Yves here. Bill Haskell at Angry Bear provided the service of summarizing an important Wall Street Journal story on the shortcomings in Medicare Advantage plans. I was remiss in not covering this article at the time and appreciate Haskell making sure the piece got additional traction.

It is not well enough understood that Medicare Advantage plans, despite the hype about extra services and even no-premium plans, are second-tier coverage. Medicare has bifurcated into Traditional Medicare, which provides generally pretty good coverage, albeit at a bit of a cost, and Medicare Advantage, which among other things has skimpier networks and a lot of gatekeeping to restrict the provision of care. The Wall Street Journal describes how adverse selection works, with patients who had enjoyed cheaper/lower service Medicare Advantage plans switching to Traditional Medicare as they get sicker.

We post regularly on the shortcomings of Medicare Advantage since some elderly prospects who can afford Traditional Medicare are too often seduced into signing up for Medicare Advantage by persistent TV ads. Mind you, there are cases where Medicare Advantage might be a good choice, mainly when contracting with an HMO affiliated with a hospital system. But even those “pretty good” plans means you are restricted to Medicare B coverage in the HMO’s footprint, and can’t, for instance, seek out specialists who are not part of that HMO’s network.

By Bill Haskell. Originally published at Angry Bear

The Government made it possible for people to choose between Traditional Medicare and Medicare Advantage for their care at 65. An alternative was provided under the guise of commercial healthcare providing better healthcare and other services to those who qualify for Medicare at a lesser cost. There are superficial and also meaningful pluses that are a part of the Medicare Advantage plans which are unavailable with Traditional Medicare. The same could be provided in Traditional Medicare except the Gov. has decided not to allow Traditional Medicare to do such. Medigap is included as a part of Medicare Advantage plan while you have to pay for it with Traditional Medicare. The same holds true for Part D (pharmaceutical).

It is said Medicare Advantage by itself can not compete with Traditional Medicare. I am finding that neither can compete with VA healthcare. That is a difference story.

As people age, the costs of healthcare increase. The cost does show up in the Medigap plans more so than in Medicare Advantage. Traditional Medicare typically sees increases in deductibles and copays for Medicare B. I am going to use part of a Wall Street Journal article and a neat graph to detail the rest of the story. I am also a subscriber to the WSJ.

As recipients get sicker, though, they may have more difficulty accessing Medicare Advantage services than people with traditional Medicare. This is the result of the insurers actively managing the care, including requiring patients to get approval for certain services, and also limiting which hospitals and doctors patients can use.

It does worsen as people age.

The Wall Street Journal found more people in the final year of their lives are leaving Medicare Advantage for traditional Medicare at double the rate of other enrollees. This was occurring from 2016 to 2022. Those private-plan dropouts numbering ~300,075 during the 2016 to 2022 time span often had long hospital and nursing-home stays after they left. The result of their going back to Traditional Medicare being large bills paid from Medicare’s Hospital Insurance (2.9% split between workers and business) fund.

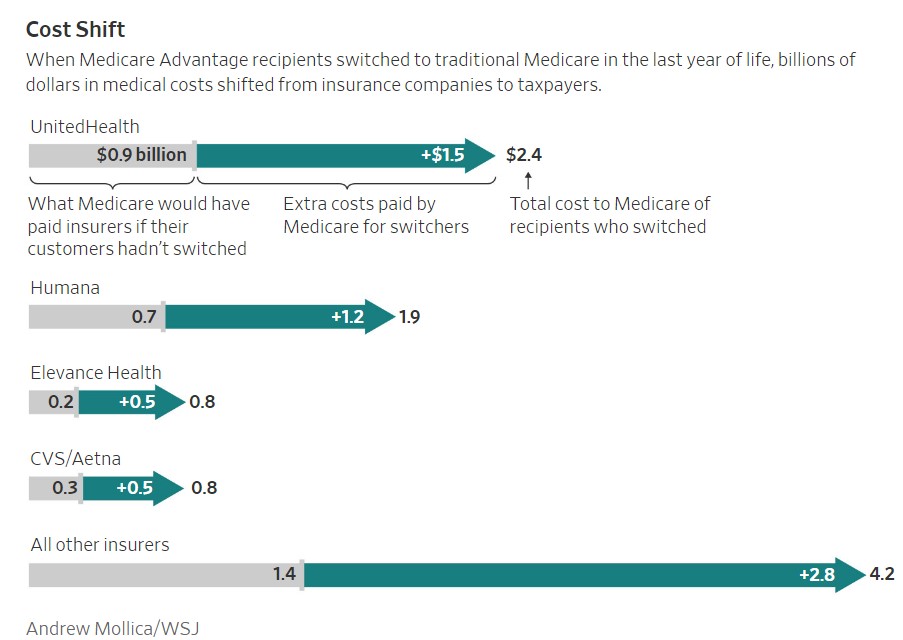

In one WSJ example of end-of-life healthcare, the total cost would have been $ .9 billion if the patient was in Traditional Medicare as compared to $2.4 billion for a person who switched back to Traditional Medicare from Medicare Advantage. The Wall Street Journal provides a chart (see below) detailing the cost of switching back using various providers of MA plans as compared to Traditional Medicare.

Medicare Advantage insurers collectively avoided $10 billion in medical costs incurred by the dropouts during that period, the analysis found. If those beneficiaries had stayed in their plans, the government would have paid the insurers about $3.5 billion in premiums, meaning the companies netted more than $6 billion in savings during that period.

“These are some of the costliest services, received by some of the costliest patients,” said Claire Ankuda, a physician and researcher at Mount Sinai Hospital in New York who focuses on end-of-life care.

“Plans are strongly motivated to reduce the cost of care delivery.”

Wall Street Journal analysis of Medicare data found a pattern of Medicare Advantage’s sickest patients dropping their privately run coverage just as their health needs soared. Many made the switch after running into problems getting their care covered.

Plans run by the private insurers in the Medicare Advantage system are supposed to offer old and disabled people the same benefits they would get from traditional Medicare. The plans can be a bargain for people because they limit out-of-pocket expenses and often offer extra benefits such as dental care.

The government through CMS does pay Medicare Advantage a premium.

Medicare Advantage companies said they use Medicare’s standards when they review and approve medical services, and that their setup improves care for their members, including those at the end of life. They said their oversight ensures that customers get safe, appropriate and high-quality care.

A UnitedHealth spokesman, Matthew Wiggin, said the Journal’s analysis focused on just a tiny fraction of the company’s Medicare recipients and that nearly all Medicare Advantage participants are satisfied with the program. He disputed that care denials by insurers played a role in people’s decisions to switch out of Medicare Advantage, saying patients at the end of life might switch coverage for many reasons.

Until Medicare covers dental and vision services, I am trapped in Medicare Advantage hell with its time commitment of due diligence coverage comparisons.

MA is dropping dental in 2025.

Thanks for this post.

My local hospital just ended accepting Medicare Advantage insurance issued by two giant insurance companies. The companies weren’t paying for the covered charges. Hospital losing too much money. Now, people covered by those policies will have to pay for hospital services themselves and then try to get their Medicare Advantage insurance company to reimburse them. Not good. Lots of hospitals have stopped accepting the Advantage plans.

Well, it doesn’t mention another big problem with switching from Medicare Advantage back to Medicare, which is that most seniors doing so will need to go underwriting for Medigap coverage and, if they are already quite sick, will probably need to pay out the wazoo for Medigap or not get that coverage. That opens them up to the unlimited 20% coinsurance not covered by Medicare. So saving money up front to get in Medicare Advantage but then switching to Medicare later might be financially problematic for the government, but it’s also problematic for the seniors.

Thank you. I was wondering how people managed to switch from MA.

https://www.kff.org/medicare/issue-brief/medigap-enrollment-and-consumer-protections-vary-across-states/

As you said, even if they could get a Medicap policy I would expect it to be extremely expensive.

Exactly. When the UnitedHealth spokesperson says “nearly all Medicare Advantage participants are satisfied with the program”, that’s not true. They’re not “satisfied”–they’re LOCKED IN. To slightly oversimplify: Once you’re 66 or older, if you’ve chosen Medicare Advantage, you’re now at the whim of the Medicare Supplement insurers as to whether you can ever switch back to regular Medicare. And if your reason for wanting to do it is that you’re now sicker and need more care, you likely will be denied.

I’m in that boat. Retired from children’s recreation for a year & dropped supplement. Went back to work til Covid hit & the tried to get a supplement. Was told because of diabetes, I was not underwriteable.

3 years ago had a blood blockage in my leg & underwent Angioplasty procedure.Medicare approved around $30,000, sticking me with a $6,000 bill. I switched to VA because of advancing age & prohibitive costs.

This is why all our extended family is on traditional medicare A & B with a high deductible G that costs about 70/mo and caps annual max at 2,800

In a real emergency or serious medical condition, that max is reached in couple minutes in ER or operating theatre.

Yes! My medigap policy, this year, is $177/mo.. $2,100/yr. A broken elbow and pin placement, with $1,800 ambulance ride, came to ~$11,000. 20% of that is over $2000. Medigap is medical bankruptcy insurance.

Any moderate stay in the hospital for serious illness could easily cost you $100,000. 20% of that is $20,000 … Ten years of Medigap premiums!

I am on Medicare for end stage renal disease and when i was no longer eligible for medicaid, i needed to find a medicare plan. I could not get a medigap plan due to the fact that I needed to use that option when I originally got on Medicare. I had to choose a MA plan and will not be eligible to switch until I turn 65 in 5 yrs.

Medicare keeps hectoring me during enrollment period: “Don’t drop the ball – compare the 55 MA plans in your area.”

And while there is a handy online way to compare, I see it as yet another tax on time.

I didn’t drop the ball, Congress did by not even considering Medicare for all!

Am in good shape and going to travel next year so looking to switch to Medicare as I don’t want to be bankrupted by out of network denial of coverage.

This article states that: ” Medigap is included as a part of Medicare Advantage plan while you have to pay for it with Traditional Medicare. The same holds true for Part D (pharmaceutical).” This is incorrect. Medicare Advantage Plans do NOT include Medigap; in fact you cannot have a Medigap plan if you are under an Advantage Plan. Advantage plans DO have “maximum out of pocket maximum” (MOOP) each year after which the plans cover anything more, but these annual maximums range from a low of $ 5500 to highs over $ 10,000. So if you have a bad thing happen to you, like a lung surgery, and incur 100,000 of hospital costs, the $ 20,000 share you will owe after Medicare covers the 80% will cost you all of your MOOP, which is a heck of a lot more than a year’s premiums for the Medicap policy.

I think the WSJ article is misleading in another way, as it suggests that people with MA plans switch back to original Medicare in the last year of their life and thus increase government taxpayer pay-out to patients as opposed to “insurance company” payments. This suggests somehow that the health system is engineered to steal from taxpayers. What the WSJ does not mention is that every person these private MA plans signs up brings with them a government subsidy payment paid directly to the insurance company, in the range of $ 900 to 1,400 a month per person. THIS is why the MA plans can offer “nonpremium” plans or even Part B “giveback” plans as well as other services like vision hearing and dental. Those government payments cover those other services and the outrageous CEO salaries, not to mention the denial of care issues and fraud issues also present.

It isn’t as if someone can switch back to Original Medicare after years on a MA plan and also get a Medigap policy, because if you are on a MA plan longer than six months after starting to receive Medicare you will face underwriting, higher fees, or outright refusal. There a number of Guaranteed Issue Rights, though, the two most important being a) if someone on a MA plan is thrown off that plan, as happened this year to many people, THEN they have the right to go to original medicare and get the Medigap; and b, if they MOVE to a new area they can get a Medigap with original Medicare, too. I am guessing a lot of the people the article speaks of who went from MA to original Medicare, that 300,000 or so, were people who essentially became poverty stricken and broke and hence qualified for Medicaid.

I have been a SHIBA advisor or SHIP counselor for a couple years now, advising people on Medicare choices as a volunteer, and as far as I can tell most people who choose MA plans are driven by the low premiums and cannot afford to pay more, despite being on the hook for high annual costs (MOOP) if something bad happens; or they have been overwhelmed by the torrent of ads and promises and bullshit. As mentioned in the comments here, more and more people are finding the high deductible Medigap policies as the way to go – low monthly payments and, yes, an exposure up to 2800 if they get really sick, but still relatively affordable, especially with the number of zero premium or low cost Part D drug plans.

The government is pushing the privatization of original Medicare by stealth. At the beginning of every enrollment period, Medicare sends me an email that emphasizes Medicare Advantage Plans with subject lines such as “Have you explored the 26 Medicare Advantage Plans in your area?” and loud text such as “Medicare plans aren’t one size fits all. You have options. In fact, there are 26 Medicare Advantage Plans available in your area . . . including 9 new plans.” There is never any explicit reference to original Medicare in these direct emails from the government until you follow the links 2 or 3 deep. And there is never an explanation that private insurance companies (Medigap plans) can underwrite their supplemental health plans after the first 6 months of Medicare eligibility which means that you can be denied supplemental coverage.

Donald Trump ran a “pilot” project which involuntarily enrolled original Medicare recipients into Medicare Advantage Plans without their full knowledge or consent. Biden has continued the program under a different name. Now that Trump is back in power, I suspect that privatization will be accelerated, and that we are well on our way to healthcare vouchers.