Yves here. This is a useful overview of the Trump tariffs and tax scheme. Note that this post forecasts, as just about any economically literate look does, that new tariffs will lower growth in comparison to current conditions.

This article does not address the likely increase in inflation. A reason for the lack of much in the way of estimates is the impact is hard to work out. For instance, from CNBC:

Exactly how much higher prices would go is hard to say. The relationship certainly isn’t as simple and direct as some Democrats have suggested by contending that tariffs would function as a “20% sales tax,” says Clark Bellin, chief investment officer at Bellwether Wealth.

“Especially when you throw the inflation we’ve been having into the mix, it’s hard to come up with a line item like, ‘This is how much things have gone up because of tariffs,’” he says.

Vox raises the question of whether Republicans on Supreme Court would block these measures. I assume that the Democrats are not expected to joing per the summary of Napoleon’s advice: “Don’t get in your enemy’s way when he is making a mistake.”

Note that Vox also found experts that are not deterred from estimating the impact of Trump tariffs but their figure vary widely. From Vox:

Though Trump inherits a strong economy and low inflation, he’s proposed a 10 to 20 percent tariff on all imports, and a 60 percent tariff on all imports from China. The Budget Lab at Yale estimates that this policy alone could raise consumer prices by as much as 5.1 percent and could diminish US economic growth by up to 1.4 percent. An analysis by the think tank Peterson Institute for International Economics, finds that Trump’s tariffs, when combined with some of his other proposals such as mass deportation, would lead to inflation rising between 6 and 9.3 percent…..

If Trump pushes through his proposed tariffs, they will undoubtedly be challenged in court — and, most likely, in the Supreme Court…

Will this Supreme Court permit Trump to enact policies that could sabotage his presidency, and with it, the Republican Party’s hopes of a political realignment that could doom Democrats to the wilderness?

The legal arguments in favor of allowing Trump to unilaterally impose high tariffs are surprisingly strong. Several federal laws give the president exceedingly broad power to impose tariffs, and the limits imposed by these statutes are quite vague.A presidential proclamation imposing such tariffs wouldn’t be unprecedented. In 1971, President Richard Nixon imposed a 10 percent tariff on nearly all foreign goods, which a federal appeals court upheld. Congress has since amended some of the laws Nixon relied on, but a key provision allowing the president to regulate importation of “any property in which any foreign country or any national thereof has or has had any interest” remains on the books.

The judiciary does have one way it might constrain Trump’s tariffs: The Supreme Court’s Republican majority has given itself an unchecked veto power over any policy decision by the executive branch that those justices deem to be too ambitious. In Biden v. Nebraska (2023), for example, the Republican justices struck down the Biden administration’s primary student loans forgiveness program, despite the fact that the program is unambiguously authorized by a federal statute.

Nebraska suggests a Nixon-style tariff should be struck down — at least if the Republican justices want to use their self-given power to veto executive branch actions consistently. Nebraska claimed that the Court’s veto power is at an apex when the executive enacts a policy of “vast ‘economic and political significance.” A presidential proclamation that could bring back 2022 inflation levels certainly seem to fit within this framework.

The Vox piece has additional detail on potential legal jousting.

By Bill Haskell. Originally published at Angry Bear

Since we have a new president who favors Tariffs, we should start talking about how those Tariffs will impact the US Economy and Citizens. The Tax Foundation offers up a brief explanation which should be readily understandable for Angry Bear readers. If Trump is able to pull this off and get it out of Congress, I do not see much favoring it in terms of economic growth. Then there is also covering the costs of the 2017 Tax Cuts and Jobs Act (TCJA) which has yet to pay for itself in economic growth.

The TCJA was supposed to die under a Biden Admin. Biden removed himself as a candidate and Democrats lost an election by not turning out. Which is very similar to what happened in 2016 with Clinton v Trump. Must be that Dems do not favor women as the Presidents? More of that later when I can examine the numbers.

There are multiple sources to this commentary on Trumps Tariffs and Tariffs in gemeral. I have linked to each if you wish additional information or check my comments further.

Introduction

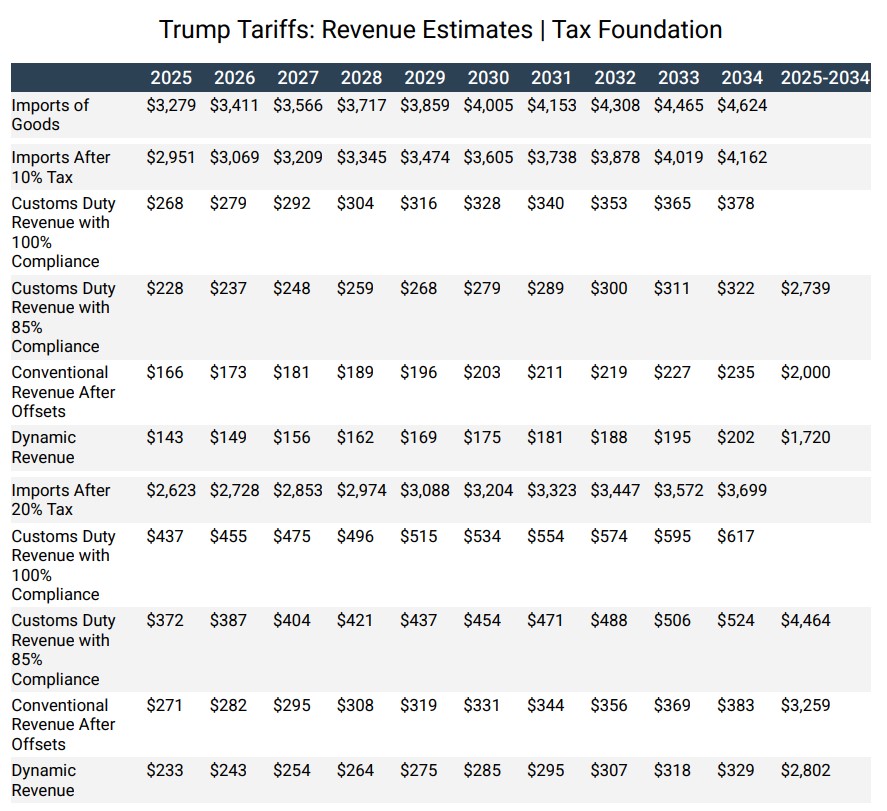

President-elect Donald Trump has proposed to implement a universal baseline tariff on imports when he takes office. We estimate a 10 percent universal tariff would raise $2 trillion and a 20 percent universal tariff would raise $3.3 trillion from 2025 through 2034, before factoring in how the taxes would shrink the US economy.

In 2025, a 10 percent universal tariff would increase taxes on US households by $1,253 on average and a 20 percent universal tariff would increase taxes on US households by $2,045 on average.

Revenue raised by tariffs would fall short of what is needed to fully offset the revenue losses of making the expiring provisions of the 2017 Tax Cuts and Jobs Act (TCJA) permanent.

Revenue Estimates of Trump’s Universal Baseline Tariffs (Billions)

Process to Estimate the Revenue Impact of a Tariff

To estimate how much revenue a universal tariff raises? We start with a baseline projection of goods imports over the next decade. Imposing a tax on imports would reduce purchases of foreign-produced goods, resulting in fewer imports. We apply an import elasticity of -1 to project how imports would fall in response to a 10 percent tariff and a 20 percent tariff. How much imports shrink thus varies with the applied tariff rate, implying that doubling the rate does not double the revenue.

From there, we multiply the import tax base by the inclusive tariff rate (the rate divided by one plus the rate) to estimate initial customs duty revenue raised under perfect compliance before making an adjustment to reflect an 85 percent compliance rate, which represents the average tax gap.

After the compliance adjustments and before accounting for income and payroll tax offsets; we estimate a 10 percent universal tariff would generate $2.7 trillion of customs duty revenues and a 20 percent universal tariff would generate $4.5 trillion of customs duty revenues.

The Total Revenue Raised

The total revenue raised will be less than the customs duty revenue generated by the tariff because tariffs reduce incomes (taxes paid as mentioned above), reducing income and payroll tax collections. Accounting for income and payroll tax offsets, our conventional revenue estimate finds that the 10 percent tariff would generate $2 trillion of increased revenue, while the 20 percent tariff would generate $3.3 trillion over a decade.

And The Economy?

Both taxes (Tariffs) would shrink the size of the US economy. The dynamic scores are smaller: $1.7 trillion for the 10 percent tariff and $2.8 trillion for the 20 percent tariff. If foreign countries retaliate, even partially, to the US-imposed tariffs, revenue will fall further as the economy shrinks even more. For example, we estimate a 10 percent tariff on all US exports would shrink tax revenues on a dynamic basis by more than $190 billion over 10 years.

Tariffs Tried?

Second Term President Trump once said during his first term. One of his primary foreign policy goals was to rein in global adversaries like China and take U.S. trade partners to task for growing trade deficits (defined as U.S. imports exceeding exports). Trump’s approach to achieving this goal was enacting tariffs, especially focusing on China. These tariffs have negatively impacted trade between the U.S. and China, leading importers to shift toward Mexico’s west coast instead of shipping directly to the United States. As a result, trade between Mexico and China has grown by 60% in one year. And . . . product was being trucked north to the U.S. The tariffs have been circumvented with an additional step. Mexico gained and the US? Nothing . . .

The tariffs were supposed to benefit the average American citizen, who would then buy cheaper products made at home. Another example and this time with Steel. The US attempted to stop the sale ofa steel company. In one politically charged example, U.S. Steel made the first moves to sell the company to the Japan-based Nippon Steel Corporation despite decades of government subsidies. Strategically, this would have been a good idea if the plant was modern. It wasn’t. Chance are, China will lose on this sale.

That did not become the reality. The policy goal of creating and safeguarding American jobs failed. A 2021 study by the U.S.-China Business Council found the Trump tariffs resulted in an estimated 245,000 American jobs lost.

NEW LEFT REVIEW

Dealignment

by Tim Barker

https://newleftreview.org/sidecar/posts/dealignment

This text is admittedly a step back on economics compared to above – but it ties in a few historic episodes, Nixon, McGovern and FDR, to deliver some interesting reading by juxtaposing present and past. The term “fascist” is used merely twice (!) and a few numbers on income and the economic sit. are interesting to non-experts like me. My expectations have so dropped since 2023 that I am already thankful that despite being a left commentary there are a few cracks to let some breathing air in. Barker even quotes Bernie´s interview with Politico after election night.

“What has been the elite counterpart to the dealignment of working-class votes? Harris won voters with household incomes over $100,000, but that is a fairly large group equivalent to more than one-third of households. She prevailed by similar margins among those making over $200,000, a more select group equivalent to just over 10% of all households. This group is also roughly equivalent to the 10% of American households which own 93% of the stock market, which has been the clearest winner in the Biden boom. This same top decile, according to a study by Thomas Ferguson and Servaas Storm, captured 59% of the overall increase in household wealth created since 2019. In turn, this wealth explosion set the pattern for a highly inegalitarian consumption boom, with the top 10% of US households accounting for 36.6% of the overall increase in consumption between 2020 and 2023. If you add in the next richest decile, the top 20% of households accounted for over half of the increase.”

or in reference to crypto:

“These forces are more publicly associated with Trump, but they are well represented within the Democratic Party by figures such as David Shor, the pollster who once said that ‘it was smart for Obama to try to ingratiate himself to the tech sector . . . and Democrats have made an enormous error by backtracking’. According to the NYT, the Harris campaign gave Shor’s consulting firm, Blue Rose Research, ‘agenda-setting power’ over a $700 million budget, much of it raised from tech. Most crypto money went to Republicans, but enough went to Democrats to get Chuck Schumer to proclaim at a ‘Crypto4Harris’ event that ‘Crypto is here to stay no matter what . . . we all believe in the future of crypto’. For most of society, class dealignment means polarization. But at the commanding heights of the economy, those with enough money to hedge their bets set themselves up to succeed in any eventuality.”

I guess that experts here however will find incorrect points.

After reading Yves’ commentary above I realised that the second potential political move, mass deportations, could also turn to be inflationary, particularly on certain labour-intensive sectors. Mercouris says, and I think he is right, that labour shortages are causing inflation spike in Russia, particularly in construction. So, some sectors which rely on cheap migrant workers, let’s say, picking up watermelons, construction, home improvement/refurbishing, care of children and the elder… (I have not good idea which are these sectors in the US, just guessing) might show high inflation pressures.

Do illegal immigrants rent? If they do, then rental prices should drop, especially for people on the low end of the income scale. They will be voting for the Republicans again come next election. I think it’s too early to tell the final economic implications of mass deportation.

Might you have rent-deflation in the neighbourhoods where you don’t want to move in?

I am not sure I follow, but for people on the lower income scale, the choice might simply be roof/no roof over your head, or living in your car if you own one.

I am simply looking at this from the production/consumption angle. Yes, businesses utilizing those immigrants to produce stuff/services will now have to hire labor at higher compensations, but those immigrants as a group also consume housing, food and other services, and although each individual immigrant does not consume as much as one regular American, I am guessing as a group their spending is quite substantial, so removing them from the consumption equation will probably cause some deflation somewhere.

It seems that rents are being held up by price collaborations through apps. So decreased demand might not lead to decreased price, but just more empty houses.

Unless Lina Khan gets to continue and shows those apps for the obvious price fixing scheme that it is.

Last year I went around the neighborhood collecting signatures for a thing I was doing. I went on weekends to catch people at home. Lots of male immigrants in my neighborhood…restaurant work, construction, landscaping. They are out working on weekends or don’t come to the door. I know that they are there. They can be seen hanging on the stoop or the porch now and then drinking a beer and gabbing. They pay the rent by jamming in three or four to a small cottage apartment or remodeled attic.

I don’t think there is much doubt but that cutting back on immigration, illegal or not, is inherently inflationary, although of course that inflation can be in the form of higher wages for working people.

A lot depends on the sector – in some sectors there is a lot of ‘flex’ in how companies work. A restaurant may simply cut back on the more labor intensive items on its menu if its finding it hard to get workers (the local cafe on my street corner did just that this month), and farmers may adjust their crop mix. But some sectors (such as meat processing), I would guess are highly vulnerable to rising labor costs.

Incidentally, a few years ago I had an interesting conversation with a distant relative who has a book keeping business in NY. He said pretty much every restaurant has two sets of books – one ‘official’, the second which includes the wages of illegals. One can only wonder what the impact would be of stopping this (maybe like happened in Italy in the 1980’s, when GNP rose 20% overnight when they started counting ‘dark’ income). As for rents, certainly in NY most illegals bus in from the far outer boroughs. I suspect a sudden drop in illegals would not impact on the overall market, but might make property in peripheral exurbs unviable. Housing markets are very complex and much depends on the peculiarity of local regulations – for example, the tolerance of local governments (or landlords) to overcrowded houses. In my apartment building we discovered that one 2 bedroom 80sq m apartment had no fewer than 16 people (all Brazilian students) living in it. The landlord claimed he rented it to a couple, who then sublet it without telling him. We quickly had them expelled, but plenty of other properties aren’t so fussy if they make money from it.

Meat processing in the United States is highly concentrated by companies like Cargill and JBS. According to Matt Stoller, this has led to lower prices for producers and has contributed to the major food inflation that we have experienced over the past few years. If this is the case (which it likely is), these companies would likely raise prices irrespective of their labor costs although they will likely blame any prices increases on labor costs as a ready excuse.

Back in the day when I was in college circa 1973, during the summer, I worked as a boiler makers apprentice for the UP railroad making $4.00/hr., a journeyman made $5.50/hr. A friend of mine worked in a packing house (meat processing) canning hams and he made $5.00/hr.

Meat packers made as much or more as the other trades at the time and then it changed.

The equivalent wages today would be in the $30-$40 dollar range. That is true I think for the railroad workers, however, for meat packers it is a different story. With the influx of illegal labor in the 80’s their wages dropped and never recovered. My understanding is wages for meat packers run in the $15 to $17/hr range today. So what would happen if all of those workers get deported and the meat packers would have to replace them? Would the wages go back to the equivalent 1973 wages, in other words doubling the current wages, which would necessitate an increase in prices causing more inflation? Or would the industry figure out a way to do the same with less?

Could get real interesting real fast.

That’s precisely what goes on here in true-blue Massachusetts. The PMCs are building wealth for themselves by purchasing single-family homes as rentals with their large cash piles (they can handle the mortgage rates) and rent at nose-bleed levels to Brazilians and Central American immigrants, who need to sublet to afford the rent.

I watched it happen in the house across the street from me over the past several years.

But *whose* economy will get smaller? If tariffs lead at the margin to US reindustrialisation, the benefits of free trade will be taken from rich consumers and given to labour. Trade with China has been used as a safety value for stagnation: people have afforded a rising standard of living because tradeable goods have fallen in price thanks to the China price but the capitalist class have stolen much of this surplus by using the “effective demand space” to cut wages and offshore the jobs and collect the difference in profits.

Similarly, if mass immigration is reversed, pressure on housing and public services will be reduced and demand for local labour will increase. Rent down, wages up will feel like growth on a per capita basis.

If the only way for the US economy to grow is to import *demand* in the form of migrants, it has a bigger problem than the distributional issues that we all diagnose here at NC.

I just linked below Angus Deatons March IMF paper which made very similar points.

This is the overall point Michael Pettis makes in his book with Michael Klein. Trade wars are proxies for internal allocation of resources between various sectors. Assessing the impact of tarrifs can’t be looked at in simple terms of price increases for manufactured goods. Its the overall industrial policy that matters.

Though I agree i think this requires an industrial policy program prior to the tariffs with incentives and disincentives, and quite probably, a “reprogramming” of US financial schemes. Is private equity suited for industrial investments?

Tall order here?

>>>Tall order here?

Yes. Tariffs could work, but the last thing you want to do is affect “shock therapy”

…and of course what is the likely default path? at least mild shock therapy.

The slow heating of the water for frogs is better? Ask the democrats.

The US has always used immigrants for cheap labor in all sectors.

Regarding public services, don’t forget the effect of adolescent kids with behavior issues who don’t speak english showing up in the middle of the school year in your kids’ school.

The school staff have to dedicate a lot of energy to managing these situations.

How to quanitify this sort of impact on quality of life for normal families???

But seriously, will the tariffs make the miracle or re-industrialisation? For too many years now we have become accustomed to buy stuff made abroad and we might have lost the know-how (sacred years ago). Where is the talent, the manpower even the willing to work in factories? With sky-high real-estate prices much more money than that strictly necessary will be needed to onshore the manufacturing. More so to ensure that everything is compliant with very complex regulatory frameworks. Investors will require all kinds of safeguards. It might work but it might take decades. I wouldn’t rule out that we are just incapable of doing so in the current environment.

This would require very serious public intervention. Not less, but more government and there Trump almost certainly fails.

The labor cost for an American worker will be so high as to sharply reduce foreign demand for American made goods. If the US wishes to completely isolate itself it can block all imports, have minimal exports, no friends, and no markets for US Treasuries. Sounds terrific, yes?

isnt all this sort of cart before horse, similar to sri lanka forcing organic ag on themselves without any transition?

i mean, we cant even make tylenol without chinese inputs.

so not just inflation, but rather severe shortages of everything.

im planning an even larger garden for next year.

What stops domestic producers from keeping their prices the same (which is still elevated from past years for most sectors of the economy) or raising them when a tariff on imports is in place?

If manufacturing is to move from China due to the tariffs, what keeps it from moving to Vietnam or Bangladesh? (Tariff or not the U.S. is still more expensive to manufacture in.)

I just don’t see how a tariff would help.

That’s pretty much what I’m thinking too. Or looking at it in logical / mathematical terms, tariffs are a necessary condition, but it looks like the incoming government thinks they’re sufficient.

Sure, you need to have at least some reasonable tariffs for an organized economy; if we’re not willing to impose even one, we may as well drift off back to laissez-faire la-la-land.

But if Trump thinks tariffs alone will suddenly train millions of workers, cut all the middle-men out of the economy, or convince capital to schedule investments more than a year out, this economy is going to be sad. And if he cuts taxes on top of that? Ruh roh, shaggy.

yeah…if you want to “incentivize” firms and people to buy local, there has to be something to buy there, first.

this is more like me insisting that everyone in town buy my cars,or else pay hefty fines… when i do not have any cars.

in fact, its similar to how the obamacare mandate went over in texas…us po folk paid the fines every year, because the insurance was just too dern high.

From what I understand, China and others got a free ride with their exports economy, also bc we shouldered the cost of our navy and keeping the sea lanes safe since WW2. But we no longer want this expense, so this is a factor in any serious adjustment to the current status quo.

In all of these complex analyses, we face the danger of singling out a few factors, or even one!

I think its critical that there be breathing room in The American Whole, so that not too many factors weigh on HUMAN INCENTIVE. All good work must be rewarded — and even better, this leveling of the field (as much as possible) should be planned and promoted.

Mistakes cost, and we don’t get unlimited ones — and these mistakes are often given an ideological veneer in America. Look at the economics of our cartel-run border today — the missing children, etc. And it will take the expense now of 40-60k troops to clean this up — the cartels have infrastructure and human capital on both sides and will go to war with us.

But all said, there have to be enough pathways to a stable living for people, not thwarted by regulations or just basic unfairness disguised as something else. (Sloppy immigration — vs. the meme “We are a nation built on immigrants.” has stoked way too much crime in my hometown, NYC, and has benefitted economically mainly Amazon and a few others.)

Someone like Lina Kahn can help, and anti-monopoly strategies in the Matt Stoller vein — and of course she will get dumped soon. But with such major moves a new complex emerges.

Trump, we should keep in mind, is a negotiator as well. Think of this e.g. : use tarrif-threats to loosen EU restrictions on free speech and X.

A lot can happen here just by setting things in motion. (Doomsday? -lol)

‘Best laid plans of mice and men.’ But some fundamental outcomes are possible, as JD Vance was quoted above here — like more secure supply chains if we can weather the storm.

in 1939, America had a relatively small economy and by 1945 it had surged to be bigger in GDP than all of our allies combined.

People have to feel deep in their bones that work gets rewarded — and it must be rewarded. The class compromises that worked under Fordism have to come back — they have been absent for decades because of what Catherine Fitts has called an elitist “Breakaway Civilization” grinding away at us.

I have to say they threw everything they had a Trump short of dropping a big bomb on his head, and we all saw it, and I believe there was a revolt. If he sees the light and really wants to help, he might have a real shot with the senate and hopefully the House in his pocket. He is old enough now and war-torn enough to care.

This is all well and good but we are in a world where that is not possible. You oppose regulation yet regulation is necessary in a complex society, otherwise we’d all be eating adulterated meat and dangerous products. And in case you need a reminder as to why even rich men need to be protected from themselves, let me hoist some text from a 2008 post:

And with repeated Covid cases leading to lasting damage, including to mental capacity and vulnerability to other diseases, we face a rising health burden. Hard to be rewarded for the effort of struggling with long Covid. And by 2040 to 2050, food shortages are projected to become widespread.

In other words, you assume a business as normal scenario when the Jackpot is upon us.

Nostalgic?

I may have succumbed to a mood.

But I’m actually not that free-wheeling. To be clearer:

I mean only bad regulation that is abusive and favors power. Example: Monsanto suing a farmer for illegal use of its products, because the wind blew its GMO seeds across into his field after he refused to sign a contract to buy and use their seeds and pesticides — one technique they use to eliminate smaller farms.

Sometimes, of course, the regulations or changes are far reaching — as when a rule in banking on the state level removes control from the state AGs and passes that control over to the big banks that then go to town on the affected population. (Elizabeth Warren had some examples of this in her books years ago, when I still liked her: regulatory changes that led to many foreclosures and bankruptcies.)

This kind of thing. Corporations and government extracting from everyone else, making life impossible for people.

___

As for the bullet train headed straight at us…

it is hard to argue that we are entering a perfect storm.

And what are tariff wars in a world lacking health and food? Or a world war?

Re the public health crisis, “Long Covd” and its consequences (something I know more about than tariffs and economic predictions), I would like to offer the following 12 pages with great humility, because this is a difficult topic. Here is the Nobel Prize in Medicine acceptance speech from 1913, by Dr. Charles Richet. It requires a careful reading but it is very accessible. It may hold the key to Long Covid.

https://www.nobelprize.org/prizes/medicine/1913/richet/lecture/

The damage may well be done. It is a very sobering thought.

Nostalgic, yes, perhaps — and yet “The history of civilization is the history of class struggle.” I’m not sure when this will cease to be meaningful. We need some basis for a class compromise — yet our ruling class no longer wants a compromise. They are going for broke, and believe they have the tools to pull it off.

The extraction mechanisms are so strong today…. Gretchen Mortgenson’s recent book, These Are The Plunderers, comes to mind, among many others.

Pro tip: When you are in a hole, stop digging. Bluntly, you are demonstrating you have NO idea what you are talking about.

Your Monsanto example does not prove your case. There is absolutely no regulation at play here. This is all strictly a private sector matter. Monsanto has patented its seeds and is asserting property rights. The farmer that had Monsanto seeds blow onto his land and did not pay for them is abusing Monsanto intellectual property.

Your state legislature v. AG example is even more ludicrous. AGs enforce laws, and that does include case law and regulations that interprets statutes. If the legislature enacts new laws or changes existing law, the AG does not get to decide to use outdated statutes.

You are further wrong about what cause the spike in foreclosures. Again it had NOTHING to do with regulation. In fact, it took new regulations on bank servicers to try to stop bad practices, but these regulations were so weak that they didn’t accomplish much.

We wrote about that exhaustively back in the day that the big driver of more foreclosures was securitization. That again was a strictly private sector practice that regulators TOLERATED when they could have cracked down on that (we even have a friend of the site who made a fortune on credit card securitization who keep asking his regulators, “You do understand what I am doing, right? And you are OK with it??” So incumbents regarded this as a very grey area).

In the stone ages, when banks retained the mortgages they made, and a borrower got in arrears, they would nearly always work out a mortgage modification if the borrow still had enough income to catch up or otherwise pay a fairly high proportion of the original obligation. A half a loaf is better than none.

In the brave new world of mortgage securitization, banks sold mortgages and they mainly wound up in trusts that issued participation certificates that represented a hierarchy of claims on the principal and interest payments (each had its own “waterfall”). Separate entities called servicers were responsible for collecting borrower payments, managing the accounting, and sending payments to the entities that then paid investors.

When a borrower got in trouble, the servicers were paid only to foreclose. They were not paid to modify mortgages. And even if they had wanted to, they did not have the capability, as had banks who made loans and evaluated borrowers as part of routine operations.

In other words, regulations are your friend. You would not have clean water, safe products, (largely) safe workplaces, or liquid securities markets, among many other things, without them. But you’ve been indoctrinated not only to criticize them, but even to blame all sorts of things that have absolutely nothing to do with regulations on them.

Thanks for the comments, they are instructive. I probably was brainwashed in my casual use of the word regulation — you certainly woke me up.

It’s important to know when it is not the regulation you should be attacking — but the person or agency who tolerated an event and did not regulate it, you wrote.

A person who befriended me a lot when I was growing up once told me this: “There is sometimes not much difference between causing something to happen, and being in a position to stop it but letting it happen anyway.”

The farmers lost their fields, and the people lost their homes, but it’s important not to confuse the root causes.

_____

Thank you for your mature response. I know I can be rough and I appreciate you taking the criticism to heart. I get very frustrated by how much clever messaging and not-so-careful reporting has confused well meaning and serious people. Most don’t have the time to follow matters all that closely. Lambert and I regularly lament that we live in an informational hall of mirrors.

I think the problem with this article and a lot of such articles on tariffs is that they make quite simplistic assumptions assuming that trading sectors operate in a vacuum, independent of many other trade variables, such as currency policy, interest rates, labor and wage policy, industrial subsidies, managed credit, infrastructure investment, regulation, etc., etc. I think its pretty clear that Trumps people (if not Trump himself) have been reading up on economists like Tooze and Pettis or more recently Angus Deaton (whose IMF paper is very interesting reading) rather than the usual Wall Street commentators.

Tariffs by themselves will do very little – it will most likely just switch over some discretionary spending and maybe do a lot of good for Mexicos economy – which alone may be a good argument for them – its the overall package that will tell whether Trump will succeed in reshoring or if all he will do is generate a lot of inflation.

Thanks for the links, PK, but such round-about economic arguments will not get Trump, Vance, Congress, or any western parliament to “tax the rich”.*

I’m afraid we’ll need another Great Fleecing before we’ll get another leader like this:

«Discrepancies between low personal incomes and very high personal incomes should be lessened; and I therefore believe that in time of this grave national danger, when all excess income should go to stopping the pandemic and climate change, no American citizen ought to have a net income, after he has paid his taxes, of more than $25,000 a year.» **

Franklin Delano Roosevelt

Message to Congress, 27 April 1942

* Deaton was a little more direct, but still could not bring himself to utter those three little words.

** Ok, FDR said “war”, not “climate change”. And $25,000 in 1942 is $500,000 today.

JD Vance gave an interview with to NBC’s Kristen Welker on Aug 2024.

https://www.youtube.com/watch?v=zETjconbCRs

His case for the tariffs is twofold:

1. If the manufacturing come back into USA, it will create jobs and raise wages which will pay for the higher prices.

2. Our dependence on hostile nations for supply of goods can make us vulnerable to supply and price shocks, so reshoring industry is the right move in the long run.

By his own admission, tariff will cause price increases in the short term. But it is a necessary pain to bear on the way to making USA an autarky (or something close to it).

Tariffs that neutralized the wage and environmental cost incentives to offshore manufacturing would probably have been game-changing before the offshoring occurred, but that ship has sailed and the institutional memory of it is gone.

I agree.

If Biden could have just snapped his fingers and re-industrialize America, he would have done it. But the funny thing is, he did, and not much has happened. The DOD with what amounts to an unlimited budget could not make enough for Ukraine. That right there tells you the driving constraint is not money or EPA regulations or anything like that, because they’ve got all the money in the world, and would blow through the regulatory constraints if they had to, to get those 155 shells to Ukraine, but it didn’t happen.

Even the JD Vances who don’t live in the 1990’s are seriously underestimating how hard re-industrializing at this point will be. That institution memory has to be re-learned, the hard way, and one of the biggest barriers to really doing that is American CEO and Wall St culture. They are really good at being Jack Welch, but other than a guy like Musk, there are not many CEOs that ramp up new heavy manufacturing.

But you can just look around for tell tale signs that they are not serious about this. I cannot believe it’s not illegal to have Chinese built components in a F-35. It sure was not acceptable when I was in. Yet, nobody’s gone on trial, nobodies going to jail. Nobody even seems to be working to correct it. The Buy American Act (illegal for US government to buy foreign made goods) was enacted in 1933. It’s never been repealed although the exception process is probably being used for the majority of the goods being bought (see F-35 apparently). They can change the rules and started enforcing it rather easily.

As for tariffs, you gonna have everything in WalMart go up another 20% in price? That’s just what got the Democrats wiped out. You could impose some weird industrial policy that forces corporations to buy American made products so that industries we need to support (EVs, batteries, wind turbines, whatever) have a guaranteed market yet let American consumers buy cheap EVs from China. Something like that might be possible (OK, it would never fly because both sides of the uniparty don’t care if they completely kill the middle class which they actually need to protect if they want to have a re-industrialization, but the uniparty owners, Wall St, want to bleed out the middle class and poor for profit if they had their way – it’s complicated.)

Agreed. Just as we pay the price of a geographically far flung military presence for the material benefits of empire, in a time of rising regional hegemons, national independence movements, and destabilizing effects of climate change, we must now pay the price associated with more geographically and jurisdictionally secure supply chains. At issue is the distribution of those costs and benefits. I’m not at all confident that merely tweaking a system that is existentially committed to and dependent for its functioning on perpetual growth will be enough.

Autarky and capitalism are not at all compatible. Autarky leads to stagnation which in the longer run can be fatal to capitalism. The United States cannot have autarky + a global empire.

Autarky does not lead to stagnation. The German economy between 1933 and 1939 grew far faster than it had grown between 1923 and 1933 despite the Nazi regime’s embrace of autarky. Autarky is basically an extreme version of import substitution, the only known method of industrialisation and currently the official policy of the USA.

*Sigh*.

Germany was not and could never be an autarky. Please use a search engine before making claims like this. We require links for this sort of thing. I don’t like having to spend my time, which is better spent on new posts, riding herd on the accuracy of claims made in the comments section.

Auturky was only an aspiration and Hitler recognized that at the outset. The big focus for autarky was military production.

From Wikipedia:

So autarky was the justification for conquest.

What’ll likely happen is that Trump “stumbles” (if you don’t like him) “A/B tests” (if you like him) into a manageable outcome.

Step1: shock therapy tariff threat and/or implementation against Chyyyna and the EU in discrete sectors;

Step 2: Counteroffer from China and EU with some sort of compromise that is marginally better than the 2024 status quo (say, a “chicken tax” on Chinese EVs, which China accepts because honestly the US market is not the center of the world anymore)

Step 3: Trump admin counts on tax cuts and regulatory easing to do the lion’s share of economic growth.

The article fails to even factor in the possible effects of retaliatory tariffs on U.S. exports or sanctions on importing things like strategic minerals. The EU is starting to realize that China has the ability to retaliate with sanctions of their own that can really bite, and it’s even starting to look like the west grossly underestimated how long it would take China to develop their own advanced lithography equipment, possibly making the gutting of ASML’s market cap, in an attempt to slow China’s tech sector, all for naught. It seems to me like the only reason that the U.S. is currently enjoying that 2.8% growth rate is because they cannibalized the EU by forcing them to buy U.S. LNG, and capturing the lion’s share of the profit from the military/industrial production fueling the proxy war in Ukraine, which I suspect the taxpayers will end up holding the bag for when Ukraine is defeated. The way it’s going there, there won’t be anything left for the economic hitmen to even ‘structurally adjust.’

Gregorio, I think you are spot on.

Thanks for this! Just finished John Jenkins’s “The New Confessions of an Economic Hitman.” Yikes. I had no idea such people existed, much less that they proudly referred to themselves as EHMs, to distinguish themselves from the jackals. The EHM did the “soft” work of arranging crippling WB loans to developing nations based on ridiculous growth projections. The jackal, who also bore his moniker with pride, did the more physical work, arranging assassinations, and so on. God bless America.

I suppose Trump deserves some credit for acting on his campaign promise. After reading this post I am not sure what Trump believes his tariffs and tax breaks might accomplish. Is there some way Trump’s supporters of substance will benefit from his tariffs? I can understand the gains from tax breaks — not unlike the gains from lax enforcement by the last many administrations. Perhaps some hidden profits lie at the heart of the tariff’s merit, although I suspect Trump pushed for raising tariffs as a knee-jerk proposal to amp up his monetarily insubstantial supporters who offered in return their knee-jerk excitement about his proposal … although I believe few gave consideration to the proposal’s consequences beyond the PMC’s knee-jerk horror at the idea. I doubt the tariffs will accomplish much more than provoking PMC ire and giving the soon to become ever more consolidated Corporate Powers parasitizing the dying remnants of the u.s. economy, an excuse to give a repeat demonstration of their price raising powers reprising their performance during the recent Covid inflation.

If Trump can accomplish anything of substance toward “Making America Great Again” during his next four years I will be greatly surprised. The too far flung and thinly spread u.s. military, the hollow, hollowing, and stiflingly consolidated u.s. industry, the appalling decline of u.s. education, science, technology, and infrastructure, these and more non-economic deficits will derive little succor or solace from tariffs.

All this talk of tariffs and “reshoring” manufacturing are just desperate moves by a desperate empire. The post-WWII status quo cannot be maintained because the world has changed dramatically. The US is no longer lording over a world devastated by war (its two oceans and docile neighbors having protected it from said devastation). For decades the US has delayed the day of reckoning by employing financial engineering on a grand scale in order to maintain its position of power. These machinations are running their course, with their effectiveness dwindling day by day. Going to war is a non-starter in a nuclear armed world, so the US will need to gain some humility and learn to play nice with the other nations of the world who have their own dreams and aspirations. This will be a bitter pill to swallow, but the pill must be swallowed if the US is to avoid being completely isolated, bereft of friends, and stewing in its own juices.