Yves here. Some things can’t be said often enough. In this case, the topic is what caused the inflation that is still stinging many Americans. It’s become a favorite hobbyhorse that the admittedly hefty Biden stimulus is the perp. But a more carefully look show that that idea is, to quote the wags, “Neat, plausible, and wrong.”

The initial driver was Covid supply chain shocks. That’s why there were very big increases in some items like lumber, meat and eggs (there due to chicken culls) and not others (gasoline). But then, as Tom Ferguson and Servaas Storm explain, the further impetus was elite spending. Remember the much decried “greedflation” where some companies put through price increases simply because they could, as opposed to due to rises in labor and materials costs? Those excess profits went into the pocket of capitalists.

Another factor not addressed here: Even if statisticians maintain that inflation has moderated (even before getting to the fact that the items they measure may not correspond well enough with the what middle and lower income Americans buy regularly), their time horizon is Wall Street’s and the Fed’s: months, a quarter, at most a year. The inflation increases were so large in categories that many consumers find essential that the fact that the rate of increase has dropped a lot still leaves them at a durable new high level compared to a few years back.

By Thomas Ferguson, Research Director of the Institute for New Economic Thinking, Professor Emeritus, University of Massachusetts, Boston; and Servaas Storm, Senior Lecturer of Economics, Delft University of Technology. Originally published at the Institute for New Economic Thinking website

It must be the Wall Street Journal’s DNA. Nothing else easily explains why the normally careful Nick Timiraos would focus so much of his account of “How the Democrats Blew It on Inflation” on the hoary argument that the “Biden Stimulus” somehow triggered worldwide inflation back in 2021.

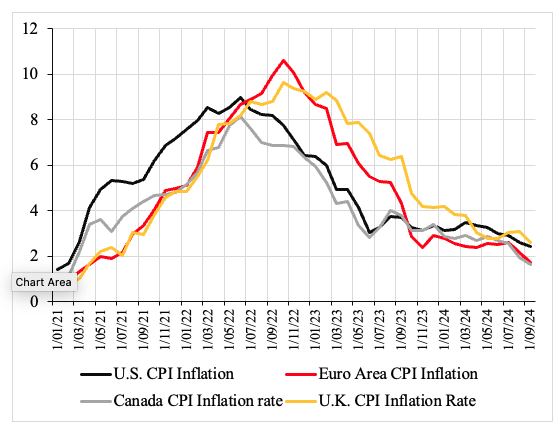

The argument never made much sense, since, as numerous studies have documented, supply-side factors drove the biggest part of the inflation and it hit virtually everybody, regardless of their stimulus policies. This is shown in Figure 1, which presents the consumer price inflation rates during 2021-2024 in the U.S., the Euro Area, Great Britain, and Canada. It can be seen that all countries went through a very similar inflation experience, with consumer price inflation in the Eurozone and the U.K. peaking at even higher levels than in the U.S.

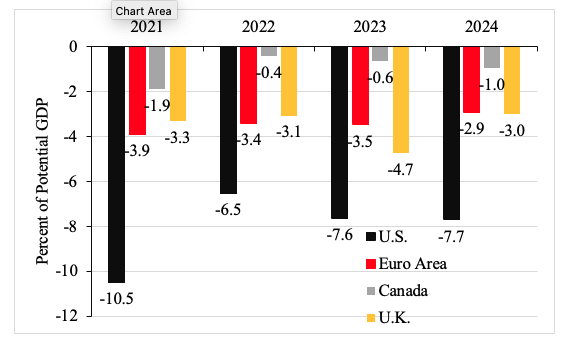

Figure 2 presents the structural government budget deficits (as a percentage of potential GDP) of these four countries during 2021-2024. It is evident that the U.S. government ran much larger structural budget deficits than governments in the Euro Area, the U.K., and especially Canada. Despite these substantial differences in the fiscal policy stance, the consumer price inflation experience has been remarkably similar across the countries (Figure 1). This just shows that the inflation was largely driven by supply-side factors, as numerous studies including the study by Bernanke and Blanchard (2024) for 11 economies have shown.

Figure 1: Consumer Price Inflation in the U.S., the Euro Area, the U.K. and Canada (Annualized monthly inflation rates; January 2021-September 2024)

Source: FRED database.

Figure 2: Structural Government Budget Deficits in the U.S., the Euro Area, the U.K. and Canada (as a percentage of potential GDP)

Source: IMF World Economic Outlook database (October 2024).

We are far from the only people making these arguments, but we found the Journal’s blithe resuscitation of this almost prehistoric line particularly jarring. Back in early 2023, we traced very carefully how federal spending flowed into the economy, using a variety of data. It quickly became obvious that most of the stimulus money was long out the door when most of the supply shock inflation hit. As we summarized: “the key data series—stimulus spending and inflation—move dramatically out of phase. While the first ebbs quickly, the second persistently surges.”

Besides climate change, war, and the other shocks that everybody but the Journal now seems to recognize, we identified another cause of inflation that the Biden administration never tried to deal with: the vast increase in spending coming from the rich. As we have documented in two subsequent studies, the firehose of affluent consumption continues to drive inflation, especially in services.[1]

There is nothing mysterious about the source of this spending: Mostly it arises from the vast, historically unprecedented (in peacetime) increase in the wealth of upper-income groups produced by the Federal Reserve’s quantitative easing program.

What’s bizarre though, is, that both of these arguments find support in recent research even by the Federal Reserve.[2]It’s simply silly for the Journal to keep preaching the gospel according to Joe Manchin as if there is no counter-evidence. And Democrats and everyone interested in serious election postmortems need to get their facts straight if their deliberations are to be anything but pure vanity projections.

Notes

[1] Ferguson and Storm, “Trump vs. Biden: The Macroeconomics of the Second Coming”; Good Policy or Good Luck? Why Inflation Fell Without a Recession.

[2] Cf. Thomas Ferguson,”INET Research and the 2024 Election;”; S.H. Hoke, L. Feler, and J. Chylak, “A Better Way of Understanding the US Consumer: Decomposing Retail Spending by Household Income.”

As a budget living renter, it infuriates me how blithely the media talks about inflation in the last four years as somehow better. I can tell you it absolutely isn’t. Rent increased by 3 to 4 percent annually under Trump; it’s been about 7 percent per year under Biden, but it’s actually more than that, because services that used to be included in rent, like water, trash, maintenance, etc. are now just tacked on to the bill, and then on top of that they charge you a service fee for the privilege of being billed for these things. Many places even charge fees just to pay your rent.

Food: I’m a budget food shopper. In a pinch, not that long ago, I used to be able to eat a fairly nutritious diet for, literally, like 20 dollars a week. That same diet now is 80. The gap between the budget/sale items and the regular stuff has diminished considerably. Also sales are less common, as well as less good. It used to be you could get enough calories for your family, if you didn’t have time to cook, from a fast food or pizza place, if you took advantage of deals, for a few dollars per person. Those deals are gone, and fast food is so expensive now, you might as well just order from a real restaurant. Effectively, this means that a huge source of prepared food, relied upon by damn near everyone in the working class, just doesn’t exist anymore. This means we have to prepare everything we eat, or watch our monthly spending cash disappear because we needed 3 meals in a month we simply couldn’t prepare for ourselves.

Medical care: If you’re working class, you can’t afford it, period. Even if you do everything right, it doesn’t matter. Deductible is more than your annual disposable income. Basic tests will have you living out of your car. For those of us without kids, the approach is basically “if we die, we die; life sucks anyway” But if you have kids you absolutely must fork over about a third of your income for the sole purpose of avoiding catastrophe (remember insurance in these plans doesn’t pay for your normal expenses, because deductibles). It’s worse than that though, because insurance will absolutely fight you, hospitals will absolutely try to scam you, and even, in many cases, your doctor will be personally running scams. If you are a deferential-to-authority, HS educated working class person, you will lose whatever fights you have the energy to pick.

School fees. If you live in a rich area, your school is well funded. If you don’t, public school now costs a lot of money. Fees alone can run you 3 to 4 figures to send one kid to school. School lunch is expensive, and god forbid your kid wants to do an extracurricular or go on a field trip.

Getting literally anything fixed. That’s all I have to say about that.

Everything sucks and breaks. Most of the clothes I wore as a kid had been previously worn by 2-4 children. I don’t think my mom paid for a single article of clothing. This was a common practice. Not anymore. Cheap clothes simply don’t last. And it’s not just clothes, crap is just always breaking, and there is no other option then to replace it with the even crappier and more expensive replacement.

And people are supposed to be happy that HD tvs and PCs are cheaper than ever?

To clarify, regarding insurance costs, I count both employee and employer contributions as direct deductions from wages.

Obviously this is not my topic but perhaps it all goes back to Obama protecting those Wall Streeters from the pitchforks. He had their backs and the runways were foamed. Since the banking class is now international perhaps this speaks to Ferguson’s point about it not just being the US. I read here that the UK also has real estate sharks pumping up the rents.

And to continue the speculation don’t some Repubs have a point that the Covid lockdowns had a huge economic effect outside of the medical argument?

Finally here on the ground we had a grocery price war just before the Covid period and for a time food was in some sectors ridiculously cheap. This all stopped when Covid and shortages gave stores and suppliers the excuse to inflate.

Maybe back to Clinton. Does the death of Glass-Steagall ring a bell?

No, Glass Steagall was over in 1989, well before Clinton, when Credit Suisse (a bank) acquired First Boston (one of the two biggest US bond dealers and a “bulge bracket” investment bank). The repeal under Clinton was merely a validation of the status quo and to allow an insurer (not a core Glass Steagall concern) to buy a major bank.

Back in day we would have called this ‘a great rap.’ As an addendum to your ‘School fees:’ in my municipality (the richest in the state) the school board was giving serious discussion to allowing public school students to wear their pajamas to school. The argument being that many parents couldn’t afford proper school attire for their kids. Amazing how ALL of the public officials around here like to squabble over crumbs, while the man behind the curtain yuks it up.

add transport…

like it or not, the reality for >90% of Americans is that they need a car to get to work due to distance and/or shift hours and/or location. (Even Uber doesn’t help as it becomes cost-prohibitive on longer drives).

Used car prices: up, auto insurance: up, car repair costs: up, new car prices: up (and manufacturers channel-stuff their inventory w/higher priced trims and more profitable models).

Amazingly, the US is in a secular low point when it comes to new cars sold per capita….and this has a knock-on effect as fewer new cars sold per capita means fewer quality used cars per capita.

https://fred.stlouisfed.org/series/TOTALSA divided by population…. https://fred.stlouisfed.org/series/POP

Did we ban the terms “stagflation” or “sticky inflation”?

Did we ban the terms “too expensive” or “too costly”?

I ask because it seems like PMC and the Investment Class simply decided that not saying certain words would allow the public to ignore the problem. Which is a bold strategy….to say the least.

There was a time when the “investment class” was largely made up of trust fund descendants who’s trust mainly invested in blue chip dividend paying stocks (no stock buy backs were illegal) and long-term government bonds. Those assets were prone to real term losses with high inflation, so the inflation of the 1970’s was bad for them, so it was a boogeyman to be derided and crushed.

Fast to our current era and inflation isn’t so much of a threat to them. They’ve diversified since then and now own almost everything but the kitchen sink. They’ve sucked up huge amounts of housing so now they’re getting rental portfolio income. As real estate and rents “inflate” so do their assets. As prices rise so do the profits of companies which use stock buy-backs to further raise their stock prices. 2020’s inflation has been boon for them so they see no comparison to the 1970’s.

Rich people overspending doesn’t increase the price of eggs. Or rent. Profiteering and higher energy prices do those things. And money printing of course. Rich people never, ever end up spending economies out of recessions so why on earth would they be causing inflation with consumer spending?

I’m not against pinning blame where it is deserved or salting the upper classes for their seven(tyish) years of plenty. But that doesn’t mean I accept them as a strawmen for calamities created at the policy level.

Rich people overspending most definitely does increase rent. They buy AirBnBs for investment and reduce the amount of rental property available to long-term tenants, driving up prices. More subtly, rich people spending has the effect that developers see them as the only desirable targets for new developments, and not middle or lower income consumers. You can see in NYC the apartment construction has been nearly entirely high or ultra high end despite an overwhelming demand for lower-price units. I understand the same pattern operates in other major US cities.

Revenant has argued with data (which due to working on a post, I sadly will not run down) that the US housing affordability crisis in in very large measure due to not enough new home building.

As we said in the post, eggs were driven up by a supply shock, avian flu and a resulting very large cull, not demand. Those prices went up well before the Biden stimulus.

>>> You can see in NYC the apartment construction has been nearly entirely high or ultra high end despite an overwhelming demand for lower-price units. I understand the same pattern operates in other major US cities.

I can vouch for Los Angeles, Oakland, San Jose, and especially San Francisco on this. The local government refuses to push for more low or even moderate income housing being as they are captured by the powerful developers and upper class home owners. The lower middle, working and poor classes are ignored, even vilified.

Thinking on it, I wonder if some of the support for deportations isn’t based on housing costs. Removing a few million people from the housing market would likely drive prices up, just as adding them drives costs (and profits) up.

If we want safe, healthy quality construction for housing, and we don’t want lots of people dying doing it, housing will need to again become a public good.

Modern building codes and OSHA require a certain minimum of safety, health, quality, and workers protections to make it happen. Land costs are a problem Zoning could ameliorate, but the real cost is in clean, safe construction built safely.

Because of these good things, the only predictably profitable residential construction is for the very wealthy.

If the broken supply lines during Covid had been the only (or even the predominant) issue, then inflation should not have been permanent. Once the supply issues had receded the prices should have gone back to their previous levels. But they did not!

It always amazes me how Keynesian – leaning people pretend that printing money does not matter (much or at all).

You are missing out on corporate concentration. Private equity has created oligopolies in many many niche markets. When I was a kid, midsized cities like Dayton had MULTIPLE corporations headquartered there. The overall economy is much much bigger but corporate concentration has increased greatly at the high end, and PE has achieved similar concentrated power widely through the mid-range company size sector.

And please tell me historically when we’ve seen falling prices, as in deflation. We didn’t, for instance, at the end of the great 1970s stagflation.

Let me repeat my argument again in more detail.

During Covid the same or similar amount of money tended to chase a diminishing stock of goods and services. That is why there was inflation. Once the Covid limitations went away, the quantity of goods and services tended to go back to the previous level. How so we do not have deflation?

Does this process work in only one direction?

The private consumption of the rich cannot account for this.

Quote (from the article):

“There is nothing mysterious about the source of this spending: Mostly it arises from the vast, historically unprecedented (in peacetime) increase in the wealth of upper-income groups produced by the Federal Reserve’s quantitative easing program”

Quantitative easing means printing money by the way. So, the above states that these rich people got rich because they received additional money (which did not exist before the quantitative easing started).

The prices of food have gone up. Rich people are a tiny percentage. There is just so much food one can eat. How so did these prices go up? Or may be you mean that less food has been produced after Covid? Under less I mean physical quantities of food (loafs of bread, liters of milk, kg/pounds of meat, etc.).

In short, there is a lot to explain and I have not heard (so far) a good enough explanation.

As to the deflation problem you mentioned. During the 19th century there have been periods of deflationary growth. Search “The Great Deflation” in Wikipedia. Lasted about 20 years. The last is a fact and not a theory. Facts must (but do not in fact) have precedence to economic theories.

Again about deflation. Many years ago (sorry, my memory fails me) there was a sudden drop of the oil prices. And there was deflation. No crisis and everybody was happy. To explain that “strange” fact I heard the powers that be to advance the following view: When only one good is the reason for the deflation, then the general theory is not valid.

This is the cleanest account of Flation: In & De included.

I can’t find an English based source for the pdf, so the highlighted box will get you a download.

Prices are sticky for the same reason wages are sticky.

For them to go down, losses have to be allocated and written down, even if it’s just in profit projections, and there’s both a systemic bias against that, all interest bearing contracts require ‘growth’ to sustain them, and the “loss aversion” cognitive bias.

The super-rich have proven to be a reservoir for soaking up liquidity and seeing to it after a short time it does very little for the larger, ie not super-rich economy, all while distorting prices upwards for everything the super rich like. Asset inflation, if its perpetual expansion is supported by monetary policy, is an infinite sponge for liquidity.

Did they ever think that high structural deficit in the US coupled with the USD as reserve currency exported inflation out to these tightly linked economic zones??

Not saying supply shocks didn’t contribute (especially in 2020-2021). However these were mostly resolved by 2022 and beyond so the fact that inflation is still there and at a stubbornly high level (despite interest rate rises) is not just explained by “supply shocks”.

Did you not read my comment at the top? Inflation is not at a stubbornly high level. Inflation is the rate of increase, the delta in prices. It’s way down. But prices have not fallen, save for energy in the US. Corporations do not feel compelled to give up their extra profits.

By high I meant relative to pre 2021 but I take your point. Some corporations are not ready to give up their extra profits because they want to maintain margins and share price. On the other side, M2 is higher so extra profits don’t translate to the same cost structure (i.e. not all of it is due to greed because profit margins are similar or the same).

The current Sep YOY for 2024 is 2.4% (as far as we can trust the data). 2019 = 1.7% and 2017 = 2.2%.

However the pre 2020 inflation rates were in a near zero interest rates and much lower debt/deficit. What do you think happens when (if) we (have to) go back to much lower rates?

Meaning – and that was the main point of my comment – the financial and trading global structure has changed (and continues to change) with that being the permanent driver of higher domestic inflation rate regardless.

I don’t understand why my reply disappeared/not accepted?

This is probably the 5th time that this happens to my replies – and in this one I even partially agreed with you and clarified my position.

Please restore my original reply (and remove this one if you prefer) – there is no reason for this.

My recollection was the Hank Paulson panic’d bailout under late-2nd-term GWB in September 2008 was the beginning of the end.

A significant amount of money flowed into the Banks and Wall Street, immediately was cleverly hypothecated and multiplied, no reckoning was demanded to mend and change ways, and that money flowed around the world dispassionately seeking returns, at the speed of light. It drove up all asset classes, and the trickle-down knock-on effects inuring more wealth to the monied class, and more marginalization of the have nots, commenced in earnest.

For the working class, that 2008 Bush/Obama recession never ended, it was the beginning of the stumble into the ant lion’s trap. Like an insurmountable scree slope… one step up, and three steps back.

My alloy laden 2 pennies.

and , for a delightful interlude and three-minute musical diversion, One Step Up, by The Boss, and performed by the Seldom Scene:

https://youtu.be/ubAJFYo0Ydc

No, that is wrong. The rehypothecation had already collapsed. Asset prices (ex very safe ones) fell sharply, included many many local housing markets, and took some years to recover. It was the super low interest rates that eventually boosted asset prices

I managed to move into my current apartment because of the housing market collapse, and I very likely will be living in my car because of the current increase in housing costs.

Someone please correct me if I’m wrong here, but while I agree that the Biden stimulus that went to individual citizens didn’t cause this massive inflation (and Biden still owes me $600), what went to individuals wasn’t all there was to the stimulus. Do remember that during the financial crisis in 2007-8, it wasn’t easy to get the bailouts passed by Congress. They failed the first time around during the end of Bush’s presidency and it was Obama’s arm twisting that got the bailouts through. Not wanting to face those difficulties in getting huge bags of cash to the donor class again, the system was changed so that massive bailouts no longer required Congressional approval, so when the pandemic came along, there were massive amounts of bailout cash (trillions of $$ if I remember right) shoveled at all kinds of companies, whether they needed them or not, and in some cases, whether the company really existed or not. And couldn’t this largesse from Uncle Sugar account in part for that “vast increase in spending coming from the rich” that is driving inflation?

Here are my 2 cents:

I manage more than 120 rentals in Socal. I know a lot of business owners and contractors too.

Its amazing what one can tell about people just looking at the garbage they throw out.

When people received the stimulus checks, we had to increase garbage collection to twice per week.

The amount of boxes of veuve clicquot champage and blue label whiskey we had to remove was astounding and lasted for a long time. Now we are back to normal and we have hit a ceiling in rent increases. They arent going up.

Regarding the rich, people forget that they received $1 trillion in PPP, that it was forgiven tax free.

One business owner I know, got $1.6 million (he was actually forced by the bank to take it), his business was never better and immediately put the money in real estate. When I talked about this kind of abuse with my tax accountant, he lol , that is nothing he said, Mossy Nissan got 20 million, and this restaurant this much and this hotel this much…it was sheer abuse of the public treasury, he knew what he was talking about.

Then why was this money forgiven to the wealthiest tax free?

So in the end, in my opinion, inflation was simply the result of money printing. Supply shocks could increase the prices of some items but not in aggregate if not followed by permanent money supply increase.

The entire discourse around “inflation is back down to 2% means inflation is solved” is talking past the common voter, who wants prices back down not prices still high but rising slower. The people want deflation, but economists are terrified by the d word.

Deflation is actually worse than inflation. The value of debt goes up in real terms. The only thing that does not go down in value is cash and the very best quality bonds. The rising debt burden produces self-reinforcing economic contraction.

Why couldn’t we get food price deflation but asset prices stay even?

Rent is another huge problem I am seeing locally. They’re asking $1500/month to rent a room around here, and that’s not even with a private bathroom.

Some folks need to take a hit like 2008. Maybe a Mike Tyson upper-cut.

I don’t disagree per se, but the problem is explaining that to the man on the street who does not understand economics nor really trust economists in the first place.

On the “story” of inflation, explaining why the price of eggs not going back down is good actually is not gonna win any votes, which is what I meant by talking past the average Joe.

I’ll also note that the popular narratives like fighting greedflation or lowering the cost of healthcare/education are deflationary in all but name.

I suspect that the man on the street understands economics relatively well, but it isn’t the kind of economics taught at the Harvard Business School.

Why would anyone trust economists in the first place? Even economists don’t trust economists.

Per my comment above, deflation makes it more costly to service debt as time passes, forcing defaults which when they become systemic collapse the macro economy.

It isn’t just economists who don’t like this.

People want deflation the same way capitalists want cheap labor: it is good for them individually in the first instance. If they both get what they want, the whole house of cards comes down. The stress we feel now is capitalist getting almost everything they want, and they want everything, for way too long.

If the spending of the rich is so influential that it causes inflation, is the trickle-down theory (partially) correct?

Trickle down implies that people at lower wages benefit.

What’s happening here is that different capitalists, and some tiny slice of labor mayby (but generally not, profits tend to get pocketed by capitalists), benefit, but this never results in general wage growth because the rich disproportionately save (mostly invested abroad or in the Fed supported asset bubble) more than they spend.

Trickle down deliberately misunderstands the circular flow of money, that every dollar spent is someone else’s income, ignoring that if profits skim more than investment replenishes, profit taking results in deflationary pressure. Because of weak labor protections, this tends to lower wages even as prices go up, as we see generally now through the erosion of real wages by inflation.

Glass-Steagall was repealed 1999 by GLBA. That was the last stroke that opened the flood gates for 2008.

I take your point about banking activities in the late ’80s and debates about sections 20 and 32.

You are completely missing my point. It was not operative by then. You had a top global bank buy an investment bank and top bond trader in 1989. I was at McKinsey advising banks how to get into investment banking in 1984 (no typo). Swiss Bank bought one of the top US derivatives firms in 19943. JP Morgan and Citi were both major securities players by the mid 1990s. Glass Steagall was irrelevant long before it was formally repealed. That repeal had absolutely nothing to do with 2008. That was a derivatives crisis, as I explained long form in ECONNED, and there were no barrier to banks being in the derivatives business (save some restrictions in the early 1990s on equity derivatives, which were gone by 1994 and equity derivatives had nada to do with the crisis).

There were many many many steps in deregulation, starting in the late 1960s. If you want to point to what might arguably be the biggest causes, it was allowing banks to operate cross border (which makes them impossible to resolve in a crisis if the offshore ops are non-trivial) and allowing credit default swaps to be treated as derivatives and not regulated (CDS are actually unregulated insurance contracts).

The timing of the rate of inflation coming down to like 3% for the 3 months prior coinciding with the timeframe that SS uses to adjust its annual cost of living payments really shows how so much inflation has trashed retirees ability to survive and spend into the economy.

As with mortgages, the real money in lending is to achieve an income stream – interest – on the inflated asset – the principle is better if it’s bigger sure – but if the principle is overpriced then your interest is locked in and payable from the asset ‘holder’ no matter what happens to the asset. To lend principle is more a button push than skin in the game.

When I go to buy something – what do I pay for a widget – My assumption would be that in the product my expenditure would be Taxes, labor, marketing, research if in name only, distribution, profit, debt servicing-interest, stock buy backs (I guess usually borrowed to call it debt servicing), dividends and a bunch others.

I guess I am trying to say that, the best way to avoid taxes is to put everything into hock and capture the resultant income stream in the most tax efficient manner. The entire edifice is designed for maximum conversion of classical wealth into financial hot money. Stocks on wall street are baseball trading cards for the most part – meta trading on the underlying and manipulate-able (stock buy-backs for instance) performance metrics.

How did so much money make it into the non-productive, financial predatory sector. My guess is it is by design of the laws and taxes that enable the most efficient gains in financial wealth in precisely those areas that are encouraged.

Inflation is what needs to be covered by the consumer – that includes all the debt bondage and overhead imposed by the financial predators – This is the neoliberal order – the free market – the hidden hand reaching into your pocket – directed by the financial sector and endorsed by congress.

The inflation – greedflation – was implemented to cover the increasing debt burden deliberately imposed by the financial sector so that they can continue to do gods work. The covid made debt servicing more difficult for the corporations indebted by the financial and PE sectors who have to be paid so, I guess, many companies had to catch up in a big way in order to service the geniuses of finance(Financial Preditors)

Sorry I rant, just that the enshitification of all things limits my ranting – I guess that could be viewed as a positive LOL

Why are we not talking about sanctions and the pivot of raw materials to the East and then resold to the West at a markup via intermediaries (e.g. India, Turkey). In addition to price, there is time and wasted energy/labor to move goods this way. Seems to me there are structural reasons we cannot get the commodities at prices before 2022. I do not see this getting better either over the next 4 years. Not necessary for this crowd and there is a difference in new plateau of high prices versus inflation (which is change in price over time). The new plateau is having real knock-on effects. Would be interested to see if Giffin goods sales or revenue are also increasing.

There are all kinds of great theories on why inflation finally took off like a bottle rocket in 2022. However, the problem with economics is that it isn’t really a science. You cannot run a controlled study with one cohort getting the inflationary stimulus and another not—unless you can invent a time machine, go back to March 2020, and implant a backbone in Jerome Powell.

Or give us a Congress that doesn’t hit the CARES Act panic button and sprays confetti money indiscriminately on every sector of the economy.

I tend to agree with some of the commenters that it was the equivalent of raw money printing during the pandemic. I suspect some very large percentage of PPP loans met the legal definition of fraud.

Biden’s IRA is a convenient scape-goat that probably didn’t help, but I doubt it was the root cause. Maybe the straw that broke the camels back.

If I had to pick one thing to run in a double-blind experiment, I would go back and shit-can the PPP and see where the data leads.

The average person looks at inflation cumulatively over a longer time frame than just vs last year. While year over year inflation has slowed down to the 2-4% range, the fact remains that prices are still 10-20% higher than they were 4 years ago. It’s not that hard to understand unless you are deliberately trying to misunderstand it.

Like it or hate him, Summers was prescient in warning the Democrats both about the inflation and the political consequences, but no one listened to him.

We like to think the prices of good are established in an auction market. But not.

Are you down with PPP???

Look no further. For your answer to why inflation has not and will not come down….

Bogus reasoning. The PPP was one shot, not sustained spending. It would not generate persistent demand.