And the Europeans are helping them do it. The Dutch government repeatedly goes along with demands from Washington that ASML, the most advanced chip making machinery company in the world, “de-risk” from China. The European energy crisis, fomented by Washington, simultaneously exacerbates power supply issues for industry in the Netherlands. And now the US is starting to unveil billion-dollar research centers that will aid ASML competitors across the Atlantic.

Trade Restrictions Hammer ASML

Shares of the Netherlands-based chip equipment maker plunged 16 percent in October —the company’s worst showing in a quarter century— and haven’t recovered. While stock prices aren’t the best gauge of company value, in this case it’s instructive as the reason for the drops is almost entirely tied to the effect of US restrictions on exports of its advanced chip manufacturing tools to China is expected to have on its sales.

“We all read newspapers, right? We all see that there is speculation around export control,” said ASML CFO Roger Dassen on an October call with analysts. “That is a driver for us to take a more cautious view on the China sales.”

ASML is the only company in the world that currently produces the extreme ultraviolet lithography (EUV) machines that can make cutting edge 5nm and 3nm chips. ASML has never sold its most advanced EUV machines to Chinese customers. Formal restrictions were put in place in 2019 to make sure the company couldn’t.

Yet Chinese companies are still able to get the deep ultra violet lithography (DUV) machines, ASML’s second-tier lithography systems that are needed to make chip circuitry. That access, however, is expected to be cut off soon. So China-based customers have been stockpiling ASML’s less advanced machines for months to get ahead of restrictions.

The Dutch government early this year started slowing the issuance of licenses for ASML to provide maintenance services to certain lithography machines in China.

In September, the Netherlands expanded export restrictions on ASML equipment. And now at Washington’s gentle request, the Dutch government reportedly plans to completely halt the company from maintaining the DUV lithography machines it has sold to China so far and forbid the selling of spare parts for the machines. There are reports that ASML has implemented “kill switches” in its EUV machines just in case the Chinese were able to get their hands on one in, say, Taiwan.

That’s not all. Last year the president of the Eindhoven University of Technology, a key source of ASML’s engineers, was questioned by the US ambassador to the Netherlands about the “large number” of Chinese students at the school. This pressure comes at the same time that ASML is so worried about its ability to find skilled employees that it is considering moving operations out of the country.

Beijing is understandably not happy about any of this. The Netherlands is going along with the restrictions despite Beijing’s warnings that it could respond by cutting ASML off “permanently” from the Chinese market. Here’s China’s Global Times:

If ASML loses the Chinese market, it will suffer significant economic losses. This loss could potentially lead to a decrease in ASML’s global market share and a shift in the balance of power in the semiconductor industry.

Reducing ASML’s presence in the Chinese market would also weaken its competitiveness in global research capabilities, potentially causing the Netherlands to lose its market-leading position in specific high-tech fields.

If the Dutch government made the decision to follow the US’ order, it will severely affect China-Netherlands relations in multiple fields. China is unlikely to stand idly by. It is expected to take corresponding counter-measures, such as imposing trade restrictions or seeking alternative suppliers, and reevaluating its cooperation with the Netherlands in more global areas…For those companies that follow the US in containing China, it will be challenging to return once they lose the Chinese market.

ASML currently holds a near-monopoly in the EUV market, with no significant direct competitors, but the Global Times also promised to out-innovate the company. Money certainly won’t be an issue as Asia FInancial points out:

Beijing is pouring tens of billions of dollars into its semiconductor industry as part of its vow to develop ‘new productive forces’ that will carry through its economy in future. The funding has meant that even though major chip firms like Semiconductor Manufacturing International Corporation (SMIC) and Huawei face low yields and significant costs in producing advanced chips with older DUV machines, they have still been successful at making significant headway.

According to an analysis by a Tokyo-based firm, China’s current chip capabilities are only three years behind Taiwan’s TSMC — the world’s leading contract chipmaker. Last year, ASML also raised the alarm about risks to its business from new chip curbs due to “new competitors with substantial financial resources, as well as from competitors driven by the ambition of self-sufficiency in the geopolitical context.”

Dutch Prime Minister Dick Schoof said last week he was still assessing the consequences of new China-targeted curbs on ASML.

As Schoof assesses the situation, the future is looking increasingly gloomy for Europe’s brightest tech firm. Here’s CNBC with a quick rundown of concerns:

Analysts at Bank of America said the firm faces a “sharp decline in China revenues.” They added that ASML’s forecast of China accounting for around 20% of its revenue in 2025, implies a 48% revenue decline year-over-year — more severe than the 3% they had anticipated.

Abishur Prakash, founder of Toronto-based advisory firm The Geopolitical Business, said that demand from China for ASML’s machines is likely to drop significantly as the firm is “severely restricted by export controls.”

“Like Intel, for whom China is the largest market, ASML is deeply reliant on China,” Prakash told CNBC via email. “For ASML, it is watching what is taking place with China as a potential restriction on business.”

“As the chip world is cut from China, ASML could see demand for its equipment drop — from China and elsewhere,” Prakash added.

Should ASML decide its China sales are too important for the company and that the restrictions are self-defeating, the US is prepared to step in with its foreign direct product rule. Here’s the Export Compliance Training Institute with the details on what that is:

How can the United States claim export control jurisdiction over an item that isn’t made in the United States, doesn’t contain any U.S.-origin content, and is traded between parties in other nations without ever touching U.S. territory?

That’s the idea behind the Foreign Direct Product Rule (FDPR), which was introduced in 1959 to place controls on the transfer of certain items made abroad with the benefit of U.S. technologies.

Stated as simply as possible, the FDPR allows the Department of Commerce’s Bureau of Industry and Security (BIS) to regulate the reexport and transfer of foreign-made items if their production involves certain technology, software or equipment. It does this by defining that technology, software and equipment as subject to the Export Administration Regulation.

Energy Crisis Hurts ASML

Lost in all the talk of the obvious fallout from the trade restrictions are quieter mentions of another factor damaging ASML: energy.

There are problems with electricity grid congestion that are affecting industrial power supplies in The Netherlands. One big reason behind the extreme gridlock is the energy war against Russia, which has caused a rapid increase in electricity demand. In 2022, the Dutch heat pump market passed one million installed units, with 57% year-over-year growth, as the country imposed a national ban on natural gas connections in new construction.

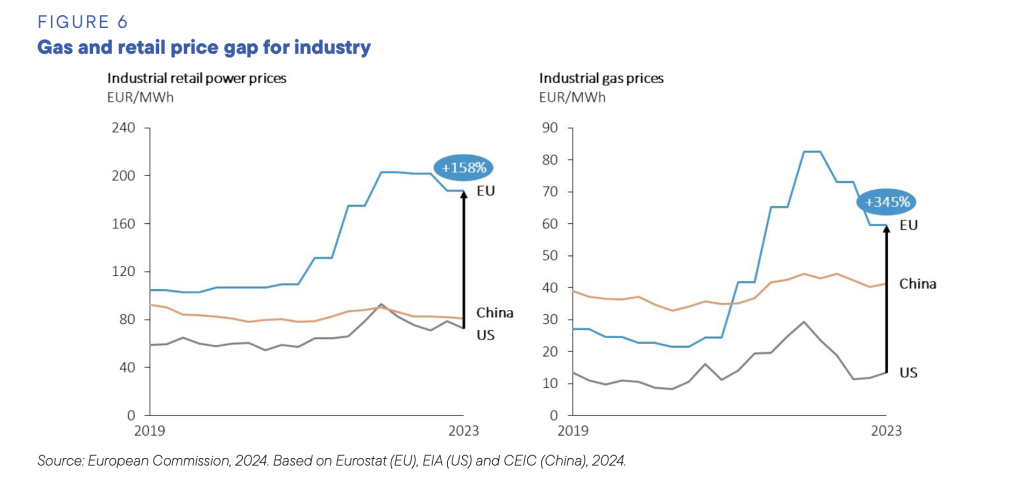

Additionally, the Netherlands is one of the hardest hit countries in Europe by the energy crisis:

There is no quick fix. From ABN AMRO:

Ultimately, these higher gas prices also affect industrial business results. The figure on the right above shows that the cost of energy and also the purchase of raw and auxiliary materials have been important determinants of the trend in the producer price index over the past two years. The sharp rise in the overall industrial producer price index in the Netherlands has been fuelled mainly by sharp price increases in raw material and energy-intensive industries, such as petroleum, chemicals, wood and building materials and basic metals. As energy, as well as other raw and auxiliary materials are important inputs for many industry subsectors, higher energy and raw material prices have undermined Dutch competitiveness. What is more, the uncertainties and risks in the global gas market will continue for some time. So, to become less vulnerable to the volatility of the gas market and further reduce import dependency, it remains important to further rationalise industrial gas consumption.

Again, this highlights the fallout from the decision on the part of the EU to reject cheap and reliable Russian pipeline gas. A minor disadvantage in energy costs turned into a critical liability, which increasingly has its companies looking to the subsidy-filled shores of the US for relocation or expansion.

The Dutch government allocated 2.5 billion euros to help shore up some of these competitive issues earlier this year, but that was less than half of what was needed, according to Jeroen Dijsselbloem, mayor of Eindhoven where ASML is based.

US Pours Subsidies into ASML Competition

Washington is funding a billion dollar research center for next generation EUV process technology, which is a direct challenge to ASML.

Announced on Friday, the American EUV Accelerator will be hosted at the Albany NanoTech Complex as the first CHIPS for America R&D flagship facility. The center will focus on extreme ultraviolet lithography, the most advanced and difficult step in chipmaking. Involved as one of the biggest beneficiaries of the largesse is US company Applied Materials which competes directly with ASML.

Billions more are expected for similar centers as the Albany location is just one of three the US is planning. The New York research facility will be using ASML machinery according to the Times Union:

NY CREATES, which operates Albany NanoTech, is installing a new ASML EUV machine called the EXE: 5200 High NA EUV scanner. It will be located in the new NanoFab Reflection building and will be one of just two in the world located at public research facilities.

A year ago, Gov. Kathy Hochul announced $1 billion in state funding to construct the new building and purchase the EUV scanner as part of a larger $10 billion EUV consortium that will include IBM and Micron, the memory chip company that’s planning a $100 billion manufacturing campus outside of Syracuse.

Meanwhile, Europe starts a trade war with China over subsidies. And the US is pressuring Brussels to start using sanctions against Beijing. Here’s the Brookings Institution:

Regardless of who wins the presidential elections, the EU is sure to face American expectations that it will implement economic sanctions against China, including new export controls, investment controls, and tariffs, to safeguard critical technologies and to curb China’s aggressive economic practices. The EU must define its economic security strategy, balancing member states’ interests with the need for a united front against China’s aggressive policies.

Brookings bemoans the fact that Germany is still reluctant to go along with an economic war against China and offers the following advice:

A full decoupling from China could incur severe costs for the German economy. Yet, a recent study suggests that losses could mirror those experienced during the global financial crisis and the COVID-19 pandemic—in that they would likely decrease after the first year and would be manageable overall.

Considering that Germany’s economy has grown 0.19 percent since the pre-pandemic fourth quarter of 2019, some might call that cold comfort. Nevertheless the Germans will likely come around after some more convincing.

If we recall back in 2022 after the passage of the US Inflation Reduction Act with its billions in subsidies for electric cars, batteries and renewable energy products and consumers who buy such American-made products, some in Europe were loudly complaining and threatening tariffs or subsidies of their own.

As EU trade chief Valdis Dombrovskis said at the time, however, there is “the danger of conflating the Inflation Reduction Act with our broader relationship with the United States.”

And so European officials quickly caved and decided to blame China and Russia instead.

An American firm will take over ASML, and all will be “right” again with the world. Heck, one almost thinks that’s the intended outcome right from the start.

Like with Nokia.

Damn. That humor is so dark that a Columbus, Ohio police officer would shoot it.

China was happy to buy foreign chips until the US started to try to destroy China’s high technology capabilities, for example with Huawei. Being the manufacturing industry leader, and far ahead in the depth of its technology talent together with a highly effective and efficient development Party-state-society complex, China has nearly the perfect set up to overcome this challenge. And it has the biggest domestic market. Then add in patriotism, as this is China’s “Manhattan Project”. Companies like Huawei will also have become inestimably stronger and more committed.

We are already seeing Chinese developments that are far ahead of what the Western policy makers expected. Both Europe and the US will be left behind many times faster than they would have been without the technology export restrictions. The European vassals are doing their populations no favours.

According to the Australian Strategic Policy Institute (very connected to the Australian security state), China is already ahead in 57 of 61 “critical technologies spanning defence, space, energy, the environment, artificial intelligence, biotechnology, robotics, cyber, computing, advanced materials and key quantum technology areas” (it was 52 in the previous report). Its only really behind in the grouping of critical technologies of “biotechnology, gene technologies and vaccines” and even there its not far behind. The US policy elites have no real understanding of the capabilities of the nation that they are targeting. It seems as if their brains are stuck in the assumptions of an earlier time.

https://www.aspi.org.au/report/aspis-two-decade-critical-technology-tracker

Well, as long as you have EUV lithography machines available, it’s much cheaper to buy them than to invest on the 5 years of development process (ASML bough SVG and thus US license in 2001 and had first the prototype in 2006) and then commercialization (maybe another 10 years).

When you don’t have them available, the only way is to cough up the money and make your own. You may likely skip some parts of the process, given that the thing has been invented already, and especially so if you don’t take IP or patents too seriously – and if you have the kind of command economy where you can bring together experts from different fields to a one laboratory (complex).

I recall Russia is building a brand new 3 story semiconductor research institute for visiting research groups. Top floor for research labs, middle floor for construction labs and workshops, ground floor is for industrial scaling.

“Well, as long as you have EUV lithography machines available, it’s much cheaper to buy them than to invest…

“When you don’t have them available, the only way is to cough up the money and make your own. You may likely skip some parts of the process, given that the thing has been invented already, and especially so if you don’t take IP or patents too seriously – and if you have the kind of command economy where you can bring together experts from different fields to a one laboratory (complex)…”

A fascinating and important comment, but partly incorrect in that the Chinese take intellectual property and patents very seriously since if abused they become significant blocks to development. How then to proceed with no patent abuse, which is what the Chinese do in instance after instance?

It seems as if their brains are stuck in the assumptions of an earlier time.

would not say it seems, their minds are stuck in a different era. We’re seeing the same thing that we saw with Russia.

With Russia, it looks to me that the major Russian advisors in Washington still see the country is what it was in the late USSR or in the early 1990s when it was a wild west situation. The Russian advisors fail to keep up even slightly with what was happening since the year 2000. At least the Russian advisors seem to speak Russian and probably have actually visited or moved in the USSR or Russia.

I don’t know who the Chinese advisors are in Washington these days, but I doubt if many of them have actually been to China at least for any length of time, or are fluent in written or spoken Chinese. For all I know, they may be working from Old National Geographics from the 1960s; it would not really surprise me. I was suspect you’re also as a certain amount of assumed superiority and a racism because they are the USA and not those yellow people on the other side of the ocean.

On the other hand, is maybe just a general problem in Washington. For the last several years I’ve been getting to feeling that that the people in Washington have no real idea of what the rest of the world is like.

As I have hello hello not too much I’m just getting dressed okayremarked here before, what I find is amazing is what a public figure will say or a public organization let’s say the Rand Corporation for example, will publish. I keep getting the feeling that these people in the USA do not realize that people in other countries speak English, will watch US TV and read all sorts of Think Tank materials that are written to tell the US Administration how to attack Russia or China or maybe choke somebody else back into proper behaviour. It’s just mind boggling.

As Napoleon said: “Pour comprendre l’homme, il faut savoir ce qui se passait dans le monde quand il avait vingt ans” — i.e.

“To understand a man, you have to know what was happening in the world when he was twenty.”

Imposing sanctions creates penalties for your own suppliers and price supports for your competition. We learned this in Econ 1A at university. China will be the world leader in semiconductors because the US is making them so.

We, The West, have to destroy ourselves to save ourselves.

IMHO, not save “ourselves”, but to save the Libertarian fools who say they must be free and want unrestrained license to do as they wish, while relying on sweetheart government contracts and grants , buffered by said tariffs and sanctions. Also saving the wannabe’s who salivate at the trough of gimme.

A system on the edge of chaos, and “planned” thus.

China must have a Milton Friedman national holiday. Without Neoliberals’ blind ambition/ greed, this discussion would be moot.

Having turned higher education into a for-profit industry, US universities have been training Chinese students to help China dominate tech as well as everything else: “In the 2022–2023 school year, there were about 289,526 Chinese students enrolled in US universities. This is a decrease from the 2019–2020 school year, when there were over 370,000 Chinese students in the US.”

Neoliberal geniuses have been, instead busy, eliminating “Affirmative Action”, which helped a hand-full of African Americans, and pushing the US into unwinable wars; the latest Ukraine and worse yet, the Genocide of Palestinians — what could go wrong?

China must have a Milton Friedman national holiday

Please do not do that. I was having a glass of wine before dinner and nearly lost a keyboard.

I remember someone a few years ago pointing out how competitive it is to get into a first class Chinese university. The writer went on to say that those who missed out but had rich parents then went to a foreign school.

This remindes me of an infamous video of lemmings jumping off cliffs. Those pushing them are not shown.

https://www.youtube.com/watch?v=0FPYp8k619g

Ultimately, this will result in a robust Chinese semiconductor manufacturing industry. Right now the Chinese are spending a ton of money on their domestic manufacturing, from EUV lithography, to domestic fabs to replacements for fabless companies.

Many Western companies are themselves lobbying against the bans because they know that in the long run, this will be counterproductive for the West because it will give the Chinese a sense of urgency that they would otherwise not have in developing their domestic chip manufacturing capabilities.

https://www.investing.com/news/stock-market-news/chipmakers-lobby-against-potential-us-restrictions-on-semiconductor-sales-to-china-93CH-3191610

Before this ill-advised US-led trade war began, semiconductors were the largest import of China, and China was the largest importer in the world. Now it’s over. The US has badly blundered by waging this trade war because now the Chinese are pouring tons of effort to making their own companies. This would have happened eventually anyways, but the US actions have sped up the pace.

This will end with another Western industry being lost. Far from building plants in the US, this will rather end with Western exports becoming noncompetitive with Chinese exports. At that point, the West will be very limited in its exports and will only be able to sell to itself.

China is pouring huge amounts of capital and human resources into this field because they rightfully understand that this is critical to their national survival and security. Unlike American companies, the Chinese won’t due short-sighted moves driven by elite greed, such as stock buybacks, which are being done by many Western companies.

Like so many other ill advised moves, Washington’s goal of keeping US hegemony only accelerates its decline. It’s no secret that this is all about kneecapping the Chinese. Like the sanctions against the Russians, this will only end up backfiring on the US. We have the least competent elite in world history in the West it seems.

As noted above, Friedman did enormous damage. It’s all about short term thinking, in this case sanctions hurt China in the short run but pretty soon they’re the leader in what was sanctioned. We’re building a wall between the low growth/ high cost west and high growth/ low cost rest. And any new restrictions on Chinese/russian imports will further increase west costs.

I suppose that long term, that world tech will have two main branches. That tech which comes out the the Collective West and that which will come out of the BRICS nations. Since China, which is part of the later, has the greater industrial base, then I would put my money on them. All these maneuvers that the US is doing is only ensuring that sooner or later, China will be a technological autarky with no need of western technology.

On the long run, the question will be, “what western technology?”

For a detailed look at the US “small yard, high fence” approach to China, here is a good overview:

https://georgetownsecuritystudiesreview.org/2023/12/26/u-s-economic-restrictions-on-china-small-yard-high-fence/

At what point do countries regain some sanity and tell the US to go pound sand with their sanctions?

When it’s too late to do anything about it, because they’ll have lost all goodwill with the RoW and will be seen as too much trouble and too unreliable to have dealings with.

The boat sailed:

https://asiatimes.com/2024/10/xiaomi-is-said-to-have-designed-its-own-3nm-chip/

I highly doubt the US investment in the next-generation EUV will do any better than 5G (when the US was going to leapfrog Asian competition) or the next generation of flat-screen TVs back in the 80s.

This is because the most advanced manufacturing requires cumulative centuries of expertise that is not in patents and requires patient capital (not a US characteristic). AMSL retained leadership because its monopoly allowed it to retain high-value employees with key experience (institutional knowledge) investing in them and the next generation. AMSL must die for the US to have a chance to recruit those employees (who are unlikely to resettle to a dysfunctional US – I lived in The Netherlands where things work, guns are not a leading cause of death, etc.).

One sees the US version, wherein a company’s founders and engineers leave, self-sabotaging, to form a new company with similar technology, and so on. This ouroboros chain leaks key process technology and knowledge. Then, manufacturing process cost savings in Asia take over.

The only area where the US manages to avoid this cycle is the MIC, which makes very high-tech (cost uncompetitive) products that sometimes perform to spec as they were designed for profit (aka useless on the battlefield—its supposed market).

With Uncle SAM paying the bill, the biggest profits are from billing, not producing. And the politicos who made the speech will not mind from their board of director positions (on the same companies).

I should have noted the article linked says Xiaomi plans to begin mass production of 3 nm chips in early 2025 and is not using AMSL EUV machines. Given that it was expected to take decades* (!) for China to catch up, but instead took ~5 years, its easy to predict the trajectory.

*https://manufacturing.asia/manufacturing/in-focus/china-may-take-decades-catch-in-advanced-chip-race-says-sp

1949: “Those Asiatic Russians will never get the atom bomb!”

2024: “Those Asiatic Chinese will never get computer chips!”

And in both cases Dr Evil paces glumly away in the end, twirling his pencil-thin moustache and muttering “Curses!”

Well the great Peter Kapitza did study with Rutherford at Cambridge and Head Mond Laboratory before returning to USSR and winning a Nobel Prize in Physics.

Russia is the largest reservoir of pure mathematical talent on earth so I assume anyone questioning Russian know-how had an Arts degree

Not really – this is just design. Article says actual manufacturing will be done in Taiwan at TSMC. If the Chinese were to design and manufacture 3nm chippery in China then that would be a real achievement. To do that manufacturing at 3nm without EUV is very difficult but not impossible. It would require double and or quadruple patterning to get the same pattern as a single EUV mask at one layer. There are many layers in a design. Quadruple patterning adds a lot of cost due to 4x masks and extra process steps not to mention lower yield (number of good chips per wafer). I would imagine that a lot of the Chinese money being thrown into semiconductors is around making quad patterning cheaper or finding an alternative to ASML EUV.

I’m not trying to disagree, but the cycle you describe of having scientists/engineers leave and form new companies was absolutely critical to how the early and middle phase of Silicon Valley functioned. It’s how Intel was formed. Plus it was extremely common for critical knowledge of how to overcome chip manufacturing problems to be exchanged after work, at the bar, between the people on the manufacturing lines making the chips. This same phenomenon was what lead to the rapid advance of American commercial aviation in the 1930’s and especially during WW2. Many companies, many engineers, in wide open competition to be the best.

Plus, how in the world can you think that the MIC has somehow escaped these problems? Battlefield results in Ukraine, and especially the IAF going up against Iran may indicate that Western tech is behind the BRICS. Certainly it’s been acknowledged that industrial capacity has the BRICS way, way ahead of the West.

The MIC can keep technology from diffusing, because it does not allow the Silicon Valley approach (that worked for Intel, when the US had no serious economic competitors) that allows proprietary knowledge to diffuse or leak – their workers are paid well enough to stay put (and the few companies in this space realize it is better for no one to poach than for everyone to try and poach).

Japan first and now China (and AMSL) did not follow the Silicon Valley approach, which is one reason why so many key technologies no longer reside in the US, but are sole-sourced to a company in Asia.

Note: I argue that the purpose of the MIC is to generate high profits, which they do very well—irrespective of battlefield performance—and they do have amazing high technology (TIR spectrometers, for example)—just not for the consumer economy and not designed for a near-peer or peer battlefield—but fine for killing civilians in Lebanon or Yemen. Sure, it was mis-advertised clearly as a business strategy to increase profits.

You mean the esteemed Fairchild Camera ?

Might interest some here. This is a very good CG animation video explaining modern cutting edge chip manufacturing. As a computer tech afficionado I am familiar with processes involwed but was still stunned. 27 min.

https://youtu.be/dX9CGRZwD-w

Excellent content. Comments on the video processes per excellent. Thanks.

Once upon a time the premier electronics firm in Europe was Philips NV. It had such a string of inventions and Matsushita of Japan was desperate to be a technology partner.

Philips had lousy management which in the small town of Eindhoven was imbued with Dutch arrogance and allowed SONY and Matsushita to eat it alive. Not content with that FUBAR this deadbeat management class spun off its start-up in Taiwan it had been funding – TSMC and then spun off its semiconductor operation as ASML which works with Carl Zeiss using what I am told is Soviet research to develop UV circuits

Now ASML or TSMC are worth so much more in shareholder terms than Philips NV one has to remark on the absolute deadbeat Dutch managers who blew up a great technological company and continue so to do

Thank you, Paul.

I’m aware as I work for the firm that fuses the host cities of Ajax and Feyenoord.

The Philips family = cousins of Karl Marx.