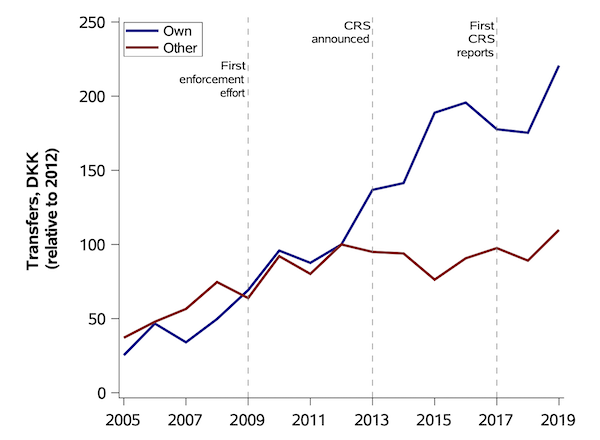

As shown in Figure 1, transfers from people’s own accounts in tax havens (‘repatriations’) increased differentially relative to other transfers from tax havens (‘other transfers’) from 2013. This points to strong repatriation responses induced by the G20 decision to make automatic information exchange the new global standard and the subsequent efforts to implement this decision.

Figure 1 Repatriation

We also document that repatriations from tax havens were associated with one-to-one increases in total wealth on the tax return and commensurate increases in taxable capital income and tax liabilities. This implies that the repatriations come from non-compliant accounts and involve an increase in tax compliance.

Self-Reporting

We then consider whether taxpayers who did not repatriate their foreign assets became more likely to self-report the financial income on foreign accounts at the onset of automatic information exchange.

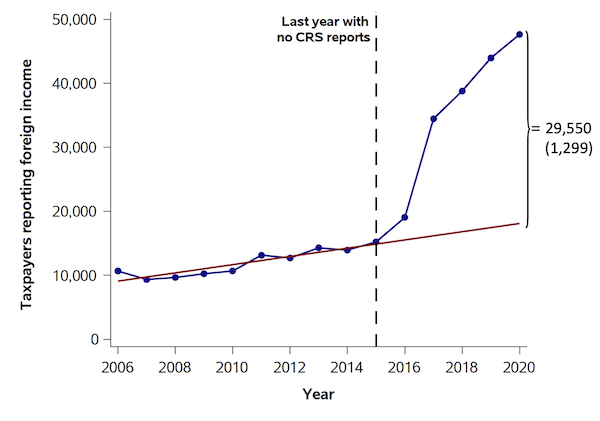

As shown in Figure 2, we observe a sharp increase in the number of taxpayers self-reporting any foreign financial income on their tax return coinciding with the beginning of automatic information exchange in 2016-2017. Indeed, the number of self-reporters roughly tripled in a short time window.

Figure 2 Self-Reporting

\

We interpret the increase in self-reporting foreign financial income as taxpayer responses to information exchange. We provide two types of evidence to bolster this interpretation:

- First, we consider separately cohorts of taxpayers who were treated at different points in time due to the staggered adoption of automatic information exchange among foreign counterpart countries. For each cohort, the sharp increase in self-reporting coincides with the first year of information exchange.

- Second, we document clear self-reporting responses to letters sent out by the Danish tax authorities informing taxpayers that they have received an information report about a foreign bank account.

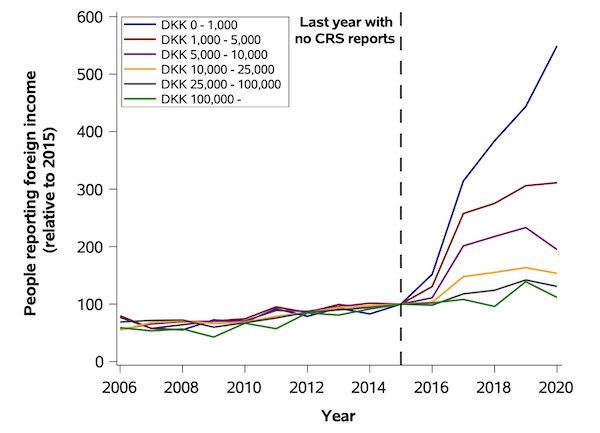

While the results imply that a large number of taxpayers have become compliant through self-reporting, the implications for revenue appear to be modest. This reflects that the increase in self-reporting is driven by taxpayers with low levels of foreign financial income, as shown in Figure 3.

Figure 3 Self-Reporting by Foreign-Income Range

]

Improved Audits

Finally, we study the scope for detecting offshore tax evasion more effectively in audits that target foreign financial income and lever the new information about foreign accounts.

In collaboration with the Danish tax authorities, we design an audit effort that targets a random subset of the taxpayers for whom a comparison of tax returns and foreign information reports suggests material tax evasion. Specifically, we select 500 taxpayers for audits among all taxpayers where interest and dividend income reported by foreign banks exceed foreign interest and dividend income reported on the tax return by the taxpayers themselves by more than 5,000 Danish krone.

The audit results allow us to estimate the offshore tax evasion that the tax authorities could potentially detect through this type of audit effort due to the new information reports from foreign banks. Our results reveal a significant audit potential, but of a smaller magnitude than the other effects, potentially reflecting that large sums have already become compliant through repatriation and self-reporting.

Discussion

Combining the estimates from the various empirical designs, we conclude that automatic information exchange has closed around two-thirds of the offshore tax gap in Denmark. Repatriations appear to make the biggest contribution to increased tax compliance but self-reporting and improved audits also play a non-negligible role.

This suggests that automatic information exchange is a relatively successful approach to tackling offshore tax evasion. This is notably the case when comparing to earlier policy approaches, which have largely failed (Oldenski et al. 2011, Johannesen 2014, Johannesen and Zucman 2014, Johannesen et al. 2020). Compared to domestic third-party reporting, however, cross-border information exchange still leaves large room for non-compliance (Kleven et al. 2011). In our paper, we discuss different possible explanations.

It is important to emphasise that our findings do not necessarily extend to other countries. In particular, developing countries with less capacity to process information reports from foreign banks may benefit less from automatic information exchange (Johannesen 2024).

Well, yes – if the tax authorities can now see your foreign assets and tax their previously untaxed income, then why not repatriate your assets and avoid the costs of maintaining foreign accounts? From that perspective, it makes sense to have global information exchange of banking information.

Two caveats – 1) It makes me uneasy, this proposed extension of the global panopticon. I mean, when “democratic” governments like Canada’s freeze the bank accounts of peaceful, legal, protesters (and those who give them money!), how can you keep your money safe from this kind of authoritarian behavior?

2) This will catch the small fish but the criminal sharks will of course be able to avoid its tentacles…..

Re “This will catch the small fish ..“:

Agreed. The study notes that “the increase in self-reporting is driven by taxpayers with low levels of foreign financial income”, and the rate of increase for the highest 2 levels of reporters is low and mostly stable (since these are absolute numbers, not percentages, it may simply be because of the increased numbers of people with foreign accounts).

Whether authorities can freeze an account not within the jurisdiction of their banking laws is an open question — the US certainly has significant leverage over global banks because those banks have branches in the US. A smaller bank operating in a single country or even several non-US countries, may be less subject to threats.

The big fish will try to, and probably succeed, in avoiding being caught in this by being well hidden beneficial owners of limited liability companies. I suppose a lot depends on this bit:

How will they systematically (every year) go through the beneficial owners of every single limited liability company (and trust?) to automatically report to the relevant (how will they know where an individual is to be taxed?) foreign tax authorities?

Anybody with serious money who is inconvenienced by the information sharing will simply move to a low-tax jurisdiction and make this discussion irrelevant. There is no tax to report to Denmark if you live in Monaco….

This is what has happened with the UK’s “General Anti-Avoidance Regime”: rather than taking advice on tax planning from UK professionals, who are now obliged to disclose any tax planning schemes to HMRC, taxpayers can just go to firms in Jersey or Switzerland, which are not subject to these rules.

I am all for taxing the 1% but our systems of taxation need to change, to tax immutable phenomena like revenues and real property, rather than profits and financial assets, and tax authorities should have a general option to acquire assets at their reported value (and no report = nil exercise price) to incentivise full and frank disclosure….

I used to work for a tax authority and, my word, your final para is an idea and a half.

I cannot claim it is original but it’s a beauty. It has a remorseless logic and you can only disagree with it if you font believe in the rule of law. We accept the principle of uberrimae fides in insurance contracts. Well, the state is the insurer of last resort of all economic activity in a state….

HM Customs used to have an interesting way to deal with those whose value declarations were suspiciously low: Any such items were seized and then auctioned off, with the importer given the stated value of the item.

Amusingly, there was a (legit) American clock maker in the early 1800s who was getting their products regularly seized. At first, they were very upset by this. Then, the company decided that if Her Majesty’s government was going to sell their clocks, then that was a suitable marketing plan. . .

Figure 3. Indicates that something like this may be happening. The lines for the higher income reporters begin dipping a couple of years after the last year with no CRS reports. The low income sailors go with the wind while the high income reporters drop the sails, switch on the engine and cruise directly to their new flag of convenience port.

Didn’t the US murder Arbenz when he nationalized United Fruit and paid their declared value?

Well put. I was immediately struck by that line about being driven by people with lower income, and wondered if this was increasing compliance costs for the middle class while the truly wealthy effortlessly slip through their grasp. Then I found the first two comments were making exactly that point, which was nice to see.

.

Is this where it’s appropriate to enquire as to what ever became of the Panama Papers? Glen Greenwald?

I was gratified when CIA cracked open Monsack Fonseca to see no Western politicians or civic leaders exposed ………discretion is vital to public confidence

Also when US rolled over UBS it was gratifying that no nabobs on US or Israel were outed.

Transparency is for those not favoured by being in the Inner Circle.

Most regulations like reporting to FINCEN only catch small fish. The big ones employ high priced tax lawyers to avoid reporting or to shelter the income. The poor bloke who happens to have money/investments just above the threshold will be subject to harassment by the authorities.

How about some hard hitting laws to prevent corps incorporating in tax free/low tax jurisdictions? In my view, they should be double tax. Apple, are you listening?