Yves here. It’s worth pointing out that the bond and stock markets are in a disconnect over the Trump election win. Admittedly, one can attribute some of the big equities rally to the fact that the popular vote margin means the Democrats won’t be engaging in massive transition of power resistance. That as many pointed out, had the potential to be extremely disruptive. “Civil war” was an overstatement given the inability of Team Blue to resource itself (let’s start with their mainly big city locations versus where food is produced) or marshal arms. But with the Trump opponents instead sinking shows of personal trauma, such as hysteria and what Aurelien calls epic sulking, the US has escaped large-scale upheaval.

Typically, higher bond yields depress equity prices. That is why, for instance, the stock market went into a swoon during the 2014 “taper tantrum”, when Bernanke threatened to have the Fed start exiting super low interest rates, and more recently, when stock prices have levitated due to the prospect of the Fed cutting interest rates.

That behavior is the result of Treasury yields serving as the foundation for the valuation of financial assets. They provide the risk-free rate to which analysts add a premium to reflect the risks of a particular investment. They then discount expected future cash flows at this rate. So higher interest rates mean that expected future income is worth less in current money terms.

One might wonder at this marked difference of readings. Perhaps investors expect further tax breaks. Trump seems to have gone so far down this route that it’s not obvious how many more gimmies he can gin up. Trump has also threatened slashing Federal spending, which would lower consumer and business spending, hurting business revenues and profits.

If Trump keeps the fiscal deficit at or not much below its yawning level under the Biden Administration, it will continue to keep the economy running at a hot level by many metrics (without going on too much, that, as many has explained has actually benefitted the wealthy and not much ordinary people, hence the discontent that produced the Trump win). That will also tend to increase inflation, so the Fed would need to keep interest rates high, or alternatively, might lower them only to soon have to raise them.

In other words, bond investors seem to have a better grip on the implications of the current economic situation and the low odds of Trump finding an easy way out of the big Biden deficits. But as Keynes famously said, the markets can stay irrational longer than you can stay solvent.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

Longer-term Treasury yields spiked this morning, on top of the surge since the September rate cut. Spiking yields means plunging prices, and it has been a bloodbath for bondholders.

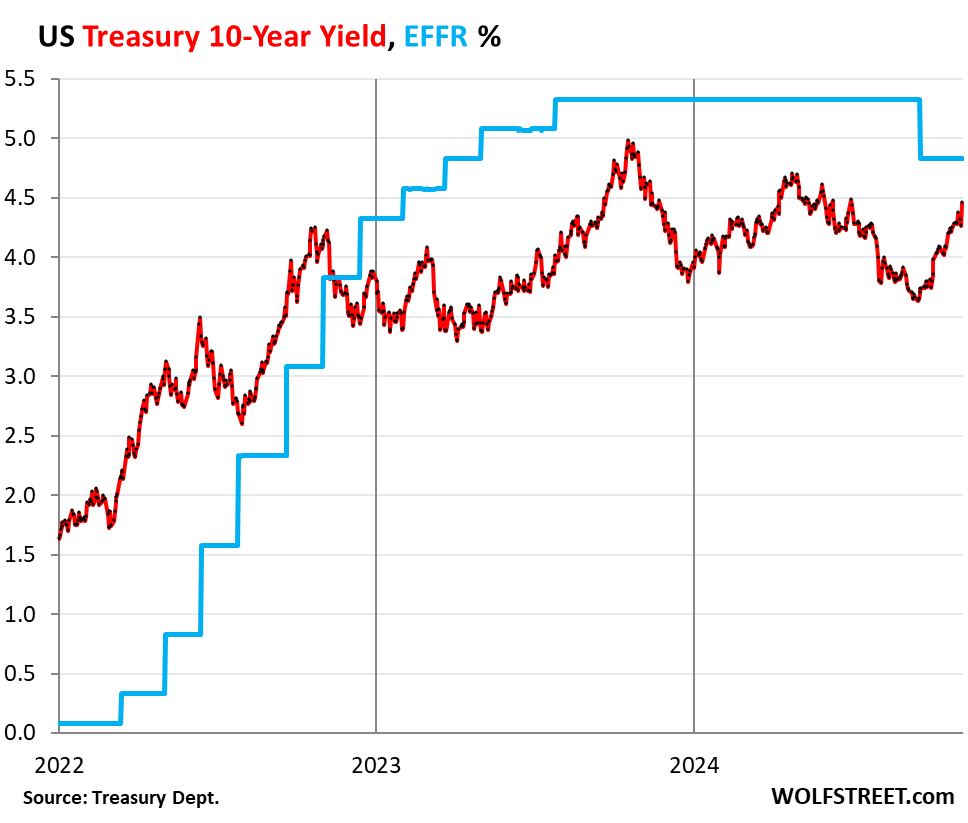

The 10-year Treasury yield spiked by 20 basis points this morning, to 4.46% at the moment, the highest since June 10. Since the Fed’s September 18 rate cut, the 10-year yield has shot up by 81 basis points. 5% here we come?

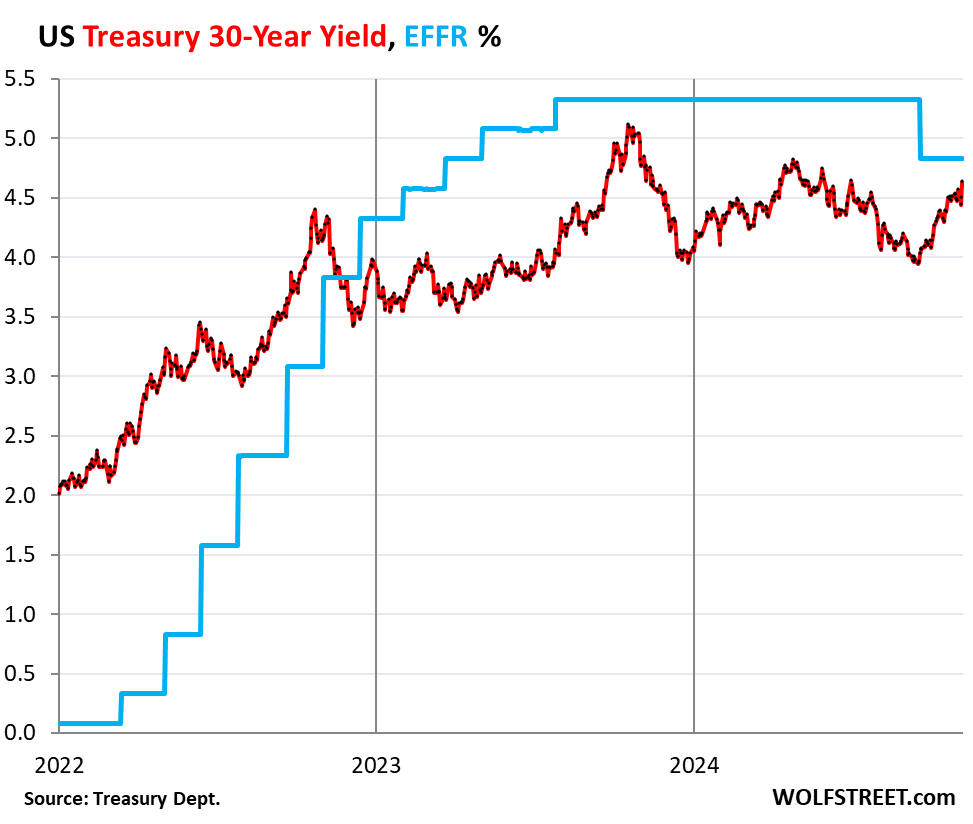

The 30-year Treasury yield spiked by 20 basis points this morning, to 4.64%, the highest since May 31 May 30. Since the Fed’s rate cut on September 18, it has shot up by 68 basis points.

So all the bond market needs to get spooked further are more rate cuts?

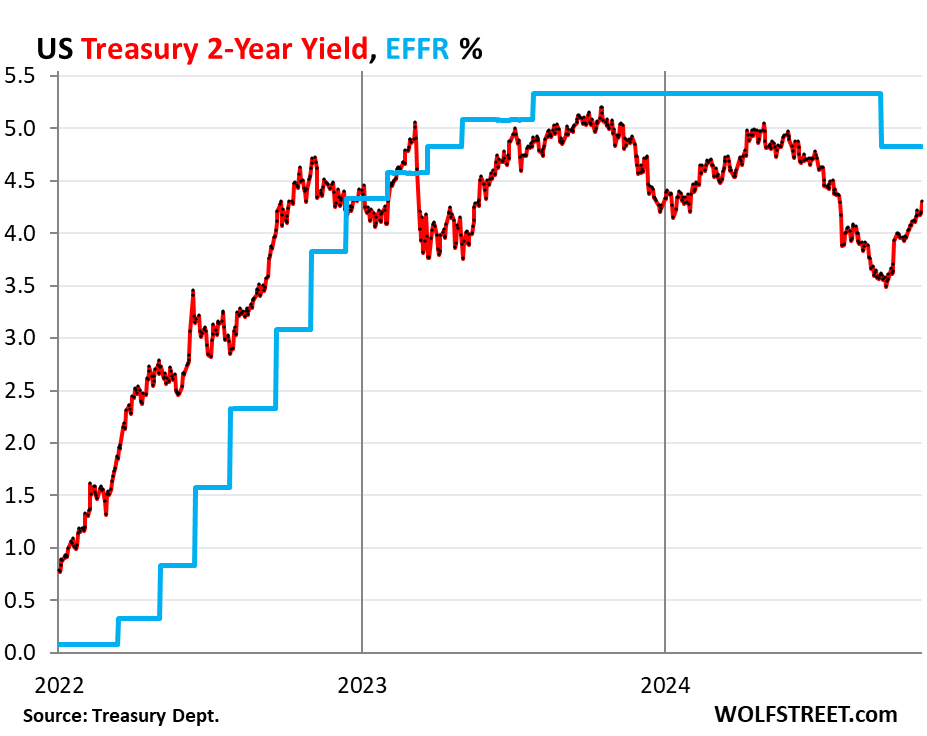

The 2-year Treasury yield shot up by 10 basis points this morning, to 4.29%, the highest since July 31. Since the rate cut, it has shot up by 69 basis points.

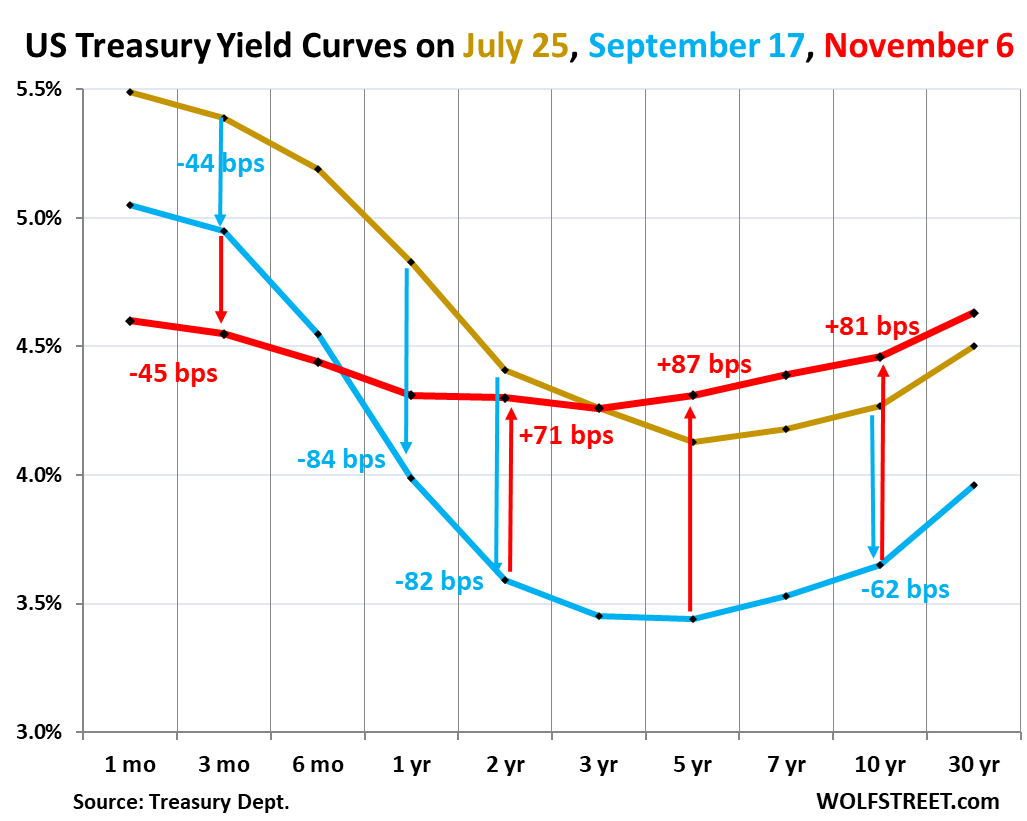

The “yield curve” un-inverted further in another massive leap today, continuing the process of un-inverting, driven by the surge in longer-term yields and the decline in short-term yields.

The normal condition of the yield curve is that longer-term Treasury yields are higher than short-term yields. The yield curve is considered “inverted” when longer-term yields are below short-term yields, which began in July 2022 as the Fed jacked up its policy rates, pushing up short-term Treasury yields, while longer-term yields also rose but more slowly, and thereby fell behind. The yield curve is now in the process of normalizing, with longer-term yields surging and surpassing short-term yields.

The chart below shows the “yield curve” with Treasury yields across the maturity spectrum, from 1 month to 30 years, on three key dates:

- Gold: July 25, 2024, before the labor market data went into a tailspin that has now been revised away.

- Blue: September 17, 2024, the day before the Fed’s mega-rate cut.

- Red: This morning, November 6, 2024 after the election results.

The 30-year yield is now higher than all other yields, and it has un-inverted completely. The 10-year yield is just a few basis points from un-inverting completely.

Note by how far those longer-term yields have risen since the September rate cut (blue line). The yields from 3-years through 10-years have shot up by over 80 basis points since the September rate cut, a screeching-tire U-turn, going down in two months, going back up faster and further in seven weeks, amid huge volatility in the Treasury market.

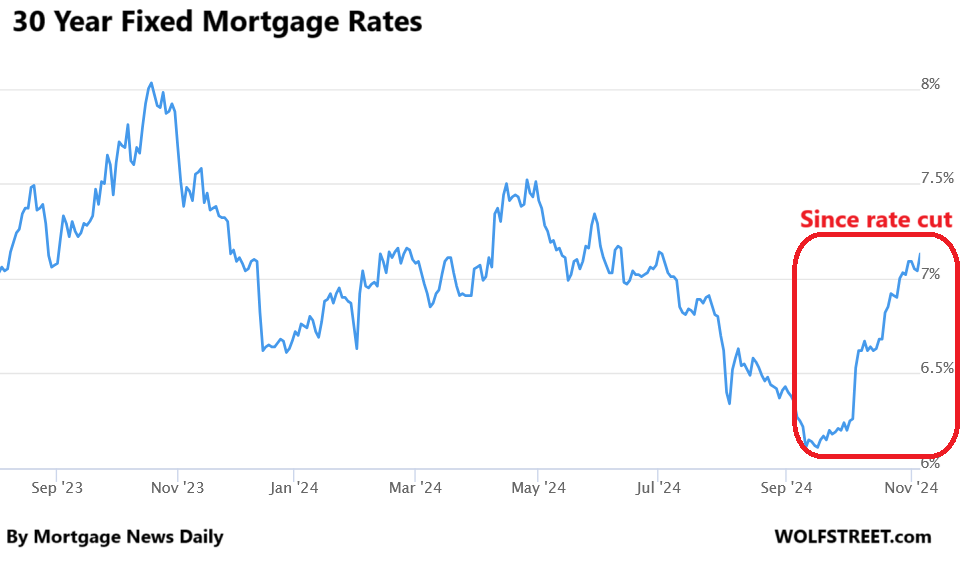

Mortgage rates too. They roughly parallel the 10-year yield, and they spiked today 7.13%, according to the daily measure from Mortgage News Daily.

Mortgage applications through the latest reporting week, which doesn’t capture the last two days, already dropped further from the frozen levels before, pushing down further the demand for existing homes, which is on track to plunge to the lowest levels since 1995 this year.

For the housing industry, and for home sellers, this U-turn was a painful slap in the face. At this pace, the yield curve will enter the normal range soon – but in the opposite way of what the real estate industry had hoped. It had hoped that the Fed would cause short-term yields to plunge to super-low levels in no time, which would drag down longer-term yields, and mortgage rates would follow.

But mortgage rates had already plunged from nearly 8% in November last year to 6.1% by mid-September this year, without any rate cuts, on just a wing and a prayer, thereby pricing in all kinds rate cuts and whatnot. And since the rate cut, much of the wing-and-a-prayer plunge in longer-term yields has reversed, that’s all that has really happened.

The real estate industry was expecting 5.x% mortgages by about right now, and they were already close in mid-September with 6.1% mortgages, and some were talking about 4.x% mortgages just in time for spring selling season, and today they’re looking at 7.13% mortgages.

I am wondering, reading all of that and not knowing too much about bonds and yields, is if the Democrats, and probably the Military Industrial Complex, are handing off an economy on the verge of collapse to the MAGA people to get rid of them once and for all?

This is a meme and Wolf debunks it frequently on his blog.

The economy is doing fine – in fact it’s surprisingly healthy. Just because people are poor and cannot afford things does not mean the people who matter aren’t sitting pretty.

There is no economic collapse or recession coming. The bull has only just escaped the stable.

Assortative mating amongst the cow herds coming up? ;p

I agree with your take. The economy is doing pretty well despite all the protestations. Yes prices have risen, but as Wolf pointed out, so has income. There’s surprisingly some softness in the luxury market (based on earnings of various companies), and people on the lower end are continuing to hurt, but the people in the middle are having a good time.

Hard to predict the future, as I like to remind myself. It was highlighted in the 9am hour yesterday on CNBC, that the M&A activities have been highly curtailed under Kanter at DOJ and of course Lina Khan. Mergers should still receive close scrutiny but it’s expected for corporate activities to heat up in 2025. One day of price discovery, so maybe in a month we have a better informed market.

Bond markets….James Carville may have been right all along. Bond vigilante / investors can do a lot of work, and that could make the job for Powell and the Fed more difficult.

As it turns out, the bond vigilantes are really just the attack dogs of the Federal Reserve. They can move the yield curve if they so choose. But they’d rather pretend there’s mystical forces at work.

They can move the yield curve — if the Fed lets them.

A central bank can always control yields as far out the curve as it is willing to buy. The Bank of Japan is instructive in this regard.

Bond vigilantes? They might be extinct at this point, I mean they seem to be ok with the Federal government running up the tab like crazy. “Debt out the Wazoo” is how Wolf has described the shaped of the national debt, so if the real bond vigilantes are not standing up now, then they might not stand up at all.

index funds and the Bank of Japan cripppled Miss Bond Vigilante.

BoJ by flooding the world with Yen and keeping the carry trade afloat…index funds by chasing the carry trade

So Dow 500K soon then?

I am heading to Japan next month for work, right in time for the Japanese hyperinflation?

Japanese hyperinflation? LOL

The real question is how seriously should his talk of tariffs be taken? If we take the Trump administration at its word about them, I think the bond market actually isn’t pricing in enough inflation. I guess it’s appropriate given the circumstances, because Trump says a whole lot of things he never actually does.

If I had to toss out a somewhat plausible scenario I could see Trump leaning on the Fed really hard in the first year of his term to cut rates, while simultaneously renewing the TCJA (maybe even expanding it), increasing the deficit, and implementing at least a portion of his tariffs. There would likely be a short boom followed by a spike in inflation even larger than 2022 circa 2026 or 2027. Double digit inflation is out of the question this time around.

Of course this means the exact opposite of what most Trump voters will want. Real estate will likely spike again. If people can handle DTI ratios on a 7% mortgage at these prices, the will be able to handle significantly more at 5% or lower. Goods of all sorts will get significantly more expensive. We could be in for an early 80s, Volker kind of era in the late 2020s.

Of course, this could be nothing more than hot air too. Trump could get into office and basically continue the status quo, abandon all his campaign promises, etc. I think that’s equally likely. I don’t believe a word the man says and you probably shouldn’t either.

Meant to say “double digit inflation isn’t out of the question.”

I agree that the man has always been ‘go with the flow’ and inherently lies and is untrustworthy (more now that he’s genuinely sundowning a la Biden, if you listen to his rallies) but the people that he is bringing in -the really bright cold harsh winter techno-authoritarian types from vance to musk are absolutely going to do everything they can to make every profit they can and cause every pain they can.

practically, the US can’t “shock therapy” itself with tariffs and turn back the fiscal clock to 1890 (where the federal government is funded by >50% tariffs).

Amazon, Walmart, Target would be crippled as a business model if the tariffs were rolled back to 1946 levels.

What’s likely going to happen is some symbolic tariffs on Chinese EVs and Chinese airplanes, tweaking tariffs on tube socks and widgets—-and then things get blocked in the Senate and forgotten about by 2028.

With labor shortages caused by immigration law enforcement being the driver that grows after-inflation wages at the bottom 1/2 of the income ladder

Pardon my ignorance about these things, but didn’t Trump’s CARES Act payments and PPP “loan” programs light-off the greedflation that got hung around Biden’s neck by voters?

As a person whose entire life has been built around highly-leveraged real estate deals, isn’t Trump’s natural inclination toward inflationary policies, like his threatened tariffs are bound to be? Doesn’t inflation benefit debtors?

Could the stock and bond handicappers be on to something?

The inflationary pressures were boosted by both a bipartisan bill which passed late 2020, and then additionally with the Biden administration leading another recovery bill by middle 2021. Root causes to pump the inflation pump in 2021 to 2023 were exacerbated by the circumstances of 2020, in my humble thoughts.

To your last sentence or question…quite likely. Say if a Trump administration part II gets the wishes met on energy that likely reduces the price per barrel which may include any knock on impact from broadly reduced energy inputs. Lowering the cost of say, diesel fuel, could benefit OTR trucking …

Federal Deficit Spending…more…and more again.

https://www.npr.org/2020/12/21/948862052/house-passes-900-billion-coronavirus-relief-bill-ending-months-long-stalemate

https://www.whitehouse.gov/briefing-room/legislation/2021/01/20/president-biden-announces-american-rescue-plan/